FALSE000131509800013150982024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2024

____________________________

Roblox Corporation

(Exact name of Registrant as Specified in Its Charter)

____________________________

| | | | | | | | |

| Delaware | 001-39763 | 20-0991664 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

970 Park Place, San Mateo, California | | 94403 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (888) 858-2569

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | | RBLX | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 31, 2024, Roblox Corporation (the “Company”) issued a press release announcing financial results for its third quarter ended September 30, 2024 as well as fourth quarter and updated full year 2024 guidance. The Company also posted a shareholder letter and supplemental materials on its investor relations website (ir.roblox.com). A copy of the press release and shareholder letter are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated by reference herein. Information on the Company’s website is not, and will not be deemed, a part of this report or incorporated into this or any other filings that the Company makes with the Securities and Exchange Commission.

Item 7.01 Regulation FD Disclosure.

The Company also reported fourth quarter and updated full year 2024 guidance in its press release and shareholder letter, which were issued on October 31, 2024, copies of which are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated by reference herein.

The information in Item 2.02 and Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| 99.1 | | |

99.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| ROBLOX CORPORATION | |

| | | |

Date: October 31, 2024 | By: | /s/ Michael Guthrie | |

| | Michael Guthrie Chief Financial Officer (Principal Financial Officer) | |

Exhibit 99.1

Roblox Reports Third Quarter 2024 Financial Results

Strong Growth Across Core Financial and Operating Metrics; Revenue up 29% year-over-year, Bookings1 up 34% year-over-year, record DAUs up 27% year-over-year and record Hours Engaged up 29% year-over-year

SAN MATEO, Calif., October 31, 2024 - Roblox Corporation (NYSE: RBLX), a global platform bringing millions of people together through shared experiences, released its third quarter 2024 financial and operational results and issued its fourth quarter and updated full year 2024 guidance today. Separately, Roblox posted a letter to shareholders and supplemental materials on the Roblox investor relations website at ir.roblox.com.

Third Quarter 2024 Financial, Operational, and Liquidity Highlights

•Revenue was $919.0 million, up 29% year-over-year.

•Bookings1 were $1,128.5 million, up 34% year-over-year.

•Net loss attributable to common stockholders was $239.3 million, while consolidated net loss was $240.4 million.

•Adjusted EBITDA1 was $55.0 million, which excludes adjustments for increases in deferred revenue and deferred cost of revenue of $216.3 million and $(47.9) million, respectively, or a total change in deferred of $168.4 million.

•Net cash and cash equivalents provided by operating activities was $247.4 million, up 120% year-over-year, while free cash flow1 was $218.0 million, up 266% year-over-year.

•Average Daily Active Users (“DAUs”) were 88.9 million, up 27% year-over-year.

•Average monthly unique payers were 19.1 million, up 30% year-over-year, and average bookings per monthly unique payer was $19.70.

•Hours engaged were 20.7 billion, up 29% year-over-year.

•Average bookings per DAU was $12.70, up 6% year-over-year.

•Cash and cash equivalents, short-term investments, and long-term investments totaled $3.9 billion; net liquidity2 was $2.9 billion.

“Roblox’s exceptional Q3 results demonstrate the strength of our platform and the effectiveness of our growth strategies. We’re particularly proud of the progress we’ve made in empowering creators, fostering social connections, and expanding our global reach. As we look ahead, we remain committed to building the world’s largest social platform for play, and we’re confident that our continued innovation and focus on safety will drive long-term value for our shareholders and the broader Roblox community,” said David Baszucki, founder and CEO of Roblox.

“In the third quarter of 2024, our key financial and operating metrics grew at high rates and in all cases were above the guidance we delivered on our Q2 2024 earnings call with significant year-over-year growth in revenue of 29%, bookings of 34%, DAUs of 27% and Hours engaged of 29%,” said Michael Guthrie, chief financial officer of Roblox.

1 Bookings, Adjusted EBITDA, and free cash flow are non-GAAP financial measures that we believe are useful in evaluating our performance and are presented for supplemental information purposes only and should not be considered in isolation from, or as a substitute for, financial information presented in accordance with GAAP. For further information, please refer to definitions and reconciliations provided below and in our annual and quarterly SEC filings.

2 Net liquidity represents cash and cash equivalents, short-term investments, and long-term investments, less long-term debt, net.

Forward Looking Guidance

Roblox provides its fourth quarter and updated full year 2024 GAAP and non-GAAP guidance:

Fourth Quarter 2024 Guidance

•Revenue between $935 million and $960 million.

•Bookings between $1,336 million and $1,361 million.

•Consolidated net loss between $(303) million and $(283) million.

•Adjusted EBITDA between $10 million and $30 million, which excludes adjustments for:

◦Increase in deferred revenue of $406 million.

◦Increase in deferred cost of revenue of $(86) million.

◦The total of these changes in deferrals of $320 million.

•Net cash and cash equivalents provided by operating activities between $170 million and $185 million.

•Capital expenditures and purchases of intangible assets of $(70) million.

•Free cash flow between $100 million and $115 million.

Updated Full Year 2024 Guidance

•Revenue between $3,549 million and $3,574 million.

•Bookings between $4,343 million and $4,368 million.

•Consolidated net loss between $(1,023) million and $(1,003) million.

•Adjusted EBITDA between $125 million and $145 million, which excludes adjustments for:

◦Increase in deferred revenue of $817 million.

◦Increase in deferred cost of revenue of $(186) million.

◦The total of these changes in deferrals of $631 million.

•Net cash and cash equivalents provided by operating activities between $808 million and $823 million.

•Capital expenditures and purchases of intangible assets of $(187) million.

•Free cash flow between $621 million and $636 million.

Earnings Q&A Session

Roblox will host a live Q&A session to answer questions regarding its third quarter 2024 results on Thursday, October 31, 2024 at 5:30 a.m. Pacific Time/8:30 a.m. Eastern Time. The webcast will be open to the public at ir.roblox.com or by clicking here.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our vision to connect one billion global DAUs, our vision to reach 10% of the global gaming software market, our efforts to improve the Roblox Platform, our investments to pursue the highest standards of trust and safety on our platform, our immersive and video advertising efforts, including our ads manager and independent measurement partnerships, our efforts to provide a safe online environment for children, our efforts regarding content curation, live operations and platform-wide events, our efforts regarding real-world shopping, the use of artificial intelligence (“AI”) on our platform, our economy and product efforts related to creator earnings and platform monetization, our sponsored experiences, branding and new partnerships and our roadmap with respect to each, our business, product, strategy and user growth, our investment strategy, including our opportunities for and expectations of improvements in financial and operating metrics, including operating leverage, margin, free cash flow, operating expenses and capital expenditures, our expectation of successfully executing such strategies and plans, disclosures regarding the seasonality of our business, disclosures and future growth rates, benefits from agreements with third-party cloud providers, disclosures about our infrastructure efficiency initiatives, changes to our estimated average lifetime of a paying user and the resulting effect on revenue, cost of revenue, deferred revenue and deferred cost of revenue, our expectations of future net losses and net cash and cash equivalents provided by operating activities, statements by our Chief Executive Officer and Chief Financial Officer, and our outlook and guidance for fourth quarter and full year 2024, and future periods. These forward-looking statements are made as of the date they were first issued and were based on current plans, expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. Words such as “expect,” “vision,” “envision,” “evolving,” “drive,” “anticipate,” “intend,” “maintain,” “should,” “believe,” “continue,” “plan,” “goal,” “opportunity,” “estimate,” “predict,” “may,” “will,” “could,” and “would,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to risks detailed in our filings with the Securities and Exchange Commission (the “SEC”), including our annual reports on Form 10-K, our quarterly reports on Form 10-Q and other filings and reports we make with the SEC from time to time. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: our ability to successfully execute our business and growth strategy; the sufficiency of our cash and cash equivalents to meet our liquidity needs, including the repayment of our senior notes; the demand for our platform in general; our ability to retain and increase our number of users, developers, and creators; the impact of inflation and global economic conditions on our operations; the impact of changing legal and regulatory requirements on our business, including the use of verified parental consent; our ability to develop enhancements to our platform, and bring them to market in a timely manner; our ability to develop and protect our brand and build new partnerships; any misuse of user data or other undesirable activity by third parties on our platform; our ability to maintain the security and availability of our platform; our ability to detect and minimize unauthorized use of our platform; and the impact of AI on our platform, users, creators, and developers. Additional information regarding these and other risks and uncertainties that could cause actual results to differ materially from our expectations is included in the reports we have filed or will file with the SEC, including our annual reports on Form 10-K and our quarterly reports on Form 10-Q.

The forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, we undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Special Note Regarding Operating Metrics

Additional information regarding our core financial and operating metrics disclosed above is included in the reports we have filed or will file with the SEC, including our annual reports on Form 10-K and our quarterly reports on Form 10-Q. We encourage investors and others to review these reports in their entirety.

ROBLOX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par values)

(unaudited)

| | | | | | | | | | | |

| | As of |

| | September 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 602,631 | | | $ | 678,466 | |

| Short-term investments | 1,720,323 | | | 1,514,808 | |

| Accounts receivable—net of allowances | 385,591 | | | 505,769 | |

| Prepaid expenses and other current assets | 70,702 | | | 74,549 | |

| Deferred cost of revenue, current portion | 588,915 | | | 501,821 | |

| Total current assets | 3,368,162 | | | 3,275,413 | |

| Long-term investments | 1,558,846 | | | 1,043,399 | |

| Property and equipment—net | 642,637 | | | 695,360 | |

| Operating lease right-of-use assets | 626,486 | | | 665,107 | |

| Deferred cost of revenue, long-term | 295,894 | | | 283,326 | |

| Intangible assets, net | 38,486 | | | 53,060 | |

| Goodwill | 142,236 | | | 142,129 | |

| Other assets | 15,215 | | | 10,284 | |

| Total assets | $ | 6,687,962 | | | $ | 6,168,078 | |

| Liabilities and Stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 42,842 | | | $ | 60,087 | |

| Accrued expenses and other current liabilities | 273,694 | | | 271,121 | |

| Developer exchange liability | 330,271 | | | 314,866 | |

| Deferred revenue—current portion | 2,792,396 | | | 2,406,292 | |

| Total current liabilities | 3,439,203 | | | 3,052,366 | |

| Deferred revenue—net of current portion | 1,397,803 | | | 1,373,250 | |

| Operating lease liabilities | 620,257 | | | 646,506 | |

| Long-term debt, net | 1,006,023 | | | 1,005,000 | |

| Other long-term liabilities | 46,218 | | | 22,330 | |

| Total liabilities | 6,509,504 | | | 6,099,452 | |

| | | |

| Stockholders’ equity | | | |

Common stock, $0.0001 par value; 5,000,000 authorized as of September 30, 2024 and December 31, 2023, 656,132 and 631,221 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively; Class A common stock—4,935,000 shares authorized as of September 30, 2024 and December 31, 2023, 607,454 and 581,135 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively; Class B common stock—65,000 shares authorized as of September 30, 2024 and December 31, 2023, 48,678 and 50,086 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 62 | | | 61 | |

| Additional paid-in capital | 3,949,491 | | | 3,134,946 | |

Accumulated other comprehensive income/(loss) | 16,416 | | | 1,536 | |

| Accumulated deficit | (3,776,064) | | | (3,060,253) | |

| Total Roblox Corporation Stockholders’ equity | 189,905 | | | 76,290 | |

| Noncontrolling interest | (11,447) | | | (7,664) | |

| Total Stockholders’ equity | 178,458 | | | 68,626 | |

| Total Liabilities and Stockholders’ equity | $ | 6,687,962 | | | $ | 6,168,078 | |

ROBLOX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Revenue(1) | $ | 918,953 | | | $ | 713,225 | | | $ | 2,613,796 | | | $ | 2,049,335 | |

| Cost and expenses: | | | | | | | |

Cost of revenue(1)(2) | 204,998 | | | 163,581 | | | 582,421 | | | 477,451 | |

| Developer exchange fees | 231,536 | | | 170,719 | | | 642,211 | | | 519,002 | |

| Infrastructure and trust & safety | 244,598 | | | 218,968 | | | 692,596 | | | 655,051 | |

| Research and development | 365,424 | | | 321,613 | | | 1,089,173 | | | 912,469 | |

| General and administrative | 98,733 | | | 97,508 | | | 302,184 | | | 291,279 | |

| Sales and marketing | 52,592 | | | 40,874 | | | 124,416 | | | 97,957 | |

| Total cost and expenses | 1,197,881 | | | 1,013,263 | | | 3,433,001 | | | 2,953,209 | |

| Loss from operations | (278,928) | | | (300,038) | | | (819,205) | | | (903,874) | |

| Interest income | 46,718 | | | 36,442 | | | 133,271 | | | 102,288 | |

| Interest expense | (10,286) | | | (10,268) | | | (30,853) | | | (30,409) | |

| Other income/(expense), net | 2,352 | | | (4,262) | | | (1,309) | | | (1,425) | |

| Loss before income taxes | (240,144) | | | (278,126) | | | (718,096) | | | (833,420) | |

| Provision for/(benefit from) income taxes | 303 | | | 682 | | | 1,466 | | | 177 | |

| Consolidated net loss | (240,447) | | | (278,808) | | | (719,562) | | | (833,597) | |

| Net loss attributable to noncontrolling interest | (1,123) | | | (1,650) | | | (3,751) | | | (5,349) | |

| Net loss attributable to common stockholders | $ | (239,324) | | | $ | (277,158) | | | $ | (715,811) | | | $ | (828,248) | |

| Net loss per share attributable to common stockholders, basic and diluted | $ | (0.37) | | | $ | (0.45) | | | $ | (1.11) | | | $ | (1.35) | |

| Weighted-average shares used in computing net loss per share attributable to common stockholders—basic and diluted | 650,961 | | | 619,350 | | | 642,977 | | | 612,938 | |

(1)Beginning April 1, 2024, the estimated average lifetime of a payer changed from 28 months to 27 months. Based on the carrying amount of deferred revenue and deferred cost of revenue as of March 31, 2024, the change resulted in an increase in revenue and cost of revenue during the three months ended September 30, 2024 of $26.4 million and $5.4 million, respectively, and $85.3 million and $17.8 million, respectively, during the nine months ended September 30, 2024. This change will increase our fiscal year 2024 revenue and cost of revenue by $98.0 million and $20.4 million, respectively. Refer to “Basis of Presentation and Summary of Significant Accounting Policies — Revenue Recognition” as described in the Company’s consolidated financial statements and related notes included in the Company’s Annual Report on Form 10-K for further background on the Company’s process to estimate the average lifetime of a payer.

(2)Depreciation of servers and infrastructure equipment included in infrastructure and trust & safety.

