Filed by Liberty Broadband Corporation pursuant

to

Rule 425 of the Securities Act of 1933, as

amended

and deemed filed pursuant to Rule 14a-12 of

the

Securities Exchange Act of 1934

Subject Company: Liberty Broadband Corporation

Commission File No.: 001-36713

Subject Company: Charter Communications, Inc.

Commission File No.: 001-33664

Excerpts from the Transcript of the Liberty

Media Corporation

Investor Day Presentation held on November 14,

2024

John C. Malone

Chairman of the Board, Liberty Broadband Corporation

…Greg was very busy in helping Charter grow rapidly

through the acquisition of Time Warner Cable and the Newhouse cable properties with us ending up as a 26% shareholder. That's

particularly interesting because we just announced yesterday the agreement to merge that holding company that we created for our 26%

into Charter thereby giving our shareholders direct ownership of the Charter company. So as part of the transaction that we've

announced with Charter, the Alaska communications business called GCI will be spun off to [Liberty] Broadband shareholders. It's a

very good business. I've been involved in it on and off, I think, for 40 years. So we have a long history of that. It will have

to be run once it's spun off by the staff at Liberty Media and then its destiny can go from there, whether, in fact, it's used as a

core asset to build another set of diversified businesses, given its very attractive tax characteristics that it will have a

post-spinoff or it may turn out that somebody, some strategic wants to buy the assets of the spun off enterprise, and we would be

considering that as an alternative and then the redeployment of the proceeds from that transaction.

…

Gregory B. Maffei

President, Chief Executive Officer and Director, Liberty Broadband

Corporation

…We announced an agreement to combine with Charter at [an exchange

ratio of 0.236].

I want to make it clear that in addition, shareholders will benefit

from GCI, and we intend to spin off GCI prior to the combination with Charter and Liberty Broadband. Charter will bear the corporate level

tax leakage of the GCI distribution to the LBRD shareholders. And I wanted to specify this because it's not clear to me that the market

understands that the value of GCI is not included in that exchange ratio. And there are -- you can all speculate on how many dollars I've

seen ranges of $5, $8, $10 a share of incremental value in GCI. You consult your own analyst, I'm not forecasting.

The goal of this transaction is obviously to rationalize the dual corporate

structure, resolve the NAV discount that we have and provide certainty to our shareholders of what they will receive in Charter. We've

had a great partnership with Charter, and I look forward as well as several of our other Liberty execs and related parties to continuing

as a Board member.

…

Question and Answer Segment

Question

…First, the timeline on the transaction with Charter is very

long. And so I wonder if you could just comment on how we should think about the pacing of the share repurchases to execute on that transaction

over the next couple of years?

And then maybe stepping back a bit, I wonder if you would just

comment, if you would on -- under a new administration and so much talk about the possibility of transactions and M&A, what kinds

of combinations within the cable industry do you think makes sense?

And what do you think could be approved, whether it's -- because obviously,

with the long time frame I just described, there's a long time for you to take advantage of that, whether it's through Charter or with

GCI.

John C. Malone

Charter’s come up with a way to essentially pace their

buyback of their equity in [Liberty] Broadband so that the transactions continue to be tax efficient and there’s no leakage

for the sale of Charter stock by [Liberty] Broadband.

Ben Oren

Executive Vice President and Treasurer, Liberty Broadband Corporation

So we've agreed to a long close June 2027, but we should

point out that away from the GCI spin, which is at our direction, and the shareholder vote, which will be at our direction, and also

on the Charter shareholders, it's quite a lockbox in terms of the likelihood of a deal not closing by that time.

During that period, Charter is going to provide for about $100 million

a month in repurchase of Charter shares from us. But we've built a mechanic where every time that we need funds away from our liquidity,

we can call on Charter for our liabilities to buy more shares from us or in the absence of buying shares from us because it would take

us below a certain threshold on the cap or because of a liquidity event for them, they can loan us funds as well. And so essentially,

while they have the benefit of not having to put that debt on their balance sheet right now or until 2027, over time, they will address

all of our liabilities. And so as Charter grows in value, you grow in value, the exchange ratio is locked. So you can effectively say, I

am now investing in Charter. And in theory, there shouldn't be any real argument for a discount pro forma for the transaction.

