0001280784FalseN-2ASR333-000000xbrli:pureiso4217:USDiso4217:USDxbrli:sharesxbrli:shares00012807842024-12-112024-12-110001280784dei:BusinessContactMember2024-12-112024-12-110001280784htgc:ClosingOfCommonStockOfferingRiskMember2024-12-112024-12-110001280784htgc:SubscriptionRightsRiskMember2024-12-112024-12-110001280784htgc:ShortTermInvestmentsRiskMember2024-12-112024-12-110001280784htgc:StockholdersMayReceiveSharesOfCommonStockAsDividendsWhichCouldResultInAdverseCashFlowsRiskMember2024-12-112024-12-1100012807842022-03-3100012807842022-01-012022-03-3100012807842022-06-3000012807842022-04-012022-06-3000012807842022-09-3000012807842022-07-012022-09-3000012807842022-12-3100012807842022-10-012022-12-3100012807842023-03-3100012807842023-01-012023-03-3100012807842023-06-3000012807842023-04-012023-06-3000012807842023-09-3000012807842023-07-012023-09-3000012807842023-12-3100012807842023-10-012023-12-3100012807842024-03-3100012807842024-01-012024-03-3100012807842024-06-3000012807842024-04-012024-06-3000012807842024-09-3000012807842024-07-012024-09-3000012807842024-10-012024-12-090001280784htgc:SecuritizedCreditFacilityWithWellsFargoCapitalFinanceMember2014-12-310001280784htgc:SecuritizedCreditFacilityWithWellsFargoCapitalFinanceMember2015-12-310001280784htgc:SecuritizedCreditFacilityWithWellsFargoCapitalFinanceMember2016-12-310001280784htgc:SecuritizedCreditFacilityWithWellsFargoCapitalFinanceMember2017-12-310001280784htgc:SecuritizedCreditFacilityWithWellsFargoCapitalFinanceMember2018-12-310001280784htgc:SecuritizedCreditFacilityWithWellsFargoCapitalFinanceMember2019-12-310001280784htgc:SecuritizedCreditFacilityWithWellsFargoCapitalFinanceMember2020-12-310001280784htgc:SecuritizedCreditFacilityWithWellsFargoCapitalFinanceMember2021-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2014-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2015-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2016-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2017-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2018-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2019-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2020-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2021-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2022-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2023-12-310001280784htgc:SecuredCreditFacilityWithMUFGBankLtd.MUFGMember2024-09-300001280784htgc:SecuredCreditFacilityWithSumitomoMitsuiBankingCorporationSMBCMember2021-12-310001280784htgc:SecuredCreditFacilityWithSumitomoMitsuiBankingCorporationSMBCMember2022-12-310001280784htgc:SecuredCreditFacilityWithSumitomoMitsuiBankingCorporationSMBCMember2023-12-310001280784htgc:SecuredCreditFacilityWithSumitomoMitsuiBankingCorporationSMBCMember2024-09-300001280784htgc:SmallBusinessAdministrationDebenturesHTIIMember2014-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIMember2015-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIMember2016-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIMember2017-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIMember2018-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIIMember2014-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIIMember2015-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIIMember2016-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIIMember2017-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIIMember2018-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIIMember2019-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIIMember2020-12-310001280784htgc:SmallBusinessAdministrationDebenturesHTIIIMember2021-12-310001280784htgc:SmallBusinessAdministrationDebenturesHCIVMember2021-12-310001280784htgc:SmallBusinessAdministrationDebenturesHCIVMember2022-12-310001280784htgc:SmallBusinessAdministrationDebenturesHCIVMember2023-12-310001280784htgc:SmallBusinessAdministrationDebenturesHCIVMember2024-09-300001280784htgc:ConvertibleNotes2016Member2014-12-310001280784htgc:ConvertibleNotes2016Member2014-01-012014-12-310001280784htgc:ConvertibleNotes2016Member2015-12-310001280784htgc:ConvertibleNotes2016Member2015-01-012015-12-310001280784htgc:ConvertibleNotes2016Member2016-12-310001280784htgc:April2019NotesMember2014-12-310001280784htgc:April2019NotesMember2014-01-012014-12-310001280784htgc:April2019NotesMember2015-12-310001280784htgc:April2019NotesMember2015-01-012015-12-310001280784htgc:April2019NotesMember2016-12-310001280784htgc:April2019NotesMember2016-01-012016-12-310001280784htgc:April2019NotesMember2017-12-310001280784htgc:September2019NotesMember2014-12-310001280784htgc:September2019NotesMember2014-01-012014-12-310001280784htgc:September2019NotesMember2015-12-310001280784htgc:September2019NotesMember2015-01-012015-12-310001280784htgc:September2019NotesMember2016-12-310001280784htgc:September2019NotesMember2016-01-012016-12-310001280784htgc:September2019NotesMember2017-12-310001280784htgc:Notes2022Member2017-12-310001280784htgc:Notes2022Member2017-01-012017-12-310001280784htgc:Notes2022Member2018-12-310001280784htgc:Notes2022Member2018-01-012018-12-310001280784htgc:Notes2022Member2019-12-310001280784htgc:Notes2022Member2019-01-012019-12-310001280784htgc:Notes2022Member2020-12-310001280784htgc:Notes2022Member2020-01-012020-12-310001280784htgc:Notes2022Member2021-12-310001280784htgc:Notes2022Member2021-01-012021-12-310001280784htgc:Notes2022Member2022-12-310001280784htgc:Notes2024Member2014-12-310001280784htgc:Notes2024Member2014-01-012014-12-310001280784htgc:Notes2024Member2015-12-310001280784htgc:Notes2024Member2015-01-012015-12-310001280784htgc:Notes2024Member2016-12-310001280784htgc:Notes2024Member2016-01-012016-12-310001280784htgc:Notes2024Member2017-12-310001280784htgc:Notes2024Member2017-01-012017-12-310001280784htgc:Notes2024Member2018-12-310001280784htgc:Notes2024Member2018-01-012018-12-310001280784htgc:Notes2024Member2019-12-310001280784htgc:Notes2025Member2018-12-310001280784htgc:Notes2025Member2018-01-012018-12-310001280784htgc:Notes2025Member2019-12-310001280784htgc:Notes2025Member2019-01-012019-12-310001280784htgc:Notes2025Member2020-12-310001280784htgc:Notes2025Member2020-01-012020-12-310001280784htgc:Notes2025Member2021-12-310001280784htgc:Notes2033Member2018-12-310001280784htgc:Notes2033Member2018-01-012018-12-310001280784htgc:Notes2033Member2019-12-310001280784htgc:Notes2033Member2019-01-012019-12-310001280784htgc:Notes2033Member2020-12-310001280784htgc:Notes2033Member2020-01-012020-12-310001280784htgc:Notes2033Member2021-12-310001280784htgc:Notes2033Member2021-01-012021-12-310001280784htgc:Notes2033Member2022-12-310001280784htgc:Notes2033Member2022-01-012022-12-310001280784htgc:Notes2033Member2023-12-310001280784htgc:Notes2033Member2023-01-012023-12-310001280784htgc:Notes2033Member2024-09-300001280784htgc:Notes2033Member2024-01-012024-09-300001280784htgc:July2024NotesMember2019-12-310001280784htgc:July2024NotesMember2020-12-310001280784htgc:July2024NotesMember2021-12-310001280784htgc:July2024NotesMember2022-12-310001280784htgc:July2024NotesMember2023-12-310001280784htgc:July2024NotesMember2024-09-300001280784htgc:February2025NotesMember2020-12-310001280784htgc:February2025NotesMember2021-12-310001280784htgc:February2025NotesMember2022-12-310001280784htgc:February2025NotesMember2023-12-310001280784htgc:February2025NotesMember2024-09-300001280784htgc:June2025NotesMember2020-12-310001280784htgc:June2025NotesMember2021-12-310001280784htgc:June2025NotesMember2022-12-310001280784htgc:June2025NotesMember2023-12-310001280784htgc:June2025NotesMember2024-09-300001280784htgc:June20253YearNotesMember2022-12-310001280784htgc:June20253YearNotesMember2023-12-310001280784htgc:June20253YearNotesMember2024-09-300001280784htgc:March2026ANotesMember2020-12-310001280784htgc:March2026ANotesMember2021-12-310001280784htgc:March2026ANotesMember2022-12-310001280784htgc:March2026ANotesMember2023-12-310001280784htgc:March2026ANotesMember2024-09-300001280784htgc:March2026BNotesMember2021-12-310001280784htgc:March2026BNotesMember2022-12-310001280784htgc:March2026BNotesMember2023-12-310001280784htgc:March2026BNotesMember2024-09-300001280784htgc:September2026NotesMember2021-12-310001280784htgc:September2026NotesMember2022-12-310001280784htgc:September2026NotesMember2023-12-310001280784htgc:September2026NotesMember2024-09-300001280784htgc:January2027NotesMember2022-12-310001280784htgc:January2027NotesMember2023-12-310001280784htgc:January2027NotesMember2024-09-300001280784htgc:AssetBackedNotes2017Member2014-12-310001280784htgc:AssetBackedNotes2017Member2014-01-012014-12-310001280784htgc:AssetBackedNotes2017Member2015-12-310001280784htgc:AssetBackedNotes2021Member2014-12-310001280784htgc:AssetBackedNotes2021Member2014-01-012014-12-310001280784htgc:AssetBackedNotes2021Member2015-12-310001280784htgc:AssetBackedNotes2021Member2015-01-012015-12-310001280784htgc:AssetBackedNotes2021Member2016-12-310001280784htgc:AssetBackedNotes2021Member2016-01-012016-12-310001280784htgc:AssetBackedNotes2021Member2017-12-310001280784htgc:AssetBackedNotes2021Member2017-01-012017-12-310001280784htgc:AssetBackedNotes2021Member2018-12-310001280784htgc:AssetBackedNotes2027Member2018-12-310001280784htgc:AssetBackedNotes2027Member2018-01-012018-12-310001280784htgc:AssetBackedNotes2027Member2019-12-310001280784htgc:AssetBackedNotes2027Member2019-01-012019-12-310001280784htgc:AssetBackedNotes2027Member2020-12-310001280784htgc:AssetBackedNotes2027Member2020-01-012020-12-310001280784htgc:AssetBackedNotes2027Member2021-12-310001280784htgc:AssetBackedNotes2028Member2019-12-310001280784htgc:AssetBackedNotes2028Member2019-01-012019-12-310001280784htgc:AssetBackedNotes2028Member2020-12-310001280784htgc:AssetBackedNotes2028Member2020-01-012020-12-310001280784htgc:AssetBackedNotes2028Member2021-12-310001280784htgc:AssetBackedNotes2031Member2022-12-310001280784htgc:AssetBackedNotes2031Member2022-01-012022-12-310001280784htgc:AssetBackedNotes2031Member2023-12-310001280784htgc:AssetBackedNotes2031Member2023-01-012023-12-310001280784htgc:AssetBackedNotes2031Member2024-09-300001280784htgc:AssetBackedNotes2031Member2024-01-012024-09-300001280784htgc:ConvertibleNotes2022Member2017-12-310001280784htgc:ConvertibleNotes2022Member2017-01-012017-12-310001280784htgc:ConvertibleNotes2022Member2018-12-310001280784htgc:ConvertibleNotes2022Member2018-01-012018-12-310001280784htgc:ConvertibleNotes2022Member2019-12-310001280784htgc:ConvertibleNotes2022Member2019-01-012019-12-310001280784htgc:ConvertibleNotes2022Member2020-12-310001280784htgc:ConvertibleNotes2022Member2020-01-012020-12-310001280784htgc:ConvertibleNotes2022Member2021-12-310001280784htgc:ConvertibleNotes2022Member2021-01-012021-12-310001280784htgc:ConvertibleNotes2022Member2022-12-310001280784htgc:SeniorSecuritiesMember2014-12-310001280784htgc:SeniorSecuritiesMember2015-12-310001280784htgc:SeniorSecuritiesMember2016-12-310001280784htgc:SeniorSecuritiesMember2017-12-310001280784htgc:SeniorSecuritiesMember2018-12-310001280784htgc:SeniorSecuritiesMember2019-12-310001280784htgc:SeniorSecuritiesMember2020-12-310001280784htgc:SeniorSecuritiesMember2021-12-310001280784htgc:SeniorSecuritiesMember2022-12-310001280784htgc:SeniorSecuritiesMember2023-12-310001280784htgc:SeniorSecuritiesMember2024-09-3000012807842024-12-092024-12-090001280784us-gaap:CommonStockMember2024-12-112024-12-110001280784us-gaap:CommonStockMember2024-12-092024-12-090001280784us-gaap:PreferredStockMember2024-12-112024-12-110001280784htgc:SubscriptionRightsMember2024-12-112024-12-110001280784us-gaap:WarrantMember2024-12-112024-12-11

