Filed Pursuant to Rule 424(b)(5)

Registration No. 333-271196

PROSPECTUS SUPPLEMENT

(To the Prospectus Dated May 2, 2023)

Eton Pharmaceuticals, Inc.

583,334 Shares of Common Stock

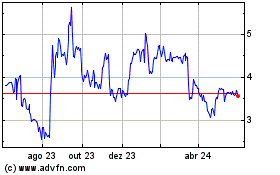

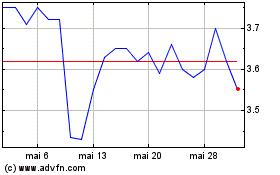

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering in a registered direct offering to an institutional investor, 583,334 shares (the “Shares”) of our common stock at a purchase price of $12.00 per share. Our common stock is listed on the Nasdaq Global Market under the symbol “ETON”. On December 11, 2024, the closing price of our common stock was $12.11 per share.

We are a smaller reporting company as defined under Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and, as such, are subject to certain reduced public company reporting requirements.

An investment in our securities involves a high degree of risk. Please read “Risk Factors” on page S-7 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement before investing in our common stock.

There is no placement agent or underwriter in connection with this offering, and, accordingly, we will receive all of the proceeds from the offering.

| |

|

Per Share

|

|

|

Total

|

|

|

Offering price

|

|

$ |

12.00 |

|

|

$ |

7,000,008.00 |

|

|

Proceeds, before expenses to us

|

|

$ |

12.00 |

|

|

$ |

7,000,008.00 |

|

Delivery of our shares of common stock is expected to be made on or about December 12, 2024, subject to satisfaction of customary closing conditions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December 10, 2024.

TABLE OF CONTENTS

Prospectus

About this Prospectus Supplement

This prospectus supplement and the accompanying prospectus dated May 3, 2023 are part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (“SEC”) utilizing a “shelf” registration process. This prospectus supplement and the accompanying prospectus relate to the offer by us of shares of our common stock. We provide information to you about this offering in two separate documents that are bound together: (1) this prospectus supplement, which describes the specific details regarding this offering; and (2) the accompanying prospectus, which provides general information, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying prospectus or any document incorporated by reference herein prior to the date of this prospectus supplement, you should rely on this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus supplement or the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement. You should also read and consider the information in the documents we have referred you to under the heading “Where You Can Find More Information; Information Incorporated by Reference.” These documents contain important information that you should consider when making your investment decision.

You should rely only on information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with information that is different. We are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus supplement, the accompanying prospectus, the documents and information incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering are accurate only as of their respective dates, regardless of the time of delivery of this prospectus supplement or of any sale of our securities.

In this prospectus supplement, unless the context otherwise indicates, the terms “Eton,” the “Company,” “we,” “our” and “us” or similar terms refer to Eton Pharmaceuticals, Inc.

We use our trademarks in this prospectus supplement as well as trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus supplement appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Cautionary Note Regarding Forward-Looking Statements

This prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, and any free writing prospectus that we have authorized for use in connection with this offering contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein, including statements regarding our future results of operations or financial condition, research and development plans, the anticipated timing, costs, design and conduct of our ongoing and planned preclinical studies and clinical trials for our product candidates, the timing and likelihood of regulatory filings and approvals for our product candidates, our ability to commercialize our product candidates, if approved, and related supply chain disruption on our business, pricing and reimbursement of our product candidates, if approved, the potential to develop future product candidates, the potential benefits of strategic collaborations, the timing and likelihood of success, plans and objectives of management for future operations, and future results of anticipated product development efforts, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein also contain estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this prospectus supplement, and are subject to a number of risks, uncertainties and assumptions, which we discuss in greater detail in the documents incorporated by reference herein, including under the heading “Risk Factors” and elsewhere in this prospectus supplement. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein, whether as a result of any new information, future events, changed circumstances or otherwise. For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Prospectus Supplement Summary

This summary provides an overview of selected information contained elsewhere in or incorporated by reference in this prospectus supplement and the accompanying prospectus and does not contain all the information you should consider before investing in our securities. Therefore, you should read the entire prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering carefully, including the “Risk Factors” section, and other documents or information included or incorporated by reference in this prospectus supplement and the accompanying prospectus before making any investment decision.

Company Overview

Eton is an innovative pharmaceutical company focused on developing and commercializing treatments for rare diseases. The Company currently has five commercial rare disease products, ALKINDI SPRINKLE® for the treatment of adrenocortical insufficiency; Carglumic Acid for the treatment of hyperammonemia due to N-acetylglutamate synthase (“NAGS”) deficiency; Betaine Anhydrous for the treatment of homocystinuria; Nitisinone for the treatment of hereditary tyrosinemia type 1 (HT-1), and PKU GOLIKE® medical formula for patients with phenylketonuria (“PKU”). The Company has three additional product candidates in late-stage development: ET-400, ET-600, and ZENEO® hydrocortisone autoinjector.

ALKINDI SPRINKLE® (hydrocortisone granules) – This product was approved by the FDA in September 2020 as a replacement therapy for Adrenocortical Insufficiency (“AI”) in children under 17 years of age. The product is the first and only FDA-approved granule hydrocortisone formulation designed to help provide accurate dosing for newborns and children with adrenal insufficiency. We acquired U.S. marketing rights to the product in March 2020 and launched ALKINDI SPRINKLE® in December 2020 with a sales force targeting pediatric endocrinologists. We believe there are approximately 10,000 children currently suffering from AI in the United States. ALKINDI SPRINKLE® is protected by three issued patents that extend to 2034.

