0001380106falseNasdaq00013801062024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 29, 2024

RAPID MICRO BIOSYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40592 | 20-8121647 |

(State or other jurisdiction

of incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

25 Hartwell Avenue, Lexington, MA | | 02421 |

(Address of principal executive offices) | | (Zip Code) |

978-349-3200

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbols | | Name of each exchange on which

registered |

| Class A Common Stock, $0.01 par value per share | | RPID | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company þ

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | |

Item 2.02 | Results of Operations and Financial Condition. |

On November 1, 2024, Rapid Micro Biosystems, Inc. (the “Company”) issued a press release announcing its unaudited financial results for its third quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference in its entirety.

The information furnished under this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as otherwise expressly stated in such filing.

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On October 29, 2024, David Hirsch, M.D., Ph.D., notified the Company of his resignation from the board of directors of the Company and all committees thereof, effective as of November 1, 2024. Dr. Hirsch was a Class I director and served as a member of the compensation committee. Dr. Hirsch’s resignation was not the result of a disagreement with the Company on any matter relating to its operations, policies or practices. Dr. Hirsch has served as a director of the Company since June 2013, and the Company thanks him for his years of service and contributions as a member of its board of directors.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, including, but not limited to, statements regarding the Company’s guidance, including with respect to full year 2024 revenue, and number of Growth Direct placements; the Company's ability to execute its strategic priorities and enhance shareholder value; and expected deployments of Growth Direct systems

In some cases, you can identify forward-looking statements by terminology such as “outlook,” “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements involve known and unknown risks, uncertainties and assumptions which may cause actual results to differ materially from any results expressed or implied by any forward-looking statement, including, but not limited to risks related to, the Company's ability to achieve positive cash flow without requiring additional financing; the Company's ability to achieve its business objectives, including the impact of the Company's previously-announced operational efficiency plan; the Company's significant losses since inception; the Company’s ability to meet its publicly announced guidance and other expectations about its business and operations; the Company’s limited experience in marketing and sales and the effectiveness of its sales processes; the Company’s need to develop new products and adapt to technological changes; the Company’s ability to establish and maintain its position as a leading provider of automated microbial quality control testing; the Company’s ability to maintain its manufacturing facility; the Company's ability to improve the gross margins of its products and services; risks related to third-parties; the Company’s ability to retain key management and other employees; risks related to regulatory and intellectual property matters; risks related to supply chain disruptions and the impact of inflation; the impact of macroeconomic volatility; and the other important factors outlined under the caption “Risk Factors” in the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”), as such factors may be updated from time to time in its other filings with the SEC, which are available on the SEC's website at www.sec.gov and the Investor Relations page of its website at investors.rapidmicrobio.com. Although the

Company believes that the expectations reflected in its forward-looking statements are reasonable, it cannot guarantee future results. The Company has no obligation, and does not undertake any obligation, to update or revise any forward-looking statement made in this Current Report on Form 8-K to reflect changes since the date of this Current Report on Form 8-K, except as may be required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| RAPID MICRO BIOSYSTEMS, INC. |

| |

| Date: November 1, 2024 | By: | /s/ Sean Wirtjes |

| | Sean Wirtjes |

| | Chief Financial Officer |

Exhibit 99.1

Rapid Micro Biosystems Reports Third Quarter 2024 Financial Results

•Reports record third quarter 2024 revenue of $7.6 million, representing growth of 24% compared to the third quarter of 2023

•Placed seven Growth Direct® systems in the third quarter of 2024, marking the highest number of system placements since the third quarter of 2021

◦Included a multi-system order at an additional site of an existing top 20 global pharma customer as part of their global Growth Direct system rollout

•Achieved inflection in gross margins to positive 8%, representing a significant company milestone and a 35 percentage point improvement compared to the third quarter of 2023

•Reaffirms full year 2024 total revenue guidance of at least $27.0 million, representing growth of at least 20% compared to the full year 2023

Lexington, MA, November 1, 2024 (GLOBE NEWSWIRE) -- Rapid Micro Biosystems, Inc. (Nasdaq: RPID) (the “Company”), an innovative life sciences technology company providing mission critical automation solutions to facilitate the efficient manufacturing and fast, safe release of healthcare products, today announced its financial results for the third quarter ended September 30, 2024.

"We are pleased to report record quarterly revenue, accelerating system placements and a positive inflection in our gross margins in the third quarter,” said Robert Spignesi, President and CEO. "The third quarter included a multi-system order from an existing top 20 pharma customer as they expand their Growth Direct footprint to new sites, and we remain actively engaged with several other customers planning global deployments of the Growth Direct system. We are excited about the continued momentum in the business, committed to consistent execution of our strategic priorities and confident in our path to enhancing shareholder value."

