As

filed with the Securities and Exchange Commission on December 20, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

AINOS,

INC.

(Exact

name of registrant as specified in its charter)

| Texas |

|

75-1974352 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

Number) |

8880

Rio San Diego Drive, Ste. 800

San

Diego, CA 92108

(858)

869-2986

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT

Corporation System

1999

Bryan St., Suite 900

Dallas,

TX 75201-3136

(214)

979-1172

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Joseph

M. Lucosky, Esq.

Steven

A. Lipstein, Esq.

Lucosky

Brookman LLP

101

Wood Avenue South, 5th Floor

Woodbridge,

NJ 08830

(732)

395-4400

APPROXIMATE

DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

registration statement contains a resale prospectus to be used for the resale by the selling stockholders, pursuant to General Instruction

I.B.3 to Form S-3, of up to 6,737,731 shares of our Common Stock held by such selling stockholders.

We

intend for the offering and sale of shares pursuant to this prospectus to be a secondary offering of our shares in accordance with General

Instruction I.B.3 of Form S-3, which allows outstanding securities to be offered for the account of any person other than the registrant.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek

an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated December 20, 2024

PROSPECTUS

AINOS,

INC.

6,737,731

Shares of Common Stock

This

prospectus relates to the resale, from time to time, of up to 6,737,731 shares (the “Shares”) of our Common Stock, par value

$0.01 per share (“Common Stock”) by the selling stockholders identified in this prospectus under “Selling Stockholders”

(the “Offering”), consisting of (1) 5,500,000 Shares issued to Taiwan Carbon Nano Technology Corporation (“TCNT”)

pursuant to a patent license agreement, dated August 6, 2024, by and between the Company and TCNT (the “TCNT Shares”), (2)

247,500 restricted stock units (“RSUs”) granted to directors, officers, and employees of the Company as special stock awards

on November 22, 2024 and vested on November 26 2024 (the “2024 Special Stock Awards Shares”), (3) 500,000 Shares issuable

upon exercise of the warrants issued to ASE Test, Inc. pursuant to the Warrant Purchase Agreement, dated May 3, 2024 (the “AST

Test Warrant Shares”), (4) 12,231 Shares issued to Ting-Chuan Lee, a director of the Company, pursuant to a purchase and sale agreement

relating to the Company’s acquisition of a vehicle with a purchase price of $48,559, dated April 26, 2023 (the “Purchase

and Sale Agreement Shares”), and (5) 478,000 RSUs granted to directors, officers, and employees of the Company as special stock

awards on October 11, 2023 and vested on November 24, 2023 (the “2023 Special Stock Awards Shares”).

We

are not selling any shares of our Common Stock under this prospectus and will not receive any proceeds from the sale of the Shares. The

Selling Stockholders will bear all commissions and discounts, if any, attributable to the sale of the Shares. We will bear all costs,

expenses, and fees in connection with the registration of the Shares.

No

securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of

the offering of such securities.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 12 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED

IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

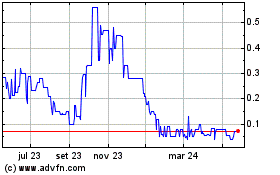

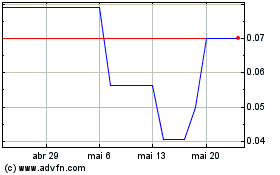

Our

Common Stock and public warrants are listed on the Nasdaq Capital Market under the symbols “AIMD” and “AIMDW,”

respectively. On December 19, 2024, the last reported sale price of our Common Stock on the Nasdaq Capital Market was $0.4401

per share.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is December [__], 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”).

You should read this prospectus and the information and documents incorporated by reference carefully. Such documents contain important

information you should consider when making your investment decision. See “Where You Can Find More Information” and

“Incorporation of Certain Information by Reference” in this prospectus.

This

prospectus may be supplemented from time to time to add, update, or change information in this prospectus. Any statement contained in

this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained

in a prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this

prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You may only

rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with

different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other

than the securities offered by this prospectus. This prospectus and any future prospectus supplement do not constitute an offer to sell

or a solicitation of an offer to buy any securities in any circumstances in which such offer or solicitation is unlawful. Neither the

delivery of this prospectus or any prospectus supplement nor any sale made hereunder shall, under any circumstances, create any implication

that there has been no change in our affairs since the date of this prospectus or such prospectus supplement or that the information

contained by reference to this prospectus or any prospectus supplement is correct as of any time after its date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You

Can Find More Information.”

The

Selling Stockholders are offering the Shares only in jurisdictions where such offer is permitted. The distribution of this prospectus

and the sale of the Shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the distribution of this prospectus and the

sale of the Shares outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, the Shares by any person in any jurisdiction in which it is unlawful for such person to make

such an offer or solicitation. If there is any inconsistency between the information in this prospectus and the applicable prospectus

supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus

and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can

Find More Information; Incorporation by Reference.”

We

have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this

prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as

of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations,

and prospects may have changed since those dates.

When

we refer to “Ainos,” “we,” “our,” “us,” and the “Company” in this prospectus,

we mean Ainos, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of

securities.

SPECIAL

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain or may contain forward-looking statements that involve risks and

uncertainties. These forward-looking statements contain information about our expectations, beliefs, or intentions regarding future events,

our future financial performance, business strategy and plans and objectives of management for future operations, including business,

financial condition, results of operations, strategies or prospects, and other similar matters. These forward-looking statements are

based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties,

risks, and changes in circumstances that are difficult to predict. These statements may be identified by words such as “expects,”

“plans,” “projects,” “will,” “may,” “anticipates,” “believes,”

“should,” “intends,” “estimates,” and other words of similar meaning.

These

statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance, or achievements to be materially different from any future results,

performance, or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ

materially from current expectations include, among other things, those listed under the section titled “Risk Factors” and

elsewhere in this prospectus, in any related prospectus supplement and in any related free writing prospectus.

