false

0001157647

0001157647

2024-10-23

2024-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2024

WESTERN NEW ENGLAND BANCORP, INC.

(Exact name of registrant as specified in its charter)

| Massachusetts |

|

001-16767 |

|

73-1627673 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 141 Elm Street |

|

| Westfield, Massachusetts |

01085 |

| (Address of principal executive offices) |

(zip code) |

Registrant's telephone number, including area code: (413)

568-1911

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common Stock, $0.01 par value per share |

WNEB |

NASDAQ |

Indicate

by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On October 23, 2024,

Western New England Bancorp, Inc. (the “Company”) issued a press release announcing its financial results for the quarter

and nine months ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 hereto and is hereby

incorporated by reference into this Item 2.02.

| Item 7.01. | Regulation FD Disclosure. |

On October 23, 2024,

the Company made available an investor presentation to be used during investor meetings. The slide show for the investor presentation

is attached to this report as Exhibit 99.2.

The information contained

in this Item 7.01 and Exhibits 99.1 and 99.2 attached hereto, is being furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor will such information or exhibits be deemed incorporated by reference into any filing made

by the Company under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the date hereof and

regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference

in such filing. The furnishing of the information included in Item 7.01 of this Current Report

on Form 8-K shall not be deemed an admission as to the materiality of any information herein that is required to be disclosed solely

by reason of Regulation FD.

| Item 9.01. | Financial Statements and Exhibits. |

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

The exhibits required by this item are set forth on the Exhibit Index

attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

WESTERN NEW ENGLAND BANCORP, INC. |

| |

|

|

|

| |

By: |

/s/ Guida R. Sajdak |

|

| |

|

Guida R. Sajdak |

|

| |

|

Chief Financial Officer |

Dated: October 23, 2024

Western New England Bancorp, Inc.

8-K

Exhibit 99.1

For further information contact:

James C. Hagan, President and CEO

Guida R. Sajdak, Executive Vice President

and CFO

Meghan Hibner, First Vice President and

Investor Relations Officer

413-568-1911

WESTERN NEW ENGLAND BANCORP, INC. REPORTS

RESULTS FOR THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND DECLARES QUARTERLY CASH DIVIDEND

Westfield, Massachusetts, October 23,

2024: Western New England Bancorp, Inc. (the “Company” or “WNEB”) (NasdaqGS: WNEB), the holding company

for Westfield Bank (the “Bank”), announced today the unaudited results of operations for the three and nine months

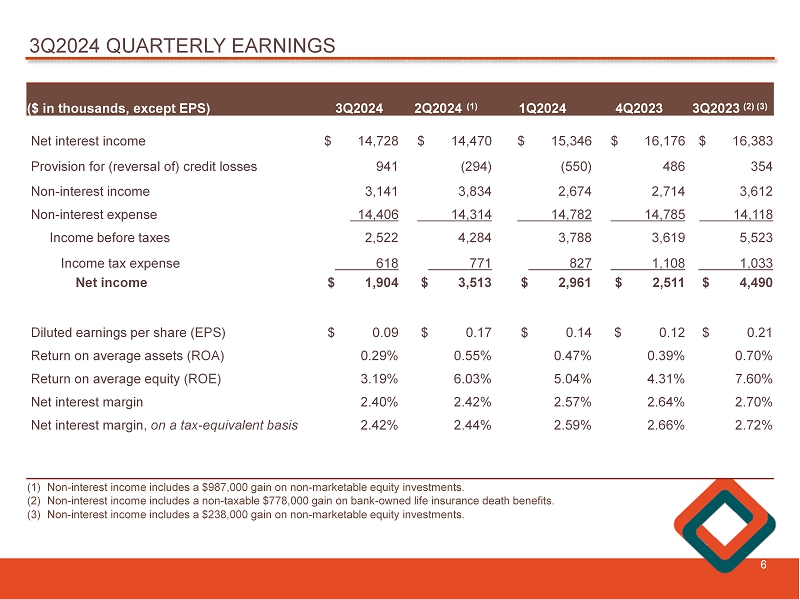

ended September 30, 2024. For the three months ended September 30, 2024, the Company reported net income of $1.9 million, or $0.09

per diluted share, compared to net income of $4.5 million, or $0.21 per diluted share, for the three months ended September 30,

2023. On a linked quarter basis, net income was $1.9 million, or $0.09 per diluted share, as compared to net income of $3.5 million,

or $0.17 per diluted share, for the three months ended June 30, 2024. For the nine months ended September 30, 2024, net income

was $8.4 million, or $0.40 per diluted share, compared to net income of $12.6 million, or $0.58 per diluted share, for the nine

months ended September 30, 2023.

The Company also announced that the Board

of Directors declared a quarterly cash dividend of $0.07 per share on the Company’s common stock. The dividend will be payable

on or about November 21, 2024 to shareholders of record on November 7, 2024.

James C. Hagan, President and Chief Executive

Officer, commented, “We believe our Company continues to be well positioned with strong capital and access to various liquidity

sources. Our financial performance has been largely impacted by the unprecedented interest rate cycle and higher funding costs

in response to the sustained increase in interest rates over the last 18-24 months. While it remains unclear whether the recent

decrease in interest rates represents an end to this trend, the balance sheet is positioned to benefit from this decrease and the

challenge will begin to subside as our liabilities begin to reprice lower. As we continue to manage the balance sheet in this uncertain

interest rate environment, we remain focused on expense management initiatives to mitigate top line pressures and improve efficiencies

over the Company’s long-term. The Company also continues to focus on our core business to grow loans and deposits as well

as retention of our customers. Total deposits increased $80.5 million, or 3.8%, and total loans increased $21.7 million, or 1.1%,

from year-end. Our asset quality remains strong, with nonperforming loans to total loans of 0.24% at September 30, 2024.”

Hagan concluded, “The Company is

considered to be well-capitalized as defined by the regulators and we remain disciplined in our capital management strategies.

During the nine months ended September 30, 2024, we repurchased 714,282 shares of the Company’s common stock at an average

price per share of $7.61. We continue to believe that buying back shares represents a prudent use of the Company’s capital

and we are pleased to be able to continue to return value to shareholders through share repurchases. Although the banking environment

has been challenged, our capital management strategies have been critical to sustaining growth in book value per share, which increased

$0.44, or 4.0%, while tangible book value per share increased $0.43, or 4.2%, to $10.73. The management team remains focused and

well positioned to serve our community and to enhance shareholder value over the long term.”

Key Highlights:

Loans and Deposits

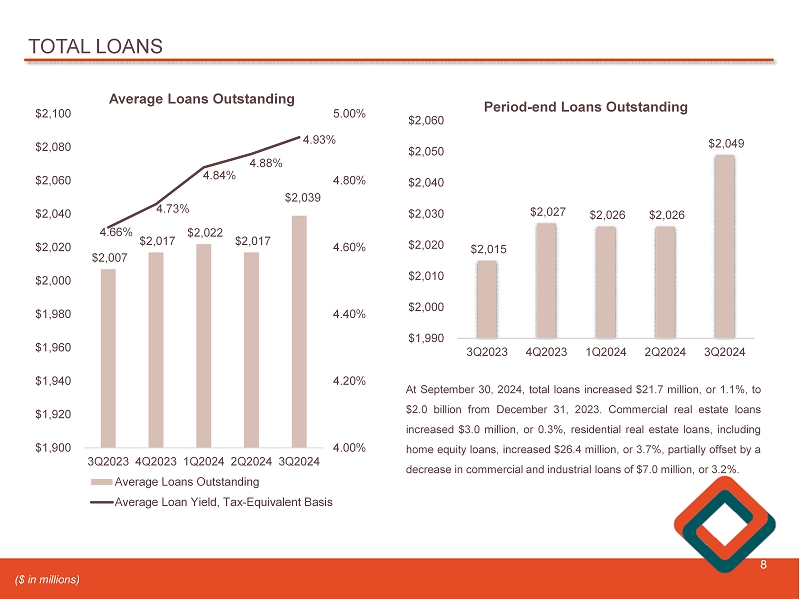

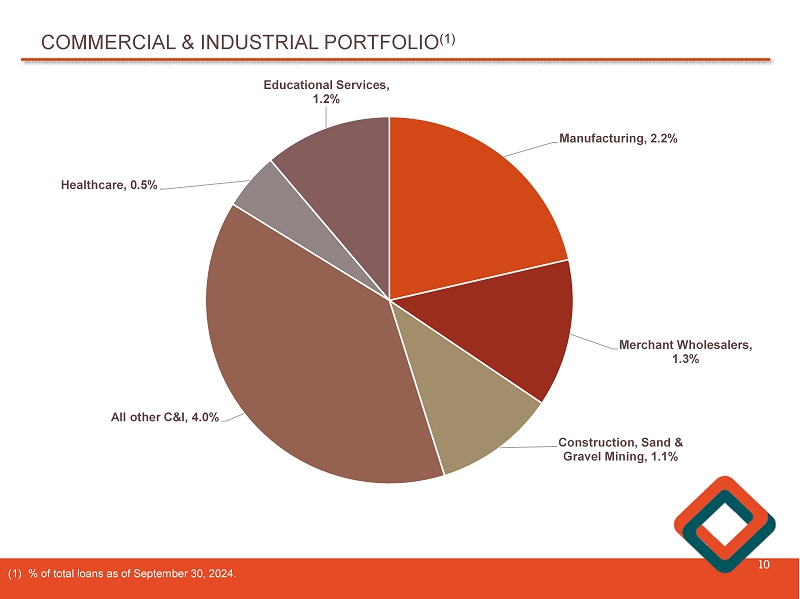

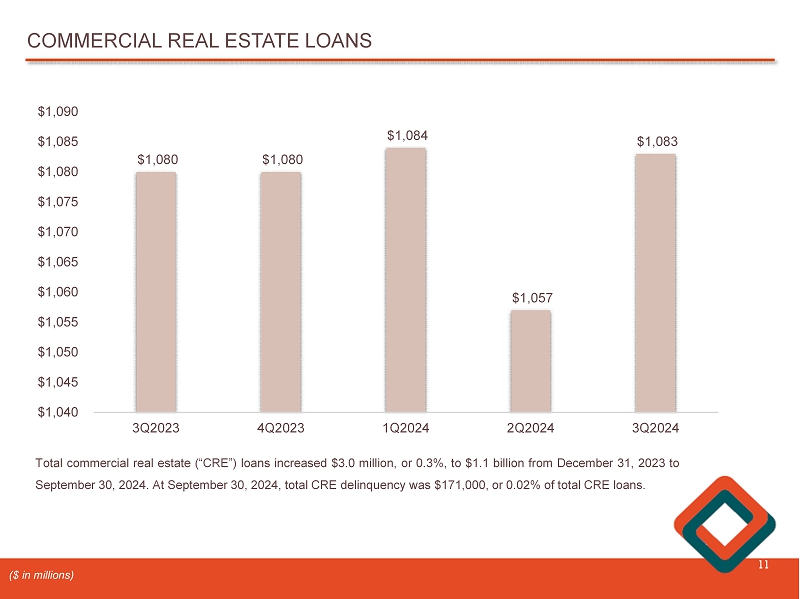

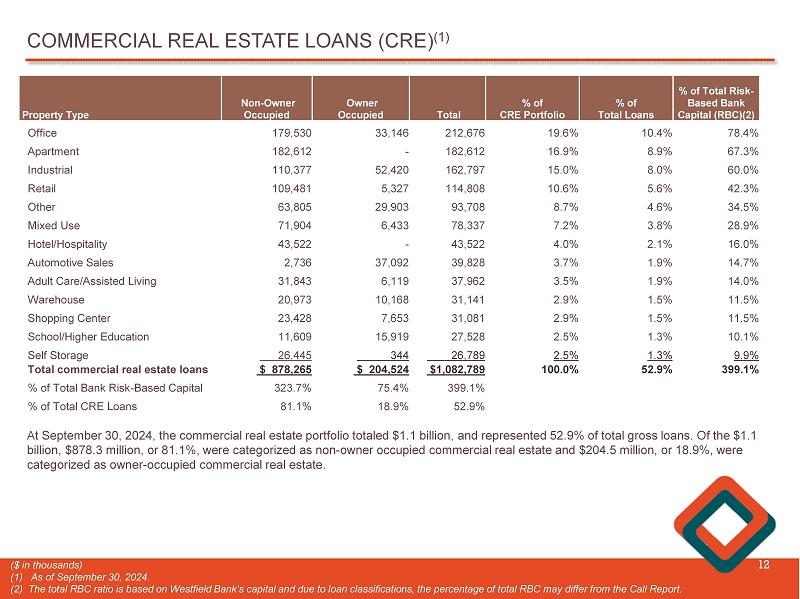

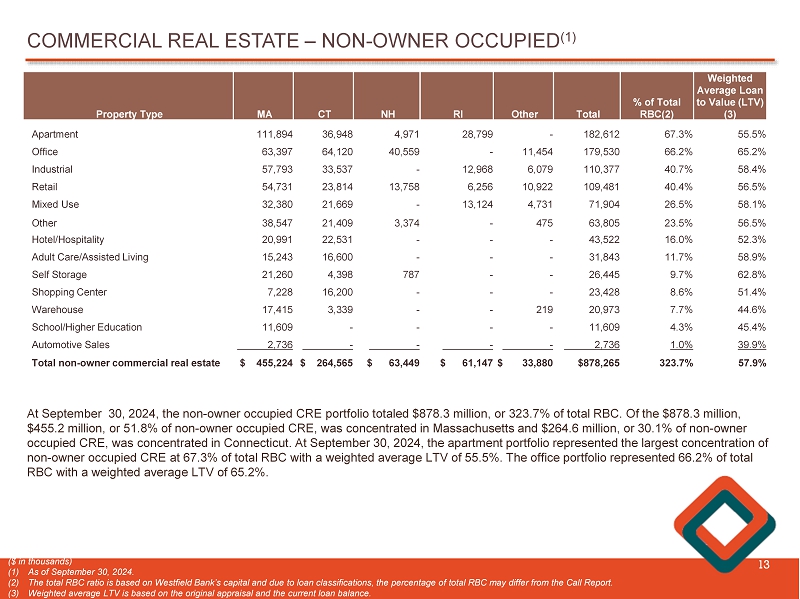

At September 30, 2024, total loans were

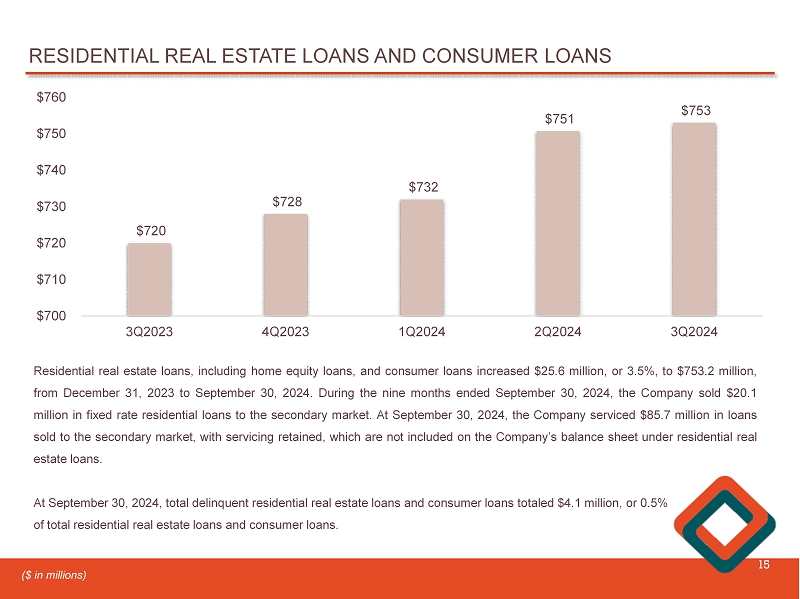

$2.0 billion and increased $21.7 million, or 1.1%, from December 31, 2023. The increase in total loans was due to an increase in

commercial real estate loans of $3.0 million, or 0.3%, an increase in residential real estate loans, including home equity loans,

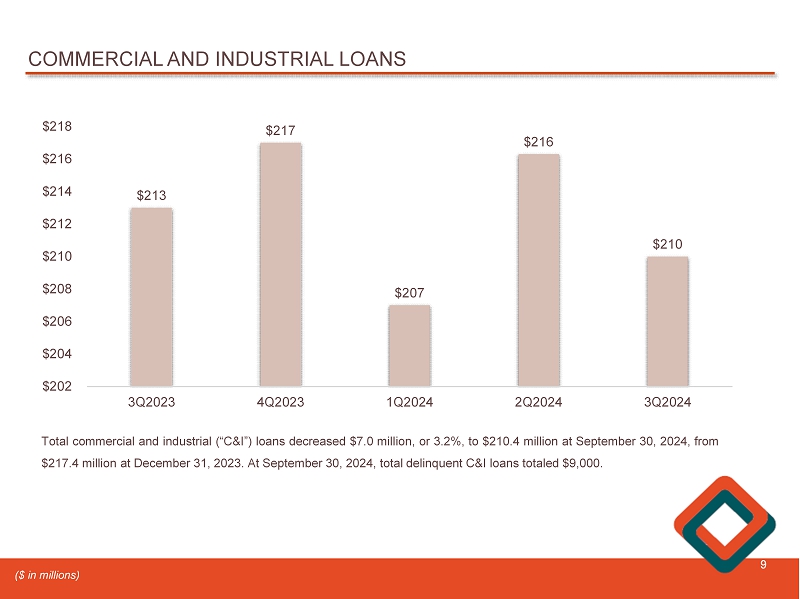

of $26.4 million, or 3.7%, partially offset by a decrease in commercial and industrial loans of $7.0 million, or 3.2%.

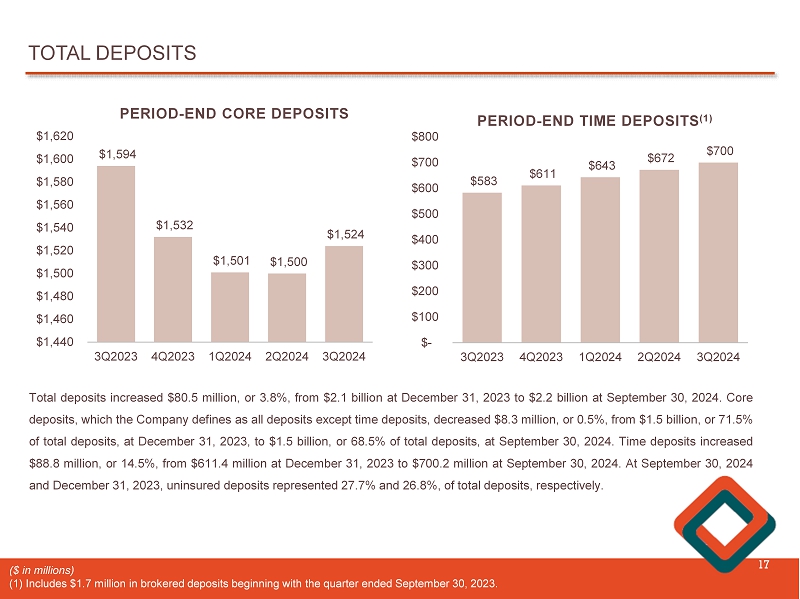

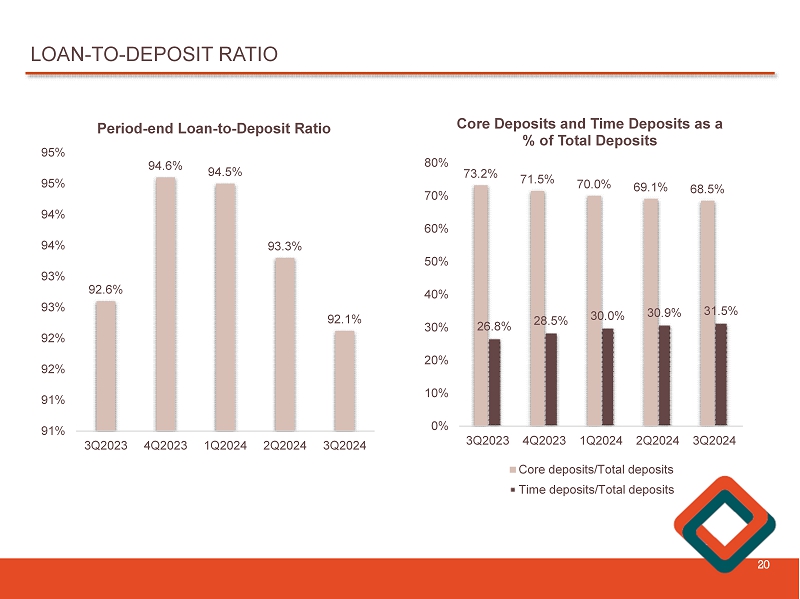

At September 30, 2024, total deposits were

$2.2 billion and increased $80.5 million, or 3.8%, from December 31, 2023. Core deposits, which the Company defines as all deposits

except time deposits, decreased $8.3 million, or 0.5%, from $1.5 billion, or 71.5% of total deposits, at December 31, 2023, to

$1.5 billion, or 68.5% of total deposits at September 30, 2024. Time deposits increased $88.8 million, or 14.5%, from $611.4 million

at December 31, 2023 to $700.2 million at September 30, 2024. Brokered time deposits, which are included in time deposits, totaled

$1.7 million at September 30, 2024 and at December 31, 2023. The loan-to-deposit ratio decreased from 94.6% at December 31, 2023

to 92.1% at September 30, 2024.

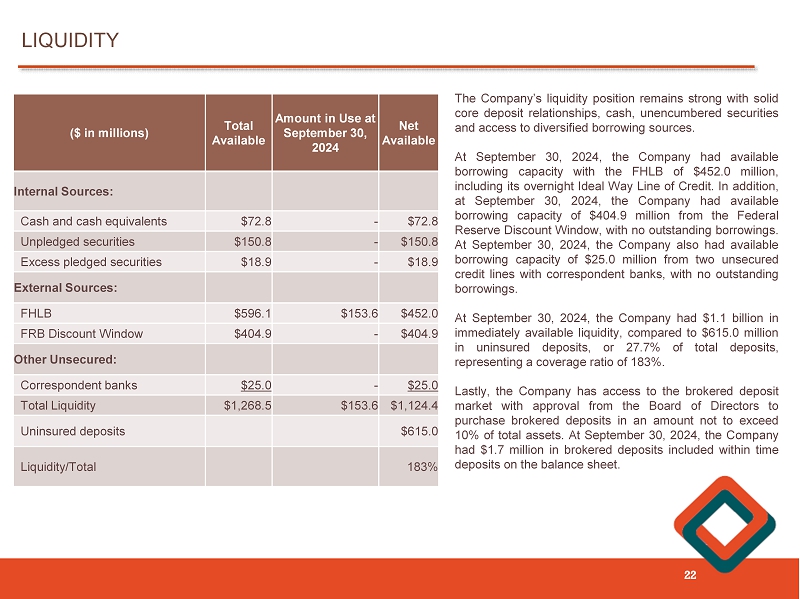

Liquidity

The Company’s liquidity position

remains strong with solid core deposit relationships, cash, unencumbered securities, a diversified deposit base and access to diversified

borrowing sources. At September 30, 2024, the Company had $1.1 billion in immediately available liquidity, compared to $615.0 million

in uninsured deposits, or 27.7% of total deposits, representing a coverage ratio of 183%. Uninsured deposits of the Bank’s

customers are eligible for FDIC pass-through insurance if the customer opens an IntraFi Insured Cash Sweep (“ICS”)

account or a reciprocal time deposit through the Certificate of Deposit Account Registry System (“CDARS”). IntraFi

allows for up to $250.0 million per customer of pass-through FDIC insurance, which would more than cover each of the Bank’s

deposit customers if such customer desired to have such pass-through insurance.

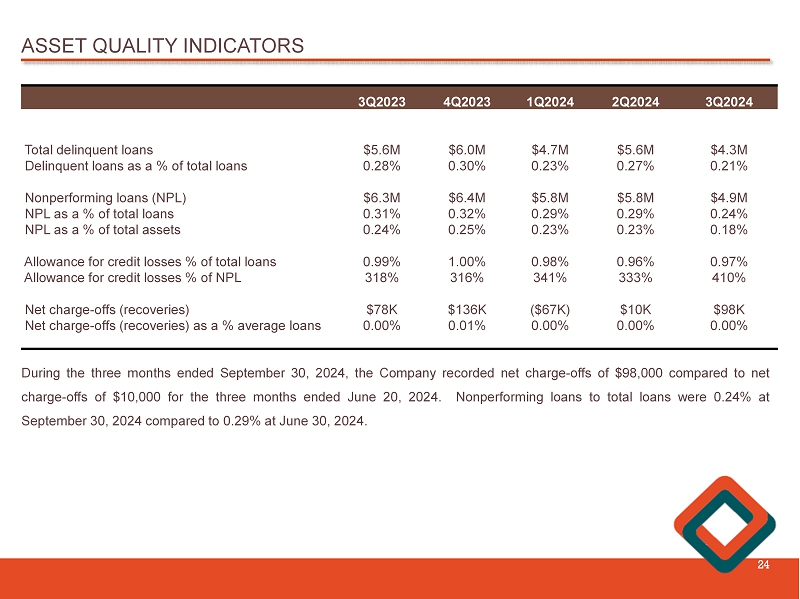

Allowance for Loan Losses and Credit

Quality

At September 30, 2024, the allowance for

credit losses was $20.0 million, or 0.97% of total loans and 409.5% of nonperforming loans, compared to $20.3 million, or 1.00%

of total loans and 315.6% of nonperforming loans at December 31, 2023. At September 30, 2024, nonperforming loans totaled $4.9

million, or 0.24% of total loans, compared to $6.4 million, or 0.32% of total loans, at December 31, 2023. Total delinquent loans

decreased $1.7 million, or 28.3%, from $6.0 million, or 0.30% of total loans, at December 31, 2023 to $4.3 million, or 0.21% of

total loans, at September 30, 2024. At September 30, 2024 and December 31, 2023, the Company did not have any other real estate

owned.

