Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

25 Outubro 2024 - 10:15AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE

ACT OF 1934

For

the month of October, 2024

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Genius

Group Limited (the “Company”) is providing the following update with regard to the pending litigation related to the Alleged

Stock Market Manipulation of the Company’s shares:

The

Company appointed lawyers Christian Attar & Warshaw Burnstein to conduct due diligence and take legal action against alleged stock

market manipulation against the Company’s stock by various parties. Counsel completed their due diligence and damages report in

February 2024, identifying evidence of multiple trade imbalances that suggest naked short selling and evidence of spoofing, with alleged

damages calculated at between $251.3 million and $262.7 million. Subsequently, the lawyers have been in the process of securing third

party financing to proceed with the case. On October 24, 2024, the Company was notified by Wes Christian of Christian Attar that funding

has been secured and that, once the most recent Company data has been reviewed to update our damage model and identify potentially new

defendants, the complaint will be filed soon thereafter.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

|

| Date:

October 24, 2024 |

|

|

| |

By: |

/s/

Roger Hamilton |

| |

Name: |

Roger

Hamilton |

| |

Title: |

Chief

Executive Officer |

| |

|

(Principal

Executive Officer) |

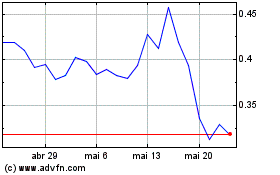

Genius (AMEX:GNS)

Gráfico Histórico do Ativo

De Out 2024 até Out 2024

Genius (AMEX:GNS)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024