Carglumic Acid tablets – Our Carglumic Acid product is an FDA-approved generic version of Carbaglu®. Our product is approved for the treatment of acute and chronic hyperammonemia due to NAGS deficiency. We acquired marketing rights to the product in October 2021 and launched the product in December 2021. We promote the product with our internal sales force.

Betaine Anhydrous for Oral Solution – Our Betaine Anhydrous product is an FDA-approved generic version of Cystadane® for the treatment of homocystinuria, a rare inherited condition that is estimated to impact fewer than 2,000 patients in the United States. We acquired the product in September 2022 and launched the product in May 2023.

Nitisinone – Our Nitisinone product is an FDA-approved generic version of Orfadin® for the treatment of tyrosinemia type 1, an ultra-rare inherited condition that is estimated to impact fewer than 500 patients in the United States. We acquired the product in October 2023 and launched the product in February 2024.

PKU GOLIKE® – Our PKU GOLIKE® product is a next generation medical formula product engineered with the patent protected, pharmaceutical grade Physiomimic™ technology for the dietary management of PKU under medical supervision. We acquired the product in March 2024.

ET-400 – Eton submitted a new drug application for the product during 2024, which could allow for an approval and launch of the product in 2025.

ET-600 – Eton expects to submit a new drug application for the diabetes insipidus product during 2025, which could allow for an approval and launch of the product in early 2026.

ZENEO® Hydrocortisone Autoinjector – Our ZENEO® hydrocortisone autoinjector product candidate is a proprietary needle-free autoinjector under development for the treatment of adrenal crisis.

Corporate Information

We are incorporated under the laws of the state of Delaware.

Our corporate headquarters are located at 21925 W. Field Parkway, Suite 235, Deer Park, Illinois, and our telephone number is (847) 787-7361. Our corporate website address is www.etonpharma.com. Information contained on, or accessible through, our website shall not be deemed incorporated into and is not a part of this prospectus or the registration statement of which it forms a part. We have included our website in this prospectus solely as an inactive textual reference.

The Offering

|

Common stock offered by us

|

583,334 shares.

|

| |

|

|

Offering price

|

$12.00 per share of common stock.

|

| |

|

|

Common stock to be outstanding immediately after this offering

|

26,634,797 shares.

|

| |

|

|

Use of proceeds

|

We intend to use the net proceeds from this offering, together with our existing cash and cash equivalents and short-term investments, for general corporate and working capital purposes, including funding acquisition opportunities for products or product candidates when and if they arise. See “Use of Proceeds.”

|

|

Nasdaq Global Market listing

|

Our common stock is listed on the Nasdaq Global Market under the symbol “ETON.”

|

| |

|

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to invest in our securities.

|

The number of shares of common stock to be outstanding after this offering is based on 26,051,463 shares outstanding as of December 11, 2024, and excludes as of that date:

| |

•

|

359,116 shares of common stock issuable upon exercise of warrants outstanding as of December 11, 2024, with an average exercise price of $5.46;

|

| |

•

|

6,003,561 shares of common stock issuable upon the exercise of options outstanding as of December 11, 2024, at a weighted average exercise price of $4.63 per share; and

|

| |

•

|

301,069 shares of common stock issuable upon the vesting of restricted stock units outstanding as of December 11, 2024.

|

Unless otherwise indicated, all information contained in this prospectus supplement assumes or gives effect to the following:

| |

•

|

no exercise of outstanding options or warrants

|

Risk Factors

Investing in our securities involves a high degree of risk. You should carefully review the risks and uncertainties described below and under the section titled “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus, before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business operations.

Risks Relating to This Offering

If you purchase shares of our common stock sold in this offering, you will experience immediate and substantial dilution in the net tangible book value of your shares. In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to investors.

The offering price per share of common stock in this offering exceeds the net tangible book value per share of our outstanding common stock. As a result, investors purchasing shares of common stock in this offering may experience immediate and substantial dilution in the net tangible book value of the shares they purchase. For a more detailed discussion of the foregoing, see the section entitled “Dilution” below. To the extent outstanding stock options or warrants are exercised, there will be further dilution to new investors. In addition, to the extent we need to raise additional capital in the future and we issue additional equity or convertible debt securities, our then existing stockholders may experience dilution and the new securities may have rights senior to those of the securities offered in this offering.

Our management team may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not yield a significant return.

Our management will have broad discretion over the use of proceeds from this offering. We intend to use the net proceeds from this offering, together with our existing cash and cash equivalents and short-term investments, for general corporate and working capital purposes, including funding our research and development. Our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not increase our operating results or enhance the value of our common stock.

Use of Proceeds

We estimate that the net proceeds to us from the sale of securities in this offering will be approximately $7.0 million, after deducting estimated offering expenses payable by us.

We intend to use the net proceeds from this offering, together with our existing cash and cash equivalents and short-term investments, for general corporate and working capital purposes, including funding strategic acquisitions of products and product candidates. The amounts and timing of our actual expenditures will depend on numerous factors as well as the amount of cash used in our operations. We therefore cannot estimate with certainty the amount of net proceeds to be used for the purposes described above. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds. Pending the uses described above, we plan to invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

Description of Securities Offered

Common Stock

Holders of shares of common stock are entitled to one vote per share on all matters to be voted upon by the stockholders generally. Stockholders are entitled to receive such dividends as may be declared from time to time by the board of directors out of funds legally available therefor, and in the event of liquidation, dissolution or winding up of the company to share ratably in all assets remaining after payment of liabilities. The holders of shares of common stock have no preemptive, conversion, subscription or cumulative voting rights. Other material terms and provisions of our common stock are described under the caption “Description of Capital Stock” on page 7 of the accompanying prospectus.

