FALSE000181080600018108062024-10-282024-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 28, 2024

| | | | | | | | |

| UNITY SOFTWARE INC. | |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 001-39497 | 27-0334803 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| 30 3rd Street | |

| San Francisco, California 94103‑3104 | |

| (Address, including zip code, of principal executive offices) | |

| (415) 638-9950 | |

| (Registrant's telephone number, including area code) | |

| Not Applicable | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.000005 par value | | U | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Operating Officer

On October 28, 2024, Unity Software Inc. (the “Company” or “Unity”) appointed Alex Blum, its Senior Vice President, Corporate Development as its Chief Operating Officer, effective as of November 1, 2024 (the “Role Change Date”).

In connection with his appointment, Mr. Blum entered into a role change letter (the “Role Change Letter”) with the Company, providing for: (i) an annual base salary of $525,000, effective as of the Role Change Date, (ii) a target bonus of 75% of his base salary, subject to the terms of the Company’s 2024 corporate bonus plan, (iii) a one-time cash bonus of $25,000 which shall be paid in February 2025, (iv) an award of 59,555 time-vesting restricted stock units (the “RSU Award”), and (v) a time-vesting option to purchase 39,703 shares of common stock (the “Option Award”). Both the RSU Award and the Option Award will be issued pursuant to the Company’s 2020 Equity Incentive Plan. The RSU Award will vest in equal quarterly installments over four years, and the Option Award will vest monthly over four years, each subject to Mr. Blum’s continuous employment.

Mr. Blum, age 62, has served as the Company’s Senior Vice President, Corporate Development since July 2024. Prior to joining Unity, Mr. Blum was an investor and advisor to a variety of privately held technology companies across numerous high growth sectors. Most recently, from January 2015 until April 2021, he served as the Executive Chairman of Tru Optik, a connected television advertising data management platform, prior to its acquisition by TransUnion. Prior to that, Mr. Blum held several roles at AOL, a web portal and online service provider including as the Vice President of Product for AOL’s Audience Business. Mr. Blum holds a B.S. degree in Mechanical Engineering from the University of Colorado, Boulder and an M.B.A. from Seattle University.

Mr. Blum will participate in the Company’s Executive Severance Plan (the “Severance Plan”), as described under the heading "Executive Severance Agreements and Change in Control Benefits" previously disclosed in the Company's definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 18, 2024.

The foregoing summaries are not complete and are qualified in their entirety by the copy of the Role Change Letter, attached as Exhibit 10.1 to this Current Report on Form 8-K. Mr. Blum will also enter into a customary indemnification agreement with the Company in the form previously approved by the Board and filed with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description of Exhibit |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | UNITY SOFTWARE INC. |

| | | |

| Date: October 30, 2024 | | By: | /s/ Matthew Bromberg |

| | | Matthew Bromberg |

| | | President and Chief Executive Officer |

| | | (Principal Executive Officer) |

Exhibit 10.1

PRIVATE AND CONFIDENTIAL

November 1st 2024

Alexander Blum

Dear Alex,

On behalf of Unity Technologies ('the Company') I'm pleased to confirm the following changes to your contract of employment:

Your new title is SVP, Chief Operating Officer.

As of November 1st 2024 your annual base salary will increase to $525,000 USD annually.

In addition you are eligible to receive a discretionary bonus up to 75% of your base salary. The exact payment date will be determined after the close of each measurement period. The actual bonus amount will be determined by the Company at its sole discretion, is subject to modification or termination by the Company, and will be paid out less all applicable withholdings and deductions required by law. In order to be eligible to receive a discretionary corporate bonus, you must be employed by the Company on the date that corporate bonuses are paid. Please note that for 2024 your bonus will be prorated from November 1st 2024 (meaning it will be based off of your original salary from your original start date until the role change, and then from your new salary through year end) . Further details regarding the discretionary bonus will be provided to you separately, via Workday.

The one-time bonus of $100,000 mentioned in the letter “Six-Month Bonus” dated July 3rd 2024, due to be paid after January 8th 2025, will be canceled. In its place we will award a one-time bonus of $25,000 to be paid February 14th 2025 so long as you are still an active employee with the Company and meeting your performance goals for the role on that date.

