false

0001582554

0001582554

2024-10-31

2024-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 31, 2024

MATINAS

BIOPHARMA HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware

|

|

001-38022 |

|

46-3011414 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

ID

Number) |

1545

Route 206 South, Suite 302

Bedminster,

New Jersey |

|

07921 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (908) 484-8805

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock |

|

MTNB

|

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.05. Costs Associated with Exit or Disposal Activities.

Matinas

BioPharma Holdings, Inc. (the “Company”) implemented an 80% workforce reduction effective as of October 31, 2024 (the “Reduction

in Force”) and ceased all product development activities to conserve cash.

At

this time the Company is not able to make a good faith determination of an estimate or a range of estimates as required by paragraphs

(b), (c) and (d) of Item 2.05 of Form 8-K with respect to the Reduction in Force and the cessation of product development activities.

The Company will file an amendment to this Current Report on Form 8-K after it makes a determination as to such estimate or range of

estimates.

Item

2.06. Material Impairments.

The

information in Item 2.05 above is incorporated herein by reference. At this time the Company is unable to make a good faith determination

of an estimate or a range of estimates of the non-cash impairment charge or the impairment charge that will result in future cash expenditures

related to the Reduction in Force and cessation of product development activities.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(b)

In connection with the Reduction in Force, the employment of James Ferguson, M.D., the Company’s Chief Medical Officer, was terminated

effective October 31, 2024.

The

Company expects to enter into a separation agreement with Dr. Ferguson pursuant to which he will be eligible to receive severance payments

equal to 12 months of his base salary at the rate in effect immediately prior to his termination over a period of 12 months, and the

continuation of health and dental benefits for a period of 12 months, in exchange for executing a general release of claims in favor

of the Company. Total payments to Dr. Ferguson will be approximately $500,000.

Item

7.01 Regulation FD Disclosure.

On

October 31, 2024, the Company issued a press release announcing the Reduction in Force and cessation of product development activities.

The full text of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The

information in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section,

nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such a filing.

Item

8.01 Other Events.

On

October 31, 2024, the Company announced that negotiations under the previously disclosed non-binding term sheet regarding global rights

to its MAT2203 product candidate have been terminated following notification from the prospective partner. As a result, the Company implemented

the Reduction in Force and has ceased all product development activities to conserve cash. The Company intends to retain an advisor to

assist the Company with the potential asset sale of MAT2203, and will evaluate other alternatives including but not limited to winddown

and dissolution of the Company.

Forward-

Looking Statements

This

Current Report on Form 8-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended, including those relating

to the potential sale of MAT 2203, and the evaluation of other alternatives for the Company, including a winddown or dissolution of the

Company. All statements other than statements of historical fact are statements that could be forward-looking statements.

These

statements may be identified by the use of forward-looking expressions, including, but not limited to, “expects,” “anticipates,”

“intends,” “plans,” “could,” “believes,” “estimates” and similar expressions.

These statements involve known and unknown risks, uncertainties and other factors which may cause actual results to be materially different

from any future results expressed or implied by the forward-looking statements. Forward-looking statements are subject to a number of

risks and uncertainties, including, but not limited to, the Company’s ability to obtain additional capital to meet its liquidity

needs on acceptable terms, or at all, including the additional capital which will be necessary to complete the clinical trials of our

product candidates; the ability to successfully complete research and further development and commercialization of our product candidates;

the uncertainties inherent in clinical testing; the timing, cost and uncertainty of obtaining regulatory approvals; our ability to protect

the Company’s intellectual property; the loss of any executive officers or key personnel or consultants; competition; changes in

the regulatory landscape or the imposition of regulations that affect the Company’s products; and the other factors listed under

“Risk Factors” in our filings with the SEC, including Forms 10-K, 10-Q and 8-K. Investors are cautioned not to place undue

reliance on such forward-looking statements, which speak only as of the date hereof. Except as may be required by law, the Company does

not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events. The Company’s product candidates are all in a development

stage and are not available for sale or use.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MATINAS

BIOPHARMA HOLDINGS, INC. |

| |

|

|

| Dated:

October 31, 2024 |

By:

|

/s/

Jerome D. Jabbour |

| |

Name:

|

Jerome

D. Jabbour |

| |

Title:

|

Chief Executive Officer |

Exhibit

99.1

Matinas

BioPharma Announces the Termination of MAT2203 Partnership Negotiations and Implements Immediate Workforce Reduction

BEDMINSTER,

N.J. (October 31, 2024) – Matinas BioPharma Holdings, Inc. (NYSE American: MTNB) announces that negotiations under the

previously disclosed non-binding term sheet regarding global rights to MAT2203, its oral formulation of amphotericin B, have been terminated

following notification from the prospective partner. As a result, Matinas has implemented an 80% workforce reduction effective immediately,

eliminating 15 positions including three members of senior management, and has ceased all product development activities to conserve

cash.

