As

filed with the Securities and Exchange Commission on November 12, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Nova

LifeStyle, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

90-0746568 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employee

Identification

No.) |

6565

E. Washington Blvd.

Commerce,

CA 90040

(323)

888-9999

(Address

of principal executive offices, including zip code)

Thanh

H. Lam

Chief

Executive Officer

6565

E. Washington Blvd.

Commerce,

CA 90040

Tel:

(323) 888-9999

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Jeffrey

Li, Esq.

FisherBroyles,

LLP

1200

G Street NW, Suite 800

Washington,

DC 20006

Tel:

(202) 830-5905

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the SEC pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting

an offer to buy securities in any state where the offer or sale is not permitted.

Subject

to Completion, dated November 12, 2024

PRELIMINARY

PROSPECTUS

1,310,000

shares of Common Stock

Offered

by the Selling Shareholders of

This

prospectus relates to the resale, from time to time, of up to an aggregate of 1,310,000 shares of our Common Stock, par value $0.001

(the “Shares”), which may be offered and sold from time to time by certain stockholders set forth in the “Selling Stockholders”

section of this prospectus.

The

Selling Shareholders may sell any or all of the shares on any stock exchange, market or trading facility on which the shares are traded

or in privately negotiated transactions at fixed prices that may be changed, at market prices prevailing at the time of sale or at negotiated

prices. Information on the Selling Shareholders and the times and manners in which they may offer and sell our shares is described under

the sections entitled “Selling Shareholders” and “Plan of Distribution” in this prospectus. While we will bear

all costs, expenses and fees in connection with the registration of the shares, we will not receive any of the proceeds from the sale

of our shares by the Selling Shareholders.

Our

shares are currently traded on the Nasdaq Stock Market under the symbol “NVFY”. On November 11, 2024, the closing price for

our shares on Nasdaq was $1.13 per share.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required.

Investing

in our securities involves risks. See “Risk Factors” beginning on page 3 of this prospectus. In addition, see “Risk

Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, which have been filed with the Securities and

Exchange Commission and is incorporated by reference into this prospectus. You should carefully read and consider these risk factors

before you invest in shares of our Common Stock.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE

SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

PROSPECTUS

DATED [●], 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is filed in conjunction with a registration statement that we filed with the Securities and Exchange Commission. Under this

registration process, the selling shareholders may from time to time sell up to 1,310,000 shares in one or more offerings. This prospectus

provides you with a general description of the securities that our selling shareholders may offer. Specific information about the offering

may also be included in a prospectus supplement, which may update or change information included in this prospectus. You should read

both this prospectus and any prospectus supplement together with additional information described under the heading “Where You

Can Find More Information.”

You

should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing

prospectus prepared by us or on our behalf. Neither we, nor the selling shareholders, have authorized any other person to provide you

with different or additional information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance

as to the reliability of, any other information that others may provide. The selling shareholders are not making an offer to sell these

securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only

as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations

and/or prospects may have changed since those dates.

Except

as otherwise set forth in this prospectus, neither we nor the selling shareholders have taken any action to permit a public offering

of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States.

Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions

relating to the offering of these securities and the distribution of this prospectus outside the United States.

Certain

Defined Terms and Conventions

Unless

otherwise indicated, references in this prospectus to:

| |

● |

“shares”

and “common shares” are to shares of our Common Stock, par value $0.001 per share. |

| |

|

|

| |

● |

“US$”

and “U.S. dollars” are to the legal currency of the United States. |

| |

|

|

| |

● |

“we,”

“us,” “our,” refer to Nova LifeStyle, Inc. a Nevada corporation, and its subsidiaries. |

PROSPECTUS

SUMMARY

This

prospectus summary highlights certain information about us and selected information contained elsewhere in or incorporated by reference

into this prospectus. This prospectus summary is not complete and does not contain all of the information that you should consider before

making an investment decision. For a more complete understanding of the Company, you should read and consider carefully the more detailed

information included or incorporated by reference in this prospectus and any applicable prospectus supplement or amendment, including

the factors described under the heading “Risk Factors,” beginning on page 3 of this prospectus, as well as the information

incorporated herein by reference, before making an investment decision.

Our

Company

Nova

LifeStyle, Inc. (“Nova LifeStyle” or the “Company”) is a U.S.-headquartered innovative designer and marketer

of contemporary styled residential and commercial furniture formerly known as Stevens Resources, Inc. We were incorporated in the State

of Nevada on September 9, 2009. The Company’s products are marketed through wholesale and retail channels as well as various online

platforms worldwide.

Nova

LifeStyle’s family of brands includes Nova LifeStyle, Diamond Sofa (www.diamondsofa.com) and Nova Living.

Our

business strength lies in our abilities to quickly adapt to changing market demand and stay ahead of the latest trends in modern furniture

designs. Our customers principally consist of designers, distributors and retailers who cater to mid-level and high-end private label

home furnishings that have little product overlap within our specific furnishings products or product lines. Nova LifeStyle is constantly

seeking to integrate new sources of distribution and manufacturing that are aligned with our growth strategies, allowing us to continually

focus on growing our customer base as well as driving the expansion of our overall distribution and manufacturing relationships worldwide,

providing our customers with trendy furnishing solutions.

We

generate the majority of our sales as a branding and marketing company with vertically integrated third-party manufacturing capabilities

for global furniture distributors and large national retailers. We have established long term relationships with our worldwide customers

by providing them with high quality, large scale and cost-effective sourcing solutions. Our worldwide logistics and delivery capabilities

provide our customers with the flexibility to select from our extensive furniture collections tailored for their respective needs. Our

experience marketing products to international customers have enabled us to fully integrate the supply scale, product delivery logistics,

marketing efficiency and design expertise to address customer demand from established markets in the North America, Central America,

South America, Asia, and the Middle East.

