Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

09 Outubro 2024 - 6:19PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-270053, 333-270053-01,

333-270053-02, 333-270053-03,

333-270053-04, 333-270053-05, 270053-06

and 270053-07

Ares

Management Corporation

$750,000,000 5.600% SENIOR NOTES DUE 2054

PRICING TERM SHEET

October 9, 2024

This pricing term sheet should be read together with the Preliminary

Prospectus Supplement dated October 9, 2024 to the Prospectus dated February 27, 2023.

| Issuer: |

Ares Management Corporation |

| |

|

| Guarantors: |

Each of Ares Holdings L.P., Ares Management LLC, Ares Finance Co. LLC, Ares Finance Co. II LLC, Ares Finance Co. III LLC, Ares Finance Co. IV LLC and Ares Investments Holdings LLC |

| |

|

| Anticipated Ratings*: |

BBB+ by Standard & Poor’s Financial Services LLC, a subsidiary of The McGraw-Hill Companies, Inc.

A- by Fitch Ratings, Inc. |

| |

|

| Legal Format: |

SEC-Registered |

| |

|

| Trade Date: |

October 9, 2024 |

| |

|

| Settlement Date**: |

October 11, 2024 (T+2) |

| |

|

| Principal Amount: |

$750,000,000 |

| |

|

| Maturity Date: |

October 11, 2054 |

| |

|

| Benchmark Treasury: |

UST 4.625% due May 15, 2054 |

| |

|

| Benchmark Treasury Price and Yield: |

104-16 / 4.353% |

| |

|

| Spread to Benchmark Treasury: |

+130 bps |

| |

|

| Yield to Maturity: |

5.653% |

| |

|

| Issue Price (Price to Public): |

99.239% of principal amount |

| |

|

| Coupon (Interest Rate): |

5.600% |

| |

|

| Interest Payment Dates: |

April 11 and October 11, commencing April 11, 2025 |

| Optional Redemption: |

The notes may be redeemed prior to maturity in whole at any time or in part from time to time at our option at a redemption price equal to the greater of 100% of the principal amount to be redeemed and a “make-whole” redemption price (T+20 bps), in either case, plus accrued and unpaid interest, if any, to, but excluding, the redemption date; provided, however, that if the Issuer redeems any notes on or after April 11, 2054 (the date falling six months prior to the Maturity Date of the notes), the redemption price for the notes will be equal to 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption. |

| |

|

| CUSIP / ISIN: |

03990B AB7 / US03990BAB71 |

| |

|

| Joint Book-Running Managers: |

Morgan Stanley & Co. LLC

Citigroup Global Markets Inc.

RBC Capital Markets, LLC

SMBC Nikko Securities America, Inc.

Truist Securities, Inc. |

| |

|

| Co-Managers: |

Ares Management Capital Markets LLC

Barclays Capital Inc.

BNY Mellon Capital Markets, LLC

BofA Securities, Inc.

Deutsche Bank Securities Inc.

Goldman Sachs & Co. LLC

J.P. Morgan Securities LLC

MUFG Securities Americas Inc.

UBS Securities LLC

U.S. Bancorp Investments, Inc.

Wells Fargo Securities, LLC

AmeriVet Securities, Inc.

Loop Capital Markets LLC

R. Seelaus & Co., LLC

Samuel A. Ramirez & Company, Inc.

Siebert Williams Shank & Co., LLC |

* A securities rating is not a recommendation

to buy, sell or hold securities and may be revised or withdrawn at any time. Each of the ratings above should be evaluated independently

of any other security rating.

** It is expected that delivery of the notes

will be made against payment therefor on or about October 11, 2024, which will be the second business day following the date of pricing

of the notes (such settlement cycle being herein referred to as “T+2”). Under Rule 15c6-1 under the Securities Exchange

Act of 1934, as amended, trades in the secondary market generally are required to settle in one business day unless the parties to any

such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to the business day immediately before

settlement will be required, by virtue of the fact that the notes initially will settle in “T+2”, to specify an alternative

settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of notes who wish to trade the notes prior to

the business day immediately before settlement should consult their own advisors.

The issuer has filed a registration statement

(including a prospectus), as amended by post-effective amendment no. 1 thereto, and a preliminary prospectus supplement with the Securities

and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read

the preliminary prospectus supplement for this offering, the related prospectus in that registration statement and any other documents

the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free

by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you may obtain a copy of the

preliminary prospectus supplement and prospectus from (ii) Morgan Stanley & Co. LLC, 180 Varick Street, New York, NY 10014, Attention:

Prospectus Department, by email at prospectus@morganstanley.com or toll-free at 1-866-718-1649 or (ii) Citigroup Global Markets Inc.,

c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, telephone: 1-800-831-9146 or email: prospectus@citi.com.

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

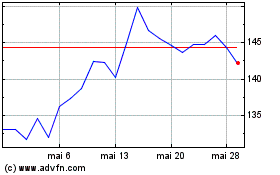

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024