The

departing senior executives include Chief Medical Officer Dr. James Ferguson, Chief Business Officer Thomas Hoover and Chief Technology

Officer Dr. Hui Liu.

The

Board intends to retain an advisor to assist the Company with the potential asset sale of MAT2203, its lead Phase 3-ready antifungal

drug candidate for the treatment of invasive fungal infections, and will evaluate other alternatives, including but not limited to winddown

and dissolution of the Company. There can be no assurance that the Company will be able to sell MAT2203 on favorable terms, or at all.

About

MAT2203

Matinas

BioPharma’s MAT2203 is a potential oral broad-spectrum treatment for invasive deadly fungal infections. Although amphotericin B

is a fungicidal agent, it is currently only available through an intravenous route of administration, which is known to be associated

with several significant safety issues such as renal toxicity and anemia due to very high circulating levels of amphotericin B. MAT2203

has the potential to overcome the significant limitations of the currently available amphotericin B products due to its targeted oral

delivery. Combining comparable fungicidal activity with targeted delivery results in a lower risk of toxicity and potentially creates

the ideal antifungal agent for the treatment of invasive fungal infections. MAT2203 was successfully evaluated in the completed Phase

2 EnACT study in HIV patients suffering from cryptococcal meningitis, meeting its primary endpoint and achieving robust survival. MAT2203

was planned to be further evaluated in a single Phase 3 registration trial as an oral step-down monotherapy following treatment with

AmBisome (liposomal amphotericin B) compared with the standard of care in patients with invasive aspergillosis who have limited treatment

options.

About

Matinas BioPharma

Matinas

BioPharma is a biopharmaceutical company focused on delivering groundbreaking therapies using its lipid nanocrystal (LNC) platform delivery

technology.

For

more information, please visit www.matinasbiopharma.com.

Forward-looking

Statements

This

release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,

including those relating to the sale of MAT2203 and the winddown and dissolution of the Company, and other statements that are predictive

in nature, that depend upon or refer to future events or conditions. All statements other than statements of historical fact are statements

that could be forward-looking statements. Forward-looking statements include words such as “expects,” “anticipates,”

“intends,” “plans,” “could,” “believes,” “estimates” and similar expressions.

These statements involve known and unknown risks, uncertainties and other factors which may cause actual results to be materially different

from any future results expressed or implied by the forward-looking statements. Forward-looking statements are subject to a number of

risks and uncertainties, including, but not limited to, our ability to continue as a going concern, our ability to obtain additional

capital to meet our liquidity needs on acceptable terms, or at all, including the additional capital which will be necessary to complete

the clinical trials of our product candidates; our ability to successfully complete research and further development and commercialization

of our product candidates; the uncertainties inherent in clinical testing; the timing, cost and uncertainty of obtaining regulatory approvals;

our ability to protect the Company’s intellectual property; the loss of any executive officers or key personnel or consultants;

competition; changes in the regulatory landscape or the imposition of regulations that affect the Company’s products; and the other

factors listed under “Risk Factors” in our filings with the SEC, including Forms 10-K, 10-Q and 8-K. Investors are cautioned

not to place undue reliance on such forward-looking statements, which speak only as of the date of this release. Except as may be required

by law, the Company does not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect

events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Matinas BioPharma’s product

candidates are all in a development stage and are not available for sale or use.

Investor

Contact

Alliance

Advisors IR

Jody

Cain

Jcain@allianceadvisors.com

310-691-7100

#

# #

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

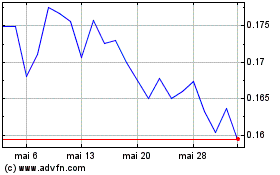

Matinas Biopharma (AMEX:MTNB)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Matinas Biopharma (AMEX:MTNB)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025