false

0001014763

0001014763

2024-11-27

2024-11-27

0001014763

AIMD:CommonStockParValue0.01PerShareMember

2024-11-27

2024-11-27

0001014763

AIMD:WarrantsToPurchaseCommonStockMember

2024-11-27

2024-11-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 27, 2024

| AINOS,

INC. |

| (Exact

name of registrant as specified in its charter) |

| Texas |

|

001-41461 |

|

75-1974352 |

(State

or other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

8880

Rio San Diego Drive, Ste.

800, San

Diego, CA

92108

(858)

869-2986

(Address

and telephone number, including area code, of registrant’s principal executive offices)

(Former

name or former address if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

AIMD |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

AIMDW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure

On

December 2, 2024, the Company issued a press release relating to the execution of the MOU (as defined below). A copy of the press release

is furnished herewith as Exhibit 99.1.

The

information furnished with this Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of

1933, as amended, or the Exchange Act.

Item

8.01. Other Events.

On

November 27, Ainos, Inc. ( the “Company”) signed a Memorandum of Understanding (“MOU”) with Taiwan

Tanabe Seiyaku Co., Ltd. (“Taiwan Tanabe”), a corporation majority-owned by Mitsubishi Tanabe Pharma Corporation.

The MOU outlines a collaboration on the manufacturing and promotion of the Company’s Sjögren’s syndrome drug, VELDONA®,

to meet market demand. Under the terms of the MOU, Taiwan Tanabe desires to become the exclusive marketer, manufacturer, and marketing

authorization holder of VELDONA®.

The

parties intend to enter into an exclusive license agreement, using the business framework outlined in the MOU as a basis for further

negotiations. The license fees, milestone payments, and profit-sharing terms will be agreed upon in such an agreement, contingent on

VELDONA® reaching the stage where a new drug application (NDA) can be approved in Taiwan.

Pursuant

to the MOU, the Company has granted Taiwan Tanabe the exclusive right of first negotiation for a period of three (3) months starting

from November 27, 2024. This period may be extended for an additional three months with mutually agreed written notice.

The

MOU does not create any legally binding obligations.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit

Number |

|

Exhibits |

| 99.1 |

|

Press Release |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Ainos,

Inc. |

| |

|

|

| Date:

December 4, 2024 |

By: |

/s/

Chun-Hsien Tsai |

| |

Name: |

Chun-Hsien

Tsai |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Ainos,

Inc. Announces Strategic Partnership with Taiwan Tanabe Seiyaku to Advance Manufacturing and Taiwan Market Promotion of Sjögren’s

Syndrome Drug

San

Diego, California—(Newsfile Corp. - December 2, 2024) - Ainos, Inc. (NASDAQ: AIMD) (NASDAQ: AIMDW) (“Ainos” or the

“Company”), an innovative healthcare company focused on advanced AI-driven point-of-care testing (“POCT”) and

low-dose interferon therapeutics, today proudly announced the signing of a strategically significant Memorandum of Understanding (MOU)

with Taiwan Tanabe Seiyaku Co., Ltd., a subsidiary of Mitsubishi Tanabe Pharma Corporation in Japan, brings extensive pharmaceutical

development and manufacturing expertise to the partnership. The collaboration aims to advance the manufacturing and Taiwan

market promotion of Ainos’ groundbreaking Sjögren’s syndrome drug, VELDONA®. Both parties may work

under the terms of the MOU to further define the partnership.

Market

Demand for Sjögren’s Syndrome Treatment

Sjögren’s

syndrome is an autoimmune disease affecting millions of patients worldwide, with a significant unmet need for effective treatments. As

the global population ages and awareness of the disease increases, the demand for therapeutic solutions is growing rapidly. According

to market analysis, the global Sjögren’s syndrome market is projected to reach billions of dollars in the next five years.

Ainos believes VELDONA® will provide a much-needed, innovative treatment option for millions of patients and fulfill this

pressing market demand.

VELDONA®’s

Clinical Progress and Success

Ainos

has dedicated years to the development of Sjögren’s syndrome treatments, with VELDONA®, a low-dose oral interferon-alpha,

showing remarkable potential in clinical trials. Previous studies have demonstrated that VELDONA® can significantly alleviate

patient symptoms, improve quality of life, and effectively control disease progression. The drug has shown strong tolerability and safety,

establishing a solid foundation for further large-scale global clinical trials.

Partnership

with Taiwan Tanabe Seiyaku

Taiwan

Tanabe Seiyaku, as a subsidiary of Mitsubishi Tanabe Pharma, offers extensive experience in pharmaceutical development and market expansion.

As part of this partnership, Taiwan Tanabe Seiyaku may collaborate with Ainos on the manufacturing and promotion of VELDONA®

to meet market demand. Both parties will clarify the specific details and responsibilities of the partnership as stipulated in

the MOU agreement.

Global

Market Impact and Future Outlook

This

collaboration with Taiwan Tanabe Seiyaku will accelerate the global market introduction of VELDONA®, ensuring that the

drug reaches patients in a timely and efficient manner. The formal contract will define the clear rights and responsibilities of both

parties, paving the way for long-term success. Ainos anticipates that as more clinical data is collected and the drug becomes available

in more markets, the demand for VELDONA® will solidify its position as a leading treatment for Sjögren’s syndrome.

Additionally, the success of this drug will open further opportunities in other autoimmune diseases, enhancing the company’s market

valuation and growth potential.

Ainos’

Future Vision

Ainos

is committed to driving medical innovation and addressing the world’s unmet medical needs. This partnership with Taiwan Tanabe

Seiyaku marks an important milestone in our global strategy, and we will continue to focus on developing breakthrough therapies that

improve the quality of life for patients worldwide.