Net Interest Margin

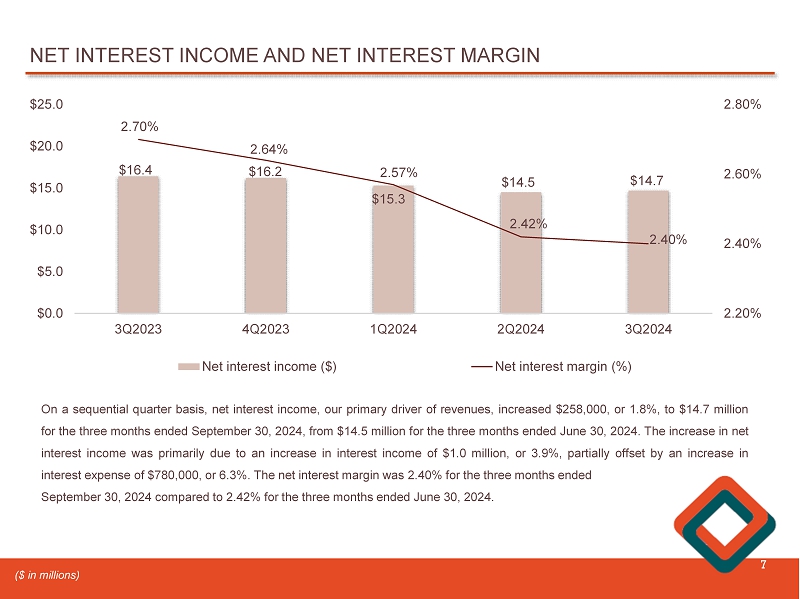

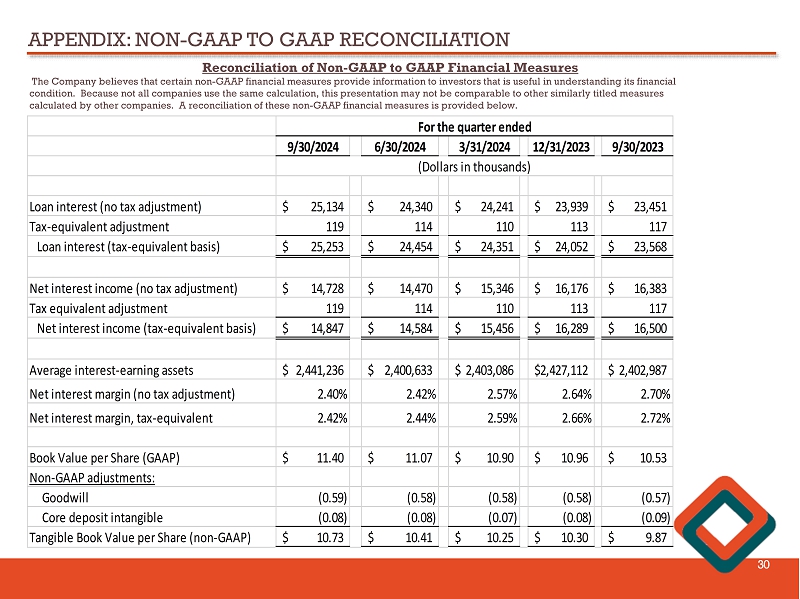

The net interest margin was 2.40% for the

three months ended September 30, 2024 compared to 2.42% for the three months ended June 30, 2024. The net interest margin, on a

tax-equivalent basis, was 2.42% for the three months ended September 30, 2024, compared to 2.44% for the three months ended June

30, 2024.

Stock Repurchase Program

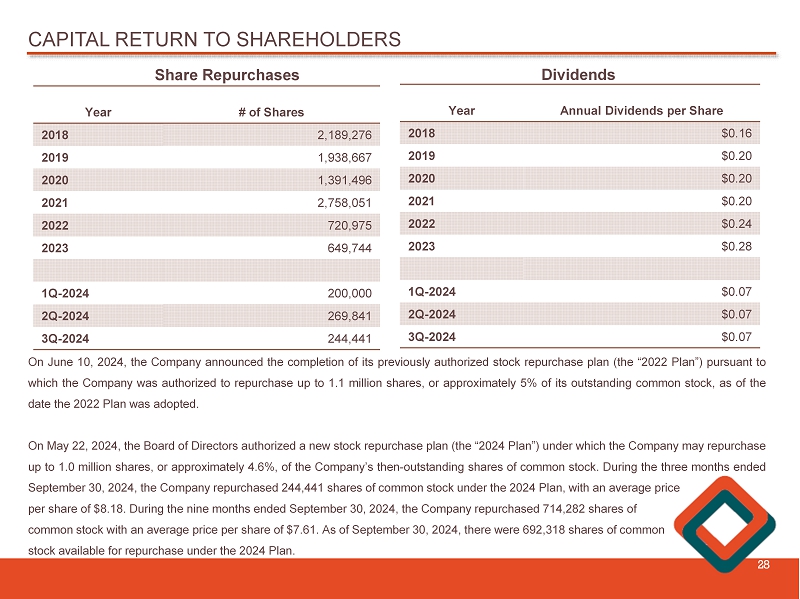

On June 10, 2024, the Company announced

the completion of its previously authorized stock repurchase plan (the “2022 Plan”) pursuant to which the Company was

authorized to repurchase up to 1.1 million shares, or approximately 5% of its outstanding common stock, as of the date the 2022

Plan was adopted. On May 22, 2024, the Board of Directors authorized a new stock repurchase plan (the “2024 Plan”)

under which the Company may repurchase up to 1.0 million shares, or approximately 4.6%, of the Company’s then-outstanding

shares of common stock.

During the three months ended September

30, 2024, the Company repurchased 244,441 shares of common stock under the 2024 Plan, with an average price per share of $8.18.

During the nine months ended September 30, 2024, the Company repurchased 714,282 shares of common stock with an average price per

share of $7.61. As of September 30, 2024, there were 692,318 shares of common stock available for repurchase under the 2024 Plan.

The repurchase of shares under the

stock repurchase program is administered through an independent broker. The shares of common stock repurchased under the 2024 Plan

have been and will continue to be purchased from time to time at prevailing market prices, through open market or privately negotiated

transactions, or otherwise, depending upon market conditions. There is no guarantee as to the exact number, or value, of shares

that will be repurchased by the Company, and the Company may discontinue repurchases at any time that the Company’s management

(“Management”) determines additional repurchases are not warranted. The timing and amount of additional share repurchases

under the 2024 Plan will depend on a number of factors, including the Company’s stock price performance, ongoing capital

planning considerations, general market conditions, and applicable legal requirements.

Book Value and Tangible Book Value

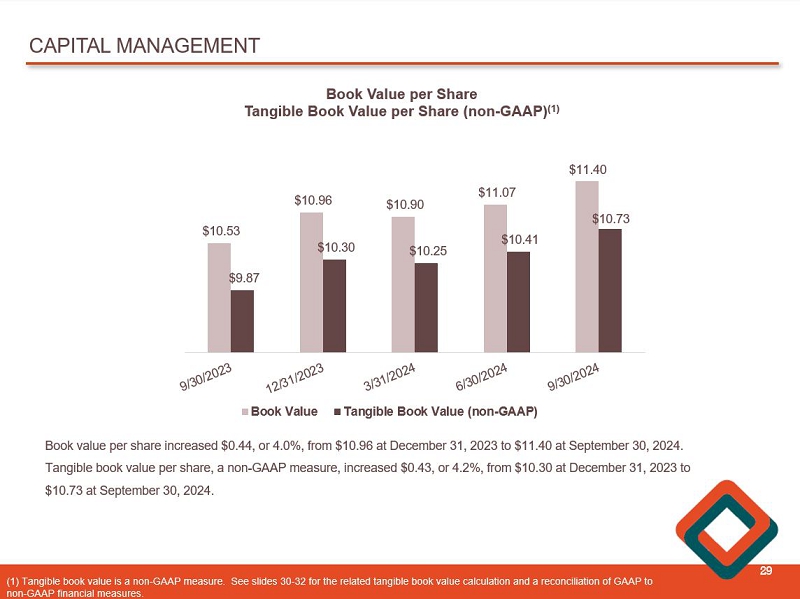

The Company’s book value per share

was $11.40 at September 30, 2024 compared to $10.96 at December 31, 2023, while tangible book value per share, a non-GAAP financial

measure, increased $0.43, or 4.2%, from $10.30 at December 31, 2023 to $10.73 at September 30, 2024. See pages 19-21 for the related

tangible book value calculation and a reconciliation of GAAP to non-GAAP financial measures.

Net Income for the Three Months Ended

September 30, 2024 Compared to the Three Months Ended June 30, 2024

The Company reported net income of $1.9

million, or $0.09 per diluted share, for the three months ended September 30, 2024, compared to net income of $3.5 million, or

$0.17 per diluted share, for the three months ended June 30, 2024. Net interest income increased $258,000, or 1.8%, the provision

for credit losses increased $1.2 million, non-interest income decreased $693,000, or 18.1%, and non-interest expense increased

$92,000, or 0.6%. Return on average assets and return on average equity were 0.29% and 3.19%, respectively, for the three months

ended September 30, 2024, compared to 0.55% and 6.03%, respectively, for the three months ended June 30, 2024.

Net Interest Income and Net Interest

Margin

On a sequential quarter basis, net interest

income, our primary driver of revenues, increased $258,000, or 1.8%, to $14.7 million for the three months ended September 30,

2024, from $14.5 million for the three months ended June 30, 2024. The increase in net interest income was primarily due to an

increase in interest income of $1.0 million, or 3.9%, partially offset by an increase in interest expense of $780,000, or 6.3%.

The net interest margin was 2.40% for the

three months ended September 30, 2024, compared to 2.42% for the three months ended June 30, 2024. The net interest margin, on

a tax-equivalent basis, was 2.42% for the three months ended September 30, 2024, compared to 2.44% for the three months ended June

30, 2024. The decrease in the net interest margin was primarily due to an increase in the average cost of interest-bearing liabilities,

which was partially offset by an increase in the average yield on interest-earning assets. During the three months ended September

30, 2024 and the three months ended June 30, 2024, the Company had a fair value hedge which contributed to an increase in the net

interest margin of seven basis points. Excluding the interest income attributed to the fair value hedge, the net interest margin

was 2.33% and 2.35%, for the three months ended September 30, 2024 and the three months ended June 30, 2024, respectively. The

fair value hedge is scheduled to mature in October of 2024.

The average yield on interest-earning assets,

without the impact of tax-equivalent adjustments, was 4.54% for the three months ended September 30, 2024, compared to 4.49% for

the three months ended June 30, 2024. The average loan yield, without the impact of tax-equivalent adjustments, was 4.90% for the

three months ended September 30, 2024, compared to 4.85% for the three months ended June 30, 2024. During the three months ended

September 30, 2024, average interest-earning assets increased $40.6 million, or 1.7% to $2.4 billion, primarily due to an increase

in average loans of $21.5 million, or 1.1%, an increase in average short-term investments, consisting of cash and cash equivalents,

$17.7 million, or 123.6%, and an increase in average other investments of $1.6 million, or 11.0%.

