Earnings: TSMC Rises 8% With a 54% Profit Increase; Nokia Drops 6% After a Sales Decline; Alcoa Climbs 5%; CSX Falls 4%

17 Outubro 2024 - 7:33AM

IH Market News

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – TSMC reported net income of T$ 325.3 billion ($10.11

billion) in the third quarter, up 54%, exceeding the T$ 300.2

billion estimate. Revenue reached US$23.5 billion, up 36%,

surpassing the forecast of $22.4 billion to $23.2 billion. Capital

expenditure was $6.4 billion, compared to US$ 6.36 billion in Q2.

For Q4, the company estimates revenue between $26.1 billion and

$26.9 billion and expects capital expenditures of just over $30

billion in 2024, in line with previous expectations. The stock, up

more than 70% year-to-date, rose 7.6% pre-market.

Nokia (NYSE:NOK) – Nokia reported a 9% increase

in Q3 operating profit, with earnings before interest and taxes

(EBIT) rising to $492.73 million (€454 million), exceeding analyst

expectations of €424 million. Despite growth in several areas, some

divisions still face market weakness. Net sales fell 8% to $4.70

billion (€4.33 billion), below the €4.76 billion estimate due to

weak sales in India. The company maintained its annual profit

forecast between €2.3 billion and €2.9 billion. Shares fell 6% in

pre-market trading after closing 1.1% higher on Wednesday.

Alcoa (NYSE:AA) – The global aluminum and

bauxite producer reported earnings per share of $0.38, with

adjusted net income of $0.57 per share. Adjusted EBITDA was $455

million. The acquisition of Alumina contributed to sequential

growth, despite a 4% drop in alumina production. Future projections

remain strong, with a focus on strategic partnerships. Shares rose

5.1% in pre-market trading after closing 1.9% higher on

Wednesday.

CSX (NASDAQ:CSX) – The U.S. rail operator

reported Q3 2024 earnings per share of $0.46, up from $0.41 a year

earlier, but below the expected $0.48. Revenue of $3.62 billion was

up 1%, driven by merchandise and intermodal volumes. Operating

margin increased to 37.4%. However, coal revenue and fuel

surcharges declined due to lower coal demand and operational

challenges. CSX forecast a “more challenging” Q4 due to lower fuel

prices, weak coal demand, and the impact of two major hurricanes in

the U.S. Southeast. CSX expects a $200 million sales loss and

declining margins. Shares fell 4% pre-market after closing down

0.1% on Wednesday.

Kinder Morgan (NYSE:KMI) – The energy

infrastructure company reported adjusted earnings of 25 cents per

share, below the expectation of 27 cents. Revenue was $3.699

billion, below the projection of $4.123 billion. Net income reached

$625 million, while adjusted EBITDA was $1.880 billion, up 2%. Free

cash flow totaled $0.6 billion. Kinder Morgan lowered its annual

forecast due to lower commodity prices and smaller crude oil

volumes. Shares fell 1.9% in pre-market trading after closing 0.7%

higher on Wednesday.

PPG Industries (NYSE:PPG) – The paint and

coatings manufacturer reported Q3 earnings per share of $2.13,

below the estimate of $2.15. Revenue was $4.58 billion, missing the

projection of $4.67 billion. Declining industrial coatings sales,

particularly in the automotive sector, impacted results. However,

the performance coatings segment saw growth, led by aerospace

coatings.

Steel Dynamics (NASDAQ:STLD) – The U.S. steel

producer reported Q3 revenue of $4.34 billion, exceeding the

estimate of $4.177 billion. Earnings per share were $2.05, above

the projection of $1.97. The company noted steady steel demand and

expects price recovery and new gains in 2025, with new coating and

aluminum rolling operations.

Rexford Industrial (NYSE:REXR) – The

California-focused industrial real estate company reported net

income of $65.1 million ($0.30 per share), up from $56.3 million a

year earlier. FFO increased 13.1%, reaching $130 million, with

$0.59 per share. Revenue totaled $241.8 million, beating the

$227.67 million projection.

Equifax (NYSE:EFX) – The credit information

services company reported Q3 2024 revenue of $1.442 billion,

slightly below the estimate of $1.443 billion. Net income was

$141.3 million, with an EPS of $1.13, down from $1.31 a year

earlier. The company expects future growth based on its

verification solutions and international expansion. However,

Equifax projected annual revenue below Wall Street forecasts due to

the impact of high interest rates on loan demand, especially

mortgages. The company expects annual revenue between $5.70 billion

and $5.72 billion, below the $5.74 billion expectations.

First Industrial Realty Trust (NYSE:FR) – The

U.S. industrial real estate company reported funds from operations

of $92.3 million, or $0.68 per share, surpassing the estimate of

$0.67. Net income was $99.4 million ($0.75 per share), with revenue

of $167.6 million, above the $166.8 million projection.

Discover Financial Services (NYSE:DFS) – The

financial services provider reported Q3 2024 net income of $965

million, up 41% from the previous year. Earnings per share were

$3.69, beating the estimate of $3.07. Total revenue was $4.453

billion, above the forecast of $4.175 billion, with 10%

year-over-year growth.

Synovus Financial Corp. (NYSE:SNV) – The

regional bank and diversified financial services provider reported

Q3 2024 earnings per share of $1.18, up from $0.60 a year earlier.

Adjusted diluted EPS was $1.23. Pre-provision net revenue grew 28%,

reaching $251 million. The credit loss provision dropped 68%. Core

deposits increased by $294.6 million.

Netflix (NASDAQ:NFLX) – The company is set to

release its Q3 earnings on October 17, with high expectations.

According to FactSet, Netflix is expected to post adjusted earnings

of $5.12 per share, compared to $3.73 last year, and revenue of

$9.77 billion, up from $8.54 billion. The subscriber count is

projected to reach 281.5 million, up from 247.2 million last

year.

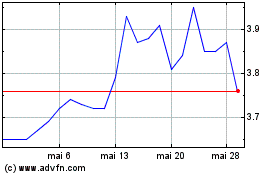

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025