Gregory B. Maffei

Maybe I could just add a word and -- or if John wants to as well on

why the delay close. Some of it's around the complexity of what to do with GCI. Some of it's around this paydown schedule, which will

make Liberty Broadband less levered at the moment it eventually becomes consolidated. And third, Chris and team, I think, appreciate

having Liberty's participation as a shareholder and Board representation and having us around until 2027 I think is viewed by them as

a positive.

Christopher L. Winfrey

President, Chief Executive Officer and Director, Charter Communications, Inc.

You put me on the spot, but the answer is yes. Look, to have long-term

strategic capital around the table has always been an advantage for us. And so when you have the combination of John Malone as a shareholder,

not only through today, but through this transaction, and John has said publicly, he intends to hold the stock even after the collapse

merger is complete. But then having Greg and the other Liberty Broadband Board members representing at the table, this is a very highly

sophisticated savvy group of people who adds a lot of value to the business.

And yes, we're very much interested in helping collapse the discount

at Liberty Broadband and capturing some of that discount for Charter shareholders, but there is real value to the participation in the

past of Liberty Broadband, and there still is going forward. And we wanted to hold on to that, frankly, as long as we could while still

getting the best outcome for our shareholders. Both of those are actually in the interest of shareholders.

Ben Oren

…Another reason why we like the agreement that we've

struck is all of the proceeds from the [sale of shares] is going to be tax-free. So the leakage that we would have otherwise had in

a transaction that would have been delayed to announcement where we were selling back shares, we would have had to pay taxes on

those. The second point is you'll notice in some of the arrangements, we've got a 26% cap currently, but there is an agreement that

if we exceed a 30% cap if the deal were to terminate, which we don't anticipate, there would be scenarios where we'd have to come

back to 30%. That is just me highlighting that Charter does anticipate buying a significant number of shares from the rest of the

market during this time period.

John C. Malone

And I think most importantly, for [Liberty] Broadband

shareholders, the certainty of the outcome and the exchange ratio being fixed permits [Liberty] Broadband shareholders to trade in

the equity of [Liberty] Broadband as if it was Charter equity.

Question

…I just wanted to ask Chris Winfrey, like why not include GCI

as part of the transaction?

Christopher L. Winfrey

…I want to say how -- what a fantastic state Alaska is.

And he and I have talked about it as well. I think that GCI is a fantastic infrastructure asset. It is a one of its kind across the

Alaskan footprint. When you take a look at what they have, nobody else is going to be able to replicate that forever from a wireless

infrastructure, from a wireline infrastructure. But to put a little bit in context, we look for -- when you think about how we've

done M&A at Charter, we look for the ability to scale our operations, do everything virtualized, national, centralized and have

a consistent operating strategy in rural, suburban and urban markets as it relates to pricing and packaging and service. That's good

from a regulatory standpoint.

But Alaska is a completely different animal. You have, what, 250,000

Internet customers. So just to put that in scale, if you saw 2.5x the size of Texas, 250,000 Internet customers, we probably have more

than that in Raleigh, North Carolina. And so from us, from our ability to scale and to run the business that we do, you need a management

team that is exclusively focused on Alaska, doing things the way that Alaska needs to be done because it is unique from a regulatory standpoint,

from a funding standpoint, operations, construction, getting out to the Aleutian Islands. You referenced the undersea fiber.

Our management team, I think, is very capable, but our ability

to scale into that footprint is not the same as -- we're much, much closer -- the state of Washington that we operate in is much closer

to Manhattan in terms of the way we operate it than Washington and Alaska by a long mile, totally different.

And so we looked at it and said, it is a fantastic asset as a private

investor, I'd say 100% great free cash flow, the inability to go replicate the asset they have. But if Charter were to buy an asset

like that and try to turn it into Spectrum with our pricing and packaging, our go-to-market, all of that, it just wouldn't be -- it wouldn't

work. And you have a very talented, very capable management team at GCI that understands Alaska and needs to run it as Alaska. And they

would tell us to buzz off probably appropriately because it wouldn't make sense to run that the way that we do.

