Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

20 Novembro 2024 - 6:34PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed under Rule 433

Registration

Statement No. 333-272328

APPLOVIN CORPORATION

PRICING TERM SHEET

November 20, 2024

5.125%

Notes due 2029

5.375% Notes due 2031

5.500% Notes due 2034

5.950% Notes

due 2054

Unless otherwise indicated, terms used but not defined herein have the meanings assigned to such terms in the preliminary prospectus supplement

dated November 20, 2024 (the “Preliminary Prospectus Supplement”).

|

|

|

|

|

|

|

|

|

| Issuer: |

|

AppLovin Corporation |

|

|

| Expected Ratings of the Notes:* |

|

Ba1 (positive) Moody’s / BBB- (positive) S&P / BBB- (stable) Fitch |

|

|

| Trade Date: |

|

November 20, 2024 |

|

|

| Settlement Date:** |

|

December 5, 2024 (T+10) |

|

|

| Joint Book-Running Managers: |

|

J.P. Morgan Securities LLC BofA

Securities, Inc. Morgan Stanley & Co. LLC Citigroup

Global Markets Inc. Goldman Sachs & Co. LLC |

|

|

| Co-Managers: |

|

BNP Paribas Securities Corp.

MUFG Bank Ltd. Scotia Capital (USA) Inc. |

|

|

|

|

|

| Title: |

|

5.125% Notes due 2029 |

|

5.375% Notes due 2031 |

|

5.500% Notes due 2034 |

|

5.950% Notes due 2054 |

|

|

|

|

|

| Size: |

|

$1,000,000,000 |

|

$1,000,000,000 |

|

$1,000,000,000 |

|

$550,000,000 |

|

|

|

|

|

| Maturity Date: |

|

December 1, 2029 |

|

December 1, 2031 |

|

December 1, 2034 |

|

December 1, 2054 |

|

|

|

|

|

| Interest Payment Dates: |

|

June 1 and December 1, commencing June 1, 2025 |

|

June 1 and December 1, commencing June 1, 2025 |

|

June 1 and December 1, commencing June 1, 2025 |

|

June 1 and December 1, commencing June 1, 2025 |

|

|

|

|

|

| Day Count: |

|

30/360 |

|

|

|

|

|

|

|

|

|

|

|

| Coupon: |

|

5.125% |

|

5.375% |

|

5.500% |

|

5.950% |

|

|

|

|

|

| Benchmark Treasury: |

|

UST 4.125% due October 31, 2029 |

|

UST 4.125% due October 31, 2031 |

|

UST 4.250% due November 15, 2034 |

|

UST 4.250% due August 15, 2054 |

|

|

|

|

|

| Treasury Yield: |

|

4.284% |

|

4.347% |

|

4.416% |

|

4.611% |

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Spread to Benchmark Treasury: |

|

T+85.0 bps |

|

T+105.0 bps |

|

T+112.5 bps |

|

T+137.5 bps |

|

|

|

|

|

| Yield to Maturity: |

|

5.134% |

|

5.397% |

|

5.541% |

|

5.986% |

|

|

|

|

|

| Price to Public: |

|

99.962% |

|

99.874% |

|

99.689% |

|

99.502% |

|

|

|

|

|

| Underwriting Discount: |

|

60.0 bps |

|

62.5 bps |

|

65.0 bps |

|

87.5 bps |

|

|

| Make-Whole Call: |

|

Prior to the applicable Par Call Date with respect to a series of notes, we may redeem the notes of such series at our option, in whole or in part, at any time and from time to time, at a redemption price equal to the

greater of (i) (a) the sum of the present values of the remaining scheduled payments of principal and interest thereon discounted to the redemption date (assuming such notes matured on the applicable Par Call Date) on a semi-annual basis

(assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 15 basis points in the case of the 2029 notes, 20 basis points in the case of the

2031 notes, 20 basis points in the case of the 2034 notes and 25 basis points in the case of the 2054 notes less (b) interest accrued to the date of redemption, and (2) 100% of the principal amount of the notes to be redeemed, plus, in either

case, accrued and unpaid interest thereon to the redemption date. |

|

|

| Par Call: |

|

On or after the applicable Par Call Date for a series of notes, we may redeem the notes of such series, in whole or in part,

at any time and from time to time, at a redemption price equal to 100% of the principal amount of such notes being redeemed, plus accrued and unpaid interest thereon to the redemption date.

“Par Call Date” means November 1, 2029, the date that is one month prior

to the maturity of the 2029 notes, October 1, 2031, the date that is two months prior to the maturity of the 2031 notes, September 1, 2034, the date that is three months prior to the maturity of the 2034 notes and June 1, 2054, the

date that is six months prior to the maturity of the 2054 notes. |

|

|

| Use of Proceeds: |

|

We intend to use the net proceeds from this offering to repay in full each of our Term Loan Facilities and, to the extent of any remaining net proceeds, for general corporate purposes. |

|

|

|

|

|

| CUSIP: |

|

03831WAB4 |

|

03831WAC2 |

|

03831WAD0 |

|

03831WAE8 |

|

|

|

|

|

| ISIN: |

|

US03831WAB46 |

|

US03831WAC29 |

|

US03831WAD02 |

|

US03831WAE84 |

| * |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time. |

| ** |

Note: We expect to deliver the notes against payment therefor on the tenth business day following the Trade

Date (such settlement being referred to as “T+10”). Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in one business day, unless the parties to a

trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes on any date prior to one business day before delivery will be required, by virtue of the fact that the notes initially will settle in T+10, to specify alternative

settlement arrangements to prevent a failed settlement and should consult their own advisors. |

The issuer has filed a preliminary

prospectus supplement and registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement, the prospectus in that

registration statement, and other documents the issuer has filed with the SEC and that are incorporated by reference into the preliminary prospectus supplement for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling J.P. Morgan

Securities LLC toll-free at 1-212-834-4533; BofA Securities, Inc. toll-free at 1-800-294-1322; or Morgan Stanley & Co. LLC toll-free at

1-866-718-1649. This pricing term sheet supplements the preliminary prospectus supplement of AppLovin Corporation, dated

November 20, 2024, relating to its prospectus, dated June 1, 2023.

2

Any disclaimers or other notices that may appear below are not applicable to this communication and

should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg or another email system.

3

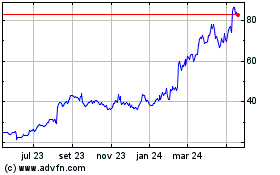

Applovin (NASDAQ:APP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

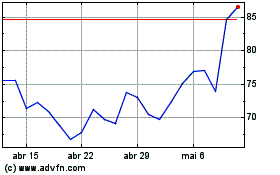

Applovin (NASDAQ:APP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024