0001831097FALSE00018310972024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

_____________________________________________

agilon health, inc.

(Exact name of Registrant as Specified in Its Charter)

_____________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-40332 | | 37-1915147 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

6210 E Hwy 290, Suite 450 | | | | |

Austin, TX | | | | 78723 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 562 256-3800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AGL | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, agilon health, inc. (the “Company”), a Delaware corporation, issued a press release setting forth its financial results for the three and nine months ended September 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On November 7, 2024, the Company issued an investor presentation regarding the Company’s financial results for the three and nine months ended September 30, 2024. A copy of the investor presentation is furnished herewith.

The information set forth in Items 2.02 and 7.01 of this Current Report on Form 8-K and the related information in Exhibits 99.1 and 99.2 attached hereto is being furnished herewith, and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be incorporated by reference in any filing with, the Securities and Exchange Commission under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference therein.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | agilon health, inc. |

| | | |

| Date: | November 7, 2024 | By: | /s/ JEFFREY SCHWANEKE |

| | | Jeffrey Schwanke

Chief Financial Officer |

Exhibit 99.1

agilon health Reports Third Quarter 2024 Results

Revenue increased 28% to $1.45 billion, Medicare Advantage membership increased 37% to 525,000, and total members on the agilon platform grew 39% to 657,000

Third quarter results were affected by lower-than-expected 2024 risk adjustment, negative prior year development mainly from risk adjustment and Part D, and higher current year medical expenses

Adjusted full year guidance reflects Q3 results and updated Q4 cost trends

AUSTIN, T.X., November 7, 2024 – agilon health, inc. (NYSE: AGL), the trusted partner empowering physicians to transform health care in our communities, today announced results for the third quarter ended September 30, 2024.

“Our full-risk model enables primary care physicians to deliver high-quality care to their senior patients. Our Q3 results show that our membership is growing across our 26 partnerships, and it also highlights why we are taking necessary actions to strengthen execution within our platform and proactively manage the challenging Medicare Advantage environment,” said Steve Sell, chief executive officer. “Against that backdrop, we have initiated steps with select partners to exit two unprofitable partnerships and other payor contracts by the end of 2024. While the overall Medicare Advantage environment will eventually realign, it is important that we take these actions in the interim to strengthen the run-rate for our business into 2025 and better position our platform and network for long-term success.”

Third Quarter 2024 Results:

•Compared to previous guidance, third quarter 2024 gross profit and medical margin was negatively impacted as a result of additional information received from payors in the third quarter. This included prior year development of $60 million primarily related to risk adjustment revenue and Part D medical expense; a reduction of estimated 2024 risk adjustment of $65 million; and higher current year medical expense of $25 million primarily in the third quarter.

•Total members on the agilon platform increased to 657,000 as of September 30, 2024, comprising 525,000 Medicare Advantage members and 132,000 ACO model beneficiaries. Medicare Advantage membership increased 37% year-over-year, with 4.8% growth in same-partner geographies.

•Total revenue of $1.45 billion in the third quarter 2024 increased 28% compared to $1.14 billion in the third quarter 2023. Year-over-year total revenue growth was primarily driven by membership growth in new markets and same geography growth.

•Gross profit was negative $64 million in the third quarter 2024 compared to positive $37 million in the third quarter 2023. Net loss was $118 million in the third quarter 2024 compared to a net loss of $31 million in the third quarter 2023. The year-over-year reduction in gross profit and higher net losses resulted from the factors discussed above.

•Medical margin was negative $58 million during the third quarter 2024, compared to $111 million for the same period 2023. The $169 million year-over-year medical margin reduction also resulted from the factors mentioned above.

•Adjusted EBITDA loss was $96 million in the third quarter 2024 compared to positive $6 million for the same period in 2023. The year-over-year change is attributable to the factors discussed above.

Key Financial and Operating Metrics ($M):

(Third Quarter 2024 vs. 2023)

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change |

| 2024 | | 2023 | | % YoY |

Medicare Advantage Members1 | 525,000 | | 384,000 | | 37% |

ACO Model Members1,2 | 132,000 | | 88,000 | | 51% |

Total Members Live on Platform1,2 | 657,000 | | 472,000 | | 39% |

| Avg. Medicare Advantage Members | 535,000 | | 389,000 | | 38% |

| Total revenues | $1,451 | | $1,137 | | 28% |

| Gross Profit | ($64) | | $37 | | NM |

| Medical Margin | ($58) | | $111 | | (153%) |

| Net (Loss) Income | ($118) | | ($31) | | NM |

Adjusted EBITDA3 | ($96) | | $6 | | NM |

| Geography Entry Costs | $7 | | $18 | | (60%) |

1.Membership metrics reflect end of period results.

2.agilon’s ACO model entities are not included within its consolidated financial results.

3.agilon’s ACO model entities contributed $12 million to Adjusted EBITDA during the third quarter 2024 and $18 million in third quarter 2023.

Capital Position and Balance Sheet:

agilon health’s balance sheet as of September 30, 2024 included cash, cash equivalents and marketable securities of $399 million and total debt of $35 million. At the end of the quarter agilon health had $113 million of cash associated with the Company’s unconsolidated ACO model entities.

