Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

20 Setembro 2024 - 10:27PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

September 2024

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One)

Form 20-F x Form 40-F ¨

|

Press Release |

|

Vale informs on the nomination of Board members

Rio de

Janeiro, September 20, 2024 – Following press releases dated March 111 and July 1, 20242, Vale S.A. (“Vale”

or “Company”) informs that the Board of Directors approved the nomination of Heloisa Belotti Bedicks and Mr. Reinaldo Castanheira

Filho for the vacant positions of independent members of the Board of Directors. The selection was performed with the support from the

consulting firm Korn Ferry and in compliance with the Company’s Bylaws and the provisions of the Directors Policy3,

as well as with applicable legislation.

| § | Mrs.

Heloisa Belotti Bedicks

is a Brazilian economist and

accountant with solid experience in corporate governance. She is a member of the Fiscal Council of TIM, the Board of Directors of the

Mapfre Group and the Audit Committee of Brasilseg and Gasmig. She voluntarily serves as a member of the Fiscal Council of Fundação

Boticário, the UN Global Compact and the Deliberative Council of the NGO Portas Abertas in Brazil. She was a member of Vale's Fiscal

Council and General Director of the Brazilian Institute of Corporate Governance (IBGC), the latter for 18 years. Among other positions,

she was a member of the Board of Directors of BNDES until January 2023, as well as of the Fiscal Council of Braskem and the Advisory Council

of the Global Reporting Initiative (GRI). She holds a master’s degree in financial administration from Universidade Presbiteriana

Mackenzie, a bachelor’s degree in economics from Unicamp and in Accounting Sciences from PUC Campinas, a specialization in corporate

governance from Yale University and Stanford University and in Boards of Directors from Chicago University. |

| § | Mr.

Reinaldo Castanheira Filho

is a Brazilian economist with

a solid professional career in the mining industry. He held several executive positions in the Vale group, including CEO of the Aluminum

business, CFO of Manganese business and Director of Investment Analysis. He was also CFO at Ferrous and previously worked at PWC and Coca-Cola.

He was a member of the Board of several companies in Brazil. Reinaldo holds a bachelor’s degree in economics from PUC-MG and has

had executive training at several global business schools |

The Board

of Directors will submit the nomination proposal to the Extraordinary General Meeting, which is expected to be held in November 2024 (“Meeting”),

with the call notice to take place in due course. Only after being elected at the Meeting, the new members will take office and serve

the unified term of office of the current Board of Directors’ composition, that is, until the Annual General Meeting to be held

in 2025.

Gustavo Duarte Pimenta

Executive Vice President, Finance and Investor

Relations

For further information, please contact:

Vale.RI@vale.com

Thiago Lofiego: thiago.lofiego@vale.com

Luciana Oliveti: luciana.oliveti@vale.com

Mariana Rocha: mariana.rocha@vale.com

Patricia Tinoco: patricia.tinoco@vale.com

Pedro Terra: pedro.terra@vale.com

This press release may include statements that

present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve

various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include

factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital

markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global

competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those

forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão

de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements” and “Risk

Factors” in Vale’s annual report on Form 20-F.

1 With the title “Vale informs on

the resignation of a Board member”, available here.

2 With the title “Vale informs on

the resignation of a Board member, available here.

3 Available here.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Vale S.A.

(Registrant) |

| |

|

| |

By: |

/s/ Thiago Lofiego |

| Date: September 20, 2024 |

|

Director of Investor Relations |

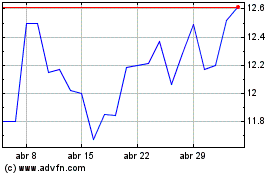

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

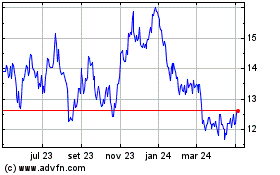

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024