False000139305200013930522024-12-052024-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________________________________________

FORM 8-K

_____________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2024

_____________________________________________________________________________

Veeva Systems Inc.

(Exact name of registrant as specified in its charter)

_____________________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | 001-36121 | 20-8235463 | |

| (State or other jurisdiction of

incorporation of organization) | (Commission File Number) | (IRS Employer

Identification No.) | |

4280 Hacienda Drive

Pleasanton, California 94588

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (925) 452-6500

Not Applicable

(Former name or former address, if changed since last report)

_____________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Class A Common Stock,

par value $0.00001 per share | | VEEV | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐

|

Item 2.02. Results of Operations and Financial Condition.

On December 5, 2024, Veeva Systems Inc. (“Veeva”) issued a press release announcing its results for its third quarter ended October 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K and the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Veeva Systems Inc. |

| |

| By: | /s/ Brian Van Wagener |

| | Brian Van Wagener |

| | Chief Financial Officer |

| | |

| Dated: | December 5, 2024 | | |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Veeva Announces Fiscal 2025 Third Quarter Results

Total Revenues of $699.2M, up 13% Year Over Year

Subscription Services Revenues of $580.9M, up 17% Year Over Year

PLEASANTON, CA - December 5, 2024 - Veeva Systems Inc. (NYSE: VEEV), a leading provider of industry cloud solutions for the global life sciences industry, today announced results for its third quarter ended October 31, 2024.

“It was a great quarter of innovation and excellent execution across the board,” said CEO Peter Gassner. “Especially significant was the hard work for the long term. We deepened a number of large, highly strategic relationships and are set to deliver the next generation of CRM this month with Vault CRM Suite to connect sales, marketing, and medical – a first for the industry.”

Fiscal 2025 Third Quarter Results:

•Revenues(1): Total revenues for the third quarter were $699.2 million, up from $616.5 million one year ago, an increase of 13% year over year. Subscription services revenues for the third quarter were $580.9 million, up from $494.9 million one year ago, an increase of 17% year over year.

•Operating Income and Non-GAAP Operating Income(1)(2): Third quarter operating income was $181.4 million, compared to $128.5 million one year ago, an increase of 41% year over year. Non-GAAP operating income for the third quarter was $304.0 million, compared to $234.6 million one year ago, an increase of 30% year over year.

•Net Income and Non-GAAP Net Income(1)(2): Third quarter net income was $185.8 million, compared to $135.2 million one year ago, an increase of 37% year over year. Non-GAAP net income for the third quarter was $288.3 million, compared to $218.7 million one year ago, an increase of 32% year over year.

•Net Income per Share and Non-GAAP Net Income per Share(1)(2): For the third quarter, fully diluted net income per share was $1.13, compared to $0.83 one year ago, while non-GAAP fully diluted net income per share was $1.75, compared to $1.34 one year ago.

"We delivered results ahead of guidance on all metrics, reflecting our operational discipline and the durability of our model,” said CFO Brian Van Wagener. “With a clear product strategy, focused execution, and large market opportunity we are well positioned for strong growth and profitability for many years to come.”

Recent Highlights:

•Leading in CRM with Innovation, Execution, and Customer Success Focus – Leadership in CRM continued with a focus on customer success and product excellence. More than 30 customers are now live on Vault CRM and the seven migrations from Veeva CRM to Vault CRM are on track for completion by year end. In November, the fourth top 20 biopharma committed to Vault CRM as its commercial foundation. And as planned, this month the latest release of Vault CRM will include the full functionality of Veeva CRM and additional new capabilities, marking the availability of the next generation of CRM for the industry.

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 1 |

| | |

•New AI Capabilities Coming to Commercial – Veeva announced three new AI innovations planned for availability in late 2025. Coming in Vault CRM is CRM Bot, a GenAI assistant, and Voice Control, a voice interface leveraging Apple Intelligence. The company also announced MLR Bot for Vault PromoMats, which uses a Veeva-hosted large language model to speed review and approval by checking quality and content of promotional materials.

