false

0001106644

0001106644

2024-12-12

2024-12-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 12, 2024

CHINA PHARMA HOLDINGS, INC.

(Exact name of Registrant as specified in charter)

| Nevada |

|

001-34471 |

|

73-1564807 |

| (State or other jurisdiction |

|

(Commission File No.) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

Second Floor, No. 17, Jinpan Road

Haikou, Hainan Province, China 570216

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: +86 898-6681-1730 (China)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17CFR230.425) |

| ☐ | Soliciting

material pursuant to Rule14a-12 under the Exchange Act (17CFR240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

CPHI |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 12, 2024,

China Pharma Holdings Inc.. (the “Company”) entered into that certain securities purchase agreement (the

“SPA”) with certain institutional investor (the “Investor”) with respect to

an at-the-market offering under which the Investor may purchase, and the Company may sell within the commitment period

from December 12, 2024 to December 31, 2024, at the Investor’s sole discretion, shares of the Company’s common stock,

par value $0.001 per share (the “Common Stock”), having an aggregate offering price of

up to $600,000 (the “Shares”) (the “Offering”). Any Shares offered and sold in the Offering will be issued

pursuant to the Company’s shelf Registration Statement on Form S-3 (File No. 333-276481) filed with the Securities

and Exchange Commission (the “SEC”) on January 12, 2024, as amended, which was declared effective on February 14,

2024, the related prospectus contained therein, and the prospectus supplement relating to the Offering filed with the SEC on

December 13, 2024.

The Investor may acquire our

Common Stock through one or more closings upon our receipt of purchase notices. The number of our Common Stock will be determined based

on the at-the-market price equal to the lower of (i) the closing price the day prior to the purchase notice or (ii) the five (5) day average

closing prices as reported by Bloomberg or on the NYSE American Market’s website,

but in no event shall the per share price be lower than $0.15, which is to be stated in the purchase notice subject to repricing adjustments

as contemplated under the SPA as follows. In the event the Company’s delivery of the shares is not confirmed by 1:00 pm E.T. on

the trading day the purchase notice is submitted, the Investor has the right to adjust the purchase price to match the at-the-market price

on the date of the delivery of the purchase notice, which is only permitted if the market price on the delivery day is lower than the

previously established price. Further, the Investor, has the right, in its sole discretion, to return to the Company any or all the shares

issued under the SPA within one business day following the initial receipt of such shares and prior to the payment of the purchase price

to the Company if, based on price discovery or market conditions, the Investor determines that the issuance of such shares is unfavorable.

Additionally, the Company

also provided “most favored nation” treatment (the “MFN”) to the Investor should the Company enter into

any financing, transaction, settlement, or similar agreement with more favorable terms within thirty (30) days after the effective date

of this SPA. In the event any of the forgoing events occurs during the term above referenced, such more favorable terms shall be retroactively

applied to all closed purchases and any future purchases under the SPA (the “MFN Adjustments”) as if the more favorable

terms had been in effect prior to each closing. MFN Adjustments may include but are not limited to, at-the-market price discounts, the

inclusion of warrants, or anti-dilution/true-up provisions. The difference in value from the MFN adjustments shall be issued to the Investor

as a convertible note.

The actual proceeds to the

Company will vary depending on the number of shares sold and the prices of such sales. Because there is no minimum offering amount required

as a condition to close this offering, the actual total offering amount and proceeds to us, if any, are not determinable

at this time.

The offering of our Common

Stock pursuant to the SPA will terminate on the earlier of (i) the date on which the Investor has purchased our Common Stock in a value

equal to $600,000, (ii) the date on which the Registration Statement is no longer effective, or (iii) December 31, 2024, unless extended

or terminated earlier in accordance with the terms of the SPA.

The foregoing description

of the SPA is not complete and is qualified in its entirety by reference to the full text of the SPA, a copy of which is filed herewith

as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference. A copy of the opinion of Flangas Law Group

relating to the legality of the issuance and sale of the Shares in the Offering is attached as Exhibit 5.1 hereto.