Finally, in recognition of your new responsibilities as SVP, Chief Operating Officer, we will recommend to the Board of Directors of the Company that you be granted both restricted stock units ("RSUs") and Stock Options with a total target value of $1,500,000 USD.

$1,125,000 USD Target Value in RSUs which is 59,555 shares based on the average closing price of the stock for the sixty (60) days preceding the date of Board approval of the grant. Settlement of the RSUs will be conditioned on the satisfaction of a single vesting requirement known as a “Time-Based Requirement.” The Time-Based Requirement will be satisfied at the rate of 1/16th or 6.25% quarterly, so long as you remain employed by the Company.

$375,000 USD Target Value in Stock Options, which is the opportunity to purchase up to 39,703 shares of Common Stock of Unity Software Inc. (the “Parent Company”) under our 2020 Equity Incentive Plan (the “Plan”). The actual number of shares was based on the average closing price of the stock price for the sixty (60) days preceding the date of Board approval and the exercise price is $19.72 which was the closing price of Unity stock on the day of board approval. The Time-Based Requirement will be satisfied at the rate of 1/48th or 2.08% monthly, so long as you remain employed by the Company.

The grant of such RSUs and Stock Options by the Parent Company is subject to the Board’s approval and this promise to recommend such approval is not a promise of compensation and is not intended to create any obligation on the part of the Parent Company.

The RSUs and Stock Options will be granted under, and subject to the terms and conditions of, the Plan , as well as the terms and conditions to be set forth in any sub-plan to the Plan, equity award agreement (including any country appendix thereto) and notice of grant.

In the spirit of making sure there is no miscommunication, we’re adding an extra sentence here to remind you that we make no promises with respect to the potential value of our stock. Further details on the Plan and the terms and conditions of any specific grant to you will be provided upon approval of such grant by the Parent Company's Board.

If your award is approved, you will see the equity grant posted in your Schwab account within a month after the next regularly scheduled Board meeting. Please refer to your Notice of Grant, RSU agreement and the Plan document on Schwab to learn about specific terms of your equity grant and Vesting Schedule. You’ll be prompted to accept this new award in Schwab. Please note that the number of RSUs and the terms of the award will ultimately be determined and approved at the discretion of the Board and the Board may exercise its discretion to alter the number of shares that are granted.

All other terms and conditions of your employment agreement remain unchanged and in effect.

Congratulations again,

| | | | | | | | |

| | ACKNOWLEDGED AND AGREED: |

| /s/ Marisa Eddy | | /s/ Alexander Blum |

Marisa Eddy Senior Vice President, Chief People Officer Unity Software Inc | | Alexander Blum |

| | October 29, 2024 |

| | Date |

APPENDIX

By signing the letter to which this appendix is attached, you acknowledge that you have read and understand the information regarding the collection, processing and transfer of your personal data described below. Capitalized terms used in this appendix shall have the meaning ascribed to such terms in the letter.

Data Collection and Usage. The Company or, if different, your employer (the “Employer”) and its Participating Companies or affiliates collect, process, transfer and use personal data about you that is necessary for the purpose of implementing, administering and managing the Plan. This personal data may include your name, home address, email address and telephone number, date of birth, social insurance number, passport or other identification number, salary, nationality and citizenship, job title, any Shares or directorships held in the Company, details of all RSUs or other entitlements to Shares, granted, canceled, exercised, vested, unvested or outstanding in your favor (“Data”), which the Company receives from you or the Employer.

Purposes and Legal Bases of Processing. The Company processes the Data for the purpose of performing its contractual obligations under the Plan, granting RSUs, implementing, administering and managing your participation in the Plan. The legal basis for the processing of the Data by the Company and the third-party service providers described below is the necessity of the data processing for the Company to perform its contractual obligations under the Plan and relevant agreement and for the Company’s legitimate business interests of managing the Plan and generally administering employee RSUs.

