false

0001677077

0001677077

2024-10-15

2024-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

___________________________________________________________________

Date of Report (Date of earliest event reported): October 15, 2024

ALZAMEND NEURO, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40483 |

|

81-1822909 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

3480 Peachtree Road NE, Second Floor, Suite

103, Atlanta, GA 30326

(Address of principal executive offices) (Zip Code)

(844) 722-6333

(Registrant's telephone number, including area

code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

ALZN |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01 | Regulation

FD Disclosure |

As previously reported under Item 3.01 (Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing), on September 26, 2023, Alzamend Neuro,

Inc. (the “Company”) was notified by the Nasdaq Stock Market, LLC (“Nasdaq”) that it did not

meet the minimum market value of listed securities requirement for continued listing on Nasdaq under Nasdaq Listing Rule 5550(b)(2), or

any other continued listing standard, such as the minimum stockholders’ equity requirement as set forth in Nasdaq Listing Rule 5550(b)(1)

(the “Equity Rule”), which requires a minimum stockholders’ equity of $2,500,000, and was provided 180 calendar

days, or until March 25, 2024, to regain compliance. The Company had not regained compliance by March 25, 2024, and Nasdaq determined

to delist the Company’s common stock. The Company appealed the delisting determination to a Hearings Panel (the “Panel”).

In May 2024, the Panel granted the Company’s request to continue its listing on The Nasdaq Capital Market, subject to Alzamend demonstrating

compliance, on or before September 23, 2024, with the Equity Rule and satisfying all applicable requirements for continued listing on

Nasdaq.

On October 14, 2024,

the Company received notice from the Panel that the COmpany Company has regained compliance with the Equity Rule, determined to continue

the listing of the Company’s securities on Nasdaq and stated that the matter is now closed.

On October 15, 2024,

the Company issued a press release to announce that the Company has demonstrated compliance with the Equity Rule and regained compliance

with Nasdaq listing standards. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated

by reference herein.

In accordance with General

Instruction B.2 of Form 8-K, the information under this item shall not be deemed filed for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, except as shall be expressly set forth by specific reference in such a filing. This report will not be deemed an admission

as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

The Securities and Exchange

Commission encourages registrants to disclose forward-looking information so that investors can better understand the future prospects

of a registrant and make informed investment decisions. This Current Report on Form 8-K and exhibits may contain these types of statements,

which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and which

involve risks, uncertainties and reflect the Registrant’s judgment as of the date of this Current Report on Form 8-K. Forward-looking

statements may relate to, among other things, operating results and are indicated by words or phrases such as “expects,” “should,”

“will,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual

results to differ materially from those anticipated at the date of this Current Report on Form 8-K. Investors are cautioned not to rely

unduly on forward-looking statements when evaluating the information presented within.

| Item 9.01 | Financial Statements and Exhibits |

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release dated October 15, 2024 |

| |

|

|

| 101 |

|

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language). |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ALZAMEND NEURO, INC. |

|

| |

|

|

| |

|

|

| Dated: October 15, 2024 |

/s/ Henry Nisser |

|

| |

Henry Nisser

Executive Vice President and General Counsel |

|

-3-

Exhibit 99.1

Alzamend Neuro Regains Compliance with Nasdaq

Listing Standards

ATLANTA, GA, October 15, 2024 -- Alzamend Neuro,

Inc. (Nasdaq: ALZN) (“Alzamend”), a clinical-stage biopharmaceutical company focused on developing novel products for

the treatment of Alzheimer’s disease (“Alzheimer’s”), bipolar disorder (“BD”), major

depressive disorder (“MDD”) and post-traumatic stress disorder (“PTSD”), today announced that it

has received formal written notice from The Nasdaq Stock Market, LLC’s Office of General Counsel (“Nasdaq”)

that Alzamend has demonstrated compliance with the minimum stockholders’ equity requirement as set forth in Nasdaq Listing Rule

5550(b)(1) (the “Equity Rule”), which requires a minimum stockholders’ equity of $2,500,000.

As previously reported, on September 26, 2023,

Alzamend was notified by Nasdaq that it did not meet the minimum market value of listed securities requirement for continued listing

on Nasdaq under Nasdaq Listing Rule 5550(b)(2), or any other continued listing standard, such as the Equity Rule, and was provided 180

calendar days, or until March 25, 2024, to regain compliance. Alzamend had not regained compliance by March 25, 2024, and Nasdaq determined

to delist Alzamend’s common stock. Alzamend appealed the delisting determination to a Hearings Panel (the “Panel”).