This Current Report on Form

8-K shall not constitute an offer to sell or the solicitation of an offer to buy the securities discussed herein, nor shall there be any

offer, solicitation, or sale of the securities in any state in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: December 13, 2024

| |

CHINA PHARMA HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Zhilin Li |

| |

|

Name: |

Zhilin Li |

| |

|

Title: |

President and Chief Executive Officer |

3

Exhibit 1.1

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this

“Agreement”) is made and entered into as of December 12, 2024, by and between China Pharma Holdings, Inc. (CPHI)

a Nevada corporation (the “Company”), and [__________]

(the “Purchaser”). The Purchaser and the Company, each a “Party” and collectively, the “Parties.”

RECITALS

WHEREAS, subject to the terms and conditions set forth in this

Agreement, the Company and the Purchaser desire to enter into this transaction to purchase the securities outlined herein under an effective

shelf registration statement on Form S-3 (Registration Number 333-276481) (the “Registration Statement”), which has at least

US$600,000 in unallocated securities registered thereunder. This Registration Statement has been declared effective in accordance with

the Securities Act of 1933, as amended (the “1933 Act”), by the United States Securities and Exchange Commission (the “SEC”).

WHEREAS, The Company desires to issue and sell to the Purchaser,

and the Purchaser desires to purchase from the Company shares of the Company’s common stock, par value $0.001 per share (“Common

Stock”), and, as applicable, with an aggregate purchase amount of up to US$600,000.

WHEREAS, the Purchaser may acquire Common Stock through one

or more Closings by submitting one or more Purchase Notices (each, a “Purchase Notice”) based on the At-the-Market Price,

which shall be confirmed on the day prior to the designated Closing Date and subject to repricing adjustments as outlined in this Agreement;

WHEREAS, the Common Stock issued under this Agreement will be

registered for resale by the Purchaser under the Company’s effective shelf registration statement filed with the United States Securities

and Exchange Commission (the “Shelf Registration Statement”);

WHEREAS, each purchase of Common Stock will be limited to up

to 4.99% of the outstanding Common Stock, with any balance exceeding such percentage acquired in a manor to be mutually agreed upon by

the Parties.

NOW, THEREFORE, for good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, the Parties hereby agree as follows:

ARTICLE I

DEFINITIONS

For purposes of this Agreement, the following terms shall have the

meanings set forth below:

“Affiliate” means any Person that, directly or indirectly

through one or more intermediaries, controls, is controlled by, or is under common control with a Person, as such terms are used in and

construed under Rule 405 of the Securities Act.

“At The Market Value”

shall mean the lower of (i) the previous day’s closing price or (ii) the five (5) day average closing price as reported by Bloomberg

or on the NYSE American Market’s website and in accordance with NYSE Rule Section 312.03(c).

“Base Prospectus” refers to the prospectus, dated

February 6, 2024, contained within the Registration Statement as filed with the U.S. Securities and Exchange Commission.

“Beneficial Ownership Limitation” means a limitation,

not exceeding 4.99%, on the beneficial ownership of outstanding shares of Common Stock by the Purchaser immediately following a Closing.

Any shares in excess of this limit will be acquired in a manor to be mutually agreed upon by the Parties in writing and shall be incorporated

by reference as an amendment to the this agreement.

“Blanket Issuance Authorization” is an authorization

granted by the Company’s board of directors permitting the issuance of shares up to the total number of Commitment Shares as outlined

in this Agreement.

“Blanket Legal Opinion” is a legal opinion provided

by the Company’s counsel confirming the eligibility of the Share Issuances under the effective Registration Statement and applicable

laws.

“Business Day” means any day other than a Saturday,

Sunday, or other day on which commercial banks in New York City are authorized or required by law to close.

“Closing” means the completion of each purchase

and sale of Common Stock pursuant to a Purchase Notice as described in Section 2.1.