We

are a U.S. holding company with no material assets in the U.S. other than the ownership interests of our wholly owned subsidiaries through

which we market, design and sell residential and commercial furniture worldwide: Nova Furniture Limited domiciled in the British Virgin

Islands (“Nova Furniture”), Nova Furniture Ltd. Domiciled in Samoa (“Nova Samoa”), Diamond Bar Outdoors, Inc.

domiciled in California (“Diamond Bar”), Nova Living (M) SDN. BHD. domiciled in Malaysia (“Nova Malaysia”). The

Company had three former subsidiaries Bright Swallow International Group Limited domiciled in Hong Kong (“Bright Swallow”

or “BSI”) which was sold in January 2020, and Nova Furniture Macao Commercial Offshore Limited domiciled in Macao (“Nova

Macao”) which was de-registration and liquidation in January 2021. In February 2022, Nova HK entered a de-registration process

and transferred all its assets and business to Nova Malaysia. The process of de-registration and liquidation of Nova HK was completed

in February 2023. On December 7, 2017, we incorporated i Design Blockchain Technology, Inc. (“i Design”) under the laws of

the State of California. The purpose of i Design is to build our own blockchain technology team. i Design is in the planning stage and

has had minimum operations to date.

Company

Information

Our

principal executive offices are located at 6565 E. Washington Blvd., Commerce, CA 90040. Our telephone number is (323) 888-9999 and our

website address is www.novalifestyle.com. We do not incorporate by reference into this prospectus the information on our website, and

you should not consider it as part of this prospectus.

Sale

and Purchase Agreement in July 2024

On

July 5, 2024, the Company, Nova Malaysia and Hong Sheng Ventures Sdn Bhd (“Hong Sheng”), a company incorporated in

Malaysia entered into a Sale and Purchase Agreement (the “Agreement”). Pursuant to the Agreement, the parties agree: (i)

Nova Malaysia will purchase a Nova Living DesignXperience System from Hong Sheng for $660,000 (the “Purchase Price”) and

(ii) the Purchase Price shall be paid in 400,000 shares of common stock (“Shares”) of the Company at $1.65 per share. The

Nova Living DesignXperience System includes Virtual Interior Design Consultation, Furniture Recommendation Generation, Realistic Rendering

of Virtual Products, Testing and Quality Assurance, Documentation and Support and Deployment and Maintenance. The Shares will be issued

pursuant to the exemption from registration provided by Regulation S promulgated under the Securities Act of 1933, as amended.

Securities

Purchase Agreements in May 2024, July 2024 and October 2024

On

May 16, 2024, the Company entered into a Securities Purchase Agreement (the “Agreement”) with Huge Energy International Limited

(the “Huge Energy”), pursuant to which the Company agreed to sell to Huge Energy in a private placement 200,000 shares (the

“Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), at a purchase

price of $2.00 per share for an aggregate price of $400,000 (the “Private Placement”). The Private Placement will be completed

pursuant to the exemption from registration provided by Regulation S promulgated under the Securities Act of 1933, as amended.

On

July 30, 2024, the Company entered into a Securities Purchase Agreement (the “Agreement”) with Huge Energy, pursuant to which

the Company agreed to sell to Huge Energy in a private placement 125,000 shares (the “Shares”) of the Company’s common

stock, par value $0.001 per share (the “Common Stock”), at a purchase price of $1.60 per share for an aggregate price of

$200,000 (the “Private Placement”). The Private Placement will be completed pursuant to the exemption from registration provided

by Regulation S promulgated under the Securities Act of 1933, as amended.

On

October 25, 2024, the Company entered into a Securities Purchase Agreement (the “Agreement”) with Huge Energy, pursuant to

which the Company agreed to sell to Huge Energy in a private placement 125,000 shares (the “Shares”) of the Company’s

common stock, par value $0.001 per share (the “Common Stock”), at a purchase price of $1.20 per share for an aggregate price

of $150,000 (the “Private Placement”). The Private Placement will be completed pursuant to the exemption from registration

provided by Regulation S promulgated under the Securities Act of 1933, as amended.

Sale

and Purchase Agreement in August 2024

On

August 7, 2024, the Company, Nova Malaysia and VT Conceptone Sdn Bhd (“VT Conceptone”), a company incorporated in Malaysia

entered into a Sale and Purchase Agreement (the “Agreement”). Pursuant to the Agreement, the parties agree: (i) Nova Malaysia

will purchase a Payment IT System from VT Conceptone for $552,000 (the “Purchase Price”) and (ii) the Purchase Price shall

be paid in 460,000 shares of common stock (“Shares”) of the Company at $1.20 per share. The Payment IT System includes User

Registration and Management, Payment Processing, Security and Compliance, Integration and APIs, Merchant Tools, Transaction Management,

Reporting and Analytics and Notification System. The Shares will be issued pursuant to the exemption from registration provided by Regulation

S promulgated under the Securities Act of 1933, as amended.

ABOUT

THIS OFFERING

The

Selling Securityholders identified in this prospectus are offering on a resale basis up to 1,310,000 shares of Common Stock of the Company.

| Common

Stock offered by the Selling Securityholders |

|

Up

to 1,310,000 shares. |

| |

|

|

| Risk

factors |

|

Before

investing in our securities, you should carefully read and consider the information set forth in “Risk Factors” on page

3. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the offering of the shares by the Selling Securityholders. See “Use of Proceeds” on

page 4. |

| |

|

|

| Trading

market and symbol |

|

The

Company’s Common Stock trades on the Nasdaq Capital Market under the symbol “NVFY.” |

RISK

FACTORS

Any

investment in the shares is speculative and involves a high degree of risk. Before making an investment decision, you should carefully

consider the risks described under “Risk Factors” in our most recent Annual Report on Form 10-K, or any updates in our Quarterly

Reports on Form 10-Q, together with all of the other information appearing in, or incorporated by reference into, this prospectus. The

risks so described are not the only risks facing our company. Additional risks not presently known to us or that we currently deem immaterial

may also impair our business operations. Our business, financial condition and results of operations could be materially adversely affected

by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your

investment.