•Long-term Focus on the Major Quality Opportunity – With the addition of more than 25 customers in the quarter, now more than 600 customers have selected at least one of the seven Vault Quality Suite applications available today. This milestone, along with the continued expansion of current customers with additional Quality applications, is the result of Veeva’s long-term view to building clear leadership in large markets through product excellence and customer success.

Financial Outlook:

Veeva is providing guidance for its fiscal fourth quarter ending January 31, 2025 as follows:

•Total revenues between $696 and $699 million.

•Non-GAAP operating income of about $275 million(3).

•Non-GAAP fully diluted net income per share of approximately $1.57(3).

Veeva is providing updated guidance for its fiscal year ending January 31, 2025 as follows:

•Total revenues between $2,722 and $2,725 million.

•Non-GAAP operating income of about $1,120 million(3).

•Non-GAAP fully diluted net income per share of approximately $6.44(3).

Conference Call Information

Prepared remarks and an investor presentation providing additional information and analysis can be found on Veeva's investor relations website at ir.veeva.com. Veeva will host a Q&A conference call at 2:00 p.m. PT today, December 5, 2024, and a replay of the call will be available on Veeva's investor relations website.

| | | | | |

| What: | Veeva Systems Fiscal 2025 Third Quarter Results Conference Call |

| When: | Thursday, December 5, 2024 |

| Time: | 2:00 p.m. PT (5:00 p.m. ET) |

| Online Registration: | https://registrations.events/direct/Q4I86021395 |

| Webcast: | ir.veeva.com |

| |

| |

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 2 |

___________

(1) The customer contracting change that standardized termination for convenience (TFC) rights in our master subscription agreements resulted in a change in the timing of revenue for certain customer contracts and reduced revenues, operating income and non-GAAP operating income, and net income and non-GAAP net income in the third quarter of fiscal 2024.

(2) This press release uses non-GAAP financial metrics that are adjusted for the impact of various GAAP items. See the section titled “Non-GAAP Financial Measures” and the tables entitled “Reconciliation of GAAP to Non-GAAP Financial Measures” below for details.

(3) Veeva is not able, at this time, to provide GAAP targets for operating income and fully diluted net income per share for the fourth fiscal quarter ending January 31, 2025 or the fiscal year ending January 31, 2025 because of the difficulty of estimating certain items excluded from non-GAAP operating income and non-GAAP fully diluted net income per share that cannot be reasonably predicted, such as charges related to stock-based compensation expense. The effect of these excluded items may be significant.

About Veeva Systems

Veeva is the global leader in cloud software for the life sciences industry. Committed to innovation, product excellence, and customer success, Veeva serves more than 1,000 customers, ranging from the world’s largest pharmaceutical companies to emerging biotechs. As a Public Benefit Corporation, Veeva is committed to balancing the interests of all stakeholders, including customers, employees, shareholders and the industries it serves. For more information, visit veeva.com.

Veeva uses its ir.veeva.com website as a means of disclosing material non-public information, announcing upcoming investor conferences, and for complying with its disclosure obligations under Regulation FD. Accordingly, you should monitor our investor relations website in addition to following our press releases, SEC filings, and public conference calls and webcasts.

Forward-looking Statements

This release contains forward-looking statements regarding Veeva’s expected future performance and, in particular, includes quotes from management and guidance, provided as of December 5, 2024, about Veeva’s expected future financial results. Estimating guidance accurately for future periods is difficult. It involves assumptions and internal estimates that may prove to be incorrect and is based on plans that may change. Hence, there is a significant risk that actual results could differ materially from the guidance we have provided in this release and we have no obligation to update such guidance. There are also numerous risks that have the potential to negatively impact our financial performance, including issues related to the performance, availability, security, or privacy of our products, competitive factors, customer decisions and priorities, events that impact the life sciences industry, general macroeconomic and geopolitical events (including inflationary pressures, changes in interest rates, currency exchange fluctuations and impacts related to Russia’s invasion of Ukraine and the Israel-Hamas conflict), and issues that impact our ability to hire, retain and adequately compensate talented employees. We have summarized what we believe are the principal risks to our business in a section titled “Summary of Risk Factors” on pages 36 and 37 in our filing on Form 10-Q for the period ended July 31, 2024 which you can find here. Additional details on the risks and uncertainties that may impact our business can be found in the same filing on Form 10-Q and in our subsequent SEC filings, which you can access at sec.gov. We recommend that you familiarize yourself with these risks and uncertainties before making an investment decision.

