false

0000056873

0000056873

2024-10-15

2024-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 15, 2024

The Kroger Co.

(Exact

name of registrant as specified in its charter)

| Ohio |

|

No. 1-303 |

|

31-0345740 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

1014 Vine Street

Cincinnati, OH 45202

(Address

of principal executive offices, including zip code)

Registrant’s telephone number, including

area code: (513) 762-4000

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common

Stock $1.00 par value per share |

|

KR |

|

New

York Stock Exchange |

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On October 15, 2024, The Kroger Co. (the “Company”)

announced that it has extended the expiration date of the previously announced offers to exchange (collectively, the “Exchange Offers”)

any and all outstanding notes (the “ACI Notes”) issued by Albertsons Companies, Inc. (“ACI”), New Albertsons,

L.P., Safeway Inc., Albertson’s LLC, Albertsons Safeway LLC and American Stores Company, LLC (collectively, the “ACI Issuing

Entities”), for up to $7,441,608,000 aggregate principal amount of new notes to be issued by the Company and cash. Additionally,

the Company announced today that it has extended the expiration date for the related solicitations of consents (collectively, the “Consent

Solicitations”) to adopt certain proposed amendments (the “Proposed Amendments”) to each of the indentures (each an

“ACI Indenture” and, collectively, the “ACI Indentures”) governing the ACI Notes, solely with respect to the Unconsented

Series (as defined in the Company’s press release issued on September 11, 2024, a copy of which was attached as Exhibit 99.1

to the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission on September 11, 2024).

The Company extended such expiration date from 5:00 p.m., New York City time, on October 16, 2024, to 5:00 p.m., New York City

time, on October 22, 2024 (as the same may be further extended, the “Expiration Date”).

The Exchange Offers and Consent Solicitations were commenced in connection

with the pending merger between a wholly owned direct subsidiary of the Company and ACI, with ACI surviving the merger as a direct, wholly

owned subsidiary of the Company (the “Merger”) and are being made solely pursuant to the terms and subject to the conditions

described in the confidential offering memorandum and consent solicitation statement dated August 15, 2024, as amended by subsequent

press releases issued by the Company, in a private offering exempt from, or not subject to, registration under the Securities Act of 1933,

as amended, and are conditioned, among other things, upon the closing of the Merger. The settlement of the Exchange Offers and Consent

Solicitations is expected to occur promptly after the Expiration Date and is expected to occur on or promptly after the closing date of

the Merger.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed with this report:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

THE KROGER CO. |

| |

|

|

| October 15, 2024 |

By: |

/s/ Christine S. Wheatley |

| |

|

Christine S. Wheatley |

| |

|

Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

Kroger Announces Extension of Exchange Offers

and Consent Solicitations for Albertsons Companies, Inc. Notes

CINCINNATI, October 15, 2024 — The

Kroger Co. (NYSE:KR) (the “Company” or “Kroger”) announced today that it has extended the expiration date of

the previously announced offers to exchange (the “Exchange Offers”) any and all outstanding notes (the “ACI Notes”)

of Albertsons Companies, Inc. (NYSE:ACI) (“ACI”), New Albertsons, L.P., Safeway Inc., Albertson’s LLC, Albertsons

Safeway LLC and American Stores Company, LLC, as applicable, for up to $7,441,608,000 aggregate principal amount of new notes to be issued

by the Company (the “Kroger Notes”) and cash. Additionally, Kroger announced today that it has extended the expiration date

for the related solicitations of consents (collectively, the “Consent Solicitations”) to adopt certain proposed amendments

(the “Proposed Amendments”) to the indentures (collectively, the “ACI Indentures”) governing the ACI Notes, solely

with respect to the Unconsented Series (as defined in the Company’s press release issued on September 11, 2024). The

Company hereby extends such expiration date from 5:00 p.m. New York City time on October 16, 2024 to 5:00 p.m. New York

City time on October 22, 2024 (as the same may be further extended, the “Expiration Date”).

As of August 29, 2024, the requisite number

of consents were received to adopt the Proposed Amendments with respect to the Consented Series (as defined in the Company’s

press release issued on September 11, 2024), and the relevant parties had executed supplemental indentures to the applicable ACI

Indentures implementing the Proposed Amendments. The Proposed Amendments will only become operative upon the settlement of the Exchange

Offers, which is expected to occur promptly after the Expiration Date.

Tenders of ACI Notes made pursuant to the Exchange

Offers (but not consents delivered pursuant to the Consent Solicitations) may be validly withdrawn at or prior to the Expiration Date.

