Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

25 Outubro 2024 - 11:55AM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

October 2024

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One)

Form 20-F x Form 40-F ¨

Vale

reaches definitive settlement with Public Authorities in Brazil for the full reparation of Samarco’s Fundão dam collapse

Rio de Janeiro, October 25, 2024 – Following the press release dated October 18, 2024, Vale S.A. (“Vale” or “Company”)

informs that Samarco Mineração S.A. (“Samarco”), BHP Billiton Brasil Ltda. (“BHP Brasil”) and the

Company (jointly, “the Companies”), together with the Brazilian Federal Government, the State Governments of Minas Gerais

and Espírito Santo, the Federal and State Public Prosecutors’ and Public Defenders’ Offices and other Brazilian public

entities (jointly, “the Parties”) reached today a definitive and substantial settlement (“Definitive Settlement”)

of claims related to the Fundão dam collapse in Mariana, Minas Gerais, Brazil, on November 5, 2015. “The Definitive Settlement

enabled a mutually beneficial resolution for all Parties under fair and effective terms, while creating definitiveness and legal certainty.

It is the result of a high-level mediation process conducted by the Brazilian Federal Court of Appeals of the 6th Region, with open dialogue

and transparency. The engagement of Brazilian authorities and public entities ensured legitimacy to the settlement, which was supported

by social, environmental and technical criteria. This important agreement also reinforces our commitment to Brazilian society and to

a better future for the people, communities and the environment", said Gustavo Pimenta, Vale’s CEO. The final and definitive settlement

documentation was approved by all Parties, including Vale’s Board of Directors, and signed today. The Definitive Agreement addresses

all demands involving the signatory Brazilian public authorities, related to the collapse of Samarco's Fundão dam, including all

socio-environmental damages and all collective and diffuse socioeconomic damages resulting from the rupture. Key financial commitments

The Definitive Settlement provides for a total financial value of approximately R$ 170 billion1, comprising past and future obligations,

to serve the people, communities and the environment impacted by the dam failure. It sets three main lines of obligations. Amounts (on

a 100% basis) Main lines of obligations R$ 100 billion Installment payments2 over 20 years to the Federal Government, the States of Minas

Gerais and Espírito Santo and the municipalities to fund compensatory programs and actions tied to public policies. R$ 32 billion

Performance obligations by Samarco, including initiatives for individual indemnification, resettlement, and environmental recovery. R$

38 billion Amounts already invested on remediation and compensation measures. R$ 170 billion in total Obligations to pay Funds will support

several compensation fronts, ensuring substantial resources for improvements in health, sanitation, fishing activities and community

funding, and a dedicated approach to indigenous and traditional communities, and municipalities. Obligations to perform Samarco will

execute certain obligations, including a voluntary-based, simplified individual indemnification system, measures towards the Doce River

environmental recovery and the completion of community 1 Future financial obligations are presented on a real, undiscounted basis and

will accrue inflation at Brazilian inflation index IPCA. 2 Adjusted by the Brazilian inflation index IPCA. Press Release resettlements,

which already reached around 94% of total cases to be delivered as of September 30, 2024. Hence, part of the Renova Foundation’s

42 programs will be gradually transferred to Samarco or the authorities, while the remaining programs will be closed. The Renova Foundation’s

governance body will cease on signing. Vale’s provision and cash outflow expectation Vale reaffirms its commitments to supporting

Samarco in repairing the damage caused by the Fundão dam collapse and to the shareholders' previously agreed obligation to finance,

up to a 50% share, the amounts that Samarco may eventually fail to fund as the primary obligor. Vale’s provision recorded for those

obligations is US$ 4.7 billion as of September 30, 2024, and includes estimates of Samarco’s contributions. The estimated timeline

for cash disbursement is presented below. Expected cash disbursement schedule3 (R$ billion) Total 4Q24 2025 2026 2027 2028 2029 2030

’31-43 Avg.4 Obligations to pay 100 5.0 6.0 7.0 5.0 5.0 5.1 5.5 4.7 Obligations to perform 32 2.4 16.8 5.1 0.8 0.7 0.6 0.8 0.5

Already disbursed5 38 - - - - - - - Total (R$ billion) 170 7.4 22.8 12.1 5.8 5.7 5.7 6.3 5.1 Vale’s contribution (R$ billion) 3.7

11.0 6.0 2.9 2.1 1.9 1.7 - Vale’s contribution (US$ billion)6 0.7 2.0 1.1 0.5 0.4 0.3 0.3 - Parties’ legitimacy A high-level

mediation process by the Brazilian Federal Court of Appeals of the 6th Region and the engagement of Brazilian public institutions, playing

their Constitutional role as authentic representatives of the affected people, have ensured transparency and legitimacy to the settlement

process. Murilo Muller Executive Vice President, Finance and Investor Relations For further information, please contact: Vale.RI@vale.com

Thiago Lofiego: thiago.lofiego@vale.com Mariana Rocha: mariana.rocha@vale.com Luciana Oliveti: luciana.oliveti@vale.com Pedro Terra:

pedro.terra@vale.com Patricia Tinoco: patricia.tinoco@vale.com This press release may include statements that present Vale’s expectations

about future events or results. All statements, when based upon expectations about the future, involve various risks and uncertainties.

Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following:

(a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and

metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets

in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please

consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários

(CVM) and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s

annual report on Form 20-F. 3 Future financial obligations are presented on a real, undiscounted basis and will accrue inflation at IPCA

inflation rate. 4 Average annual payments between 2031 and 2043. 5 As per previous framework agreements. 6 Considering an average exchange

rate of 5.4481 as of September 30,2024

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Vale S.A.

(Registrant) |

| |

|

| |

By: |

/s/ Thiago Lofiego |

| Date: October 25, 2024 |

|

Director of Investor Relations |

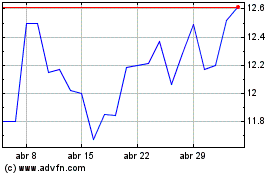

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

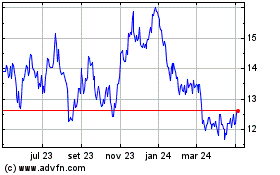

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025