ROBLOX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Consolidated net loss | $ | (240,447) | | | $ | (278,808) | | | $ | (719,562) | | | $ | (833,597) | |

| Adjustments to reconcile net loss including noncontrolling interest to net cash and cash equivalents provided by operations: | | | | | | | |

| Depreciation and amortization expense | 68,613 | | | 53,600 | | | 175,126 | | | 153,611 | |

| Stock-based compensation expense | 265,165 | | | 220,022 | | | 757,558 | | | 617,288 | |

| Operating lease non-cash expense | 31,104 | | | 26,048 | | | 88,592 | | | 70,801 | |

| (Accretion)/amortization on marketable securities, net | (20,909) | | | (20,474) | | | (60,442) | | | (52,219) | |

| Amortization of debt issuance costs | 344 | | | 331 | | | 1,023 | | | 982 | |

| Impairment expense, (gain)/loss on investment and other asset sales, and other, net | 1,907 | | | 1,578 | | | 2,350 | | | 7,747 | |

| Changes in operating assets and liabilities, net of effect of acquisitions: | | | | | | | |

| Accounts receivable | (40,585) | | | (29,454) | | | 119,460 | | | 93,174 | |

| Prepaid expenses and other current assets | 16,295 | | | 4,298 | | | 3,340 | | | (1,861) | |

| Deferred cost of revenue | (46,876) | | | (23,477) | | | (99,491) | | | (62,074) | |

| Other assets | 1,744 | | | 502 | | | (4,922) | | | (6,189) | |

| Accounts payable | 4,424 | | | 2,279 | | | (4,404) | | | 3,855 | |

| Accrued expenses and other current liabilities | 8,238 | | | 19,745 | | | (15,278) | | | (2,599) | |

| Developer exchange liability | (18) | | | 18,880 | | | 15,405 | | | 7,724 | |

| Deferred revenue | 212,159 | | | 130,943 | | | 409,809 | | | 360,098 | |

| Operating lease liabilities | (25,292) | | | (15,994) | | | (54,621) | | | (46,837) | |

| Other long-term liabilities | 11,564 | | | 2,685 | | | 23,882 | | | 4,971 | |

| Net cash and cash equivalents provided by operating activities | 247,430 | | | 112,704 | | | 637,825 | | | 314,875 | |

| Cash flows from investing activities: | | | | | | | |

| Acquisition of property and equipment | (29,405) | | | (53,196) | | | (115,786) | | | (255,470) | |

| Payments related to business combination, net of cash acquired | (840) | | | (3,859) | | | (2,840) | | | (3,859) | |

| Purchases of intangible assets | — | | | — | | | (1,370) | | | (13,500) | |

| Purchases of investments | (1,607,405) | | | (761,151) | | | (3,474,187) | | | (3,803,911) | |

| Maturities of investments | 842,450 | | | 632,000 | | | 2,431,770 | | | 956,010 | |

| Sales of investments | 161,547 | | | 117,487 | | | 394,853 | | | 346,766 | |

| Net cash and cash equivalents used in investing activities | (633,653) | | | (68,719) | | | (767,560) | | | (2,773,964) | |

| Cash flows from financing activities: | | | | | | | |

| Proceeds from issuance of common stock | 19,949 | | | 16,209 | | | 57,196 | | | 47,316 | |

| | | | | | | |

| Proceeds from debt issuances | — | | | — | | | — | | | 14,700 | |

| | | | | | | |

| Financing payments related to acquisitions | — | | | — | | | (4,450) | | | (750) | |

| | | | | | | |

| Net cash and cash equivalents provided by financing activities | 19,949 | | | 16,209 | | | 52,746 | | | 61,266 | |

| Effect of exchange rate changes on cash and cash equivalents | 2,499 | | | (409) | | | 1,154 | | | 398 | |

| Net increase/(decrease) in cash and cash equivalents | (363,775) | | | 59,785 | | | (75,835) | | | (2,397,425) | |

| Cash and cash equivalents | | | | | | | |

| Beginning of period | 966,406 | | | 520,264 | | | 678,466 | | | 2,977,474 | |

| End of period | $ | 602,631 | | | $ | 580,049 | | | $ | 602,631 | | | $ | 580,049 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Non-GAAP Financial Measures

This press release and the accompanying tables contain the non-GAAP financial measure bookings, Adjusted EBITDA, and free cash flow.

We use this non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that this non-GAAP financial information may be helpful to investors because it provides consistency and comparability with past financial performance.

Bookings is defined as revenue plus the change in deferred revenue during the period and other non-cash adjustments. Substantially all of our bookings are generated from sales of virtual currency, which can ultimately be converted to virtual items on the Roblox Platform. Sales of virtual currency reflected as bookings include one-time purchases and monthly subscriptions purchased via payment processors or through prepaid cards. Bookings also include an insignificant amount from advertising and licensing arrangements. We believe bookings provide a timelier indication of trends in our operating results that are not necessarily reflected in our revenue as a result of the fact that we recognize the majority of revenue over the estimated average lifetime of a paying user. The change in deferred revenue constitutes the vast majority of the reconciling difference from revenue to bookings. By removing these non-cash adjustments, we are able to measure and monitor our business performance based on the timing of actual transactions with our users and the cash that is generated from these transactions. Adjusted EBITDA represents our GAAP consolidated net loss, excluding interest income, interest expense, other income/(expense), provision for/(benefit from) income taxes, depreciation and amortization expense, stock-based compensation expense, and certain other nonrecurring adjustments. We believe that, when considered together with reported GAAP amounts, Adjusted EBITDA is useful to investors and management in understanding our ongoing operations and ongoing operating trends. Our definition of Adjusted EBITDA may differ from the definition used by other companies and therefore comparability may be limited. Free cash flow represents the net cash and cash equivalents provided by operating activities less purchases of property, equipment, and intangible assets acquired through asset acquisitions. We believe that free cash flow is a useful indicator of our unit economics and liquidity that provides information to management and investors about the amount of cash generated from our core operations that, after the purchases of property, equipment, and intangible assets acquired through asset acquisitions, can be used for strategic initiatives.

Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial information as a tool for comparison. As a result, our non-GAAP financial information is presented for supplemental informational purposes only and should not be considered in isolation from, or as a substitute for financial information presented in accordance with GAAP.

Reconciliation tables of the most comparable GAAP financial measure to the non-GAAP financial measure used in this press release are included below. We encourage investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure, and to view these non-GAAP measures in conjunction with the most directly comparable GAAP financial measures.

GAAP to Non-GAAP Financial Measures Reconciliations

The following table presents a reconciliation of revenue, the most directly comparable financial measure calculated in accordance with GAAP, to bookings, for each of the periods presented (in thousands, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of revenue to bookings: | | | | | | | |

| Revenue | $ | 918,953 | | | $ | 713,225 | | | $ | 2,613,796 | | | $ | 2,049,335 | |

| Add (deduct): | | | | | | | |

| Change in deferred revenue | 216,325 | | | 130,957 | | | 410,657 | | | 360,112 | |

| Other | (6,758) | | | (4,729) | | | (16,998) | | | (15,489) | |

| Bookings | $ | 1,128,520 | | | $ | 839,453 | | | $ | 3,007,455 | | | $ | 2,393,958 | |

The following table presents a reconciliation of consolidated net loss, the most directly comparable financial measure calculated in accordance with GAAP, to Adjusted EBITDA, for each of the periods presented (in thousands, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of consolidated net loss to Adjusted EBITDA: | | | | | | | |

| Consolidated net loss | $ | (240,447) | | | $ | (278,808) | | | $ | (719,562) | | | $ | (833,597) | |

| Add (deduct): | | | | | | | |

| Interest income | (46,718) | | | (36,442) | | | (133,271) | | | (102,288) | |

| Interest expense | 10,286 | | | 10,268 | | | 30,853 | | | 30,409 | |

| Other (income)/expense, net | (2,352) | | | 4,262 | | | 1,309 | | | 1,425 | |

| Provision for/(benefit from) income taxes | 303 | | | 682 | | | 1,466 | | | 177 | |

Depreciation and amortization expense(A) | 68,613 | | | 53,600 | | | 175,126 | | | 153,611 | |

| Stock-based compensation expense | 265,165 | | | 220,022 | | | 757,558 | | | 617,288 | |

RTO severance charge(B) | 108 | | | — | | | 1,101 | | | — | |

Other non-cash charges(C) | — | | | — | | | — | | | 6,988 | |

| Adjusted EBITDA | $ | 54,958 | | | $ | (26,416) | | | $ | 114,580 | | | $ | (125,987) | |

(A)Includes a one-time charge of $17.9 million related to the re-assessment of the estimated useful life of certain software licenses, resulting in the acceleration of their remaining depreciation within infrastructure and trust & safety expenses.