If

we fail to continue to meet the listing standards of NASDAQ, our common stock may be delisted, which could have a material adverse effect

on the liquidity of our common stock.

Our

common stock is currently listed on the Nasdaq Capital Market. The NASDAQ Stock Market LLC has requirements that a company must meet

in order to remain listed on NASDAQ.

On

April 18, 2024, the Company received written notice from the NASDAQ Stock Market (“NASDAQ”) stating that the Company does

not meet the requirement of maintaining a minimum of $2,500,000 in stockholders’ equity for continued listing on the NASDAQ Capital

Market, as set forth in NASDAQ Listing Rule 5550(b)(1), the Company also does not meet the alternative of market value of listed securities

of $35 million under NASDAQ Listing Rule 5550(b)(2) or net income from continuing operations of $500,000 in the most recently completed

fiscal year or in two of the last three most recently completed fiscal years under NASDAQ Listing Rule 5550(b)(3), and the Company is

no longer in compliance with the NASDAQ Listing Rules.

The

NASDAQ notification letter provides the Company until June 6, 2024 to submit a plan to regain compliance. If the plan is accepted, NASDAQ

can grant the Company an extension up to 180 calendar days from the date of NASDAQ letter to demonstrate compliance. If NASDAQ does not

accept the Company’s compliance plan, the Company will have the opportunity to appeal that decision to a Hearing Panel per NASDAQ

Listing Rule 5815(a).

The

Company submitted its plan of compliance on May 28, 2024 and a supplemental letter to the plan of compliance on June 20, 2024. Based

on the review of the letters submitted by the Company, Staff has determined to grant the Company an extension until October 14, 2024

to regain compliance with the Rule and the Company must complete its initiatives and provide evidences for the compliance with the Rule

as required by Nasdaq.

The

Company and Nova Samoa have entered into orders to purchase inventories in total amount of $4,600,000, which will be paid in 3,321,429

shares (“Transaction”) of common stock of the Company at US$1.40 per share, as disclosed in the Form 8-K filed by the Company

with SEC on October 11, 2024 (the “Form 8-K”). The Company believes it has regained compliance with the stockholders’

equity requirement based upon the Transaction.

Based

on the Form 8-K, staff of Nasdaq (“Staff”) has determined that the Company complies with the Listing Rule 5550(b)(1). However,

as noted in its letter dated, June 27, 2024, if the Company fails to evidence compliance upon filing its next periodic report covering

the period of the Transaction, it may be subject to delisting. At that time, Staff will provide written notification to the Company,

which may then appeal Staff’s determination to a Hearings Panel.

In

addition, we may be unable to meet other applicable NASDAQ listing requirements, including maintaining minimum levels of stockholders’

equity or market values of our common stock in which case, our common stock could be delisted. If our common stock were to be delisted,

the liquidity of our common stock would be materially adversely affected and the market price of our common stock could decrease.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

Some

of the information in this prospectus, any prospectus supplement, and the documents we incorporate by reference contains forward-looking

statements within the meaning of the federal securities laws. You should not rely on forward-looking statements in this prospectus, any

prospectus supplement, or the documents we incorporate by reference. Forward-looking statements typically are identified by use of terms

such as “anticipate,” “believe,” “plan,” “expect,” “future,” “intend,”

“may,” “will,” “should,” “estimate,” “predict,” “potential,”

“continue,” and similar words, although some forward-looking statements are expressed differently. This prospectus, any prospectus

supplement, and the documents we incorporate by reference may also contain forward-looking statements attributed to third parties relating

to their estimates regarding the growth of our markets. All forward-looking statements address matters that involve risks and uncertainties,

and there are many important risks, uncertainties and other factors that could cause our actual results, as well as those of the markets

we serve, levels of activity, performance, achievements and prospects to differ materially from the forward-looking statements contained

in this prospectus, any prospectus supplement, and the documents we incorporate by reference. You should also consider carefully the

statements under “Risk Factors” and other sections of this prospectus, any prospectus supplement, and the documents we incorporate

by reference, which address additional facts that could cause our actual results to differ from those set forth in the forward-looking

statements. We caution investors not to place significant reliance on the forward-looking statements contained in this prospectus, any

prospectus supplement, and the documents we incorporate by reference. We undertake no obligation to publicly update or review any forward-looking

statements, whether as a result of new information, future developments or otherwise.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of the Shares covered by this prospectus. The selling stockholders will receive all of the

proceeds. However, we will pay all costs, fees and expenses incurred in connection with the registration of the Shares covered by this

prospectus.

DIVIDEND

POLICY

We

do not currently have any plans to pay any cash dividends in the foreseeable future. We currently intend to retain most, if not all,

of our available funds and any future earnings to operate and expand our business. Even if our board of directors decides to pay dividends

in the future, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus,

general financial condition, contractual restrictions and other factors that our board of directors may deem relevant.

DESCRIPTION

OF COMMON STOCK

As

of November 11, 2024, there were 7,210,706 shares of our Common Stock outstanding, held by approximately 55 stockholders of record. In

addition, there are 12,000 option shares that were granted and vested but not yet issued, 1,500 shares of unvested restricted

stock of the Company’s common stock and the warrants to purchase 245,192 shares of common stock of the Company as

of November 11, 2024. Our Common Stock is currently traded on The NASDAQ Stock Market LLC under the symbol “NVFY”. The transfer

agent and registrar for our common stock is Issuer Direct Corporation.

The

holders of our Common Stock are entitled to one vote per share. Our Articles of Incorporation do not provide for cumulative voting. The

holders of our Common Stock are entitled to receive ratably such dividends, if any, as may be declared by our board of directors out

of legally available funds; however, the current policy of our board of directors is to retain earnings, if any, for operations and growth.