###

| | | | | | | | |

Investor Relations Contact: | | Media Contact: |

Gunnar Hansen | | Maria Scurry |

Veeva Systems Inc. | | Veeva Systems Inc. |

267-460-5839 | | 781-366-7617 |

ir@veeva.com | | pr@veeva.com |

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 3 |

VEEVA SYSTEMS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| October 31,

2024 | | January 31,

2024 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,044,511 | | | $ | 703,487 | |

| Short-term investments | 4,018,475 | | | 3,324,269 | |

| Accounts receivable, net | 255,817 | | | 852,172 | |

| Unbilled accounts receivable | 45,472 | | | 36,365 | |

| Prepaid expenses and other current assets | 82,885 | | | 86,918 | |

| Total current assets | 5,447,160 | | | 5,003,211 | |

| Property and equipment, net | 55,695 | | | 58,532 | |

| Deferred costs, net | 22,515 | | | 23,916 | |

| Lease right-of-use assets | 60,325 | | | 45,602 | |

| Goodwill | 439,877 | | | 439,877 | |

| Intangible assets, net | 48,527 | | | 63,017 | |

| Deferred income taxes | 322,652 | | | 233,463 | |

| Other long-term assets | 56,102 | | | 43,302 | |

| Total assets | $ | 6,452,853 | | | $ | 5,910,920 | |

| | | |

Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 31,845 | | | $ | 31,513 | |

| Accrued compensation and benefits | 34,634 | | | 43,433 | |

| Accrued expenses and other current liabilities | 30,906 | | | 32,980 | |

| Income tax payable | 10,803 | | | 11,862 | |

| Deferred revenue | 739,657 | | | 1,049,761 | |

Lease liabilities | 9,156 | | | 9,334 | |

| Total current liabilities | 857,001 | | | 1,178,883 | |

| Deferred income taxes | 475 | | | 2,052 | |

| Lease liabilities, noncurrent | 62,545 | | | 46,441 | |

| Other long-term liabilities | 31,429 | | | 38,720 | |

| Total liabilities | 951,450 | | | 1,266,096 | |

| Stockholders’ equity: | | | |

Common stock | 2 | | | 2 | |

| | | |

| Additional paid-in capital | 2,248,890 | | | 1,915,002 | |

| Accumulated other comprehensive loss | (6,459) | | | (10,637) | |

| Retained earnings | 3,258,970 | | | 2,740,457 | |

| Total stockholders’ equity | 5,501,403 | | | 4,644,824 | |

Total liabilities and stockholders’ equity | $ | 6,452,853 | | | $ | 5,910,920 | |

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 4 |

VEEVA SYSTEMS INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended October 31, | | Nine months ended October 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

Subscription services(4) | $ | 580,850 | | | $ | 494,912 | | | $ | 1,676,082 | | | $ | 1,380,095 | |

Professional services and other(5) | 118,357 | | | 121,593 | | | 349,651 | | | 352,960 | |

| Total revenues | 699,207 | | | 616,505 | | | 2,025,733 | | | 1,733,055 | |

Cost of revenues(6): | | | | | | | |

| Cost of subscription services | 82,638 | | | 74,435 | | | 239,577 | | | 213,179 | |

| Cost of professional services and other | 91,751 | | | 93,247 | | | 279,068 | | | 290,184 | |

| Total cost of revenues | 174,389 | | | 167,682 | | | 518,645 | | | 503,363 | |

| Gross profit | 524,818 | | | 448,823 | | | 1,507,088 | | | 1,229,692 | |

Operating expenses(6): | | | | | | | |

| Research and development | 172,411 | | | 161,278 | | | 511,551 | | | 465,466 | |

| Sales and marketing | 98,695 | | | 96,773 | | | 297,524 | | | 282,269 | |

| General and administrative | 72,359 | | | 62,283 | | | 195,001 | | | 187,887 | |

| Total operating expenses | 343,465 | | | 320,334 | | | 1,004,076 | | | 935,622 | |

| Operating income | 181,353 | | | 128,489 | | | 503,012 | | | 294,070 | |

| Other income, net | 60,937 | | | 42,187 | | | 171,239 | | | 111,260 | |

| Income before income taxes | 242,290 | | | 170,676 | | | 674,251 | | | 405,330 | |