Any

forward-looking statement in this prospectus, in any related prospectus supplement, and in any related free writing prospectus reflects

our current view with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to our

business, results of operations, industry, and future growth. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus, any related

prospectus supplement, and any related free writing prospectus and the documents that we reference herein and therein and have filed

as exhibits hereto and thereto completely and with the understanding that our actual future results may be materially different from

any future results expressed or implied by these forward-looking statements. Except as required by law, we assume no obligation to update

or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This

prospectus, any related prospectus supplement, and any related free writing prospectus also contain or may contain estimates, projections,

and other information concerning our industry, our business, and the markets for our products, including data regarding the estimated

size of those markets and their projected growth rates. Information that is based on estimates, forecasts, projections, or similar methodologies

is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected

in this information. Unless otherwise expressly stated, we obtained these industry, business, market and other data from reports, research

surveys, studies, and similar data prepared by third parties, industry and general publications, government data, and similar sources.

In some cases, we do not expressly refer to the sources from which these data are derived.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this Offering and information appearing elsewhere in this prospectus and in the documents,

we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before

investing in our securities. To fully understand this Offering and its consequences to you, you should read this entire prospectus carefully,

including the information referred to under the heading “Risk Factors” in this prospectus beginning on page 12, the financial

statements, and other information incorporated by reference in this prospectus when making an investment decision. This is only a summary

and may not contain all the information that is important to you. You should carefully read this prospectus, including the information

incorporated by reference therein, and any other offering materials, together with the additional information described under the heading

“Where You Can Find More Information.”

THE

COMPANY

Overview

Ainos,

Inc. (the “Company”), incorporated in the State of Texas in 1984, is a diversified healthcare company focused on the development

of novel point-of-care testing (the “POCT”), therapeutics based on very low-dose interferon alpha (the “VELDONA”),

and synthetic RNA-driven preventative medicine. Our product pipeline includes commercial-stage VELDONA Pet cytoprotein supplements, clinical-stage

VELDONA human therapeutics and telehealth-friendly POCTs powered by the AI Nose technology platform.

We

have historically been involved in the research and development of therapeutics based on VELDONA. Building on our research and development

on VELDONA since inception, we are focused on commercializing a suite of VELDONA-based product candidates.

In

2021 and 2022, we acquired certain types of intellectual property from controlling shareholder, Ainos Inc., a Cayman Island corporation

(“Ainos KY”), to expand our product portfolio into POCTs aimed to provide connected, rapid, and convenient testing for a

broad range of health conditions. Pivoting from the sales of COVID-19 POCT, we aim to commercialize POCTs that detect volatile organic

compounds (the “VOC”) emitted by the body, powered by our AI Nose technology platform. Our lead VOC POCT candidate, Ainos

Flora, aims to test female vaginal health and certain common sexually transmitted infections (the “STIs”) quickly and easily.

We

believe the following attributes differentiate us from other diversified life science companies:

| |

- |

Intuitive,

telehealth-friendly point-of-care testing; |

| |

|

|

| |

- |

AI-powered

VOC testing platform; |

| |

|

|

| |

- |

decades

of proprietary low-dose oral interferon clinical research; |

| |

|

|

| |

- |

capital-efficient

business model; |

| |

|

|

| |

- |

outsourced

manufacturing; and |

| |

|

|

| |

- |

global

distribution relationships. |

Recent

Development

On

March 15, 2024, the Board of Directors appointed Christopher Hsin-Liang Lee as the Chief Financial Officer of the Company. Christopher

Lee, aged 53, brings over 25 years of experience in accounting and finance, encompassing US GAAP, PCAOB standards, and SEC rules and

regulations. Before joining the Company, Mr. Lee served as CFO of a Nasdaq-listed company for 10 years, was a partner at KEDP CPA Group

from August 2009 to June 2011, and operated as a self-employed accountant from July 2011 to August 2014. He has served on the Board of

Directors of Aixin Life International Inc. since February 2021. Mr. Lee holds a BS degree in accounting from Ohio State University and

an MS degree in business taxation from Golden Gate University. He is licensed as a Certified Public Accountant (CPA) in the United States.

On

January 9, 2024, the Company and Taiwan Carbon Nano Technology Corporation (“TCNT”) entered into an addendum to its five-year

Product Development Agreement (the “Addendum Agreement”) to modify the scope of co-development covered by the Product Development

Agreement and certain other terms. For products defined in the Addendum Agreement, TCNT will provide facilities, equipment, mass production

process technology, ISO9001 and ISO13485 related management, as well as mass production support. The procurement of parts and raw materials,

rental fees, and utility expenses are excluded. The Company will pay a total fee of NT$5 million (approximately USD$161,000) for five-years

of development commencing from 2024.

For

six months commencing from January 2024, TCNT will provide non-exclusive use of certain patents related to VOC and POCT technologies

for a monthly fee of US$95,000 (plus 5% sales tax), with negotiable payment terms. The parties can discuss subsequent use of the patents

at later dates.

On

May 3, 2024, the Company entered into a Convertible Note and Warrant Purchase Agreement with ASE Test, Inc., Taiwanese company (“ASE

Test”), pursuant to which the Company issued to ASE Test a convertible note in the aggregate principal amount of US$9,000,000.

The note bears six percent compound interest and has a three-year term through May 3, 2027. The note is convertible at ASE Test’s

election into shares of the Company’s common stock at a conversion price of US$4.50 per share, subject to customary anti-dilution

adjustments as set forth in the note. As part of the transaction, ASE Test received a five-year common stock purchase warrant which vests

and becomes exercisable on the first day following a six-month period from the date of issuance. The warrant may be exercised for up

to 500,000 shares of common stock at a price of US$4.50 per share. Closing of the placement is subject to customary closing conditions.

As

part of the Addendum Agreement entered on July 8, 2024, TCNT provided non-exclusive use of certain patents related to VOC and POCT technologies

for a monthly fee of $95,000 (plus 5% indirect tax), with negotiable payment terms for extend another three months from July 2024 to

September 2024.

On

August 6, 2024, the Company entered into a patent license agreement (the “License Agreement”) with TCNT, as an effort to

bolster the Company’s AI Nose and point-of-care testing (POCT) technologies while preserving cash. As of August 5, 2024, prior

to TCNT entering into the License Agreement, TCNT controlled, via its majority interest in Ainos Inc., a Cayman Islands corporation (“Ainos

KY”) which is a party to certain previously disclosed Voting Agreements, approximately 38% of the voting power of the Company.

