false

0001996862

0001996862

2024-09-20

2024-09-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C., 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): September 20, 2024

BUNGE GLOBAL SA

(Exact name of registrant as specified in its charter)

| Switzerland |

000-56607 |

98-1743397 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| Route de Florissant 13, |

|

| 1206 Geneva, Switzerland |

N/A |

|

(Address of registered office and principal

executive offices) |

(Zip Code) |

| 1391 Timberlake Manor Parkway |

|

| Chesterfield, MO |

63017 |

|

(Address of corporate headquarters) |

(Zip Code) |

(314) 292-2000

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each

class |

|

Trading Symbol(s) |

|

Name of each

exchange on which registered |

| Registered Shares, par value $0.01 per share |

|

BG |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging growth company

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

Results of Early Participation in Exchange Offers and Consent Solicitations

On September 23, 2024, Bunge Global SA (“Bunge”)

and Bunge Limited Finance Corp. (“BLFC”) announced the early participation results of their previously announced (i) offers

to exchange (collectively, the “Exchange Offers”) any and all outstanding 2.000% Notes due 2026 (the “Existing Viterra

2026 Notes”), 4.900% Notes due 2027 (the “Existing Viterra 2027 Notes”), 3.200% Notes due 2031 (the “Existing

Viterra 2031 Notes”), and 5.250% Notes due 2032 (the “Existing Viterra 2032 Notes”, and with the Existing Viterra 2026

Notes, the Existing Viterra 2027 Notes and the Existing Viterra 2031 Notes, collectively, the “Existing Viterra Notes”), each

series as issued by Viterra Finance B.V. (“VFBV”) and guaranteed by Viterra Limited (“Viterra”) and Viterra B.V.,

for (1) up to $1.95 billion aggregate principal amount of new notes issued by BLFC and guaranteed by Bunge and (2) cash; and

(ii) solicitations of consent (collectively, the “Consent Solicitations”), on behalf of VFBV, from eligible holders of

the (i) Existing Viterra 2026 Notes and the Existing Viterra 2031 Notes to amend the VFBV base indenture dated April 21, 2021,

governing the Existing Viterra 2026 Notes and the Existing Viterra 2031 Notes (the “Existing Viterra 2026 and 2031 Notes Indenture”);

and (ii) Existing Viterra 2027 Notes and the Existing Viterra 2032 Notes to amend the VFBV base indenture dated April 21, 2022,

governing the Existing Viterra 2027 Notes and the Existing Viterra 2032 Notes (the “Existing Viterra 2027 and 2032 Notes Indenture”,

and with the Existing Viterra 2026 and 2031 Notes Indenture, each an “Existing Viterra Indenture” and collectively, the “Existing

Viterra Indentures”), to among other things, eliminate certain of the covenants, restrictive provisions and events of default and

modify or amend certain other provisions, including unconditionally releasing and discharging the guarantees by each of Viterra and Viterra

B.V. (with respect to the corresponding Existing Viterra Indenture for that series and, together, as the context requires, the “Proposed

Amendments”).

As of 5:00 p.m., New York City time, on

September 20, 2024 (the “Early Tender Date”), BLFC has received consents from holders representing (i) 96.5%

in principal amount of the Existing Viterra 2026 Notes and Existing Viterra 2031 Notes, voting as one class; and (ii) 97.6% in

principal amount of the Existing Viterra 2027 Notes and Existing Viterra 2032 Notes, voting as one class. In accordance with the

terms of the Existing Viterra Indentures and the confidential offering memorandum and consent solicitation statement, dated

September 9, 2024, BLFC has received consents sufficient to amend the respective indentures governing the Existing

Viterra Notes to unconditionally release and discharge the guarantees by each of Viterra and Viterra B.V.