Dilution

If you invest in our securities in this offering, your interest will be diluted to the extent of the difference between the offering price per share and the net tangible book value per share of our common stock after this offering., assuming no value is attributed to the Purchase Warrants issued in this offering. Our net tangible book value per share represents the amount of our total tangible assets reduced by the amount of our total liabilities, divided by the total number of shares of our common stock outstanding. As of September 30, 2024, our net tangible book value was $10.1 million, or $0.39 per share, based on 25,836,204 shares of our common stock outstanding as of September 30, 2024.

After giving effect to our sale in this offering of 583,334 shares of common stock at an offering price of $12.00 per share, after deducting estimated offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2024 would have been $17.1 million, or $0.65 per share. This represents an immediate increase of net tangible book value of $0.26 per share to our existing stockholders and an immediate dilution of $11.35 per share to the investor purchasing securities in this offering. The following table illustrates this per share dilution.

|

Offering price per share of common stock

|

|

|

|

|

|

$ |

12.00 |

|

|

Net tangible book value per share at September 30, 2024

|

|

|

|

|

|

$ |

0.39 |

|

|

Increase per share attributable to new investors purchasing shares in this offering

|

|

|

|

|

|

$ |

0.26 |

|

|

As adjusted net tangible book value per share as of September 30, 2024, after giving effect to this offering

|

|

|

|

|

|

$ |

0.65 |

|

|

Dilution per share to new investors purchasing our common stock in this offering

|

|

|

|

|

|

$ |

11.35 |

|

The above discussion and table are based on 25,836,204 shares outstanding as of September 30, 2024 and excludes as of that date:

| |

• |

359,116 shares of common stock issuable upon exercise of warrants outstanding as of September 30, 2024, with an average exercise price of $5.46; |

| |

|

|

| |

• |

6,083,127 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2024, at a weighted average exercise price of $4.53 per share; and |

| |

|

|

| |

•

|

235,803 shares of common stock issuable upon the vesting of restricted stock units outstanding as of September 30, 2024. |

To the extent that outstanding options or warrants are exercised, you may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that we raise additional capital by issuing equity or convertible debt securities, your ownership will be further diluted.

Plan of Distribution

The shares of common stock are being sold directly to an institutional investor and not through any placement agent or underwriter, so there will be no placement agent or underwriters fees payable by us in the offering.

Delivery of the securities offered hereby is expected to take place on or about December 12, 2024, subject to satisfaction of certain closing conditions.

We estimate the total expenses of this offering paid or payable by us will be approximately $0.03 million.

The purchase and sales under the purchase agreement are registered pursuant to our shelf registration statement on Form S-3 File Number 333-271196 and as to which this prospectus supplement relates.

Trading Market

Our common stock is listed on the Nasdaq Global Market under the symbol “ETON”.

Legal Matters

The validity of the issuance of the securities offered hereby will be passed upon for us by Croke Fairchild Duarte & Beres LLC, Chicago, Illinois.

Experts

The consolidated financial statements as of December 31, 2023 and 2022 and for the years then ended incorporated by reference in this prospectus supplement and in the registration statement have been so incorporated in reliance on the reports of KMJ Corbin & Company LLP, an independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

Where You Can Find More Information; Information Incorporated By Reference

Available Information

We have filed with the SEC a registration statement on Form S-3 under the Securities Act, of which this prospectus supplement forms a part. The rules and regulations of the SEC allow us to omit from this prospectus supplement and the accompanying prospectus certain information included in the registration statement. For further information about us and the securities we are offering under this prospectus supplement, you should refer to the registration statement and the exhibits and schedules filed with the registration statement. With respect to the statements contained in this prospectus supplement and the accompanying prospectus regarding the contents of any agreement or any other document, in each instance, the statement is qualified in all respects by the complete text of the agreement or document, a copy of which has been filed as an exhibit to the registration statement.

We file reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address is www.etonpharma.com. The information on, or accessible through, our website is not part of, and is not incorporated into, this prospectus supplement or the accompanying prospectus and should not be considered part of this prospectus supplement or the accompanying prospectus.

Incorporation By Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus supplement, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement and the accompanying prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus supplement and accompanying prospectus to the extent that a statement contained in this prospectus supplement or the accompanying prospectus modifies or replaces that statement.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus supplement, between the date of this prospectus supplement and the termination of the offering of the securities described in this prospectus supplement. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including our Compensation Committee report and performance graph or any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

This prospectus supplement and the accompanying prospectus incorporate by reference the documents set forth below that have previously been filed with the SEC:

| |

•

|

our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 14, 2024, as amended on March 22, 2024;

|

| |

•

|

our Current Reports on Form 8-K filed with the SEC on March 22, 2024, April 18, 2024, April 30, 2024, May 9, 2024, June 11, 2024, June 21, 2024, July 15, 2024, August 2, 2024, August 8, 2024, October 03, 2024, November 7, 2024, November 12, 2024, November 25, 2024 and December 3, 2024; and

|

| |

•

|

the description of our common stock contained in our registration statement on Form 8-A, filed with the SEC on November 8, 2018 and any amendment or report filed with the SEC for the purpose of updating the description.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus supplement and the accompanying prospectus and deemed to be part of this prospectus supplement and the accompanying prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus supplement and the accompanying prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

Eton Pharmaceuticals, Inc.