“Closing Date” refers to the date(s) by which the Purchaser’s

payment obligation must be fulfilled, provided that the following conditions have been met: (i) execution of all Transaction Documents,

(ii) the Purchaser’s submission of Exhibit A, the “Purchase Notice,” and (iii) the Company’s delivery of shares

in accordance with the instructions provided on the preceding day.

“Commitment Amount” is the total dollar amount of

the Company’s Common Stock that the Purchaser commits to purchase under the terms of this Agreement.

“Commitment Period” is the period beginning on the

Effective Date of this Agreement and ending on the earlier of (i) the date on which the Purchaser has purchased Common Stock equal to

the Maximum Commitment Amount, (ii) the date on which the Registration Statement is no longer effective, or (iii) December 31, 2024, unless

extended or terminated earlier in accordance with the terms of this Agreement.

“Commission” means the United States Securities

and Exchange Commission.

“Common Stock” means the Company’s common

stock, par value $0.001 per share, and any class of securities into which such securities may hereafter be reclassified or changed.

“Daily Penalty” has the meaning

set forth in Section 2.3.5(a).

“Delivery Failure” refers to the failure of the

Company to deliver the Purchased Shares through DWAC within the specified time frame following the receipt of a valid Purchase Notice

from the Purchaser.

“DWAC” (Deposit/Withdrawal at Custodian) means the

electronic transfer system used to deposit and withdraw securities at The Depository Trust Company in accordance with the Company’s

Transfer Agent instructions.

“Effective Date” is the date on which this Agreement

is executed by both parties.

“Exchange Act” refers to the Securities Exchange

Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Irrevocable Transfer Agent Instruction” or “ITAI”

refers to documented instructions that allow the Purchaser to direct the issuance and transfer of the Common Stock referenced in this

Agreement, held in the Share Reservation.

“Medallion Signature Waiver” is a waiver that negates

the need for a Medallion Signature guarantee for the Purchaser when transferring shares, accompanied by an indemnity provision favoring

the Transfer Agent against any related claims.

“Most Favored Nations Clause” refers to the provisions

granting the Purchaser certain rights in the event the Company grants more favorable terms to another party, as set forth in Section 4.2.1

of this Agreement.

“Person” means an individual, corporation, partnership,

trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency

or subdivision thereof), or other entity of any kind.

“Purchase Amount” means the total amount specified

by the Purchaser in each Purchase Notice, based on the At-the-Market Price.

“Purchase Notice” refers to a formal notification

by the Purchaser to the Company specifying the number of shares to be purchased under the terms set forth in Exhibit A of this Agreement,

within the limitations of the Commitment Amount.

“RegSHO Short Sale” is the condition under which

the Purchaser is deemed to sell shares it does not yet own or has borrowed, complying with the regulations under Regulation SHO, including

marking requirements and applicable restrictions.

“Reliance Letter” is a directive for the Transfer

Agent to rely on an external legal opinion regarding the validity of share issuances under this Agreement if deemed necessary by both

parties.

“SEC Required Filings” are the mandatory filings

that the Company must submit to the SEC, including but not limited to Forms 10-K, 10-Q, 8-K, and any other necessary documents.

“Share Reservation” is the obligation for the Company

to reserve shares equivalent to the Commitment Amount within five (5) business days of signing this Agreement, confirmed by a receipt

from the Transfer Agent.

“Securities Act” means the Securities Act of 1933,

as amended, and the rules and regulations promulgated thereunder.

“Total Outstanding Shares” refers to the total number

of issued shares of the Company’s Common Stock as verified by the Transfer Agent at the time of each issuance under this Agreement.

“Trading Day” means any day on which the principal

Trading Market is open for trading.

“Trading Market” means any of the markets or exchanges

on which the Common Stock is listed or quoted, including the NYSE American, or any other successor marketplace.

“Transaction Documents” means this Agreement, the

Purchase Notice, the Share Reservation Instructions, the ITAI, the Blanket Opinion Letter, the Blanket Issuance Authorization, and the

Medallion Signature Waiver.

