UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-41579

American Lithium Corp.

(Translation of registrant's name into English)

1030 West Georgia St., Suite 710

Vancouver, BC

Canada V6E 2Y3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 9, 2024 |

American Lithium Corp.

(Registrant)

/s/ Alex Tsakumis

Alex Tsakumis

Interim Chief Executive Officer & Director |

EXHIBIT INDEX

AMERICAN LITHIUM REPORTS RESULTS OF ANNUAL GENERAL AND SPECIAL MEETING

VANCOUVER, BRITISH COLUMBIA, November 27, 2024 - American Lithium Corp. ("American Lithium" or the "Company") (TSX-V:LI | NASDAQ:AMLI | Frankfurt:5LA1) reports the voting results for the Company's Annual and Special Meeting of Shareholders (the "Meeting") held today in Vancouver, British Columbia.

Detailed voting results of the election of the Company's board of directors (the "Board of Directors") are set out below:

|

Nominee

|

Votes For

|

% For

|

Votes Withheld

|

% Withheld

|

|

Andrew Bowering

|

20,678,971

|

57%

|

15,474,981

|

43%

|

|

Alex Tsakumis

|

35,472,118

|

98%

|

681,834

|

2%

|

|

Laurence Stefan

|

20,305,825

|

56%

|

15,848,127

|

44%

|

|

G.A. (Ben) Binninger

|

29,196,876

|

81%

|

6,957,076

|

19%

|

|

Claudia Tornquist

|

28,884,387

|

80%

|

7,269,565

|

20%

|

|

Carsten Korch

|

29,188,907

|

81%

|

6,965,045

|

19%

|

|

Rona Sellers

|

29,127,118

|

81%

|

7,026,834

|

19%

|

All nominees, as set forth in the Company's Management Information Circular dated October 23, 2024 (the "Circular"), were elected as directors of American Lithium at the Meeting.

At the Meeting, shareholders also approved: (1) the appointment of Davidson & Company LLP as auditor of the Company for the ensuing year and authorizing the Board of Directors to fix the remuneration of the auditor and (2) the re-approval of the Company's omnibus incentive plan, as more particularly described in the Circular.

For further information regarding the matters considered at the Meeting readers are encouraged to review the Circular, a copy of which is available under the profile for the Company on SEDAR+ (www.sedarplus.ca). The Company has also filed a report of voting results on all resolutions voted on at the Meeting under its profile on SEDAR+.

About American Lithium

American Lithium is developing two of the world's largest, advanced-stage lithium projects, along with the largest undeveloped uranium project in Latin America. They include the TLC claystone lithium project in Nevada, the Falchani hard rock lithium project and the Macusani uranium deposit, both in southern Peru. All three projects have been through robust preliminary economic assessments, exhibit significant expansion potential and enjoy strong community support.

For more information, please contact the Company at info@americanlithiumcorp.com or visit our website at www.americanlithiumcorp.com.

Follow us on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of American Lithium Corp.

"Alex Tsakumis"

Interim Chief Executive Officer

Tel: 604 428 6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward Looking Information

This news release contains certain forward-looking information and forward-looking statements (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements regarding the business plans, expectations and objectives of American Lithium. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend", "indicate", "scheduled", "target", "goal", "potential", "subject", "efforts", "option" and similar words, or the negative connotations thereof, referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management and are not, and cannot be, a guarantee of future results or events. Although American Lithium believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since American Lithium can provide no assurance that such opinions and expectations will prove to be correct. All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: American Lithium's ability to achieve its stated goals;, which could have a material adverse impact on many aspects of American Lithium's businesses including but not limited to: the ability to access mineral properties for indeterminate amounts of time, the health of the employees or consultants resulting in delays or diminished capacity, social or political instability in Peru which in turn could impact American Lithium's ability to maintain the continuity of its business operating requirements, may result in the reduced availability or failures of various local administration and critical infrastructure, reduced demand for the American Lithium's potential products, availability of materials, global travel restrictions, and the availability of insurance and the associated costs; the ongoing ability to work cooperatively with stakeholders, including but not limited to local communities and all levels of government; the potential for delays in exploration or development activities; the interpretation of drill results, the geology, grade and continuity of mineral deposits; the possibility that any future exploration, development or mining results will not be consistent with our expectations; risks that permits will not be obtained as planned or delays in obtaining permits; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which American Lithium operates; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, any of which could continue to negatively affect global financial markets, including the trading price of American Lithium's shares and could negatively affect American Lithium's ability to raise capital and may also result in additional and unknown risks or liabilities to American Lithium. Other risks and uncertainties related to prospects, properties and business strategy of American Lithium are identified in the "Risk Factors" section of American Lithium's Management's Discussion and Analysis filed on October 15, 2024, and in recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements. American Lithium undertakes no obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

