0000885725false00008857252024-11-152024-11-150000885725us-gaap:CommonStockMember2024-11-152024-11-150000885725bsx:SeniorNotedue2027Member2024-11-152024-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

_____________________________________________________________________

Date of Report (Date of earliest event reported): November 15, 2024

BOSTON SCIENTIFIC CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 1-11083 | | 04-2695240 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

300 Boston Scientific Way, Marlborough, Massachusetts 01752-1234

(Address of principal executive offices) (Zip Code)

(508) 683-4000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | BSX | | New York Stock Exchange |

| 0.625% Senior Notes due 2027 | | BSX27 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On November 15, 2024, Boston Scientific Corporation (the “Company”) completed its acquisition of Axonics, Inc. (“Axonics”), a public medical technology company focused on the development and commercialization of differentiated devices to treat urinary and bowel dysfunction. The purchase price of $71 cash per share represents an equity value of $3.7 billion and an enterprise value of $3.3 billion net of cash and short-term investments acquired. The transaction is expected to be immaterial to adjusted earnings per share in 2024 and 2025 and accretive thereafter. On a GAAP basis, the transaction is expected to be less accretive, or more dilutive, due to amortization expense and acquisition-related charges.

A copy of the Company's press release announcing the completion of the acquisition of Axonics is included as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference; provided, however, that information on or connected to our website or the website of any third-party hyperlinked from or referenced in the Company's press release included as Exhibit 99.1 to this Current Report on Form 8-K is expressly not incorporated by reference into or intended to be filed as a part of this Current Report on Form 8-K.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by words like “anticipate,” “expect,” “project,” “believe,” “plan,” “estimate,” “intend” and similar words. These forward-looking statements are based on our beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. These forward-looking statements include, among other things, statements regarding the financial and business impact of the transaction and anticipated benefits of the transaction, our business plans and strategy, and product performance and impact. If our underlying assumptions turn out to be incorrect, or if certain risks or uncertainties materialize, actual results could vary materially from the expectations and projections expressed or implied by our forward-looking statements. These factors, in some cases, have affected and in the future (together with other factors) could affect our ability to implement our business strategy and may cause actual results to differ materially from those contemplated by the statements expressed in this press release. As a result, readers are cautioned not to place undue reliance on any of our forward-looking statements.

Factors that may cause such differences include, among other things: future economic, political, competitive, reimbursement and regulatory conditions; geopolitical events; manufacturing, distribution and supply chain disruptions and cost increases; disruptions caused by cybersecurity events; disruptions caused by extreme weather or other climate change-related events; labor shortages and increases in labor costs; variations in outcomes of ongoing and future clinical trials and market studies; new product introductions; expected procedural volumes; demographic trends; the closing and integration of acquisitions, including our ability to achieve the anticipated benefits of the transaction and successfully integrate Axonics’ operations; business disruptions (including disruptions in relationships with employees, customers and suppliers) following the announcement and/or closing of the transaction; intellectual property; litigation; financial market conditions; the execution and effect of our business strategy, including our cost-savings and growth initiatives; and future business decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item 1A – Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we may update in Part II, Item 1A – Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter. We disclaim any intention or obligation to publicly update or revise any forward-looking statements to reflect any change in our expectations or in events, conditions or circumstances on which those expectations may be based, or that may affect the likelihood that actual results will differ from those contained in the forward-looking statements, except as required by law. This cautionary statement is applicable to all forward-looking statements contained or incorporated herein by reference in this Current Report on Form 8-K.

Use of Non-GAAP Financial Measures

To supplement our consolidated financial statements presented on a GAAP basis, we disclose certain non-GAAP financial measures, including adjusted net income and adjusted net income (earnings) per share that excludes certain charges and/or credits, such as amortization expense and acquisition-related net charges (credits). These non-GAAP financial measures are not in accordance with generally accepted accounting principles in the United States and should not be considered in isolation from or as a replacement for the most directly comparable GAAP financial measures. Further, other companies may calculate these non-GAAP financial measures differently than we do, which may limit the usefulness of those measures for comparative purposes. For further information regarding our non-GAAP measures, see Part II, Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations in our most recent Annual Report on Form 10-K, which we may update in Quarterly Reports on Form 10-Q we have filed or will file hereafter.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

104 Cover Page Interactive Date File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | November 15, 2024 | BOSTON SCIENTIFIC CORPORATION |

| | | |

| | By: | /s/ Susan Thompson |

| | | Susan Thompson |

| | | Vice President, Chief Corporate Counsel and Assistant Secretary |

Exhibit 99.1

Boston Scientific Closes Acquisition of Axonics, Inc.

