FALSE000181080600018108062024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2024

| | | | | | | | |

| UNITY SOFTWARE INC. | |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 001-39497 | 27-0334803 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| 30 3rd Street | |

| San Francisco, California 94103‑3104 | |

| (Address, including zip code, of principal executive offices) | |

| (415) 638-9950 | |

| (Registrant's telephone number, including area code) | |

| Not Applicable | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.000005 par value | | U | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Unity Software Inc. (“Unity” or the “Company”) issued a letter to its shareholders announcing its financial results for the quarter ended September 30, 2024. A copy of the shareholder letter is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 of this Current Report on Form 8-K and the exhibit attached hereto as 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Principal Financial Officer

On November 7, 2024, Unity announced that Jarrod Yahes, age 49, has been appointed to serve as the Company’s Senior Vice President and Chief Financial Officer, effective January 1, 2025 (the “Start Date”).

Mr. Yahes served as the Chief Financial Officer of Shutterstock, Inc., a global creative platform, (“Shutterstock”) from December 2019 until his resignation in October 2024, effective November 1, 2024. He will continue to serve in an advisory role at Shutterstock until December 31, 2024. Prior to joining Shutterstock, Mr. Yahes served as Chief Financial Officer at Zeta Global, a marketing technology company, from October 2016 to November 2019, Chief Financial Officer at Jackson Hewitt Tax Services, Inc., a provider of tax preparation services, from April 2015 to October 2016, and served in multiple capacities at ExlService Holdings, a business process solutions company, from February 2005 to April 2015, advancing to Senior Vice President, Global Controller. Mr. Yahes earned a B.S. in applied economics from Cornell University and an M.B.A. from the University of California at Berkeley.

In connection with his appointment, on November 4, 2024, Mr. Yahes entered into a letter agreement with the Company (the “Offer Letter”), providing for an annual base salary of $525,000; the ability to participate in the Company’s Cash Incentive Bonus Plan with a bonus target equal to 75% of his annual base salary; a sign-on bonus of $400,000, which will be paid 50% at the Start Date and 50% at the one year anniversary of the Start Date; and an award of restricted stock units pursuant to the Company’s 2020 Equity Incentive Plan. The number of restricted stock units will be equal to $12 million divided by the average closing price of the Company’s common stock for the 60 trading days leading up to the Start Date, and will vest 12.5% on August 25, 2025, and 6.25% quarterly thereafter, subject to Mr. Yahes’ continuous employment. In addition, subject to Mr. Yahes’ continuous employment through the date that the Company approves its senior executive annual equity awards in 2025, Mr. Yahes will receive a grant of equity awards equal to at least $4 million, which will be awarded in a combination of restricted stock units and performance-based restricted stock units, subject to vesting criteria that will be determined at the grant date.

Mr. Yahes will participate in the Company’s Executive Severance Plan (the “Severance Plan”), as described under the heading "Executive Severance Agreements and Change in Control Benefits" previously disclosed in the Company's definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 18, 2024. Mr. Yahes will also enter into a customary indemnification agreement with the Company in the form previously approved by the board of directors and filed as Exhibit 10.1 to the Company’s Registration Statement on Form S-1/A filed with the Securities and Exchange Commission on September 9, 2020.

The foregoing summaries are not complete and are qualified in their entirety by the copy of the Offer Letter, attached as Exhibit 10.1 to this Current Report on Form 8-K.

Transition of Principal Financial Officer

On November 7, 2024, the Company announced that Mark Barrysmith, Senior Vice President and Chief Accounting Officer and Interim Chief Financial Officer, would no longer serve as the Interim Chief Financial Officer as of January 1, 2025, but will continue in his role as Senior Vice President and Chief Accounting Officer and will continue as the Principal Accounting Officer.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description of Exhibit |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | UNITY SOFTWARE INC. |

| | | |

Date: November 7, 2024 | | By: | /s/ Mark Barrysmith |

| | | Mark Barrysmith |

| | | Senior Vice President, Interim Chief Financial Officer, and Chief Accounting Officer |

| | | (Principal Financial Officer, Principal Accounting Officer, and Duly Authorized Signatory) |

Exhibit 10.1

November 4, 2024

Jarrod Yahes

/by email

Re: Offer of Employment by Unity Technologies SF

Dear Jarrod:

I am very pleased to confirm our offer to you of employment with Unity Technologies SF (the "Company"). You will report to Matthew Bromberg, Chief Executive Officer, in the position of Senior Vice President, Chief Financial Officer. The terms of our offer and the benefits currently provided by the Company are as follows:

1.Starting Salary. This is an exempt position. Your starting base salary will be USD $43,750.00 per month (USD $525,000.00 on an annualized basis). Any salary will be paid out on a semi- monthly basis less all applicable taxes, withholdings, and deductions required by law.

2.Start Date. Your start date will be January 1, 2025 (“Start Date”).

3.Location and Travel. You will work from the Company’s New York City office and be expected to travel as appropriate.

4.Corporate Bonus. You are eligible to receive a discretionary corporate bonus targeted at 75% of your earned annual base salary during the previous fiscal year pursuant to the terms of the discretionary bonus letter that will be provided to you outside of this agreement and only to the extent determined appropriate by the Company in its sole discretion. In the event that you are hired on or after October 1st, you will not be eligible to participate in the bonus program for the current fiscal year; participation will begin as of January 1st of the next fiscal year. If you are hired before October 1st, any Target Bonus amounts will be prorated based on the number of days you are employed by the Company during that fiscal year. In order to be eligible to receive a discretionary corporate bonus, you must be employed by the Company on the date that corporate bonuses are paid. Any bonus amount will be paid out less all applicable taxes, withholdings, and deductions required by law.

5.Sign-On Bonus. The Company will provide you with a one--time discretionary sign--on bonus equivalent of $400,000.00, paid in two equal installments. The first payment of $200,000.00 will be made to you in the first payroll following your Start Date. The second payment of $200,000.00 will be made to you in the first payroll following the one-year anniversary of your Start Date. Both payments will be made less all applicable taxes, withholdings, and deductions as required by local law.

6.Benefits. Beginning on the Start Date, you will be eligible to participate in any benefits plans offered to the employees of the Company. A presentation of our benefits program will be given to you during your first month of employment. The Company may modify benefits policies from time to time, as it deems necessary.

7.Restricted Stock Units. You will be granted restricted stock units (“RSUs”) with a value of USD $12,000,000.00 based on the average closing price of the stock for the sixty (60) days preceding your Start Date (“Initial Grant”). Settlement of the RSUs will be conditioned on the satisfaction of a single vesting requirement known as a “Time-Based Requirement.” For the Initial Grant, the Time-Based Requirement will be satisfied at the rate of 12.5% of the RSUs on the next quarterly installment date following your sixth full month of employment with the Company and an additional 6.25% on a quarterly basis thereafter, so long as you remain employed by the Company.