On September 23, 2024, VFBV, Viterra and Viterra

B.V. executed (i) a Supplemental Indenture to the Existing Viterra 2026 and 2031 Notes Indenture (the “Existing Viterra 2026

and 2031 Notes Supplemental Indenture”); and (ii) a Supplemental Indenture to the Existing Viterra 2027 and 2032 Notes Indenture

(collectively, with the Existing Viterra 2026 and 2031 Notes Supplemental Indenture, each an “Existing Viterra Supplemental Indenture”

and collectively, the “Existing Viterra Supplemental Indentures”) in order to effect the Proposed Amendments. The Existing

Viterra Supplemental Indentures will become operative only upon the settlement date for the Exchange Offers and the Consent Solicitations,

which is expected to be within two business days after the expiration date of the Exchange Offers of 5:00 p.m., New York City time, on

October 7, 2024 (the “Expiration Date”).

To the extent the consummation of Bunge’s

pending acquisition (the “Business Combination”) of Viterra is not anticipated to occur on or before the then-anticipated

settlement date, for any reason, BLFC anticipates extending the Expiration Date until such time that the Business Combination may be consummated

on or before the settlement date. During any extension of the Expiration Date, all Existing Viterra Notes previously tendered (and not

validly withdrawn) in an extended Exchange Offer will remain subject to such Exchange Offer and may be accepted for exchange by BLFC.

A copy of the press release announcing the early

participation results of the Exchange Offers and Consent Solicitations is attached hereto as Exhibit 99.1, and the information contained

therein is incorporated herein by reference.

This Form 8-K is not intended to and does

not constitute an offer to sell or purchase, or the solicitation of an offer to sell or purchase, or the solicitation of any vote of approval

or the solicitation of tenders or consents with respect to any security. No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction.

Cautionary Statement Regarding Forward-Looking

Statements

This Current Report on Form 8-K contains

forward-looking statements. All statements, other than statements of historical fact are, or may be deemed to be, forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements are not based on historical facts, but rather reflect our current expectations and

projections about our future results, performance, prospects and opportunities. We have tried to identify these forward-looking statements

by using words including "may," "will," "should," "could," "expect," "anticipate,"

"believe," "plan," "intend," "estimate," "continue" and similar expressions. These forward-looking

statements, which include those related to BLFC’s ability to consummate the Exchange Offers and the Consent Solicitations, Bunge’s

ability to generate sufficient cash flows to service debt and other obligations and ability to access capital, including debt or equity,

and Bunge’s ability to achieve the benefits contemplated by the Exchange Offers and the Consent Solicitations, are subject to a

number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities to differ

materially from those expressed in, or implied by, these forward-looking statements, which are described in our Securities and Exchange

Commission ("SEC") filings, including those set forth in the Risk Factors section and under the heading "Cautionary Statement

Regarding Forward Looking Statements" in our most recently filed Annual Report on Form 10-K for the fiscal year ended December 31,

2023, which we filed on February 22, 2024 and in our most recently filed Quarterly Report on Form 10-Q for the quarterly period

ended June 30, 2024, which we filed on August 1, 2024. You are cautioned not to place undue reliance on Bunge’s forward-looking

statements. The forward-looking statements included in this Current Report on Form 8-K are made only as of the date of this Current

Report on Form 8-K, and except as otherwise required by federal securities law, we do not have any obligation to publicly update

or revise any forward-looking statements to reflect subsequent events or circumstances.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

BUNGE GLOBAL SA |

| |

|

|

| Date: September 23, 2024 |

By: |

/s/ Lisa

Ware-Alexander |

| |

|

Lisa

Ware-Alexander |

| |

|

Secretary |

Exhibit 99.1

| |

Media Contact: |

Bunge News Bureau

Bunge

636-292-3022

news@bunge.com |

| |

|

|

| |

Investor Contact: |

Ruth Ann Wisener

Bunge

636-292-3014

Ruthann.wisener@bunge.com |

Bunge Limited Finance Corp.

Announces Results of Early Participation in Exchange Offers and Consent Solicitations

ST.