“Transfer Agent” means Equiniti Trust Company.

“Total Outstanding Shares” means the total

number of issued and outstanding shares of the Company’s Common Stock as verified by the Transfer Agent at the time of Closing pursuant

to this Agreement.

ARTICLE II

CLOSING AND SETTLEMENT

2.1. PURCHASE

AND SALE

| 2.1.1. | Timing of Delivery and Payment |

The Closing of each transaction is initiated by a Purchase Notice and

shall occur on the following business day after the confirmed delivery of the Purchased Shares, marking the due date for the Purchase

Price to be paid to the Company by wire transfer, subject to any applicable price adjustments.

The Company is required to deliver the Shares according to the DWAC

(Deposit/Withdrawal at Custodian) instructions specified in the Purchase Notice. Delivery shall be deemed complete when the Shares are

successfully transferred to the Purchaser’s account per these instructions.

| 2.1.3. | Payment of Purchase Price |

The Purchaser is required to pay the Purchase Price by Wire Transfer

on or before the Closing.

| 2.1.4. | Purchase Price Floor |

Notwithstanding anything to the contrary in this Agreement, the Purchaser

and the Company agree that no shares of the Company’s Common Stock shall be sold or purchased under this Agreement at a price per

share below $0.15 (the “Purchase Price Floor”), unless mutually agreed in writing by both parties.

| 2.1.5. | Purchase Price Adjustments |

If the Company’s delivery of Common Stock, as per the Purchase

Notice, is not confirmed by 1 pm ET on the Trading Day it was submitted, the Purchaser has the right to adjust the purchase price listed

in Exhibit A to match the current At-the-Market price on the date of delivery. This adjustment is permitted only if the market price on

the delivery day is lower than the previously established price. The updated Exhibit A reflecting this adjustment must be submitted along

with the Wire Transfer Receipt.

A Delivery Failure occurs if the Company does not deliver the Shares

on the required date as specified in the Purchase Notice. In the event of a Delivery Failure, the Purchaser shall be entitled to the following

remedies:

| a) | Daily Penalty for Delay: A 4% daily penalty, calculated

based on the Notional Value of the undelivered Shares, shall accrue until the delivery obligation is fulfilled. |

| b) | Extended Delivery Failure: If a Delivery Failure extends

beyond two (2) trading days, the Purchaser shall be entitled to additional compensation for any damages or trading losses directly resulting

from complications in trade settlement. The Purchaser may submit substantiated documentation, including but not limited to records of

broken trades, trade confirmations, and any other complications arising from the delay, along with a detailed accounting of fees and

losses incurred due to the extended Delivery Failure. |

2.2. CONDITIONS

TO PURCHASER’S CLOSING OBLIGATIONS

The Purchaser’s obligation to purchase the Shares is subject

to the fulfillment of each of the following conditions at or prior to each Closing:

| a) | Effectiveness of Registration Statement: The Registration

Statement must be effective and must remain effective for the issuance of Shares as of each Closing Date, as well as the Company remaining

in good standing with all timely filings required by the SEC. |

| b) | Accuracy of Representations and Warranties: All representations

and warranties made by the Company in this Agreement shall be true and correct in all material respects as of each Closing Date. |

| c) | Performance of Covenants: The Company shall have performed,

satisfied, and complied with all covenants, agreements, and conditions required by this Agreement in all material respects. |

| d) | Executed Transaction Documents: The Purchaser shall

have executed and delivered all required Transaction Documents and submitted a completed Exhibit A “Purchase Notice.” |

2.3. CONDITIONS

TO COMPANY’S CLOSING OBLIGATIONS

The Company’s obligation to issue and sell the Shares is subject

to the fulfillment of each of the following conditions at or prior to each Closing:

| a) | Delivery of Purchase Price: The Purchaser shall have

delivered the Purchase Price in accordance with the instructions provided by the Company. |

| b) | Accuracy of Representations and Warranties: All representations

and warranties made by the Company in this Agreement shall be true and correct in all material respects as of each Closing Date. |

| c) | Performance of Covenants: The Purchaser shall have

performed, satisfied, and complied with all covenants, agreements, and conditions required by this Agreement in all material respects. |

| d) | Submission of Purchase Notice: The Purchaser shall

have submitted a completed Exhibit A “Purchase Notice” containing the total number of shares being acquired and the final terms

based on the At-the-Market purchase price. |

ARTICLE III

COVENANTS AND REPRESENTATIONS

3.1.