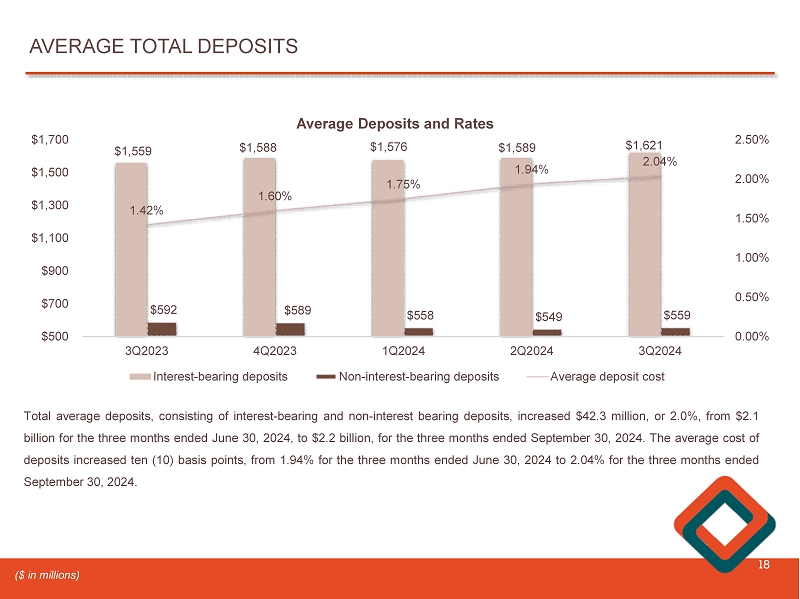

The average cost of total funds, including

non-interest bearing accounts and borrowings, increased eight basis points from 2.16% for the three months ended June 30, 2024

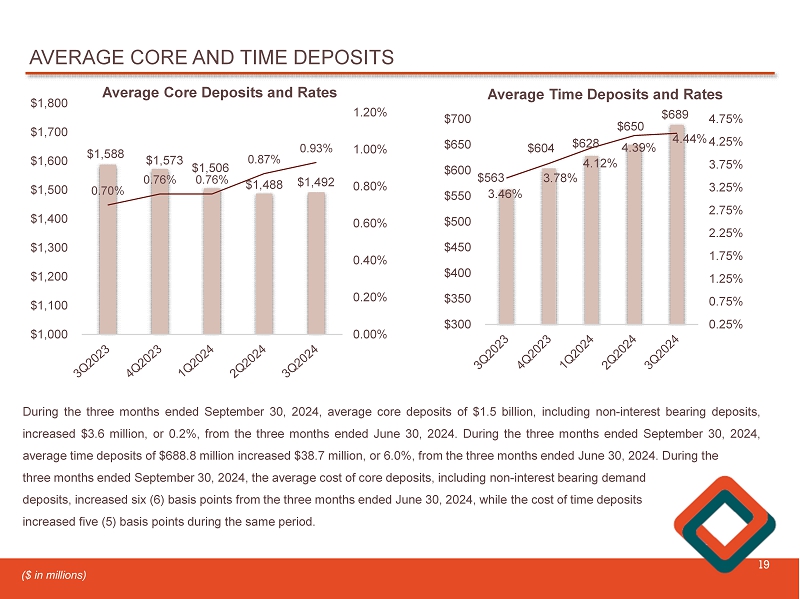

to 2.24% for the three months ended September 30, 2024. The average cost of core deposits, which the Company defines as all deposits

except time deposits, increased six basis points to 0.93% for the three months ended September 30, 2024, from 0.87% for the three

months ended June 30, 2024. The average cost of time deposits increased five basis points from 4.39% for the three months ended

June 30, 2024 to 4.44% for the three months ended September 30, 2024. The average cost of borrowings, including subordinated debt,

increased five basis points from 5.00% for the three months ended June 30, 2024 to 5.05% for the three months ended September 30,

2024. Average demand deposits, an interest-free source of funds, increased $10.4 million, or 1.9%, from $548.8 million, or 25.7%

of total average deposits, for the three months ended June 30, 2024, to $559.2 million, or 25.7% of total average deposits, for

the three months ended September 30, 2024.

Provision for (Reversal of) Credit Losses

During the three months ended September

30, 2024, the Company recorded a provision for credit losses of $941,000, compared to a reversal for credit losses of $294,000

during the three months ended June 30, 2024. The provision for credit losses includes a provision for credit losses on loans of

$609,000 and a reserve on unfunded loan commitments of $332,000. The increase in the provision for credit losses on loans was due

to changes in the economic environment and related adjustments to the quantitative components of the CECL methodology as well as

growth in the loan portfolio. The provision for credit losses was determined by a number of factors: the continued strong credit

performance of the Company’s loan portfolio, changes in the loan portfolio mix and Management’s consideration of existing

economic conditions and the economic outlook from the Federal Reserve’s actions to control inflation. The increase in reserves

on unfunded loan commitments was due to an increase in commercial real estate unfunded loan commitments of $33.5 million, or 20.7%,

from $161.8 million at June 30, 2024 to $195.3 million at September 30, 2024. Management continues to monitor macroeconomic

variables related to increasing interest rates, inflation and the concerns of an economic downturn, and believes it is appropriately

reserved for the current economic environment.

During the three months ended September

30, 2024, the Company recorded net charge-offs of $98,000, compared to net charge-offs of $10,000 for the three months ended June

30, 2024.

Non-Interest Income

On a sequential quarter basis, non-interest

income decreased $693,000, or 18.1%, to $3.1 million for the three months ended September 30, 2024, from $3.8 million for the three

months ended June 30, 2024. Service charges and fees on deposits were $2.3 million for the three months ended September 30, 2024

and the three months ended June 30, 2024. Income from bank-owned life insurance (“BOLI”) decreased $32,000, or 6.4%,

from the three months ended June 30, 2024 to $470,000, for the three months ended September 30, 2024. During the three months ended

September 30, 2024, the Company reported $74,000 in other income from loan-level swap fees on commercial loans and did not have

comparable income during the three months ended June 30, 2024. During the three months ended September 30, 2024, the Company sold

$20.1 million in fixed rate residential loans to the secondary market and reported income from mortgage banking activities of $246,000

and did not have comparable income during the three months ended June 30, 2024. During the three months ended September 30, 2024

and the three months ended June 30, 2024, the Company reported unrealized gains on marketable equity securities of $10,000 and

$4,000, respectively. During the three months ended June 30, 2024, the Company reported a gain on non-marketable equity investments

of $987,000 and did not have comparable gains or losses from non-marketable equity investments during the three months ended September

30, 2024.

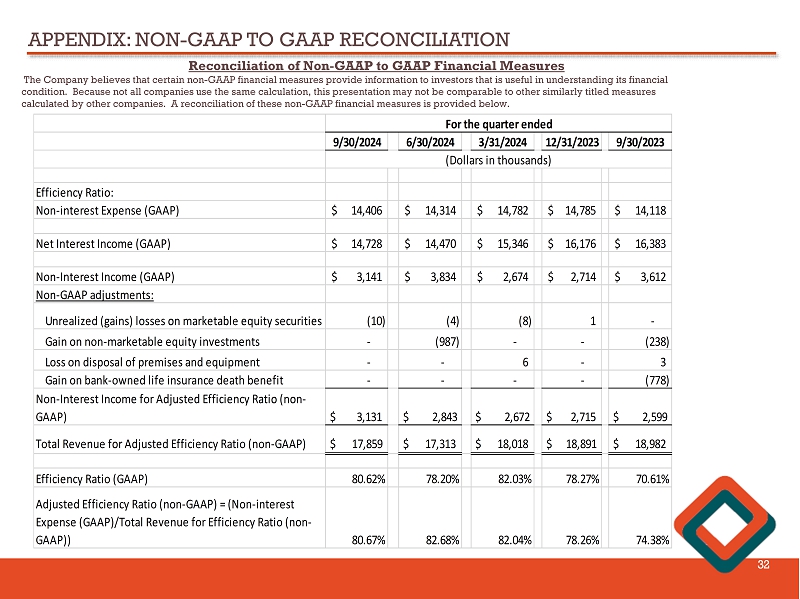

Non-Interest Expense

For the three months ended September 30,

2024, non-interest expense increased $92,000, or 0.6%, to $14.4 million from $14.3 million for the three months ended June 30,

2024. Salaries and employee benefits increased $211,000, or 2.7%, to $8.1 million, software expenses increased $46,000, or 8.1%,

data processing expense increased $23,000, or 2.7%, FDIC insurance expense increased $15,000, or 4.6%, and debit card and ATM processing

fees increased $6,000, or 0.9%. During the same period, these increases were partially offset by a decrease in professional fees

of $41,000, or 7.1%, a decrease in advertising expense of $68,000, or 20.1%, a decrease in occupancy expense of $1,000, or 0.1%,

and a decrease in other non-interest expense of $99,000, or 7.0%.

For the three months ended September 30,

2024, the efficiency ratio was 80.6%, compared to 78.2% for the three months ended June 30, 2024. For the three months ended September

30, 2024, the adjusted efficiency ratio, a non-GAAP financial measure, was 80.7% compared to 82.7% for the three months ended June

30, 2024. The increases in the efficiency ratio and the adjusted efficiency ratio were driven by lower revenues, defined as the

sum of net interest income and non-interest income, during the three months ended September 30, 2024. See pages 19-21 for the related

adjusted efficiency ratio calculation and a reconciliation of GAAP to non-GAAP financial measures.

Income Tax Provision

Income tax expense for the three months

ended September 30, 2024 was $618,000, or an effective tax rate of 24.5%, compared to $771,000, or an effective tax rate of 18.0%,

for the three months ended June 30, 2024. The increase in the effective tax rate for the three months ended September 30, 2024

was driven by the Company’s projections of pre-tax income for the year ending December 31, 2024.

Net Income for the Three Months Ended

September 30, 2024 Compared to the Three Months Ended September 30, 2023.

The Company reported net income of $1.9

million, or $0.09 per diluted share, for the three months ended September 30, 2024, compared to net income of $4.5 million, or

$0.21 per diluted share, for the three months ended September 30, 2023. Net interest income decreased $1.7 million, or 10.1%, provision

for credit losses increased $587,000, non-interest income decreased $471,000, or 13.0%, and non-interest expense increased $288,000,

or 2.0%, during the same period. Return on average assets and return on average equity were 0.29% and 3.19%, respectively, for

the three months ended September 30, 2024, compared to 0.70% and 7.60%, respectively, for the three months ended September 30,

2023.

Net Interest Income and Net Interest

Margin

Net interest income decreased $1.7 million,

or 10.1%, to $14.7 million, for the three months ended September 30, 2024, from $16.4 million for the three months ended September

30, 2023. The decrease in net interest income was due to an increase in interest expense of $3.6 million, or 37.8%, partially offset

by an increase in interest and dividend income of $1.9 million, or 7.5%. Interest expense on deposits increased $3.5 million, or

44.9%, and interest expense on borrowings increased $133,000, or 7.3%. The increase in interest expense was a result of competitive

pricing on deposits due to the continued higher interest rate environment and the unfavorable shift in the deposit mix from low

cost core deposits to high cost time deposits.

The net interest margin was 2.40% for the

three months ended September 30, 2024, compared to 2.70% for the three months ended September 30, 2023. The net interest margin,

on a tax-equivalent basis, was 2.42% for the three months ended September 30, 2024, compared to 2.72% for the three months ended

September 30, 2023. The decrease in the net interest margin was primarily due to an increase in the average cost of interest-bearing

liabilities and the unfavorable shift in the deposit mix from low cost core deposits to high cost time deposits, which was partially

offset by an increase in the average yield on interest-earning assets. During the three months ended September 30, 2024 and the

three months ended September 30, 2023, the Company had a fair value hedge which contributed to an increase in the net interest

margin of seven basis points. Excluding the interest income from the fair value hedge, the net interest margin was 2.33% and 2.64%,

for the three months ended September 30, 2024 and three months ended September 30, 2023, respectively. The fair value hedge is

scheduled to mature in October of 2024.

The average yield on interest-earning assets,

without the impact of tax-equivalent adjustments, was 4.54% for the three months ended September 30, 2024, compared to 4.28% for

the three months ended September 30, 2023. The average loan yield, without the impact of tax-equivalent adjustments, was 4.90%

for the three months ended September 30, 2024, compared to 4.64% for the three months ended September 30, 2023. During the three

months ended September 30, 2024, average interest-earning assets increased $38.2 million, or 1.6% to $2.4 billion, primarily due

to an increase in average loans of $31.3 million, or 1.6%, an increase in average short-term investments, consisting of cash and

cash equivalents, of $9.7 million, or 43.4%, an increase in average other investments of $3.7 million, or 30.8%, partially offset

by a decrease in average securities of $6.5 million, or 1.8%.

The average cost of total funds, including

non-interest bearing accounts and borrowings, increased 60 basis points from 1.64% for the three months ended September 30, 2023

to 2.24% for the three months ended September 30, 2024. The average cost of core deposits, which the Company defines as all deposits

except time deposits, increased 23 basis points to 0.93% for the three months ended September 30, 2024, from 0.70% for the three

months ended September 30, 2023. The average cost of time deposits increased 98 basis points from 3.46% for the three months ended

September 30, 2023 to 4.44% for the three months ended September 30, 2024. The average cost of borrowings, including subordinated

debt, increased 24 basis points from 4.81% for the three months ended September 30, 2023 to 5.05% for the three months ended September

30, 2024. Average demand deposits, an interest-free source of funds, decreased $32.7 million, or 5.5%, from $591.9 million, or

27.5% of total average deposits, for the three months ended September 30, 2023, to $559.2 million, or 25.7% of total average deposits,

for the three months ended September 30, 2024.

