false000115846300011584632024-12-042024-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 4, 2024

JETBLUE AIRWAYS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 000-49728 | 87-0617894 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

27-01 Queens Plaza North | Long Island City | New York | 11101 |

| (Address of principal executive offices) | (Zip Code) |

(718) 286-7900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | JBLU | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

JetBlue Airways Corporation ("JetBlue" or the "Company") announced today an operational and financial update of its expected fourth quarter and full year 2024 results.

JetBlue continues to rapidly execute its JetForward strategy. Through reliability investments, the Company saw year-over-year on-time performance improve 12 points in October and seven points in November, resulting in a range of benefits to date, from greater customer satisfaction to lower operational costs.

Booking performance for travel in November and December was higher than expectations immediately following the U.S. presidential election and as a result, the fourth quarter revenue headwind from the election is now estimated to be 0.5 points compared to the previous forecast of 1.0 point. Furthermore, improved close-in demand and strong operational performance over Thanksgiving week resulted in better revenue performance during the November holiday peak. For travel in December, in-quarter bookings have exceeded prior expectations in both peak and off-peak travel periods. JetBlue’s 2024 revenue initiatives are expected to exceed $300 million of cumulative benefit in the fourth quarter, supported by preferred seating, the Blue Basic carry-on baggage policy change, and other initiatives.

JetBlue's fourth quarter non-fuel unit costs are expected to improve versus prior guidance, driven by controllable cost benefits as a result of a more reliable and on-time operation. Fuel price has declined since the start of the fourth quarter, further improving projected operating expenses for the quarter.

The table below provides JetBlue’s updated investor guidance for the fourth quarter and full year ending December 31, 2024.

| | | | | | | | | | | | | | |

| Fourth Quarter and Full Year 2024 Outlook | Estimated 4Q 2024 | Previously Estimated 4Q 2024 (1) | Estimated FY 2024 | Previously Estimated FY 2024 (1) |

| | | | |

| Capacity and Revenue | | | | |

| Available Seat Miles ("ASMs") Year-Over-Year | (6.5%) - (4.5%) | (7.0%) - (4.0%) | (4.0%) - (3.0%) | (4.5%) - (2.5%) |

| Revenue Year-Over-Year | (5.0%) - (2.0%) | (7.0%) - (3.0%) | (4.5%) - (3.5%) | (5.0%) - (4.0%) |

| Expense | | | | |

CASM Ex-Fuel (2) Year-Over-Year | 12.5% - 14.5% | 13.0% - 15.0% | 7.0% - 7.5% | 7.0% - 8.0% |

Fuel Price per Gallon (3), (4) | $2.40 - $2.50 | $2.50 - $2.65 | $2.73 - $2.76 | $2.75 - $2.80 |

| Interest Expense | $145 - $155 million | $155 - $165 million | $360 - $370 million | $370 - $380 million |

| Capital Expenditures | No change | ~$450 million | No change | ~$1.6 billion |

(1) As of October 29, 2024.

(2) Non-GAAP financial measure; refer to Note A for further details on non-GAAP forward looking information.

(3) Includes fuel taxes, hedges and other fuel fees.

(4) JetBlue utilizes the forward Brent crude curve and the forward Brent crude to jet crack spread to calculate the unhedged portion of its current quarter. Fuel price is based on forward curve as of November 22, 2024.

Forward Looking Information

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). All statements other than statements of historical facts contained in this Current Report on Form 8-K are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "expects," "plans," "intends," "anticipates," "indicates," "remains," "believes," "estimates," "forecast," "guidance," "outlook," "may," "will," "should," "seeks," "goals," "targets" or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts,

such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Current Report on Form 8-K include, without limitation, statements regarding our outlook and underlying expectations, including with respect to fuel prices and interest expense. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the risk associated with the execution of our strategic operating plans in the near-term and long-term; our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to the NEA and our wind-down of the NEA; risks associated with cybersecurity and privacy, including information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year.

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Current Report on Form 8-K, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the "SEC"), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2023, as may be updated by our other SEC filings. In light of these risks and uncertainties, the forward-looking events discussed in this Current Report on Form 8-K might not occur. Our forward-looking statements speak only as of the date of this Current Report on Form 8-K. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Note A - Non-GAAP Financial Measures

We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Current Report on Form 8-K. Non-GAAP financial measures are financial measures that are derived from the condensed consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies.

With respect to JetBlue’s CASM Ex-Fuel guidance (1), we are not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measures cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results.

(1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, other non-airline operating expenses, and special items.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | JETBLUE AIRWAYS CORPORATION |

| | | (Registrant) |

| | | |

| Date: | December 4, 2024 | By: | /s/ Dawn Southerton |

| | | Dawn Southerton |

| | | Vice President, Controller |

| | | (Principal Accounting Officer) | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

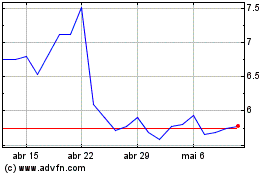

JetBlue Airways (NASDAQ:JBLU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

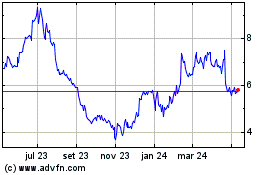

JetBlue Airways (NASDAQ:JBLU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024