Pursuant to the License Agreement, TCNT has agreed to assign and grant, and the Company has agreed to accept, an exclusive, irrevocable,

and perpetual license of certain invention patents and patent applications related to gas sensors and medical devices (the “Licensed

Patents”), in exchange for 5,500,000 shares of the Company’s common stock (the “Common Stock”), at a price per

share of 1.05 times the highest closing sale price of the Common Stock during the 30-trading day period preceding the effective date

of the License Agreement. The License Agreement shall remain in effect until terminated by mutual written agreement of the parties, or

until the expiration of the Licensed Patents, or all claims for alleged infringement of the Licensed Patents are barred by applicable

laws.

On

August 16, 2024, the Company paid off the note payable was issued to i2China Management Group, LLC (“i2China”) in exchange

for consulting services in 2020 (the “i2China Note”) remain outstanding amount of $42,000 with accrued interest.

On

September 17, 2024, the Company announced that it plans to initiate a clinical study in Taiwan for VELDONA as potential treatment of

oral warts in HIV-Seropositive patients.

On

September 23, 2024, the Company announced that it plans to initiate a Taiwan clinical study of VELDONA for treating Sjögren’s

Syndrome.

On

October 7, 2024, the company has repaid the remaining note payable principal amount of $270,000 with accrued interest to Ainos KY, the

controlling shareholder of the Company.

As

part of the Addendum Agreement entered into on October 16, 2024 the Company entered an Addendum Agreement with TCNT. TCNT will provide

exclusive use of certain patents related to VOC, POCT and nitrogen-oxygen separation machine technologies for a monthly fee of $50,000

(plus 5% indirect tax) for twelve months from October 16, 2024, with negotiable payment terms.

On

December 02, 2024, the Company announced that it has signed a Memorandum of Understanding (“MOU”) with Taiwan Tanabe Seiyaku

Co., Ltd. (“Taiwan Tanabe”), a corporation majority-owned by Mitsubishi Tanabe Pharma Corporation. The MOU outlines a collaboration

on the manufacturing and promotion of the Company’s Sjögren’s syndrome drug.

Our

Technologies

VELDONA

Interferons

are proteins made by host cells in response to the presence of pathogens. Interferons allow for communication between cells to trigger

the protective defenses of the immune system. VELDONA formulation, delivered into the oral cavity as a lozenge in low doses, is designed

to enhance autoimmunity to resist virus damages, potentially reducing side effects and risks caused by high-dose interferon and other

small molecule drugs.

We

believe VELDONA has shown to be safe and effective in the clinical studies for treatment of intended human and animal diseases. Since

our inception to date, 68 human clinical trials have been conducted with low-dose oral IFNα. 63 studies were Phase 2 trials, and

3 Phase 1 and 2 Phase 3 studies have also been conducted.

In

28 studies performed by Ainos, VELDONA was found to exhibit systemic effects in mice, cats, dogs, ferrets, chickens, rats, guinea pigs,

horses, calves/cows, and particularly pigs. VELDONA aided in boosting feed conversion efficiency and fighting deadly viral infections

in these species, including canine parvovirus, equine herpesvirus, feline coronavirus, and others. We believe the studies demonstrate

VELDONA’s therapeutic or preventive effect via the oral mucosa and shows VELDONA modulates systemic and mucosal immunity without

serious side effects.

We

have researched VELDONA for a broad range of human disease indications. We intend to prioritize advancing the following candidates: oral

warts for HIV-seropositive patients, Sjogren’s Syndrome, mid COVID-19 syndromes, common cold, influenza, aphthous stomatitis, and

chemotherapy-induced stomatitis. The United States Food and Drug Administration (the “U.S. FDA”) has granted Orphan Drug

Designation (“ODD”) for our VELDONA formulation as a potential treatment for oral warts in HIV-seropositive patients.

Leveraging

our VELDONA technology, we have launched a series of health supplements for dogs and cats under the brand name “VELDONA Pet”

in Taiwan since the second quarter of 2023 and we intend to explore international sales and marketing opportunities. Our VELDONA Pet

product line is formulated to address a variety of health issues, including skin, gum, emotion, discomfort caused by allergies, eye,

and weight-related issues. We also intend to conduct clinical studies in Taiwan for the treatment of feline chronic gingivostomatitis

(FCGS).

Point-of-Care

Tests (POCTs)

Our

POCT technologies aim to provide a simple, effective and telehealth-friendly tests that can deliver results within minutes. Our POCT

detection technologies consists of VOC sensing, lateral flow immunochromatographic assay and nucleic acid. Currently we prioritize developing

products based on VOC sensing. We intend to evaluate our lateral flow and nucleic acid test technologies for potential applications for

other disease indication.

VOC

Sensing Powered by AI Nose

We

believe the analysis of VOC is a powerful, non-invasive option for disease detection and health monitoring. Our VOC sensing technology

aims to detect the target VOCs within few minutes. AI Nose, the key enabler of our VOC sensing, consists of three key technologies: 1)

a “digital nose” detects the target VOCs; 2) a trained artificial intelligence (“AI”) algorithm analyzes the

target VOCs; 3) a “Smell ID” stores the VOC’s digital profile in the cloud.

We

believe VOC sensing powered by AI Nose is scalable into a broad range of industries for two reasons. First, digital nose sensors can

be made small and at low cost through semiconductor manufacturing technology. Second, as we train our AI with more Smell IDs, our VOC

sensing can continue to improve. While health testing is our near-term focus, we believe we can broaden VOC sensing powered by AI Nose

to other applications including telehealth, automotive, industrial, and environmental safety.

Our

Pipeline

An

integral part of our operating strategy is to create multiple revenue streams through sales of commercially ready products, out-licensing

or forming strategic relationships to develop and commercialize our products. As of March 31, 2024, we have commercialized the following

products:

●

COVID-19 Antigen Rapid Test Kit. As the first commercialized products we sell, we have marketed COVID-19 antigen rapid test kits in Taiwan

under emergency use authorization (“EUA”) issued by the Taiwan Food and Drug Administration (“TFDA”) to TCNT,

the product manufacturer. We have pivoted away from this business and have ceased selling the product since the first quarter of 2024.