Upon liquidation, dissolution or winding-up, the holders of our Common Stock are entitled to share ratably in all assets that are legally

available for distribution. The holders of our Common Stock have no preemptive, subscription, redemption or conversion rights.

All

issued and outstanding shares of Common Stock are fully paid and nonassessable. The shares of our Common Stock that may be offered for

resale, from time to time, under this prospectus will be fully paid and nonassessable.

Nevada

Anti-Takeover Provisions

As

a Nevada corporation, we are also subject to certain provisions of the Nevada Revised Statutes (the “NRS”) that have anti-takeover

effects and may inhibit a non-negotiated merger or other business combination. These provisions are intended to encourage any person

interested in acquiring us to negotiate with, and to obtain the approval of, our board of directors in connection with such a transaction.

However, certain of these provisions may discourage a future acquisition of us, including an acquisition in which the stockholders might

otherwise receive a premium for their shares. As a result, stockholders who might desire to participate in such a transaction may not

have the opportunity to do so. The NRS provides that specified persons who, with or through their affiliates or associates, own, or affiliates

and associates of the subject corporation at any time within two years own or did own, 10% or more of the outstanding voting stock of

a corporation cannot engage in specified business combinations with the corporation for a period of two years after the date on which

the person became an interested stockholder, unless the combination meets all of the requirements of the articles of incorporation of

the company, and: (i) the combination or transaction by which such person first became an interested stockholder was approved by the

board of directors before they first became an interested stockholder; or (ii) such combination is approved by: (x) the board of directors;

and (y) at an annual or special meeting of the stockholders (not by written consent), the affirmative vote of stockholders representing

at least 60% of the outstanding voting power not beneficially owned by such interested stockholder. The law defines the term “business

combination” to encompass a wide variety of transactions with or caused by an interested stockholder, including mergers, asset

sales and other transactions in which the interested stockholder receives or could receive a benefit on other than a pro rata basis with

other stockholders.

SELLING

SHAREHOLDERS

We

have agreed to register the 1,310,000 shares of our Common Stock of the Company (the “Shares”) that are beneficially owned

by the selling stockholders identified below. Such selling shareholders may from time to time offer and sell pursuant to this prospectus

any or all of the shares owned by them. The selling shareholders, however, make no representations that the shares will be offered for

sale. The tables below present information regarding the selling shareholders and the shares that each such selling shareholder may offer

and sell from time to time under this prospectus.

Unless

otherwise indicated, all information with respect to ownership of our shares of the selling shareholders has been furnished by or on

behalf of the selling shareholders and is as of November 11, 2024. We believe, based on information supplied by the selling shareholders,

that except as may otherwise be indicated in the footnotes to the tables below, the selling shareholders have sole voting and dispositive

power with respect to the shares reported as beneficially owned by them. Because the selling shareholders identified in the tables may

sell some or all of the shares owned by them which are included in this prospectus, and because, except as set forth herein, there are

currently no agreements, arrangements or understandings with respect to the sale of any of the shares, no estimate can be given as to

the number of shares available for resale hereby that will be held by the selling shareholders upon termination of this offering. In

addition, the selling shareholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of,

at any time and from time to time, the shares they hold in transactions exempt from the registration requirements of the Securities Act

after the date on which they provided the information set forth on the table below. We have, therefore, assumed for the purposes of the

following table, that the selling shareholders will sell all of the shares owned beneficially by them that are covered by this prospectus,

but will not sell any other shares that they presently own. However, we are not aware of any agreements, arrangements or understandings

with respect to the sale of any of the shares by any of the selling shareholders. Beneficial ownership for the purposes of this table

is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial

owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition

thereof or has the right to acquire such powers within 60 days.

The

selling shareholders and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning

of the Securities Act with respect to the shares offered by this prospectus, and any profits realized or commissions received may be

deemed underwriting compensation. Additional selling shareholders not named in this prospectus will not be able to use this prospectus

for resales until they are named in the tables by prospectus supplement or post-effective amendment. Transferees, successors and donees

of identified selling shareholders will not be able to use this prospectus for resales until they are named in the tables by prospectus

supplement or post-effective amendment. If required, we will add transferees, successors and donees by prospectus supplement in instances

where the transferee, successor or donee has acquired its shares from holders named in this prospectus after the effective date of this

prospectus.

The

following table sets forth:

| |

● |

the

name of each selling shareholder holding shares; |

| |

|

|

| |

● |

the

number of shares beneficially owned by each selling shareholder prior to the sale of the shares covered by this prospectus; |

| |

|

|

| |

● |

the

number of shares that may be offered by each selling shareholder pursuant to this prospectus; |

| |

|

|

| |

● |

the

number of shares to be beneficially owned by each selling shareholder following the sale of the shares covered by this prospectus;

and |

| |

|

|

| |

● |

the

percentage of our issued and outstanding shares to be owned by each selling shareholder before and after the sale of the shares covered

by this prospectus. |

| Name Of Selling Shareholder | |

Number Of Shares Beneficially Owned Prior To This Offering | | |

% Of Outstanding Shares Beneficially Owned Before Sale Of Shares | | |

Number Of Shares Available Pursuant To This Prospectus | | |

Number Of Shares Beneficially Owned After Sale Of Shares | | |

% Of Outstanding Shares Beneficially Owned After Sale Of Shares | |

| Huge Energy International Limited (1) | |

| 450,000 | | |

| 6.24 | % | |

| 450,000 | | |

| 0 | | |

| * | |

| VT Conceptone Sdn Bhd. (2) | |

| 460,000 | | |

| 6.38 | % | |

| 460,000 | | |

| 0 | | |

| * | |

| Hong Sheng Ventures Sdn Bhd.(3) | |

| 400,000 | | |

| 5.55 | % | |

| 400,000 | | |

| 0 | | |

| * | |

| |

(1) |

Ng

Man Shek is the sole shareholder and director of Huge Energy International Limited and

holds the voting and dispositive power over the shares held by Huge Energy. The principal

business address of Huge Energy is Unit B 19/F,

Hillier Commercial Building 89-91 Wing Lok St, Sheung Wan, Hong Kong. |

| |

(2) |

Tia

Venus is the sole shareholder and director of VT Conceptone Sdn Bhd. (“VT Conceptone”) and holds the voting and dispositive

power over the shares held by VT Conceptone. The principal business address of VT Conceptone is A-07-3A Ekocheras, No. 693, Batu