As filed with the Securities and Exchange Commission on December 11, 2024

Securities Act File No. 333-

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

☒ REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Check the appropriate box or boxes:

☐ Pre-Effective Amendment No.

☐ Post-Effective Amendment No.

Hercules Capital, Inc.

(Exact name of Registrant as specified in its charter)

1 N B Street, Suite 2000

San Mateo, CA 94401

(Address of Principal Executive Offices)

(650) 289-3060

(Registrant’s Telephone Number, Including Area Code)

Scott Bluestein

Chief Executive Officer

Hercules Capital, Inc.

1 N B Street, Suite 2000

San Mateo, CA 94401

(Name and Address of Agent for Service)

Copies to:

William Bielefeld

Ian Hartman

Jay Alicandri

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

| | | | | |

| Approximate date of proposed public offering: From time to time after the effective date of this Registration Statement |

| ☐ | Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans. |

| ☒ | Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan. |

| ☒ | Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. |

| ☒ | Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act. |

| |

| |

| ☐ | Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act. |

| It is proposed that this filing will become effective (check appropriate box): |

| ☐ | when declared effective pursuant to Section 8(c) of the Securities Act. |

| Check each box that appropriately characterizes the Registrant: |

| ☐ | Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)). |

| ☒ | Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act). |

| Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act). |

| ☐ | A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form). |

| ☒ | Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| ☐ | Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”). |

| ☐ | If an Emerging Growth Company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| ☐ | New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing). |

PROSPECTUS

Hercules Capital, Inc.

Common Stock

Preferred Stock

Warrants

Subscription Rights

Debt Securities

Units

This prospectus relates to the offer, from time to time, in one or more offerings or series of shares of our common stock, par value $0.001 per share, preferred stock, par value $0.001 per share, warrants representing rights to purchase shares of our common stock, preferred stock or debt securities, subscription rights, debt securities, or units comprised of any combination of the foregoing, which we refer to, collectively, as the “securities.” The preferred stock, debt securities, subscription rights and warrants (including as part of a unit) offered hereby may be convertible or exchangeable into shares of our common stock. We may sell our securities through underwriters or dealers, “at-the-market” to or through a market maker into an existing trading market or otherwise directly to one or more purchasers, including existing stockholders in a rights offering, or through agents or through a combination of methods of sale, including auctions. The identities of such underwriters, dealers, market makers or agents, as the case may be, will be described in one or more supplements to this prospectus. The securities may be offered at prices and on terms to be described in one or more supplements to this prospectus.

In the event we offer common stock, the offering price per share will not be less than the net asset value per share of our common stock at the time we make the offering except (1) in connection with a rights offering to our existing stockholders, (2) with the consent of the holders of the majority of our voting securities and approval of our Board of Directors, or (3) under such circumstances as the Securities and Exchange Commission, or the SEC, may permit. See “Risk Factors” and “Sales of Common Stock Below Net Asset Value” below for more information.