●

VELDONA Pet. VELDONA Pet is formulated to address a variety of health issues in dogs and cats, including skin, gum, emotion, discomfort

caused by allergies, eye, and weight-related issues. We currently sell VELDONA Pet in Taiwan.

From

time to time, we assess our development plan based on available resources and market dynamics. Our current pipeline of the products,

which are under development, includes the following:

●

VELDONA human drugs. Our programs include treatment of oral warts in human immunodeficiency virus (HIV) seropositive patients, Sjögren’s

syndrome common cold, influenza, and treatment for mild COVID-19 symptoms. Except for COVID-19, we have conducted Phase 2 studies for

these programs. The United States Food and Drug Administration (the “U.S. FDA”) have granted orphan drug designation for

our VELDONA formulation as a potential treatment for oral warts in HIV-seropositive patients.

●

VOC POCT - Ainos Flora. Ainos Flora, powered by AI Nose, is intended to perform a non-invasive test for female vaginal health and certain

common STIs within a few minutes. A companion app is also being developed that enables users to conveniently manage test results. We

believe Ainos Flora can provide connected, convenient, discreet, rapid testing in a point-of-care setting. We are conducting a clinical

study in Taiwan and exploring strategic opportunities to commercialize the product.

●

VOC platform - NISD co-development. We are co-developing a VOC sensing platform with Nisshinbo Micro Devices Inc. (“NISD”)

and Taiwan Inabata Sangyo Co. (“Taiwan Inabata”). The platform under development is intended to be used in applications including

telehealth, automotive, industrial, and environmental safety.

●

VOC POCT - Ainos Pen. The device is intended to be a cloud-connected, multi-purpose, portable breath analyzer that is intended to monitor

health conditions within minutes, powered by AI Nose. We expect consumers to be empowered to share test results with their physicians

through in-person and telehealth medical consultations.

●

VOC POCT - CHS430. The CHS430 device, powered by AI Nose, is intended to provide non-invasive testing for ventilator-associated pneumonia

within a few minutes, as compared to current standard of care invasive culture tests that typically take more than two days to provide

results.

●

Synthetic RNA (“SRNA”). We plan to develop a SRNA technology platform in Taiwan with a long-term goal of developing next-generating

precision treatments and rapid tests.

Our

Business Model

We

believe our business model is capital efficient based on the following:

Operation

in Taiwan. We have constructed our operation to be capital efficient by choosing Taiwan as our R&D and operating center.

We believe Taiwan has been a key center of the global technology supply chain and it is also home to high-caliber engineers, scientists

and healthcare professionals. We believe maintaining operations in Taiwan, at least in the near-term, allows us to access high-caliber

talent while staying cost effective, enabling us to develop high quality, affordable, consumer-friendly products.

Outsourced

Manufacturing. We believe our outsourced manufacturing strategy potentially saves us the time and resources required to establish

our own infrastructure. We outsource manufacturing of our POCT product candidates to Taiwan Carbon Nano Technology (“TCNT”).

We outsource manufacturing of VELDONA drugs for human-use to Swiss Pharmaceutical Co., Ltd., a Taiwan-based company. We outsource manufacturing

of VELDONA Pet supplements to a Taiwan-based third party and to TCNT.

Distribution

Relationships. We work with distributors to sell products. We appointed Inabata & Co. Ltd. (“Inabata”), a Japanese

corporation, as our non-exclusive worldwide distributor and preferred distributor for customers based in Japan. Inabata’s Taiwan

subsidiary (Taiwan Inabata Sangyo Co.) coordinates business logistics and working capital for our designated programs. Topmed International

Biotech Co., Ltd. (“Topmed”), a Taiwanese biotech company, is a distributor of our VELDDONA Pet supplements in Taiwan.

Intellectual

Property

We

own a portfolio of patents covering various aspects of our core technologies. As of November 30, 2024, we had fifty-five (55) patents

issued and fifteen (15) pending patent applications. Forty-eight (48) of the issued patents relate to acquired VOC and POCT technologies,

four (4) relate to interferon technologies and three (3) relate to our smart drug injection technology. Forty-seven (47) of the issued

patents are foreign patents and eight (8) are U.S. patents. Two (2) issued patents are licensed patents. Of the issued patents, thirty-three

(33) are invention patents, fourteen (14) are utility model patents and eight (8) are design patents. Of our issued patents, five (5)

shall expire between 2026 and 2029; twenty-two (22) between 2030 and 2034, twenty-eight (28) between 2035 and 2046.

Pursuant

to the Addendum Agreement with TCNT, for six months commencing from January 2024, TCNT will provide non-exclusive use of certain patents

related to VOC and POCT technologies for a monthly fee of US$95,000 (plus 5% sales tax), with negotiable payment terms. The parties will

discuss subsequent use of the patents at later dates.

As

part of the Addendum Agreement entered into on October 16, 2024 the Company entered an Addendum Agreement with TCNT. TCNT will provide

exclusive use of certain patents related to VOC, POCT and nitrogen-oxygen separation machine technologies for a monthly fee of $50,000

(plus 5% indirect tax) for twelve months from October 16, 2024, with negotiable payment terms.

We

own a registered trademark for VELDONA in Taiwan, Europe, Japan and China, as well as certain trademarks for our VELDONA Pet supplement

in Taiwan. We also have several trademark applications for certain countries outside of Taiwan.

Employees

As

of November 30, 2024, we had 44 full-time employees, of which 23 are in research and development. Majority of our employees are in

Taiwan. None of our employees are represented by a labor union or are a party to a collective bargaining agreement. We plan to continue

expand our manpower in research development, sales and marketing, and general operations to support our business programs.

Additional

Information

Under

our former name, Amarillo Biosciences, Inc., we completed an initial public offering on the Nasdaq SmallCap Market in August 1996 and

have traded on the U.S. over-the-counter market since October 1999. On October 31, 2013, we filed a voluntary petition for reorganization

under Chapter 11 of the United States bankruptcy code. We emerged from bankruptcy on January 23, 2015. We established a Taiwan branch

office in 2017. We renamed as Ainos, Inc in April 2021.