Provision for Credit Losses

During the three months ended September

30, 2024, the Company recorded a provision for credit losses of $941,000, compared to a provision for credit losses of $354,000,

during the three months ended September 30, 2023. The increase was primarily due to an increase in the loan portfolio, specifically

unfunded commercial real estate loan commitments, as well as changes in the economic environment and related adjustments to the

quantitative components of the CECL methodology. The provision for credit losses was determined by a number of factors: the continued

strong credit performance of the Company’s loan portfolio, changes in the loan portfolio mix and Management’s consideration

of existing economic conditions and the economic outlook from the Federal Reserve’s actions to control inflation. Management

continues to monitor macroeconomic variables related to increasing interest rates, inflation and the concerns of an economic downturn,

and believes it is appropriately reserved for the current economic environment.

The Company recorded net charge-offs of

$98,000 for the three months ended September 30, 2024, as compared to net charge-offs of $78,000 for the three months ended September

30, 2023.

Non-Interest Income

Non-interest income decreased $471,000,

or 13.0%, from $3.6 million for the three months ended September 30, 2023 to $3.1 million for the three months ended September

30, 2024. Service charges and fees on deposits increased $196,000, or 9.1%, and income from BOLI increased $16,000, or 3.5%, from

the three months ended September 30, 2023 to the three months ended September 30, 2024. During the three months ended September

30, 2024, the Company reported $74,000 in other income from loan-level swap fees on commercial loans and did not have comparable

income during the three months ended September 30, 2023. During the three months ended September 30, 2024, the Company reported

income of $246,000 in mortgage banking activities due to the sale of fixed rate residential loans and did not have comparable income

during the three months ended September 30, 2023. During the three months ended September 30, 2024, the Company reported $10,000

in unrealized gains of marketable equity securities and did not have comparable income during the three months ended September

30, 2023. During the three months ended September 30, 2023, the Company reported a gain on non-marketable equity investments of

$238,000 and did not have comparable non-interest income during the three months ended September 30, 2024. During the three months

ended September 30, 2023, non-interest income included a non-taxable gain of $778,000 on BOLI death benefits. The Company did not

have comparable income during the three months ended September 30, 2024. During the three months ended September 30, 2023, the

Company reported a loss on the sales of premises and equipment of $3,000 and did not have comparable expense during the three months

ended September 30, 2024.

Non-Interest Expense

For the three months ended September 30,

2024, non-interest expense increased $288,000, or 2.0%, to $14.4 million from $14.1 million, for the three months ended September

30, 2023. Salaries and employee benefits increased $157,000, or 2.0%, to $8.1 million, debit card and ATM processing fees increased

$87,000, or 15.5%, software expenses increased $83,000, or 15.7%, occupancy expense increased $58,000, or 5.0%, data processing

expense increased $45,000, or 5.5%, other non-interest income increased $54,000, or 4.3%, and furniture and equipment related expenses

increased $1,000, or 0.2%. These increases were partially offset by a decrease in professional fees of $103,000, or 16.0%, a decrease

in advertising expense of $91,000, or 25.1%, and a decrease in FDIC insurance expense of $3,000, or 0.9%.

For the three months ended September 30,

2024, the efficiency ratio was 80.6%, compared to 70.6% for the three months ended September 30, 2023. For the three months ended

September 30, 2024, the adjusted efficiency ratio, a non-GAAP financial measure, was 80.7% compared to 74.4% for the three months

ended September 30, 2023. The increases in the efficiency ratio and the non-GAAP adjusted efficiency ratio were driven by lower

revenues during the three months ended September 30, 2024, compared to the three months ended September 30, 2023. See pages 19-21

for the related adjusted efficiency ratio calculation and a reconciliation of GAAP to non-GAAP financial measures.

Income Tax Provision

Income tax expense for the three months

ended September 30, 2024 was $618,000, or an effective tax rate of 24.5%, compared to $1.0 million, or an effective tax rate of

18.7%, for the three months ended September 30, 2023. The effective tax rate for the three months ended September 30, 2023 included

$778,000 in non-taxable BOLI death benefits.

Net Income for the Nine Months Ended

September 30, 2024 Compared to the Nine Months Ended September 30, 2023

For the nine months ended September 30,

2024, the Company reported net income of $8.4 million, or $0.40 per diluted share, compared to $12.6 million, or $0.58 per diluted

share, for the nine months ended September 30, 2023. Return on average assets and return on average equity were 0.44% and 4.74%

for the nine months ended September 30, 2024, respectively, compared to 0.66% and 7.19% for the nine months ended September 30,

2023, respectively.

Net Interest Income and Net Interest

Margin

During the nine months ended September

30, 2024, net interest income decreased $7.2 million, or 13.9%, to $44.5 million, compared to $51.7 million for the nine months

ended September 30, 2023. The decrease in net interest income was due to an increase in interest expense of $14.1 million, or 62.3%,

partially offset by an increase in interest and dividend income of $6.9 million, or 9.3%. The $14.1 million increase in interest

expense was primarily due to an increase of $12.9 million, or 72.3%, in interest expense on deposits as a result of competitive

pricing and an unfavorable shift in the deposit mix from low cost core deposits to high cost time deposits.

The net interest margin for the nine months

ended September 30, 2024 was 2.46%, compared to 2.88% during the nine months ended September 30, 2023. The net interest margin,

on a tax-equivalent basis, was 2.48% for the nine months ended September 30, 2024, compared to 2.90% for the nine months ended

September 30, 2023. The decrease in the net interest margin was primarily due to an increase in the average cost of interest-bearing

liabilities and the unfavorable shift in the deposit mix from low cost core to high cost time deposits, which was partially offset

by an increase in the average yield on interest-earning assets. During the nine months ended September 30, 2024 and the nine months

ended September 30, 2023, the Company had a fair value hedge which contributed to an increase in the net interest margin of seven

and three basis points, respectively. Excluding the interest income from the fair value hedge, the net interest margin was 2.39%

and 2.85%, for the nine months ended September 30, 2024 and the nine months ended September 30, 2023, respectively. The fair value

hedge is scheduled to mature in October of 2024.

The average yield on interest-earning assets,

without the impact of tax-equivalent adjustments, was 4.49% for the nine months ended September 30, 2024, compared to 4.14% for

the nine months ended September 30, 2023. The average loan yield, without the impact of tax-equivalent adjustments, was 4.86% for

the nine months ended September 30, 2024, compared to 4.49% for the nine months ended September 30, 2023. During the nine months

ended September 30, 2024, average interest-earning assets increased $14.5 million, or 0.6%, to $2.4 billion, from the same period

in 2023. The increase was primarily due to an increase in average loans of $23.4 million, or 1.2%, an increase in average short-term

investments, consisting of cash and cash equivalents, of $5.7 million, or 44.2%, and an increase in other interest-earning assets

of $1.7 million, or 13.7%, partially offset by a decrease in average securities of $16.3 million, or 4.4%.

The average cost of total funds, including

non-interest bearing accounts and borrowings, increased 80 basis points from 1.32% for the nine months ended September 30, 2023

to 2.12% for the nine months ended September 30, 2024. The average cost of core deposits, which the Company defines as all deposits

except time deposits, increased 24 basis points to 0.86% for the nine months ended September 30, 2024, from 0.62% for the nine

months ended September 30, 2023. The average cost of time deposits increased 160 basis points from 2.72% for the nine months ended

September 30, 2023 to 4.32% for the nine months ended September 30, 2024. The average cost of borrowings, including subordinated

debt, increased 15 basis points from 4.84% for the nine months ended September 30, 2023 to 4.99% for the nine months ended September

30, 2024. Average demand deposits, an interest-free source of funds, decreased $52.1 million, or 8.6%, from $607.3 million, or

28.0% of total average deposits, for the nine months ended September 30, 2023, to $555.3 million, or 25.8% of total average deposits,

for the nine months ended September 30, 2024.

Provision for Credit Losses

During the nine months ended September

30, 2024, the Company recorded a provision for credit losses of $97,000, compared to a provision for credit losses of $386,000

during the nine months ended September 30, 2023. The decrease was primarily due to changes in the loan mix as well as economic

environment and related adjustments to the quantitative components of the CECL methodology. The provision for credit losses was

determined by a number of factors: the continued strong credit performance of the Company’s loan portfolio, changes in the

loan portfolio mix and Management’s consideration of existing economic conditions and the economic outlook from the Federal

Reserve’s actions to control inflation. Management continues to monitor macroeconomic variables related to increasing interest

rates, inflation and the concerns of an economic downturn, and believes it is appropriately reserved for the current economic environment.

During the nine months ended September

30, 2024, the Company recorded net charge-offs of $41,000 compared to net charge-offs of $1.9 million for the nine months ended

September 30, 2023. The charge-offs during the nine months ended September 30, 2023 were related to one commercial relationship

acquired in October 2016 from Chicopee Bancorp, Inc. The Company recorded a $1.9 million charge-off on the relationship, which

represented the non-accretable credit mark that was required to be grossed-up to the loan’s amortized cost basis with a corresponding

increase to the allowance for credit losses under the CECL implementation.

Non-Interest Income

For the nine months ended September 30,

2024, non-interest income increased $1.5 million, or 17.9%, from $8.2 million during the nine months ended September 30, 2023 to

$9.6 million. Service charges and fees on deposits increased $328,000, or 5.0%, and income from BOLI increased $37,000, or 2.7%.

During the nine months ended September

30, 2024, the Company reported a gain of $987,000 on non-marketable equity investments, compared to a gain of $590,000 during the

nine months ended September 30, 2023. During the nine months ended September 30, 2024, the Company reported income of $246,000

from mortgage banking activities due to the sale of fixed rate residential real estate loans and did not have comparable income

during the nine months ended September 30, 2023. During the nine months ended September 30, 2024, the Company reported $74,000

in other income from loan-level swap fees on commercial loans and did not have comparable income during the nine months ended September

30, 2023. During the nine months ended September 30, 2024, the Company reported $22,000 in unrealized gains of marketable equity

securities and did not have comparable income during the nine months ended September 30, 2023. Gains and losses from the investment

portfolio vary from quarter to quarter based on market conditions, as well as the related yield curve and valuation changes. During

the nine months ended September 30, 2024, the Company reported a loss on the sales of premises and equipment of $6,000 compared

to $3,000 during the nine months ended September 30, 2023. During the nine months ended September 30, 2023, the Company recorded

a $1.1 million final termination expense related to the defined benefit pension plan (the “DB Plan”) termination. The

Company did not have comparable income or expense during the nine months ended September 30, 2024. During the nine months ended

September 30, 2023, non-interest income included a non-taxable gain of $778,000 on BOLI death benefits. The Company did not have

comparable income during the nine months ended September 30, 2024.

Non-Interest Expense

For the nine months ended September 30,

2024, non-interest expense decreased $63,000, or 0.1%, to $43.5 million, compared to $43.6 million for the nine months ended September

30, 2023. The decrease in non-interest expense was primarily due to a decrease in professional fees of $513,000, or 23.3%, a decrease

in salaries and employee benefits of $218,000, or 0.9%, a decrease in advertising expense of $159,000, or 14.2%, a decrease in

other non-interest expense of $120,000, or 2.9%, and a decrease in furniture and equipment related expense of $10,000, or 0.7%.

These decreases were partially offset by an increase in software related expenses of $309,000, or 19.7%, an increase in debit card

and ATM processing fees of $264,000, or 16.7%, an increase in data processing of $208,000, or 8.8%, an increase in FDIC insurance

expense of $88,000, or 9.0%, and an increase in occupancy expense of $88,000, or 2.4%.

For the nine months ended September 30,

2024, the efficiency ratio was 80.3%, compared to 72.7% for the nine months ended September 30, 2023. For the nine months ended

September 30, 2024, the adjusted efficiency ratio, a non-GAAP financial measure, was 81.8% compared to 73.0% for the nine months

ended September 30, 2023. The increases in the efficiency ratio and the non-GAAP adjusted efficiency ratio were driven by lower

revenues during the nine months ended September 30, 2024, compared to the nine months ended September 30, 2023. See pages 19-21

for the related adjusted efficiency ratio calculation and a reconciliation of GAAP to non-GAAP financial measures.

Income Tax Provision

Income tax expense for the nine months

ended September 30, 2024 was $2.2 million, representing an effective tax rate of 20.9%, compared to $3.4 million, representing

an effective tax rate of 21.3%, for nine months ended September 30, 2023.

