false

0001996862

0001996862

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C., 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 30, 2024

BUNGE GLOBAL SA

(Exact name of registrant as specified in its charter)

| Switzerland |

000-56607 |

98-1743397 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| Route de Florissant 13, |

|

| 1206 Geneva, Switzerland |

N/A |

|

(Address of registered office and principal

executive offices) |

(Zip Code) |

| 1391 Timberlake Manor Parkway |

|

| Chesterfield, MO |

63017 |

|

(Address of corporate headquarters) |

(Zip Code) |

(314) 292-2000

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each

class |

|

Trading Symbol(s) |

|

Name of each

exchange on which registered |

| Registered Shares, par value $0.01 per share |

|

BG |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging growth company

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On October 30, 2024, Bunge Global SA (“Bunge”)

announced that its wholly-owned subsidiary, Bunge Limited Finance Corp. (“BLFC”), further extended the expiration date of

its previously announced (A) offers to exchange (collectively, the “Exchange Offers”) any and all outstanding 2.000%

Notes due 2026 (the “Existing Viterra 2026 Notes”), 4.900% Notes due 2027 (the “Existing Viterra 2027 Notes”),

3.200% Notes due 2031 (the “Existing Viterra 2031 Notes”), and 5.250% Notes due 2032 (the “Existing Viterra 2032 Notes”,

and with the Existing Viterra 2026 Notes, the Existing Viterra 2027 Notes and the Existing Viterra 2031 Notes, collectively, the “Existing

Viterra Notes”), each series as issued by Viterra Finance B.V. (“VFBV”) and guaranteed by Viterra Limited (“Viterra”)

and Viterra B.V., for (1) up to $1.95 billion aggregate principal amount of new notes issued by BLFC and guaranteed by Bunge, and

(2) cash; and (B) solicitations of consent (collectively, the “Consent Solicitations”), on behalf of VFBV, from

eligible holders of the (1) Existing Viterra 2026 Notes and the Existing Viterra 2031 Notes to amend the VFBV base indenture dated

April 21, 2021, governing the Existing Viterra 2026 Notes and the Existing Viterra 2031 Notes (the “Existing Viterra 2026 and

2031 Notes Indenture”); and (2) Existing Viterra 2027 Notes and the Existing Viterra 2032 Notes to amend the VFBV base indenture

dated April 21, 2022, governing the Existing Viterra 2027 Notes and the Existing Viterra 2032 Notes (the “Existing Viterra

2027 and 2032 Notes Indenture”, and with the Existing Viterra 2026 and 2031 Notes Indenture, each an “Existing Viterra Indenture”

and collectively, the “Existing Viterra Indentures”), to among other things, eliminate certain of the covenants, restrictive

provisions and events of default and modify or amend certain other provisions, including unconditionally releasing and discharging the

guarantees by each of Viterra and Viterra B.V. (with respect to the corresponding Existing Viterra Indenture for that series and, together,

as the context requires, the “Proposed Amendments”).

The expiration date is extended from 5:00 p.m.,

New York City time, on October 31, 2024, to 5:00 p.m., New York City time, on January 2, 2025, as may be further extended (the

“Expiration Date”).

The Exchange Offers and the Consent Solicitations

are being conducted in connection with Bunge’s pending acquisition (the “Business Combination”) of Viterra. To the extent

the Business Combination is not anticipated to occur on or before the Expiration Date, for any reason, BLFC anticipates further extending

the then-anticipated Expiration Date until such time that the Business Combination may be consummated on or before the Expiration Date.

BLFC will provide notice of any such extension in advance of the Expiration Date.

Supplemental indentures to each of the Existing

Viterra Indentures effecting the Proposed Amendments were executed on September 23, 2024. The Proposed Amendments effectuated by

the supplemental indentures will only become operative on the settlement date of the Exchange Offers and the Consent Solicitations.

BLFC is making the Exchange Offers and Consent

Solicitations solely pursuant to the terms and subject to the conditions set forth in the offering memorandum and consent solicitation

statement dated September 9, 2024 (the “Statement”), as amended by subsequent press releases issued by Bunge, in a private

offering exempt from, or not subject to, registration under the Securities Act of 1933, as amended, and are conditioned, among other things,

upon the closing of the Business Combination. The settlement of the Exchange Offers and Consent Solicitations is expected to occur within

two business days after the Expiration Date.

A copy of the press release announcing the extension

of the Expiration Date of the Exchange Offers and Consent Solicitations is attached hereto as Exhibit 99.1, and the information contained

therein is incorporated herein by reference.