On

August 9, 2022, our common stock and warrants began trading on the Nasdaq Capital Market under the trading symbols “AIMD”

and “AIMDW,” respectively. We effectuated a 1-for-15 reverse stock split of our common stock on August 8, 2022, and a 1-for-5

reverse stock split on December 14, 2023.

Our

annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available

free of charge on the Company’s website at www.ainos.com as soon as reasonably practicable after such material is electronically

filed with, or furnished to, the Securities and Exchange Commission. Information contained on or accessible through our website is not,

and should not be considered, part of, or incorporated by reference into, this prospectus.

Government

Regulation

Regulation

of Medical Devices in Taiwan

Our

product candidates and operations are subject to the Taiwan Medical Devices Act and its implementation regulations (collectively the

“Taiwan MDA”), which govern the development, design, pre-clinical and clinical research, manufacturing, safety, efficacy,

labeling, packaging, storage, installation, servicing, recordkeeping, premarket clearance or approval, import, export, adverse event

reporting, advertising, promotion, marketing and distribution of medical devices. Under the Taiwan MDA, medical devices, depending on

the degree of risk associated with each medical device and the extent of manufacturer and regulatory control needed to provide reasonable

assurance of its safety and effectiveness, will be subject to differentiated level of review and examination of TFDA before marketing

the device. Unless an exemption applies, each medical device requires either (a) an approval granted by TFDA or (b) a registration with

TFDA before launching distribution or marketing in Taiwan. The latter is a simplified premarket review process applicable to some medical

devices classified as “lower risk level” items listed in the TFDA announcement. Our product candidates are not on the list

of “lower risk level” and the approval of TFDA will be required for us to launch distribution or marketing of such products

in Taiwan.

Personal

Data Protection Laws in Taiwan

Under

the Taiwan Personal Data Protection Act (“PDPA”), each individual or governmental or non-governmental agencies, including

our affiliate in Taiwan, should be subject to certain requirements and restrictions for collecting, processing or using personal data.

The definition of “personal data” is extended to cover a broad scope, including name, birthday, ID, special features, fingerprints,

marriage status, family, education, occupation, medical records, medical history, genetic information, sex life, health examination report,

criminal records, contact information, financial status, social activities, and any other data which is sufficient to directly or indirectly

identify a specific person. Due to the nature of the use of medical devices, our operation and the operation of our partners might collect,

process, or use the data pertaining to a person’s medical records and healthcare, genetics (collectively, sensitive data), which

is subject to stricter scrutiny. Generally, we can only obtain such sensitive data when the person consents in writing or electronically.

Furthermore, in January 2022, the TFDA published the Regulations for the Security and the Maintenance of Personal Information Files in

Wholesaling and Retailing Medical Devices authorized under the PDPA, which requires the medical devices wholesalers and retailers to

adopt necessary data security/protection measures, and establish prevention and reporting mechanisms in relation to any data breach.

The bill also empowers the TFDA to conduct regular inspections and audits. If we fail to comply with the PDPA, we may be subject to punishment

for civil claims, criminal offenses and administrative liabilities; the defendant may be subject to an imprisonment; and the penalty

for administrative liabilities, and may be imposed consecutively if such violation continues.

Regulation

of Veterinary Drugs in Taiwan

Our

veterinary product candidates are subject laws and regulations in Taiwan including, but not limited to, the Veterinary Drugs Control

Act, Enforcement Rules under the Veterinary Control Act, Guidelines of Good Manufacture Practice for Veterinary Drug Manufacturers, and

Taiwan Regulations for Pet Foods and Supplements. The laws and regulations govern, among other things, product design and development,

pre-clinical and clinical testing, quality testing, manufacturing, packaging, labeling, storage, record keeping and reporting, clearance

or approval, marketing, sales and distribution, promotion and advertising, import and export and post-marketing surveillance.

Under

Taiwan law, a “veterinary drug” refers to one of the following substances in the form of bulk chemical compound, formulated

preparation, or over the counter drug: Biologics specifically made for preventing and treating animal diseases based on microbiology,

immunology or molecular biology; Antibiotics specifically made for preventing and treating animal diseases; Diagnostics announced and

designated by the central competent authority for the diagnosis of animal diseases; and drugs that enhance or regulate animal physical

functions specifically for preventing and treating animal diseases.

The

competent authorities with licensing and enforcement authority under the Veterinary Drugs Control Act include the Council of Agriculture

of the central government, the municipal government of a special municipality, or a local city or county.

Regulation

of Medical Devices in the United States

Our

product candidates and operations are subject to extensive and ongoing regulation by the FDA under the Federal Food, Drug, and Cosmetic

Act of 1938 and its implementing regulations, collectively referred to as the FDCA, as well as other federal and state regulatory bodies

in the United States. The laws and regulations govern, among other things, product design and development, pre-clinical and clinical

testing, manufacturing, packaging, labeling, storage, record keeping and reporting, clearance or approval, marketing, distribution, promotion,

import and export and post-marketing surveillance.

The

FDA regulates the development, design, pre-clinical and clinical research, manufacturing, safety, efficacy, labeling, packaging, storage,

installation, servicing, recordkeeping, premarket clearance or approval, import, export, adverse event reporting, advertising, promotion,

marketing and distribution of medical devices in the United States to ensure that medical devices distributed domestically are safe and

effective for their intended uses and otherwise meet the requirements of the FDCA. Failure to comply with applicable requirements may

subject a device and/or its manufacturer to a variety of administrative sanctions, such as FDA refusal to approve pending premarket applications,

issuance of warning letters, mandatory product recalls, import detentions, civil monetary penalties, and/or judicial sanctions, such

as product seizures, injunctions, and criminal prosecution.