Outlook for Fiscal Year 2024 ($M):

Guidance below includes results from the third quarter 2024 and updated cost trends for the fourth quarter 2024. Medical margin guidance below includes approximately $100 million of negative prior period development. Guidance for fiscal year 2024 does not reflect the impact of actions the Company is currently undertaking or plans to take before the close of the fiscal year.

| | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2024 |

| Updated Guidance | | Previous Guidance |

| Low | | High | | Low | | High |

Medicare Advantage Members1 | 526,000 | | 528,000 | | 518,000 | | 520,000 |

ACO Model Members1,2 | 127,000 | | 129,000 | | 123,000 | | 128,000 |

Total Members Live on Platform1 | 653,000 | | 657,000 | | 641,000 | | 648,000 |

| Avg. Medicare Advantage Members | 522,000 | | 522,000 | | 513,000 | | 514,000 |

| Total Revenues | $6,050 | | $6,065 | | $6,010 | | $6,040 |

| Medical Margin | $210 | | $240 | | $400 | | $450 |

Adjusted EBITDA3 | ($155) | | ($135) | | ($60) | | ($15) |

Geography Entry Costs4 | $37 | | $33 | | $55 | | $45 |

1.Membership reflects management’s outlook for end of period.

2.agilon’s partnered ACO model entities are not consolidated within its financial results.

3.Adjusted EBITDA contribution from ACO model is expected to be approximately $38 million for fiscal year 2024.

4.Geography Entry Costs represent the corresponding expense included in the low-end and high-end of management’s outlook for adjusted EBITDA.

Outlook for Fourth Quarter 2024 ($M):

| | | | | | | | | | | |

| Quarter Ended December 31, 2024 |

| Low | | High |

Medicare Advantage Members1 | 526,000 | | 528,000 |

ACO Model Members1,2 | 127,000 | | 129,000 |

Total Members Live on Platform1 | 653,000 | | 657,000 |

| Avg. Medicare Advantage Members | 526,000 | | 527,000 |

| Total Revenues | $1,512 | | $1,527 |

| Medical Margin | $5 | | $35 |

Adjusted EBITDA3 | ($85) | | ($65) |

Geography Entry Costs4 | $14 | | $10 |

1.Membership reflects management’s outlook for end of period.

2.agilon’s partnered ACO model entities are not consolidated within its financial results.

3.Adjusted EBITDA contribution from ACO model is expected to be approximately $5 million for the fourth quarter 2024.

4.Geography Entry Costs represent the corresponding expense included in the low-end and high-end of management’s outlook for adjusted EBITDA.

The Company has not reconciled guidance for medical margin to gross profit or adjusted EBITDA to net income (loss), the most comparable GAAP measures, and has not provided forward-looking guidance for net income (loss) in each case because of the uncertainty around certain items that may impact gross profit or net income (loss), including non-cash stock-based compensation.

Webcast and Conference Call:

agilon health will host a conference call to discuss third quarter 2024 results on Thursday, November 7, 2024 at 4:30 PM Eastern Time. The conference call can be accessed by dialing (833) 470-1428 for U.S. participants and +1 (404) 975-4839 for international participants and referencing participant code 520026. A simultaneous listen-only, live webcast can be accessed by visiting the “Events & Presentations” section of agilon’s Investor Relations website at https://investors.agilonhealth.com. A replay of the call will be available via webcast for on-demand listening shortly after the completion of the call.

About agilon health

agilon health is the trusted partner empowering physicians to transform health care in our communities. Through our partnerships and purpose-built platform, agilon is accelerating at scale how physician groups and health systems transition to a value-based Total Care Model for their senior patients. agilon provides the technology, people, capital, process, and access to a peer network of 2,800+ PCPs that allow its physician partners to maintain their independence and focus on the total health of their most vulnerable patients. Together, agilon and its physician partners are creating the healthcare system we need – one built on the value of care, not the volume of fees. The result: healthier communities and empowered doctors. agilon is the trusted partner in 30+ diverse communities and is here to help more of our nation's leading physician groups and health systems

have a sustained, thriving future. For more information visit www.agilonhealth.com and connect with us on Instagram, LinkedIn and YouTube.

