Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

18 Novembro 2024 - 8:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

November, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 9th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras and Yara sign agreements

for technical cooperation and industrialization of ARLA 32

—

Rio de Janeiro, November 18,

2024 – Petróleo Brasileiro S.A. - Petrobras, following up on the release disclosed on July 9, 2024, informs that it has

signed two agreements with Yara and Araucária Nitrogenados S.A. (ANSA), a wholly-owned subsidiary of the company, in a next step

towards structuring a potential partnership within fertilizers and industrial products.

The first agreement includes the

commercialization by Yara of Automotive Liquid Reducing Agent (ARLA 32) produced at ANSA, which will be made using urea supplied by Yara

as a raw material. This agreement will allow the resumption of domestic production of the product, which is currently imported. The industrialization

process will be carried out in parallel with the activities to fully resume operations at the Araucária plant.

The second is a technical cooperation

agreement for the development of joint studies of fertilizers and industrial products, as well as energy transition efforts linked to

decarbonization projects and the production of renewable and low-carbon fertilizers. This scientific, technological and operational cooperation

aims to achieve greater production efficiency and increase the supply of these products on the market.

On the resumption of ANSA

According to notices released

to the market on June 6 and August 15, 2024, Petrobras will invest R$870 million to resume ANSA's operational activities. The plant, located

in Paraná, has been mothballed since 2020 and had the return to operation approved in June 2024. The plant is expected to start

operating again in May 2025, in an effort to bring forward the initial forecast. The resumption activities are being carried out directly

by Petrobras and ANSA.

About Yara

Founded in Norway in 1905, Yara

has 18,000 employees and operations in more than 60 countries. In Brazil, Yara is positioned in all the main agricultural hubs. With more

than 5,000 employees in the country, the company serves all types of producers and crops and has been working to boost fertilizer production,

reducing dependence on raw material imports and modernizing the domestic industry.

www.petrobras.com.br/ir For more information: PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br Av. Henrique Valadares, 28 – 9th floor – 20231-030 – Rio de Janeiro, RJ. Tel.: 55 (21) 3224-1510/9947 This document may contain forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects", "predicts", "intends", "plans", "projects", "aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included herein. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 18, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

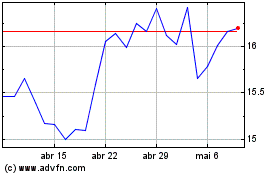

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024