We are a specialty finance company focused on providing senior secured loans to high-growth, innovative venture capital-backed and institutional-backed companies in a variety of technology and life sciences industries. We source our investments through our principal office located in San Mateo, CA, as well as through additional offices in Boston, MA, New York, NY, San Diego, CA, Denver, CO and London, United Kingdom. Our primary business objectives are to increase our net income, net investment income, and net asset value through our investments. We principally invest in debt securities and, to a lesser extent, equity securities, with a particular emphasis on Structured Debt. We use the term “Structured Debt” to refer to a debt investment that is structured with an equity, warrant, option, or other right to purchase or convert into common or preferred stock. We aim to achieve our business objectives by maximizing our portfolio total return through generation of current income from our debt investments and capital appreciation from our warrant and equity investments.

We are an internally-managed, non-diversified closed-end investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. Our common stock is traded on the New York Stock Exchange, or NYSE, under the symbol “HTGC.” On December 9, 2024, the last reported sale price of a share of our common stock on the NYSE, was $19.39. The net asset value per share of our common stock as of September 30, 2024 (the last date prior to the date of this prospectus on which we determined net asset value) was $11.40.

An investment in our securities may be speculative and involves risks including a heightened risk of total loss of investment. In addition, the companies in which we invest are subject to special risks. See “Risk Factors” on page 12 of this prospectus, in our most recent Annual Report on Form 10-K, in our Quarterly Reports on Form 10-Q, in any of our other filings with the Securities and Exchange Commission, and in any applicable prospectus supplement and in any free writing prospectus to read about risks that you should consider before investing in our securities, including the risk of leverage.

Please read this prospectus and any free writing prospectus before investing and keep it for future reference. It contains important information about us that a prospective investor ought to know before investing in our securities. We file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission. The information is available free of charge by contacting us at 1 N B Street, Suite 2000, San Mateo, California 94401 or by telephone calling collect at (650) 289-3060 or on our website at www.htgc.com. The Securities and Exchange Commission also maintains a website at www.sec.gov that contains such information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to consummate sales of any securities unless accompanied by a prospectus supplement.

The date of this prospectus is December 11, 2024

You should rely only on the information contained in this prospectus, any applicable prospectus supplement, any free writing prospectus, the documents incorporated by reference in this prospectus and any applicable prospectus supplement, or any other information which we have referred you. We have not authorized any dealer, salesperson or other person to provide you with different information or to make representations as to matters not stated in this prospectus or in any free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any applicable prospectus supplement, and any free writing prospectus do not constitute an offer to sell, or a solicitation of an offer to buy, any securities by any person in any jurisdiction where it is unlawful for that person to make such an offer or solicitation or to any person in any jurisdiction to whom it is unlawful to make such an offer or solicitation. The information in this prospectus, any applicable prospectus supplement, and any free writing prospectus is accurate only as of its date, and under no circumstances should the delivery of this prospectus, any applicable prospectus supplement, or any free writing prospectus or the sale of any securities imply that the information in this prospectus, any applicable prospectus supplement, or any free writing prospectus is accurate as of any later date or that the affairs of Hercules Capital, Inc. have not changed since the date hereof. This prospectus will be updated to reflect material changes.

Hercules Capital, Inc., our logo and other trademarks of Hercules Capital, Inc. mentioned in this prospectus are the property of Hercules Capital, Inc. All other trademarks or trade names referred to in this prospectus are the property of their respective owners.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission using the “shelf” registration process as a “well-known seasoned issuer,” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act. Under the shelf registration process, which constitutes a delayed offering in reliance on Rule 415 under the Securities Act, we may offer, from time to time, in one or more offerings or series, our common stock, preferred stock, warrants representing rights to purchase shares of our common stock, preferred stock or debt securities, subscription rights or debt securities on the terms to be determined at the time of the offering. We may sell our securities through underwriters or dealers, “at-the-market” to or through a market maker, into an existing trading market or otherwise directly to one or more purchasers, including existing stockholders in a rights offering, or through agents or through a combination of methods of sale. The securities may be offered at prices and on terms described in one or more supplements to this prospectus. This prospectus provides you with a general description of the securities that we may offer. Each time we use this prospectus to offer securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. Such prospectus supplement and/or free writing prospectus (collectively referred to hereinafter as the “prospectus supplement”) may also add, update or change information contained in this prospectus or in the documents we incorporate by reference herein. This prospectus and the prospectus supplement, together with any documents incorporated by reference herein, will include all material information relating to the applicable offering. Please carefully read this prospectus and the prospectus supplement, together with any documents incorporated by reference in this prospectus and the applicable prospectus supplement, any exhibits and the additional information described under the headings “Available Information,” “Incorporation of Certain Information By Reference,” “Prospectus Summary” and “Risk Factors” before you make an investment decision.

| | |

PROSPECTUS SUMMARY This summary highlights some of the information contained elsewhere in this prospectus. It is not complete and may not contain all of the information that you may want to consider. You should read carefully the more detailed information set forth under “Risk Factors” and the other information included or incorporated by reference in this prospectus and the accompanying prospectus supplement. In this prospectus, unless the context otherwise requires, the “Company,” “Hercules,” “HTGC,” “we,” “us” and “our” refer to Hercules Capital, Inc. and its wholly owned subsidiaries and its affiliated securitization trust. THE COMPANY Overview We are a specialty finance company focused on providing senior secured loans to high-growth, innovative venture capital-backed and institutional-backed companies in a variety of technology and life sciences industries. We source our investments through our principal office located in San Mateo, CA, as well as through additional offices in Boston, MA, New York, NY, San Diego, CA, Denver, CO and London, United Kingdom. We make investments in companies that are active across a variety of technology industry sub-sectors or are characterized by products or services that require advanced technologies, including, but not limited to, computer software and hardware, networking systems, semiconductors, semiconductor capital equipment, information technology infrastructure or services, consumer and business services, telecommunications, telecommunications equipment, media and renewable or alternative energy. Within the life sciences sub-sector, we generally focus on medical devices, bio-pharmaceutical, drug discovery and development, drug delivery, health care services and information systems companies. Within the sustainable and renewable technology sub-sector, we focus on sustainable and renewable energy technologies and energy efficiency and monitoring technologies. We refer to all of these companies as “technology-related” companies and intend, under normal circumstances, to invest at least 80% of the value of our total assets in such businesses. Our primary business objectives are to increase our net income, net investment income, and net asset value (“NAV”) through our investments in primarily Structured Debt or senior secured debt instruments of venture capital-backed and institutional-backed companies across a variety of technology-related industries at attractive yields. We use the term “Structured Debt” to refer to a debt investment that is structured with an equity, warrant, option, or other right to purchase or convert into common or preferred stock. We aim to achieve our business objectives by maximizing our portfolio total return through generation of current income from our debt investments and capital appreciation from our warrant and equity investments. Our equity ownership in our portfolio companies may exceed 25% of the voting securities of such companies, which represents a controlling interest under the Investment Company Act of 1940, as amended, or the 1940 Act. In some cases, we receive the right to make additional equity investments in our portfolio companies in connection with future equity financing rounds. Capital that we provide directly to venture capital- backed companies in technology-related industries is generally used for growth and general working capital purposes as well as in select cases for acquisitions or recapitalizations. The Company formed Hercules Capital Management LLC and Hercules Adviser LLC in 2020 as wholly owned Delaware limited liability subsidiaries. The Company was granted no-action relief by the staff of the SEC to allow Hercules Adviser LLC, or the Adviser Subsidiary, to register as a registered investment adviser under the Investment Advisers Act of 1940, as amended, or the Advisers Act. The Adviser Subsidiary provides investment advisory and related services to investment vehicles, or Adviser Funds, owned by one or more unrelated third-party investors, or External Parties. The Adviser Subsidiary is owned by Hercules Capital Management LLC and collectively held and presented with Hercules Partner Holdings, LLC, which separately wholly owns the general partnership vehicles to each of the Adviser Funds. See “Item 1. Business” in our most recent Annual Report on Form 10-K for additional information about us. |