This Form 8-K is not intended to and does

not constitute an offer to sell or purchase, or the solicitation of an offer to sell or purchase, or the solicitation of any vote of approval

or the solicitation of tenders or consents with respect to any security. No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction.

Cautionary Statement Regarding Forward-Looking

Statements

This Current Report on Form 8-K contains

forward-looking statements. All statements, other than statements of historical fact are, or may be deemed to be, forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements are not based on historical facts, but rather reflect our current expectations and

projections about our future results, performance, prospects and opportunities. We have tried to identify these forward-looking statements

by using words including "may," "will," "should," "could," "expect," "anticipate,"

"believe," "plan," "intend," "estimate," "continue" and similar expressions. These forward-looking

statements, which include those related to BLFC’s ability to consummate the Exchange Offers and the Consent Solicitations, Bunge’s

ability to generate sufficient cash flows to service debt and other obligations and ability to access capital, including debt or equity,

and Bunge’s ability to achieve the benefits contemplated by the Exchange Offers and the Consent Solicitations, are subject to a

number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities to differ

materially from those expressed in, or implied by, these forward-looking statements, which are described in our Securities and Exchange

Commission ("SEC") filings, including those set forth in the Risk Factors section and under the heading "Cautionary Statement

Regarding Forward Looking Statements" in our most recently filed Annual Report on Form 10-K for the fiscal year ended December 31,

2023, which we filed on February 22, 2024 and in our most recently filed Quarterly Report on Form 10-Q for the quarterly period

ended June 30, 2024, which we filed on August 1, 2024. You are cautioned not to place undue reliance on Bunge’s forward-looking

statements. The forward-looking statements included in this Current Report on Form 8-K are made only as of the date of this Current

Report on Form 8-K, and except as otherwise required by federal securities law, we do not have any obligation to publicly update

or revise any forward-looking statements to reflect subsequent events or circumstances.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

BUNGE GLOBAL SA |

| |

|

|

| Date: October 30, 2024 |

By: |

/s/ Lisa Ware-Alexander |

| |

|

Lisa Ware-Alexander |

| |

|

Secretary |

Exhibit 99.1

| |

Media

Contact: |

Bunge

News Bureau

Bunge

636-292-3022

news@bunge.com

|

| |

Investor

Contact:

|

Ruth

Ann Wisener

Bunge

636-292-3014

Ruthann.wisener@bunge.com |

Bunge Limited Finance Corp. Announces Extension

of Exchange Offers

ST. LOUIS – October 30,

2024 – Bunge Global SA (NYSE: BG) (“Bunge”), today announced that its wholly-owned subsidiary, Bunge

Limited Finance Corp. (“BLFC”), has further extended the expiration date of its previously announced (A) offers to exchange

(each an “Exchange Offer” and, collectively the “Exchange Offers”) any and all outstanding 2.000% Notes due 2026

(the “Existing Viterra 2026 Notes”), 4.900% Notes due 2027 (the “Existing Viterra 2027 Notes”), 3.200% Notes

due 2031 (the “Existing Viterra 2031 Notes”) and 5.250% Notes due 2032 (the “Existing Viterra 2032 Notes”, and

together with the Existing Viterra 2026 Notes, the Existing Viterra 2027 Notes, and the Existing Viterra 2031 Notes, collectively, the

“Existing Viterra Notes”), each series as issued by Viterra Finance B.V. (“VFBV”) and guaranteed by Viterra Limited

(“Viterra”) and Viterra B.V., for (1) up to $1.95 billion aggregate principal amount of new notes to be issued by BLFC

and guaranteed by Bunge (the “New Bunge Notes”), and (2) cash; and (B) related solicitations of consents by BLFC,

on behalf of VFBV (each a “Consent Solicitation” and, collectively, the “Consent Solicitations”) from Eligible

Holders (as defined below) of the (1) Existing Viterra 2026 Notes and the Existing Viterra 2031 Notes to amend the VFBV base indenture

dated April 21, 2021, governing the Existing Viterra 2026 Notes and the Existing Viterra 2031 Notes (the “Existing Viterra

2026 and 2031 Notes Indenture”); and (2) Existing Viterra 2027 Notes and the Existing Viterra 2032 Notes to amend the VFBV

base indenture dated April 21, 2022, governing the Existing Viterra 2027 Notes and the Existing Viterra 2032 Notes (the “Existing

Viterra 2027 and 2032 Notes Indenture”, and with the Existing Viterra 2026 and 2031 Notes Indenture, each an “Existing Viterra

Indenture” and collectively, the “Existing Viterra Indentures”). Bunge and BLFC hereby extend such expiration date

from 5:00 p.m., New York City time, on October 31, 2024, to 5:00 p.m., New York City time, on January 2, 2025, unless further

extended (the “Expiration Date”).