Cautionary Note Regarding 32 Concessions

Thirty-two of the one-hundred-seventy-four concessions comprising the Falchani and Macusani Projects are currently subject to Administrative and Judicial processes in Peru to overturn resolutions issued by INGEMMET and the Mining Council of MINEM in February 2019 and July 2019, respectively, which declared title to thirty-two concessions invalid due to late receipt of the annual validity payments. On November 2, 2021, American Lithium was awarded a favorable ruling in regard to title to the concessions, but on November 26, 2021, appeals of the judicial ruling were lodged by INGEMMET and MINEM. A three-judge tribunal of Peru's Superior Court unanimously upheld the ruling in a decision reported in November 2023. American Lithium was subsequently notified that INGEMMET and MINEM have filed petitions to the Supreme Court of Peru to assume jurisdiction in the proceedings. Given the precedent of the original ruling it is hoped that the Supreme Court will not assume jurisdiction; however, there is no assurance of the outcome at this time.

AMERICAN LITHIUM CORP.

(the "Company")

REPORT OF VOTING RESULTS

In accordance with Section 11.3 of National Instrument 51-102 - Continuous Disclosure Obligations, the Company hereby advises of the results of the voting on the matters submitted to the annual and special meeting (the "Meeting") of shareholders of the Company (the "Shareholders") held on Wednesday, November 27, 2024. At the Meeting, the Shareholders were asked to consider certain matters outlined in the Notice of Annual and Special Meeting of Shareholders and Management Information Circular dated October 23, 2024 (the "Circular"). The matters voted upon at the Meeting and the results of the voting as provided by Odyssey Trust Company after the Meeting were as follows:

1. Fixing the Number of Directors

The voting results showed that 29.22% of the issued and outstanding shares of the Company were voted on this matter, the results of which are as follows:

| |

Votes For |

% of Votes

For |

Votes

Against |

% of Votes

Against |

| Fixing the Number of Directors to Seven (7) |

61,530,018 |

97% |

2,098,140 |

3% |

2. Election of Directors

The voting results showed that 16.60% of the issued and outstanding shares of the Company were voted on this matter, the results of which are as follows:

|

Nominee

|

Votes For

|

% For

|

Votes Withheld

|

% Withheld

|

|

Andrew Bowering

|

20,678,971

|

57%

|

15,474,981

|

43%

|

|

Alex Tsakumis

|

35,472,118

|

98%

|

681,834

|

2%

|

|

Laurence Stefan

|

20,305,825

|

56%

|

15,848,127

|

44%

|

|

G A (Ben) Binninger

|

29,196,876

|

81%

|

6,957,076

|

19%

|

|

Claudia Tornquist

|

28,884,387

|

80%

|

7,269,565

|

20%

|

|

Carsten Korch

|

29,188,907

|

81%

|

6,965,045

|

19%

|

|

Rona Sellers

|

29,127,118

|

81%

|

7,026,834

|

19%

|

As a result of the foregoing each of the above-noted nominee directors were elected directors of the Company for the ensuing year or until their successors are elected or appointed.

3. Appointment of Auditors

The voting results showed that 29.22% of the issued and outstanding shares of the Company were voted on this matter, the results of which are as follows:

|

|

Votes For

|

% of Votes

For

|

Votes

Withheld

|

% of Votes

Withheld

|

|

Appointment of Auditor

|

62,325,531

|

98%

|

1,302,626

|

2%

|

As a result of the foregoing, Davidson & Company LLP, were appointed as the auditors of the Company for the ensuing year until the close of the next annual general meeting of shareholders, at a remuneration to be fixed by the Board of Directors.

4. Amended Omnibus Incentive Plan

The vote on this resolution was required to be approved by the affirmative vote of a simple majority of the votes cast by disinterested shareholders. The voting results showed that 16.60% of the issued and outstanding shares of the Company were voted on this matter, the results of which are as follows:

|

|

Votes For

|

% of Votes

For

|

Votes

Against

|

% of Votes

Against

|

|

Amended Omnibus Incentive Plan

|

34,367,567

|

95%

|

1,786,384

|

5%

|

As a result of the foregoing, the resolution described on page 20 of the Circular was adopted as an ordinary resolution of the disinterested shareholders of the Company and the Amended Omnibus Incentive Plan was approved.

DATED this 27th day of November, 2024.

AMERICAN LITHIUM CORP.

By: /s/ Alex Tsakumis

Alex Tsakumis, Interim Chief Executive Officer

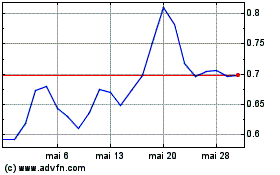

American Lithium (NASDAQ:AMLI)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

American Lithium (NASDAQ:AMLI)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025