Third Quarter Financial Results

Total revenue for the third quarter of 2024 increased 24% to $7.6 million compared to $6.1 million in the third quarter of 2023. The Company placed seven new Growth Direct® systems and completed the validation of four customer systems compared to five placements and four validations in the third quarter of 2023. Product revenue increased by 25% to $5.3 million, compared to $4.2 million in the third quarter of 2023. Service revenue increased by 21% to $2.3 million, compared to $1.9 million in the third quarter of 2023. Recurring revenue increased by 8% to $3.7 million, compared to $3.4 million in the third quarter of 2023.

Total cost of revenue was $7.0 million in the third quarter of 2024, a decrease of 10% compared to $7.8 million in the third quarter of 2023. Gross margin was positive $0.6 million, or positive 8%, compared to negative $1.6 million or negative 27% in the third quarter of 2023.

Total operating expenses were $12.7 million in the third quarter of 2024, essentially flat compared to the prior year. General and administrative expenses decreased by 9%, research and development expenses increased by 16%, and sales and marketing expenses decreased by 3% compared to the third quarter of 2023.

Net loss for the third quarter of 2024 was $11.3 million, compared to $13.4 million in the third quarter of 2023. Net loss per share for the third quarter of 2024 was $0.26, compared to $0.31 in the third quarter of 2023.

Cash, cash equivalents and short-term investments were approximately $61 million, and the Company had no debt outstanding as of September 30, 2024.

2024 Outlook

The Company is reaffirming its full year 2024 total revenue guidance of at least $27.0 million, representing growth of at least 20% compared to full year 2023, and the placement of at least 20 systems.

Webcast Details

The Company will host a conference call before the market opens today, November 1, 2024, at 9:00 a.m. ET to discuss its third quarter 2024 financial results. The live call is accessible on the Company’s website at investors.rapidmicrobio.com and will be archived and available for replay for one year.

About Rapid Micro Biosystems

Rapid Micro Biosystems is an innovative life sciences technology company providing mission critical automation solutions to facilitate the efficient manufacturing and fast, safe release of healthcare products such as biologics, vaccines, cell and gene therapies, and sterile injectables. The Company’s flagship Growth Direct system automates and modernizes the antiquated, manual microbial quality control (“MQC”) testing workflows used in the largest and most complex pharmaceutical manufacturing operations across the globe. The Growth Direct system brings the quality control lab to the manufacturing floor, unlocking the power of MQC automation to deliver the faster results, greater accuracy, increased operational efficiency, better compliance with data integrity regulations, and quicker decision making that customers rely on to ensure safe and consistent supply of important healthcare products. The Company is headquartered Lexington, Massachusetts and has U.S. manufacturing in Lowell, Massachusetts, with global locations in Switzerland, Germany, and the Netherlands. For more information, please visit www.rapidmicrobio.com or follow the Company on X (formerly known as Twitter) at @rapidmicrobio or on LinkedIn.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, but not limited to, statements regarding the Company’s guidance, including with respect to full year 2024 revenue and number of Growth Direct placements; the Company's ability to execute its strategic priorities and enhance shareholder value; and expected deployments of Growth Direct systems.

In some cases, you can identify forward-looking statements by terminology such as “outlook,” “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements involve known and unknown risks, uncertainties and assumptions which may cause actual results to differ materially from any results expressed or implied by any forward-looking statement, including, but not limited to risks related to, the Company's ability to achieve positive cash flow without requiring additional financing; the Company's ability to achieve its business objectives, including the impact of the Company's previously-announced operational efficiency plan; the Company's significant losses since inception; the Company’s ability to meet its publicly announced guidance and other expectations about its business and operations; the Company’s limited experience in marketing and sales and the effectiveness of its sales processes; the Company’s need to develop new products and adapt to technological changes; the Company’s ability to establish and maintain its position as a leading provider of automated microbial quality control testing; the Company’s ability to maintain its manufacturing facility; the Company's ability to improve the gross margins of its products and services; risks related to third-parties; the Company’s ability to retain key management and other employees; risks related to regulatory and intellectual property matters; risks related to supply chain disruptions and the impact of inflation; the impact of macroeconomic volatility; and the other important factors outlined under the caption “Risk Factors” in the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”), as such factors may be updated from time to time in its other filings with the SEC, which are available on the SEC's website at www.sec.gov and the Investor Relations page of its website at investors.rapidmicrobio.com. Although the Company believes that the expectations reflected in its forward-looking statements are reasonable, it cannot guarantee future results. The Company has no obligation, and does not undertake any obligation, to update or revise any forward-looking statement made in this press release to reflect changes since the date of this press release, except as may be required by law.

Investor Contact

Michael Beaulieu, CFA

Vice President, Investor Relations and Corporate Communications

investors@rapidmicrobio.com

Media Contact

media@rapidmicrobio.com

RAPID MICRO BIOSYSTEMS, INC.