5, Jalan Cheras, 56000 Kuala Lumpur, Malaysia. |

| |

(3) |

Zhou

Li is the sole shareholder and director of Hong Sheng Ventures Sdn Bhd. (“Hong

Sheng Ventures”) and holds the voting and dispositive power over the shares held by Hong

Sheng Ventures. The principal business address of Hong Sheng Ventures is A-07-3A

Ekocheras, No. 693, Batu 5, Jalan Cheras, 56000 Kuala Lumpur, Malaysia. |

| |

* |

Less

than 1% |

PLAN

OF DISTRIBUTION

The

selling shareholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares or interests

in shares received after the date of this prospectus from a selling shareholder as a gift, pledge, partnership distribution or other

transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of the shares on any stock exchange, market or trading

facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices

at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated

prices.

The

selling shareholders may use any one or more of the following methods when disposing of shares:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as

principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

● |

short

sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

broker-dealers

may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share; |

| |

|

|

| |

● |

a

combination of any such methods of sale; and |

| |

|

|

| |

● |

any

other method permitted by applicable law. |

The

selling shareholders may, from time to time, pledge or grant a security interest in some or all of the shares owned by them and, if they

default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares, from time to

time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities

Act amending the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders

under this prospectus. The selling shareholders also may transfer the shares in other circumstances, in which case the transferees, pledgees

or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In

connection with the sale of their shares or interests therein, the selling shareholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of such shares in the course of hedging the positions they assume.

The selling shareholders may also sell shares short and deliver these securities to close out their short positions, or loan or pledge

the shares to broker-dealers that in turn may sell these securities. The selling shareholders may also enter into option or other transactions

with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to

such broker-dealer or other financial institution of the shares offered by this prospectus, which shares such broker-dealer or other

financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

aggregate proceeds to the selling shareholders from the sale of the shares offered by them will be the purchase price of such shares

less discounts or commissions, if any. Each of the selling shareholders reserves the right to accept and, together with their agents

from time to time, to reject, in whole or in part, any proposed purchase of shares to be made directly or through agents. We will not

receive any of the proceeds from the resale of the shares.

The

selling shareholders also may resell all or a portion of their shares in open market transactions in reliance upon Rule 144 under the

Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

The

selling shareholders and any underwriters, broker-dealers or agents that participate in the sale of the shares therein may be “underwriters”

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale

of the shares may be underwriting discounts and commissions under the Securities Act. Selling shareholders who are “underwriters”

within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To

the extent required, the shares to be sold, the names of the selling shareholders, the respective purchase prices and public offering

prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will

be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that

includes this prospectus.

In

order to comply with the securities laws of some states, if applicable, the shares may be sold in these jurisdictions only through registered

or licensed brokers or dealers. In addition, in some states the shares may not be sold unless it has been registered or qualified for

sale or an exemption from registration or qualification requirements is available and is complied with.

We

have advised the selling shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares

in the market and to the activities of the selling shareholders and their affiliates. In addition, to the extent applicable, we will

make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling shareholders for the

purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling shareholders may indemnify any broker-dealer

that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the

Securities Act. We have agreed to indemnify the selling shareholders against liabilities, including liabilities under the Securities

Act and state securities laws, relating to the registration of the shares offered by this prospectus.

LEGAL

MATTERS

The

validity of the shares of common stock offered hereby will be passed upon for us by FisherBroyles, LLP, Washington, DC.

EXPERTS

The

financial statements incorporated by reference in this prospectus have been audited by WWC, P.C., our independent registered public accounting

firm, and are included in reliance upon such reports given upon the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

For

the purposes of this section, the term registration statement means the original registration statement and any and all amendments including

the schedules and exhibits to the original registration statement or any amendment. This prospectus does not contain all of the information

included in the registration statement we filed. For further information regarding us and the shares offered in this prospectus, you

may desire to review the full registration statement, including the exhibits. The registration statement, including its exhibits and

schedules, may be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Room 1580, Washington,

D.C. 20549. You may obtain information on the operation of the public reference room by calling 1-202-551-8090. Copies of such materials

are also available by mail from the Public Reference Branch of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates.

In addition, the SEC maintains a website (http://www.sec.gov) from which interested persons can electronically access the registration

statement, including the exhibits and schedules to the registration statement.

We

are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In accordance

with the Exchange Act, we file reports with the SEC, including annual reports on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we file with them. This means that we can disclose important

information to you by referring you to those documents. Each document incorporated by reference is current only as of the date of such

document, and the incorporation by reference of such documents should not create any implication that there has been no change in our

affairs since the date thereof or that the information contained therein is current as of any time subsequent to its date. The information

incorporated by reference is considered to be a part of this prospectus and should be read with the same care. When we update the information

contained in documents that have been incorporated by reference by making future filings with the SEC, the information incorporated by

reference in this prospectus is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency

between information contained in this prospectus and information incorporated by reference into this prospectus, you should rely on the

information contained in the document that was filed later.