The Exchange Offers and Consent Solicitations

are being made pursuant to the terms and subject to the conditions described in the confidential offering memorandum and consent solicitation

statement dated August 15, 2024 (the “Offering Memorandum”), as amended by subsequent related press releases issued

by the Company and as further amended by this press release, and is conditioned upon the closing of the merger of a wholly owned subsidiary

of the Company with and into ACI, with ACI surviving the merger as a direct, wholly owned subsidiary of the Company (the “Merger”),

which condition may not be waived by Kroger, and certain other conditions that may be waived by Kroger. The closing of the Merger

is not conditioned upon the completion of the Exchange Offers or Consent Solicitations.

The settlement of the Exchange Offers and Consent

Solicitations is expected to occur promptly after the Expiration Date and is expected to occur on or promptly after the closing date

of the Merger. The Merger is expected to close during the fourth quarter of calendar year 2024 and, as a result, the Expiration Date

may be further extended by the Company. Kroger currently anticipates providing notice of any such extension in advance of the Expiration

Date. If, at the Expiration Date, the conditions to the Exchange Offers and Consent Solicitations (other than the consummation of the

Merger) have been satisfied or waived, then settlement will occur on or about the date that the Merger is consummated.

Except as described in this press release and

the Company’s related press releases regarding the Exchange Offers, all other terms of the Exchange Offers and Consent Solicitations

remain unchanged.

Documents relating to the Exchange Offers and

Consent Solicitations will only be distributed to eligible holders of ACI Notes who complete and return an eligibility certificate confirming

that they are either a “qualified institutional buyer” under Rule 144A or not a “U.S. person” and outside

the United States under Regulation S for purposes of applicable securities laws. The complete terms and conditions of the Exchange Offers

and Consent Solicitations are described in the Offering Memorandum, copies of which may be obtained by contacting the exchange agent

and information agent in connection with the Exchange Offers and Consent Solicitations, at (855) 654-2015 (toll-free) or (212) 430-3774

(banks and brokers), or by email at contact@gbsc-usa.com. The eligibility certificate is available electronically at: https://gbsc-usa.com/eligibility/kroger

and is also available by contacting Global Bondholder Services Corporation.

This press release does not constitute an

offer to sell or purchase, or a solicitation of an offer to sell or purchase, or the solicitation of tenders or consents with respect

to, any security. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation or sale

would be unlawful. The Exchange Offers and Consent Solicitations are being made solely pursuant to the Offering Memorandum and only to

such persons and in such jurisdictions as are permitted under applicable law.

The Kroger Notes offered in the Exchange Offers

have not been registered under the Securities Act of 1933, as amended, or any state securities laws. Therefore, the Kroger Notes may

not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the

Securities Act of 1933, as amended, and any applicable state securities laws.

About Kroger

At The Kroger Co. (NYSE:KR),

we are dedicated to our Purpose: to Feed the Human Spirit™. We are, across our family of companies nearly 420,000 associates who

serve over eleven million customers daily through a seamless digital shopping experience and retail food stores under a variety of banner

names, serving America through food inspiration and uplift, and creating #ZeroHungerZeroWaste communities.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended. These statements are

based on Kroger’s assumptions and beliefs in light of the information currently available to the Company. These statements are

subject to a number of known and unknown risks, uncertainties and other important factors, including the risks and other factors discussed

in the “Risk Factors” section of the Offering Memorandum, that could cause actual results and outcomes to differ materially

from any future results or outcomes expressed or implied by such forward looking statements. Such statements are indicated by words or

phrases such as “achieve,” “affect,” “anticipate,” “assumptions,” “believe,”

“committed,” “continue,” “could,” “deliver,” “effect,” “enable,”

“estimate,” “expects,” “future,” “goal,” “growth,” “guidance,”

“intended,” “likely,” “maintain,” “may,” “model,” “plan,” “position,”

“program,” “result,” “strategy,” “strong,” “trend,” “will” and

“would,” and variations of such words and similar phrases. Forward-looking statements are subject to inherent risks and uncertainties.

Various uncertainties and other factors could cause actual results to differ materially from those contained in the forward-looking statements.