(B)Relates to cash severance costs associated with the Company’s return-to-office (“RTO”) plan announced in October 2023, which required a subset of the Company’s remote employees to begin working from the San Mateo headquarters for three days a week, beginning in the summer of 2024.

(C)Includes impairment expenses related to certain operating lease right-of-use assets and related property and equipment.

The following table presents a reconciliation of net cash and cash equivalents provided by operating activities, the most directly comparable financial measure calculated in accordance with GAAP, to free cash flow, for each of the periods presented (in thousands, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Reconciliation of net cash and cash equivalents provided by operating activities to free cash flow: | | | | | | | |

| Net cash and cash equivalents provided by operating activities | $ | 247,430 | | | $ | 112,704 | | | $ | 637,825 | | | $ | 314,875 | |

| Deduct: | | | | | | | |

| Acquisition of property and equipment | (29,405) | | | (53,196) | | | (115,786) | | | (255,470) | |

| Purchases of intangible assets | — | | | — | | | (1,370) | | | (13,500) | |

| Free cash flow | $ | 218,025 | | | $ | 59,508 | | | $ | 520,669 | | | $ | 45,905 | |

Forward Looking Guidance3: GAAP to Non-GAAP Financial Measures Reconciliations

The following table presents a reconciliation of revenue, the most directly comparable financial measure calculated in accordance with GAAP, to bookings, for each of the periods presented (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Guidance | | Updated Guidance |

| Three Months Ended December 31, 2024 | | Twelve Months Ended December 31, 2024 |

| Low | | High | | Low | | High |

| Reconciliation of revenue to bookings: | | | | | | | |

| Revenue | $ | 935,000 | | | $ | 960,000 | | | $ | 3,548,796 | | | $ | 3,573,796 | |

| Add (deduct): | | | | | | | |

| Change in deferred revenue | 406,000 | | | 406,000 | | | 816,657 | | | 816,657 | |

| Other | (5,000) | | | (5,000) | | | (21,998) | | | (21,998) | |

| Bookings | $ | 1,336,000 | | | $ | 1,361,000 | | | $ | 4,343,455 | | | $ | 4,368,455 | |

The following table presents a reconciliation of consolidated net loss, the most directly comparable financial measure calculated in accordance with GAAP, to Adjusted EBITDA, for each of the periods presented (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Guidance | | Updated Guidance |

| Three Months Ended December 31, 2024 | | Twelve Months Ended December 31, 2024 |

| Low | | High | | Low | | High |

| Reconciliation of consolidated net loss to Adjusted EBITDA: | | | | | | | |

| Consolidated net loss | $ | (303,000) | | | $ | (283,000) | | | $ | (1,022,562) | | | $ | (1,002,562) | |

| Add (deduct): | | | | | | | |

| Interest income | (40,000) | | | (40,000) | | | (173,271) | | | (173,271) | |

| Interest expense | 11,000 | | | 11,000 | | | 41,853 | | | 41,853 | |

| Other (income)/expense, net | — | | | — | | | 1,309 | | | 1,309 | |

| Provision for/(benefit from) income taxes | 2,000 | | | 2,000 | | | 3,466 | | | 3,466 | |

| Depreciation and amortization expense | 55,000 | | | 55,000 | | | 230,126 | | | 230,126 | |

| Stock-based compensation expense | 285,000 | | | 285,000 | | | 1,042,558 | | | 1,042,558 | |

RTO severance charge(A) | — | | | — | | | 1,101 | | | 1,101 | |

| | | | | | | |

Adjusted EBITDA | $ | 10,000 | | | $ | 30,000 | | | $ | 124,580 | | | $ | 144,580 | |

(A)Relates to cash severance costs associated with the Company’s RTO plan announced in October 2023, which required a subset of the Company’s remote employees to begin working from the San Mateo headquarters for three days a week, beginning in the summer of 2024.

3 Beginning April 1, 2024, the estimated average lifetime of a payer changed from 28 months to 27 months, which is reflected in our fourth quarter and updated full year 2024 GAAP and non-GAAP guidance. Based on the carrying amount of deferred revenue and deferred cost of revenue as of March 31, 2024, the April 1, 2024 change in estimated average lifetime of a payer will result in an increase in revenue and cost of revenue of $12.7 and $2.6 million, respectively, during the fourth quarter of 2024 and an increase in revenue and cost of revenue of $98.0 million and $20.4 million, respectively, during the full year 2024. Refer to “Basis of Presentation and Summary of Significant Accounting Policies — Revenue Recognition” as described in the Company’s consolidated financial statements and related notes included in the Company’s Annual Report on Form 10-K for further background on the Company’s process to estimate the average lifetime of a payer.

The following table presents a reconciliation of net cash and cash equivalents provided by operating activities, the most directly comparable financial measure calculated in accordance with GAAP, to free cash flow, for each of the periods presented (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Guidance | | Updated Guidance |

| Three Months Ended December 31, 2024 | | Twelve Months Ended December 31, 2024 |

| Low | | High | | Low | | High |

Reconciliation of net cash and cash equivalents provided by operating activities to free cash flow: | | | | | | | |

| Net cash and cash equivalents provided by operating activities | $ | 170,000 | | | $ | 185,000 | | | $ | 807,825 | | | $ | 822,825 | |

| Deduct: | | | | | | | |

| Acquisition of property and equipment | (70,000) | | | (70,000) | | | (185,786) | | | (185,786) | |

| Purchase of intangible assets | — | | | — | | | (1,370) | | | (1,370) | |

| Free cash flow | $ | 100,000 | | | $ | 115,000 | | | $ | 620,669 | | | $ | 635,669 | |

About Roblox

Roblox is an immersive platform for connection and communication. Every day, millions of people come to Roblox to create, play, work, learn, and connect with each other in experiences built by our global community of creators. Our vision is to reimagine the way people come together– in a world that is safe, civil, and optimistic. To achieve this vision, we are building an innovative company that, together with the Roblox community, has the ability to strengthen our social fabric and support economic growth for people around the world. For more about Roblox, please visit corp.roblox.com.

CONTACTS

Stefanie Notaney

Roblox Corporate Communications

press@roblox.com

ROBLOX and the Roblox logo are among the registered and unregistered trademarks of Roblox Corporation in the United States and other countries. © 2024 Roblox Corporation. All rights reserved.