U.S.

drug and biological product development

In

the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act (FDCA) and its implementing regulations and

biologics under the FDCA, the Public Health Service Act (PHSA), and their implementing regulations. Both drugs and biologics also are

subject to other federal, state and local statutes and regulations. Failure to comply with applicable U.S. requirements at any time during

the product development process, approval process or following approval may subject us to administrative or judicial sanctions. These

sanctions could include, among other actions, the FDA’s refusal to approve pending applications, license revocation, a clinical

hold, untitled or warning letters, product recalls, market withdrawals, product seizures, total or partial suspension of production or

distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement and civil or criminal penalties.

Our

VELDONA product candidates for human use must be approved by the FDA through a Biologics License Application (BLA) or new drug application

(NDA), or supplemental BLA or supplemental NDA, process before they may be legally marketed in the United States.

Health

Insurance Portability and Accountability Act

We

may be subject to compliance with the federal Health Insurance Portability and Accountability Act of 1996, as amended by the Healthcare

Information Technology for Economic and Clinical Health Act of 2009, or HIPAA, among other things, established federal protection for

the privacy and security of protected health information, or PHI. The HIPAA privacy regulations protect PHI by limiting its use and disclosure,

giving patients the right to access certain information about them, and limiting most disclosures of PHI to the minimum amount necessary

to accomplish an intended purpose. The HIPAA security standards require the adoption of administrative, physical, and technical safeguards

and the adoption of written security policies and procedures.

U.S.

Federal, State and Foreign Fraud and Abuse Laws

The

U.S. federal and state governments have enacted, and actively enforce, a number of laws to address fraud and abuse in federal healthcare

programs. Our business is subject to compliance with these laws.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and

have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. Accordingly, we may provide

less public disclosure than larger public companies, including the inclusion of only two years of audited consolidated financial statements

and only two years of management’s discussion and analysis of financial condition and results of operations disclosure and the

inclusion of reduced disclosure about our executive compensation arrangements. As a smaller reporting company, we are also exempt from

compliance with the auditor attestation requirements pursuant to the Sarbanes-Oxley Act. As a result, the information that we provide

to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based on our common

stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float

or a public float (based on our common stock) that is less than $700 million, annual revenues of $100 million or more during the most

recently completed fiscal year.

Corporate

Information

Our

principal executive offices are located at 8880 Rio San Diego Drive, Ste. 800, San Diego, CA 92108, and our telephone number is (858)

869-2986. We maintain a website at www.ainos.com. Information contained on or accessible through our website is not, and should

not be considered, part of, or incorporated by reference into, this prospectus.

THE

OFFERING

| Issuer |

|

Ainos,

Inc. |

| |

|

|

| Shares

of Common Stock offered by us |

|

None |

| |

|

|

| Shares

of Common Stock offered by the Selling Stockholders |

|

6,737,731

shares, consisting of (1) 5,500,000 TCNT Shares,

(2) 247,500 2024 Special Stock Awards Shares, (3) 500,000 ASE Test Warrant Shares, (4) 12,231 Purchase and Sale Agreement

Shares, and (5) 478,000 2023 Special Stock Awards Shares. (1) |

| |

|

|

| Shares

of Common Stock outstanding before the Offering |

|

14,086,326

shares (1) |

| |

|

|

| Shares

of Common Stock outstanding after completion of this offering, assuming the sale of all shares offered hereby |

|

14,586,326

shares, assuming ASE Test, Inc. exercises the ASE Test Warrant Shares (1) |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the resale of the Common Stock by the Selling Stockholders. |

| |

|

|

| Market

for Common Stock |

|

Our

Common Stock and public warrants are listed on the Nasdaq Capital Market under the symbols “AIMD” and “AIMDW,”

respectively. |

| |

|

|

| Risk

Factors |

|

Investing

in our securities involves a high degree of risk. See the “Risk Factors” section of this prospectus on page 12 and in the documents we incorporate by reference in this prospectus for a discussion of factors you should consider carefully before

deciding to invest in our securities. |

| (1) | The

number of shares of common stock outstanding before and after the Offering is based on 14,086,326

shares outstanding as of December 19, 2024 and excludes the following: |

| |

● | 500,000

shares of ASE Test Warrant Shares; |

| |

● | 1,409,810 shares of common stock issuable upon the exercise

of outstanding warrants at exercise prices ranging from $2.16 to $23.375 per share, 1,201,944

of which, with an exercise price from $2.16 to $ 4.5, are subject to potential anti-dilution

adjustment as a result of this offering; |

| |

● | 13,366 shares of common stock issuable upon exercise of options

(or in the form of warrants) granted under the 2018 Employee Stock Option Plan and 2018 Officers,

Directors, Employees, and Consultants Nonqualified Stock Option Plan; |

| |

● | 54,210 shares of common stock issuable upon the vesting of

restricted stock units under the 2021 Stock Incentive Plan; |

| |

● | 2,831,472 shares of common stock reserved for issuance upon

conversion of convertible notes issued in March and September 2023 and January and May 2024;

and |

| |

● | 1,365,280 shares of common stock reserved for future issuance

under our 2023 Stock Incentive Plan; and |

| |

● | 1,073,966 shares of reserved for ATM. |

RISK

FACTORS

Investment

in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider

the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form

10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by

reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information

contained in the applicable prospectus supplement before acquiring any of such securities. The occurrence of any of these risks might

cause you to lose all or part of your investment in the offered securities.

USE

OF PROCEEDS

We

are not selling any securities in this prospectus. All proceeds from the resale of the shares of our Common Stock offered by this prospectus

will belong to the Selling Stockholders. We will not receive any proceeds from the resale of the shares of our Common Stock by the Selling

Stockholders.

SELLING

STOCKHOLDERS

We

are registering the shares of our Common Stock in order to permit the Selling Stockholder to offer the Shares for resale from time to

time. Except as otherwise described in the footnotes to the table below and for the ownership of the registered shares issued to the

Selling Stockholders, neither the Selling Stockholder nor any of the persons that control them has had any material relationships with

us or our affiliates within the past three (3) years.

The

table below lists the Selling Stockholder and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (and the rules and regulations thereunder) of the

Shares of our Common Stock by the Selling Stockholder.

The

second column lists the number of shares of our Common Stock beneficially owned by each Selling Stockholder before this Offering (including

shares which the Selling Stockholder has the right to acquire within 60 days, including upon conversion of any convertible securities).