And so I think it's one of those classic cases of knowing the difference

between a great asset and who's the right owner for that asset, and that's really what that came down to.

Gregory B. Maffei

Maybe I could just touch on, make sure we're all on the same page.

So GCI will be outside the Charter transaction. It's expected that we will spin that away from Liberty Broadband. Yes, it's overseen by

Liberty Media in terms of shared services, but spun away from Liberty Broadband, not Media. Any tax that is recognized upon that at the

corporate level will be handled up to a number by GCI and then the shareholders will receive their own tax upon the distribution, probably

some sharing between -- they're allocating some basis between the GCI stock and their Charter stock that they'll receive.

The point about the basis is, as part of that, we're likely to get

a step-up in basis and have pretty good protection on the taxes that are generated by GCI and in terms of the ability to shield the income

that GCI generates. Whether something else could be added into that, that's interesting, that's the creativity to come.

Shane Kleinstein

Senior Vice President of Investor Relations, Liberty Broadband Corporation

Just to clarify before John jumps in, I think tax is borne by

Charter on the GCI split.

Cautionary Note Regarding Forward Looking

Statements

This

communication includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things,

the proposed transaction between Charter and Liberty Broadband. Although we believe that our plans, intentions and expectations as reflected

in or suggested by these forward-looking statements are reasonable, we cannot assure you

that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties

and assumptions including, without limitation: (i) the effect of the announcement of the proposed transaction on the ability of Charter

and Liberty Broadband to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships;

(ii) the timing of the proposed transaction; (iii) the ability to satisfy closing conditions to the completion of the proposed

transaction (including stockholder and regulatory approvals); (iv) the possibility that the transactions may be more expensive to

complete than anticipated, including as a result of unexpected factors or events; (v) the ability of Liberty Broadband to consummate

the spin-off of its GCI business; (vi) litigation relating to the proposed transaction; (vii) other risks related to the completion

of the proposed transaction and actions related thereto; and (viii) the factors described under “Risk Factors” from time

to time in Charter’s and Liberty Broadband’s filings with the Securities and Exchange Commission (the “SEC”).

Many of the forward-looking statements contained in this communication may be identified by the use of forward-looking words such as “believe,”

“expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,”

“estimated,” “aim,” “on track,” “target,” “opportunity,” “tentative,”

“positioning,” “designed,” “create,” “predict,” “project,” “initiatives,”

“seek,” “would,” “could,” “continue,” “ongoing,” “upside,” “increases,”

“grow,” “focused on” and “potential,” among others.

All forward-looking statements speak only

as of the date they are made and are based on information available at that time. Neither Charter nor Liberty Broadband assumes any obligation

to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were

made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements

involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Additional Information

Charter intends to file a registration statement

on Form S-4 with the SEC to register the shares of Charter common stock and Charter preferred stock that will be issued to Liberty

Broadband stockholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of

Charter and Liberty Broadband that will also constitute a prospectus of Charter. Investors and security holders of Charter and Liberty

Broadband are urged to read the registration statement, joint proxy statement, prospectus and/or other documents filed with the SEC carefully

in their entirety if and when they become available as they will contain important information about the proposed transaction. The definitive

joint proxy statement/prospectus (if and when available) will be mailed to stockholders of Charter and Liberty Broadband, as applicable.

Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed

with the SEC by Charter or Liberty Broadband through the website maintained by the SEC at http://www.sec.gov or by contacting the investor

relations department of Charter or Liberty Broadband at:

| Charter Communications, Inc. |

|

Liberty Broadband Corporation |

400 Washington Blvd.

Stamford, CT 06902

Attention: Investor Relations

Telephone: (203) 905-7801 |

|

12300 Liberty Boulevard,

Englewood, Colorado 80112

Attention: Investor Relations

Telephone: (720) 875-5700 |

Participants in Solicitation

This communication is neither a solicitation

of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Charter, Liberty Broadband

and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies

in respect of the proposed transaction. Information regarding the interests of such potential participants will be included in one or

more registration statements, proxy statements or other documents filed with the SEC if and when they become available. These documents

(if and when available) may be obtained free of charge from the SEC’s website http://www.sec.gov.