8.2025 Equity Awards. Assuming you remain continuously employed with the Company through the date that Company senior executive annual equity awards are approved in 2025, the

Company will recommend that the Board grant to you equity awards having a target value of not less than $4,000,000.00, of which such value shall be comprised of 75% Restricted Stock Units and 25% Performance Stock Units (the terms of which will be set in the first quarter of 2025).

9.Executive Severance Plan. You are eligible to participate in the Executive Severance Plan (“Severance Plan”), which will be provided to you separately. If you accept the terms of the Severance Plan, notwithstanding the vesting schedules listed in the Restricted Stock Units section above, you will be eligible for accelerated equity vesting under certain circumstances as set out in the Severance Plan.

10.Executive Clawback Policy. You agree you will be bound by the Unity Software Inc. Executive Clawback Policy, as may be amended, restated, supplemented or otherwise modified from time to time, and you will sign an acknowledgment form confirming the same within thirty (30) days of your Start Date.

11.Confidentiality; Company Rules and Policies. As an employee of the Company, you will have access to certain confidential information of the Company and you may, during the course of your employment, develop certain information or inventions that will be the property of the Company. To protect the interests of the Company, you will need to sign the Company's standard "Employee Nondisclosure and Assignment Agreement," attached as Attachment 1, as a condition of your employment. During the period that you render services to the Company, you agree to not engage in any employment, business or activity that is in any way competitive with the business or proposed business of the Company. You will disclose to the Company in writing any other gainful employment, business or activity that you are currently associated with or participate in so the company may assess whether a conflict exists. You will not assist any other person or organization in competing with the Company or in preparing to engage in competition with the business or proposed business of the Company. You will also be required to abide by all Company rules and policies. Therefore you will be asked to acknowledge that you have read the employee handbook, Global Code of Conduct, and supplemental policies, which will be provided to you during your onboarding. In order to retain necessary flexibility in the administration of its policies and procedures, the Company reserves the right to change or revise its policies, procedures, and benefits at any time.

12.Global Privacy Notice to the Workforce. You confirm that you have read and understood Unity’s Data Privacy Policy attached as Attachment 2.

13.No Breach of Obligations to Prior Employers. We wish to impress upon you that we do not want you to, and we hereby direct you not to, bring with you any confidential or proprietary material of any former employer or to violate any other obligations you may have to any former employer. You represent that your signing of this offer letter, agreement(s) concerning restricted stock units or stock options granted to you, if any, under the Plan (as defined below) and the Company's Employee Nondisclosure and Assignment Agreement and your commencement of employment with the Company will not violate any agreement currently in place between yourself and current or past employers.

14.At Will Employment. While we look forward to a long relationship, should you decide to accept our offer, you will be an at-will employee of the Company, which means the employment relationship can be terminated by either of us for any reason, at any time, with or without prior notice and with or without cause. Any statements or representations to the contrary (and, indeed, any statements contradicting any provision in this letter) should be regarded by you as ineffective. Further, your participation in any stock plan or benefit program is not to be regarded as assuring you of continuing employment for any particular period of time. Any modification or change in your at will employment status may only occur by way of a written employment agreement signed by you and the Chief People Officer of the Company.

15.Authorization to Work. Please note that because of employer regulations adopted in the Immigration Reform and Control Act of 1986, within three (3) business days of starting your new

position you will need to present documentation demonstrating that you have authorization to work in the United States. If you have questions about this requirement, which applies to U.S. citizens and non-U.S. citizens alike, you may contact our personnel office.

16.Arbitration. To the fullest extent permitted by applicable law, you and the Company agree to submit to mandatory binding arbitration of any and all claims arising out of or related to your employment with the Company and the termination thereof, including claims by the Company, claims against the Company, and claims against any current or former parent, affiliate, subsidiary, or successor of the Company, and each of the Company’s and these entities’ respective officers, directors, agents or employees. To the fullest extent permitted by applicable law, this includes, but is not limited to, tort claims, contract claims, statutory claims, and claims for unpaid wages or other forms of compensation, wrongful termination, retaliation, and/or discrimination (including harassment) based upon any federal, state or other ordinance, statute, regulation or constitutional provision, except that each party may, at its, his or her option, seek injunctive relief in court related to the improper use, disclosure or misappropriation of a party’s proprietary, confidential or trade secret information. All arbitration hearings shall be conducted in San Francisco, California (or another mutually agreeable location). THE PARTIES HEREBY WAIVE ANY RIGHTS THEY MAY HAVE TO TRIAL BY JURY IN REGARD TO SUCH CLAIMS. The parties further agree that any arbitrable claims shall be resolved on an individual basis, and you agree to waive your right, to the extent allowed by applicable law, to consolidate any arbitrable claims with the claims of any other person in a class or collective action. This Agreement does not restrict your right to file administrative claims you may bring before any government agency where, as a matter of law, the parties may not restrict the employee’s ability to file such claims (including, but not limited to, the National Labor Relations Board, Equal Employment Opportunity Commission, disputes solely before government agencies, claims under applicable workers’ compensation law, and unemployment claims). However, the parties agree that, to the fullest extent permitted by law, arbitration shall be final and binding on the parties and shall be the exclusive remedy for the subject matter of such administrative claims. Further, this Agreement does not apply to claims that have been expressly excluded from mandatory arbitration by a governing law not preempted by the Federal Arbitration Act, including but not limited to a sexual assault dispute and sexual harassment dispute as defined under applicable federal law. The arbitration shall be conducted through JAMS before a single neutral arbitrator, in accordance with the JAMS employment arbitration rules then in effect. The Company agrees to pay the fees and costs of the arbitrator. The JAMS rules may be found and reviewed at http://www.jamsadr.com/rules-employment-arbitration. If you are unable to access these rules, inform the Company’s Human Resources Department and a hardcopy will be provided to you. To initiate an arbitration, you or the Company must submit a demand for arbitration to JAMS and the Company will timely pay the JAMS initial invoice. As in any arbitration, the burden of proof shall be allocated as provided by applicable law. The arbitrator shall apply the applicable substantive law in deciding the claims at issue. Claims will be governed by their applicable statute of limitations and failure to demand arbitration within the prescribed time period shall bar the claims as provided by law. The arbitrator shall issue a written decision that contains the essential findings and conclusions on which the decision is based. The arbitrator shall have the same authority as a court to award equitable relief, damages, costs, and fees (excluding the costs and fees of the arbitrator) as provided by law for the particular claims asserted. This arbitration clause shall be governed by and construed in all respects under the terms of the Federal Arbitration Act and the California Arbitration Act, including Cal. Civ. Proc. Code § 1283.05.