| | |

Corporate Information We are an internally-managed, non-diversified, closed-end investment company that has elected to be regulated as a business development company, or a BDC, under the 1940 Act. Effective January 1, 2006, we elected to be treated for tax purposes as a regulated investment company, or RIC, under the Internal Revenue Code of 1986, as amended, or the Code. As a RIC, we generally will not be subject to U.S. federal income tax on the portion of our investment company taxable income and net capital gain (i.e., net realized long-term capital gains in excess of net realized short-term capital losses) we distribute (or are deemed to distribute) as dividends for U.S. federal income tax purposes to stockholders with respect to that taxable year. We will be subject to a 4% non-deductible U.S. federal excise tax on certain undistributed income and gains unless we make distributions treated as dividends for U.S. federal income tax purposes in a timely manner to our stockholders in respect of each calendar year subject to certain requirements as defined for RICs. See “Item 1. Business—Certain United States Federal Income Tax Considerations” in our most recent Annual Report on Form 10-K incorporated by reference herein for additional information about our tax requirements. The Company has also established certain wholly owned subsidiaries, all of which are structured as Delaware corporations or Limited Liability Companies (“LLCs”), to hold portfolio companies organized as LLCs (or other forms of pass-through entities). These subsidiaries are consolidated for financial reporting purposes in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). Certain of the subsidiaries are taxable and not consolidated with Hercules for income tax purposes and may generate income tax expense, or benefit, and tax assets and liabilities as a result of their ownership of certain portfolio investments. We are a Maryland corporation formed in December 2003 that began investment operations in September 2004. Our principal executive offices are located at 1 N B Street, Suite 2000, San Mateo, California 94401, and our telephone number is (650) 289-3060.

Risk Factors Investing in Hercules involves risks. The following is a summary of the principal risks that you should carefully consider before investing in our securities. In addition, see “Item 1A. Risk Factors” beginning on page 12 and in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q incorporated by reference herein for a more detailed discussion of the principal risks as well as certain other risks you should carefully consider before deciding to invest in our securities.

Risks Related To Our Business And Structure •We operate in a highly competitive market for investment opportunities. •We are dependent upon senior management personnel for our future success, particularly our CEO, Scott Bluestein. •Our success depends on attracting and retaining qualified personnel in a competitive environment. •Our business model depends to a significant extent upon strong referral relationships. •Our Board may change our operating policies and strategies without prior notice or stockholder approval, the effects of which may be adverse. •We may not be able to pay distributions to our stockholders, our distributions may not grow over time, and a portion of distributions paid to our stockholders may be a return of capital, which is a distribution of the stockholders’ invested capital. •We are subject to risks related to corporate social responsibility.

|

| | |

Risks Related To Our Investments •Our investments in portfolio companies involve higher levels of risk, and we could lose all or part of our investment. •Our investments are concentrated in certain technology-related industries, which subjects us to the risk of significant loss if any one or more of such industries experiences a downturn. •Our financial results could be negatively affected if a significant portfolio investment fails to perform as expected. •We may be exposed to higher risks with respect to our investments that include PIK interest or Exit fees. •The lack of liquidity in our investments may adversely affect our business. •We may not have the funds or ability to make additional investments in our portfolio companies. •There may be circumstances where our debt investments could be subordinated to claims of other creditors or we could be subject to lender liability claims. •We are a non-diversified investment company within the meaning of the 1940 Act, and therefore we are not limited with respect to the proportion of our assets that may be invested in securities of a single issuer, which may subject us to a risk of significant loss if any such issuer experiences a downturn. •We generally will not control our portfolio companies, which may result in the portfolio company making decisions which could adversely impact the value of our investments in the portfolio company’s securities. •Defaults by our portfolio companies will harm our operating results. •Substantially all of our portfolio investments are recorded at fair value as determined in accordance with our Valuation Guidelines and, as a result, there may be uncertainty as to the value of our portfolio investments. •Any unrealized depreciation we experience on our investment portfolio may be an indication of future realized losses, which could reduce our income available for distribution and could impair our ability to service our borrowings. •We are subject to risks associated with the current interest rate environment and changes in interest rates will affect our cost of capital, net investment income and the value of our investments. •We may not realize gains from our equity or warrant investments. •Our investments in foreign securities or investments denominated in foreign currencies may involve significant risks in addition to the risks inherent in U.S. and U.S.-denominated investments.

Risks Related to Leverage •Because we borrow money, the potential for gain or loss on amounts invested in us is magnified and may increase the risk of investing in us. •Substantially all of our assets are subject to security interests under our senior securities and if we default on our obligations under our senior securities, we may suffer adverse consequences, including foreclosure on our assets.

|

| | |

Risks Related To Our Investment Management Activities •Our executive officers and employees, through the Adviser Subsidiary, are expected to manage the Adviser Funds or separately managed accounts, which includes funds from External Parties, that operate in the same or a related line of business as we do, which may result in significant conflicts of interest. •Investments in the Adviser Funds managed by our Adviser Subsidiary may create conflicts of interests. •We, through the Adviser Subsidiary, derive revenues from managing third-party funds pursuant to management agreements that may be terminated, which could negatively impact our operating results. Risks Related To BDCs •Failure to comply with applicable laws or regulations and changes in laws or regulations governing our operations may adversely affect our business or cause us to alter our business strategy. •Failure to maintain our status as a BDC would reduce our operating flexibility. •Operating under the constraints imposed on us as a BDC and RIC may hinder the achievement of our investment objectives. •Regulations governing our operation as a BDC will affect our ability to, and the way in which we, raise additional capital. Risks Related To Our Securities •Investing in our securities may involve a high degree of risk. •Shares of closed-end investment companies, including BDCs, may trade at a discount to their NAV. •The market price of our securities may be volatile and fluctuate significantly. •Stockholders may incur dilution if we sell shares of our common stock in one or more offerings at prices below the then current NAV per share of our common stock or issue securities to subscribe to, convert to or purchase shares of our common stock. •Certain debt securities are unsecured and therefore effectively subordinated to any current or future secured indebtedness or may be structurally subordinated to the indebtedness and other liabilities of our subsidiaries. •Our debt securities may or may not have an established trading market. If a trading market in our debt securities is developed, it may not be maintained. •A downgrade, suspension, or withdrawal of the credit rating assigned by a rating agency to us or our debt securities, if any, or change in the debt markets could cause the liquidity or market value of our debt securities to decline significantly. •The indentures under which our debt securities were issued contain limited protections for the holders of the debt securities. •If we default on our obligations to pay our other indebtedness, we may not be able to make payments on our outstanding Notes and Credit Facilities. •We may not be able to prepay the Notes upon a change in control.

|

| | |

Risks Related To Our SBIC Subsidiaries •We, through our wholly owned subsidiary, issue debt securities guaranteed by the Small Business Association (“SBA”) and sold in the capital markets. As a result of its guarantee of the debt securities, the SBA has fixed dollar claims on the assets of our subsidiary that are superior to the claims of our securities holders. •Our wholly owned subsidiary is licensed by the SBA, and therefore subject to small business investment company (“SBIC”) regulations. •Our SBIC subsidiary may be unable to make distributions to us that will enable us to meet or maintain RIC status, which could result in the imposition of an entity-level tax.

Risks Related To Operating As A RIC And U.S. Federal Income Taxes •We will be subject to U.S. federal income taxes if we are unable to qualify as a RIC under Subchapter M of the Code. •We may have difficulty paying the distributions required to maintain our RIC status under the Code if we recognize income before or without receiving cash representing such income. •Legislative or regulatory tax changes could adversely affect our stockholders.

General Risk Factors •We are currently operating in a period of economic and political uncertainty, and capital markets may experience periods of disruption and instability in the future. These market conditions may materially and adversely affect debt and equity capital markets in the United States and abroad, which may have a negative impact on our business and operations. •Terrorist attacks, acts of war, public health crises or natural disasters may affect any market for our securities, impact the businesses in which we invest and harm our business, operating results and financial condition. •We are highly dependent on information systems and systems failures could significantly disrupt our business, which may, in turn, negatively affect the market price of our common stock and our ability to pay dividends. •The failure in cyber security systems, as well as the occurrence of events unanticipated in our disaster recovery systems and business continuity planning could impair our ability to conduct business effectively. •We may be the target of litigation.

Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our business, financial condition and/or operating results.

|

| | | | | |

OFFERINGS

We may offer, from time to time, in one or more offerings or series, our common stock, preferred stock, debt securities, subscription rights to purchase shares of our common stock, warrants representing rights to purchase shares of our common stock, preferred stock or debt securities, or units comprised of any combination of the foregoing, on terms to be determined at the time of the offering. We will offer our securities at prices and on terms to be set forth in one or more supplements to this prospectus. The offering price per share of our common stock, less any underwriting commissions or discounts, generally will not be less than the NAV per share of our common stock at the time of an offering. However, we may issue shares of our common stock pursuant to this prospectus at a price per share that is less than our NAV per share (a) in connection with a rights offering to our existing stockholders, (b) with the prior approval of the majority of our common stockholders or (c) under such other circumstances as the SEC may permit. Any such issuance of shares of our common stock below NAV may be dilutive to the NAV of our common stock. See “Item 1A. Risk Factors—Risks Relating to Our Securities” in our most recent Annual Report on Form 10-K as well as “Risk Factors” and “Sales of Common Stock Below Net Asset Value” included in this prospectus. We may offer our securities directly to one or more purchasers, including existing stockholders in a rights offering, through agents that we designate from time to time or to or through underwriters or dealers. The prospectus supplement relating to each offering will identify any agents or underwriters involved in the sale of our securities, and will set forth any applicable purchase price, fee, commission or discount arrangement between us and our agents or underwriters or among our underwriters or the basis upon which such amount may be calculated. See “Plan of Distribution.” We may not sell any of our securities through agents, underwriters or dealers without delivery of a prospectus supplement describing the method and terms of the offering of our securities. Set forth below is additional information regarding offerings of our securities: |

| |

| Use of Proceeds | Unless otherwise specified in a prospectus supplement or any free writing prospectus relating to an offering, we intend to use the net proceeds from selling our securities to fund investments in debt and equity securities in accordance with our investment objectives, to make acquisitions, to retire certain debt obligations and for other general corporate purposes. Each supplement to this prospectus relating to an offering will more fully identify the use of the proceeds from such offering. See “Use of Proceeds.” |

| Distributions | Subject to applicable legal restrictions and the sole discretion of our board of directors, we intend to declare and pay regular cash distributions on a quarterly basis. From time to time, we may also pay special interim distributions in the form of cash or shares of our common stock at the discretion of our board of directors. The timing and amount of any future distributions to stockholders are subject to applicable legal restrictions and the sole discretion of our board of directors. See “Price Range of Common Stock and Distributions.” |

| Taxation | We have elected to be subject to tax as a RIC under Subchapter M of the Code. As a RIC, we generally will not be subject to pay corporate- level U.S. federal income taxes on any ordinary income or capital gains that we timely distribute each tax year as distributions for U.S. federal income tax purposes to our stockholders. To qualify for and maintain our qualification as a RIC, we must, among other things, meet certain source-of-income and asset diversification requirements (as described herein). See “Material U.S. Federal Income Tax Considerations.” |

| Distribution reinvestment plan | We have adopted a dividend reinvestment plan, through which all distributions are paid to our stockholders in the form of additional shares of our common stock, unless a stockholder elects to receive cash as provided below. In this way, a stockholder can maintain an undiluted investment in our common stock and still allow us to pay out the required distributable income. See “Dividend Reinvestment Plan” below. |

| NYSE Trading Symbol | “HTGC” |

| | | | | |

| Leverage | We borrow funds to make additional investments. We use this practice, which is known as “leverage,” to attempt to increase returns to our stockholders, but it involves significant risks. See “Risk Factors” and “Senior Securities” below. We are currently allowed to borrow amounts such that our asset coverage, as calculated pursuant to the Investment Company Act, equals at least 150% after such borrowing. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition, Liquidity and Capital Resources” in our most recent Annual Report on Form 10-K and “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition, Liquidity and Capital Resources” in our most recent Quarterly Report on Form 10-Q. |

| Available Information | We file annual, quarterly and current periodic reports, proxy statements and other information with the SEC under the Exchange Act. The SEC maintains an Internet website that contains reports, proxy and information statements and other information filed electronically by us with the SEC which are available on the SEC’s Internet website at http://www.sec.gov. We maintain a website on the Internet at www.htgc.com. Except for the documents incorporated by reference into this prospectus, the information on our website is not part of this prospectus. We make available, free of charge, on our website our proxy statement, annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. See “Available Information.” |

| Incorporation by Reference | This prospectus is part of a registration statement that we have filed with the SEC. The information incorporated by reference is considered to comprise a part of this prospectus from the date we file that document. Any reports filed by us with the SEC before the date that any offering of any securities by means of this prospectus and any accompanying prospectus supplement is terminated will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus. See “Incorporation by Reference.” |

FEES AND EXPENSES

The following table is intended to assist you in understanding the various costs and expenses that an investor in our common stock will bear directly or indirectly. However, we caution you that some of the percentages indicated in the table below are estimates and may vary. The footnotes to the fee table state which items are estimates. Except where the context suggests otherwise, whenever this prospectus contains a reference to fees or expenses paid by “you” or “us” or that “we” will pay fees or expenses, stockholders will indirectly bear such fees or expenses as investors in Hercules Capital, Inc.

| | | | | | | | | | | |

| Stockholder Transaction Expenses (as a percentage of the public offering price): | | | |

Sales load (as a percentage of offering price)(1) | — | % | | |

| Offering expenses | — | % | | (2) |

| Dividend reinvestment plan fees | — | % | | (3) |

| Total stockholder transaction expenses (as a percentage of the public offering price) | — | % | | (4) |

| | | |

Annual Expenses (as a percentage of net assets attributable to common stock):(5) | | | |

| Operating expenses | 4.57 | % | | (6)(7) |

| Interest and fees paid in connection with borrowed funds | 4.61 | % | | (8) |

| Acquired fund fees and expenses | 0.01 | % | | (10) |

| Total annual expenses | 9.19 | % | | (9) |

(1)In the event that our securities are sold to or through underwriters, a corresponding prospectus supplement to the Prospectus will disclose the applicable sales load.

(2)In the event that we conduct an offering of our securities, a corresponding prospectus supplement to this prospectus will disclose the estimated offering expenses.

(3)The expenses associated with the administration of our dividend reinvestment plan are included in “Operating expenses.” We pay all brokerage commissions incurred with respect to open market purchases, if any, made by the administrator under the plan. For more details about the plan, see “Dividend Reinvestment Plan.”

(4)Total stockholder transaction expenses may include sales load and will be disclosed in a future prospectus supplement, if any.

(5)“Net assets attributable to common stock” equals the weighted average net assets for the nine months ended September 30, 2024, which is approximately $1,846.2 million.

(6)“Operating expenses” represent our estimated operating expenses by annualizing our actual expenses for the nine months ended September 30, 2024, including all fees and expenses of our consolidated subsidiaries and excluding interest and fees on our debt.

(7)We do not have an investment adviser and are internally managed by our executive officers under the supervision of our Board. As a result, we do not pay investment advisory fees, but instead we pay the operating costs associated with employing investment management professionals.

(8)“Interest and fees paid in connection with borrowed funds” represent our estimated interest, fees, and credit facility expenses by annualizing our actual interest, fees and credit facility expenses incurred for the nine months ended September 30, 2024.

(9)“Total annual expenses” is the sum of “Operating expenses”, “Interest and fees paid in connection with borrowed funds”, and “Acquired fund fees and expenses”. “Total annual expenses” is presented as a percentage of weighted average net assets attributable to common stockholders, because the holders of shares of our common stock (and not the holders of our debt securities or preferred stock, if any) bear all of our fees and expenses, including the fees and expenses of our wholly-owned consolidated subsidiaries, all of which are included in this fee table presentation.

(10)“Acquired fund fees and expenses” represent the estimated indirect expenses by annualizing our actual indirect expenses incurred due to investments in other investment companies and private funds for the nine months ended September 30, 2024 .