Stock Plan Administration Service Providers. The Company transfers Data to Charles Schwab & Co., Inc (including its affiliated companies) (“Schwab”) and /or Equity Plan Solutions (“EPS”), independent service providers with operations, relevant to the company, in Canada and the United States, which assists the Company with the implementation, administration and management of the Plan. In the future, the Company may select a different service provider and share your Data with another service provider that serves in a similar manner. The Company’s service provider may open an account for you to receive and trade Shares. The processing of your Data will take place through both electronic and non-electronic means. You may be asked to agree on separate terms and data processing practices with Schwab or EPS, with such agreement being a condition of the ability to participate in the Plan. You understand that the recipients of the Data may be located in your country of work and/or residence, or elsewhere, and that any recipient’s country may have different data privacy laws and protections than your country of work and/or residence. You understand that you may request a list with the names and addresses of any potential recipients of the Data by contacting your local human resources representative. You authorize the Company, Schwab and EPS and any other possible recipients which may assist the Company (presently or in the future) with implementing, administering and managing the Plan to receive, possess, use, retain and transfer the Data, in electronic or other form, for the purpose of implementing, administering and managing your participation in the Plan. You understand that Data will be held only as long as is necessary to implement, administer and manage your participation in the Plan. You understand that you may, at any time, view the Data, request additional information about the storage and processing of the Data, require any necessary amendments to the Data or refuse to participate withdraw your participation herein, in any case without cost, by contacting in writing your local human resources representative. Further, you understand that you are participating herein on a purely voluntary basis. If you do not participate, or if you later seek to revoke your participation, your employment status or service with the Employer will not be affected; the only consequence of refusing or withdrawing your participation is that the Company would not be able to grant you RSUs or administer or maintain such RSUs. Therefore, you understand that refusal or withdrawal of your participation may affect your ability to participate in the Plan. For more information on the consequences of your refusal to participate or withdrawal of participation, you understand that you may contact your local human resources representative.

International Data Transfers. You understand that the recipients of the Data may be located in the United States or elsewhere, and that the recipients’ country (e.g., the United States) may have different

data privacy laws and protections than your country. You understand that you may request a list with the names and addresses of any then-current recipients of the Data by contacting DPO@unity3d.com. When transferring Data to its affiliates, Schwab and EPS, the Company provides appropriate safeguards described in the Company’s applicable policy on data privacy.

Data Retention. The Company will use your Data only as long as is necessary to implement, administer and manage your participation in the Plan or as required to comply with legal or regulatory obligations, including under tax, exchange control, securities, and labor laws. When the Company no longer needs your Data, the Company will remove it from its systems. The Company may keep some of your Data longer to satisfy legal or regulatory obligations and the Company’s legal basis for such use would be necessary to comply with legal obligations.

Contractual Requirement. Your provision of Data and its processing as described above is a contractual requirement and a condition to your ability to participate in the Plan. You understand that, as a consequence of your refusing to provide Data, the Company may not be able to allow you to participate in the Plan, grant RSUs to you or administer or maintain such RSUs. However, your participation in the Plan and acceptance of the relevant agreement are purely voluntary. While you will not receive RSUs if you decide against participating in the Plan or providing Data as described above, your career and salary will not be affected in any way.

Data Subject Rights. You have a number of rights under data privacy laws in your country. Depending on where you are based, your rights may include the right to (i) request access or copies of your Data the Company processes, (ii) rectify incorrect Data and/or delete your Data, (iii) restrict processing of your Data, (iv) portability of your Data, (v) lodge complaints with the competent data protection authorities in your country and/or (vi) obtain a list with the names and addresses of any recipients of your Data. To receive clarification regarding your rights or to exercise your rights please contact the Company at Unity Software Inc., stockadmin@unity3d.com, Attn: Stock Administrator.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

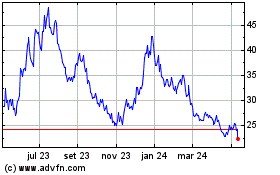

Unity Software (NYSE:U)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

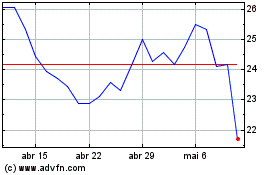

Unity Software (NYSE:U)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024