17.Entire Agreement. This offer, once accepted, constitutes the entire agreement between you and the Company with respect to the subject matter hereof and supersedes all prior offers, negotiations and agreements, if any, whether written or oral, relating to such subject matter. You acknowledge that neither the Company nor its agents have made any promise, representation or warranty whatsoever, either express or implied, written or oral, which is not contained in this agreement for the purpose of inducing you to execute the agreement, and you acknowledge that

you have executed this agreement in reliance only upon such promises, representations and warranties as are contained herein.

18.Severability. If any term of this letter is held to be invalid, void, or unenforceable, the remainder of the terms herein will remain in full force and effect and will in no way be affected, and the parties will use their best efforts to find an alternative way to achieve the same result.

19.Governing Law. The terms of this letter and the resolution of any dispute as to the meaning, effect, performance or validity of this letter or arising out of, related to, or in any way connected with this letter, your employment with the Company or any other relationship between you and the Company (a “Dispute”) will be governed by the laws of the the state in which you primarily work for Unity as recorded in Unity’s systems, without giving effect to the principles of conflict of laws. To the extent not subject to arbitration as described in Section 10, you and the Company consent to the exclusive jurisdiction of, and venue in, the state courts in San Francisco County in the State of California (or in the event of exclusive federal jurisdiction, the courts of the Northern District of California in connection with any Dispute or any claim related to any Dispute).

20.Background Check. This offer is contingent upon the successful completion of background and reference checks.

21.Acceptance. This offer will remain open until November 5, 2024. If you decide to accept our offer, and I hope you will, please sign the enclosed copy of this letter in the space indicated and return it to me. Your signature will acknowledge that you have read and understood and agreed to the terms and conditions of this offer letter and the attached documents, if any. Should you have anything else that you wish to discuss, please do not hesitate to call me.

We look forward to the opportunity to welcome you to the Company.

| | | | | | | | |

| Very truly yours, | |

| | |

| By: /s/ Matthew Bromberg | |

| Matthew Bromberg | |

| Chief Executive Officer | |

I have read and understood this offer letter and hereby acknowledge, accept and agree to the terms as set forth above and further acknowledge that no other commitments were made to me as part of my employment offer except as specifically set forth herein.

| | | | | | | | |

| /s/ Jarrod Yahes | | 11/05/2024 |

| Jarrod Yahes | | Date |

Attachment 1

EMPLOYEE NONDISCLOSURE AND ASSIGNMENT AGREEMENT

| | | | | | | | | | | |

| This Employee Nondisclosure and Assignment Agreement ("Agreement") sets forth in writing certain understandings and procedures in effect as of the date of my initial employment with Unity Technologies SF (“Company”). In this Agreement, “Company Group” means Company and/or any affiliated company. | | suppliers and any other nonpublic information that has commercial value or (b) any information Company Group has received from others that Company Group is obligated to treat as confidential or proprietary, which may be made known to me by Company Group, a third party or otherwise that I may learn during my employment with Company. |

| 1.Duties. In return for the compensation now and hereafter paid to me, I will perform such duties for Company as the Company may designate from time to time. During my employment with Company, I will devote my best efforts to the interests of Company, will not engage in other employment or in any conduct in direct conflict with Company’s interests that would cause a material and substantial disruption to Company and will otherwise abide by all of Company’s policies and procedures. Furthermore, I will not (a) reveal, disclose or otherwise make available to any unauthorized person any Company password or key, whether or not the password or key is assigned to me or (b) obtain, possess or use in any manner a Company password or key that is not assigned to me. I will use my best efforts to prevent the unauthorized use of any laptop or personal computer, peripheral device, software or related technical documentation that the Company issues to me, and I will not input, load or otherwise attempt any unauthorized use of software in any Company computer, whether or not such computer is assigned to me. | 3 | Ownership and Nondisclosure of Proprietary Information. All Proprietary Information and all worldwide: patents (including, but not limited to, any and all patent applications, patents, continuations, continuation-in-parts, reissues, divisionals, substitutions, and extensions), copyrights, mask works, trade secrets and other worldwide rights in and to the Proprietary Information are the property of Company, Company’s assigns, Company’s customers and Company’s suppliers, as applicable. I will not disclose any Proprietary Information to anyone outside Company, and I will use and disclose Proprietary Information to those inside Company only as necessary to perform my duties as an employee of Company. If I have any questions as to whether information is Proprietary Information, or to whom, if anyone, inside Company, any Proprietary Information may be disclosed, I will ask my manager at Company. |

| 2 | “Proprietary Information” Definition. “Proprietary Information” includes (a) any information that is confidential or proprietary, technical or non-technical information of Company Group, including for example and without limitation, information related to Company Innovations (as defined in Section 7 below), concepts, techniques, processes, methods, systems, designs, computer programs, source documentation, trade secrets, formulas, development or experimental work, work in progress, forecasts, proposed and future products, marketing plans, business plans, customers and | 4 | U.S. Defend Trade Secrets Act. 18 U.S.C. § 1833(b) states: “An individual shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that—(A) is made—(i) in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.” Accordingly, I have the right to disclose in confidence trade secrets to federal, state, and local government officials, or to an attorney, for the sole purpose of reporting or investigating a suspected violation of law. I also |

| | | | | | | | | | | |

| have the right to disclose trade secrets in a document filed in a lawsuit or other proceeding, but only if the filing is made under seal and protected from public disclosure. Nothing in this Agreement is intended to conflict with 18 U.S.C.§ 1833(b) or create liability for disclosures of trade secrets that are expressly allowed by 18 U.S.C. § 1833(b). | | through multiple tiers of sublicensees) to make, have made, use, import, sell, offer to sell, practice any method or process in connection with, copy, distribute, prepare derivative works of, display, perform and otherwise exploit such Prior Innovations or intellectual property owned or controlled by me and/or any third party. |

| 5 | “Innovations” Definition. In this Agreement, “Innovations” means all discoveries, designs, developments, improvements, inventions (whether or not protectable under patent laws), works of authorship, information fixed in any tangible medium of expression (whether or not protectable under copyright laws), software, trade secrets, know-how, ideas and concepts (whether or not protectable under trade secret laws), mask works, trademarks, service marks, trade names and trade dress. | 7 | Disclosure and Assignment of Company Innovations. In the normal course of my employment with Company and as otherwise requested by Company, I will promptly disclose and describe to Company all Company Innovations. I hereby assign and agree to assign to Company all my right, title, and interest in and to (a) all Innovations (including all Moral Rights therein) that are made, conceived, discovered or developed by me (either alone or jointly with others), or result from or are suggested by any work performed by me (either alone or jointly with others) for or on behalf of Company, (i) during the period of my employment with Company, whether before or after the execution of this Agreement and whether or not made, conceived, discovered or developed during regular business hours; or (ii) during or after the period of my employment with Company, whether before or after the execution of this Agreement, if based on or using Proprietary Information or otherwise in connection with my activities as an employee of Company (collectively, the “Company Innovations”); and