Source: Roblox Corporation

Shareholder Letter Q3 2024 October 31, 2024 Exhibit 99.2

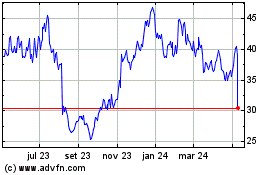

To Our Shareholders: In the third quarter of 2024, our key financial and operating metrics grew at high rates and in all cases were above the guidance we delivered on our Q2 2024 earnings call. ● Revenue of $919.0 million grew by 29% over Q3 2023, and was ahead of our guidance of $860 million - $885 million ● Bookings were $1,128.5 million, an increase of 34% year-over-year, and better than our guidance of $1,000 million - $1,025 million ● Consolidated net loss was $240.4 million, better than our guidance of a loss of between $275 million - $255 million ● Adjusted EBITDA was $55.0 million, above our guidance range of $22 million - $42 million. Adjusted EBITDA excludes the adjustments for an increase in deferred revenue of $216.3 million and an increase in deferred cost of revenue of $47.9 million, or a total change in deferred of $168.4 million. The total change in deferred was higher than our guidance of $113 million due to higher Bookings than in our guidance numbers. ● Cash flow from operations was $247.4 million, up 120% year-over-year and above our guidance of $147 million - $162 million ● Free cash flow was $218.0 million, up 266% (or 3.7x) over free cash flow in Q3 2023 and above our guidance of $105 million - $120 million Since Robloxʼs initial public filing the company has included a “Special Note Regarding Operating Metricsˮ that explains how the companyʼs key operating metrics – including Daily Active Users DAUs and hours engaged Hours – are calculated. As in all prior quarters, we calculated these metrics consistently and believe these numbers are comparable with prior periods, provide investors with valuable insight into key business trends, and correlate closely with Bookings: ● DAUs reached 88.9 million in Q3 2024, representing 27% year-over-year growth ● Hours totaled 20.7 billion, 29% higher than Q3 2023 ● Bookings were $1,128.5 million, an increase of 34% year-over-year It is important to note that Bookings is the primary metric by which we run the business. It is also the metric on which we have the most precise validation because it measures cash and so we reconcile net Bookings to our cash balances. Investors often ask us about the interplay among DAUs, Hours, and Bookings. We believe they are highly correlated (see charts below) and over the last six years Hours have grown slightly faster than DAUs, and Bookings have grown faster than Hours. There are many reasons, but generally 1

over time, as the content on Roblox has improved and DAUs increased in tenure, engagement overall has tended to go up. Similarly, over time as content has improved and platform functionality has expanded, we have seen more users becoming payers and those payers, on average, increasing their purchase of Robux. This has driven up both Average Bookings per Monthly Unique Payer ABPMUP, see page titled Payer Community in our Q3 2024 Supplemental Materials) and overall Bookings per hour. Please note that these have been the overall progressions over the past six years. Within any given month or quarter the behavior of the metrics has not been, and will not always be, consistent. To test the assumptions that over a long period of time these metrics are correlated and will generally behave in certain ways in relation to each other, we first calculated the changes in DAUs, Hours, and Bookings over the past six years. These are the six years for which we have publicly disclosed our financial results. To do those calculations, and to control for seasonality, we examined compound annual growth rates CAGR from Q3 2018 to Q3 2024 for all three metrics. To reflect the relative growth rates of all three metrics, all figures are indexed to 3Q 2018. From Q3 2018 to Q3 2024 ● DAUs grew at a CAGR of 38.2% ● Hours compounded at a CAGR of 41.1% ● Bookings grew at a CAGR of 45.5% Thus, over the same time period, engagement Hours / DAU compounded by 2.1% and monetization Bookings / Hour) compounded by 3.2%. 2

In addition to the simple calculation of the 6-year growth rates, we also examined, in more detail, the relationships between DAUs and Bookings as well as between Hours and Bookings. We calculated the correlation coefficient, known as the R-value, a statistical measurement that describes the strength and direction of a linear relationship between two variables. An R-value of 1 is a perfect positive correlation where one variable (in these cases Bookings) increases as the other variables DAUs in one example and Hours in the other) increase. The correlation coefficient for DAUs and Bookings and Hours and Bookings were both 0.96, very close to a perfect positive correlation. We also calculated the R-squared, known as the coefficient of determination. This measurement explains the percent of variation in one variable (in these cases Bookings) that is explained by another variable or variables (in one example DAUs and Hours in the other). The coefficient of determination between DAUs and Bookings and Hours and Bookings was 0.92. This means that 92% of the variability in Bookings can be explained by the changes in DAUs and Hours (again, each correlation is measured separately). An R-squared value above 0.85 is generally considered to be high. These figures are shown in the graph below: Note: analysis based on quarterly data from Q3 2018 to Q3 2024. 3

Again, in all of the analyses presented, we calculated DAUs, Hours, and Bookings consistently and as defined in our public filings. Finishing up on our core metrics: ● Our fully diluted share count, consisting primarily of shares of Class A and Class B common stock issued and outstanding, stock options outstanding, and unvested RSUs outstanding, was 726.8 million shares as of September 30, 2024, an increase of 2.7% from September 30, 2023. ● Cash and cash equivalents, short-term investments, and long-term investments totalled $3,881.8 million as of September 30, 2024, up from $3,115.6 million as of September 30, 2023. Cash and cash equivalents, short-term investments, and long-term investments, net of debt, increased to $2,875.8 million as of September 30, 2024, up from $2,110.9 million as of September 30, 2023. Our results in Q3 were well beyond the financial targets communicated at our Investor Day last November: 1. Compounding top line by 20% per year through at least 2027 2. Targeting margin expansion of 100 - 300 basis points each year 3. Moderating capital expenditures now that we are through a significant investment cycle, thereby providing free cash flow leverage We believe that several key initiatives are contributing to the acceleration of growth we have seen over the past two quarters including: ● Search and Discovery: improvements to our AI-driven discovery algorithms advanced personalization allowing us to feature more relevant experiences and items thereby driving engagement and spending ● Virtual Economy and Marketplace: initiatives such as dynamic price floors, UGC For All, and in-experience price optimizations, among others, boosted monetization ● App Performance: improvements to app launch time, reductions in crash rates, and increases to frame rate and app quality led to longer uninterrupted play times and more seamless app experiences ● Live Ops: platform events both attracted new users and grew returning users thereby increasing DAUs 4

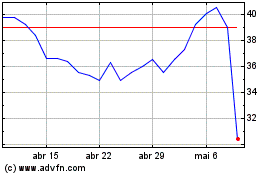

In parallel, we see several developments that, if they continue, point to the long-term health of the Roblox platform: ● As compared to last year, the developer community is publishing more significant content updates of higher quality which drive increases to DAUs and spending ● The emergence of new viral experiences breaking into the top charts, and ● Spending growth becoming more evenly distributed among the top 100 experiences We believe homepage curation and discovery changes are supporting these healthy developments. Through the introduction of Todayʼs Picks and improved placement of sponsored sorts, developers now have more avenues for their content updates and new experiences to be discovered. We believe quicker and new avenues for discovery provide an incentive for creators to increase the cadence of their content development and updating. Finally, the number of unique experiences receiving impressions from homepage recommendations is increasing. This helps further personalize discovery for users while building a healthier creator ecosystem. Financial Commentary In Q3 2024, revenue grew by 29% year-over-year to $919.0 million, while Bookings grew by 34% year-over-year to $1,128.5 million. Top line growth was driven by growth in Monthly Unique Payers MUPs which reached an all-time high of 19.1 million in Q3 2024, an increase of approximately 30% over Q3 2023, as well as an approximately 3.6% growth in ABPMUP which increased to $19.70 from $19.02. In addition, the Q3 2024 Bookings year-over-year growth benefited from unusually high growth in our console business compared to last year primarily because in Q3 2024 we were operating on the PlayStation console while we were not in Q3 2023. Bookings on console accounted for 8% of Bookings in Q3 2024. The remaining 92% of Bookings in Q3 2024 were primarily from non-console platforms – desktop, mobile, etc. – and those Bookings grew 28% over non-console Bookings in Q3 2023. In Q3 2024, we continued to manage our costs and capital expenditures while investing strategically. 5