LOUIS – September 23, 2024 – Bunge Global SA (NYSE: BG) (“Bunge”), today announced that

its wholly-owned subsidiary, Bunge Limited Finance Corp. (“BLFC”), has received consents from Eligible Holders (as defined

herein) representing (i) 96.5% in principal amount of 2.000% Notes due 2026 (the “Existing Viterra 2026 Notes”) and 3.200% Notes due 2031 (the

“Existing Viterra 2031 Notes”), voting as one class; and (ii) 97.6% in principal amount of 4.900% Notes due 2027 (the

“Existing Viterra 2027 Notes”) and 5.250% Notes due 2032 (the “Existing Viterra 2032 Notes”), voting as one class, each series as issued by Viterra Finance B.V. (“VFBV”) and guaranteed by Viterra

Limited (“Viterra”) and Viterra B.V., pursuant to Bunge and BLFC’s previously announced (A) offers to exchange

(each an “Exchange Offer” and, collectively the “Exchange Offers”) any and all outstanding Existing Viterra 2026

Notes, Existing Viterra 2027 Notes, Existing Viterra 2031 Notes, and Existing Viterra 2032 Notes (collectively, the “Existing Viterra

Notes”), for (1) up to $1.95 billion aggregate principal amount of new notes to be issued by BLFC and guaranteed by Bunge

(the “New Bunge Notes”), and (2) cash; and (B) related solicitations of consents by BLFC, on behalf of VFBV (each

a “Consent Solicitation” and, collectively, the “Consent Solicitations”) from Eligible Holders of the (1) Existing

Viterra 2026 Notes and the Existing Viterra 2031 Notes to amend the VFBV base indenture dated April 21, 2021, governing the Existing

Viterra 2026 Notes and the Existing Viterra 2031 Notes (the “Existing Viterra 2026 and 2031 Notes Indenture”); and (2) Existing

Viterra 2027 Notes and the Existing Viterra 2032 Notes to amend the VFBV base indenture dated April 21, 2022, governing the Existing

Viterra 2027 Notes and the Existing Viterra 2032 Notes (the “Existing Viterra 2027 and 2032 Notes Indenture”, and with the

Existing Viterra 2026 and 2031 Notes Indenture, each an “Existing Viterra Indenture” and collectively, the “Existing

Viterra Indentures”).

Tenders of Existing Viterra Notes in the Exchange

Offers may be withdrawn at any time prior to 5:00 p.m., New York City time, on October 7, 2024, unless extended (the “Expiration

Date”); however, consents delivered in the Consent Solicitations with respect to each series of Existing Viterra Notes may no longer

be revoked.

The consents received in the Consent Solicitations permit VFBV,

Viterra and Viterra B.V. to eliminate certain of the covenants, restrictive provisions, events of default and guarantee provisions

from such Existing Viterra Indenture (with respect to the corresponding Existing Viterra Indenture for that series and, together, as

the context requires, the “Proposed Amendments”). In accordance with the terms of the Existing Viterra Indentures and

the offering memorandum and consent solicitation statement dated September 9, 2024 (the “Statement”), BLFC has

received consents sufficient to amend the respective indentures governing the Existing Viterra Notes to unconditionally release

and discharge the guarantees by each of Viterra and Viterra B.V. The Proposed Amendments are further described in the Statement.

Accordingly, VFBV, Viterra and Viterra B.V. have executed supplemental indentures (the “Existing Viterra Supplemental

Indentures”) to each of the Existing Viterra Indentures to effect the Proposed Amendments approved in the Consent

Solicitations. The Proposed Amendments effectuated by the Existing Viterra Supplemental Indentures will become operative only upon

the settlement date for the Exchange Offers and the Consent Solicitations, which is expected to be within two business days after

the Expiration Date.

As of 5:00 p.m., New York City time, on September 20,

2024 (the “Early Tender Date”), the principal amounts of Existing Viterra Notes set forth in the table below had been validly

tendered and not validly withdrawn (and consents thereby validly delivered and not validly revoked).

For each $1,000 principal amount of Existing Viterra

Notes validly tendered (and not validly withdrawn) at or prior to the Early Tender Date, Eligible Holders of Existing Viterra Notes are

eligible to receive $1,000 principal amount of New Bunge Notes of the applicable series, plus a consent payment (the “Consent Payment”)

of $1.00 in cash (plus cash in respect of any fractional portion of New Bunge Notes) (the “Total Exchange Consideration”).