Balance Sheet

At September 30, 2024, total assets were

$2.6 billion, an increase of $75.9 million, or 3.0%, from December 31, 2023. The increase in total assets was primarily due to

an increase in cash and cash equivalents of $44.0 million, or 152.4%, an increase in total loans of $21.7 million, or 1.1%, and

an increase in investment securities of $8.7 million, or 2.4%.

Investments

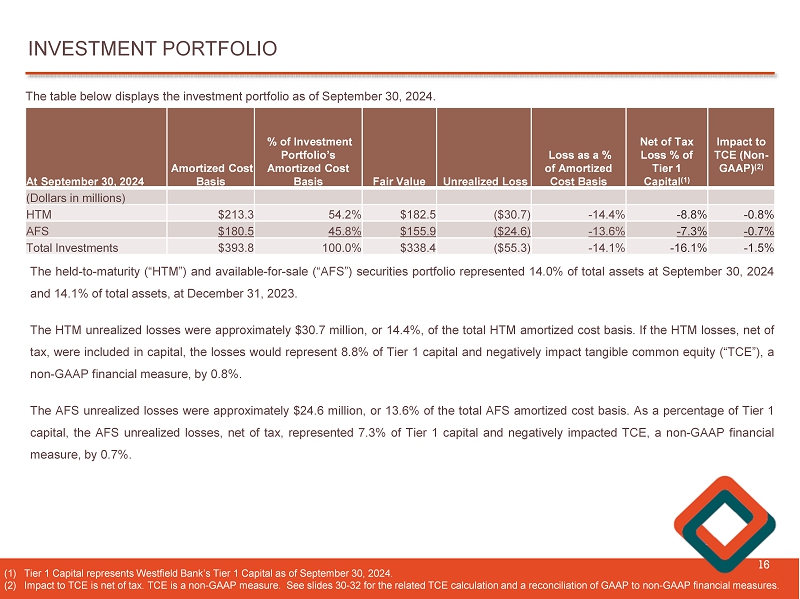

At September 30, 2024, the investment securities

portfolio totaled $369.4 million, or 14.0% of total assets, compared to $360.7 million, or 14.1%, of total assets, at December

31, 2023. At September 30, 2024, the Company’s available-for-sale (“AFS”) securities portfolio, recorded at fair

market value, increased $18.8 million, or 13.7%, from $137.1 million at December 31, 2023 to $155.9 million. The held-to-maturity

(“HTM”) securities portfolio, recorded at amortized cost, decreased $10.1 million, or 4.5%, from $223.4 million at

December 31, 2023 to $213.3 million at September 30, 2024.

At September 30, 2024, the Company reported

unrealized losses on the AFS securities portfolio of $24.6 million, or 13.6% of the amortized cost basis of the AFS securities

portfolio, compared to unrealized losses of $29.2 million, or 17.5% of the amortized cost basis of the AFS securities at December

31, 2023. At September 30, 2024, the Company reported unrealized losses on the HTM securities portfolio of $30.7 million, or 14.4%,

of the amortized cost basis of the HTM securities portfolio, compared to $35.7 million, or 16.0% of the amortized cost basis of

the HTM securities portfolio at December 31, 2023.

The securities in which the Company may

invest are limited by regulation. Federally chartered savings banks have authority to invest in various types of assets, including

U.S. Treasury obligations, securities of various government-sponsored enterprises, mortgage-backed securities, certain certificates

of deposit of insured financial institutions, repurchase agreements, overnight and short-term loans to other banks, corporate debt

instruments and marketable equity securities. The securities, with the exception of $4.6 million in corporate bonds, are issued

by the United States government or government-sponsored enterprises and are therefore either explicitly or implicitly guaranteed

as to the timely payment of contractual principal and interest. These positions are deemed to have no credit impairment, therefore,

the disclosed unrealized losses with the securities portfolio relate primarily to changes in prevailing interest rates. In all

cases, price improvement in future periods will be realized as the issuances approach maturity.

Management regularly reviews the portfolio

for securities in an unrealized loss position. At September 30, 2024 and December 31, 2023, the Company did not record any credit

impairment charges on its securities portfolio and attributed the unrealized losses primarily due to fluctuations in general interest

rates or changes in expected prepayments and not due to credit quality. The primary objective of the Company’s investment

portfolio is to provide liquidity and to secure municipal deposit accounts while preserving the safety of principal. The Company

expects to strategically redeploy available cash flows from the securities portfolio to fund loan growth and deposit outflows.

Total Loans

Total loans increased $21.7 million, or

1.1%, from December 31, 2023, to $2.0 billion at September 30, 2024. The increase in total loans was due to an increase in commercial

real estate loans of $3.0 million, or 0.3%, an increase in residential real estate loans, including home equity loans, of $26.4

million, or 3.7%, partially offset by a decrease in commercial and industrial loans of $7.0 million, or 3.2%. During the three

months ended September 30, 2024, the Company sold $20.1 million in fixed rate residential loans to the secondary market with servicing

retained.

The following table presents the summary of the loan portfolio

by the major classification of the loan at the periods indicated:

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

(Dollars in thousands) | |

| Commercial real estate loans: | |

| | | |

| | |

| Non-owner occupied | |

$ | 878,265 | | |

$ | 881,643 | |

| Owner-occupied | |

| 204,524 | | |

| 198,108 | |

| Total commercial real estate loans | |

| 1,082,789 | | |

| 1,079,751 | |

| | |

| | | |

| | |

| Residential real estate loans: | |

| | | |

| | |

| Residential | |

| 631,649 | | |

| 612,315 | |

| Home equity | |

| 116,923 | | |

| 109,839 | |

| Total residential real estate loans | |

| 748,572 | | |

| 722,154 | |

| | |

| | | |

| | |

| Commercial and industrial loans | |

| 210,390 | | |

| 217,447 | |

| | |

| | | |

| | |

| Consumer loans | |

| 4,631 | | |

| 5,472 | |

| Total gross loans | |

| 2,046,382 | | |

| 2,024,824 | |

| Unamortized premiums and net deferred loans fees and costs | |

| 2,620 | | |

| 2,493 | |

| Total loans | |

$ | 2,049,002 | | |

$ | 2,027,317 | |

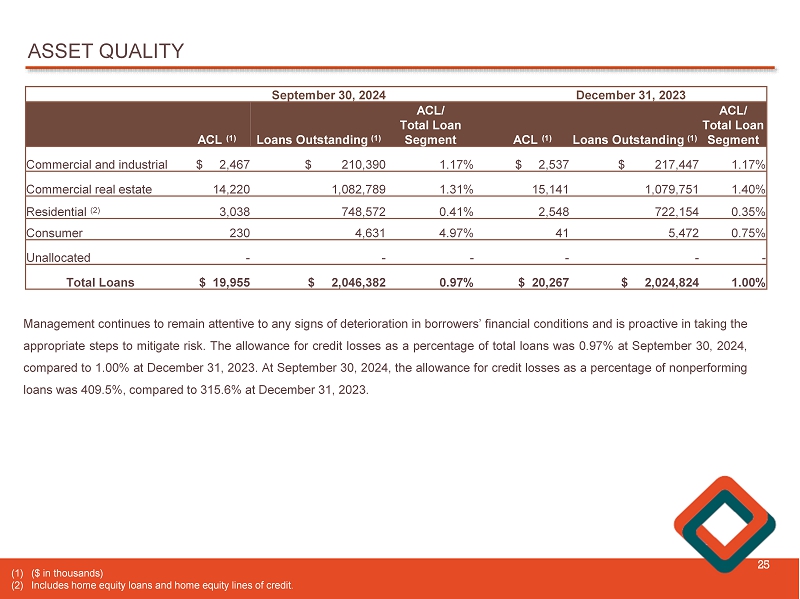

Credit Quality

Management continues to closely monitor

the loan portfolio for any signs of deterioration in borrowers’ financial condition and also in light of speculation that

commercial real estate values may deteriorate as the market continues to adjust to higher vacancies and interest rates. We continue

to proactively take steps to mitigate risk in our loan portfolio.

Total delinquency was $4.3 million, or

0.21% of total loans, at September 30, 2024, compared to $6.0 million, or 0.30% of total loans at December 31, 2023. At September

30, 2024, nonperforming loans totaled $4.9 million, or 0.24% of total loans, compared to $6.4 million, or 0.32% of total loans,

at December 31, 2023. Total nonperforming assets totaled $4.9 million, or 0.18% of total assets, at September 30, 2024, compared

to $6.4 million, or 0.25% of total assets, at December 31, 2023. At September 30, 2024 and December 31, 2023, there were no loans

90 or more days past due and still accruing interest. At September 30, 2024 and December 31, 2023, the Company did not have any

other real estate owned.

At September 30, 2024, the allowance for

credit losses as a percentage of total loans was 0.97% as compared to 1.00% at December 31, 2023. At September 30, 2024, the allowance

for credit losses as a percentage of nonperforming loans was 409.5% as compared to 315.6% at December 31, 2023.

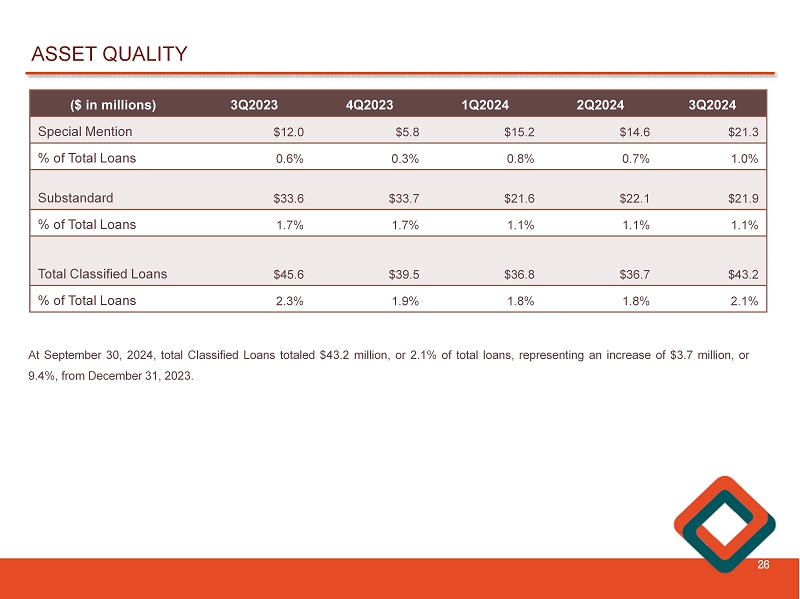

Total classified loans, defined as special

mention and substandard loans, increased $3.7 million, or 9.4%, from $39.5 million, or 1.9% of total loans, at December 31, 2023

to $43.2 million, or 2.1%, of total loans at September 30, 2024. We continue to maintain diversity among property types and within

our geographic footprint. More details on the diversification of the loan portfolio are available in the supplementary earnings

presentation.

Deposits

Total deposits increased $80.5 million,

or 3.8%, from $2.1 billion at December 31, 2023 to $2.2 billion at September 30, 2024. Core deposits, which the Company defines

as all deposits except time deposits, decreased $8.3 million, or 0.5%, from $1.5 billion, or 71.5% of total deposits, at December

31, 2023, to $1.5 billion, or 68.5% of total deposits, at September 30, 2024. Non-interest-bearing deposits decreased $10.9 million,

or 1.9%, to $568.7 million, money market accounts increased $1.5 million, or 0.2%, to $635.8 million, savings accounts decreased

$8.2 million, or 4.4%, to $179.2 million and interest-bearing checking accounts increased $9.3 million, or 7.1%, to $140.3 million.

Time deposits increased $88.8 million, or 14.5%, from $611.4 million at December 31, 2023 to $700.2 million at September 30, 2024.

Brokered time deposits, which are included in time deposits, totaled $1.7 million at September 30, 2024 and at December 31, 2023.

The table below is a summary of our deposit

balances for the periods noted:

| | |

September 30, 2024 | | |

June 30, 2024 | | |

December 31, 2023 | |

| | |

(Dollars in thousands) | |

| Core Deposits: | |

| | | |

| | | |

| | |

| Demand accounts | |

$ | 568,685 | | |

$ | 553,329 | | |

$ | 579,595 | |

| Interest-bearing accounts | |

| 140,332 | | |

| 149,100 | | |

| 131,031 | |

| Savings accounts | |

| 179,214 | | |

| 186,171 | | |

| 187,405 | |

| Money market accounts | |

| 635,824 | | |

| 611,501 | | |

| 634,361 | |

| Total Core Deposits | |

$ | 1,524,055 | | |

$ | 1,500,101 | | |

$ | 1,532,392 | |

| Time Deposits: | |

| 700,151 | | |

| 671,708 | | |

| 611,352 | |

| Total Deposits: | |

$ | 2,224,206 | | |

$ | 2,171,809 | | |

$ | 2,143,744 | |

During the nine months ended September

30, 2024, the Company continued to experience an unfavorable shift in deposit mix from low cost core deposits to high cost time

deposits as customers continue to migrate to higher deposit rates. The Company continues to focus on the maintenance, development,

and expansion of its core deposit base to meet funding requirements and liquidity needs, with an emphasis on retaining a long-term

customer relationship base by competing for and retaining deposits in our local market. At September 30, 2024, the Bank’s

uninsured deposits represented 27.7% of total deposits, compared to 26.8% at December 31, 2023.

