Form 8-K - Current report

11 Outubro 2024 - 6:23PM

Edgar (US Regulatory)

false

0001473334

0001473334

2024-10-11

2024-10-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 11, 2024

Nova

LifeStyle, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-36259 |

|

90-0746568 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

6565

E. Washington Blvd., Commerce, CA 90040

(Address

of Principal Executive Office) (Zip Code)

(323)

888-9999

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

NVFY |

|

Nasdaq

Stock Market |

Item

1.01. Entry into a Material Definitive Agreement.

On

October 11, 2024, Nova LifeStyle, Inc. (the “Company”) and Nova Furniture Limited (Samoa), a wholly owned subsidiary of the

Company (“Nova Samoa”) entered into five purchase orders (“POs”) to purchase certain furniture products (the

“Products”) from Iconic Tech SDN BHD (“Iconic Tech”), Onefull Technologies SDN. BHD. (“Onefull Technologies”),

Skyvip SDH BHD (“Skyvip”), United Poles SDH BHD (“United Poles”) and Teclutions System SDN. BHD (“Teclutions”,

collectively with Iconic Tech, Onefull Technologies, Skyvip and United Poles as the Sellers). Pursuant to the POs, the Company, Nova

Samoa and Sellers agree that (i) Nova Samoa will purchase Background Light Slabs from Iconic Tech for a total of $945,000 (the “Iconic

Order Price”); (ii) Nova Samoa will purchase Porcelin Slabs from Onefull Technologies for a total of $925,000 (the “Onefull

Order Price”); (iii) Nova Samoa will purchase Transparent Marble Slabs from Skyvip for a total of $900,000 (the “Skyvip Order

Price”); (iv) Nova Samoa will purchase Ultrathinstone from United Poles for a total of $940,000 (the “United Order Price”)

(v) the Nova Samoa will purchase Light Transmitting Slate Stone from Teclutions for a total of $940,000 (the “Teclutions Order

Price”, collectively with Iconic Order Price, Onefull Order Price, Skyvip Order Price and United Order Price as the Order Prices);

(vi) the Order Prices shall be paid up to the Sellers in 3,321,429 shares (“Shares”) of common stock of the Company at US$1.40

per share. The Shares will be issued pursuant to the exemption from registration provided by Regulation S promulgated under the Securities

Act of 1933, as amended.

The

form of PO is filed as Exhibit 10.1 to this Current Report on Form 8-K. The foregoing summary of the terms of the PO is subject to, and

qualified in its entirety by, the form of PO, which is incorporated herein by reference.

Item 8.01 Other Events.

As

previously disclosed, on April 18, 2024, the Company received written notice from the NASDAQ Stock Market (“NASDAQ”) stating

that the Company does not meet the requirement of maintaining a minimum of $2,500,000 in stockholders’ equity for continued listing

on the NASDAQ Capital Market, as set forth in NASDAQ Listing Rule 5550(b)(1), the Company also does not meet the alternative of market

value of listed securities of $35 million under NASDAQ Listing Rule 5550(b)(2) or net income from continuing operations of $500,000 in

the most recently completed fiscal year or in two of the last three most recently completed fiscal years under NASDAQ Listing Rule 5550(b)(3),

and the Company is no longer in compliance with the NASDAQ Listing Rules. The NASDAQ notification letter provided the Company until June

6, 2024 to submit a plan to regain compliance. If the plan is accepted, NASDAQ can grant the Company an extension up to 180 calendar

days from the date of NASDAQ letter to demonstrate compliance.

The

Company submitted its plan of compliance on May 28, 2024 and a supplemental letter to the plan of compliance on June 20, 2024. Based

on the review of the letters submitted by the Company, Staff has determined to grant the Company an extension until October 14, 2024

to regain compliance with the Rule and the Company must complete its initiatives and provide evidences for the compliance with the Rule

as required by Nasdaq.

As

discussed in Item 1.01, the Company and Nova Samoa have entered into orders to purchase inventories in total amount of $4,600,000, which

will be paid in 3,321,429 shares (“Shares”) of common stock of the Company at US$1.40 per share. As of the date of the report,

the Company believes it has regained compliance with the stockholders’ equity requirement based upon the specific transaction referenced

in Item 1.01. The Company confirms that Nasdaq will continue to monitor the Company’s ongoing compliance with the stockholders’

equity requirement and, if at the time of its next periodic report the Company does not evidence compliance, that it may be subject to

delisting.