Income tax provision | 56,482 | | | 35,518 | | | 155,738 | | | 27,023 | |

| Net income | $ | 185,808 | | | $ | 135,158 | | | $ | 518,513 | | | $ | 378,307 | |

| Net income per share: | | | | | | | |

| Basic | $ | 1.15 | | | $ | 0.84 | | | $ | 3.21 | | | $ | 2.36 | |

| Diluted | $ | 1.13 | | | $ | 0.83 | | | $ | 3.15 | | | $ | 2.32 | |

Weighted-average shares used to compute net income per share: | | | | | | | |

| Basic | 161,987 | | | 160,768 | | | 161,707 | | | 160,344 | |

| Diluted | 164,979 | | | 163,761 | | | 164,838 | | | 163,129 | |

| Other comprehensive income: | | | | | | | |

| Net change in unrealized (loss) gain on available-for-sale investments | $ | (738) | | | $ | (2,637) | | | $ | 5,576 | | | $ | (6,100) | |

| Net change in cumulative foreign currency translation loss | (146) | | | (518) | | | (1,398) | | | (309) | |

| Comprehensive income | $ | 184,924 | | | $ | 132,003 | | | $ | 522,691 | | | $ | 371,898 | |

| | | | | | | |

(4) Includes subscription services revenues from the following product areas: | | | | | | | |

| Veeva Commercial Solutions | $ | 278,377 | | | $ | 251,167 | | | $ | 811,503 | | | $ | 733,921 | |

| Veeva R&D Solutions | 302,473 | | | 243,745 | | | 864,579 | | | 646,174 | |

| Total subscription services | $ | 580,850 | | | $ | 494,912 | | | $ | 1,676,082 | | | $ | 1,380,095 | |

| | | | | | | |

(5) Includes professional services and other revenues from the following product areas: | | | | | | | |

| Veeva Commercial Solutions | $ | 45,855 | | | $ | 47,899 | | | $ | 139,695 | | | $ | 140,082 | |

| Veeva R&D Solutions | 72,502 | | | 73,694 | | | 209,956 | | | 212,878 | |

| Total professional services and other | $ | 118,357 | | | $ | 121,593 | | | $ | 349,651 | | | $ | 352,960 | |

| | | | | | | |

(6) Includes stock-based compensation as follows: | | | | | | | |

| Cost of revenues: | | | | | | | |

| Cost of subscription services | $ | 1,696 | | | $ | 1,604 | | | $ | 4,892 | | | $ | 4,857 | |

| Cost of professional services and other | 12,929 | | | 12,943 | | | 38,640 | | | 39,881 | |

| Research and development | 48,014 | | | 45,711 | | | 138,741 | | | 129,909 | |

| Sales and marketing | 21,214 | | | 23,460 | | | 67,928 | | | 67,084 | |

| General and administrative | 34,006 | | | 17,508 | | | 71,945 | | | 53,109 | |

| Total stock-based compensation | $ | 117,859 | | | $ | 101,226 | | | $ | 322,146 | | | $ | 294,840 | |

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 5 |

VEEVA SYSTEMS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | Nine months ended October 31, |

| | | | | 2024 | | 2023 |

| Cash flows from operating activities | | | | | | | |

| Net income | | | | | $ | 518,513 | | | $ | 378,307 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | | | | | 29,451 | | | 24,000 | |

| Reduction of operating lease right-of-use assets | | | | | 8,348 | | | 8,885 | |

| Accretion of discount on short-term investments | | | | | (20,442) | | | (19,298) | |