On the early tender date and consent revocation deadline

of September 20, 2024, BLFC received consents sufficient to amend the respective Existing Viterra Indentures to, among other things,

eliminate certain of the covenants, restrictive provisions and events of default and modify or amend certain other provisions, including

unconditionally releasing and discharging the guarantees by each of Viterra and Viterra B.V. (with respect to the corresponding Existing

Viterra Indenture for that series and, together, as the context requires, the “Proposed Amendments”). Supplemental indentures

to the Existing Viterra Indentures were executed on September 23, 2024 in order to effect the Proposed Amendments (each an “Existing

Viterra Supplemental Indenture” and collectively, the “Existing Viterra Supplemental Indentures”). The Existing Viterra

Supplemental Indentures will become operative only upon the settlement date for the Exchange Offers and the Consent Solicitations, which

is expected to be within two business days after the Expiration Date.

Each Exchange Offer and Consent Solicitation is subject

to the satisfaction of certain conditions, including among other things, the consummation of Bunge’s pending acquisition (the “Business

Combination”) of Viterra. The parties’ obligations to complete the Business Combination are conditioned upon (i) the

receipt of antitrust approvals and (ii) certain other customary closing conditions. The consummation of the Business Combination

is not subject to the completion of the Exchange Offers or Consent Solicitations or a financing condition.

To the extent the Business Combination is not anticipated

to occur on or before the Expiration Date, for any reason, BLFC anticipates further extending the then-anticipated Expiration Date until

such time that the Business Combination may be consummated on or before the Expiration Date. BLFC will provide notice of any such extension

in advance of the Expiration Date.

The regulatory approval process for the announced

Business Combination is continuing to progress. Bunge expects to receive the remaining approvals and close the Business Combination in

the next several months.

Tenders of Existing Viterra Notes in the Exchange

Offers and related consents validly delivered (and not validly revoked) prior to the extension of the Expiration Date remain valid. Tenders

of Existing Viterra Notes in the Exchange Offers may be validly withdrawn at or prior to the Expiration Date. A valid withdrawal of tendered

Existing Viterra Notes prior to the Expiration Date will not be deemed a revocation of the related consent and such consent will continue

to be deemed validly delivered and not validly withdrawn. All Existing Viterra Notes previously tendered (and not validly withdrawn)

or re-tendered (and not validly withdrawn) in an extended Exchange Offer will remain subject to such Exchange Offer and may be accepted

for exchange by BLFC.

Except as described in this press release, the press

release issued by the Company on September 23, 2024, and the press release issued by the Company on October 7, 2024, all other

terms of the Exchange Offers and Consent Solicitations remain unchanged.

As of 6:00 a.m., New York City time, on October 30,

2024, the principal amounts of Existing Viterra Notes set forth in the table below had been validly tendered and not validly withdrawn

(and consents thereby validly delivered and not validly revoked).

Title of Series of

Existing Viterra | |

CUSIP Number of | |

Title Series of New | |

Aggregate Principal

Amount | | |

Existing Viterra Notes Tendered | |

| Notes | |

Existing Viterra Notes | |

Bunge Notes | |

Outstanding | | |

Principal Amount | | |

Percentage | |

| 2.000% Notes due 2026 | |

144A CUSIP: 92852LAA7 Reg S CUSIP: N9354LAA9 | |

2.000% Notes due 2026 | |

$ | 600,000,000 | | |

$ | 566,348,000 | | |

| 94.4 | % |

| 4.900% Notes due 2027 | |

144A CUSIP: 92852LAC3 Reg S CUSIP: N9354LAE1 | |

4.900% Notes due 2027 | |

$ | 450,000,000 | | |

$ | 436,993,000 | | |

| 97.1 | % |

| 3.200% Notes due 2031 | |

144A CUSIP: 92852LAB5 Reg S CUSIP: N9354LAB7 | |

3.200% Notes due 2031 | |

$ | 600,000,000 | | |

$ | 596,056,000 | | |

| 99.3 | % |

| 5.250% Notes due 2032 | |

144A CUSIP: 92852LAD1 Reg S CUSIP: N9354LAF8 | |

5.250% Notes due 2032 | |

$ | 300,000,000 | | |

$ | 295,000,000 | | |

| 98.3 | % |

BLFC is making the Exchange Offers and Consent Solicitations

pursuant to the terms and subject to the conditions set forth in the offering memorandum and consent solicitation statement dated September 9,