(b) all benefits, privileges, causes of action and remedies relating to Company Innovations, whether before or hereafter accrued (including, without limitation, the exclusive rights to apply for and maintain all registrations, renewals and/or extensions; to sue for all past, present or future infringements or other violations of any rights in the Innovation; and to settle and retain proceeds from any such actions), free and clear of all liens and encumbrances. To the extent allowed by applicable law, the assignment of the Company Innovations includes all rights of paternity, integrity, disclosure and withdrawal and any other rights that may be known as or referred to as “moral rights,” “artist’s rights,” “droit moral,” or the like (collectively “Moral Rights”). To the extent any of the rights, title and interest in and to Company Innovations cannot be assigned by me to Company, I hereby grant to Company an

|

| 6 | Disclosure and License of Prior Innovations. I have listed on Exhibit A (Prior Innovations) attached hereto all Innovations relating in any way to Company Group’s business or demonstrably anticipated research and development or business, which were conceived, reduced to practice, created, derived, developed, or made by me prior to my employment with Company (collectively, the “Prior Innovations”). I represent that I have no rights in any such Company-related Innovations other than those Innovations listed in Exhibit A (Prior Innovations). If nothing is listed on Exhibit A (Prior Innovations), I represent that there are no Prior Innovations at the time of signing this Agreement. I will not incorporate, nor permit to be incorporated, any Prior Innovations or any intellectual property owned or controlled by me and/or any third party in any Company Innovations (defined in Section 7) without Company’s prior written consent. If, in the course of my employment with the Company, I incorporate or permit to be incorporated, any Prior Innovation or any intellectual property owned or controlled by me and/or any third party into Company Group property or Company Innovations, with or without Company approval, I hereby grant to Company a royalty-free, perpetual, irrevocable, worldwide, transferable, fully paid-up license (with rights to sublicense | |

| | | | | | | | | | | |

| exclusive, royalty-free, transferable, irrevocable, worldwide license (with rights to sublicense through multiple tiers of sublicensees) to practice such non-assignable rights, title and interest, including, but not limited to, the right to make, use, sell, offer for sale, import, have made, have sold, copy, distribute, prepare derivative works of, display, perform and otherwise exploit such Company Innovations. To the extent any of the rights, title and interest in and to Company Innovations can neither be assigned nor licensed by me to Company, I hereby irrevocably waive and agree never to assert such non-assignable and non-licensable rights, title and interest against Company Group, any of Company Group’s successors in interest, or any of Company Group’s customers. This Section 7 shall not apply to any Innovation that meets any of the following conditions: (a) it does not relate, at the time of conception, reduction to practice, creation, derivation, development or making of such Innovation to Company Group’s business or actual or demonstrably anticipated research, development or business; and (b) it was developed entirely on my own time; and (c) it was developed without use of any of Company Group’s equipment, supplies, facilities or trade secret information; and (d) it did not result from any work I performed for Company Group. | | protected under patent laws. I have reviewed the notification in Exhibit B (Limited Exclusion Notification) and agree that my signature acknowledges receipt of the notification. |

| 10 | Cooperation in Perfecting Rights to Company Innovations. I agree to perform, during and after my employment, all acts that Company deems necessary or desirable to permit and assist Company, at its expense, in obtaining and enforcing the full benefits, enjoyment, rights and title throughout the world in the Company Innovations as provided to Company under this Agreement. If Company is unable for any reason to secure my signature to any document required to file, prosecute, register or memorialize the assignment of any rights or application or to enforce any right under any Company Innovations as provided under this Agreement, I hereby irrevocably designate and appoint Company and Company’s duly authorized officers and agents as my agents and attorneys- in-fact to act for and on my behalf and instead of me to take all lawfully permitted acts to further the filing, prosecution, registration, memorialization of assignment, issuance, and enforcement of rights under such Innovations, all with the same legal force and effect as if executed by me. The foregoing is deemed a power coupled with an interest and is irrevocable. |

| 8 | Future Innovations. I will disclose promptly in writing to Company all Innovations conceived, reduced to practice, created, derived, developed, or made by me within the scope of my employment with the Company and for three (3) months thereafter, whether or not I believe such Innovations are subject to this Agreement, to permit a determination by Company as to whether or not the Innovations should be considered Company Innovations. Company will receive any such information in confidence. | 11 | Return of Materials. At any time upon Company’s request, and when my employment with Company is over, I will return all materials (including, without limitation, documents, drawings, papers, diskettes and tapes) containing or disclosing any Proprietary Information (including all copies thereof), as well as any keys, pass cards, identification cards, computers, printers, pagers, personal digital assistants or similar items or devices that the Company has provided to me. I will provide Company with a written certification of my compliance with my obligations under this Section. |

| 9 | Notice of Nonassignable Innovations to Employees in California. This Agreement does not apply to an Innovation that qualifies fully as a nonassignable invention under the provisions of Section 2870 of the California Labor Code. I acknowledge that a condition for an Innovation to qualify fully as a non-assignable invention under the provisions of Section 2870 of the California Labor Code is that the invention must be | 12 | No Violation of Rights of Third Parties. During my employment with Company, I will not (a) breach any agreement to keep in confidence any confidential or proprietary information, knowledge or data acquired by me prior to my employment with Company or (b) disclose to |

| | | | | | | | | | | |

| Company Group, or use or induce Company Group to use, any confidential or proprietary information or material belonging to any previous employer or any other third party. I am not currently a party, and will not become a party, to any other agreement that is in conflict, or will prevent me from complying, with this Agreement. | | Human Resources Department or to such other address as Company may specify in writing. |

| 17 | Governing Law; Forum. This Agreement shall be governed by the laws of the United States of America and by the laws of the state in which I primarily work for Unity as recorded in Unity’s systems. Company and I each irrevocably consent to the exclusive personal jurisdiction of the federal and state courts courts located in the state in which I primarily work for Unity as recorded in Unity’s systems, as applicable, for any matter arising out of or relating to this Agreement, except that in actions seeking to enforce any order or any judgment of such federal or state courts located in California, such personal jurisdiction shall be nonexclusive. Additionally, notwithstanding anything in the foregoing to the contrary, a claim for equitable relief arising out of or related to this Agreement may be brought in any court of competent jurisdiction. |

| 13 | Survival. This Agreement (a) shall survive my employment by Company; (b) does not in any way restrict my right to resign or the right of Company to terminate my employment at any time, for any reason or for no reason; (c) inures to the benefit of successors and assigns of Company; and (d) is binding upon my heirs and legal representatives. | |

| 14 | No Solicitation. During my employment with Company and for one (1) year thereafter, I will not solicit, encourage, or cause others to solicit or encourage any employees of Company Group to terminate their employment with Company Group. | |