COMPANY COVENANTS AND REPRESENTATIONS

The Company makes the following covenants and representations to the

Purchaser, acknowledging that the Purchaser is relying on these covenants and representations as a material inducement to enter into this

Agreement:

| 3.1.1. | Corporate Status and Authorization |

The Company is duly organized, validly existing, and in good standing

under the laws of its jurisdiction of incorporation. The Company has all requisite corporate power and authority to enter into this Agreement,

perform its obligations hereunder, and consummate the transactions contemplated by this Agreement.

The Shares to be issued under this Agreement will be, when issued and

delivered against payment in full as provided in this Agreement, duly authorized, validly issued, fully paid, non-assessable, and free

from all liens and encumbrances.

The execution, delivery, and performance of this Agreement by the Company,

including the issuance of the Shares, will not result in (i) a violation of the Company’s Certificate of Incorporation or Bylaws,

(ii) a breach of any agreement to which the Company is a party, or (iii) a violation of any law or governmental order applicable to the

Company.

The Company is in compliance with all periodic reporting requirements

of the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company has filed all reports required

to be filed under the Exchange Act and has not received any notification from the SEC or any other regulatory authority indicating any

deficiency in compliance with applicable regulations.

| 3.1.5. | No Material Non-Public Information |

The Company represents that it has reviewed and understands the Purchaser’s

“Chinese Wall Policy” and has not, and will not, disclose any Material Non-Public Information (MNPI) that could impact the Purchaser’s

ability to trade the Company’s stock. The Company shall promptly notify the Purchaser if it becomes aware of any inadvertent disclosure

of MNPI and take all necessary actions to remediate the disclosure.

| 3.1.6. | Reservation of Shares |

The Company shall at all times maintain a reserve from its duly authorized

shares of Common Stock sufficient to enable the full issuance of the Commitment Amount under this Agreement.

| 3.1.7. | Right to Return Shares |

Notwithstanding any other provision of this Agreement, the Purchaser

shall have the right, at its sole discretion, to return to the Company any or all Shares issued under this Agreement within 1 Business

Day following the initial receipt of such Shares and prior to Closing (the “Return Period”) if, based on price discovery or

market conditions, the Purchaser determines that the issuance of such Shares is unfavorable.

The Purchaser shall provide written notice to the Company during

the Return Period, specifying the number of Shares to be returned (the “Returned Shares”) and the basis for the return.

Upon the Company’s receipt of the Returned Shares, the

Company shall promptly cancel such Shares on its books and records.

The Purchaser shall be entitled to a credit or refund of the

corresponding Exercise Price or consideration paid for the Returned Shares, which shall be applied toward any future purchase obligations

or refunded to the Purchaser within [5] Business Days of the return.

The Returned Shares must be free of any encumbrances, liens,

or third-party claims arising from the Purchaser’s actions, except as set forth in this Agreement.

This clause shall not affect the Purchaser’s rights or

obligations under this Agreement with respect to Shares that are not returned within the Return Period.

| 3.1.8. | Compliance with Laws |

The Company shall comply with all applicable federal, state, and local

laws and regulations, including securities laws, and shall maintain all licenses and permits necessary to conduct its business.

| 3.1.9. | No Violation of Others’ Rights |

The Company’s execution and performance of this Agreement will

not conflict with or violate any rights of any third party, including creditors and shareholders of the Company, or result in the creation

of any lien or encumbrance on any assets or properties of the Company.

3.2.