Forward-Looking Statements

Statements in this release that are not historical factual statements are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” or the negative versions of these words or other comparable terms. Examples of forward-looking statements include, among other things: statements regarding our expectations related to operating and financial results, our ability to negotiate more favorable economic terms in our payor contracts, the value of and demand for our full-risk model for primary care physicians, the strengthening of our value proposition to physicians and payers, our ability to efficiently exit unprofitable markets, and our long-term opportunities and strategic growth plans and alignment with the macro environment, expected revenue, medical costs, net income and gross profit, total and average membership, Adjusted EBITDA, Medical Margin, geography entry costs and other financial projections and assumptions, including our fiscal year and third quarter 2024 guidance. Forward-looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations. While forward-looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be outside our control. These risks and uncertainties that could cause actual results and outcomes to differ from those reflected in forward-looking statements include, but are not limited to: our history of net losses and the expectation that our expenses will increase in the future; failure to identify and develop successful new geographies, physician partners and payors, or execute upon our growth initiatives; success in executing our operating strategies or achieving results consistent with our historical performance; medical expenses incurred on behalf of our members may exceed revenues we receive; our ability to secure contracts with Medicare Advantage payors; our ability to grow new physician partner relationships sufficient to recover startup costs; availability of additional capital, on acceptable terms or at all, to support our business in the future; significant reduction in our membership; transition to a Total Care Model may be challenging for physician partners; public health crises, such as COVID-19, could adversely affect us; inaccuracy in estimates of our members’ risk adjustment factors, medical services expense, incurred but not reported claims, and earnings pursuant to payor contracts; the impact of restrictive clauses or exclusivity provisions in some of our contracts with physician partners; our ability to hire and retain qualified personnel; our ability to realize the full value of our intangible assets; security breaches, cybersecurity attacks, loss of data and other disruptions to our information systems; our ability to protect the confidentiality of our know-how and other proprietary and internally developed information; reliance on our subsidiaries; Environmental, Social, and Governance issues; reliance on a limited number of key payors; the limited terms of contracts with our payors and our ability to renew them upon expiration; our ability to navigate the changing healthcare payor market reliance on our payors, physician partners and other providers to operate our business; our ability to obtain accurate and complete diagnosis data; reliance on third-party software, data, infrastructure and bandwidth; consolidation and competition in the healthcare industry; the impact of changes to, and dependence on, federal government healthcare programs; uncertain or adverse economic and macroeconomic conditions, including a downturn or decrease in government expenditures; regulation of the healthcare industry and our and our physician partners’ ability to comply with such laws and regulations; federal and state investigations, audits and enforcement actions; repayment obligations arising out of payor audits; negative publicity regarding the managed healthcare industry generally; our use, disclosure and processing of personally identifiable information, protected health information, and de-identified data; failure to obtain or maintain an insurance license, a certificate of authority or an equivalent authorization; lawsuits not covered by insurance; changes in tax laws and regulations, or changes in related judgments or assumptions; our indebtedness and our potential to incur more debt; dependence on our subsidiaries for cash to fund all of our operations and expenses; provisions in our governing documents; ability to achieve a return on your investment depends on appreciation in the price of our common stock; the material weakness in our internal control over financial reporting and our ability to remediate such material weakness; and risks related to other factors discussed in our filings with the Securities and Exchange Commission (the “SEC”), including the factors discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which can be found at the SEC’s website at www.sec.gov. Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward-looking statements, which speak only as of the date on which they are made.

agilon health, inc.

Condensed Consolidated Balance Sheets

In thousands, except per share data

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| (unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 148,161 | | | $ | 107,570 | |

| Restricted cash and equivalents | 5,629 | | | 6,759 | |

| Marketable securities | 244,766 | | | 380,773 | |

| Receivables, net | 1,368,349 | | | 942,461 | |

| Prepaid expenses and other current assets, net | 44,854 | | | 42,513 | |

| Total current assets | 1,811,759 | | | 1,480,076 | |

| Property and equipment, net | 28,194 | | | 27,576 | |

| Intangible assets, net | 73,412 | | | 63,769 | |

| Goodwill | 24,133 | | | 24,133 | |

| Other assets | 153,913 | | | 145,312 | |

| Total assets | $ | 2,091,411 | | | $ | 1,740,866 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | |

| Current liabilities: | | | |

| Medical claims and related payables | $ | 1,190,665 | | | $ | 737,724 | |

| Accounts payable, accrued expenses and other | 218,492 | | | 239,432 | |

| Total current liabilities | 1,409,157 | | | 977,156 | |

| Long-term debt, net of current portion | 34,884 | | | 32,308 | |

| Other liabilities | 72,498 | | | 70,381 | |

| Total liabilities | 1,516,539 | | | 1,079,845 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Stockholders' equity (deficit): | | | |

| Common stock, $0.01 par value: 2,000,000 shares authorized; 411,960 and 406,387 shares issued and outstanding, respectively | 4,120 | | | 4,064 | |

| Additional paid-in capital | 2,051,638 | | | 1,986,899 | |

| Accumulated deficit | (1,481,187) | | | (1,326,826) | |

| Accumulated other comprehensive income (loss) | 301 | | | (2,298) | |

| Total agilon health, inc. stockholders' equity (deficit) | 574,872 | | | 661,839 | |

| Noncontrolling interests | — | | | (818) | |

| Total stockholders’ equity (deficit) | 574,872 | | | 661,021 | |

| Total liabilities and stockholders’ equity (deficit) | $ | 2,091,411 | | | $ | 1,740,866 | |

agilon health, inc.

Condensed Consolidated Statements of Operations

In thousands, except per share data

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Revenues: | | | | | | | |

| Medical services revenue | $ | 1,447,697 | | | $ | 1,133,457 | | | $ | 4,528,471 | | | $ | 3,253,810 | |

| Other operating revenue | 3,235 | | | 3,406 | | | 9,573 | | | 6,480 | |

| Total revenues | 1,450,932 | | | 1,136,863 | | | 4,538,044 | | | 3,260,290 | |

| Expenses: | | | | | | | |

| Medical services expense | 1,505,950 | | | 1,022,871 | | | 4,323,852 | | | 2,853,266 | |

| Other medical expenses | 9,149 | | | 77,153 | | | 171,096 | | | 242,486 | |

General and administrative (including noncash stock-based compensation expense of $13,259, $20,619, $48,375, and $53,650, respectively) | 63,123 | | | 72,058 | | | 209,157 | | | 221,064 | |