The

third column lists the Shares of our Common Stock being offered by this prospectus by each Selling Stockholder.

The

fourth and fifth columns list the number of shares of Common Stock beneficially owned by each Selling Stockholder and their percentage

ownership after the Offering (including shares which the Selling Stockholder has the right to acquire within 60 days, including upon

conversion of any convertible securities), assuming the sale of all of the Shares offered by each Selling Stockholder pursuant to this

prospectus.

Under

the terms of the Warrant Agreement, a Selling Stockholder may not exercise the Warrants to the extent such conversion or exercise would

cause such Selling Stockholder, together with any other person with which the Selling Stockholder is considered to be part of a group

under Section 13 of the Exchange Act or with which the Selling Stockholder otherwise files reports under Section 13 and/or 16 of the

Exchange Act, to beneficially own a number of shares of Common Stock which exceeds 9.99% of the Equity Interests of a class that is registered

under the Exchange Act that is outstanding at such time. The number of shares in the third column does not reflect this limitation.

The

amounts and information set forth below are based upon information provided to us by the Selling Stockholder as of December 19,

2024, except as otherwise noted below. The Selling Stockholder may sell all or some of the shares of Common Stock it is offering, and

may sell, unless indicated otherwise in the footnotes below, shares of our Common Stock otherwise than pursuant to this prospectus. The

tables below assume the Selling Stockholder sell all of the shares offered by them in offerings pursuant to this prospectus, and do not

acquire any additional shares. We are unable to determine the exact number of shares that will actually be sold or when or if these sales

will occur.

| Selling Stockholder | |

Number of Shares Owned Before Offering | | |

Shares Offered Hereby | | |

Number of Shares Owned After Offering | | |

Percentage of Shares Beneficially Owned After Offering | |

| Taiwan Carbon Nano Technology Corporation (1) | |

| - | | |

| 5,500,000 | | |

| 5,500,000 | | |

| 26.73 | % |

| Chun-Hsien Tsai (2) | |

| 146,830 | | |

| 180,000 | | |

| 326,830 | | |

| 1.59 | % |

| Ting-Chuan Lee (3) | |

| 72,711 | | |

| 66,231 | | |

| 138,942 | | |

| * | % |

| Chun-Jung Tsai (4) | |

| 65,103 | | |

| 54,000 | | |

| 119,103 | | |

| * | % |

| Chung-Yi Tsai (5) | |

| 4,400 | | |

| 50,000 | | |

| 54,400 | | |

| * | % |

| Wen-Han Chang (6) | |

| 4,400 | | |

| 50,000 | | |

| 54,400 | | |

| * | % |

| Yao-Chung Chiang (7) | |

| 4,400 | | |

| 50,000 | | |

| 54,400 | | |

| * | % |

| Pao-Sheng Wei (8) | |

| 4,400 | | |

| 50,000 | | |

| 54,400 | | |

| * | % |

| Lawrence K. Lin (9) | |

| 9,620 | | |

| 6,000 | | |

| 15,620 | | |

| * | % |

| ASE Test, Inc. (10) | |

| 29,411 | | |

| 500,000 | | |

| 529,411 | | |

| 2.57 | % |

| Christopher Hsin-Liang Lee (11) | |

| 3,357 | | |

| 4,000 | | |

| 7,357 | | |

| * | % |

| Employees (12) | |

| 290,289 | | |

| 227,500 | | |

| 517,789 | | |

| 2.52 | % |

| Total | |

| | | |

| 6,737,731 | | |

| | | |

| - | |

| * |

Less

than 1%. |

| (1) |

Based

upon information provided by Taiwan Carbon Nano Technology Corporation. The address of Taiwan Carbon Nano Technology Corporation

is 10F-2, No. 66, Shengyi 5th Rd., Zhubei City, Hsinchu County 302 , Taiwan (R.O.C.). |

| (2) |

Chun-Hsien

Tsai has served as our Chairman, President, and Chief Executive Officer since April 2021. From April 2021 to August 2021, he also

served as Chief Financial Officer. He has served as the chairman and CEO of Taiwan Carbon Nano Technology Corporation (TCNT) since

July 2018, as a director of Ainos Inc. (Cayman Islands) since October 2017, as director and CEO of AI Nose Corporation since 2016,

and as a director of TCNT since 2012. |

| (3) |

Ting-Chuan

Lee has served as a Director of the Company since April 2021. She is also a manager at the CEO office. She has served as the chairperson

of AI Nose Corporation since March 2016, and as a member of the board of director of Taiwan Carbon Nano Technology Corporation (TCNT)

since July 2012. |

| (4) |

Chun-Jung

Tsai has served as a Director of the Company since April 2021. He is also a manager of the Company’s sales team. He has served

as a director of Ainos Inc. (Cayman Islands) since 2019, a director of AI Nose Corporation since March 2016, and a director of Taiwan

Carbon Nano Technology Corporation (TCNT) since July 2012. |

| (5) |

Chung-Yi

Tsai has served as a Director of the Company since April 2021 and as a director of TCNT since July 2012. |

| (6) |

Wen-Han

Chang has served as a Director of the Company since April 2021 and has served as the Chairperson of our Compensation Committee and

a member of our Audit Committee since August 2021. |

| (7) |

Yao-Chung

Chiang has served as a Director of the Company since April 2021 and has served as a member of our Audit Committee since August 2021. |

| (8) |

Pao-Sheng

Wei has served as a Director of the Company, Chairperson of the Audit Committee and as a member of the Compensation Committee since

June 2022. |

| (9) |

Lawrence

K. Lin. Mr. Lin served as Executive Vice President of Operations from August 1, 2021 to August 9, 2024. Mr. Lin currently no longer

serves as an executive officer of the Company. |

| (10) |

Includes 500,000 ASE Test Warrant Shares. ASE

Test, Inc. is a shareholder of our controlling shareholder, Ainos Inc., a Cayman Island corporation. ASE Technology Holding Co.,

Ltd. has control over the selling stockholder and is deemed as the controlling person of the selling stockholder. The address of

ASE Test, Inc. is 10, West 5th Street, Nanzih Dist., Kaohsiung, 811, Taiwan. |

| (11) |

Christopher

Hsin-Liang Lee has served as the Chief Financial Officer of the Company since March 15, 2024. |

| (12) |

The

selling stockholders are employees of the Company who are not officers of the Company. |

LEGAL

MATTERS

Lucosky

Brookman LLP will pass upon certain legal matters relating to the issuance and sale of the securities offered hereby on behalf of Ainos,

Inc.