| 15 | Injunctive Relief. I agree that if I violate this Agreement, Company will suffer irreparable and continuing damage for which money damages are insufficient, and Company shall be entitled to injunctive relief and/or a decree for specific performance, and such other relief as may be proper (including money damages if appropriate), to the extent permitted by law. | 18 | Severability. If an arbitrator or court of law holds any provision of this Agreement to be illegal, invalid or unenforceable, (a) that provision shall be deemed amended to provide Company the maximum protection permitted by applicable law and (b) the legality, validity and enforceability of the remaining provisions of this Agreement shall not be affected. |

| 16 | Notices. Any notice required or permitted by this Agreement shall be in writing and shall be delivered as follows, with notice deemed given as indicated: (a) by personal delivery, when actually delivered; (b) by overnight courier, upon written verification of receipt; (c) by facsimile transmission, upon acknowledgment of receipt of electronic transmission; or (d) by certified or registered mail, return receipt requested, upon verification of receipt. Notices to me shall be sent to any address in Company’s records or such other address as I may provide in writing. Notices to Company shall be sent to Company’s | 19 | Waiver; Modification. If Company waives any term, provision or breach by me of this Agreement, such waiver shall not be effective unless it is in writing and signed by Company. No waiver shall constitute a waiver of any other or subsequent breach by me. This Agreement may be modified only if both Company and I consent in writing. |

| 20 | Entire Agreement. This Agreement, including any agreement to arbitrate claims or disputes relating to my employment that I may have signed in connection with my employment by Company, represents my entire understanding with Company with respect to the subject matter of this Agreement and supersedes all previous understandings, written or oral. |

I certify and acknowledge that I have carefully read all of the provisions of this Agreement and that I understand and will fully and faithfully comply with such provisions.

| | | | | | | | |

| “COMPANY” | | EMPLOYEE: |

| UNITY TECHNOLOGIES SF | | Jarrod Yahes |

| | |

| By: Matthew Bromberg | | /s/ Jarrod Yahes |

| | |

| /s/ Matthew Bromberg | | |

| Date November 4, 2024 | | Date November 4, 2024 |

Exhibit A

(Prior Innovations)

If you have no such Prior Innovations:

•Please leave blank or write “None” in the Box Below

OR

If you do have such Prior Innovations:

•Provide in the box below at a minimum a basic description of each of your claimed Prior Innovations sufficient to identify it, excluding those described in any issued patent or published patent application as of the date of signing.

Q3 2024 | November 7, 2024 SHAREHOLDER LETTER

DEAR UNITY SHAREHOLDERS To Our Shareholders: It’s a privilege to address you once again on behalf of my colleagues around the world. We are at the beginning of a period of meaningful and productive change at Unity. The enthusiasm and excitement generated thus far, both inside and outside the Company, has been enormously encouraging. We saw real progress on our plan during the third quarter, and are looking forward to the transformational work ahead. Unity is the only company we know of that can deliver value to developers of games and interactive experiences across the entire lifecycle, from prototyping to live service operation right through user acquisition and monetization. That capability, and its connection to the 3B monthly downloads of applications created with Unity, positions us well to become the global platform of choice. As we continue to improve our ability to leverage data to provide measurable increases in stability, speed, efficiency, innovation, and ROI to our customers, we believe Unity will continue to prosper. Last quarter, we told you we’d focus on fostering a culture of execution and discipline, accelerating the pace of product innovation, and strengthening the bond with our customers and community. And that’s just what we did. The cancellation of the Runtime Fee for gaming customers, the reversion to a subscription-based model, and the introduction of price increases that customers could embrace has unblocked renewals and accelerated new relationships. Then we delivered Unity 6, the best performing, most stable version of Unity we’ve ever shipped, and outlined a new upgrade philosophy which is designed to enable customers to upgrade to new features without sacrificing stability. The combination of a new approach, new pricing, and new software has begun to change the decision calculus. When developers choose Unity, they’re potentially building a business on top of our platform for decades — and we’re dedicated to making that choice easier every day. © 2024 Unity Technologies U N I T Y . C O M | 2

We also told you that adding world class talent to the team was going to be critical. In October we announced the hiring of a new Chief Technology Officer, Steve Collins, who brings decades of experience in game development (he was CTO at King, the studio behind hits like Candy Crush); engines (he was the co- founder and CTO of Havok, the pioneering physics engine that helped define modern gaming); and marketing technology (he was the CTO of Swrve, a real- time marketing automation cloud for mobile apps). Today, we’re equally excited to announce that we’ve hired a new Chief Financial Officer, Jarrod Yahes, who begins full time with us on January 1. Jarrod joins Unity from Shutterstock, where he has served as CFO for the past five years, helping to drive the company’s portfolio expansion into 3D content, data monetization, and digital advertising while emphasizing revenue growth and profitability. Steve and Jarrod join a new management team that has the quality and depth of experience to carry us through the exciting work ahead. Finally, we talked last quarter about embarking on a fundamental rebuild of our machine learning stack and data infrastructure designed to enhance the return on investment we’re able to deliver to our advertising customers. We’re happy to report great progress on that work, which is already in testing on live data. We’re very encouraged by the early results we’re seeing. We believe that our new data platform will not only drive performance improvements in user acquisition and monetization, but also surface insights critical to game production and live service management, where understanding consumer behavior is core to being able to build and operate great games. These investments are core to our vision of a unified platform that can deliver for our customers across the full lifecycle of game development. © 2024 Unity Technologies U N I T Y . C O M | 3

THIRD QUARTER RESULTS Third quarter results exceeded our guidance for both revenue of our strategic portfolio and Adjusted EBITDA. Revenue from our strategic portfolio was $429 million, down 2% year-over-year, as compared to guidance of $415 to $420 million. Our net loss for the quarter was $125 million, as compared to net loss of $125 million in the third quarter of 2023 and net loss of $126 million in the second quarter of this year. Adjusted EBITDA for the total company for the quarter was $92 million, compared to guidance of $75 to $80 million. Adjusted EBITDA for the total company was $94 million in the same quarter last year (excluding customer credits of $37 million as described in our shareholder letter for the year ended December 31, 2023. Third quarter Create Solutions revenue from our strategic portfolio was $132 million, up 5% year-over-year, and up 2% quarter-over-quarter. The year-over- year increase was driven by a 12% growth in subscriptions revenue, as customers upgraded and renewed at increased prices.1 The quarter-over- quarter increase was also driven primarily by subscription growth. Grow Solutions revenue from our strategic portfolio in the third quarter was $298 million, down 5% year-over-year and up 1% quarter-over-quarter. Revenue for the total company for the third quarter was $447 million, down 18% year-over-year driven by decreases in Grow Solutions revenue and our portfolio reset. During the third quarter, revenue from our non-strategic portfolio was $17 million, down 84% year-over-year as a result of our portfolio reset. We expect revenue from our non-strategic portfolio in the fourth quarter to continue to decline compared to the third quarter. © 2024 Unity Technologies U N I T Y . C O M | 4 1 Create Solutions revenue for the total company and Grow Solutions revenue for the total company were $147 million and $299 million, respectively. Our subscriptions include revenue associated with support we provide our customers as part of their subscriptions and is inclusive of China.