| Stock-based compensation | | | | | 322,146 | | | 294,840 | |

| Amortization of deferred costs | | | | | 11,507 | | | 12,843 | |

| Deferred income taxes | | | | | (91,231) | | | (80,132) | |

| (Gain) loss on foreign currency from mark-to-market derivative | | | | | (880) | | | 841 | |

| Bad debt expense | | | | | 415 | | | 630 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | | | | | 595,940 | | | 446,921 | |

| Unbilled accounts receivable | | | | | (9,107) | | | 37,337 | |

| Deferred costs | | | | | (10,106) | | | (751) | |

| Prepaid expenses and other current and long-term assets | | | | | 1,354 | | | (6,806) | |

| Accounts payable | | | | | 424 | | | (5,502) | |

| Accrued expenses and other current liabilities | | | | | (10,240) | | | (9,572) | |

| Income taxes payable | | | | | (1,059) | | | 1,614 | |

| Deferred revenue | | | | | (321,090) | | | (228,120) | |

| Operating lease liabilities | | | | | (7,131) | | | (4,263) | |

| Other long-term liabilities | | | | | 3,695 | | | 1,796 | |

| Net cash provided by operating activities | | | | | 1,020,507 | | | 853,570 | |

| Cash flows from investing activities | | | | | | | |

| Purchases of short-term investments | | | | | (2,206,521) | | | (2,142,068) | |

| Maturities and sales of short-term investments | | | | | 1,537,874 | | | 1,170,881 | |

| Long-term assets | | | | | (15,799) | | | (18,461) | |

| Net cash used in investing activities | | | | | (684,446) | | | (989,648) | |

| Cash flows from financing activities | | | | | | | |

| Proceeds from exercise of common stock options | | | | | 65,104 | | | 52,184 | |

| Taxes paid related to net share settlement of equity awards | | | | | (59,800) | | | (57,888) | |

| Net cash provided by (used in) financing activities | | | | | 5,304 | | | (5,704) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | | | | | (1,346) | | | (973) | |

| Net change in cash, cash equivalents, and restricted cash | | | | | 340,019 | | | (142,755) | |

| Cash, cash equivalents, and restricted cash at beginning of period | | | | | 706,670 | | | 889,650 | |

| Cash, cash equivalents, and restricted cash at end of period | | | | | $ | 1,046,689 | | | $ | 746,895 | |

| | | | | | | |

| Supplemental disclosures of other cash flow information: | | | | | | | |

| | | | | | | |

| Excess tax benefits from employee stock plans | | | | | $ | 5,160 | | | $ | 68,575 | |

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 6 |

Non-GAAP Financial Measures

In Veeva’s public disclosures, Veeva has provided non-GAAP measures, which it defines as financial information that has not been prepared in accordance with generally accepted accounting principles in the United States, or GAAP. In addition to its GAAP measures, Veeva uses these non-GAAP financial measures internally for budgeting and resource allocation purposes and in analyzing its financial results. For the reasons set forth below, Veeva believes that excluding the following items provides information that is helpful in understanding its operating results, evaluating its future prospects, comparing its financial results across accounting periods, and comparing its financial results to its peers, many of which provide similar non-GAAP financial measures.

•Excess tax benefits. Excess tax benefits from employee stock plans are dependent on previously agreed-upon equity grants to our employees, vesting of those grants, stock price, and exercise behavior of our employees, which can fluctuate from quarter to quarter. Because these fluctuations are not directly related to our business operations, Veeva excludes excess tax benefits for its internal management reporting processes. Veeva management also finds it useful to exclude excess tax benefits when assessing the level of cash provided by operating activities. Given the nature of the excess tax benefits, Veeva believes excluding it allows investors to make meaningful comparisons between our operating cash flows from quarter to quarter and those of other companies.

•Stock-based compensation expenses. Veeva excludes stock-based compensation expenses primarily because they are non-cash expenses that Veeva excludes from its internal management reporting processes. Veeva’s management also finds it useful to exclude these expenses when they assess the appropriate level of various operating expenses and resource allocations when budgeting, planning and forecasting future periods. Moreover, because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use, Veeva believes excluding stock-based compensation expenses allows investors to make meaningful comparisons between our recurring core business operating results and those of other companies.