We

incorporate by reference the documents listed below:

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on April 15, 2024; |

| |

|

|

| |

● |

our

Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2024 and June 30, 2024, filed with the SEC on May 15, 2024

and August 14, 20245; |

| |

|

|

| |

● |

our

definitive Proxy Statement on Schedule 14A filed on April 19, 2024 that was incorporated by reference in our Annual Report on Form

10-K for the year ended December 31, 2023; |

| |

|

|

| |

● |

Our

Current Reports on Form 8-K and Form 8-K/A filed with the SEC on October 28, 2024, October 15, 2024, October 11, 2024, September 26, 2024, August 12, 2024, August 2, 2024, July 11, 2024, July 1, 2024, June 3, 2024, May 21, 2024 and April 23, 2024; and |

| |

|

|

| |

● |

All

documents that we file with the SEC on or after the effective time of this prospectus pursuant to Sections 13(a), 13(c), 14 or 15(d)

of the Securities Exchange Act of 1934 and prior to the sale of all the securities registered hereunder or the termination of the

registration statement. |

Unless

expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to,

but not filed with, the SEC.

We

will provide to each person, including any beneficial owner, who receives a copy of this prospectus, upon written or oral request, without

charge, a copy of any or all of the documents we refer to above which we have incorporated by reference in this prospectus, except for

exhibits to such documents unless the exhibits are specifically incorporated by reference into this prospectus. You should direct your

requests to the attention of our chief financial officer at our principal executive office located at 6565 E. Washington Blvd., Commerce,

CA 90040. Our telephone number at this address is (323) 888-9999.

You

should rely only on the information contained or incorporated by reference in this prospectus, in any applicable prospectus supplement

or any related free writing prospectus that we may authorize to be delivered to you. We have not authorized any other person to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will

not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information

appearing in this prospectus, the applicable supplement to this prospectus or in any related free writing prospectus is accurate as of

its respective date, and that any information incorporated by reference is accurate only as of the date of the document incorporated

by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since

those dates.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

We

estimate the fees and expenses to be incurred by us in connection with the resale of the shares in this offering, other than underwriting

discounts and commissions, to be as follows:

| SEC registration fee | |

$ | 210.60 | |

| Legal fees and expenses | |

$ | 10,000 | |

| Accounting fees and expenses | |

$ | 10,000 | |

| Miscellaneous expenses | |

$ | 500 | |

| | |

| | |

| Total | |

$ | 20,710.60 | |

All

amounts are estimated except the SEC registration fee.

Item 15. Indemnification of Directors and Officers

Section

78.138 of the NRS provides that a director or officer is not individually liable to the corporation or its shareholders or creditors

for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that (1)

the director’s or officer’s act or failure to act constituted a breach of his fiduciary duties as a director or officer and

(2) his or her breach of those duties involved intentional misconduct, fraud or a knowing violation of law.

This

provision is intended to afford directors and officers protection against and to limit their potential liability for monetary damages

resulting from suits alleging a breach of the duty of care by a director or officer. As a consequence of this provision, shareholders

of our Company will be unable to recover monetary damages against directors or officers for action taken by them that may constitute

negligence or gross negligence in performance of their duties unless such conduct falls within one of the foregoing exceptions. The provision,

however, does not alter the applicable standards governing a director’s or officer’s fiduciary duty and does not eliminate

or limit the right of our company or any shareholder to obtain an injunction or any other type of non-monetary relief in the event of

a breach of fiduciary duty.

Our

Articles of Incorporation and Amended and Restated Bylaws provide, among other things, that a director, officer, employee or agent of

the corporation may be indemnified against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement

actually and reasonably incurred by such person in connection with such claim, action, suit or proceeding if such person acted in good

faith and in a manner such person reasonably believed to be in or not opposed to the best of our interests, and with respect to any criminal

action or proceeding, such person had no reasonable cause to believe that such person’s conduct was unlawful. The Company also

maintains an insurance policy to assist in funding indemnification of directors and officers for certain liabilities.

Insofar

as indemnification for liabilities arising under the Securities Act may be provided for directors, officers, employees, agents or persons

controlling an issuer pursuant to the foregoing provisions, the opinion of the SEC is that such indemnification is against public policy

as expressed in the Securities Act, and is therefore unenforceable. In the event that a claim for indemnification by such director, officer

or controlling person of us in the successful defense of any action, suit or proceeding is asserted by such director, officer or controlling

person in connection with the securities being offered, we will, unless in the opinion of our counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public

policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 16. Exhibits

| Exhibit |

|

Title |

| |

|

|

| 3.1 |

|

Articles of Incorporation (Incorporated herein by reference to Exhibit 3.1 to the Company’s Registration Statement on Form S-1, dated November 10, 2009; File No. 333-163019). |

| 3.2 |

|

Certificate of Amendment to Articles of Incorporation (Incorporated herein by reference to Exhibit 3.3 to the Company’s Current Report on Form 8-K filed on June 30, 2011). |

| 3.3 |

|

Amended and Restated Bylaws (Incorporated herein by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed on June 30, 2011). |

| 3.4 |

|

First Amendment to the Amended and Restated Bylaws of Nova Lifestyle, Inc. (Incorporated herein by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on February 28, 2018) |

| 3.5 |

|

Certificate of Change to Authorized Shares of Nova Lifestyle, Inc. (Incorporated herein by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on December 20, 2019) |

| 3.6 |

|

Certificate of Change filed with the Nevada Secretary of State on May 22, 2023 (Incorporated herein by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on May 23, 2023) |

| 3.7 |

|

Certificate of Change to the Articles of Incorporation of Nova LifeStyle Inc. filed with the Nevada Secretary of State on September 5, 2023 (Incorporated herein by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on September 6, 2023) |

| 5.1 |

|

Opinion of FisherBroyles, LLP |

| 10.1 |

|

Securities Purchase Agreement by and between Nova LifeStyle Inc. and Huge Energy International Limited dated May 16, 2024 (Incorporated herein by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on May 21, 2024) |