PURCHASER COVENANTS AND REPRESENTATIONS

The Purchaser makes the following covenants and representations to

the Company, acknowledging that the Company is relying on these covenants and representations as a material inducement to enter into this

Agreement:

| 3.2.1. | Accredited Investor Status |

The Purchaser represents and warrants that it is an “accredited

investor” as defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”),

or a “qualified institutional buyer” as defined in Rule 144A under the Securities Act.

The Purchaser is acquiring the Shares for its own account for investment

purposes only and not with a view to, or for sale in connection with, any distribution thereof within the meaning of the Securities Act.

| 3.2.3. | Authority and Authorization |

The Purchaser has all necessary power and authority to enter into this

Agreement, perform its obligations hereunder, and consummate the transactions contemplated by this Agreement. This Agreement constitutes

the valid and binding obligation of the Purchaser, enforceable against it in accordance with its terms.

The execution, delivery, and performance of this Agreement by the Purchaser

do not (i) conflict with any governing documents of the Purchaser, (ii) breach any contract or agreement to which the Purchaser is a party,

or (iii) violate any applicable law or governmental regulation.

| 3.2.5. | Compliance with Securities Laws |

The Purchaser shall comply with all applicable securities laws in connection

with the purchase of Shares under this Agreement. The Purchaser represents that it understands the securities laws applicable to the purchase,

holding, and disposition of the Shares.

| 3.2.6. | No Material Non-Public Information |

The Purchaser acknowledges that it is not receiving any Material Non-Public

Information (MNPI) from the Company or any representative of the Company and agrees not to solicit MNPI from the Company or its representatives.

| 3.2.7. | Access to Information |

The Purchaser has had access to the Company’s filings with the

SEC and has been afforded (i) the opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives

of the Company concerning the terms and conditions of the Offering, (ii) access to information about the Company sufficient to enable

it to evaluate its investment, and (iii) the opportunity to obtain such additional information as it has deemed necessary to make an informed

investment decision.

| 3.2.8. | No General Solicitation |

The Purchaser represents that it was not solicited by any form of general

solicitation or general advertising in connection with its purchase of the Shares, including, but not limited to, any advertisement, article,

notice, or other communication published in any newspaper, magazine, or similar media, or broadcast over television, radio, or the internet.

ARTICLE IV

RIGHTS AND ENTITLEMENTS

4.1.

COMPANY RIGHTS AND ENTITLEMENTS

The Company shall have the following rights and entitlements under

this Agreement:

| 4.1.1. | Right to Refuse Non-Compliance |

The Company reserves the right to refuse any Purchase Notice or other

instructions from the Purchaser if it determines, in good faith, that such notice or instruction does not comply with the terms of this

Agreement or applicable securities laws. The Company shall notify the Purchaser in writing of the basis for any such refusal within one

business day of receipt of the Purchase Notice.

| 4.1.2. | Right to Monitor Purchaser Compliance |

The Company retains the right to verify the Purchaser’s compliance

with applicable securities laws, including, but not limited to, determining the Purchaser’s adherence to accreditation standards.

The Company shall conduct any such verification in a commercially reasonable manner and without undue interference with the Purchaser’s

operations.

| 4.1.3. | Right to Withdraw Registration Statement |

The Company reserves the right to withdraw or suspend the Registration

Statement at any time due to changes in applicable securities laws, regulatory orders, or significant corporate events, provided that

it notifies the Purchaser promptly and takes all reasonable actions to minimize any adverse effects on the Purchaser.

| 4.1.4. | Right to Enforce Covenants |

The Company has the right to enforce all covenants and obligations

agreed upon by the Purchaser, including, but not limited to, representations regarding compliance with securities laws, confidentiality,

and adherence to the terms set forth in this Agreement.

In the event that the Purchaser fails to complete payment by the next

business day following confirmation of share delivery, the Company reserves the right to cancel the applicable Purchase Notice. Upon exercising

this Right to Cancel, the Purchaser is required to Reverse DWAC the Purchased Shares to the Company’s Transfer Agent.