•Amortization of purchased intangibles. Veeva incurs amortization expense for purchased intangible assets in connection with acquisitions of certain businesses and technologies. Amortization of intangible assets is a non-cash expense and is inconsistent in amount and frequency because it is significantly affected by the timing, size of acquisitions and the inherent subjective nature of purchase price allocations. Because these costs have already been incurred and cannot be recovered, and are non-cash expenses, Veeva excludes these expenses for its internal management reporting processes. Veeva’s management also finds it useful to exclude these charges when assessing the appropriate level of various operating expenses and resource allocations when budgeting, planning and forecasting future periods. Investors should note that the use of intangible assets contributed to Veeva’s revenues earned during the periods presented and will contribute to Veeva’s future period revenues as well.

•Litigation settlement. We exclude costs related to the settlement of certain litigation matters because they are non-recurring and outside the ordinary course of business. Because these costs are unrelated to our day-to-day business operations, we believe excluding them enables more consistent evaluation of our operating results.

•Income tax effects on the difference between GAAP and non-GAAP costs and expenses. The income tax effects that are excluded relate to the imputed tax impact on the difference between GAAP and non-GAAP costs and expenses due to stock-based compensation and purchased intangibles for GAAP and non-GAAP measures.

There are limitations to using non-GAAP financial measures because non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non-GAAP financial measures provided by other companies. The non-GAAP financial measures are limited in value because they exclude certain items that may have a material impact upon our reported financial results. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by Veeva’s management about which items are adjusted to calculate its non-GAAP financial measures. Veeva compensates for these limitations by analyzing current and future results on a GAAP basis as well as a non-GAAP basis and also by providing GAAP measures in its public disclosures.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Veeva encourages its investors and others to review its financial information in its entirety, not to rely on any single financial measure to evaluate its business, and to view its non-GAAP financial

measures in conjunction with the most directly comparable GAAP financial measures. A reconciliation of GAAP to the non-GAAP financial measures has been provided in the tables below.

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 7 |

VEEVA SYSTEMS INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Dollars in thousands)

(Unaudited)

The following tables reconcile the specific items excluded from GAAP metrics in the calculation of non-GAAP metrics for the periods shown below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Cash Provided by Operating Activities (GAAP basis to non-GAAP basis) | Three months ended October 31, | | Nine months ended October 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities on a GAAP basis | $ | 164,117 | | | $ | 82,598 | | | $ | 1,020,507 | | | $ | 853,570 | |

| Excess tax benefits from employee stock plans | (898) | | | (3,275) | | | (5,160) | | | (68,575) | |

| | | | | | | |

| Net cash provided by operating activities on a non-GAAP basis | $ | 163,219 | | | $ | 79,323 | | | $ | 1,015,347 | | | $ | 784,995 | |

| Net cash used in investing activities on a GAAP basis | $ | (298,226) | | | $ | (73,324) | | | $ | (684,446) | | | $ | (989,648) | |

| Net cash provided by (used in) financing activities on a GAAP basis | $ | 12,960 | | | $ | (6,889) | | | $ | 5,304 | | | $ | (5,704) | |

| | | | | | | |

| Reconciliation of Financial Measures (GAAP basis to non-GAAP basis) | Three months ended October 31, | | Nine months ended October 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of subscription services revenues on a GAAP basis | $ | 82,638 | | | $ | 74,435 | | | $ | 239,577 | | | $ | 213,179 | |

| Stock-based compensation expense | (1,696) | | | (1,604) | | | (4,892) | | | (4,857) | |

| Amortization of purchased intangibles | (1,043) | | | (1,126) | | | (3,265) | | | (3,343) | |

| Cost of subscription services revenues on a non-GAAP basis | $ | 79,899 | | | $ | 71,705 | | | $ | 231,420 | | | $ | 204,979 | |

| | | | | | | |

| Gross margin on subscription services revenues on a GAAP basis | 85.8 | % | | 85.0 | % | | 85.7 | % | | 84.6 | % |