MARLBOROUGH, Mass., November 15, 2024 – Boston Scientific Corporation (NYSE: BSX) today announced the close of its acquisition of Axonics, Inc. (Nasdaq: AXNX), a medical technology company focused on the development and commercialization of differentiated devices to treat urinary and bowel dysfunction.

“Over the last decade, it has been impressive to see the meaningful innovations Axonics has delivered for patients with overactive bladder and incontinence,” said Meghan Scanlon, senior vice president and president, Urology, Boston Scientific. “By closing this acquisition, we’re pleased to welcome the Axonics team into Boston Scientific. The addition of the Axonics product portfolio enables us to expand into sacral neuromodulation, a high-growth adjacency for our Urology business, while bringing a comprehensive portfolio of products to patients around the world who are seeking tailored treatment options based on their life stage and incontinence severity.”

The purchase price of $71 cash per share represents an equity value of $3.7 billion and an enterprise value of $3.3 billion.1 The transaction is expected to be immaterial to adjusted earnings per share in 2024 and 2025 and accretive thereafter. On a GAAP basis, the transaction is expected to be less accretive, or more dilutive, due to amortization expense and acquisition-related charges.

Additional information about this transaction is available on the Events and Presentations section of the Boston Scientific investor relations website.

About Boston Scientific

Boston Scientific transforms lives through innovative medical technologies that improve the health of patients around the world. As a global medical technology leader for more than 45 years, we advance science for life by providing a broad range of high-performance solutions that address unmet patient needs and reduce the cost of health care. Our portfolio of devices and therapies helps physicians diagnose and treat complex cardiovascular, respiratory, digestive, oncological, neurological and urological diseases and conditions. Learn more at www.bostonscientific.com and connect on LinkedIn and X, formerly Twitter.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by words like “anticipate,” “expect,” “project,” “believe,” “plan,” “estimate,” “intend” and similar words. These forward-looking statements are based on our beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. These forward-looking statements include, among other things, statements regarding the financial and business impact of the transaction and anticipated

benefits of the transaction, our business plans and strategy, and product performance and impact. If our underlying assumptions turn out to be incorrect, or if certain risks or uncertainties materialize, actual results could vary materially from the expectations and projections expressed or implied by our forward-looking statements. These factors, in some cases, have affected and in the future (together with other factors) could affect our ability to implement our business strategy and may cause actual results to differ materially from those contemplated by the statements expressed in this press release. As a result, readers are cautioned not to place undue reliance on any of our forward-looking statements.

Factors that may cause such differences include, among other things: future economic, political, competitive, reimbursement and regulatory conditions; geopolitical events; manufacturing, distribution and supply chain disruptions and cost increases; disruptions caused by cybersecurity events; disruptions caused by extreme weather or other climate change-related events; labor shortages and increases in labor costs; variations in outcomes of ongoing and future clinical trials and market studies; new product introductions; expected procedural volumes; demographic trends; the closing and integration of acquisitions, including our ability to achieve the anticipated benefits of the transaction and successfully integrate Axonics’ operations; business disruptions (including disruptions in relationships with employees, customers and suppliers) following the announcement and/or closing of the transaction; intellectual property; litigation; financial market conditions; the execution and effect of our business strategy, including our cost-savings and growth initiatives; and future business decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item 1A – Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we may update in Part II, Item 1A – Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter. We disclaim any intention or obligation to publicly update or revise any forward-looking statements to reflect any change in our expectations or in events, conditions or circumstances on which those expectations may be based, or that may affect the likelihood that actual results will differ from those contained in the forward-looking statements, except as required by law. This cautionary statement is applicable to all forward-looking statements contained in this document.

CONTACTS

Media: Investors:

Nate Gilbraith Jon Monson

701-212-9589 (office) 508-683-5450 (office)

Media Relations Investor Relations

Boston Scientific Corporation Boston Scientific Corporation

nate.gilbraith@bsci.com BSXInvestorRelations@bsci.com

1Equity value based on total fully diluted share count of approximately 51.7 million shares including management incentives; Enterprise value is equal to Equity value minus net cash and short-term investments of approximately $0.4 billion as of September 30, 2024.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bsx_SeniorNotedue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

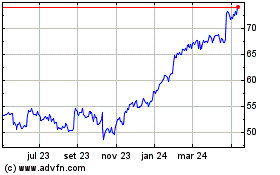

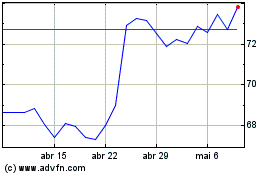

Boston Scientific (NYSE:BSX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Boston Scientific (NYSE:BSX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024