| Depreciation and amortization | 6,218 | | | 4,075 | | | 17,969 | | | 11,308 | |

| Total expenses | 1,584,440 | | | 1,176,157 | | | 4,722,074 | | | 3,328,124 | |

| Income (loss) from operations | (133,508) | | | (39,294) | | | (184,030) | | | (67,834) | |

| Other income (expense): | | | | | | | |

| Income (loss) from equity method investments | 2,047 | | | 14,659 | | | 17,686 | | | 24,507 | |

| Other income (expense), net | 16,061 | | | 5,423 | | | 26,794 | | | 20,402 | |

| | | | | | | |

| Interest expense | (1,622) | | | (1,617) | | | (4,603) | | | (4,665) | |

| Income (loss) before income taxes | (117,022) | | | (20,829) | | | (144,153) | | | (27,590) | |

| Income tax benefit (expense) | 590 | | | (1,210) | | | 306 | | | (524) | |

| Income (loss) from continuing operations | (116,432) | | | (22,039) | | | (143,847) | | | (28,114) | |

| Discontinued operations: | | | | | | | |

| Income (loss) before gain (loss) on sales | (1,183) | | | (9,444) | | | (1,701) | | | (4,205) | |

| Gain (loss) on sales of assets, net | — | | | — | | | (8,763) | | | — | |

| Total discontinued operations | (1,183) | | | (9,444) | | | (10,464) | | | (4,205) | |

| Net income (loss) | (117,615) | | | (31,483) | | | (154,311) | | | (32,319) | |

| Noncontrolling interests’ share in (earnings) loss | — | | | 47 | | | (50) | | | 156 | |

| Net income (loss) attributable to common shares | $ | (117,615) | | | $ | (31,436) | | | $ | (154,361) | | | $ | (32,163) | |

| | | | | | | |

| Net income (loss) per common share, basic and diluted | | | | | | | |

| Continuing operations | $ | (0.29) | | | $ | (0.06) | | | $ | (0.35) | | | $ | (0.07) | |

| Discontinued operations | $ | — | | | $ | (0.02) | | | $ | (0.03) | | | $ | (0.01) | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 411,591 | | 405,787 | | 410,604 | | 412,077 |

| Diluted | 411,591 | | 405,787 | | 410,604 | | 412,077 |

agilon health, inc.

Condensed Consolidated Statements of Cash Flows

In thousands

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (154,311) | | | $ | (32,319) | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | |

| Depreciation and amortization | 17,969 | | | 15,014 | |

| Stock-based compensation expense | 48,375 | | | 53,980 | |

| Loss (income) from equity method investments | (17,686) | | | (24,507) | |

| Distributions of earnings from equity method investments | 3,340 | | | — | |

| (Gain) loss on sale of assets, net | 3,784 | | | — | |

| Other noncash items | (491) | | | (1,511) | |

| Changes in operating assets and liabilities: | 24,824 | | | (105,690) | |

| Net cash provided by (used in) operating activities | (74,196) | | | (95,033) | |

| Cash flows from investing activities: | | | |

| Purchase of property and equipment | (9,985) | | | (11,898) | |

| Purchase of intangible assets | (18,877) | | | (3,535) | |

| Investment in loans receivable and other | (9,742) | | | (8,778) | |

| Investments in marketable securities | (12,006) | | | (107,020) | |

| Proceeds from maturities of marketable securities and other | 166,828 | | | 133,894 | |

| Net cash paid in business combination | — | | | (44,479) | |

| | | |

| Net cash provided by (used in) investing activities | 116,218 | | | (41,816) | |

| Cash flows from financing activities: | | | |

| Proceeds from equity issuances, net | 1,189 | | | 11,462 | |

| Common stock repurchase | — | | | (200,000) | |

| Repayments of long-term debt | (3,750) | | | (3,750) | |

| Net cash provided by (used in) financing activities | (2,561) | | | (192,288) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash and equivalents | 39,461 | | | (329,137) | |

| Cash, cash equivalents and restricted cash and equivalents from continuing operations, beginning of period | 114,329 | | | 475,912 | |

| Cash, cash equivalents and restricted cash and equivalents from discontinued operations, beginning of period | — | | | 31,768 | |

| Cash, cash equivalents and restricted cash and equivalents, beginning of period | 114,329 | | | 507,680 | |

| Cash, cash equivalents and restricted cash and equivalents from continuing operations, end of period | 153,790 | | | 169,660 | |

| Cash, cash equivalents and restricted cash and equivalents from discontinued operations, end of period | — | | | 8,883 | |

| Cash, cash equivalents and restricted cash and equivalents, end of period | $ | 153,790 | | | $ | 178,543 | |

agilon health, inc.