EXPERTS

The

financial statements of the Company at December 31, 2023 and 2022, and for each of the two years then ended, have been audited by KCCW

Accountancy Corp. (KCCW), an independent registered public accounting firm, as set forth in their report thereon and have been incorporated

by reference herein and in the registration statement.

WHERE

YOU CAN FIND MORE INFORMATION

Available

Information

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities being offered by

this prospectus. This prospectus, which constitutes part of the registration statement, does not contain all of the information in the

registration statement and its exhibits. For further information with respect to us and our securities offered by this prospectus, we

refer you to the registration statement and its exhibits. Statements contained in this prospectus as to the contents of any contract

or any other document referred to are not necessarily complete, and in each instance, we refer you to the copy of the contract or other

document filed as an exhibit to the registration statement. Each of these statements is qualified in all respects by this reference.

You can read our SEC filings, including the registration statement, over the internet at the SEC’s website at www.sec.gov.

We

are subject to the information reporting requirements of the Exchange Act, and we file reports, proxy statements and other information

with the SEC. These reports, proxy statements and other information will be available for review at the SEC’s website at www.sec.gov.

Incorporation

by Reference

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We

incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or

15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between

the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however,

incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not

deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits

furnished pursuant to Item 9.01 of Form 8-K.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC:

●

Our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 8, 2024;

●

Our Quarterly Reports on Form 10-Q for the period ended March 31, 2024, June 30, 2024, and September 30, 2024, filed with the SEC on

May 13, 2024, August 5, 2024, and November 6, 2024, respectively; and

●

Our Current Reports on Form 8-K filed with the SEC on January 2, 2024, January 12, 2024, January 25, 2024, March 15, 2024, March 19, 2024, May 6, 2024, June 20, 2024, July 12, 2024, July 19, 2024, October 1, 2024, October 22, 2024, and December 4, 2024.

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination

of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior

to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will

also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports

and documents.

You

may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically

incorporated by reference in the documents) by writing or telephoning us at the following address:

Ainos,

Inc.

Attn:

Chief Financial Officer

8880

Rio San Diego Drive, Ste. 800

San

Diego, CA 92108

(858)

869-2986

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and

any accompanying prospectus supplement.

The

incorporated reports and other documents may also be accessed on website at www.ainos.com. The information on our website, however, is

not, and should not be deemed to be, a part of this prospectus.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following is an estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities

being registered hereby.

| SEC registration fee | |

$ | 465 | |

| Legal fees and expenses* | |

$ | 15,000 | |

| Accounting fees and expenses* | |

$ | 1,500 | |

| Miscellaneous | |

$ | | |

| Total* | |

$ | 16,965 | |

*These

fees are estimates.

Item

15. Indemnification of Directors and Officers.

Section

8.101 of the Texas Business Organizations Code allows a Texas corporation to indemnify a person who was, is, or is threatened to be made

a defendant or respondent in a proceeding because the person is or was a director or officer if it is determined that the person (1)

acted in good faith, (2) reasonably believed that his conduct in his official capacity as director was in the best interest of the corporation

and in all other cases was at least not opposed to the corporation’s best interest, and (3) in the case of any criminal proceeding,

had no reasonable cause to believe his conduct was unlawful. Indemnification under section 8.101 may be made for judgments, penalties,

fines, settlements, and reasonable expenses actually incurred by the person in connection with the proceeding, subject to limitations

provided therein. Section 8.051(A) requires indemnification of a defendant / respondent director or officer against reasonable expenses

incurred by him in connection with a proceeding in which he has been wholly successful, on the merits or otherwise, in the defense of

the proceeding. Our Bylaws provide for such limitation of liability.

Item

16. Exhibits.

(a)

Exhibits

A

list of exhibits filed with this registration statement on Form S-3 is set forth on the Exhibit Index and is incorporated herein by reference.

Item

17. Undertakings.

The

undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii)To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement.

(2)

That for the purpose of determining any liability under the Securities Act of 1933 each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule

424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other

than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the

date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is

part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement

or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first

use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such date of first use.

(5)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities:

The

undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold

to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will

be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(ii)Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the

undersigned registrant;

(iii)The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv)Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling

persons of the Registrant pursuant to the provisions described in Item 14 above, or otherwise, the Registrant has been advised that in

the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer, or controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer, or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue.

(7)

The undersigned Registrant hereby undertakes:

(i)

That for purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as

part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant

to Rule 424(b)(1) or (4), or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time

it was declared effective.

(ii)That

for the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and this offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

EXHIBIT

INDEX

*Filed

herewith.

+To

be filed upon amendment.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in the City of Taipei, Taiwan (R.O.C.), on December 20, 2024.

| AINOS,

INC. |

|

| |

|

| By: |

/s/

Chun-Hsien Tsai |

|

| |

Chun-Hsien

Tsai, Chairman of the Board, |

|

| |

President,

and Chief Executive Officer |

|

POWER

OF ATTORNEY

Each

person whose signature appears below hereby constitutes and appoints Chun-Hsien Tsai his true and lawful attorney-in-fact and agent with

full power of substitution and re-substitution, for him and in his name, place, and stead, in any and all capacities, to sign any and

all amendments (including post-effective amendments) and additions to this registration statement, and to file the same, with all exhibits

thereto, and other documents in connection therewith, with the Securities and Exchange Commission, and hereby grants to such attorney-in-fact

and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all

intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or

his substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the

capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Chun-Hsien Tsai |

|

Chairman

of the Board, President and Chief Executive Officer |

|

December 20, 2024 |

| Chun-Hsien

Tsai |

|

|

|

|

| |

|

|

|

|

| /s/