The Total Exchange Consideration includes the early tender payment, payable in New Bunge Notes, equal to $30.00. For each $1,000 principal

amount of Existing Viterra validly tendered after the Early Tender Date but at or prior to the Expiration Date, Eligible Holders of Existing

Viterra Notes will be eligible to receive $1,000 principal amount of New Bunge Notes (plus cash in respect of any fractional portion

of New Bunge Notes) (the “Exchange Consideration”) but will not receive the Consent Payment.

| | |

| |

| |

| | | |

| Existing

Viterra Notes Tendered at Early Tender

Date | |

Title

of Series of

Existing Viterra Notes | |

CUSIP

Number of Existing

Viterra Notes | |

Title

Series of New

Bunge Notes | |

| Aggregate

Principal

Amount Outstanding | | |

| Principal

Amount | | |

Percentage | |

| 2.000% Notes due 2026 | |

144A CUSIP: 92852LAA7

Reg S CUSIP: N9354LAA9 | |

2.000% Notes due 2026 | |

$ | 600,000,000 | | |

$ | 566,348,000 | | |

94.4 | % |

| 4.900% Notes due 2027 | |

144A CUSIP: 92852LAC3

Reg S CUSIP: N9354LAE1 | |

4.900% Notes due 2027 | |

$ | 450,000,000 | | |

$ | 436,993,000 | | |

97.1 | % |

| 3.200% Notes due 2031 | |

144A CUSIP: 92852LAB5

Reg S CUSIP: N9354LAB7 | |

3.200% Notes due 2031 | |

$ | 600,000,000 | | |

$ | 591,131,000 | | |

98.5 | % |

| 5.250% Notes due 2032 | |

144A CUSIP: 92852LAD1

Reg S CUSIP: N9354LAF8 | |

5.250% Notes due 2032 | |

$ | 300,000,000 | | |

$ | 295,000,000 | | |

98.3 | % |

Eligible Holders who (i) validly tender their

Existing Viterra Notes at or prior to the Early Tender Date, (ii) validly deliver their related consent in the applicable Consent

Solicitation at or prior to the Early Tender Date, and (iii) beneficially own such Existing Viterra Notes at the Expiration Date,

will be eligible to receive the Total Exchange Consideration.

Eligible Holders who (i) validly tender their

Existing Viterra Notes after the Early Tender Date and prior to the Expiration Date, (ii) validly deliver their related consents

in the applicable Consent Solicitation after the Early Tender Date and prior to the Expiration Date, and (iii) beneficially own

such Existing Viterra Notes at the Expiration Date, will be eligible to receive the Exchange Consideration.

The settlement date will be promptly after the Expiration

Date and is expected to be within two business days after the Expiration Date. To the extent the consummation of Bunge’s pending

acquisition (the “Business Combination”) of Viterra is not anticipated to occur on or before the then-anticipated settlement

date, for any reason, BLFC anticipates extending the Expiration Date until such time that the Business Combination may be consummated

on or before the settlement date. During any extension of the Expiration Date, all Existing Viterra Notes previously tendered (and not

validly withdrawn) in an extended Exchange Offer will remain subject to such Exchange Offer and may be accepted for exchange by BLFC.

BLFC

is making the Exchange Offers and Consent Solicitations pursuant to the terms and subject to the conditions set forth in the Statement.

The Statement and other documents relating to the Exchange Offers and Consent Solicitations have and will only be distributed to holders

of Existing Viterra Notes who complete and return a letter of eligibility certifying that they are (i) “qualified institutional

buyers” within the meaning of Rule 144A under the Securities Act of 1933, as amended (“Securities Act”) or (ii) not

“U.S. persons” and are outside of the United States within the meaning of Regulation S under the Securities Act and who are

“non-U.S. qualified offerees” (as defined in the Statement) and who are not located in Canada are authorized to receive and

review the Statement (such persons, “Eligible Holders”). Eligible Holders of Existing Viterra Notes who desire to obtain

and complete the letter of eligibility and obtain copies of the Statement should call D.F. King & Co., Inc. (the “Information &

Exchange Agent”) at (800) 967-5074 (toll-free) or (212) 269-5550 (collect for banks and brokers).