Key Operating Metrics

In thousands

(unaudited)

GROSS PROFIT

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Total revenues | $ | 1,450,932 | | | $ | 1,136,863 | | | $ | 4,538,044 | | | $ | 3,260,290 | |

| Medical services expense | (1,505,950) | | | (1,022,871) | | | (4,323,852) | | | (2,853,266) | |

Other medical expenses(1) | (9,149) | | | (77,153) | | | (171,096) | | | (242,486) | |

| Gross profit | $ | (64,167) | | | $ | 36,839 | | | $ | 43,096 | | | $ | 164,538 | |

______________________________________________________________

(1)Represents physician compensation expense related to surplus sharing and other care management expenses that help to create medical cost efficiency. Includes costs in geographies that are in implementation and are not yet generating revenue and investments to grow existing markets. For the three months ended September 30, 2024 and 2023, costs incurred in implementing geographies were $1.4 million and $10.3 million, respectively. For the nine months ended September 30, 2024 and 2023, costs incurred in implementing geographies were $2.0 million and $20.3 million, respectively.

GENERAL AND ADMINISTRATIVE COSTS, INCLUDING PLATFORM SUPPORT COSTS

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Platform support costs | $ | 42,353 | | | $ | 41,590 | | | $ | 129,752 | | | $ | 126,923 | |

Geography entry costs(1) | 5,857 | | | 8,064 | | | 21,182 | | | 28,620 | |

| Severance and related costs | 1,453 | | | — | | | 4,736 | | | 188 | |

| Stock-based compensation expense | 13,259 | | | 20,619 | | | 48,375 | | | 53,650 | |

Other(2) | 201 | | | 1,785 | | | 5,112 | | | 11,683 | |

| General and administrative | $ | 63,123 | | | $ | 72,058 | | | $ | 209,157 | | | $ | 221,064 | |

______________________________________________________________

(1)Represents direct geography entry costs, including investments to develop and expand our platform and costs in geographies that are in implementation and are not yet generating revenue and investments to grow existing markets.

(2)Includes transaction-related costs.

Our platform support costs, which include regionally-based support personnel and other operating costs to support our geographies, are expected to decrease over time as a percentage of revenue as our physician partners add members and our revenue grows. Our operating expenses at the enterprise level include resources and technology to support payor contracting, clinical program development, quality, data management, finance, and legal and compliance functions.

agilon health, inc.

Non-GAAP Financial Measures

In thousands

(unaudited)

MEDICAL MARGIN

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Gross profit(1) | $ | (64,167) | | | $ | 36,839 | | | $ | 43,096 | | | $ | 164,538 | |

| Other operating revenue | (3,235) | | | (3,406) | | | (9,573) | | | (6,480) | |

| Other medical expenses | 9,149 | | | 77,153 | | | 171,096 | | | 242,486 | |

| Medical margin | $ | (58,253) | | | $ | 110,586 | | | $ | 204,619 | | | $ | 400,544 | |

______________________________________________________________

(1)Gross profit is defined as total revenues less medical services expense and other medical expenses.

ADJUSTED EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss)(1) | $ | (117,615) | | | $ | (31,483) | | | $ | (154,311) | | | $ | (32,319) | |

| (Income) loss from discontinued operations, net of income taxes | 1,183 | | | 9,444 | | | 10,464 | | | 4,205 | |

| Interest expense | 1,622 | | | 1,617 | | | 4,603 | | | 4,665 | |

| Income tax expense (benefit) | (590) | | | 1,210 | | | (306) | | | 524 | |

| Depreciation and amortization | 6,218 | | | 4,075 | | | 17,969 | | | 11,308 | |

| | | | | | | |

| Severance and related costs | 1,453 | | | — | | | 4,736 | | | 188 | |

| Stock-based compensation expense | 13,259 | | | 20,619 | | | 48,375 | | | 53,650 | |

EBITDA adjustments related to equity method investments(2) | 9,719 | | | 3,702 | | | 15,025 | | | 8,426 | |

Other(3) | (11,718) | | | (3,631) | | | (16,800) | | | (8,587) | |

| Adjusted EBITDA | $ | (96,469) | | | $ | 5,553 | | | $ | (70,245) | | | $ | 42,060 | |

______________________________________________________________

(1)Includes direct geography entry costs, including investments to develop and expand our platform and costs in geographies that are in implementation and are not yet generating revenue and investments to grow existing markets. For the three months ended September 30, 2024 and 2023, (i) $1.4 million and $10.3 million, respectively, are included in other medical expenses and (ii) $5.8 million and $8.0 million, respectively, are included in general and administrative expenses. For the nine months ended September 30, 2024 and 2023, (i) $2.0 million and $20.3 million, respectively, are included in other medical expenses and (ii) $21.2 million and $28.6 million, respectively, are included in general and administrative expenses.

(2)Includes elimination of certain administrative services provided by agilon health, inc. to equity method investments.

(3)Includes interest income, transaction-related costs and elimination of certain administrative services provided by agilon health, inc. to equity method investments.

agilon health, inc.