In Q3 2024, certain infrastructure and trust & safety expenses grew to $129.5 million, 4% higher year-over-year versus Q3 2023 and 6% higher sequentially versus Q2 2024. As a result of rapid top line growth, certain infrastructure and trust & safety expenses amounted to 14% of revenue and 11% of Bookings in Q3 2024 versus 17% of revenue and 15% of Bookings in Q3 2023. Personnel costs, exclusive of stock-based compensation expense, were $202.2 million in Q3 2024, up 3% year-over-year and down 1% sequentially. Over the past five quarters, these costs have remained relatively flat as we have carefully managed incremental headcount. Because of our careful management of these costs and strong top line growth, personnel expenses amounted to 22% of revenue and 18% of Bookings in Q3 2024 versus 27% of revenue and 23% of Bookings in Q3 2023. Developer exchange fees were $231.5 million in Q3 2024, a record for the amount of economics earned by our developers and creators. Developer exchange fees in Q3 2024 grew 36% over the amounts in Q3 2023, and 11% sequentially over Q2 2024. The high growth in Bookings drove the growth in Developer exchange fees. Developer exchange fees were 25% of revenue and 21% of Bookings in Q3 2024, just slightly higher than in Q3 2023 when the fees were 24% of revenue and 20% of Bookings. Primarily as a result of the strong top line growth and thoughtful management of investments highlighted above, net cash and cash equivalents provided by operating activities grew to $247.4 million in Q3 2024, up 120% from $112.7 million in Q3 2023. Capital expenditures in Q3 2024 were $29.4 million, down from $53.2 million in Q3 2023. Free cash flow for the quarter was $218.0 million, an increase of 266% (or 3.7x) over free cash flow of $59.5 million in Q3 2023. As of September 30, 2024 our cash, cash equivalents and investments totaled $3,881.8 million, up from $3,115.6 million as of September 30, 2023. 6

Liquidity As of September 30, 2024, the balances of our liquidity components were: ● Cash and cash equivalents: $602.6 million ● Short-term investments: $1,720.3 million ● Long-term investments: $1,558.8 million ● Carrying amount of the senior notes due 2030 $991.3 million) and the portion of the non-eliminated carrying amount of notes due 2026 issued by the Companyʼs fully consolidated joint venture $14.7 million), or $1,006.0 million1 in total. ● Cash and cash equivalents plus short-term and long-term investments totaled $3,881.8 million in Q3 2024. ● Net liquidity (cash, cash equivalents and investments less debt) was $2,875.8 million. On October 3, 2024 Moodyʼs upgraded our senior notes from Ba2 to Ba1. In Q2 2024, Standard & Poorʼs upgraded our senior notes from BB to BB. We are now one notch below Investment Grade at both agencies. 1 $991.3 million represents the net carrying amount of the senior notes due 2030 and $14.7 million represents the portion of the non-eliminated carrying amount of notes due 2026 issued by the Companyʼs fully consolidated joint venture, each as of September 30, 2024. The principal amounts of the 2030 Notes and 2026 Notes were $1.0 billion and $14.7 million, respectively. 7

Our Commitment to Providing a Safe and Secure Environment for All Users Our highest priority is to create one of the safest online environments for users, a goal not only core to our founding values but critical to our ability to meet our long-term growth vision. Because our platform was originally created for children and now includes all ages over 5, our policies are purpose-built to be strict. We have a multilayered moderation system that is designed to assess all content uploaded to Roblox for potential safety issues. Our policies which define acceptable content, communication, as well as our user behavior inform a wide range of AI algorithms that automatically moderate content. Those algorithms are backed up by a team of thousands of moderators focused on improving quality and handling the most difficult decisions. On top of that, we have sophisticated user reporting and automated monitoring systems that provide additional coverage. We are deeply troubled by any incident that endangers our users and take concerns about safety on the platform extremely seriously. At the same time, we know that millions of users have safe and positive experiences every day and abide by Robloxʼs stringent Community Standards. For instance, of the more than 36.2 million reports to National Center for Missing & Exploited Childrenʼs CyberTipline in 2023, Roblox provided less than 0.04% of them. Our safety and civility initiatives also have been recognized by safety-focused industry organizations such as Save the Children, the Digital Wellness Lab, Connect Safely, the United Nationsʼ Office of the Special Representative of the Secretary-General on Violence against Children, and the Family Online Safety Institute FOSI. The Simon Wiesenthal Center in its 2023 Digital Terrorism and Hate Report ranked Roblox the highest among 24 major technology platforms for efforts to combat extremism. Roblox's approach to user safety has several interlocking elements that include: ● Proactive Measures and Default Settings: Our combination of human moderators and automated tools proactively detect and take swift action to review and remove inappropriate content. Rigorous text chat filters block inappropriate words and phrases. Our policies do not allow user-to-user image sharing. Our filters are designed to block attempts to direct under-13 users off platform and prevent the sharing of personal information such as a phone number or address. 8

● Community empowerment: We encourage and make it easy for users to report any content or behavior they believe violates Roblox's policies, and we promptly investigate and act on, as necessary, these reports. Our highly talented creator community is dedicated to making safe and positive content. ● Expanding and Simplifying Parental Controls:We offer a range of controls, and substantial parent resources, so parents can restrict access to certain content and communications features, and to monitor their children's activity on the platform. Based on feedback from parents, community members, and outside experts, we continue to update and refine the tools available to help manage the online experiences of our youngest users. Last week, we shared information on new parental controls and insights that will start rolling out next month. These new tools help parents customize their childʼs experience and better understand our platform. We will share more information on these updates when the changes go into effect next month. ● Partnerships and Increased Education: Roblox actively collaborates with leading child safety organizations, industry groups, and law enforcement agencies to share insights, develop best practices, develop educational campaigns, and stay ahead of emerging threats. Knowing child safety is not just a one-platform issue but an industry-wide concern, we are active members of the Tech Coalition and its cross-platform signal-sharing program Lantern and have provided an open-source model of our voice safety classifier to help others improve their platforms. ● Continuous Improvement: Roblox will continue to invest in technology, policies, and partnerships to pursue the highest standards of trust and safety on our platform. For example, over the last few years we developed a much more robust content review process, and also increased our proactive detection. We are constantly updating our algorithms and training our moderators to handle complex tasks and safety issues. And our ongoing investments in AI and machine learning, which run alongside expert human moderators, allow us to scale and get better at the same time. We only use AI when it produces more accurate results than humans at scale and our human moderators handle appeals and hard cases, while working to improve our AI models by constantly training and monitoring. The combination is significantly increasing the responsiveness, accuracy and capacity of Robloxʼs moderation. We understand there is always more work to be done, and we are committed to taking steps to make Roblox a safe and positive environment for all users. 9