Attn: Corporate Secretary

21925 W. Field Parkway, Suite 235

Deer Park, Illinois 60010-7208

847-787-7361

PROSPECTUS

$ 100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Subscription Rights

Units

We may offer and sell, from time to time in one or more offerings, any combination of common stock, preferred stock, debt securities, warrants, subscription rights or units having a maximum aggregate offering price of $100,000,000. When we decide to sell a particular class or series of securities, we will provide specific terms of the offered securities in a prospectus supplement issued in connection with such offering.

The prospectus supplement may also add to, update, modify or amend information contained in, or incorporated by reference into, this prospectus. However, no prospectus supplement shall offer a security that is not registered and described in this prospectus at the time of its effectiveness. You should read this prospectus and any prospectus supplement, as well as the documents incorporated by reference or deemed to be incorporated by reference into this prospectus or a prospectus supplement, carefully before you invest. This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement relating to the offered securities.

Our common stock is traded on The Nasdaq Global Market under the symbol “ETON.” Each prospectus supplement will contain information, where applicable, as to our listing on The Nasdaq Global Market or any other securities exchange of the securities covered by such prospectus supplement.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through a combination of these methods. See “Plan of Distribution” in this prospectus for further details. We may also describe the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale of our securities will also be included in a prospectus supplement.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading “Risk Factors” on page 4 of this prospectus as well as those contained in any applicable prospectus supplement, any related free writing prospectus, and in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 2, 2023

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the sections entitled “Prospectus Summary,” “Risk Factors,” and “Use of Proceeds,” contains forward-looking statements. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning the following:

|

●

|

our future financial and operating results;

|

|

●

|

our intentions, expectations and beliefs regarding anticipated growth, market penetration and trends in our business;

|

|

●

|

the timing and success of our plan of commercialization;

|

|

●

|

our ability to successfully develop and clinically test our product candidates;

|

|

●

|

our ability to file for U.S. Food and Drug Administration (“FDA”) approval of our product candidates through the 505(b)(2) regulatory pathway;

|

|

●

|

our ability to obtain FDA approval for any of our product candidates;

|

|

●

|

our ability to comply with all U.S. and foreign regulations concerning the development, manufacture and sale of our product candidates;

|

|

●

|

the adequacy of the net proceeds of this offering;

|

|

●

|

the effects of market conditions on our stock price and operating results;

|

|

●

|

our ability to maintain, protect and enhance our intellectual property;

|

|

●

|

the effects of increased competition in our market and our ability to compete effectively;

|

|

●

|

our plans to use the proceeds from this offering;

|

|

●

|

costs associated with initiating and defending intellectual property infringement and other claims;

|

|

●

|

the attraction and retention of qualified employees and key personnel;

|

|

●

|

future acquisitions of or investments in complementary companies or technologies; and

|

|

●

|

our ability to comply with evolving legal standards and regulations, particularly concerning requirements for being a public company.

|

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors” and elsewhere in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the Securities and Exchange Commission (“SEC”) as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. Under this shelf registration process, we may offer from time to time securities having a maximum aggregate offering price of $100,000,000. Each time we offer securities pursuant to this prospectus, we will prepare and file with the SEC a prospectus supplement and/or a free writing prospectus (collectively referred to herein as a “prospectus supplement”) that describes the specific amounts, prices and terms of the securities we offer. The prospectus supplement also may add, update or change information contained in this prospectus or the documents incorporated herein by reference. You should read carefully both this prospectus and any prospectus supplement together with additional information described below under the caption “Where You Can Find Additional Information About Us.”

This prospectus does not contain all the information provided in the registration statement we filed with the SEC. For further information about us or our securities offered hereby, you should refer to that registration statement, which you can obtain from the SEC as described below under “Where You Can Find Additional Information About Us.”

You should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized any other person to provide you with different or additional information. If anyone provides you with different, additional or inconsistent information, you should not rely on it. This prospectus is not an offer to sell securities, and it does not constitute solicitation of an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of the date of such documents only. Our business, financial condition, results of operations and prospects may have changed since those dates.

We may sell securities through underwriters or dealers, through agents, directly to purchasers or through any combination of these methods. We and our agents reserve the sole right to accept or reject in whole or in part any proposed purchase of securities. Any prospectus supplement, which we will prepare and file with the SEC each time we offer securities, will set forth the names of any underwriters, agents or others involved in the sale of securities, and any applicable fee, commission or discount arrangements with them. See “Plan of Distribution.”

As used, or incorporated by reference, in this prospectus, unless otherwise stated or the context requires otherwise, the “Company” and terms such as “we,” “us” “our,” and “Eton” refer to Eton Pharmaceuticals, Inc, a Delaware corporation.

PROSPECTUS SUMMARY

The following summary, because it is a summary, may not contain all the information that may be important to you. This prospectus incorporates important business and financial information about Eton that is not included in, or delivered with, this prospectus. Before making an investment, you should read the entire prospectus and any amendment carefully. You should also carefully read the risks of investing discussed under “Risk Factors” and the financial statements included in our other filings with the SEC, including in our most recent Annual Report on Form 10-K and in our most recent subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K filed with the SEC. This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information About Us.”

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus but not delivered with this prospectus. You may request a copy of these filings, excluding the exhibits to such filings which we have not specifically incorporated by reference in such filings, at no cost, by writing us at the following address: 21925 W. Field Parkway, Suite 235, Deer Park, Illinois, 60010.