FHLB and Subordinated Debt

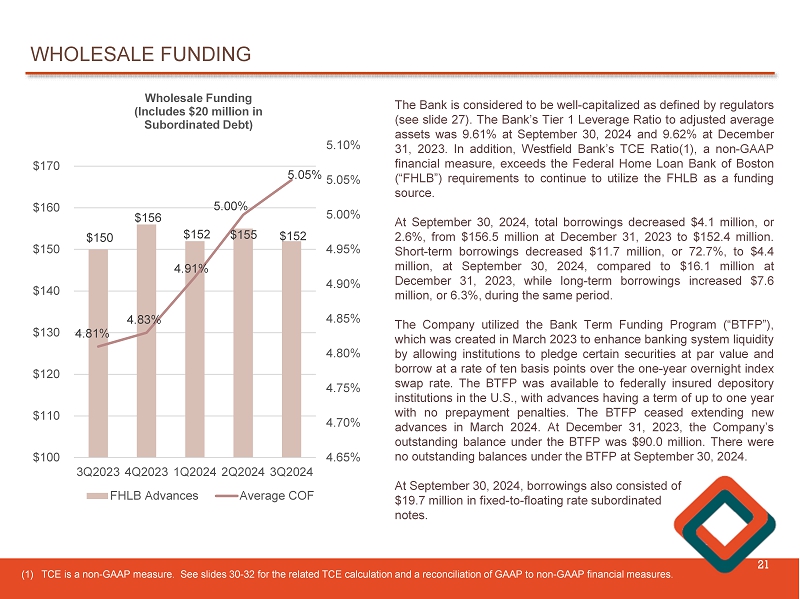

At September 30, 2024, total borrowings

decreased $4.1 million, or 2.6%, from $156.5 million at December 31, 2023 to $152.4 million. Short-term borrowings decreased $11.7

million, or 72.7%, to $4.4 million, compared to $16.1 million at December 31, 2023. Long-term borrowings increased $7.6 million,

or 6.3%, from $120.6 million at December 31, 2023 to $128.3 million at September 30, 2024. At September 30, 2024 and December 31,

2023, borrowings also consisted of $19.7 million in fixed-to-floating rate subordinated notes.

The Company utilized the Bank Term Funding

Program (“BTFP”), which was created in March 2023 to enhance banking system liquidity by allowing institutions to pledge

certain securities at par value and borrow at a rate of ten basis points over the one-year overnight index swap rate. The BTFP

was available to federally insured depository institutions in the U.S., with advances having a term of up to one year with no prepayment

penalties. The BTFP ceased extending new advances in March 2024. At December 31, 2023, the Company’s outstanding balance

under the BTFP was $90.0 million. There were no outstanding balance under the BTFP at September 30, 2024.

As of September 30, 2024, the Company had

$452.0 million of additional borrowing capacity at the Federal Home Loan Bank, $404.9 million of additional borrowing capacity

under the Federal Reserve Bank Discount Window and $25.0 million of other unsecured lines of credit with correspondent banks.

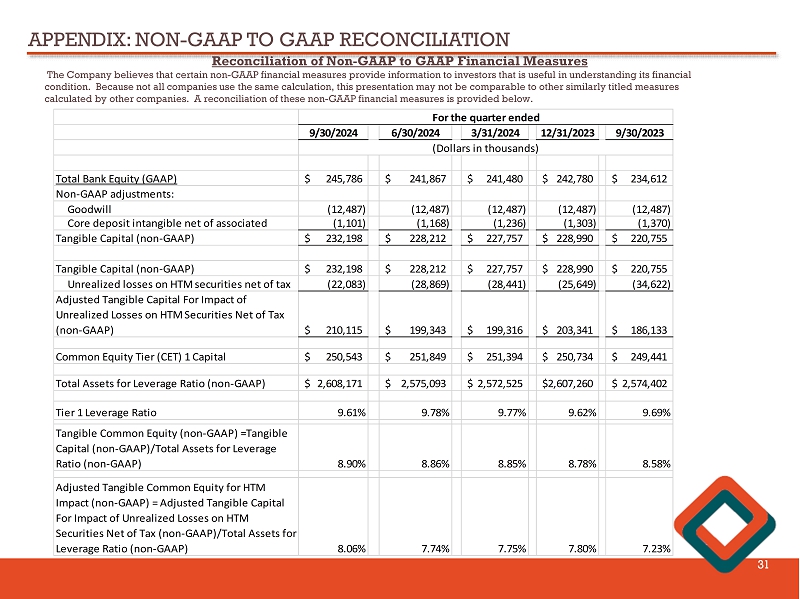

Capital

At September 30, 2024, shareholders’

equity was $240.7 million, or 9.1% of total assets, compared to $237.4 million, or 9.3% of total assets, at December 31, 2023.

The change was primarily attributable to a decrease in accumulated other comprehensive loss of $3.4 million, cash dividends paid

of $4.5 million, repurchase of shares at a cost of $5.6 million, partially offset by net income of $8.4 million. At September 30,

2024, total shares outstanding were 21,113,408.

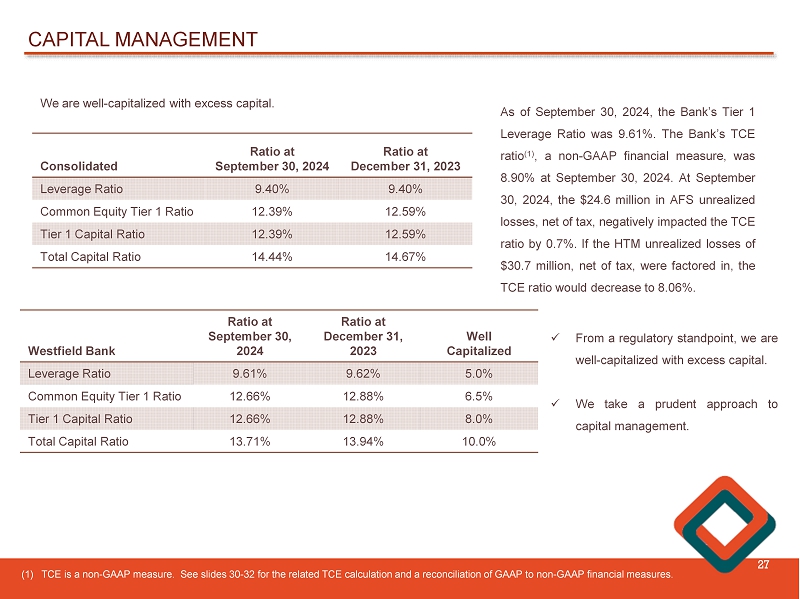

The Company’s regulatory capital

ratios continue to be strong and in excess of regulatory minimum requirements to be considered well-capitalized as defined by regulators

and internal Company targets. Total Risk-Based Capital Ratio was 14.4% at September 30, 2024 and 14.7% at December 31, 2023.

The Bank’s Tier 1 Leverage Ratio to adjusted average assets was 9.61% at September 30, 2024 and 9.62% at December 31, 2023.

Dividends

Although the Company has historically paid

quarterly dividends on its common stock and currently intends to continue to pay such dividends, the Company’s ability to

pay such dividends depends on a number of factors, including restrictions under federal laws and regulations on the Company’s

ability to pay dividends, and as a result, there can be no assurance that dividends will continue to be paid in the future.

About Western New England Bancorp, Inc.

Western New England Bancorp, Inc. is a

Massachusetts-chartered stock holding company and the parent company of Westfield Bank, CSB Colts, Inc., Elm Street Securities

Corporation, WFD Securities, Inc. and WB Real Estate Holdings, LLC. Western New England Bancorp, Inc. and its subsidiaries are

headquartered in Westfield, Massachusetts and operate 25 banking offices throughout western Massachusetts and northern Connecticut.

To learn more, visit our website at www.westfieldbank.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, with respect to the Company’s financial condition, liquidity, results of operations, future

performance, and business. Forward-looking statements may be identified by the use of such words as “believe,” “expect,”

“anticipate,” “should,” “planned,” “estimated,” and “potential.”

Examples of forward-looking statements include, but are not limited to, estimates with respect to our financial condition, results

of operations and business that are subject to various factors which could cause actual results to differ materially from these

estimates. These factors include, but are not limited to:

| ● | unpredictable changes in general economic

conditions, financial markets, fiscal, monetary and regulatory policies, including actual or potential stress in the banking industry; |

| ● | the duration and scope of potential pandemics,

including the emergence of new variants and the response thereto; |

| ● | unstable political and economic conditions

which could materially impact credit quality trends and the ability to generate loans and gather deposits; |

| ● | inflation and governmental responses to

inflation, including recent sustained increases and potential future increases in interest rates that reduce margins; |

| ● | the effect on our operations of governmental

legislation and regulation, including changes in accounting regulation or standards, the nature and timing of the adoption and

effectiveness of new requirements under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Basel guidelines,

capital requirements and other applicable laws and regulations; |

| ● | significant changes in accounting, tax

or regulatory practices or requirements; |

| ● | new legal obligations or liabilities or

unfavorable resolutions of litigation; |

| ● | disruptive technologies in payment systems

and other services traditionally provided by banks; |

| ● | the highly competitive industry and market

area in which we operate; |

| ● | changes in business conditions and inflation;

|

| ● | operational risks or risk management failures

by us or critical third parties, including without limitation with respect to data processing, information systems, cybersecurity,

technological changes, vendor issues, business interruption, and fraud risks; |

| ● | failure or circumvention of our internal

controls or procedures; |

| ● | changes in the securities markets which

affect investment management revenues; |

| ● | increases in Federal Deposit Insurance

Corporation deposit insurance premiums and assessments; |

| ● | the soundness of other financial services

institutions which may adversely affect our credit risk; |

| ● | certain of our intangible assets may become

impaired in the future; |

| ● | new lines of business or new products

and services, which may subject us to additional risks; |

| ● | changes in key management personnel which

may adversely impact our operations; |

| ● | severe weather, natural disasters, acts

of war or terrorism and other external events which could significantly impact our business; and |

| ● | other risk factors detailed from time

to time in our SEC filings. |

Although we believe that the expectations

reflected in such forward-looking statements are reasonable, actual results may differ materially from the results discussed in

these forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak

only as of the date hereof. We do not undertake any obligation to republish revised forward-looking statements to reflect events

or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except to the extent required by law.