Charter anticipates that the following

individuals will be participants (the “Charter Participants”) in the solicitation of proxies from holders of Charter

common stock in connection with the proposed transaction: Eric L. Zinterhofer, Non-Executive Chairman of the Charter board of

directors, W. Lance Conn, Kim C. Goodman, Gregory B. Maffei, John D. Markley, Jr., David C. Merritt, James E. Meyer, Steven A.

Miron, Balan Nair, Michael A. Newhouse, Mauricio Ramos and Carolyn J. Slaski, all of whom are members of the Charter board of

directors, Christopher L. Winfrey, President, Chief Executive Officer and Director, Jessica M. Fischer, Chief Financial Officer, and

Kevin D. Howard, Executive Vice President, Chief Accounting Officer and Controller. Information about the Charter Participants,

including a description of their direct or indirect interests, by security holdings or otherwise, and Charter’s transactions

with related persons is set forth in the sections entitled “Proposal No. 1: Election of Directors”,

“Compensation Committee Interlocks and Insider Participation”, “Compensation Discussion and Analysis”,

“Certain Beneficial Owners of Charter Class A Common Stock”, “Certain Relationships and Related

Transactions”, “Proposal No. 2: Increase the Number of Shares in 2019 Stock Incentive Plan”, “Pay

Versus Performance” and “CEO Pay Ratio” contained in Charter’s definitive proxy statement for its 2024

annual meeting of shareholders, which was filed with the SEC on March 14, 2024 (which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1091667/000119312524067965/d534477ddef14a.htm) and other documents subsequently

filed by Charter with the SEC. To the extent holdings of Charter stock by the directors and executive officers of Charter have

changed from the amounts of Charter stock held by such persons as reflected therein, such changes have been or will be reflected on

Statements of Change in Ownership on Form 4 filed with the SEC.

Liberty

Broadband anticipates that the following individuals will be participants (the “Liberty Broadband Participants”) in the solicitation

of proxies from holders of Liberty Broadband Series A common stock, Series C common stock and Series A cumulative redeemable

preferred stock in connection with the proposed transaction: John C. Malone, Chairman of the Liberty Broadband board of directors, Gregg

L. Engles, Julie D. Frist, Richard R. Green, Sue Ann R. Hamilton, J. David Wargo and John E. Welsh III, all of whom are members of the

Liberty Broadband board of directors, Gregory B. Maffei, Liberty Broadband’s President, Chief Executive Officer and Director, and

Brian J. Wendling, Liberty Broadband’s Chief Accounting Officer and Principal Financial Officer. Information regarding the Liberty

Broadband Participants, including a description of their direct or indirect interests, by security holdings or otherwise, and Liberty

Broadband’s transactions with related persons can be found under the captions “Proposal 1 – The Election of Directors

Proposal”, “Director Compensation”, “Proposal 3 – The Incentive Plan Proposal”, “Proposal

4 – The Say-On-Pay Proposal”, “Executive Officers”, “Executive Compensation”, “Security

Ownership of Certain Beneficial Owners and Management—Security Ownership of Management” and “Certain Relationships and

Related Party Transactions” contained in Liberty Broadband’s definitive proxy statement for its 2024 annual meeting of stockholders,

which was filed with the SEC on April 25, 2024 (which is available at: https://www.sec.gov/ix?doc=/Archives/edgar/data/1611983/000110465924051479/tm242809d6_def14a.htm)

and other documents subsequently filed by Liberty Broadband with the SEC. To the extent holdings of Liberty Broadband stock by the directors

and executive officers of Liberty Broadband have changed from the amounts of Liberty Broadband stock held by such persons as reflected

therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to beneficial ownership

reports on Schedules 13D filed with the SEC. Free copies of these documents may be obtained as described above.

No Offer or Solicitation

This

communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote

or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

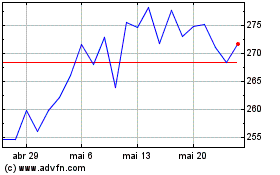

Charter Communications (NASDAQ:CHTR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Charter Communications (NASDAQ:CHTR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025