Our Company

Eton is an innovative pharmaceutical company focused on developing, acquiring, and commercializing innovative products to address unmet needs in patients suffering from rare diseases.

The Company currently has three commercial rare disease products, ALKINDI SPRINKLE® for the treatment of adrenocortical insufficiency, Carglumic Acid for the treatment of hyperammonemia due to N-acetylglutamate synthase (NAGS) deficiency, and Betaine Anhydrous for the treatment of homocystinuria and has three additional product candidates in late-stage development. The Company is developing dehydrated alcohol injection, which has received Orphan Drug Designation for the treatment of methanol poisoning, ZENEO® hydrocortisone autoinjector for the treatment of adrenal crisis, and ET-400.

In addition, the Company is entitled to royalties or milestone payments from five FDA-approved products and one product candidate under development that the Company developed and out-licensed. The products are Alaway® Preservative Free, EPRONTIA®, Cysteine Hydrochloride, ZONISADE™, Biorphen®, and Lamotrigine for Oral Suspension.

The Offering

This prospectus is part of a registration statement that we filed with the SEC utilizing a shelf registration process. Under this shelf registration process, we may sell any combination of:

| |

●

|

common stock;

|

| |

|

|

| |

●

|

preferred stock;

|

| |

|

|

| |

●

|

debt securities;

|

| |

|

|

| |

●

|

warrants to purchase any of the securities listed above;

|

| |

|

|

| |

●

|

subscription rights to purchase any of the securities listed above; and/or

|

| |

|

|

| |

●

|

units consisting of one or more of the foregoing,

|

in one or more offerings up to a total dollar amount of $100,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that specific offering and include a discussion of any risk factors or other special considerations that apply to those securities. The prospectus supplement may also add to, update, amend or modify information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find Additional Information About Us.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information About Us.”

RISK FACTORS

An investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the risk factors described below together with all of the risks, uncertainties and assumptions described in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we subsequently file with the SEC. If any of the risks incorporated by reference occurs, our business, operations and financial condition could suffer significantly. As a result, you could lose some or all of your investment in our Common Stock. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, operations and financial condition or cause the value of our Common Stock to decline.

USE OF PROCEEDS

Except as may be stated in the applicable prospectus supplement, we intend to use the net proceeds we receive from the sale of the securities offered by this prospectus for business expansion and general corporate purposes, which may include, among other things, repayment of debt, capital expenditures, the financing of possible acquisitions or in-licensing of additional product candidates, increasing our working capital and the financing of ongoing operating expenses and overhead. Pending the application of the net proceeds, we may invest the proceeds in marketable securities and short-term investments.

DESCRIPTIONS OF THE SECURITIES WE MAY OFFER

The descriptions of the securities contained in this prospectus, together with any applicable prospectus supplement, summarize all the material terms and provisions of the various types of securities that we may offer. We will describe in the applicable prospectus supplement relating to a particular offering the specific terms of the securities offered by that prospectus supplement. We will indicate in the applicable prospectus supplement if the terms of the securities differ from the terms we have summarized below. We will also include in the prospectus supplement information, where applicable, material U.S. federal income tax considerations relating to the securities.

We may sell from time to time, in one or more offerings:

| |

●

|

shares of our common stock;

|

| |

|

|

| |

●

|

shares of our preferred stock;

|

| |

|

|

| |

●

|

debt securities;

|

| |

|

|

| |

●

|

warrants to purchase any of the securities listed above;

|

| |

|

|

| |

●

|

subscription rights to purchase any of the securities listed above; and/or

|

| |

|

|

| |

●

|

units consisting of one or more of the foregoing.

|

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

DESCRIPTION OF CAPITAL STOCK

General

As of March 31, 2023, our authorized capital stock consists of 50,000,000 shares of common stock, par value $0.001 per share, of which 25,504,378 shares are issued and outstanding, held of record by approximately eight stockholders, and 10,000,000 shares of preferred stock, par value $0.001 per share, of which none are issued and outstanding. The following description summarizes the most important terms of our capital stock. Because it is only a summary, it does not contain all the information that may be important to you. For a complete description, you should refer to our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws and to the applicable provisions of Delaware law.

The authorized and unissued shares of common stock and preferred stock are available for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities may be listed. Unless approval of our stockholders is so required, our board of directors will not seek stockholder approval for the issuance and sale of our common stock or our preferred stock.

Common Stock

Holders of shares of common stock are entitled to one vote per share on all matters to be voted upon by the stockholders generally. Stockholders are entitled to receive such dividends as may be declared from time to time by the board of directors out of funds legally available therefor, and in the event of liquidation, dissolution or winding up of the company to share ratably in all assets remaining after payment of liabilities. The holders of shares of common stock have no preemptive, conversion, subscription or cumulative voting rights.