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | |

| Product revenue | $ | 5,255 | | | $ | 4,200 | | | $ | 13,505 | | | $ | 10,693 | | | | | | | | | |

| Service revenue | 2,349 | | | 1,945 | | | 6,328 | | | 5,489 | | | | | | | | | |

| Total revenue | 7,604 | | | 6,145 | | | 19,833 | | | 16,182 | | | | | | | | | |

| Costs and operating expenses: | | | | | | | | | | | | | | | |

| Cost of product revenue | 5,314 | | | 5,691 | | | 15,404 | | | 15,361 | | | | | | | | | |

| Cost of service revenue | 1,668 | | | 2,085 | | | 5,519 | | | 6,134 | | | | | | | | | |

| Research and development | 3,609 | | | 3,116 | | | 11,195 | | | 9,502 | | | | | | | | | |

| Sales and marketing | 3,376 | | | 3,498 | | | 10,284 | | | 10,161 | | | | | | | | | |

| General and administrative | 5,676 | | | 6,204 | | | 17,121 | | | 19,399 | | | | | | | | | |

| Total costs and operating expenses | 19,643 | | | 20,594 | | | 59,523 | | | 60,557 | | | | | | | | | |

| Loss from operations | (12,039) | | | (14,449) | | | (39,690) | | | (44,375) | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | | | |

| Interest income, net | 768 | | | 1,093 | | | 2,589 | | | 3,169 | | | | | | | | | |

| Other expense, net | (39) | | | (26) | | | (91) | | | (66) | | | | | | | | | |

| Total other income, net | 729 | | | 1,067 | | | 2,498 | | | 3,103 | | | | | | | | | |

| Loss before income taxes | (11,310) | | | (13,382) | | | (37,192) | | | (41,272) | | | | | | | | | |

| Income tax expense | 13 | | | 10 | | | 31 | | | 23 | | | | | | | | | |

| Net loss | $ | (11,323) | | | $ | (13,392) | | | $ | (37,223) | | | $ | (41,295) | | | | | | | | | |

| Net loss per share — basic and diluted | $ | (0.26) | | | $ | (0.31) | | | $ | (0.86) | | | $ | (0.96) | | | | | | | | | |

| Weighted average common shares outstanding — basic and diluted | 43,668,656 | | 43,080,095 | | 43,510,911 | | 42,985,184 | | | | | | | | |

RAPID MICRO BIOSYSTEMS, INC.

Unaudited Condensed Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 22,044 | | | $ | 24,285 | |

| Short-term investments | 38,788 | | | 67,768 | |

| Accounts receivable | 3,740 | | | 5,532 | |

| Inventory | 21,253 | | | 19,961 | |

| Prepaid expenses and other current assets | 2,109 | | | 2,869 | |

| Total current assets | 87,934 | | | 120,415 | |

| Property and equipment, net | 11,563 | | | 12,832 | |

| Right-of-use assets, net | 5,420 | | | 6,240 | |

| Long-term investments | — | | | 2,911 | |

| Other long-term assets | 642 | | | 770 | |

| Restricted cash | 284 | | | 284 | |

| Total assets | $ | 105,843 | | | $ | 143,452 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,329 | | | $ | 1,973 | |

| Accrued expenses and other current liabilities | 7,038 | | | 9,907 | |

| Deferred revenue | 5,360 | | | 5,974 | |

| Lease liabilities, short-term | 1,193 | | | 1,132 | |

| Total current liabilities | 15,920 | | | 18,986 | |

| | | |

| Lease liabilities, long-term | 5,261 | | | 6,214 | |

| Other long-term liabilities | 289 | | | 263 | |

| Total liabilities | 21,470 | | | 25,463 | |

| Total stockholders’ equity | 84,373 | | | 117,989 | |

| Total liabilities and stockholders’ equity | $ | 105,843 | | | $ | 143,452 | |

RAPID MICRO BIOSYSTEMS, INC.

Unaudited Cash, Cash Equivalents and Investments

(in thousands)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| Cash and cash equivalents | $ | 22,044 | | | $ | 24,285 | |

| Short-term investments | 38,788 | | | 67,768 | |

| Long-term investments | — | | | 2,911 | |

| Cash, cash equivalents and investments | $ | 60,832 | | | $ | 94,964 | |

Cover Page

|

Oct. 29, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 29, 2024

|

| Entity Registrant Name |

RAPID MICRO BIOSYSTEMS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40592

|

| Entity Tax Identification Number |

20-8121647

|

| Entity Address, Address Line One |

25 Hartwell Avenue,

|

| Entity Address, City or Town |

Lexington,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02421

|

| City Area Code |

978

|

| Local Phone Number |

349-3200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value per share

|

| Trading Symbol |

RPID

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001380106

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

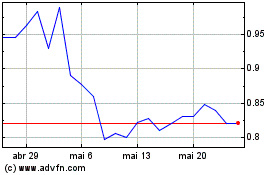

Rapid Micro Biosystems (NASDAQ:RPID)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Rapid Micro Biosystems (NASDAQ:RPID)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024