4.2.

PURCHASER RIGHTS AND ENTITLEMENTS

The Purchaser shall have the following rights and entitlements under

this Agreement:

| 4.2.1. | Most Favored Nations (MFN) Rights |

For thirty (30) days following the Effective Date of this Agreement,

should the Company enter into any financing, transaction, settlement, or similar agreement with more favorable terms than those provided

to the Purchaser hereunder, such favorable terms shall be retroactively applied to all closed tranches and any future tranches within

the Agreement.

| a) | MFN Trigger and Trigger Date: The MFN Rights are triggered if the Company enters into any transaction, settlement, or exchange

with terms that would have provided a more favorable economic outcome when adopting such terms in past Closings. The MFN Trigger Date

is the date of such transaction. |

| b) | MFN Adjustments: Any adjustment shall apply to past and, if applicable, future transactions as if the more favorable terms

had been in effect prior to each closing. Adjustments may include but are not limited to, At-The-Market price discounts, the inclusion

of warrants, or anti-dilution/true-up provisions. |

| c) | Adjustment Mechanism: The difference in value from the MFN adjustments shall be issued to the Purchaser as a Convertible Note

(the “Adjustment Note”). The Adjustment Note shall be calculated based on the notional value at each closing and shall include

any applicable Default Interest or Penalties. |

Upon triggering the MFN clause, the Adjustment Note will be issued

to the Purchaser under the following conditions:

| a) | Adjustment Note Value Calculation: The value of the Adjustment Note shall be determined by calculating the difference in the

economic value of any prior closings by including the more favorable terms in any and all prior closings, plus if applicable, any accrued

interest and penalties from the MFN Trigger Date until the time the Company has cured the defaults under the Adjustment Note. |

| b) | Initial Terms: The Adjustment Note shall initially be non-interest-bearing and convertible at the At-The-Market price. If the

current S3 registration lacks the capacity to register the Note, the Company must file an S-1 Registration Statement within twenty (20)

days of the MFN trigger date. |

| c) | Failure to Register or File within Twenty (20) Business Days: If the Company fails to file an S-1 Registration Statement within

twenty (20) days of the MFN Trigger Date, the Adjustment Note will accrue interest retroactively at an 8% per annum rate from the Trigger

Date. Additionally, it will become convertible at a 15% discount to the prevailing market price. |

| d) | Failure to Register within Sixty (60) Business Days: Should the Company fail to register the underlying Common Stock of the

Adjustment Note within sixty (60) Business Days of the MFN Trigger, a Failure to Register penalty equal to 8% of the Adjustment Note’s

Current Value shall be added to the principal each week until the Adjustment Note is registered or fully converted into Common Stock by

the Purchaser. |

| e) | Confession of Judgment: The Adjustment Note shall include a Confession of Judgment, permitting the Purchaser to seek a legal

validation of any accrued fees, damages, or legal costs associated with enforcing the Purchaser’s rights, if necessary. |

| f) | Inclusion in Irrevocable Transfer Agent Instruction (ITAI): The Adjustment Note will be included within the ITAI, enabling

the Purchaser to direct the Transfer Agent to reserve shares equivalent to the Adjustment Note balance, convert shares at its discretion,

and if unregistered, instruct the Transfer Agent to remove any restrictive legend per the Reliance Letter and accompanying legal opinion

on exemption from registration requirements. |

| 4.2.3. | Notification Requirement |

The Company shall notify the Purchaser in writing within three (3)

Business Days of any Triggering Event that may impact the economic value or rights of prior closings, including any new securities issuance,

transaction, or material event that affects the terms of this Agreement.

| 4.2.4. | Notification Penalty |

In the event the Company fails to notify the Purchaser of a Triggering

Event, a 10% Default Penalty shall be applied to the Adjustment Note’s Value.

The Purchaser shall have the right to audit the Company’s compliance

with the Most Favored Nations (MFN) Clause. The Purchaser may request, and the Company shall promptly provide all relevant documents and

records necessary to verify compliance with the MFN terms.