Preferred Stock

Our Amended and Restated Certificate of Incorporation authorizes the issuance of preferred stock (“Preferred Stock”) from time to time in one or more series. The Board of Directors of the Company (the “Board of Directors”) is hereby expressly authorized to provide for the issue of any or all of the unissued and undesignated shares of the Preferred Stock in one or more series, and to fix the number of shares and to determine or alter for each such series, such voting powers, full or limited, or no voting powers, and such designation, preferences, and relative, participating, optional, or other rights and such qualifications, limitations, or restrictions thereof, as shall be stated and expressed in the resolution or resolutions adopted by the Board of Directors providing for the issuance of such shares and as may be permitted by the Delaware General Corporation Law (“DGCL”). The Board of Directors is also expressly authorized to increase or decrease the number of shares of any series subsequent to the issuance of shares of that series, but not below the number of shares of such series then outstanding. In case the number of shares of any series shall be decreased in accordance with the foregoing sentence, the shares constituting such decrease shall resume the status that they had prior to the adoption of the resolution originally fixing the number of shares of such series. The number of authorized shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of the stock of the Company entitled to vote thereon, without a separate vote of the holders of the Preferred Stock, or of any series thereof, unless a vote of any such holders is required pursuant to the terms of any certificate of designation filed with respect to any series of Preferred Stock.

If the Preferred Stock contains any restriction on the repurchase or redemption of shares by the registrant while there is any arrearage in the payment of dividends or sinking fund installments, such restrictions will be described in the prospectus supplement.

Transfer Agent and Registrar; Market

The transfer agent and registrar for our common stock is Computershare Investor Services. Its address is 462 S. Fourth Street, Suite 1600, Louisville, KY 40202 and its telephone number is (800) 962-4284. Our common stock is listed on The Nasdaq Global Market under the symbol “ETON.”

See “Where You Can Find Additional Information About Us” elsewhere in this prospectus for information on where you can obtain copies of our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws, which have been filed with and are publicly available from the SEC.

Anti-Takeover Effects of Certain Provisions of Delaware Law and Our Charter Documents

The following is a summary of certain provisions of the DGCL, our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws. This summary does not purport to be complete and is qualified in its entirety by reference to the DGCL and our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws.

Effect of Delaware Anti-Takeover Statute. We are subject to Section 203 of the DGCL, an anti-takeover law. In general, Section 203 prohibits a Delaware corporation from engaging in any business combination (as defined below) with any interested stockholder (as defined below) for a period of three years following the date that the stockholder became an interested stockholder, unless:

| |

●

|

prior to that date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

| |

|

|

| |

●

|

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares of voting stock outstanding (but not the voting stock owned by the interested stockholder) those shares owned by persons who are directors and officers and by excluding employee stock plans in which employee participants do not have the right to determine whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

| |

|

|

| |

●

|

on or subsequent to that date, the business combination is approved by the board of directors of the corporation and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

Section 203 defines “business combination” to include the following:

| |

●

|

any merger or consolidation involving the corporation and the interested stockholder;

|

| |

|

|

| |

●

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

| |

|

|

| |

●

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

| |

|

|

| |

●

|

subject to limited exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

| |

|

|

| |

●

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203 defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation, or who beneficially owns 15% or more of the outstanding voting stock of the corporation at any time within a three-year period immediately prior to the date of determining whether such person is an interested stockholder, and any entity or person affiliated with or controlling or controlled by any of these entities or persons.

Our Charter Documents. Our charter documents include provisions that may have the effect of discouraging, delaying or preventing a change in control or an unsolicited acquisition proposal that a stockholder might consider favorable, including a proposal that might result in the payment of a premium over the market price for the shares held by our stockholders. Certain of these provisions are summarized in the following paragraphs.

Effects of Authorized But Unissued Common Stock. One of the effects of the existence of authorized but unissued common stock may be to enable our Board of Directors to make more difficult or to discourage an attempt to obtain control of our Company by means of a merger, tender offer, proxy contest or otherwise, and thereby to protect the continuity of management. If, in the due exercise of its fiduciary obligations, the Board of Directors were to determine that a takeover proposal was not in our best interest, such shares could be issued by the Board of Directors without stockholder approval in one or more transactions that might prevent or render more difficult or costly the completion of the takeover transaction by diluting the voting or other rights of the proposed acquirer or insurgent stockholder group, by putting a substantial voting block in institutional or other hands that might undertake to support the position of the incumbent Board of Directors, by effecting an acquisition that might complicate or preclude the takeover, or otherwise.

Cumulative Voting. Our Amended and Restated Certificate of Incorporation does not provide for cumulative voting in the election of directors, which would allow holders of less than a majority of the stock to elect some directors.

Vacancies. Our Amended and Restated Certificate of Incorporation provides that all vacancies may be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum.

Special Meeting of Stockholders and Stockholder Action by Written Consent. A special meeting of stockholders may only be called by our president, Board of Directors, or such officers or other persons as our board may designate at any time and for any purpose or purposes as shall be stated in the notice of the meeting.

DESCRIPTION OF WARRANTS

The following description, together with the additional information we may include in any applicable prospectus supplement, summarizes the material terms and provisions of the warrants that we may offer under this prospectus and any related warrant agreements and warrant certificates. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the specific terms of any series of warrants in more detail in the applicable prospectus supplement. If we indicate in the prospectus supplement, the terms of any warrants offered under that prospectus supplement may differ from the terms described below. Specific warrant agreements will contain additional important terms and provisions and will be incorporated by reference as an exhibit to the registration statement which includes this prospectus.

General

We may issue warrants for the purchase of common stock, preferred stock and debt securities in one or more series. We may issue warrants independently or together with common stock, preferred stock and debt securities, and the warrants may be attached to or separate from these securities.

We may evidence each series of warrants by warrant certificates that we may issue under a separate agreement. We may enter into a warrant agreement with a warrant agent. Each warrant agent may be a bank, transfer agent or trust company that we select which has its principal office in the United States. We may also choose to act as our own warrant agent. We will indicate the name and address of any warrant agent in the applicable prospectus supplement relating to a particular series of warrants.