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in our common stock. These amounts are based upon our payment of annual operating expenses at the levels set forth in the table above and assume no additional leverage.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years |

You would pay the following expenses on a $1,000 investment,

assuming a 5% annual return | | $ | 90 | | | $ | 259 | | | $ | 415 | | | $ | 751 | |

|

The example and the expenses in the tables above should not be considered a representation of our future expenses, and actual expenses may be greater or lesser than those shown. Moreover, while the example assumes, as required by the applicable rules of the SEC, a 5% annual return, our performance will vary and may result in a return greater or lesser than 5%. In addition, while the example assumes reinvestment of all distributions at NAV, participants in our dividend reinvestment plan may receive shares valued at the market price in effect at that time. This price may be at, above or below NAV. See “Dividend Reinvestment Plan” for additional information regarding our dividend reinvestment plan.

FINANCIAL HIGHLIGHTS

The financial data set forth in the following table as of and for the years ended December 31, 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015, and 2014 are derived from our consolidated financial statements. The financial data as of and for the years ended December 31, 2023, 2022, 2021, 2020, and 2019 are derived from our consolidated financial statements, which have been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, whose report thereon is incorporated by reference in this prospectus. The financial data as of and for the years ended December 31, 2018, 2017, 2016, 2015, and 2014 are derived from audited consolidated financial statements not incorporated by reference in this prospectus, which may be obtained from www.sec.gov or upon request. The financial data set forth in the following table as of and for the nine months ended September 30, 2024 are derived from our unaudited consolidated financial statements, but in the opinion of management, reflect all adjustments (consisting only of normal recurring adjustments) that are necessary to present fairly the results of such interim period. Interim results as of and for the nine months ended September 30, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024. You should read these financial highlights in conjunction with our consolidated financial statements and notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference into this prospectus, any documents incorporated by reference in this prospectus, our most recent Annual Report on Form 10-K, or our Quarterly Reports on Form 10-Q incorporated by reference herein.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of and for the nine months ended September 30, 2024 | Year Ended December 31, |

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

Per share data (1): | | | | | | | | | | | |

| Net asset value at beginning of period | $ | 11.43 | | $ | 10.53 | | $ | 11.22 | | $ | 11.26 | | $ | 10.55 | | $ | 9.90 | | $ | 9.96 | | $ | 9.90 | | $ | 9.94 | | $ | 10.18 | | $ | 10.51 | |

| Net investment income | 1.53 | | 2.11 | | 1.50 | | 1.29 | | 1.39 | | 1.41 | | 1.20 | | 1.17 | | 1.36 | | 1.06 | | 1.16 | |

| Net realized gain (loss) | 0.01 | | 0.06 | | (0.01) | | 0.18 | | (0.50) | | 0.16 | | (0.12) | | (0.32) | | 0.06 | | 0.07 | | 0.32 | |

| Net unrealized appreciation (depreciation) | (0.28) | | 0.17 | | (0.68) | | 0.03 | | 1.13 | | 0.14 | | (0.23) | | 0.11 | | (0.49) | | (0.51) | | (0.33) | |

| Total from investment operations | 1.26 | | 2.34 | | 0.81 | | 1.50 | | 2.02 | | 1.71 | | 0.85 | | 0.96 | | 0.93 | | 0.62 | | 1.15 | |

Net increase (decrease) in net assets from capital share transactions(1) | 0.10 | | 0.44 | | 0.34 | | (0.08) | | 0.01 | | 0.20 | | 0.23 | | 0.26 | | 0.18 | | 0.26 | | (0.37) | |

Distributions of net investment income(6) | (1.45) | | (1.93) | | (1.63) | | (1.06) | | (1.03) | | (1.15) | | (1.26) | | (1.07) | | (1.14) | | (1.04) | | (1.27) | |

Distributions of capital gains(6) | — | | — | | (0.36) | | (0.49) | | (0.36) | | (0.18) | | — | | (0.18) | | (0.11) | | (0.22) | | — | |

Stock-based compensation expense included in net investment income and other movements(2) | 0.06 | | 0.05 | | 0.15 | | 0.09 | | 0.07 | | 0.07 | | 0.12 | | 0.09 | | 0.10 | | 0.14 | | 0.16 | |

| Net asset value at end of period | $ | 11.40 | $ | 11.43 | | $ | 10.53 | | $ | 11.22 | | $ | 11.26 | | $ | 10.55 | | $ | 9.90 | | $ | 9.96 | | $ | 9.90 | | $ | 9.94 | | $ | 10.18 | |

| | | | | | | | | | | |

| Ratios and supplemental data: | | | | | | | | | | | |

| Per share market value at end of period | $ | 19.64 | | $ | 16.67 | | $ | 13.22 | | $ | 16.59 | | $ | 14.42 | | $ | 14.02 | | $ | 11.05 | | $ | 13.12 | | $ | 14.11 | | $ | 12.19 | | $ | 14.88 | |

Total return(3) | 26.84 | % | 42.00 | % | (10.14) | % | 25.62 | % | 14.31 | % | 39.36 | % | (7.56) | % | 1.47 | % | 26.87 | % | (9.70) | % | (1.75) | % |

| Shares outstanding at end of period | 162,505 | | 157,758 | | 133,045 | | 116,619 | | 114,726 | | 107,364 | | 96,501 | | 84,424 | | 79,555 | | 72,118 | | 64,715 | |

| Weighted average number of common shares outstanding | 159,742 | | 144,091 | | 125,189 | | 114,742 | | 111,985 | | 101,132 | | 90,929 | | 82,519 | | 73,753 | | 69,479 | | 61,862 | |

| Net assets at end of period | $ | 1,851,810 | | $ | 1,802,706 | | $ | 1,401,459 | | $ | 1,308,547 | | $ | 1,291,704 | | $ | 1,133,049 | | $ | 955,444 | | $ | 840,967 | | $ | 787,944 | | $ | 717,134 | | $ | 658,864 | |

Ratio of total expense to average net assets(4) | 9.18 | % | 9.92 | % | 9.92 | % | 9.86 | % | 11.30 | % | 11.95 | % | 10.73 | % | 11.37 | % | 11.25 | % | 11.55 | % | 10.97 | % |

Ratio of net investment income before investment gains and losses to average net assets(4) | 17.67 | % | 19.26 | % | 13.96 | % | 11.28 | % | 13.64 | % | 13.74 | % | 11.78 | % | 11.61 | % | 13.65 | % | 10.15 | % | 10.94 | % |

Portfolio turnover rate(5) | 20.06 | % | 31.95 | % | 19.29 | % | 51.58 | % | 32.38 | % | 31.30 | % | 38.76 | % | 49.03 | % | 36.22 | % | 46.34 | % | 56.15 | % |

| Weighted average debt outstanding | $ | 1,696,442 | | $ | 1,607,278 | | $ | 1,468,335 | | $ | 1,248,177 | | $ | 1,309,903 | | $ | 1,177,379 | | $ | 826,931 | | $ | 784,455 | | $ | 635,365 | | $ | 615,198 | | $ | 535,127 | |

| Weighted average debt per common share | $ | 10.62 | | $ | 11.15 | | $ | 11.73 | | $ | 10.88 | | $ | 11.70 | | $ | 11.64 | | $ | 9.09 | | $ | 9.51 | | $ | 8.61 | | $ | 8.85 | | $ | 8.65 | |

(1)All per share activity is calculated based on the weighted average shares outstanding for the relevant period, except net increase (decrease) in net assets from capital share transactions, which is based on the common shares outstanding as of the relevant balance sheet date.

(2)Adjusts for the impact of stock-based compensation expense, which is a non-cash expense and has no net impact to net asset value. Pursuant to ASC Topic 718, the expense is offset by a corresponding increase in paid-in capital. Additionally, adjusts for other items attributed to the difference between certain per share data based on the weighted-average basic shares outstanding and those calculated using the shares outstanding as of a period end or transaction date.