| 10.2 |

|

Securities Purchase Agreement by and between Nova LifeStyle Inc.and Huge Energy International Limited dated July 30, 2024 (Incorporated herein by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on August 2, 2024) |

| 10.3 |

|

Securities Purchase Agreement by and between Nova LifeStyle Inc.and Huge Energy International Limited dated October 25, 2024 (Incorporated herein by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on October 28, 2023) |

| 10.4 |

|

Sale and Purchase Agreement by and among Nova LifeStyle Inc., Nova Living (M) Sdn Bhd and Hong Sheng Sdn Bhd dated July 5, 2024 (Incorporated herein by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on July 11, 2024) |

| 10.5 |

|

Sale and Purchase Agreement by and among Nova LifeStyle Inc., Nova Living (M) Sdn Bhd and VT Conceptone Sdn Bhd dated August 7, 2024 (Incorporated herein by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on August 12, 2024) |

| 23.1 |

|

Consent of WWC, P.C. |

| 23.2 |

|

Consent of FisherBroyles, LLP (included in Exhibit 5.1) |

| 24.1 |

|

Power of Attorney |

| 107 |

|

Calculation of Filing Fee Tables |

Item 17. Undertakings

The

undersigned hereby undertakes:

| |

(1) |

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

(i) |

To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| |

|

|

| |

(ii) |

To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end

of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b)

(§230.424(b)) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

and |

| |

|

|

| |

(iii) |

To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

provided,

however, that paragraphs (1)(i), (1)(ii) and (1)(iii) above do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section

13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained

in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| |

(2) |

That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. |

| |

|

|

| |

(3) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| |

|

|

| |

(4) |

That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| |

(i) |

Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) (§230.424(b)(3)) shall be deemed to be part of the registration

statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| |

|

|

| |

(ii) |

Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement

or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into

the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract

of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus

that was part of the registration statement or made in any such document immediately prior to such effective date. |

| |

(5) |

That,

for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller

to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| |

(i) |

Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424 (§230.424); |

| |

|

|

| |

(ii) |

Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant; |

| |

|

|

| |

(iii) |

The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and |

| |

|

|

| |

(iv) |

Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| |

(6) |

The

undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

|

|

| |

(7) |

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion

of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant

of expenses incurred or paid by a director, officer, or controlling person of the registrant in the successful defense of any action,

suit, or proceeding) is asserted by such director, officer, or controlling person in connection with the securities being registered,

the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities

Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Commerce, State of California on November 12, 2024.

| |

NOVA

LIFESTYLE, INC. |

| |

|

|

| |

By: |

/s/

Thanh H. Lam |

| |

|

Thanh

H. Lam |

| |

|

Chief

Executive Officer (Principal Executive Officer) |

Each

person whose signature appears below constitutes and appoints Thanh Lam as his or her true and lawful attorneys-in-fact and agents, with

full power of substitution and resubstitution, for her and in her name, place and stead, in any and all capacities, to sign any and all

amendments to this Registration Statement on Form S-3 or other applicable form, with all exhibits thereto, or any and all amendments

(including pre-effective and post-effective amendments) and supplements to a registration statement, and to file the same, with exhibits

thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact

and agents, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection

therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact

and agents, or their substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

|

Date |

|

Title |

| |

|

|

|

|

| /s/

Thanh H. Lam |

|

November

12, 2024 |

|

Chief

Executive Officer, President, |

| Thanh

H. Lam |

|

|

|

Director

and Chairperson

(Principal

Executive Officer) |

| |

|

|

|

|

| /s/

Jeffery Chuang |

|

November

12, 2024 |

|

Chief

Financial Officer |

| Jeffery

Chuang |

|

|

|

(Principal

Financial and Accounting Officer) |

| |

|

|

|

|

| /s/

Min Su |

|

November

12, 2024 |

|

Director |

| Min

Su |

|

|

|

|

| |

|

|

|

|

| /s/

Umesh Patel |

|

November

12, 2024 |

|

Director |

| Umesh

Patel |

|

|

|

|

| |

|

|

|

|

| /s/

Ming-Cherng Sky Tsai |

|

November

12, 2024 |

|

Director |

| Ming-Cherng

Sky Tsai |

|

|

|

|

| |

|

|

|

|

| /s/

Huy P. La |

|

November

12, 2024 |

|

Director |

| Huy

P. La |

|

|

|

|

Exhibit

5.1

November

12, 2024

Nova

LifeStyle, Inc.

6565

E. Washington Blvd.

Commerce,

CA 90040

Re:

Registration Statement on Form S-3

Ladies

and Gentlemen:

We

have acted as counsel to Nova LifeStyle, Inc., a Nevada corporation (the “Company”), in connection with the preparation

and filing with the Securities and Exchange Commission (the “Commission”) of the Company’s Registration Statement

on Form S-3 (the “Registration Statement”) under the Securities Act of 1933 (the “Securities Act”),

registering a total 1,310,000 shares (the “Shares”) of the Common Stock of the Company, $0.001 par value per share, by those

certain selling stockholders named in the Registration Statement (the “Selling Stockholders”) pursuant to Rule 415

under the Securities Act. This opinion letter is being rendered pursuant to Item 16 of Form S-3 and Item 601(b)(5) of Regulation S-K.

The only opinion rendered by this firm consists of the matter set forth in numbered paragraph (1) below (our “Opinion”),

and no opinion is implied or to be inferred beyond such matter. Additionally, our Opinion is based upon and subject to the qualifications,

limitations and exceptions set forth in this letter.