These include:

| ● | the

extent to which Kroger’s sources of liquidity are sufficient to meet its requirements

may be affected by the state of the financial markets and the effect that such condition

has on its ability to issue commercial paper at acceptable rates. Kroger’s ability

to borrow under its committed lines of credit, including its bank credit facilities, could

be impaired if one or more of Kroger’s lenders under those lines is unwilling or unable

to honor its contractual obligation to lend to Kroger, or in the event that global pandemics,

natural disasters or weather conditions interfere with the ability of Kroger lenders to lend

to Kroger. Kroger’s ability to refinance maturing debt may be affected by the state

of the financial markets; |

| ● | Kroger’s

ability to achieve sales, earnings, incremental FIFO operating profit, and adjusted free

cash flow goals, which may be affected by: its proposed transaction with ACI including, among

other things, Kroger’s ability to consummate the proposed transaction and related divestiture

plan, including on the terms of the Merger Agreement and divestiture plan, on the anticipated

timeline, with the required regulatory approvals, and/or resolution of pending litigation

challenging the Merger; labor negotiations; potential work stoppages; changes in the unemployment

rate; pressures in the labor market; changes in government-funded benefit programs; changes

in the types and numbers of businesses that compete with us; pricing and promotional activities

of existing and new competitors, and the aggressiveness of that competition; Kroger’s

response to these actions; the state of the economy, including interest rates, the inflationary,

disinflationary and/or deflationary trends and such trends in certain commodities, products

and/or operating costs; the geopolitical environment including wars and conflicts; unstable

political situations and social unrest; changes in tariffs; the effect that fuel costs have

on consumer spending; volatility of fuel margins; manufacturing commodity costs; supply constraints;

diesel fuel costs related to Kroger’s logistics operations; trends in consumer spending;

the extent to which Kroger’s customers exercise caution in their purchasing in response

to economic conditions; the uncertainty of economic growth or recession; stock repurchases;

changes in the regulatory environment in which Kroger operates; Kroger’s ability to

retain pharmacy sales from third party payors; consolidation in the healthcare industry,

including pharmacy benefit managers; Kroger’s ability to negotiate modifications to

multi-employer pension plans; natural disasters or adverse weather conditions; the effect

of public health crises or other significant catastrophic events; the potential costs and

risks associated with potential cyber-attacks or data security breaches; the success of Kroger’s

future growth plans; the ability to execute Kroger’s growth strategy and value creation

model, including continued cost savings, growth of Kroger’s alternative profit businesses,

and Kroger’s ability to better serve its customers and to generate customer loyalty

and sustainable growth through its strategic pillars of Fresh, Our Brands, Data &

Personalization, and Seamless; the successful integration of merged companies and new partnerships;

Kroger’s ability to maintain an investment grade credit rating; and the risks relating

to or arising from its proposed nationwide opioid litigation settlement, including our ability

to finalize and effectuate the settlement, the scope and coverage of the ultimate settlement

and the expected financial or other impacts that could result from the settlement; |

| ● | Kroger’s

ability to achieve these goals may also be affected by its ability to manage the factors

identified above. Kroger’s ability to execute its financial strategy may be affected

by its ability to generate cash flow; |

| ● | Kroger’s

effective tax rate may differ from the expected rate due to changes in tax laws or policies,

the status of pending items with various taxing authorities, and the deductibility of certain

expenses; and |

| ● | the

outcome of the Exchange Offers and Consent Solicitations. |

The Company cannot fully foresee the effects

of changes in economic conditions on Kroger’s business. Other factors and assumptions not identified above, including those discussed

in the “Risk Factors” section of the Offering Memorandum, the “Risk Factors” section in Kroger’s most recently

filed Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and in any subsequent documents that Kroger files with

the U.S. Securities and Exchange Commission, could also cause actual results to differ materially from those set forth in the forward-looking

information. Accordingly, actual events and results may vary significantly from those included in, contemplated or implied by forward-looking

statements made by Kroger or Kroger’s representatives. The Company undertakes no obligation to update the forward-looking information

contained in this press release.

Media Contacts

Erin Rolfes

Director, Corporate Communications & Media Relations

erin.rolfes@kroger.com

Investor Contacts

Rob Quast

Senior Director of Investor Relations

investorrelations@kroger.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

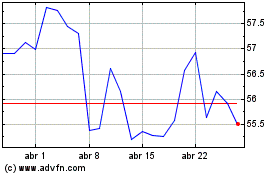

Kroger (NYSE:KR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

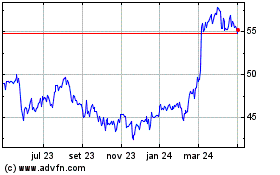

Kroger (NYSE:KR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024