PRODUCT FOCUS In September, after months of listening to customers, partners, and our community, we announced the cancellation of the Runtime Fee and a reversion to our existing seat-based subscription model for all gaming customers. We also introduced pricing changes, effective January 1, 2025, which will apply to all new and existing Unity Pro and Enterprise customers upon purchase, renewal, or upgrade. Since announcing these decisions, we’ve seen a positive trend in renewals and an increase in early adoption of Unity 6. The future financial impact on our Create subscription revenues will be dependent on the timing of renewals and contract negotiations with our Enterprise customers but we believe that, over time, these pricing changes will help us to drive consistent revenue growth in the double digit range for our core subscription business. In October, we launched Unity 6, the most stable and best performing version of Unity. Unity 6 is designed to enable the creation of better games, built more quickly and more efficiently than ever before. Built, tested, and refined in production environments in partnership with developers, Unity 6 marks a shift in how we’ll approach our development cycle moving forward. The key will be in maintaining a better and more consistent feedback loop that will ensure we deliver tools that make a tangible difference for our customers every day. Some of the new features in Unity 6 include end-to-end multiplayer workflows that speed development of connected games; tools that enable developers to reach even more players by targeting mobile web; and with new graphics capabilities that move workloads from the CPU to the GPU we have seen CPU computation time improvements of up to 4X, dropping from from 40 milliseconds to 10 milliseconds per computation in internal stress tests. Bringing cross-platform 3D visualization to market segments outside of gaming is a major focal point of our strategy, and remains the fastest growing segment of our subscription business. We are beginning to achieve global scale through partnerships with global system integrators (GSIs), distributors and value- added resellers (VARs) in every region. New Unity customers in the quarter include Dutch airline KLM and Deutsche Bahn, the national railway company of Germany. KLM used Unity to build a VR cockpit training application that allows pilots to practice, hone their skills and enhance situational awareness. By using Unity, the airline achieved significant reductions in iteration time, full immersion for trainees using the latest headset technology, and enhanced quality and customization of training scenarios. Deutsche Bahn used Unity to build guided customer experiences in AR to help passengers navigate transit changes, and created VR environments for staff training that include a fire safety training simulator for train operators and a railway interlocking system training © 2024 Unity Technologies U N I T Y . C O M | 5

simulator for train dispatchers. Finally, the pace of Product releases in our Grow business also accelerated, highlighted by efforts to increase the scale and quality of users acquired, fine tune automated ROAS campaigns on our ad networks, and build diversity and effectiveness of ad placements. We’ve also continued to invest in our Ad Quality product, which gives publishers critical transparency into how the ads running inside their apps and games impact user engagement, and the tools to immediately shut off those that are having a negative impact. All of this work continues alongside the more fundamental data infrastructure and machine learning work being prepared for a 2025 launch. © 2024 Unity Technologies U N I T Y . C O M | 6

GUIDANCE2 For the fourth quarter, we are guiding revenue for our strategic portfolio to $422 to $427 million. We are guiding Adjusted EBITDA to $79 to $84 million for the total company. We are raising guidance for the full year due to better than expected performance in Q3, with full year revenue guidance for our strategic portfolio now at $1,703 to $1,708 million compared to $1,680 to $1,690 million previously and Adjusted EBITDA of $363 to $368 million compared to $340 to $350 million previously. We closed the third quarter with 488 million fully-diluted shares as compared to our third quarter fully diluted share count in guidance of 488 million. We expect 488 million fully diluted shares at the end of the fourth quarter. © 2024 Unity Technologies U N I T Y . C O M | 7 2 These statements are forward-looking and actual results may differ materially. Refer to the “Cautionary Statement Regarding Forward-Looking Statements” safe harbor section below for information on the factors that could cause our actual results to differ materially from these forward-looking statements. We have not reconciled our estimates for non-GAAP financial measures to GAAP due to the uncertainty and potential variability of expenses that may be incurred in the future. As a result, a reconciliation is not available without unreasonable effort and we are unable to address the probable significance of the unavailable information. We have provided a reconciliation of other GAAP to non-GAAP financial measures in the financial statement tables for our third quarter non-GAAP results included in this shareholder letter.

CONCLUDING THOUGHTS The entire gaming ecosystem functions better when Unity is delivering on its commitment to provide developers and publishers what they need to make and market great games. While we’re just at the beginning of our journey to transform the Company, we’re energized by our progress and the response from our customers and the community. The opportunity is clear, the market wants us to succeed, and we believe we have everything we need to deliver consistent, sustainable growth and profitability in the years ahead. As always, our deepest gratitude goes out to our customers, partners, employees, and investors for their unwavering support. Warm regards, Matt Bromberg President and Chief Executive Officer © 2024 Unity Technologies U N I T Y . C O M | 8