Supplemental Financial Information

In thousands

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, 2024 | | Nine Months Ended

September 30, 2024 |

| Medicare Advantage (Consolidated) | | CMS ACO Models (Unconsolidated) | | Medicare Advantage (Consolidated) | | CMS ACO Models (Unconsolidated) |

| Medical services revenue | $ | 1,447,697 | | | $ | 454,410 | | | $ | 4,528,471 | | | $ | 1,341,484 | |

| Other operating revenue | 3,235 | | | — | | | 9,573 | | | — | |

| Total revenues | 1,450,932 | | | 454,410 | | | 4,538,044 | | | 1,341,484 | |

| Medical services expense | (1,505,950) | | | (413,189) | | | (4,323,852) | | | (1,218,902) | |

| Other medical expenses | (9,149) | | | (23,817) | | | (171,096) | | | (71,490) | |

| Gross profit | (64,167) | | | 17,404 | | | 43,096 | | | 51,092 | |

| Other operating revenue | (3,235) | | | — | | | (9,573) | | | — | |

| Other medical expenses | 9,149 | | | 23,817 | | | 171,096 | | | 71,490 | |

| Medical margin | $ | (58,253) | | | $ | 41,221 | | | $ | 204,619 | | | $ | 122,582 | |

Certain of our operations are not consolidated for the period presented because we do not have the ability to control certain activities due to another party’s control of the entities’ board of directors. Although revenues of the unconsolidated operations are not recorded as revenues by us, income (loss) from equity method investments is nonetheless a significant portion of our overall earnings. See Note 14 to the Condensed Consolidated Financial Statements in the Quarterly Report on Form 10-Q for the period ending September 30, 2024 for additional discussion on our equity method investments.

In addition to providing results that are determined in accordance with GAAP, we present Medical Margin and Adjusted EBITDA, which are non-GAAP financial measures.

We define Medical Margin as medical services revenue after medical services expense is deducted. Medical services expense represents costs incurred for medical services provided to our members. As our platform matures over time, we expect Medical Margin to increase in absolute dollars. However, Medical Margin per member per month (PMPM) may vary as the percentage of new members brought onto our platform fluctuates. New membership added to the platform is typically dilutive to Medical Margin PMPM. We believe this metric provides insight into the economics of our capitation arrangements as it includes all medical services expense directly associated with our members’ care.

We define Adjusted EBITDA as net income (loss) adjusted to exclude: (i) income (loss) from discontinued operations, net of income taxes, (ii) interest expense, (iii) income tax expense (benefit), (iv) depreciation and amortization, (v) stock-based compensation expense, (vi) severance and related costs, and (vii) certain other items that are not considered by us in the evaluation of ongoing operating performance. We reflect our share of Adjusted EBITDA for equity method investments by applying our actual ownership percentage for the period to the applicable reconciling items on an entity-by-entity basis.

Gross profit is the most directly comparable GAAP measure to Medical Margin. Net income (loss) is the most directly comparable GAAP measure to Adjusted EBITDA.

We believe Medical Margin and Adjusted EBITDA help identify underlying trends in our business and facilitate evaluation of period-to-period operating performance of our operations by eliminating items that are variable in nature and not considered by us in the evaluation of ongoing operating performance, allowing comparison of our recurring core business operating results over multiple periods. We also believe Medical Margin and Adjusted EBITDA provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to key metrics we use for financial and operational decision-making. We believe Medical Margin and Adjusted EBITDA or similarly titled non-GAAP measures are widely used by investors, securities analysts, ratings agencies, and other parties in evaluating companies in our industry as a measure of financial performance. Other companies may calculate Medical Margin and Adjusted EBITDA or similarly titled non-GAAP measures differently from the way we calculate these metrics. As a result, our presentation of Medical Margin and Adjusted EBITDA may not be comparable to similarly titled measures of other companies, limiting their usefulness as comparative measures.

Contacts

Investor Contact

Leland Thomas

Investor Relations

investors@agilonhealth.com

Media Contact

Maureen Merkle

Communications

media@agilonhealth.com

Source: agilon health

November 7, 2024 Third Quarter 2024 Earnings Results Copyright © 2024 agilon health

2 Disclaimers and Forward-Looking Statements FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION Statements in this presentation that are not historical factual statements are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “int ends,” “plans,” “estimates,” “anticipates” or the negative versions of these words or other comparable terms. Examples of forward-looking statements include, among other things: statements regarding timing, outcomes and other details relating to current, pending or contemplated new markets, growth opportunities, ability to deliver sustainable long-term value, demand for our products and services among PCPs and payors, busin ess environment, long-term opportunities and strategic growth plans, expected revenue and net income, total and average membership, Adjusted EBITDA, Medical Margin, geography entry costs and other financ ial projections, guidance and assumptions. Forward-looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations. While forward-looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assu rance that our expectations or forecasts will be attained. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be outside our control. These risks and uncertainties that could cause actual results and outcomes to differ from those reflected in forward - looking statements include, but are not limited to, those factors discussed in our filings with the Securities and Exchange C ommission (the “SEC”), including the factors discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which can be found at the SEC’s website at www.sec.gov. Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward-looking statements, which speak only as of the date on which they are made. NON-GAAP This presentation includes references to non‐GAAP financial measures, including but not limited to Medical Margin and Adjuste d EBITDA. We believe medical margin and Adjusted EBITDA help identify underlying trends in our business and facilitate evaluation of period-to-period operating performance of our operations by eliminating items that are variable in nature and not considered by us in the evaluation of ongoing operating performance, allowing comparison of our recurring core business operating results over multiple periods. We also be lieve medical margin and Adjusted EBITDA provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects, and allow for greater tran sparency with respect to key metrics we use for financial and operational decision - making. We believe medical margin and Adjusted EBITDA or similarly titled non -GAAP measures are widely used by investors, securities analysts, ratings agencies, and other parties in evaluating companies in our industry as a measure of financial performance. Other companies may calculate medical margin and Adjusted EBITDA or similarly titled non-GAAP measures differently from the way we calculate these metrics. As a result, our presentation of medical margin and Adjusted EBITDA may not be comparable to similarly titled measures of other co mpanies, limiting their usefulness as comparative measures Medical Margin and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as an alternative to GAAP measures or other financial statement data presented in agilon’s consolidated financial statements. Reconciliation of such non-GAAP measures to the applicable GAAP measures are set forth in the appendix. TRADEMARKS All rights to the trademarks included herein, other than the Company’s trademarks, belong to their respective owners and our use hereof does not imply any endorsement by the owners of these trademarks. Copyright © 2024 agilon health

