Filed by Liberty Broadband Corporation pursuant

to

Rule 425 of the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12 of the

Securities Exchange Act of 1934

Subject Company: Liberty Broadband Corporation

Commission File No.: 001-36713

Subject Company: Charter Communications, Inc.

Commission File No.: 001-33664

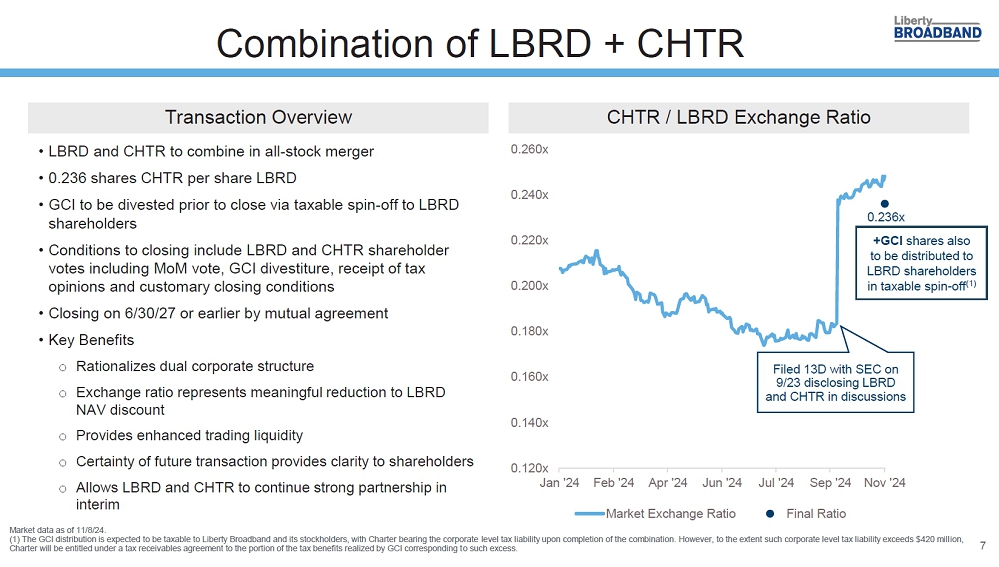

Excerpts of Slides from Liberty Media Corporation 2024 Investor Day Presentations Regarding the Proposed Transaction

Cautionary Note Regarding Forward Looking

Statements

This

presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things,

the proposed transaction between Charter and Liberty Broadband. Although we believe that our plans, intentions and expectations as reflected

in or suggested by these forward-looking statements are reasonable, we cannot assure you

that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties

and assumptions including, without limitation: (i) the effect of the announcement of the proposed transaction on the ability of Charter

and Liberty Broadband to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships;

(ii) the timing of the proposed transaction; (iii) the ability to satisfy closing conditions to the completion of the proposed

transaction (including stockholder and regulatory approvals); (iv) the possibility that the transactions may be more expensive to

complete than anticipated, including as a result of unexpected factors or events; (v) the ability of Liberty Broadband to consummate

the spin-off of its GCI business; (vi) litigation relating to the proposed transaction; (vii) other risks related to the completion

of the proposed transaction and actions related thereto; and (viii) the factors described under “Risk Factors” from time

to time in Charter’s and Liberty Broadband’s filings with the Securities and Exchange Commission (the “SEC”).

Many of the forward-looking statements contained in this presentation may be identified by the use of forward-looking words such as “believe,”

“expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,”

“estimated,” “aim,” “on track,” “target,” “opportunity,” “tentative,”

“positioning,” “designed,” “create,” “predict,” “project,” “initiatives,”

“seek,” “would,” “could,” “continue,” “ongoing,” “upside,” “increases,”

“grow,” “focused on” and “potential,” among others.

All forward-looking statements speak only

as of the date they are made and are based on information available at that time. Neither Charter nor Liberty Broadband assumes any obligation

to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were

made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements

involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Additional Information

Charter intends to file a registration statement

on Form S-4 with the SEC to register the shares of Charter common stock and Charter preferred stock that will be issued to Liberty

Broadband stockholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of

Charter and Liberty Broadband that will also constitute a prospectus of Charter. Investors and security holders of Charter and Liberty

Broadband are urged to read the registration statement, joint proxy statement, prospectus and/or other documents filed with the SEC carefully

in their entirety if and when they become available as they will contain important information about the proposed transaction. The definitive

joint proxy statement/prospectus (if and when available) will be mailed to stockholders of Charter and Liberty Broadband, as applicable.

Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed

with the SEC by Charter or Liberty Broadband through the website maintained by the SEC at http://www.sec.gov or by contacting the investor

relations department of Charter or Liberty Broadband at:

|

Charter Communications, Inc. |

|

Liberty Broadband

Corporation |

|

400 Washington Blvd.

Stamford, CT 06902

Attention: Investor Relations

Telephone: (203) 905-7801 |

|

12300 Liberty Boulevard,

Englewood, Colorado 80112

Attention: Investor Relations

Telephone: (720) 875-5700 |

Participants in Solicitation

This presentation is neither a solicitation

of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Charter, Liberty Broadband

and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies

in respect of the proposed transaction. Information regarding the interests of such potential participants will be included in one or

more registration statements, proxy statements or other documents filed with the SEC if and when they become available. These documents

(if and when available) may be obtained free of charge from the SEC’s website http://www.sec.gov.

Charter anticipates that the following individuals

will be participants (the “Charter Participants”) in the solicitation of proxies from holders of Charter common stock in connection

with the proposed transaction: Eric L. Zinterhofer, Non-Executive Chairman of the Charter board of directors, W. Lance Conn, Kim C. Goodman,

Gregory B. Maffei, John D. Markley, Jr., David C. Merritt, James E. Meyer, Steven A. Miron, Balan Nair, Michael A. Newhouse, Mauricio

Ramos and Carolyn J. Slaski, all of whom are members of the Charter board of directors, Christopher L. Winfrey, President, Chief Executive

Officer and Director, Jessica M. Fischer, Chief Financial Officer, and Kevin D. Howard, Executive Vice President, Chief Accounting Officer

and Controller. Information about the Charter Participants, including a description of their direct or indirect interests, by security

holdings or otherwise, and Charter’s transactions with related persons is set forth in the sections entitled “Proposal No. 1:

Election of Directors”, “Compensation Committee Interlocks and Insider Participation”, “Compensation Discussion

and Analysis”, “Certain Beneficial Owners of Charter Class A Common Stock”, “Certain Relationships and Related

Transactions”, “Proposal No. 2: Increase the Number of Shares in 2019 Stock Incentive Plan”, “Pay Versus

Performance” and “CEO Pay Ratio” contained in Charter’s definitive proxy statement for its 2024 annual meeting

of shareholders, which was filed with the SEC on March 14, 2024 (which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1091667/000119312524067965/d534477ddef14a.htm)

and other documents subsequently filed by Charter with the SEC. To the extent holdings of Charter stock by the directors and executive

officers of Charter have changed from the amounts of Charter stock held by such persons as reflected therein, such changes have been or

will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

Liberty

Broadband anticipates that the following individuals will be participants (the “Liberty Broadband Participants”) in the solicitation

of proxies from holders of Liberty Broadband Series A common stock, Series C common stock and Series A cumulative redeemable

preferred stock in connection with the proposed transaction: John C. Malone, Chairman of the Liberty Broadband board of directors, Gregg

L. Engles, Julie D. Frist, Richard R. Green, Sue Ann R. Hamilton, J. David Wargo and John E. Welsh III, all of whom are members of the

Liberty Broadband board of directors, Gregory B. Maffei, Liberty Broadband’s President, Chief Executive Officer and Director, and

Brian J. Wendling, Liberty Broadband’s Chief Accounting Officer and Principal Financial Officer. Information regarding the Liberty

Broadband Participants, including a description of their direct or indirect interests, by security holdings or otherwise, and Liberty

Broadband’s transactions with related persons can be found under the captions “Proposal 1 – The Election of Directors

Proposal”, “Director Compensation”, “Proposal 3 – The Incentive Plan Proposal”, “Proposal

4 – The Say-On-Pay Proposal”, “Executive Officers”, “Executive Compensation”, “Security

Ownership of Certain Beneficial Owners and Management—Security Ownership of Management” and “Certain Relationships and

Related Party Transactions” contained in Liberty Broadband’s definitive proxy statement for its 2024 annual meeting of stockholders,

which was filed with the SEC on April 25, 2024 (which is available at: https://www.sec.gov/ix?doc=/Archives/edgar/data/1611983/000110465924051479/tm242809d6_def14a.htm)

and other documents subsequently filed by Liberty Broadband with the SEC. To the extent holdings of Liberty Broadband stock by the directors

and executive officers of Liberty Broadband have changed from the amounts of Liberty Broadband stock held by such persons as reflected

therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to beneficial ownership

reports on Schedules 13D filed with the SEC. Free copies of these documents may be obtained as described above.

No Offer or Solicitation

This

presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote

or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Charter Communications (NASDAQ:CHTR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Charter Communications (NASDAQ:CHTR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025