| Stock-based compensation expense | 0.3 | | | 0.3 | | | 0.3 | | | 0.3 | |

| Amortization of purchased intangibles | 0.1 | | | 0.2 | | | 0.2 | | | 0.2 | |

| Gross margin on subscription services revenues on a non-GAAP basis | 86.2 | % | | 85.5 | % | | 86.2 | % | | 85.1 | % |

| | | | | | | |

| Cost of professional services and other revenues on a GAAP basis | $ | 91,751 | | | $ | 93,247 | | | $ | 279,068 | | | $ | 290,184 | |

| Stock-based compensation expense | (12,929) | | | (12,943) | | | (38,640) | | | (39,881) | |

| Amortization of purchased intangibles | (139) | | | (139) | | | (412) | | | (411) | |

| Cost of professional services and other revenues on a non-GAAP basis | $ | 78,683 | | | $ | 80,165 | | | $ | 240,016 | | | $ | 249,892 | |

| | | | | | | |

| Gross margin on professional services and other revenues on a GAAP basis | 22.5 | % | | 23.3 | % | | 20.2 | % | | 17.8 | % |

| Stock-based compensation expense | 10.9 | | | 10.6 | | | 11.1 | | | 11.3 | |

| Amortization of purchased intangibles | 0.1 | | | 0.2 | | | 0.1 | | | 0.1 | |

| Gross margin on professional services and other revenues on a non-GAAP basis | 33.5 | % | | 34.1 | % | | 31.4 | % | | 29.2 | % |

| | | | | | | |

| Gross profit on a GAAP basis | $ | 524,818 | | | $ | 448,823 | | | $ | 1,507,088 | | | $ | 1,229,692 | |

| Stock-based compensation expense | 14,625 | | | 14,547 | | | 43,532 | | | 44,738 | |

| Amortization of purchased intangibles | 1,182 | | | 1,265 | | | 3,677 | | | 3,754 | |

| Gross profit on a non-GAAP basis | $ | 540,625 | | | $ | 464,635 | | | $ | 1,554,297 | | | $ | 1,278,184 | |

| | | | | | | |

| Gross margin on total revenues on a GAAP basis | 75.1 | % | | 72.8 | % | | 74.4 | % | | 71.0 | % |

| Stock-based compensation expense | 2.1 | | | 2.4 | | | 2.1 | | | 2.6 | |

| Amortization of purchased intangibles | 0.1 | | | 0.2 | | | 0.2 | | | 0.2 | |

| Gross margin on total revenues on a non-GAAP basis | 77.3 | % | | 75.4 | % | | 76.7 | % | | 73.8 | % |

| | | | | | | |

| Research and development expense on a GAAP basis | $ | 172,411 | | | $ | 161,278 | | | $ | 511,551 | | | $ | 465,466 | |

| Stock-based compensation expense | (48,014) | | | (45,711) | | | (138,741) | | | (129,909) | |

| Amortization of purchased intangibles | (29) | | | (29) | | | (85) | | | (85) | |

| Research and development expense on a non-GAAP basis | $ | 124,368 | | | $ | 115,538 | | | $ | 372,725 | | | $ | 335,472 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 8 |

VEEVA SYSTEMS INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(Dollars in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended October 31, | | Nine months ended October 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Sales and marketing expense on a GAAP basis | $ | 98,695 | | | $ | 96,773 | | | $ | 297,524 | | | $ | 282,269 | |

| Stock-based compensation expense | (21,214) | | | (23,460) | | | (67,928) | | | (67,084) | |

| Amortization of purchased intangibles | (3,544) | | | (3,555) | | | (10,558) | | | (10,550) | |

| Sales and marketing expense on a non-GAAP basis | $ | 73,937 | | | $ | 69,758 | | | $ | 219,038 | | | $ | 204,635 | |

| | | | | | | |

| General and administrative expense on a GAAP basis | $ | 72,359 | | | $ | 62,283 | | | $ | 195,001 | | | $ | 187,887 | |

| Stock-based compensation expense | (34,006) | | | (17,508) | | | (71,945) | | | (53,109) | |

| Amortization of purchased intangibles | (57) | | | (57) | | | (170) | | | (169) | |