In May 2024, the Panel granted Alzamend’s request to continue its listing on The Nasdaq Capital Market, subject to Alzamend demonstrating

compliance, on or before September 23, 2024, with the Equity Rule and satisfying all applicable requirements for continued listing on

Nasdaq.

Earlier this year, Alzamend entered into a securities

purchase agreement to provide for the sale of $25 million of Alzamend’s Series A Convertible Preferred Stock (“Series A

Preferred”) over a period of time. To date, the investor has purchased $8 million of Series A Preferred, with (i) an additional

$2 million to be funded within the next 30 days, as Alzamend has achieved the milestones for such payment and (ii) the investor is obligated

to purchase $1 million of Series A Preferred each month going forward, subject to the terms and conditions set forth in the purchase agreement,

until January 2026. Accordingly, on October 14, 2024, the Panel provided Alzamend with written notice that it had regained compliance

with the Equity Rule and determined to continue the listing of Alzamend’s securities on Nasdaq.

Stephan Jackman, CEO of Alzamend, stated,

“We are very pleased to announce that Alzamend has regained compliance with Nasdaq’s listing standards. We presented a strategic

plan of compliance to the Panel at our hearing in May, which we have successfully executed upon. Regaining compliance with Nasdaq listing

standards was an important goal for Alzamend, and we appreciate the Panel’s confirmation that we were able to deliver on our commitment.

We remain focused on moving forward with our five phase II clinical trials of AL001 in partnership with Massachusetts General Hospital,

which we intend to initiate in 2025.”

About Alzamend Neuro

Alzamend Neuro is a clinical-stage biopharmaceutical

company focused on developing novel products for the treatment of Alzheimer’s, BD, MDD and PTSD. Our mission is to rapidly develop

and market safe and effective treatments. Our current pipeline consists of two novel therapeutic drug candidates, AL001 - a patented ionic

cocrystal technology delivering lithium via a therapeutic combination of lithium, salicylate and L-proline, and ALZN002 - a patented method

using a mutant-peptide sensitized cell as a cell-based therapeutic vaccine that seeks to restore the ability of a patient’s immunological

system to combat Alzheimer’s by removing beta-amyloid from the brain. The latter is a second-generation active-immunity approach

designed to mitigate the disadvantages of approved passive immunity marketed antibody products, particularly by reducing the required

frequency and costs of dosing associated with antibody products. Both of our product candidates are licensed from the University of South

Florida Research Foundation, Inc. pursuant to royalty-bearing exclusive worldwide licenses.

Forward-Looking Statements

This press release contains “forward looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. These forward-looking statements generally include statements that are predictive in nature and depend upon or

refer to future events or conditions, and include words such as “believes,” “plans,” “anticipates,”

“projects,” “estimates,” “expects,” “intends,” “strategy,” “future,”

“opportunity,” “may,” “will,” “should,” “could,” “potential,”

or similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based

on current beliefs and assumptions that are subject to risks and uncertainties. Forward-looking statements speak only as of the date they

are made, and Alzamend undertakes no obligation to update any of them publicly in light of new information or future events. Actual results

could differ materially from those contained in any forward-looking statement as a result of various factors. More information, including

potential risk factors, that could affect Alzamend’s business and financial results are included in Alzamend’s filings with

the U.S. Securities and Exchange Commission. All filings are available at www.sec.gov and on Alzamend’s website at www.Alzamend.com.

Contacts:

Email: Info@Alzamend.com or call: 1-844-722-6333

v3.24.3

Cover

|

Oct. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 15, 2024

|

| Entity File Number |

001-40483

|

| Entity Registrant Name |

ALZAMEND NEURO, INC.

|

| Entity Central Index Key |

0001677077

|

| Entity Tax Identification Number |

81-1822909

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3480 Peachtree Road NE

|

| Entity Address, Address Line Two |

Second Floor

|

| Entity Address, Address Line Three |

Suite

103

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30326

|

| City Area Code |

(844)

|

| Local Phone Number |

722-6333

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

ALZN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

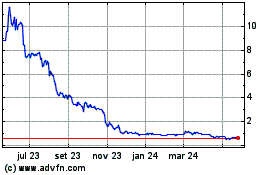

Alzamend Neuro (NASDAQ:ALZN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

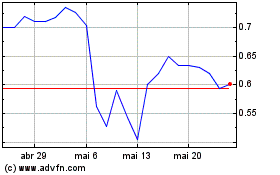

Alzamend Neuro (NASDAQ:ALZN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024