(3)The total return for the nine months ended September 30, 2024 and the years ended December 31, 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015 and 2014 equals to the change in the ending market value over the beginning of the period price per share plus distributions paid per share during the period, divided by the beginning price assuming the distribution is reinvested on the date of the distribution. As such, the total return is not annualized. The total return does not reflect any sales load that must be paid by investors.

(4)The ratios are calculated based on weighted average net assets for the relevant period and are annualized.

(5)The portfolio turnover rate for the years ended December 31, 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015 and 2014 equals to the lesser of investment portfolio purchases or sales during the period, divided by the average investment portfolio value during the period. As such, portfolio turnover rate is not annualized.

(6)Includes distributions on unvested restricted stock awards.

RISK FACTORS

You should carefully consider the risk factors described below, and in the section titled “Risk Factors” in the applicable prospectus supplement and any related free writing prospectus, and the risks discussed in the section titled “Item 1A. Risk Factors” in our Annual Report on Form 10-K, the section titled “Item 1A. Risk Factors,” which are incorporated by reference herein, in our Quarterly Reports on Form 10-Q, which are incorporated by reference herein, and any subsequent filings we have made with the SEC that are incorporated by reference into this prospectus or any prospectus supplement, together with all of the other information included in this prospectus, the accompanying prospectus supplement and any documents incorporated by reference herein, including our consolidated financial statements and the related notes thereto, before you decide whether to make an investment in our securities. The risks set out below and described in such documents are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results. If any of the following events occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the net asset value of our common stock and the trading price, if any, of our securities could decline, and you may lose all or part of your investment.

Investors in offerings of our common stock will likely incur immediate dilution upon the closing of such offering.

We generally expect the public offering price of any offering of shares of our common stock to be higher than the book value per share of our outstanding common stock (unless we offer shares pursuant to a rights offering or after obtaining prior approval for such issuance from our stockholders and our independent directors). Accordingly, investors purchasing shares of our common stock in offerings pursuant to this prospectus may pay a price per share that exceeds the tangible book value per share after such offering.

Your interest in us may be diluted if you do not fully exercise your subscription rights in any rights offering. In addition, if the subscription price is less than our NAV per share, then you will experience an immediate dilution of the aggregate NAV of your shares.

In the event we issue subscription rights, stockholders who do not fully exercise their subscription rights should expect that they will, at the completion of a rights offering pursuant to this prospectus, own a smaller proportional interest in us than would otherwise be the case if they fully exercised their rights. We cannot state precisely the amount of any such dilution in share ownership because we do not know at this time what proportion of the shares will be purchased as a result of such rights offering.

In addition, if the subscription price is less than the NAV per share of our common stock, then our stockholders would experience an immediate dilution of the aggregate NAV of their shares as a result of the offering. The amount of any decrease in NAV is not predictable because it is not known at this time what the subscription price and NAV per share will be on the expiration date of a rights offering or what proportion of the shares will be purchased as a result of such rights offering. Such dilution could be substantial. See “Item 1A. Risk Factors—Risks Relating to Our Securities—We have received the approval from our stockholders to issue shares of our common stock at prices below the then current NAV per share of our common stock, subject to certain limitations and with the approval from our independent directors. If we receive such approval from the independent directors, we may periodically issue shares of our common stock at a price below the then current NAV per share of common stock. Any such issuance could materially dilute your interest in our common stock and reduce our NAV per share” in our most recent Annual Report on Form 10-K and “Sales of Common Stock Below Net Asset Value” below.

We may initially invest a portion of the net proceeds of offerings pursuant to this prospectus primarily in high-quality short-term investments, which will generate lower rates of return than those expected from the interest generated on first and second lien senior secured loans, mezzanine debt, including “unitranche” loans, as well as returns generated by other investments permitted by our investment objective.

We may initially invest a portion of the net proceeds of offerings pursuant to this prospectus primarily in cash, cash equivalents, U.S. government securities and other high-quality short-term investments. These securities generally earn yields substantially lower than the income that we anticipate receiving once we are fully invested in accordance with our investment objective. As a result, we may not, for a time, be able to achieve our investment objective and/or we may need to, for a time, decrease the amount of any dividend that we may pay to our stockholders to a level that is substantially lower than the level that we expect to pay when the net proceeds of offerings are fully invested in accordance with our investment objective. If we do not realize yields in excess of our expenses, we may incur operating losses and the market price of our shares may decline.

Our stockholders may receive shares of our common stock as dividends, which could result in adverse cash flow consequences to them.

In order to satisfy the Annual Distribution Requirement applicable to RICs, we have the ability to declare a large portion of a dividend in shares of our common stock instead of in cash. As long as a portion of such dividend is paid in cash (which portion could be as low as 20%) and certain requirements are met, the entire distribution would be treated as a dividend for U.S. federal income tax purposes. As a result, a stockholder would be taxed on 100% of the fair market value of the shares received as part of the dividend on the date a stockholder received it in the same manner as a cash dividend, even though most of the dividend was paid in shares of our common stock.

FORWARD-LOOKING STATEMENTS

The matters discussed in this prospectus, including the documents that we incorporate by reference herein, and any applicable prospectus supplement or free writing prospectus, including the documents we incorporate by reference therein, as well as in future oral and written statements by management of Hercules Capital, Inc., that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Important assumptions include our ability to originate new investments, achieve certain margins and levels of profitability, the availability of additional capital, and the ability to maintain certain debt to asset ratios. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this prospectus should not be regarded as a representation by us that our plans or objectives will be achieved. The forward- looking statements contained in this prospectus and any applicable prospectus supplement or free writing prospectus include statements as to:

•our current and future management structure;

•our future operating results;

•our business prospects and the prospects of our prospective portfolio companies;

•the impact of investments that we expect to make;

•our informal relationships with third parties including in the venture capital industry;

•the expected market for venture capital investments and our addressable market;

•the dependence of our future success on the general economy and its impact on the industries in which we invest;

•our ability to access debt markets and equity markets;

•the occurrence and impact of macro-economic developments (for example, global pandemics, natural disasters, terrorism, international conflicts and war) on us and our portfolio companies;

•the ability of our portfolio companies to achieve their objectives;

•our expected financings and investments;

•our regulatory structure and tax status as a RIC;

•our ability to operate as a BDC and our subsidiaries ability to operate as SBICs;

•the adequacy of our cash resources and working capital;

•the timing of cash flows, if any, from the operations of our portfolio companies;

•the timing, form and amount of any distributions;

•the impact of fluctuations in interest rates on our business;

•the valuation of any investments in portfolio companies, particularly those having no liquid trading market; and

•our ability to recover unrealized depreciation on investments.

You should not place undue reliance on these forward-looking statements. The forward-looking statements made in this prospectus, any free writing prospectus, and the documents incorporated by reference into this prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date of this prospectus.

USE OF PROCEEDS

We intend to use the net proceeds from selling our securities to fund investments in debt and equity securities in accordance with our investment objectives, to make acquisitions, to retire certain debt obligations and for other general corporate purposes. The supplement to this prospectus or any free writing prospectus relating to an offering will more fully identify the use of proceeds from such offering.

We anticipate that substantially all of the net proceeds from any offering of our securities will be used as described above within twelve months, but in no event longer than two years. Pending such uses and investments, we will invest the net proceeds primarily in cash, cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment. Our ability to achieve our investment objective may be limited to the extent that the net proceeds of any offering, pending full investment, are held in lower yielding short-term instruments.

PRICE RANGE OF COMMON STOCK AND DISTRIBUTIONS

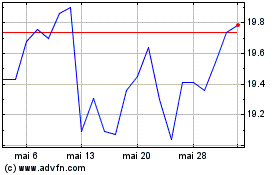

Our common stock is traded on the NYSE under the symbol “HTGC.”