We will describe in the applicable prospectus supplement the terms of the series of warrants, including:

| |

●

|

the offering price and aggregate number of warrants offered;

|

| |

|

|

| |

●

|

if applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with each such security or each principal amount of such security;

|

| |

|

|

| |

●

|

if applicable, the date on and after which the warrants and the related securities will be separately transferable;

|

| |

|

|

| |

●

|

in the case of warrants to purchase debt securities, the principal amount of debt securities purchasable upon exercise of one warrant and the price at, and currency in which, this principal amount of debt securities may be purchased upon such exercise;

|

| |

|

|

| |

●

|

in the case of warrants to purchase common stock or preferred stock, the number or amount of shares of common stock or preferred stock, as the case may be, purchasable upon the exercise of one warrant and the price at, and currency in which, these shares may be purchased upon such exercise;

|

| |

|

|

| |

●

|

the manner of exercise of the warrants, including any cashless exercise rights;

|

| |

|

|

| |

●

|

the warrant agreement under which the warrants will be issued;

|

| |

|

|

| |

●

|

the effect of any merger, consolidation, sale or other disposition of our business on the warrant agreement and the warrants;

|

| |

|

|

| |

●

|

anti-dilution provisions of the warrants, if any;

|

| |

|

|

| |

●

|

the terms of any rights to redeem or call the warrants;

|

| |

|

|

| |

●

|

any provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants;

|

| |

|

|

| |

●

|

the dates on which the right to exercise the warrants will commence and expire or, if the warrants are not continuously exercisable during that period, the specific date or dates on which the warrants will be exercisable;

|

| |

|

|

| |

●

|

the manner in which the warrant agreement and warrants may be modified;

|

| |

|

|

| |

●

|

the identities of the warrant agent and any calculation or other agent for the warrants;

|

| |

●

|

federal income tax consequences of holding or exercising the warrants;

|

| |

|

|

| |

●

|

the terms of the securities issuable upon exercise of the warrants;

|

| |

|

|

| |

●

|

any securities exchange or quotation system on which the warrants or any securities deliverable upon exercise of the warrants may be listed or quoted; and

|

| |

|

|

| |

●

|

any other specific terms, preferences, rights or limitations of or restrictions on the warrants.

|

Before exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise, including:

| |

●

|

in the case of warrants to purchase debt securities, the right to receive payments of principal of, or premium, if any, or interest on, the debt securities purchasable upon exercise or to enforce covenants in the applicable indenture; or

|

| |

|

|

| |

●

|

in the case of warrants to purchase common stock or preferred stock, the right to receive dividends, if any, or, payments upon our liquidation, dissolution or winding up or to exercise voting rights, if any.

|

Exercise of Warrants

Each warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price that we describe in the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement, holders of the warrants may exercise the warrants at any time up to 5:00 P.M. eastern time on the expiration date that we set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Holders of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with specified information and paying the required exercise price by the methods provided in the applicable prospectus supplement. We will set forth on the reverse side of the warrant certificate, and in the applicable prospectus supplement, the information that the holder of the warrant will be required to deliver to the warrant agent.

Upon receipt of the required payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement, we will issue and deliver the securities purchasable upon such exercise. If fewer than all of the warrants represented by the warrant certificate are exercised, then we will issue a new warrant certificate for the remaining amount of warrants.

Enforceability of Rights By Holders of Warrants

Any warrant agent will act solely as our agent under the applicable warrant agreement and will not assume any obligation or relationship of agency or trust with any holder of any warrant. A single bank, transfer agent or trust company may act as warrant agent for more than one issue of warrants. A warrant agent will have no duty or responsibility in case of any default by us under the applicable warrant agreement or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate legal action the holder’s right to exercise, and receive the securities purchasable upon exercise of, its warrants in accordance with their terms.

Warrant Agreement Will Not Be Qualified Under Trust Indenture Act

No warrant agreement will be qualified as an indenture, and no warrant agent will be required to qualify as a trustee, under the Trust Indenture Act. Therefore, holders of warrants issued under a warrant agreement will not have the protection of the Trust Indenture Act with respect to their warrants.

Governing Law

Each warrant agreement and any warrants issued under the warrant agreements will be governed by Delaware law.

Calculation Agent

Any calculations relating to warrants may be made by a calculation agent, an institution that we appoint as our agent for this purpose. The prospectus supplement for a particular warrant will name the institution that we have appointed to act as the calculation agent for that warrant as of the original issue date for that warrant, if any. We may appoint a different institution to serve as calculation agent from time to time after the original issue date without the consent or notification of the holders. The calculation agent’s determination of any amount of money payable or securities deliverable with respect to a warrant will be final and binding in the absence of manifest error.

DESCRIPTION OF DEBT SECURITIES

We may issue debt securities, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. When we offer to sell debt securities, we will describe the specific terms of any debt securities offered from time to time in a supplement to this prospectus, which may supplement or change the terms outlined below. Senior debt securities will be issued under one or more senior indentures, dated as of a date prior to such issuance, between us and a trustee to be named in a prospectus supplement, as amended or supplemented from time to time. Any subordinated debt securities will be issued under one or more subordinated indentures, dated as of a date prior to such issuance, between us and a trustee to be named in a prospectus supplement, as amended or supplemented from time to time. We have filed forms of the senior trust indenture and subordinated indenture as exhibits to the registration statement of which this prospectus is a part. The indentures will be subject to and governed by the Trust Indenture Act of 1939, as amended.