Product & Business Highlights This year weʼve started to map out what we believe the distribution of content on Roblox will look like on our way to 1 billion daily active users. At our 10th annual Roblox Developers Conference we unveiled our vision for the next step towards reaching one billion daily active users: capturing 10% of the global gaming software market within the Roblox ecosystem. The gaming market is large: every year over 3 billion people play games and the industry supports over $180 billion in content revenue2. To achieve our goal, we announced several new features and products aimed at three key areas: evolving our platform technology in support of our game creatorsʼ ambitions and an expanded ecosystem; increasing developer opportunities through innovation in our economic systems – including a commerce integration partnership with Shopify; and amplifying creators' growth through on and off platform organic and paid acquisition. Our brand partnerships also continue to demonstrate strong performance and potential for future growth. Notable brand launches in Q3 include a collaboration with the NFL and Roblox developer Voldex on NFL Universe Football, which saw significant user engagement and monetization uplift, becoming the 32nd highest experience by spend in September3 and continuing to rise in the ranks. Finally, we are working with our new measurement partner DoubleVerify to begin the development of 3D in-experience viewability and invalid traffic IVT measurement on Roblox, integrating with immersive ads across image and video formats on mobile web and in-app environments. We believe our brand partnerships will be a key driver of future success, and we are committed to delivering innovative and impactful collaborations that benefit brands, developers, and users alike. 3 For the period September 13 - 30, 2024. The integration launched on September 13, 2024. 2 Source: Newzooʼs Global Games Market Report 2024. 10

Guidance4: Before giving guidance, in particular Bookings guidance, we note the following: since Investor Day in November 2023, we have referenced a 20% year-over-year growth target for Bookings. We have exceeded 20% in six of the last eight quarters, and during those eight quarters the average Bookings year-over-year growth rate was approximately 23%. We expect to continue to use the 20% growth target for the foreseeable future and we will build our expense models on that expectation so that we can continue to invest wisely while trying to achieve continued operating leverage. In Q3 2024, we saw the emergence of viral hits and significant updates from a large number of existing top experiences. The timing and significance of these viral hits and significant updates caused results to deviate positively from our 20% organic growth rate. We are pleased with the recent results, however, we will not incorporate significantly higher growth into our guidance until we see sustained evidence that higher levels of growth are expected. Finally, note that non-console Bookings growth in Q3 2024 was 28% year-over-year and accounted for approximately 92% of total Bookings in Q3 2024. Bookings from consoles in Q3 2024 accounted for 8% of total Bookings and grew year-over-year much more quickly. We do not expect much, if any, growth in the console business in Q4 2024 as we lap the initial halo effect from the launch of PlayStation last year. Looking ahead into 2025, we expect more normalized growth rates on console wherein console Bookings will be more in-line with overall platform growth. Managementʼs guidance is as follows: Q4 2024 ● Revenue between $935 million - $960 million, or year-over-year growth of 2528%. ● Bookings between $1,336 million - $1,361 million, or year-over-year growth of 1921%. This range represents an increase to Q4 guidance of $35 million over the Q4 Bookings implied by our prior Q3 guidance and our prior full year FY 2024 guidance. ● Consolidated net loss between $303 million - $283 million, an improvement compared to $325 million in Q4 2023. 4 Beginning April 1, 2024, the estimated average lifetime of a payer changed from 28 months to 27 months, which is reflected in our fourth quarter and updated full year 2024 guidance. Based on the carrying amount of deferred revenue and deferred cost of revenue as of March 31, 2024, the April 1, 2024 change in estimated average lifetime of a payer will result in an increase in revenue and cost of revenue of $12.7 million and $2.6 million, respectively, during the fourth quarter of 2024 and an increase in revenue and cost of revenue of $98.0 million and $20.4 million, respectively, during the full year 2024. 11

● Adjusted EBITDA between $10 million - $30 million, an improvement compared to $45 million in Q4 2023, which excludes adjustments for: - Increase in deferred revenue of $406 million. - Increase in deferred cost of revenue of $86 million. - The total of these changes in deferrals of $320 million. ● Net cash and cash equivalents provided by operating activities between $170 million - $185 million, a year-over-year increase of 1929%. ● Capital expenditures of $70 million. ● Free cash flow between $100 million - $115 million, a year-over-year increase of 2847%. Fiscal 2024 Based on the Q4 2024 guidance above and Q3 year-to-date actual results, Fiscal 2024 guidance is as follows: ● Revenuebetween $3,549 million - $3,574 million, or year-over-year growth of 2728%. ● Bookings between $4,343 million - $4,368 million, or year-over-year growth of 2324%. The high end of this range for FY 2024 Bookings guidance is $138 million above the high end of our prior FY 2024 Bookings guidance. That incremental amount represents the $104 million by which our actual Q3 Bookings exceeded prior guidance, plus an increase to Q4 guidance of $35 million (noted above) over the Q4 Bookings implied by our prior Q3 guidance and our prior full year FY 2024 guidance. ● Consolidated net loss between $1,023 million - $1,003 million, an improvement compared to $1,159 million in FY 2023. ● Adjusted EBITDA between $125 million - $145 million, an improvement compared to $171 million in FY 2023, which excludes adjustments for: - Increase in deferred revenue of $817 million. - Increase in deferred cost of revenue of $186 million. - The total of these changes in deferrals of $631 million. ● Net cash and cash equivalents provided by operating activities between $808 million - $823 million, a year-over-year increase of 7680%. ● Capital expenditures of $187 million, a year-over-year decrease of 44%. ● Free cash flow between $621 million - $636 million, or year-over-year increase of 400413%. Our Q4 2024 Bookings guidance of $1,336 million - $1,361 million implies a year-over-year growth range of 1921%. Our Q4 2024 guidance assumes that the broad-based strength we saw in Q2 and Q3 generally persists and recognizes that we are lapping a strong Q4 2023 that included the PlayStation launch. 12

For the full year, we increased our Bookings guidance range to $4,343 million - $4,368 million, implying a year-over-year growth range of 2324% for 2024. The midpoint of this range is above the midpoint of the ranges we provided on our previous calls. Further, we expect to continue managing our fixed costs and capital expenditures while investing in platform safety and our key growth vectors. Our Q4 2024 operating cash flow guidance implies year-over-year growth of 1929%, and year-over-year free cash flow growth of 2847%. Our FY 2024 guidance implies year-over-year operating cash flow growth of 7680% and year-over-year free cash flow growth of 400413%. Although we intend to provide formal FY 2025 guidance during our Q4 2024 earnings call in the new year, we are currently comfortable anchoring to our 2023 Investor Day growth target of 20% year-over-year for Bookings growth in 2025. The first half of 2025 will likely benefit from easier comps and so at this point we assume in our models that year-over-year growth in Q1 and Q2 will be higher than in Q3 and Q4. Further, in 2025, we believe we can continue to invest in platform safety and our key growth vectors while improving margins between 100300 basis points. Capital expenditures will likely be a bit higher in 2025 than in 2024, but we still expect free cash flow growth to exceed Bookings growth. Additionally, we intend to keep share dilution under 3%. 13

EARNINGS Q&A SESSION We will host a live Q&A session to answer questions regarding our third quarter 2024 results on Thursday, October 31, 2024 at 530 a.m. Pacific Time/830 a.m. Eastern Time. The live webcast and Q&A session will be open to the public at ir.roblox.com and we invite you to join us and to visit our investor relations website at ir.roblox.com to review supplemental information. 14