The following table sets forth the range of high and low closing sales prices of our common stock, the sales price as a percentage of NAV and the distributions declared by us for each fiscal quarter. The stock quotations are interdealer quotations and do not include markups, markdowns or commissions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Price Range | | Premium / Discount of High Sales Price to NAV | | Premium / Discount of Low Sales Price to NAV | | Cash Dividend Distribution per Share(2) |

| | NAV(1) | | High | | Low | | | |

| 2022 | | | | | | | | | | | | |

| First quarter | $ | 10.82 | | | $ | 18.23 | | | $ | 16.56 | | | 68.5 | % | | 53.0 | % | | $ | 0.48 | |

| Second quarter | $ | 10.43 | | | $ | 18.91 | | | $ | 12.82 | | | 81.3 | % | | 22.9 | % | | $ | 0.48 | |

| Third quarter | $ | 10.47 | | | $ | 16.13 | | | $ | 11.45 | | | 54.1 | % | | 9.4 | % | | $ | 0.50 | |

| Fourth quarter | $ | 10.53 | | | $ | 14.92 | | | $ | 11.59 | | | 41.7 | % | | 10.1 | % | | $ | 0.51 | |

| 2023 | | | | | | | | | | | | |

| First quarter | $ | 10.82 | | | $ | 16.24 | | | $ | 11.56 | | | 50.1 | % | | 6.8 | % | | $ | 0.47 | |

| Second quarter | $ | 10.96 | | | $ | 15.08 | | | $ | 12.38 | | | 37.6 | % | | 13.0 | % | | $ | 0.47 | |

| Third quarter | $ | 10.93 | | | $ | 18.02 | | | $ | 14.86 | | | 64.9 | % | | 36.0 | % | | $ | 0.48 | |

| Fourth quarter | $ | 11.43 | | | $ | 16.93 | | | $ | 15.09 | | | 48.2 | % | | 32.1 | % | | $ | 0.48 | |

| 2024 | | | | | | | | | | | | |

| First quarter | $ | 11.63 | | | $ | 18.77 | | | $ | 16.67 | | | 61.4 | % | | 43.3 | % | | $ | 0.48 | |

| Second quarter | $ | 11.43 | | | $ | 20.45 | | | $ | 17.96 | | | 78.9 | % | | 57.1 | % | | $ | 0.48 | |

| Third quarter | $ | 11.40 | | | $ | 21.67 | | | $ | 17.71 | | | 90.1 | % | | 55.4 | % | | $ | 0.48 | |

| Fourth quarter (through December 9, 2024) | * | | $ | 20.22 | | | $ | 18.53 | | | * | | * | | $ | 0.48 | |

(1)Net asset value per share is generally determined as of the last day in the relevant quarter and therefore may not reflect the net asset value per share on the date of the high and low sales prices. The net asset values shown are based on outstanding shares at the end of each period.

(2)Represents the dividend or distribution declared in the relevant quarter.

* NAV has not yet been calculated for this period.

The last reported price for our common stock on December 9, 2024 was $19.39 per share.

Shares of BDCs may trade at a market price that is less than the value of the net assets attributable to those shares. The possibility that our shares of common stock will trade at a discount from NAV or at premiums that are unsustainable over the long term are separate and distinct from the risk that our NAV will decrease. At times, our shares of common stock have traded at a premium to NAV and at times our shares of common stock have traded at a discount to the net assets attributable to those shares. It is not possible to predict whether the shares offered hereby will trade at, above, or below NAV.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The information contained under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our most recent Annual Report on Form 10-K and of our Quarterly Reports on Form 10-Q are incorporated by reference herein.

PORTFOLIO COMPANIES

The following tables set forth certain information as of September 30, 2024 regarding each portfolio company in which we had a debt or equity investment. Other than these investments, our only formal relationship with our portfolio companies is the offer to make available significant managerial assistance. In addition, we may have board representation or receive rights to observe the Board of Directors’ meetings of our portfolio companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of September 30, 2024 |

| (dollar amounts in thousands) |

| (unaudited) |

| Portfolio Company | | Type of

Investment | | Maturity Date | | Interest Rate and Floor(1) | | Principal

Amount | | Cost(2) | | Value | | Footnotes |

| Debt Investments | | | | | | | | | | | | | | |

| Biotechnology Tools | | | | | | | | | | | | | | |

PathAI, Inc.

1325 Boylston Street, Suite 10000

Boston, MA 02215 | | Senior Secured | | January 2027 | | Prime + 2.15%, Floor rate 9.15%, 7.85% Exit Fee | | $ | 32,000 | | | $ | 32,572 | | | $ | 33,600 | | | (12)(13) |

| Subtotal: Biotechnology Tools (1.81%)* | | | | | | | | | | 32,572 | | | 33,600 | | | |

| Communications & Networking | | | | | | | | | | | | | | |

Aryaka Networks, Inc.

3945 Freedom Circle, Suite 1100

Santa Clara, CA 95054 | | Senior Secured | | July 2026 | | Prime + 3.25%, Floor rate 6.75%, PIK Interest 1.05%, 3.55% Exit Fee | | $ | 25,351 | | | 25,427 | | | 26,373 | | | (12)(14)(19) |

| Subtotal: Communications & Networking (1.42%)* | | | | | | | | | | 25,427 | | | 26,373 | | | |

| Consumer & Business Services | | | | | | | | | | | | | | |

Altumint, Inc.

4600 Forbes Blvd, Suite 203

Lanham, MD 20706 | | Senior Secured | | December 2027 | | Prime + 3.65%, Floor rate 12.15%, 2.50% Exit Fee | | $ | 10,000 | | | 9,958 | | | 10,107 | | | (15) |

Carwow LTD

2nd Floor, 10 Bressenden Place

London, United Kingdom SW1E 5DH | | Senior Secured | | December 2027 | | Prime + 4.70%, Floor rate 11.45%, PIK Interest 1.45%, 4.95% Exit Fee | | £ | 20,287 | | | 27,650 | | | 27,128 | | | (5)(10)(14) |

Houzz, Inc.

285 Hamilton Avenue, 4th Floor

Palo Alto, CA 94301 | | Convertible Debt | | May 2028 | | PIK Interest 10.00% | | $ | 25,011 | | | 25,011 | | | 25,745 | | | (9)(14) |

Jobandtalent USA, Inc.

12 New Fetter Lane

London, United Kingdom EC4A 1JP | | Senior Secured | | August 2025 | | 1-month SOFR + 8.86%, Floor rate 9.75%, 2.87% Exit Fee | | $ | 13,123 | | | 13,345 | | | 13,345 | | | (5)(10) |

Plentific Ltd

Third Floor Yarnwicke, 119-121 Cannon Street

London, United Kingdom EC4N 5AT | | Senior Secured | | October 2026 | | Prime + 2.55%, Floor rate 11.05%, 2.95% Exit Fee | | $ | 3,325 | | | 3,264 | | | 3,324 | | | (5)(10)(13) |

Provi

1 North Dearborn, Suite 700

Chicago, IL 60602 | | Senior Secured | | December 2026 | | Prime + 4.40%, Floor rate 10.65%, 2.95% Exit Fee | | $ | 15,000 | | | 15,043 | | | 15,229 | | | (15) |

Riviera Partners LLC

141 10thStreet

San Francisco, CA 94103 | | Senior Secured | | April 2027 | | 1-month SOFR + 8.27%, Floor rate 9.27% | | $ | 36,587 | | | 36,161 | | | 34,807 | | | (17)(18) |

RVShare, LLC

155 Montrose West Avenue

Akron, OH 44321 | | Senior Secured | | December 2026 | | 3-month SOFR + 5.50%, Floor rate 6.50%, PIK Interest 4.00% | | $ | 29,771 | | | 29,442 | | | 29,753 | | | (13)(14)(15) |

SeatGeek, Inc.

902 Broadway, 10th Floor

New York, NY 10010 | | Senior Secured | | May 2026 | | Prime + 7.00%, Floor rate 10.50%, PIK Interest 0.50%, 4.00% Exit Fee | | $ | 25,295 | | | 25,313 | | | 25,736 | | | (11)(14)(16) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of September 30, 2024 |

| (dollar amounts in thousands) |

| (unaudited) |

| Portfolio Company | | Type of

Investment | | Maturity Date | | Interest Rate and Floor(1) | | Principal

Amount | | Cost(2) | | Value | | Footnotes |