UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign

Private Issuer

Pursuant to Rule

13a-16 or 15d-16 under

the Securities Exchange

Act of 1934

Report on Form 6-K

dated November 22, 2024

(Commission File

No. 1-13202)

Nokia Corporation

Karakaari 7

FI-02610 Espoo

Finland

(Translation of

the registrant’s name into English and address of registrant’s principal executive office)

| Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

| |

|

|

| Form 20-F: x |

|

Form 40-F: ¨ |

Enclosures:

| · | Stock

Exchange Release: Nokia Board of Directors resolved on issuing shares without consideration to the company and a subsequent directed

issuance related to the planned completion of the Infinera Corporation acquisition |

| · | Stock

Exchange Release: Nokia launches share buyback program to offset the dilutive effect of the Infinera acquisition |

|

Stock

exchange release

22 November 2024 |

1 (3) |

Nokia Corporation

Stock Exchange Release

22 November 2024 at 11:45 EET

Nokia Board of Directors resolved on issuing shares without consideration to the company and a subsequent directed issuance related to

the planned completion of the Infinera Corporation acquisition

Espoo,

Finland – Nokia’s Board of Directors has resolved to issue 150 000 000 new shares in a directed share issuance

without consideration to Nokia Corporation. The new shares will be later used to satisfy the company’s obligations under the Agreement

and Plan of Merger made and entered into as of 27 June 2024, by and among Nokia Corporation, Neptune of America Corporation and Infinera

Corporation (the “Merger Agreement”).

Nokia

expects that the new shares will be registered with the Finnish Trade Register on or about 25 November 2024 and entered in the book-entry

system maintained by Euroclear Finland Ltd on or about 25 November 2024. The total number of Nokia shares following the registration

will equal 5 763 496 565. The new shares will remain in Nokia Corporation’s treasury pending the planned completion under the Merger

Agreement and are expected to be admitted to trading on Nasdaq Helsinki as of 26 November 2024, and on Euronext Paris as of 27 November

2024, together with other Nokia shares (NOKIA). Euronext Paris will publish a separate notice announcing the admission of the new shares

to trading on Euronext Paris.

Additionally,

the Board of Directors has resolved on a directed issuance of a maximum number of 150 000 000 Nokia shares (NOKIA) held by

Nokia Corporation, which the company holds in treasury as a result of the above-mentioned issuance to itself, to settle its commitments

under the Merger Agreement in respect of shares to be delivered to eligible stockholders of Infinera Corporation upon the completion

of the merger under the Merger Agreement. The completion under the Merger Agreement is expected to occur during the first half of 2025.

The directed share issue is conditional on the completion of the merger under the Merger Agreement and the subscription price for the

Nokia share (NOKIA) will be the closing price of the Company’s share on Nasdaq Helsinki on the date of completion of the merger

under the Merger Agreement. The Nokia shares (NOKIA) will be delivered to the eligible stockholders of Infinera Corporation by Nokia’s

Exchange Agent in the form of American Depositary Shares.

To

the extent that the newly issued shares would not be needed to settle Nokia’s obligations under the Merger Agreement, the Board

has resolved on a directed share issuance of up to the total amount of the aforementioned newly issued shares without consideration to

participants of Nokia's and Infinera's equity programs. These programs include Nokia LTI Plans 2021‒2023 and 2024–2026, Nokia

Employee Share Purchase Plan 2024‒2026 and 2016 Equity Incentive Plan of Infinera Corporation which will be assumed by Nokia following

completion of the merger under the Merger Agreement ("Equity Programs"). The assumption by Nokia of the Infinera Incentive

Plan is subject to the completion of the merger under the Merger Agreement.

Each

delivery of shares and the corresponding change in the number of Nokia’s own shares will be published separately by a stock exchange

release.

www.nokia.com

|

Stock

exchange release

22 November 2024 |

2 (3) |

The

resolutions to issue shares are based on the authorization granted to the Board of Directors by the Annual General Meeting on 3 April

2024.

About Nokia

At Nokia, we

create technology that helps the world act together.

As a B2B technology

innovation leader, we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks.

In addition, we create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

With truly

open architectures that seamlessly integrate into any ecosystem, our high-performance networks create new opportunities for monetization

and scale. Service providers, enterprises and partners worldwide trust Nokia to deliver secure, reliable, and sustainable networks today

– and work with us to create the digital services and applications of the future.

Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: press.services@nokia.com

Maria Vaismaa, Global Head of External

Communications

Nokia

Investor Relations

Phone: +358 40 803 4080

Email: investor.relations@nokia.com

www.nokia.com

|

Stock

exchange release

22 November 2024 |

3 (3) |

Forward-looking statements

Certain statements

herein that are not historical facts are forward-looking statements. These forward-looking statements reflect Nokia’s current expectations

and views of future developments and include statements regarding: A) expectations, plans, benefits or outlook related to our strategies,

projects, programs, product launches, growth management, licenses, sustainability and other ESG targets, operational key performance

indicators and decisions on market exits; B) expectations, plans or benefits related to future performance of our businesses (including

the expected impact, timing and duration of potential global pandemics, geopolitical conflicts and the general or regional macroeconomic

conditions on our businesses, our supply chain, the timing of market changes or turning points in demand and our customers’ businesses)

and any future dividends and other distributions of profit; C) expectations and targets regarding financial performance and results of

operations, including market share, prices, net sales, income, margins, cash flows, cost savings, the timing of receivables, operating

expenses, provisions, impairments, taxes, currency exchange rates, hedging, investment funds, inflation, product cost reductions, competitiveness,

revenue generation in any specific region, and licensing income and payments; D) ability to execute, expectations, plans or benefits

related to our ongoing transactions and changes in organizational structure and operating model; E) impact on revenue with respect to

litigation/renewal discussions; and F) any statements preceded by or including “continue”, “believe”, “envisage”,

“expect”, “aim”, “will”, “target”, “may”, “would”, "see",

“plan” or similar expressions. These forward-looking statements are subject to a number of risks and uncertainties, many

of which are beyond our control, which could cause our actual results to differ materially from such statements. These statements are

based on management’s best assumptions and beliefs in light of the information currently available to them. These forward-looking

statements are only predictions based upon our current expectations and views of future events and developments and are subject to risks

and uncertainties that are difficult to predict because they relate to events and depend on circumstances that will occur in the future.

Factors, including risks and uncertainties that could cause these differences, include those risks and uncertainties specified in our

2023 annual report on Form 20-F published on 29 February 2024 under Operating and financial review and prospects – Risk factors.

www.nokia.com

|

Stock

exchange release

22 November 2024 |

1 (2) |

Nokia Corporation

Stock Exchange Release

22 November 2024 at 12:15 EET

Nokia launches share buyback program

to offset the dilutive effect of the Infinera acquisition

Espoo, Finland – In line with

the announcement made on 27 June 2024, Nokia Corporation ("Nokia" or the "Company") has today decided to launch a

share buyback program to offset the dilutive effect of issuing new shares to the shareholders of Infinera Corporation and from Infinera’s

existing share-based incentives. The daily buyback volume is expected to increase following the completion of the Infinera acquisition,

and the program will be terminated if the acquisition is cancelled.

The main terms of the share buyback

program:

| · | The

program targets to repurchase 150 million shares, for an aggregate purchase price not exceeding

EUR 900 million. |

| · | The

repurchases will start at the earliest on 25 November 2024 and end latest by 31 December

2025. |

| · | The

purpose of the repurchases is to reduce Nokia’s capital to offset the dilution from

issuing additional shares. The repurchased shares will be cancelled accordingly. The repurchases

will be funded using the Company's funds in the reserve for invested unrestricted equity

and the repurchases will reduce the Company's total unrestricted equity. |

| · | The

repurchases are based on the authorization granted to the Board of Directors by Nokia's Annual

General Meeting on 3 April 2024. The maximum number of shares that can be repurchased under

the program is 150 million shares corresponding to approximately 3% of the total number of

shares in Nokia. |

| · | The

shares will be acquired through public trading on the regulated market of Nasdaq Helsinki

and select multilateral trading facilities. No repurchases will be made in the United States.

Nokia has appointed a third-party broker as the lead-manager for the buyback program. The

lead-manager will make trading decisions independently of and without influence from Nokia.

The repurchases will be carried out in accordance with the so-called safe harbour rules referred

to in Article 5 of the EU Market Abuse Regulation (EU N:o 596/2014). |

| · | The

price payable per share shall be determined in public trading on the relevant trading venue

at the time of the repurchase, in compliance with the price and volume limits applicable

under the safe harbour rules. |

www.nokia.com

|

Stock

exchange release

22 November 2024 |

2 (2) |

The program may be terminated prior

to its scheduled end date and Nokia will in such case issue a stock exchange release to this effect.

About Nokia

At Nokia, we

create technology that helps the world act together.

As a B2B technology

innovation leader, we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks.

In addition, we create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

With truly

open architectures that seamlessly integrate into any ecosystem, our high-performance networks create new opportunities for monetization

and scale. Service providers, enterprises and partners worldwide trust Nokia to deliver secure, reliable, and sustainable networks today

– and work with us to create the digital services and applications of the future.

Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: press.services@nokia.com

Maria Vaismaa, Global Head of External

Communications

Nokia

Investor Relations

Phone: +358 40 803 4080

Email: investor.relations@nokia.com

www.nokia.com

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant, Nokia Corporation, has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| Date: November 22, 2024 |

|

Nokia Corporation |

| |

|

| |

By: |

/s/

Johanna Mandelin |

| |

Name: |

Johanna Mandelin |

| |

Title: |

Global Head of Corporate Legal |

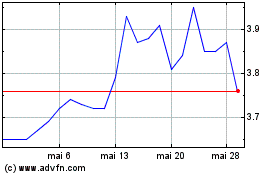

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025