WESTERN NEW ENGLAND BANCORP, INC. AND

SUBSIDIARIES

Consolidated Statements of Net Income

and Other Data

(Dollars in thousands, except per share

data)

Unaudited)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2023 | | |

2024 | | |

2023 | |

| INTEREST AND DIVIDEND INCOME: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans | |

$ | 25,134 | | |

$ | 24,340 | | |

$ | 24,241 | | |

$ | 23,939 | | |

$ | 23,451 | | |

$ | 73,715 | | |

$ | 67,230 | |

| Securities | |

| 2,121 | | |

| 2,141 | | |

| 2,114 | | |

| 2,094 | | |

| 2,033 | | |

| 6,376 | | |

| 6,276 | |

| Other investments | |

| 189 | | |

| 148 | | |

| 136 | | |

| 140 | | |

| 166 | | |

| 473 | | |

| 418 | |

| Short-term investments | |

| 396 | | |

| 173 | | |

| 113 | | |

| 597 | | |

| 251 | | |

| 682 | | |

| 424 | |

| Total interest and dividend income | |

| 27,840 | | |

| 26,802 | | |

| 26,604 | | |

| 26,770 | | |

| 25,901 | | |

| 81,246 | | |

| 74,348 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INTEREST EXPENSE: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 11,165 | | |

| 10,335 | | |

| 9,293 | | |

| 8,773 | | |

| 7,704 | | |

| 30,793 | | |

| 17,876 | |

| Short-term borrowings | |

| 71 | | |

| 186 | | |

| 283 | | |

| 123 | | |

| 117 | | |

| 540 | | |

| 1,466 | |

| Long-term debt | |

| 1,622 | | |

| 1,557 | | |

| 1,428 | | |

| 1,444 | | |

| 1,444 | | |

| 4,607 | | |

| 2,513 | |

| Subordinated debt | |

| 254 | | |

| 254 | | |

| 254 | | |

| 254 | | |

| 253 | | |

| 762 | | |

| 760 | |

| Total interest expense | |

| 13,112 | | |

| 12,332 | | |

| 11,258 | | |

| 10,594 | | |

| 9,518 | | |

| 36,702 | | |

| 22,615 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest and dividend income | |

| 14,728 | | |

| 14,470 | | |

| 15,346 | | |

| 16,176 | | |

| 16,383 | | |

| 44,544 | | |

| 51,733 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| PROVISION FOR (REVERSAL OF) CREDIT LOSSES | |

| 941 | | |

| (294 | ) | |

| (550 | ) | |

| 486 | | |

| 354 | | |

| 97 | | |

| 386 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest and dividend income after provision for (reversal of) credit losses | |

| 13,787 | | |

| 14,764 | | |

| 15,896 | | |

| 15,690 | | |

| 16,029 | | |

| 44,447 | | |

| 51,347 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NON-INTEREST INCOME: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service charges and fees on deposits | |

| 2,341 | | |

| 2,341 | | |

| 2,219 | | |

| 2,283 | | |

| 2,145 | | |

| 6,901 | | |

| 6,573 | |

| Income from bank-owned life insurance | |

| 470 | | |

| 502 | | |

| 453 | | |

| 432 | | |

| 454 | | |

| 1,425 | | |

| 1,388 | |

| Unrealized gain (loss) on marketable equity securities | |

| 10 | | |

| 4 | | |

| 8 | | |

| (1 | ) | |

| — | | |

| 22 | | |

| — | |

| Gain on sale of mortgages | |

| 246 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 246 | | |

| — | |

| Gain on non-marketable equity investments | |

| — | | |

| 987 | | |

| — | | |

| — | | |

| 238 | | |

| 987 | | |

| 590 | |

| Loss on disposal of premises and equipment | |

| — | | |

| — | | |

| (6 | ) | |

| — | | |

| (3 | ) | |

| (6 | ) | |

| (3 | ) |

| Loss on defined benefit plan termination | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,143 | ) |

| Gain on bank-owned life insurance death benefit | |

| — | | |

| — | | |

| — | | |

| — | | |

| 778 | | |

| — | | |

| 778 | |

| Other income | |

| 74 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 74 | | |

| — | |

| Total non-interest income | |

| 3,141 | | |

| 3,834 | | |

| 2,674 | | |

| 2,714 | | |

| 3,612 | | |

| 9,649 | | |

| 8,183 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NON-INTEREST EXPENSE: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Salaries and employees benefits | |

| 8,112 | | |

| 7,901 | | |

| 8,244 | | |

| 7,739 | | |

| 7,955 | | |

| 24,257 | | |

| 24,475 | |

| Occupancy | |

| 1,217 | | |

| 1,218 | | |

| 1,363 | | |

| 1,198 | | |

| 1,159 | | |

| 3,798 | | |

| 3,710 | |

| Furniture and equipment | |

| 483 | | |

| 483 | | |

| 484 | | |

| 494 | | |

| 482 | | |

| 1,450 | | |

| 1,460 | |

| Data processing | |

| 869 | | |

| 846 | | |

| 862 | | |

| 788 | | |

| 824 | | |

| 2,577 | | |

| 2,369 | |

| Software | |

| 612 | | |

| 566 | | |

| 699 | | |

| 598 | | |

| 529 | | |

| 1,877 | | |

| 1,568 | |

| Debit/ATM card processing expense | |

| 649 | | |

| 643 | | |

| 552 | | |

| 559 | | |

| 562 | | |

| 1,844 | | |

| 1,580 | |

| Professional fees | |

| 540 | | |

| 581 | | |

| 569 | | |

| 674 | | |

| 643 | | |

| 1,690 | | |

| 2,203 | |

| FDIC insurance | |

| 338 | | |

| 323 | | |

| 410 | | |

| 338 | | |

| 341 | | |

| 1,071 | | |

| 983 | |

| Advertising | |

| 271 | | |

| 339 | | |

| 349 | | |

| 377 | | |

| 362 | | |

| 959 | | |

| 1,118 | |

| Other | |

| 1,315 | | |

| 1,414 | | |

| 1,250 | | |

| 2,020 | | |

| 1,261 | | |

| 3,979 | | |

| 4,099 | |

| Total non-interest expense | |

| 14,406 | | |

| 14,314 | | |

| 14,782 | | |

| 14,785 | | |

| 14,118 | | |

| 43,502 | | |

| 43,565 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INCOME BEFORE INCOME TAXES | |

| 2,522 | | |

| 4,284 | | |

| 3,788 | | |

| 3,619 | | |

| 5,523 | | |

| 10,594 | | |

| 15,965 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INCOME TAX PROVISION | |

| 618 | | |

| 771 | | |

| 827 | | |

| 1,108 | | |

| 1,033 | | |

| 2,216 | | |

| 3,408 | |

| NET INCOME | |

$ | 1,904 | | |

$ | 3,513 | | |

$ | 2,961 | | |

$ | 2,511 | | |

$ | 4,490 | | |

$ | 8,378 | | |

$ | 12,557 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share | |

$ | 0.09 | | |

$ | 0.17 | | |

$ | 0.14 | | |

$ | 0.12 | | |

$ | 0.21 | | |

$ | 0.40 | | |

$ | 0.58 | |

| Weighted average shares outstanding | |

| 20,804,162 | | |

| 21,056,173 | | |

| 21,180,968 | | |

| 21,253,452 | | |

| 21,560,940 | | |

| 21,013,003 | | |

| 21,631,067 | |

| Diluted earnings per share | |

$ | 0.09 | | |

$ | 0.17 | | |

$ | 0.14 | | |

$ | 0.12 | | |

$ | 0.21 | | |

$ | 0.40 | | |

$ | 0.58 | |

| Weighted average diluted shares outstanding | |

| 20,933,833 | | |

| 21,163,762 | | |

| 21,271,323 | | |

| 21,400,664 | | |

| 21,680,113 | | |

| 21,122,208 | | |

| 21,681,251 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Return on average assets (1) | |

| 0.29 | % | |

| 0.55 | % | |

| 0.47 | % | |

| 0.39 | % | |

| 0.70 | % | |

| 0.44 | % | |

| 0.66 | % |

| Return on average equity (1) | |

| 3.19 | % | |

| 6.03 | % | |

| 5.04 | % | |

| 4.31 | % | |

| 7.60 | % | |

| 4.74 | % | |

| 7.19 | % |

| Efficiency ratio | |

| 80.62 | % | |

| 78.20 | % | |

| 82.03 | % | |

| 78.27 | % | |

| 70.61 | % | |

| 80.27 | % | |

| 72.71 | % |

| Adjusted efficiency ratio (2) | |

| 80.67 | % | |

| 82.68 | % | |

| 82.04 | % | |

| 78.26 | % | |

| 74.38 | % | |

| 81.79 | % | |

| 72.98 | % |

| Net interest margin | |

| 2.40 | % | |

| 2.42 | % | |

| 2.57 | % | |

| 2.64 | % | |

| 2.70 | % | |

| 2.46 | % | |

| 2.88 | % |

| Net interest margin, on a fully tax-equivalent basis | |

| 2.42 | % | |

| 2.44 | % | |

| 2.59 | % | |

| 2.66 | % | |

| 2.72 | % | |

| 2.48 | % | |

| 2.90 | % |

| (2) | The adjusted efficiency ratio (non-GAAP) represents the

ratio of operating expenses divided by the sum of net interest and dividend income and non-interest income, excluding realized

and unrealized gains and losses on securities, gain on non-marketable equity investments, loss on disposal of premises and equipment,

loss on defined benefit plan termination and gain on bank-owned life insurance death benefit. |

WESTERN NEW ENGLAND BANCORP, INC. AND

SUBSIDIARIES

Consolidated Balance Sheets

(Dollars in thousands)

(Unaudited)

| | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | |

| | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2023 | |

| Cash and cash equivalents | |

$ | 72,802 | | |

$ | 53,458 | | |

$ | 22,613 | | |

$ | 28,840 | | |

$ | 62,267 | |

| Securities available-for-sale, at fair value | |

| 155,889 | | |

| 135,089 | | |

| 138,362 | | |

| 137,115 | | |

| 130,709 | |

| Securities held to maturity, at amortized cost | |

| 213,266 | | |

| 217,632 | | |

| 221,242 | | |

| 223,370 | | |

| 225,020 | |

| Marketable equity securities, at fair value | |

| 252 | | |

| 233 | | |

| 222 | | |

| 196 | | |

| — | |

| Federal Home Loan Bank of Boston and other restricted stock - at cost | |

| 7,143 | | |

| 7,143 | | |

| 3,105 | | |

| 3,707 | | |

| 3,063 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans | |

| 2,049,002 | | |

| 2,026,226 | | |

| 2,025,566 | | |

| 2,027,317 | | |

| 2,014,820 | |

| Allowance for credit losses | |

| (19,955 | ) | |

| (19,444 | ) | |

| (19,884 | ) | |

| (20,267 | ) | |

| (19,978 | ) |

| Net loans | |

| 2,029,047 | | |

| 2,006,782 | | |

| 2,005,682 | | |

| 2,007,050 | | |

| 1,994,842 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Bank-owned life insurance | |

| 76,570 | | |

| 76,100 | | |

| 75,598 | | |

| 75,145 | | |

| 74,713 | |

| Goodwill | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | |

| Core deposit intangible | |

| 1,531 | | |

| 1,625 | | |

| 1,719 | | |

| 1,813 | | |

| 1,906 | |

| Other assets | |

| 71,492 | | |

| 75,521 | | |

| 76,206 | | |

| 74,848 | | |

| 79,998 | |

| TOTAL ASSETS | |

$ | 2,640,479 | | |

$ | 2,586,070 | | |

$ | 2,557,236 | | |

$ | 2,564,571 | | |

$ | 2,585,005 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total deposits | |

$ | 2,224,206 | | |

$ | 2,171,809 | | |

$ | 2,143,747 | | |

$ | 2,143,744 | | |

$ | 2,176,303 | |

| Short-term borrowings | |

| 4,390 | | |

| 6,570 | | |

| 11,470 | | |

| 16,100 | | |

| 8,890 | |

| Long-term debt | |

| 128,277 | | |

| 128,277 | | |

| 120,646 | | |

| 120,646 | | |

| 121,178 | |

| Subordinated debt | |

| 19,741 | | |

| 19,731 | | |

| 19,722 | | |

| 19,712 | | |

| 19,702 | |

| Securities pending settlement | |

| 2,513 | | |

| 102 | | |

| — | | |

| — | | |

| 2,253 | |

| Other liabilities | |

| 20,697 | | |

| 23,104 | | |

| 25,855 | | |

| 26,960 | | |

| 25,765 | |

| TOTAL LIABILITIES | |

| 2,399,824 | | |

| 2,349,593 | | |

| 2,321,440 | | |

| 2,327,162 | | |

| 2,354,091 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL SHAREHOLDERS' EQUITY | |

| 240,655 | | |

| 236,477 | | |

| 235,796 | | |

| 237,409 | | |

| 230,914 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | |

$ | 2,640,479 | | |

$ | 2,586,070 | | |

$ | 2,557,236 | | |

$ | 2,564,571 | | |

$ | 2,585,005 | |

WESTERN NEW ENGLAND BANCORP, INC. AND

SUBSIDIARIES

Other Data

(Dollars in thousands, except per share

data)

(Unaudited)

| | |

Three Months Ended | |

| | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | |

| | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2023 | |

| Shares outstanding at end of period | |

| 21,113,408 | | |

| 21,357,849 | | |

| 21,627,690 | | |

| 21,666,807 | | |

| 21,927,242 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating results: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

$ | 14,728 | | |

$ | 14,470 | | |

$ | 15,346 | | |

$ | 16,176 | | |

$ | 16,383 | |

| Provision for (reversal of) credit losses | |

| 941 | | |

| (294 | ) | |

| (550 | ) | |

| 486 | | |

| 354 | |

| Non-interest income | |

| 3,141 | | |

| 3,834 | | |

| 2,674 | | |

| 2,714 | | |

| 3,612 | |

| Non-interest expense | |

| 14,406 | | |

| 14,314 | | |

| 14,782 | | |

| 14,785 | | |

| 14,118 | |

| Income before income provision for income taxes | |

| 2,522 | | |

| 4,284 | | |

| 3,788 | | |

| 3,619 | | |

| 5,523 | |

| Income tax provision | |

| 618 | | |

| 771 | | |

| 827 | | |

| 1,108 | | |

| 1,033 | |

| Net income | |

| 1,904 | | |

| 3,513 | | |

| 2,961 | | |

| 2,511 | | |