Forward-Looking Statements This letter and the live webcast and Q&A session which will be held at 530 a.m. Pacific Time/830 a.m. Eastern Time on Thursday, October 31, 2024 contain “forward-looking statementsˮ within the meaning of the “safe harborˮ provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our vision to connect one billion global DAUs, our vision to reach 10% of the global gaming software market, our efforts to improve the Roblox Platform, our investments to pursue the highest standards of trust and safety on our platform, our immersive and video advertising efforts, including our ads manager and independent measurement partnerships, our efforts to provide a safe online environment for children, our efforts regarding content curation, live operations and platform-wide events, our efforts regarding real-world shopping, the use of artificial intelligence (“AIˮ) on our platform, our economy and product efforts related to creator earnings and platform monetization, our sponsored experiences, branding and new partnerships and our roadmap with respect to each, our business, product, strategy and user growth, our investment strategy, including our opportunities for and expectations of improvements in financial and operating metrics, including operating leverage, margin, free cash flow, operating expenses and capital expenditures, our expectation of successfully executing such strategies and plans, disclosures regarding the seasonality of our business, disclosures and future growth rates, benefits from agreements with third-party cloud providers, disclosures about our infrastructure efficiency initiatives, changes to our estimated average lifetime of a paying user and the resulting effect on revenue, cost of revenue, deferred revenue and deferred cost of revenue, our expectations of future net losses and net cash and cash equivalents provided by operating activities, statements by our Chief Executive Officer and Chief Financial Officer, and our outlook and guidance for fourth quarter and full year 2024, and future periods. These forward-looking statements are made as of the date they were first issued and were based on current plans, expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. Words such as “expect,ˮ “vision,ˮ “envision,ˮ “evolving,ˮ “drive,ˮ “anticipate,ˮ “intend,ˮ “maintain,ˮ “should,ˮ “believe,ˮ “continue,ˮ “plan,ˮ “goal,ˮ “opportunity,ˮ “estimate,ˮ “predict,ˮ “may,ˮ “will,ˮ “could,ˮ and “would,ˮ and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to risks detailed in our filings with the Securities and Exchange Commission (the “SECˮ), including our annual reports on Form 10K, our quarterly reports on Form 10Q and other filings and reports we make with the SEC from time to time. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: our ability to successfully execute our business and growth strategy; the sufficiency of our cash and cash equivalents to meet our liquidity needs, including the repayment of our senior notes; the demand for our platform in general; our ability to retain and increase our number of users, developers, and creators; the impact of inflation and global economic conditions on our operations; the impact of changing legal and regulatory requirements on our business, including the use of verified parental consent; our ability to develop enhancements to our platform, and bring them to market in a timely manner; our ability to develop and protect our brand and build new partnerships; any misuse of user data or other undesirable activity by third parties on our platform; our ability to maintain the security and availability of our platform; our ability to detect and minimize unauthorized use of our platform; and the impact of AI 15

on our platform, users, creators, and developers. Additional information regarding these and other risks and uncertainties that could cause actual results to differ materially from our expectations is included in the reports we have filed or will file with the SEC, including our annual reports on Form 10K and our quarterly reports on Form 10Q. The forward-looking statements included in this letter represent our views as of the date of this letter. We anticipate that subsequent events and developments will cause our views to change. However, we undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this letter. Special Note Regarding Operating Metrics Additional information regarding our core financial and operating metrics disclosed above is included in the reports we have filed or will file with the SEC, including our annual reports on Form 10K and our quarterly reports on Form 10Q. We encourage investors and others to review these reports in their entirety. 16

Non-GAAP Financial Measures This letter contains the non-GAAP financial measures Bookings, Adjusted EBITDA, and free cash flow. We use this non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that this non-GAAP financial information may be helpful to investors because it provides consistency and comparability with past financial performance. Bookings is defined as revenue plus the change in deferred revenue during the period and other non-cash adjustments. Substantially all of our bookings are generated from sales of virtual currency, which can ultimately be converted to virtual items on the Roblox Platform. Sales of virtual currency reflected as bookings include one-time purchases and monthly subscriptions purchased via payment processors or through prepaid cards. Bookings also include an insignificant amount from advertising and licensing arrangements. We believe bookings provide a timelier indication of trends in our operating results that are not necessarily reflected in our revenue as a result of the fact that we recognize the majority of revenue over the estimated average lifetime of a paying user. The change in deferred revenue constitutes the vast majority of the reconciling difference from revenue to bookings. By removing these non-cash adjustments, we are able to measure and monitor our business performance based on the timing of actual transactions with our users and the cash that is generated from these transactions. Adjusted EBITDA represents our GAAP consolidated net loss, excluding interest income, interest expense, other income/(expense), provision for/(benefit from) income taxes, depreciation and amortization expense, stock-based compensation expense, and certain other nonrecurring adjustments. We believe that, when considered together with reported GAAP amounts, Adjusted EBITDA is useful to investors and management in understanding our ongoing operations and ongoing operating trends. Our definition of Adjusted EBITDA may differ from the definition used by other companies and therefore comparability may be limited. Free cash flow represents the net cash and cash equivalents provided by operating activities less purchases of property, equipment, and intangible assets acquired through asset acquisitions. We believe that free cash flow is a useful indicator of our unit economics and liquidity that provides information to management and investors about the amount of cash generated from our core operations that, after the purchases of property, equipment, and intangible assets acquired through asset acquisitions, can be used for strategic initiatives. Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial information as a tool for comparison. As a result, our non-GAAP financial information is presented for supplemental informational purposes only and should not be considered in isolation from, or as a substitute for financial information presented in accordance with GAAP. 17

Reconciliation tables of the most comparable GAAP financial measure to the non-GAAP financial measure used in this letter are included at the end of this letter. We encourage investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure, and to view these non-GAAP measures in conjunction with the most directly comparable GAAP financial measures. 18

GAAP to Non-GAAP Financial Measures Reconciliations The following table presents a reconciliation of revenue, the most directly comparable financial measure calculated in accordance with GAAP, to Bookings, for each of the periods presented (in thousands, unaudited): Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Reconciliation of revenue to Bookings: Revenue $ 918,953 $ 713,225 $ 2,613,796 $ 2,049,335 Add (deduct): Change in deferred revenue 216,325 130,957 410,657 360,112 Other 6,758 4,729 16,998 15,489 Bookings $ 1,128,520 $ 839,453 $ 3,007,455 $ 2,393,958 The following table presents a reconciliation of consolidated net loss, the most directly comparable financial measure calculated in accordance with GAAP, to Adjusted EBITDA, for each of the periods presented (in thousands, unaudited): Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Reconciliation of consolidated net loss to Adjusted EBITDA Consolidated net loss $ 240,447 $ 278,808 $ 719,562 $ 833,597 Add (deduct): Interest income 46,718 36,442 133,271 102,288 Interest expense 10,286 10,268 30,853 30,409 Other (income)/expense, net 2,352 4,262 1,309 1,425 Provision for/(benefit from) income taxes 303 682 1,466 177 Depreciation and amortization expenseA 68,613 53,600 175,126 153,611 Stock-based compensation expense 265,165 220,022 757,558 617,288 RTO severance chargeB 108 — 1,101 — Other non-cash chargesC — — — 6,988 Adjusted EBITDA $ 54,958 $ 26,416 $ 114,580 $ 125,987 A Includes a one-time charge of $17.9 million related to the re-assessment of the estimated useful life of certain software licenses, resulting in the acceleration of their remaining depreciation within infrastructure and trust & safety expenses. B Relates to cash severance costs associated with the Companyʼs return-to-office (“RTOˮ) plan announced in October 2023, which required a subset of the Companyʼs remote employees to begin working from the San Mateo headquarters for three days a week, beginning in the summer of 2024. C Includes impairment expenses related to certain operating lease right-of-use assets and related property and equipment. 19

The following table presents a reconciliation of net cash and cash equivalents provided by operating activities, the most directly comparable financial measure calculated in accordance with GAAP, to free cash flow, for each of the periods presented (in thousands, unaudited): Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Reconciliation of net cash and cash equivalents provided by operating activities to free cash flow: Net cash and cash equivalents provided by operating activities $ 247,430 $ 112,704 $ 637,825 $ 314,875 Deduct: Acquisition of property and equipment 29,405 53,196 115,786 255,470 Purchases of intangible assets — — 1,370 13,500 Free cash flow $ 218,025 $ 59,508 $ 520,669 $ 45,905 20