Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

12 Novembro 2024 - 8:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16

OR 15d-16 OF

THE SECURITIES EXCHANGE

ACT OF 1934

For the month of November 2024

Commission file number:

001-39278

Kingsoft

Cloud Holdings Limited

(Exact Name of Registrant

as Specified in Its Charter)

Building D, Xiaomi Science

and Technology Park, No. 33 Xierqi Middle Road,

Haidian District

Beijing, 100085, the

People’s Republic of China

(Address of Principal

Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

EXPLANATORY NOTE

We submitted a voluntary announcement dated November 11, 2024 to The Stock Exchange of Hong Kong Limited in relation to the entering into

the finance lease agreement. For details, please refer to Exhibit 99.1 to this current report on Form 6-K.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Kingsoft

Cloud Holdings Limited |

| | |

| Date: November 12, 2024 | By: |

/s/ Haijian He |

| | |

Name: |

Haijian He |

| | |

Title: |

Chief Financial Officer and Director |

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Kingsoft

Cloud Holdings Limited

金山云控股有限公司

(Incorporated

in the Cayman Islands with limited liability)

(Stock

Code: 3896)

(Nasdaq

Stock Ticker: KC)

VOLUNTARY

ANNOUNCEMENT

ENTERING

INTO THE FINANCE LEASE AGREEMENT

This

announcement is made by Kingsoft Cloud Holdings Limited (the “Company”) on a voluntary basis and in accordance with

the terms of the Agreement (as defined below).

The board of directors of the

Company (the “Board”) announces that, in order to accelerate its investment into AI infrastructure, on November 11,

2024, Beijing Kingsoft Cloud Network Technology Co., Ltd. (a consolidated affiliated entity of the Company, “Kingsoft Cloud

Network”) and CITIC Financial Leasing Co., Ltd. (“CITIC Financial Leasing”) entered into a finance

lease agreement (the “Agreement”) after arm’s length negotiation, pursuant to which CITIC Financial Leasing

agreed to provide finance lease service to Kingsoft Cloud Network by way of sale and leaseback of certain servers with the total amount

of finance lease principal of RMB250 million. The term of the Agreement is three years, and the initial annual interest rate is 4.35%.

The

Company believes that entering into the Agreement will extend the Company’s financing channels, enhance the liquidity source and

optimize the capital structure of the Company by replenishing its working capital.

As

at the date of this announcement, entering into the Agreement and the transactions contemplated thereunder do not constitute notifiable

transactions or connected transactions under the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited.

| |

By

order of the Board |

| |

Kingsoft

Cloud Holdings Limited |

| |

Mr. Zou Tao |

| |

Executive

Director, Vice Chairman of the Board and acting Chief Executive Officer |

Hong

Kong, November 11, 2024

As

at the date of this announcement, the board of directors of the Company comprises Mr. Lei Jun as Chairman and non-executive director,

Mr. Zou Tao as Vice Chairman and executive director, Mr. He Haijian as executive director, Mr. Feng Honghua as non-executive

director, and Mr. Yu Mingto, Mr. Wang Hang and Ms. Qu Jingyuan as independent non-executive directors.

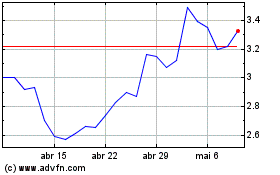

Kingsoft Cloud (NASDAQ:KC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

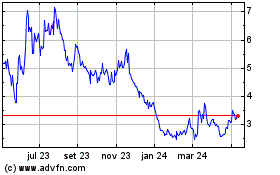

Kingsoft Cloud (NASDAQ:KC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025