2024 (the “Statement”). The Statement and other documents relating to the Exchange Offers and Consent Solicitations have

and will only be distributed to holders of Existing Viterra Notes who complete and return a letter of eligibility certifying that they

are (i) “qualified institutional buyers” within the meaning of Rule 144A under the Securities Act of 1933, as amended

(“Securities Act”) or (ii) not “U.S. persons” and are outside of the United States within the meaning of

Regulation S under the Securities Act and who are “non-U.S. qualified offerees” (as defined in the Statement) and who are

not located in Canada are authorized to receive and review the Statement (such persons, “Eligible Holders”). Eligible Holders

of Existing Viterra Notes who desire to obtain and complete the letter of eligibility and obtain copies of the Statement should call

D.F. King & Co., Inc. (the “Information & Exchange Agent”) at (800) 967-5074 (toll-free) or (212)

269-5550 (collect for banks and brokers).

Among other risks described in the Statement, the

Exchange Offers and Consent Solicitations are expected to result in reduced liquidity for the Existing Viterra Notes that are not exchanged

and, the Proposed Amendments will reduce protection to remaining holders of Existing Viterra Notes. Eligible Holders should refer to

the Statement for more details on the risks related to the Exchange Offers and Consent Solicitations.

BLFC has engaged BofA Securities, Inc. and J.P.

Morgan Securities LLC as Lead Dealer Managers and Solicitation Agents, and SMBC Nikko Securities America, Inc. as Co-Dealer Manager

and Solicitation Agent for the Exchange Offers and Consent Solicitations. Please direct questions regarding the Exchange Offers and Consent

Solicitations to BofA Securities, Inc. at (888) 292-0070 (toll-free) or (980) 387-3907 (collect for banks and brokers) or J.P. Morgan

Securities LLC at (866) 834-4666 (toll-free) or (212) 834-3554 (collect for banks and brokers).

The New Bunge Notes have not been registered under

the Securities Act or any state or foreign securities laws, and they may not be offered or sold except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements of the Securities Act and any applicable state and foreign securities

laws.

About

Bunge

At Bunge (NYSE: BG), our purpose is to connect farmers

to consumers to deliver essential food, feed and fuel to the world. With more than two centuries of experience, unmatched global scale

and deeply rooted relationships, we work to strengthen global food security, increase sustainability where we operate, and help communities

prosper. As a world leader in oilseed processing and a leading producer and supplier of specialty plant-based oils and fats, we value

our partnerships with farmers to bring quality products from where they’re grown to where they’re consumed. At the same time,

we collaborate with our customers to develop tailored and innovative solutions to meet evolving dietary needs and trends in every part

of the world. Our Company has its registered office in Geneva, Switzerland and its corporate headquarters in St. Louis, Missouri. We

have approximately 23,000 dedicated employees working across approximately 300 facilities located in more than 40 countries.

Cautionary

Statement Concerning Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995

provides a "safe harbor" for forward looking statements to encourage companies to provide prospective information to investors.

This press release includes forward looking statements that reflect our current expectations and projections about our future results,

performance, prospects and opportunities. Forward looking statements include all statements that are not historical in nature. We have

tried to identify these forward looking statements by using words including "may," "will," "should," "could,"

"expect," "anticipate," "believe," "plan," "intend," "estimate," "continue"

and similar expressions. These forward-looking statements, which include those related to BLFC’s ability to consummate the Exchange

Offers and the Consent Solicitations, Bunge’s ability to generate sufficient cash flows to service debt and other obligations and

ability to access capital, including debt or equity, and Bunge’s ability to achieve the benefits contemplated by the Exchange Offers

and the Consent Solicitations, are subject to a number of risks, uncertainties and other factors that could cause our actual results,

performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements,

which are described in our Securities and Exchange Commission filings, including those set forth in “Item 1A. Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 22, 2024 and “Part II

— Item 1A. Risk Factors” in our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed

with the SEC on August 1, 2024.

The forward looking statements included in this release

are made only as of the date of this release, and except as otherwise required by federal securities law, we do not have any obligation

to publicly update or revise any forward looking statements to reflect subsequent events or circumstances.

No

Offer or Solicitation

This communication is not intended to and does not

constitute an offer to purchase, or the solicitation of an offer to sell, or the solicitation of tenders or consents with respect to

any security. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation, or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In the case of the Exchange

Offers and Consent Solicitations, the Exchange Offers and Consent Solicitations are being made solely pursuant to the Statement and only

to such persons and in such jurisdictions as is permitted under applicable law.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

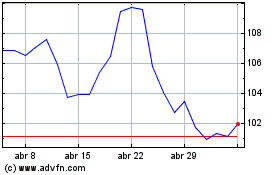

Bunge Global (NYSE:BG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bunge Global (NYSE:BG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024