3 Strengthening the business for long-term success Key Takeaways Improving baseline mix exiting 2024 and stronger jumping off point for 2025 Taking key actions to drive improved profitability, improve execution and further strengthen our business Business fundamentals and demand are strong despite macro headwinds

4 Strengthening the Business for Long-Term Success Core business fundamentals are strong and there is a significant TAM • >80% of Year 1+ partnerships estimated market AEBITDA positive (incurred) for ‘24 • Class of ‘24 performing at high end of typical year one market medical margin range • Class of ‘25 targets ~ 45k members • Payor support via better Y2+ market economics and alternative risk terms for Y1 markets • High MA quality scores and ACO REACH performance highlight leadership role in value Taking key actions to improve profitability • Exiting 2 unprofitable partnerships and select other payor contracts • Reducing future beta: Narrowing ‘25 exposure to Part D risk • Delaying onboarding of one Class of '25 partner group given local payor dynamics

5 Prior Guidance at Q2 (Midpoint) Updated Guidance at Q3 (Midpoint) Number of Partnerships • EOY ’24 • Class of ‘25 New Partnerships 26 5 24 4 Membership (MA) • EOY ‘24 • Impact of planned partnership exits EOY ‘24 • Class of ’25 New Partnerships 519K -- 60K 527K (45K - 75K) 45K* Total Revenue • EOY ‘24 • Impact of planned partnership exits EOY ‘24 $6,025M -- $6,057M ($470M - $785M) Number of Unprofitable AEBITDA Partnerships (MA) 5 of 26 Partnerships Impact after planned partnership exits 3 of 24 Partnerships 2024 Key Updates Driving 2025 Step Off * Class of ‘25 New Partnerships for Year 1 may be recorded net vs. gross depending on the structure of each individual contract, which are still in negotiation.

2024 Medical Margin Bridge - Change from Aug 6 Guidance Medical Margin Guidance Bridge for Full Year 2024 Note: We have not reconciled guidance for Medical Margin to Gross Profit or Adjusted EBITDA to Net Income (Loss), the most comparable GAAP measures, and have not provided forward-looking guidance for Net Income (Loss) in each case because of the uncertainty around certain items that may impact Gross Profit or Net Income (Loss), including non-cash stock-based compensation. Mid-year RAF info. received from payor partners during Q3 PYD driven primarily by updated statement data regarding Part D costs and final Risk adjustment information for 2023 Elevated costs from Q3 leading to increased Q4 projection 6

2024 AEBITDA Bridge - Change from Aug 6 Guidance AEBITDA Guidance Bridge for Full Year 2024 7Note: We have not reconciled guidance for Medical Margin to Gross Profit or Adjusted EBITDA to Net Income (Loss), the most comparable GAAP measures, and have not provided forward-looking guidance for Net Income (Loss) in each case because of the uncertainty around certain items that may impact Gross Profit or Net Income (Loss), including non-cash stock-based compensation.

2024 Medical Margin Bridge 2024 Medical Margin Step Off – Breakout of Prior Year Development • Prior Year Development (~$100M) • Primarily driven by Part D and risk adjustment settlements (~$80M) • Medical expenses through Q3 (~$20M). • Q1 ($19M), Q2 ($21M), Q3 ($60M) • Partnerships/Contracts Exits – continued focus on profitability • Planned exit of 2 unprofitable partnerships and select payor contracts in other markets 8Note: We have not reconciled guidance for Medical Margin to Gross Profit or Adjusted EBITDA to Net Income (Loss), the most comparable GAAP measures, and have not provided forward-looking guidance for Net Income (Loss) in each case because of the uncertainty around certain items that may impact Gross Profit or Net Income (Loss), including non-cash stock-based compensation.

2024 AEBITDA Bridge 2024 AEBITDA Step Off – Breakout of Prior Year Development • The AEBITDA impact from the prior year development within medical margin (~$100M) is partially offset by a corresponding decrease in partner physician incentives. • The net AEBITDA impact post adjustment in partner physician incentives is (~$65M). 9Note: We have not reconciled guidance for Medical Margin to Gross Profit or Adjusted EBITDA to Net Income (Loss), the most comparable GAAP measures, and have not provided forward-looking guidance for Net Income (Loss) in each case because of the uncertainty around certain items that may impact Gross Profit or Net Income (Loss), including non-cash stock-based compensation.