Litigation settlement | — | | | — | | | (5,000) | | | — | |

| General and administrative expense on a non-GAAP basis | $ | 38,296 | | | $ | 44,718 | | | $ | 117,886 | | | $ | 134,609 | |

| | | | | | | |

| Operating expense on a GAAP basis | $ | 343,465 | | | $ | 320,334 | | | $ | 1,004,076 | | | $ | 935,622 | |

| Stock-based compensation expense | (103,234) | | | (86,679) | | | (278,614) | | | (250,102) | |

| Amortization of purchased intangibles | (3,630) | | | (3,641) | | | (10,813) | | | (10,804) | |

Litigation settlement | — | | | — | | | (5,000) | | | — | |

| Operating expense on a non-GAAP basis | $ | 236,601 | | | $ | 230,014 | | | $ | 709,649 | | | $ | 674,716 | |

| | | | | | | |

| Operating income on a GAAP basis | $ | 181,353 | | | $ | 128,489 | | | $ | 503,012 | | | $ | 294,070 | |

| Stock-based compensation expense | 117,859 | | | 101,226 | | | 322,146 | | | 294,840 | |

| Amortization of purchased intangibles | 4,812 | | | 4,906 | | | 14,490 | | | 14,558 | |

Litigation settlement | — | | | — | | | 5,000 | | | — | |

| Operating income on a non-GAAP basis | $ | 304,024 | | | $ | 234,621 | | | $ | 844,648 | | | $ | 603,468 | |

| | | | | | | |

| Operating margin on a GAAP basis | 25.9 | % | | 20.8 | % | | 24.8 | % | | 17.0 | % |

| Stock-based compensation expense | 16.9 | | | 16.4 | | | 15.9 | | | 17.0 | |

| Amortization of purchased intangibles | 0.7 | | | 0.9 | | | 0.8 | | | 0.8 | |

Litigation settlement | — | | | — | | | 0.2 | | | — | |

| Operating margin on a non-GAAP basis | 43.5 | % | | 38.1 | % | | 41.7 | % | | 34.8 | % |

| | | | | | | |

| Net income on a GAAP basis | $ | 185,808 | | | $ | 135,158 | | | $ | 518,513 | | | $ | 378,307 | |

| Stock-based compensation expense | 117,859 | | | 101,226 | | | 322,146 | | | 294,840 | |

| Amortization of purchased intangibles | 4,812 | | | 4,906 | | | 14,490 | | | 14,558 | |

Litigation settlement | — | | | — | | | 5,000 | | | — | |

Income tax effect on non-GAAP adjustments(7) | (20,160) | | | (22,612) | | | (57,598) | | | (123,070) | |

| Net income on a non-GAAP basis | $ | 288,319 | | | $ | 218,678 | | | $ | 802,551 | | | $ | 564,635 | |

| | | | | | | |

| Diluted net income per share on a GAAP basis | $ | 1.13 | | | $ | 0.83 | | | $ | 3.15 | | | $ | 2.32 | |

| Stock-based compensation expense | 0.71 | | | 0.62 | | | 1.95 | | | 1.81 | |

| Amortization of purchased intangibles | 0.03 | | | 0.03 | | | 0.09 | | | 0.09 | |

Litigation settlement | — | | | — | | | 0.03 | | | — | |

Income tax effect on non-GAAP adjustments(7) | (0.12) | | | (0.14) | | | (0.35) | | | (0.76) | |

| Diluted net income per share on a non-GAAP basis | $ | 1.75 | | | $ | 1.34 | | | $ | 4.87 | | | $ | 3.46 | |

________________________

(7) For the three and nine months ended October 31, 2024 and 2023, management used an estimated annual effective non-GAAP

tax rate of 21.0%.

| | | | | | | | |

© 2024 Veeva Systems Inc. All rights reserved. Veeva, V, Vault and Crossix are registered trademarks of Veeva Systems Inc. | | 9 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

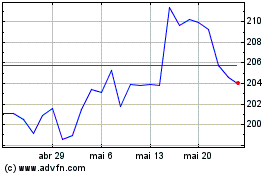

Veeva Systems (NYSE:VEEV)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Veeva Systems (NYSE:VEEV)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024