About

Ainos, Inc.

Headquartered

in San Diego, California, Ainos is a diversified healthcare company focused on novel AI-powered point-of-care testing (POCT) and low-dose

interferon therapeutics (VELDONA®). The Company’s clinical-stage product pipeline includes VELDONA®

human and animal oral therapeutics, human orphan drugs, and telehealth-friendly POCT solutions powered by its AI Nose technology platform.

To learn more, visit https://www.ainos.com. Follow Ainos on X, formerly known as Twitter, (@AinosInc) and LinkedIn

to stay up-to-date.

About

Taiwan Tanabe Seiyaku Co., Ltd.

Taiwan

Tanabe Seiyaku Co., Ltd., a subsidiary of Mitsubishi Tanabe Pharma Corporation, was established in 1962. The company is focused on providing

high-quality pharmaceutical products and innovative therapeutic solutions in Taiwan and neighboring markets, covering key therapeutic

areas such as autoimmune diseases, diabetes, and other major health conditions.

Safe

Harbor Statement

Certain

statements in this press release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking

statements. Forward-Looking statements can be identified by the use of words such as “anticipate,” “believe,”

“estimate,” “approximate,” “expect,” “intend,” “plan,” “predict,”

“project,” “target,” “future,” “likely,” “strategy,” “foresee,”

“may,” “guidance,” “potential,” “outlook,” “forecast,” “should,”

“will” or other similar words or phrases. Similarly, statements that describe the Company’s objectives, plans or goals

are, or may be, forward-looking statements. Forward-Looking statements are based only on the Company’s current beliefs, expectations,

and assumptions. Forward-Looking statements are subject to inherent uncertainties, risks, and changes in circumstances that are difficult

to predict and many of which are outside of the Company’s control. The Company’s actual results may differ materially from

those indicated in the forward-looking statements.

Important

factors that could cause the Company’s actual results to differ materially from the projections, forecasts, estimates and expectations

discussed in this press release include, among others, the cost of production and sales potential of the products announced in this press

release; the Company’s dependence on projected revenues from the sale of current or future products; the Company’s limited

cash and history of losses; the Company’s ability to achieve profitability; the Company’s ability to raise additional capital

to continue the Company’s product development; the ability to accurately predict the future operating results of the Company; the

ability to advance Ainos’ current or future product candidates through clinical trials, obtain marketing approval and ultimately

commercialize any product candidates the Company develops; the ability to obtain and maintain regulatory approval of Ainos’ product

candidates; delays in completing the development and commercialization of the Company’s current and future product candidates,

which could result in increased costs to the Company, delay or limit the ability to generate revenue and adversely affect the business,

financial condition, results of operations and prospects of the Company; intense competition and rapidly advancing technology in the

Company’s industry that may outpace its technology; customer demand for the products and services the Company develops; the accuracy

of third-party market research data, the impact of competitive or alternative products, technologies and pricing; disruption in research

and development facilities; lawsuits and other claims by third parties or investigations by various regulatory agencies governing the

Company’s operations; potential cybersecurity attacks; increased requirements and costs related to cybersecurity; the Company’s

ability to realize the benefits of third party licensing agreements; the Company’s ability to obtain and maintain intellectual

property protection for Ainos product candidates; compliance with applicable laws, regulations and tariffs; continued listing on and

compliance with the applicable regulations of the Nasdaq Capital Market; and the Company’s success in managing growth. A more complete

description of these risk factors and others is included in the “Risk Factors” section of Ainos’ Annual Report on Form

10-K for the year ended December 31, 2023, and other public filings with the U.S. Securities and Exchange Commission (“SEC”),

many of which risks are beyond the Company’s control. In addition to the risks described above and in the Company’s filings

with the SEC, other unknown or unpredictable factors also could cause actual results to differ materially from the projections, forecasts,

estimates and expectations discussed in this press release.

The

forward-looking statements made in this press release are expressly qualified in their entirety by the foregoing cautionary statements.

Any forward-looking statements contained in this press release represent Ainos’ views only as of today and should not be relied

upon as representing its views as of any subsequent date. Ainos undertakes no obligation to, and expressly disclaims any such obligation

to, publicly update or revise any forward-looking statement to reflect changed assumptions, the occurrence of anticipated or unanticipated

events or changes to the future results over time or otherwise, except as required by law.

Contact

Information

Feifei

Shen

ir@ainos.com

To

view the source version of this press release, please visit https://www.newsfilecorp.com/release/231739

v3.24.3

Cover

|

Nov. 27, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 27, 2024

|

| Entity File Number |

001-41461

|

| Entity Registrant Name |

AINOS,

INC.

|

| Entity Central Index Key |

0001014763

|

| Entity Tax Identification Number |

75-1974352

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Address, Address Line One |

8880

Rio San Diego Drive

|

| Entity Address, Address Line Two |

Ste.

800

|

| Entity Address, City or Town |

San

Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92108

|

| City Area Code |

(858)

|

| Local Phone Number |

869-2986

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.01 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

AIMD

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Common Stock |

|

| Title of 12(b) Security |

Warrants

to purchase Common Stock

|

| Trading Symbol |

AIMDW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AIMD_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AIMD_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

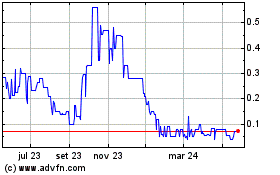

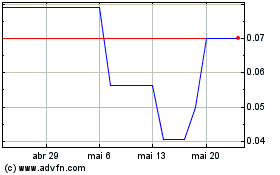

Ainos (NASDAQ:AIMDW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Ainos (NASDAQ:AIMDW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025