10 Q3 2024 Results and Change Drivers Q3 ’24 Guidance (as of Aug 6,2024) Q3 ’24 Results Key Change Drivers Medicare Advantage Members 514,000-516,000 525,000 • Outperformed expectations driven by same geo and new market membership growth. Total Revenues ($M) $1,465-$1,475 $1,451 • Largely Part D and Risk adjustment updates partially offset by higher membership volume of approximately ($70M). Medical Margin ($M) $90-$110 ($58) • Shortfall due to prior year development ($60M), current year Risk adjustment updates ($65M), and continued elevated current year cost trends ($25M). Adjusted EBITDA ($M) ($30)-($10) ($96) • Shortfall due to flow through of factors above. Geography Entry Costs ($M) $19-$14 $7 • Continued discipline on growth and delay of a market expansion from 2025 to 2026. Note: We have not reconciled guidance for Medical Margin to Gross Profit or Adjusted EBITDA to Net Income (Loss), the most comparable GAAP measures, and have not provided forward-looking guidance for Net Income (Loss) in each case because of the uncertainty around certain items that may impact Gross Profit or Net Income (Loss), including non-cash stock-based compensation.

11 Quarter Ending December 31, 2024 Medicare Advantage Members 526,000 – 528,000 ACO REACH Members 127,000 – 129,000 Total Members Live on Platform 653,000 – 657,000 Avg. Medicare Advantage Members 526,000 – 527,000 Total Revenues ($M) $1,512 – $1,527 Medical Margin ($M) $5 – $35 Adjusted EBITDA ($M) ($85) – ($65) Geography Entry Costs ($M) $14 – $10 Financial Outlook for Q4 2024 Note: We have not reconciled guidance for Medical Margin to Gross Profit or Adjusted EBITDA to Net Income (Loss), the most comparable GAAP measures, and have not provided forward-looking guidance for Net Income (Loss) in each case because of the uncertainty around certain items that may impact Gross Profit or Net Income (Loss), including non-cash stock-based compensation.

12 Year Ending December 31, 2024 Updated Guidance Previous Guidance Medicare Advantage Members 526,000 – 528,000 518,000 – 520,000 ACO REACH Members 127,000 – 129,000 123,000 – 128,000 Total Members Live on Platform 653,000 – 657,000 641,000 – 648,000 Avg. Medicare Advantage Members 522,000 – 522,000 513,000 – 514,000 Total Revenues ($M) $6,050 – $6,065 $6,010 – $6,040 Medical Margin ($M) $210 – $240 $400 – $450 Adjusted EBITDA ($M) ($155) – ($135) ($60) – ($15) Geography Entry Costs ($M) $37 – $33 $55 – $45 Financial Outlook for Fiscal Year 2024 Note: We have not reconciled guidance for Medical Margin to Gross Profit or Adjusted EBITDA to Net Income (Loss), the most comparable GAAP measures, and have not provided forward-looking guidance for Net Income (Loss) in each case because of the uncertainty around certain items that may impact Gross Profit or Net Income (Loss), including non-cash stock-based compensation.

13 Appendix Copyright © 2024 agilon health

14 Non-GAAP Reconciliations (Dollars in thousands) Quarter Ending September 30, 2024 2023 Gross profit(1) $ (64,167) $ 36,839 Other operating revenue (3,235) (3,406) Other medical expenses 9,149 77,153 Medical margin (58,253) 110,586 1) Gross profit is defined as total revenues less medical services expenses and other medical expense. Medical Margin

15 Non-GAAP Reconciliations (Dollars in thousands) Three Months Ended September 30, 2024 2023 Net income (loss)(1) $ (117,615) $ (31,483) (Income) loss from discontinued operations, net of income taxes 1,183 9,444 Interest expense 1,622 1,617 Income tax expense (benefit) (590) 1,210 Depreciation and amortization 6,218 4,075 Severance and related costs 1,453 — Stock-based compensation expense 13,259 20,619 EBITDA adjustment related to equity method investments(2) 9,719 3,702 Other(3) (11,718) (3,631) Adjusted EBITDA $ (96,469) $ 5,553 1) Includes direct geography entry costs, including investments to develop and expand our platform and costs in geographies that are in implementation and are not yet generat ing revenue and investments to grow existing markets. For the three months ended September 30, 2024 and 2023, (i) $1.4 million and $10.3 million, respectively, are included in other medical expenses and (ii) $5.8 million and $8.0 million, respectively, are included in general and administrative expenses. 2) Includes elimination of certain administrative services provided by agilon health, inc. to equity method investments. 3) Includes interest income, transaction-related costs and elimination of certain administrative services provided by agilon health, inc. to equity method investments. Adjusted EBITDA

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

agilon health, inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40332

|

| Entity Tax Identification Number |

37-1915147

|

| Entity Address, Address Line One |

6210 E Hwy 290

|

| Entity Address, Address Line Two |

Suite 450

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78723

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

AGL

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001831097

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

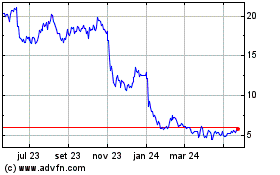

Agilon Health (NYSE:AGL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

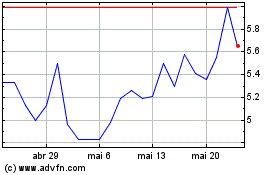

Agilon Health (NYSE:AGL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025