In

rendering our Opinion, we have examined such agreements, documents, instruments and records as we deemed necessary or appropriate under

the circumstances for us to express our Opinion, including, without limitation, the Articles of Incorporation of the Company, as amended,

the Bylaws of the Company, as amended, and the record of corporate proceedings. In making all of our examinations, we assumed the genuineness

of all signatures, the authority of the persons who executed such documents, the authenticity of all documents submitted to us as originals,

the conformity to the original documents of all documents submitted to us as copies, and the due execution and delivery of all documents

by any persons or entities where due execution and delivery by such persons or entities is a prerequisite to the effectiveness of such

documents. As to various factual matters that are material to our Opinion, we have relied upon certificates of public officials and certificates,

resolutions, documents, statements and other information of the Company or its representatives. We have not independently verified or

investigated, nor do we assume any responsibility for, the factual accuracy or completeness of such factual statements.

We

do not herein express any opinion concerning any matter respecting or affected by any laws other than provisions of Chapter 78 of the

Nevada Revised Statutes as now in effect and that, in the exercise of reasonable professional judgment, are normally considered in transactions

such as the issuance of the Shares. We are not opining on, and we assume no responsibility for, the applicability to or effect on any

of the matters covered herein of any other laws, the laws of any other jurisdiction or the local laws of any jurisdiction. The Opinion

hereinafter set forth is based upon pertinent laws and facts in existence as of the date hereof, and we expressly disclaim any obligation

to advise you of changes to such pertinent laws or facts that hereafter may come to our attention.

Based

upon and subject to the foregoing, and in reliance thereon, we are of the following opinion:

1.

the Shares of Common Stock that are issued, outstanding and held by the Selling Stockholders are duly authorized, validly issued, fully

paid and non-assessable.

This

opinion letter is provided for use solely in connection with the resale of the Shares covered by the Registration Statement and except

for its use in connection with such resale, may not be furnished to, quoted from or relied upon by any person, firm, or corporation without

our express written consent. No opinion may be implied or inferred beyond the Opinion expressly stated in the paragraph immediately above.

Our Opinion expressed herein is as of the date hereof, and we undertake no obligation to advise you of any changes in applicable law

or any other matters that may come to our attention after the date hereof that may affect our opinions expressed herein.

We

consent to the filing of this opinion letter as an exhibit to the Registration Statement and to the use of our name under the heading

“Legal Matters” in the prospectus constituting a part thereof. In giving such consent, we do not thereby admit that we are

within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission

thereunder.

| Very

truly yours, |

|

| |

|

| /s/

FisherBroyles, LLP |

|

| FisherBroyles,

LLP |

|

Exhibit

23.1

Consent

of Independent Registered Public Accounting Firm

Nova

LifeStyle, Inc.

We

hereby consent to the incorporation by reference in the Registration Statement on Form S-3 of our report dated April 12, 2024, relating

to the consolidated balance sheets of Nova LifeStyle, Inc., and subsidiaries (collectively the “Company”) as of December

31, 2023 and 2022, and the related consolidated statements of loss and comprehensive loss, stockholders’ equity, and cash flows

in each of the years for the two-year period ended December 31, 2023 and the related notes (collectively referred to as the “financial

statements”) which appears in the Annual Report on Form 10-K of the Company for the year ended December 31, 2023.

We

also consent to the Company’s reference to WWC, P.C., Certified Public Accountants, as experts in accounting and auditing under

the caption “Experts” in such Registration Statement.

/s/

WWC, P.C.

WWC,

P.C.

Certified

Public Accountants

San

Mateo, California

PCAOB

ID: 1171

November

12, 2024

Exhibit

107

Calculation

of Filing Fee Tables

S-3

(Form

Type)

Nova

LifeStyle, Inc.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered and Carry Forward Securities

| | |

Security Type | |

Security

Class Title | |

Fee Calculation

or Carry Forward

Rule | |

Amount

Registered | | |

Proposed Maximum

Offering Price Per

Share(2) | | |

Maximum

Aggregate

Offering Price | | |

Fee Rate | | |

Amount of

Registration

Fee(2) | |

| |

| Newly Registered Securities |

| Fees to Be Paid | |

Equity | |

Common stock, par value $0.001 per share | |

Rule 457(c) | |

| 1,310,000 | | |

$ | 1.05005 | | |

$ | 1,375,565.5 | | |

| 0.00015310 | | |

$ | 210.60 | |

| Fees previously Paid | |

| |

| |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

Total Offering Amounts | |

| | | |

$ | 1.05005 | | |

$ | 1,375,565.5 | | |

| 0.00015310 | | |

$ | 210.60 | |

| | |

Total Fees Previously Paid | |

| | | |

| | | |

| | | |

| | | |

| — | |

| | |

Total Fee Offsets | |

| | | |

| | | |

| | | |

| | | |

| — | |

| | |

Net Fee Due | |

| | | |

| | | |

| | | |

| | | |

$ | 210.60 | |

(1)

Represents the shares of common stock, $0.001 par value per share (the “common stock”), of Nova LifeStyle, Inc. (the “Registrant”)

that will be offered for resale by the selling stockholder pursuant to the prospectus to which this exhibit is attached. Pursuant to

Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares being registered hereunder include

such indeterminate number of additional shares of common stock as may be issuable as a result of stock splits, stock dividends or similar

transactions with respect to the shares being registered hereunder.

(2)

This estimate is made pursuant to Rule 457(c) of the Securities Act solely for purposes of calculating the registration fee. The price

per share and aggregate offering price are based upon the average of the high and low prices of the Registrant’s common stock on

November 11, 2024, as reported on The Nasdaq Capital Market.

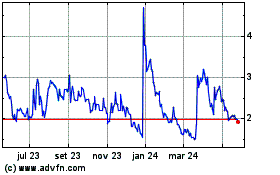

Nova Lifestyle (NASDAQ:NVFY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

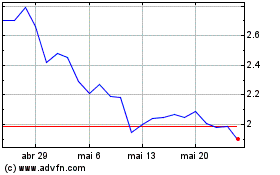

Nova Lifestyle (NASDAQ:NVFY)