Among other risks described in the Statement, the

Exchange Offers and Consent Solicitations are expected to result in reduced liquidity for the Existing Viterra Notes that are not exchanged

and, the Proposed Amendments to the Existing Viterra Indentures will reduce protection to remaining holders of Existing Viterra Notes.

Eligible Holders should refer to the Statement for more details on the risks related to the Exchange Offers and Consent Solicitations.

BLFC has engaged BofA Securities, Inc. and J.P.

Morgan Securities LLC as Lead Dealer Managers and Solicitation Agents, and SMBC Nikko Securities America, Inc. as Co-Dealer Manager

and Solicitation Agent for the Exchange Offers and Consent Solicitations. Please direct questions regarding the Exchange Offers and Consent

Solicitations to BofA Securities, Inc. at (888) 292-0070 (toll-free) or (980) 387-3907 (collect for banks and brokers) or J.P. Morgan

Securities LLC at (866) 834-4666 (toll-free) or (212) 834-3554 (collect for banks and brokers).

The New Bunge Notes have not been registered under

the Securities Act or any state or foreign securities laws, and they may not be offered or sold except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements of the Securities Act and any applicable state and foreign securities

laws.

About

Bunge

At Bunge (NYSE: BG), our purpose is to connect farmers

to consumers to deliver essential food, feed and fuel to the world. With more than two centuries of experience, unmatched global scale

and deeply rooted relationships, we work to strengthen global food security, increase sustainability where we operate, and help communities

prosper. As a world leader in oilseed processing and a leading producer and supplier of specialty plant-based oils and fats, we value

our partnerships with farmers to bring quality products from where they’re grown to where they’re consumed. At the same time,

we collaborate with our customers to develop tailored and innovative solutions to meet evolving dietary needs and trends in every part

of the world. Our Company has its registered office in Geneva, Switzerland and its corporate headquarters in St. Louis, Missouri. We

have approximately 23,000 dedicated employees working across approximately 300 facilities located in more than 40 countries.

Cautionary

Statement Concerning Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995

provides a "safe harbor" for forward looking statements to encourage companies to provide prospective information to investors.

This press release includes forward looking statements that reflect our current expectations and projections about our future results,

performance, prospects and opportunities. Forward looking statements include all statements that are not historical in nature. We have

tried to identify these forward looking statements by using words including "may," "will," "should," "could,"

"expect," "anticipate," "believe," "plan," "intend," "estimate," "continue"

and similar expressions. These forward-looking statements, which include those related to BLFC’s ability to consummate the Exchange

Offers and the Consent Solicitations, Bunge’s ability to generate sufficient cash flows to service debt and other obligations and

ability to access capital, including debt or equity, and Bunge’s ability to achieve the benefits contemplated by the Exchange Offers

and the Consent Solicitations, are subject to a number of risks, uncertainties and other factors that could cause our actual results,

performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements,

which are described in our Securities and Exchange Commission filings, including those set forth in “Item 1A. Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 22, 2024 and “Part II

— Item 1A. Risk Factors” in our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed

with the SEC on August 1, 2024.

The forward looking statements included in this release

are made only as of the date of this release, and except as otherwise required by federal securities law, we do not have any obligation

to publicly update or revise any forward looking statements to reflect subsequent events or circumstances.

No

Offer or Solicitation

This communication is not intended to and does not

constitute an offer to purchase, or the solicitation of an offer to sell, or the solicitation of tenders or consents with respect to

any security. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation, or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In the case of the Exchange

Offers and Consent Solicitations, the Exchange Offers and Consent Solicitations are being made solely pursuant to the Statement and only

to such persons and in such jurisdictions as is permitted under applicable law.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

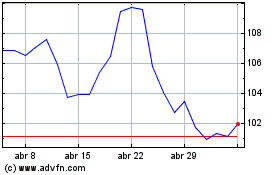

Bunge Global (NYSE:BG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bunge Global (NYSE:BG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024