APPENDIX Cautionary Statement Regarding Forward-Looking Statements This shareholder letter and the earnings call referencing this shareholder letter contain “forward-looking statements,” as that term is defined under federal securities laws, including, but not limited to, statements regarding Unity’s outlook and future financial performance, including: (i) Unity’s ability to position itself as the gaming platform of choice; (ii) the efficacy of Unity’s efforts to leverage data to provide measurable increases in stability, speed, efficiency, innovation and ROI to its customers; (iii) that Unity will prosper; (iv) that customer relationships will improve, unblocking renewals and accelerating new relations; (v) Unity’s fundamental rebuild of its machine learning stack and data infrastructure; and (vi) Unity’s financial guidance for the fourth quarter and full year 2024. The words “aim,” “believe,” “may,” “will,” “estimate,” “continue,” “intend,” “expect,” “plan,” “project,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to risks, uncertainties, and assumptions. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Risks include, but are not limited to, those related to: (i) the impact of macroeconomic conditions, such as inflation, high interest rates, and limited credit availability which could further cause economic uncertainty and volatility; (ii) competition in the advertising market and Unity’s ability to compete effectively; (iii) ongoing restrictions related to the gaming industry in China; (iv) ongoing geopolitical instability, particularly in Israel, where a significant portion of the Grow Solutions operations is located; (v) Unity’s ability to recover or reengage its customers, or attract new customers; (vi) the impact of any decisions to change how Unity prices its products and services; (vii) Unity’s ability to achieve and sustain profitability; (viii) Unity’s ability to retain existing customers and expand the use of its platform; (ix) Unity’s ability to further expand into new industries and attract new customers; (x) the impact of any changes of terms of service, policies or technical requirements from operating system platform providers or application stores which may result in changes to Unity or its customers’ business practices; (xi) Unity’s ability to maintain favorable relationships with hardware, operating system, device, game console and other technology providers; (xii) breaches in its security measures, unauthorized access to its platform, data, or its customers’ or other users’ personal data; (xiii) Unity’s ability to manage growth effectively and manage costs effectively; (xiv) the rapidly changing and increasingly stringent laws, regulations, contractual obligations and industry standards that relate to privacy, data security and the protection of children; (xv) the effectiveness of the company reset; and (xvi) Unity’s ability to successfully transition executive leadership. Further information on these and additional risks that could affect our results is included in our filings with the Securities and Exchange Commission (SEC), including our Quarterly Report on Form 10-Q, filed with the SEC on November 7, 2024, and our future reports that we may file with the SEC from time to time, which could cause actual results to vary from expectations. Copies of reports filed with the SEC are available on the Unity Investor Relations website. Statements herein speak only as of the date of this release, and Unity assumes no obligation to, and does not currently intend to, update any such forward- looking statements after the date of this release except as required by law. About Non-GAAP Financial Measures To supplement our consolidated financial statements prepared and presented in accordance with generally accepted accounting principles in the United States (GAAP) we use certain non-GAAP financial measures, as described below, to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe the following non-GAAP measures are useful in evaluating our operating performance. We are presenting these non- GAAP financial measures because we believe, when taken collectively, they may be helpful to investors because they provide consistency and comparability with past financial performance. However, non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. As a result, our non-GAAP financial measures are presented for supplemental informational purposes only and should not be considered in isolation or as a substitute for our consolidated financial statements presented in accordance with GAAP. © 2024 Unity Technologies U N I T Y . C O M | 9

APPENDIX We define Adjusted EBITDA as GAAP net income or loss excluding benefits or expenses associated with stock- based compensation, amortization of acquired intangible assets, depreciation, restructurings and reorganizations, interest, income tax, and other non-operating activities, which primarily consist of foreign exchange rate gains or losses. We define Adjusted EBITDA margin as Adjusted EBITDA as a percentage of revenue. We define adjusted gross profit as GAAP gross profit excluding expenses associated with stock-based compensation, amortization of acquired intangible assets, depreciation, and restructurings and reorganizations. We define adjusted gross margin as adjusted gross profit as a percentage of revenue. We define non-GAAP research and development expense as research and development expense, excluding expenses associated with stock-based compensation, amortization of acquired intangible assets, depreciation, and restructurings and reorganizations. We define non-GAAP sales and marketing expense as GAAP sales and marketing expense, excluding expenses associated with stock-based compensation, amortization of acquired intangible assets, depreciation, and restructurings and reorganizations. We define non-GAAP general and administrative expense as general and administrative expense excluding expenses associated with stock-based compensation, depreciation, and restructurings and reorganizations. We define free cash flow as net cash provided by operating activities less cash used for purchases of property and equipment. Adjusted EBITDA Reconciliation 2023 2024 $ in thousands Q3 Q4 Q1 Q2 Q3 Revenue $ 544,210 $ 609,268 $ 460,380 $ 449,259 $ 446,517 GAAP net loss (125,310) (253,985) (291,478) (125,738) (124,548) Add: Stock-based compensation expense 147,177 180,953 139,888 113,766 105,271 Amortization of intangible assets expense 99,220 219,647 87,957 88,432 88,517 Depreciation of property and equipment 11,977 12,606 13,853 12,977 14,083 Restructuring and reorganization costs — 31,396 211,746 27,714 10,997 Interest expense 6,154 6,155 6,035 5,829 5,839 Interest income and other expense, net (16,013) (20,840) (76,643) (10,457) (15,350) Income tax expense 7,771 9,710 (12,843) 946 6,913 Adjusted EBITDA $ 130,976 $ 185,642 $ 78,515 $ 113,469 $ 91,722 GAAP net loss margin (23%) (42%) (63%) (28%) (28%) Adjusted EBITDA margin 24% 30% 17% 25% 21% © 2024 Unity Technologies U N I T Y . C O M | 10

GAAP gross profit $ 334,463 $ 392,861 Add: Stock-based compensation expense 10,334 19,591 Amortization of intangible assets expense 27,293 35,191 Depreciation expense 2,265 2,892 Restructuring and reorganization costs 77 — Adjusted gross profit $ 374,432 $ 450,535 GAAP gross margin 75% 72% Adjusted gross margin 84% 83% Operating expenses reconciliation Research and development GAAP research and development expense $ 215,197 $ 240,003 Stock-based compensation expense (57,971) (66,618) Amortization of intangible assets expense (17,592) (18,606) Depreciation expense (6,912) (5,940) Restructuring and reorganization costs (2,553) — Non-GAAP research and development expense $ 130,169 $ 148,839 GAAP research and development expense as a percentage of revenue 48% 44% Non-GAAP research and development expense as a percentage of revenue 29% 27% Sales and marketing GAAP sales and marketing expense $ 176,423 $ 194,000 Stock-based compensation expense (23,168) (35,075) Amortization of intangible assets expense (43,632) (45,423) Depreciation expense (2,956) (2,479) Restructuring and reorganization costs 869 — Non-GAAP sales and marketing expense $ 107,536 $ 111,023 GAAP sales and marketing expense as a percentage of revenue 40% 36% Non-GAAP sales and marketing expense as a percentage of revenue 24% 20% UNITY SOFTWARE, INC. Non-GAAP Reconciliation (In thousands) Three Months Ended September 30, 2024 2023 © 2024 Unity Technologies U N I T Y . C O M | 11

General and administrative GAAP general and administrative expense $ 69,989 $ 86,256 Stock-based compensation expense (13,798) (25,893) Depreciation expense (1,950) (666) Restructuring and reorganization costs (9,236) — Non-GAAP general and administrative expense $ 45,005 $ 59,697 GAAP general and administrative expense as a percentage of revenue 16% 16% Non-GAAP general and administrative expense as a percentage of revenue 10% 11% Free Cash Flow Net cash provided by operating activities $ 122,358 $ 120,053 Less: Purchases of property and equipment (7,151) (16,092) Free cash flow 115,207 103,961 Net cash provided by (used in) investing activities (19,651) (18,092) Net cash provided by (used in) financing activities 20,000 (226,950) UNITY SOFTWARE, INC. Non-GAAP Reconciliation (In thousands) Three Months Ended September 30, 2024 2023 © 2024 Unity Technologies U N I T Y . C O M | 12