The indentures in the forms initially filed as exhibits to the registration statement of which this prospectus forms a part do not limit the amount of debt securities that we may issue, including senior debt securities, senior subordinated debt securities, subordinated debt securities and junior subordinated debt securities, and do not limit us from issuing any other debt, including secured and unsecured debt. We may issue debt securities up to an aggregate principal amount as we may authorize from time to time. The terms of each series of debt securities will be established by or pursuant to (a) a supplemental indenture, (b) a resolution of our Board of Directors, or (c) an officers’ certificate pursuant to authority granted under a resolution of our Board of Directors. For the complete terms of the debt securities, you should refer to the applicable prospectus supplement and the form of indentures for those particular debt securities. The prospectus supplement will describe the terms of any debt securities being offered, including:

| |

●

|

the title;

|

| |

|

|

| |

●

|

the principal amount being offered, and if a series, the total amount authorized and the total amount outstanding;

|

| |

|

|

| |

●

|

any limit on the amount that may be issued;

|

| |

|

|

| |

●

|

whether or not we will issue the series of debt securities in global form, the terms and who the depositary will be;

|

| |

|

|

| |

●

|

the maturity date;

|

| |

|

|

| |

●

|

the annual interest rate, which may be fixed or variable, or the method for determining the rate and the date interest will begin to accrue, the dates interest will be payable and the regular record dates for interest payment dates or the method for determining such dates;

|

| |

|

|

| |

●

|

whether and under what circumstances, if any, we will pay additional amounts on any debt securities held by a person who is not a U.S. person for tax purposes, and whether we can redeem the debt securities if we have to pay such additional amounts;

|

| |

|

|

| |

●

|

whether or not the debt securities will be secured or unsecured, and the terms of any secured debt;

|

| |

|

|

| |

●

|

the terms of the subordination of any series of subordinated debt;

|

| |

|

|

| |

●

|

the place where payments will be payable;

|

| |

|

|

| |

●

|

restrictions on transfer, sale or other assignment, if any;

|

| |

|

|

| |

●

|

our right, if any, to defer payment of interest and the maximum length of any such deferral period;

|

| |

|

|

| |

●

|

the date, if any, after which, and the price at which, we may, at our option, redeem the series of debt securities pursuant to any optional or provisional redemption provisions and the terms of those redemption provisions;

|

| |

|

|

| |

●

|

the date, if any, on which, and the price at which we are obligated, pursuant to any mandatory sinking fund or analogous fund provisions or otherwise, to redeem, or at the holders’ option to purchase, the series of debt securities and the currency or currency unit in which the debt securities are payable;

|

| |

|

|

| |

●

|

any restrictions on our ability and the ability of our subsidiaries to:

|

| |

|

|

| |

●

|

incur additional indebtedness;

|

| |

●

|

issue additional securities;

|

| |

|

|

| |

●

|

create liens;

|

| |

|

|

| |

●

|

pay dividends and make distributions in respect of our capital stock and the capital stock of our subsidiaries;

|

| |

|

|

| |

●

|

redeem capital stock;

|

| |

|

|

| |

●

|

place restrictions on our ability and our subsidiaries’ ability to pay dividends, make distributions or transfer assets;

|

| |

|

|

| |

●

|

make investments or other restricted payments;

|

| |

|

|

| |

●

|

sell or otherwise dispose of assets;

|

| |

|

|

| |

●

|

enter into sale-leaseback transactions;

|

| |

|

|

| |

●

|

engage in transactions with stockholders and affiliates;

|

| |

|

|

| |

●

|

effect a consolidation or merger;

|

| |

|

|

| |

●

|

whether the indenture will require us to maintain any interest coverage, fixed charge, cash flow-based, asset-based or other financial ratios;

|

| |

|

|

| |

●

|

discussion of any material United States federal income tax considerations applicable to the debt securities;

|

| |

|

|

| |

●

|

information describing any book-entry features;

|

| |

|

|

| |

●

|

provisions for a sinking fund purchase or other analogous fund, if any;

|

| |

|

|

| |

●

|

the denominations in which we will issue the series of debt securities

|

| |

|

|

| |

●

|

the currency of payment of debt securities if other than U.S. dollars and the manner of determining the equivalent amount in U.S. dollars; and

|

| |

|

|

| |

●

|

any other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities, including any additional events of default or covenants provided with respect to the debt securities, and any terms that may be required by us or advisable under applicable laws or regulations.

|

Conversion or Exchange Rights

We will set forth in the prospectus supplement the terms on which a series of debt securities may be convertible into or exchangeable for our common stock or our other securities. We will include provisions as to whether conversion or exchange is mandatory, at the option of the holder or at our option. We may include provisions pursuant to which the number of shares of our common stock or our other securities that the holders of the series of debt securities receive would be subject to adjustment.

DESCRIPTION OF UNITS

We may issue units comprised of one or more of the other securities described in this prospectus or in any prospectus supplement in any combination. Each unit will be issued so that the holder of the unit is also the holder, with the rights and obligations of a holder, of each security included in the unit. The unit agreement under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately, at any time or at any time before a specified date or upon the occurrence of a specified event or occurrence.

The applicable prospectus supplement will describe:

| |

●

|

the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

|

| |

|

|

| |

●

|

any unit agreement under which the units will be issued;

|

| |

|

|

| |

●

|

any provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units; and

|

| |

|

|

| |

●

|

whether the units will be issued in fully registered or global form.

|

DESCRIPTION OF SUBSCRIPTION RIGHTS