Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

21 Novembro 2024 - 11:35AM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE

ACT OF 1934

Dated November 21, 2024

Commission File Number 1-14878

GERDAU S.A.

(Translation of Registrant’s Name into English)

Av. Dra. Ruth Cardoso, 8,501 – 8° andar

São Paulo, São Paulo - Brazil CEP

05425-070

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: November 21, 2024

| |

GERDAU S.A. |

| |

|

| |

By: |

/s/ Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President Investor Relations Director |

Exhibit 99.1

Gerdau S.A.

Corporate Taxpayer ID (CNPJ) n.º 33.611.500/0001-19

Registry (NIRE) n.º 35300520696

NOTICE TO THE MARKET

Gerdau S.A. (B3: GGBR / NYSE: GGB) (“Company”)

announces that the Board of Directors approved, on this date, its 18th issuance of unsecured, non-convertible debentures, in

up to two series, for a total amount of R$1,500,000,000.00 (“Debentures” and “Issuance”, respectively).

The Issuance will be the carried out by means

of a public offering, under automatic registration procedure, pursuant to CVM Resolution No. 160, dated July 13, 2022, through the intermediation

of financial institutions that are part of the securities distribution system, under a firm commitment underwriting arrangement for the

entirety of the Debentures, and targeting professional investors. The main characteristics of Debentures are:

| |

Main Characteristics |

| 1st Série |

2nd Série |

| Issuance Date |

December 10, 2024 |

| Maturity Date |

4 years |

7 years |

| Interest |

DI Rate +0.50% |

DI Rate + 0.64% |

| Volume (R$) and Quantity |

The Bookbuilding Procedure will define the number of series and the number of Debentures to be allocated to each series and, consequently, the volume of each series, observing the system of interconnected vessels. A total of 1,500,000 Debentures will be issued |

The net funds obtained by the Company from the

issuance will be used for ordinary management business.

The general Issuance conditions are detailed in

the minutes of the Meeting of the Company’s Board of Directors available on the websites of the Company’s Investor Relations

and of CVM.

This notice to the market is for information purposes

only under the terms of the regulations in force and does not constitute and should not be construed as any effort to sell the Debentures.

São Paulo, November 19, 2024

Rafael Dorneles Japur

Executive Vice-President and Investor Relations

Officer

Exhibit 99.2

GERDAU S.A.

Corporate Tax ID (CNPJ/MF):

33.611.500/0001-19

Registry (NIRE): 35300520696

NOTICE TO THE MARKET

Gerdau S.A. (B3: GGBR / NYSE: GGB) (“Company”)

informs its shareholders and the market in general that it has entered into an agreement with Sumitomo Corporation and The Japan Steel

Works Ltd. to acquire 39,53% and 1,74% of the total shares issued by Gerdau Summit Aços Fundidos e Forjados S.A. (“Gerdau

Summit”), respectively. This acquisition will result in Gerdau holding 100% of Gerdau Summit’s share capital. The acquisition

price is approximately USD 32.6 million, to be paid in cash using available resources by the closing date of the transaction.

Gerdau Summit, located in Pindamonhangaba, São

Paulo, has an installed capacity of 40,000 tons of cast and forged steel, especially for the production of rolls and shafts in the steel,

aluminum, sugar and ethanol, and energy sectors. The transaction is aligned with Gerdau’s strategy to generate greater synergy between

its businesses and offer higher value-added products and services to its customers.

The transaction is expected to close in early

2025, after the verification of the fulfillment of customary conditions, including approval by competition authorities.

The Company will keep its shareholders and the market informed about

the completion of the transaction.

São Paulo, November 21, 2024.

Rafael Dorneles Japur

Executive Vice-President and

Investor Relations Officer

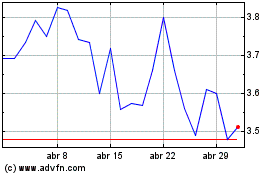

Gerdau (NYSE:GGB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

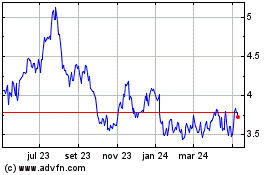

Gerdau (NYSE:GGB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024