UNITY SOFTWARE INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except par share data) (Unaudited) As of September 30, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 1,405,276 $ 1,590,325 Accounts receivable, net 576,436 611,723 Prepaid expenses and other 134,656 122,843 Total current assets 2,116,368 2,324,891 Property and equipment, net 108,085 140,887 Goodwill 3,166,304 3,166,304 Intangible assets, net 1,154,699 1,406,745 Other assets 180,399 204,614 Total assets $ 6,725,855 $ 7,243,441 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 15,195 $ 14,517 Accrued expenses and other 289,340 307,704 Publisher payables 382,552 385,113 Deferred revenue 189,810 186,769 Total current liabilities 876,897 894,103 Convertible notes 2,238,083 2,711,750 Long-term deferred revenue 17,257 6,015 Other long-term liabilities 167,058 217,195 Total liabilities 3,299,295 3,829,063 Commitments and contingencies Redeemable noncontrolling interests 236,914 225,797 Stockholders' equity: Common stock, $0.000005 par value: Authorized shares - 1,000,000 and 1,000,000 Issued and outstanding shares - 402,578 and 384,872 2 2 Additional paid-in capital 6,799,899 6,259,479 Accumulated other comprehensive loss (2,987) (5,009) Accumulated deficit (3,613,217) (3,071,830) Total Unity Software Inc. stockholders' equity 3,183,697 3,182,642 Noncontrolling interest 5,949 5,939 Total stockholders' equity 3,189,646 3,188,581 Total liabilities and stockholders' equity $ 6,725,855 $ 7,243,441 © 2024 Unity Technologies U N I T Y . C O M | 13

UNITY SOFTWARE INC. CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (In thousands, except per share amounts) (Unaudited) Three Months Ended Nine Months Ended September 30, September 30, 2024 2023 2024 2023 Revenue $ 446,517 $ 544,210 $ 1,356,156 $ 1,578,049 Cost of revenue 112,054 151,349 365,316 472,140 Gross profit 334,463 392,861 990,840 1,105,909 Operating expenses Research and development 215,197 240,003 706,860 788,438 Sales and marketing 176,423 194,000 576,902 619,258 General and administrative 69,989 86,256 338,573 272,047 Total operating expenses 461,609 520,259 1,622,335 1,679,743 Loss from operations (127,146) (127,398) (631,495) (573,834) Interest expense (5,839) (6,154) (17,703) (18,425) Interest income and other income (expense), net 15,350 16,013 102,450 38,689 Loss before income taxes (117,635) (117,539) (546,748) (553,570) Provision for (benefit from) Income taxes 6,913 7,771 (4,984) 18,767 Net loss (124,548) (125,310) (541,764) (572,337) Net income (loss) attributable to noncontrolling interest and redeemable noncontrolling interests 191 (1,239) (377) (3,075) Net loss attributable to Unity Software Inc. (124,739) (124,071) (541,387) (569,262) Net loss (124,548) (125,310) (541,764) (572,337) Other comprehensive income (loss), net of taxes: Change in foreign currency translation adjustment 7,412 (1,405) 2,558 (10,403) Change in unrealized gains on derivative instruments — — — 289 Comprehensive loss $ (117,136) $ (126,715) $ (539,206) $ (582,451) Comprehensive income attributable to noncontrolling interest and redeemable noncontrolling interests: Net income (loss) attributable to noncontrolling interest and redeemable noncontrolling interests 191 (1,239) (377) (3,075) Foreign currency translation attributable to noncontrolling interest and redeemable noncontrolling interests 1,501 (302) 536 (2,159) Comprehensive loss attributable to noncontrolling interest and redeemable noncontrolling interests 1,692 (1,541) 159 (5,234) Comprehensive loss attributable to Unity Software Inc. $ (118,828) $(125,174) $ (539,365) $(577,217) Basic and diluted net loss per share attributable to Unity Software Inc. $ (0.31) $ (0.32) $ (1.38) $ (1.49) Weighted-average shares used in computation of basic and diluted net loss per share 398,810 383,674 392,855 382,939 © 2024 Unity Technologies U N I T Y . C O M | 14

2024 2023 2024 2023 Operating activities Net loss $ (124,548) $ (125,310) $ (541,764) $ (572,337) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 102,600 111,023 305,819 331,662 Stock-based compensation expense 104,617 147,181 485,893 467,743 Gain on repayment of convertible note — — (61,371) — Impairment of property and equipment 956 — 22,874 — Other (648) 10,036 14,735 11,557 Changes in assets and liabilities, net of effects of acquisitions: Accounts receivable, net (2,603) 26,713 35,463 28,346 Prepaid expenses and other 7,866 (495) (11,949) 22,354 Other assets 6,753 9,222 4,367 33,533 Accounts payable 550 3,637 90 568 Accrued expenses and other 24,934 9,706 (15,367) (24,021) Publisher payables (5,701) (37,690) (2,561) (37,362) Other long-term liabilities (12,146) (21,460) (46,782) (59,262) Deferred revenue 19,728 (12,510) 13,914 (40,184) Net cash provided by operating activities 122,358 120,053 203,361 162,597 Investing activities Purchases of short-term investments — — — (212) Proceeds from principal repayments and maturities of short-term investments — — — 102,673 Purchases of non-marketable investments — (2,000) — (2,500) Purchases of intangible assets (12,500) — (12,860) — Purchases of property and equipment (7,151) (16,092) (23,107) (44,560) Net cash provided by (used in) investing activities (19,651) (18,092) (35,967) 55,401 Financing activities Repayments of convertible note — — (414,999) — Repurchase and retirement of common stock — (250,000) — (250,000) Proceeds from issuance of common stock from employee equity plans 20,000 23,050 57,302 64,994 Net cash provided by (used in) financing activities 20,000 (226,950) (357,697) (185,006) Effect of foreign exchange rate changes on cash, cash equivalents, and restricted cash 11,464 (8,871) 2,004 (17,656) Increase (decrease) in cash, cash equivalents, and restricted cash 134,171 (133,860) (188,299) 15,336 Cash, cash equivalents, and restricted cash, beginning of period 1,281,797 1,654,884 1,604,267 1,505,688 Cash, cash equivalents, and restricted cash, end of period $ 1,415,968 $ 1,521,024 $ 1,415,968 $ 1,521,024 UNITY SOFTWARE INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) Three Months Ended Nine Months Ended September 30, September 30, © 2024 Unity Technologies U N I T Y . C O M | 15

U N I T Y . C O M

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

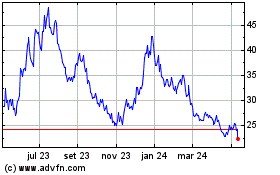

Unity Software (NYSE:U)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

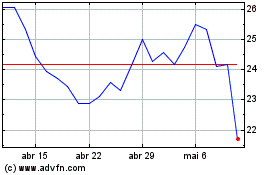

Unity Software (NYSE:U)