Item

9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

Nova

LifeStyle, Inc. |

| |

|

|

| |

By:

|

/s/

Thanh H. Lam |

| |

|

Thanh

H. Lam |

| |

|

Chairperson,

President and Chief Executive Officer |

Date:

October 11, 2024

Exhibit

10.1

| Customer: |

Invoice

Number: |

| |

Date:

10/11/2024 |

| NOVA

Furniture Limited |

|

| Product | |

Qty | | |

Price | | |

Amount | |

| | |

| | | |

$ | | | |

$ | | |

| | |

| | | |

| | | |

| | |

| Total Amount |

| | |

$ | | |

|

Payment

Terms

Payment

Due Date: [ ] days from invoice date

Payment

Methods:

Terms

and Conditions

| I. |

The

total price of this order is US$[ ] and Parties agree that such price shall be paid by the buyer in [ ] shares of common stock

of Nova Lifestyle (the “Shares”) at the price of US$1.40 per share with the total value of which is equivalent to the

purchase price of the order. |

| |

|

| II. |

Services

will be delivered in accordance with the agreed timelines and terms. Any delays due to buyer-side actions or omissions will extend

the completion date. |

| |

|

| III. |

Ownership

of all products or services will remain with [ ] until full payment, including the stock transfer, has been completed. |

| |

|

| IV. |

The

Seller hereby acknowledges that the Shares are not registered with SEC and shall be restricted and may not be sold, transferred,

exchanged, pledged, redeemed or otherwise disposed of for the holding period required in accordance with the requirement of Regulation

S and Rule 144. The Shares will be acquired hereunder by [ ](the “Seller”) solely for the account of the Seller,

for investment, and not with a view to the resale or distribution thereof. |

| |

|

| V. |

The

Seller is aware that an investment in the shares of Nova Lifestyle, Inc. (“NVFY”) is highly speculative and that there

can be no assurance as to what, if any, return the Seller may realize in connection with the transaction. The Seller is aware of

NVFY’ business affairs, business plans and financial condition, and has made its own evaluation of the merits and risks of

the proposed transaction and of the advisability of the transaction. The Seller is aware that the NVFY is subject to a high degree

of risk that could result in the loss of the Seller’s investment in part or in whole. |

| VI. |

The

Seller has experience as an investor in securities of companies and acknowledges that the Seller is able to fend for itself, can

bear the economic risk of its investment in the Shares and has such knowledge and experience in financial or business matters that

the Seller is capable of evaluating the merits and risks of, and protecting the Seller’s own interests in connection with,

the transaction and its investment in the Shares. |

| |

|

| VII. |

The

Seller has had full access to all of the information it considers necessary or appropriate to make an informed investment decision

with respect to the Shares to be acquired under this order. The Seller further has had an opportunity to ask questions and receive

answers from NVFY and to obtain additional information necessary to verify any information furnished to the Seller or to which the

Seller had access. The Seller has had access to the NVFY’s publicly filed reports with the SEC and has been furnished during

the course of the transactions. |

| The

Seller |

|

| |

|

| |

|

| Name: |

|

| Title: |

|

| |

|

| The

Purchaser |

|

| Nova

Furniture Limited (Samoa) |

|

| |

|

| |

|

| Name: |

|

| Title: |

|

| |

|

| The

Issuer |

|

| Nova

LifeStyle, Inc. |

|

| |

|

| |

|

| Name: |

|

| Title: |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

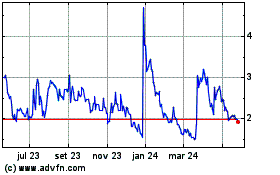

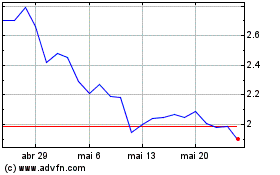

Nova Lifestyle (NASDAQ:NVFY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Nova Lifestyle (NASDAQ:NVFY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024