ARTICLE V

MISCELLANEOUS

5.1. ARBITRATION

Any dispute, controversy, or claim arising out of, relating to, or

in connection with this Agreement, including any question regarding its existence, validity, or termination, shall be resolved through

binding arbitration. The arbitration shall be conducted in Florida in accordance with the rules of the American Arbitration Association

(AAA) or JAMS then in effect. Judgment on the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof.

5.2. LIMITATION

OF LIABILITY

Each party’s aggregate liability to the other party arising out of

or relating to this Agreement, whether in contract, tort (including negligence), breach of statutory duty, or otherwise, shall be limited

to the total dollar amount of the Commitment Amount specified in Section 1.11 of this Agreement. In no event shall either party be liable

to the other for any indirect, incidental, consequential, special, or punitive damages, including lost profits or business opportunities,

even if advised of the possibility of such damages.

5.3. GOVERNING

LAW

This Agreement shall be governed by and construed in accordance with

the laws of the State of Florida, without regard to its conflicts of law principles. Both parties agree to submit to the exclusive jurisdiction

of the state and federal courts located within the State of Florida for the purposes of enforcing any arbitration award under this Agreement

or for any other actions not subject to arbitration.

5.4. ENTIRE

AGREEMENT

This Agreement, together with all exhibits and schedules attached hereto,

constitutes the entire understanding between the parties with respect to the subject matter hereof, superseding all prior negotiations,

discussions, agreements, and understandings, whether written or oral. No modification, amendment, or waiver of any provision of this Agreement

shall be effective unless in writing and signed by both parties.

5.5. SEVERABILITY

If any provision or portion of this Agreement is found to be invalid,

illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision

of this Agreement or invalidate or render unenforceable, such provision in any other jurisdiction. The remaining provisions of this Agreement

shall remain in full force and effect, and the invalid or unenforceable provision shall be amended or replaced by a valid, enforceable

provision that most closely achieves the parties’ original intent.

5.6. WAIVER

No waiver by either party of any breach or non-fulfillment of any provision

of this Agreement shall be deemed to be a waiver of any subsequent breach or non-fulfillment, and no waiver shall be effective unless

it is in writing and signed by the waiving party.

5.7. COUNTERPARTS

This Agreement may be executed in any number of counterparts, each

of which shall be deemed an original, and all of which together shall constitute one and the same instrument. Signatures delivered via

electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

5.8. FORCE MAJEURE

Neither party shall be liable for any delay or failure to perform its

obligations under this Agreement (except for payment obligations) if such delay or failure is due to events beyond the reasonable control

of the affected party, including acts of God, fire, flood, war, terrorism, government action, labor disputes, or other similar events.

5.9. NOTICES

All notices or other communications required or permitted under this

Agreement shall be in writing and shall be deemed effectively given (i) upon personal delivery to the party to be notified, (ii) when

sent by email or facsimile if sent during regular business hours of the recipient, or (iii) one (1) business day after deposit with a

reputable overnight courier, specifying next-day delivery, with written verification of receipt. Notices shall be sent to the respective

parties at the addresses set forth below or to such other address as may be designated by a party in writing.

5.10. HEADINGS

The headings in this Agreement are included for convenience of reference

only and shall not affect the interpretation of this Agreement.

5.11. COUNTERPARTS;

ELECTRONIC SIGNATURES

This Agreement may be executed in any number of counterparts, each

of which shall be deemed an original and all of which together shall constitute one and the same agreement. A signed copy of this Agreement

delivered by facsimile, e-mail, or other electronic transmission shall be deemed to have the same legal effect as delivery of an original

signed copy of this Agreement.

{Signature Page Follows}

IN WITNESS WHEREOF, the parties hereto have executed this Securities

Purchase Agreement as of the date first written above.

| China Pharma Holdings, Inc. | |

| | | |

| By: | | |

| Name: | Zhilin Li | |

| Title: | CEO & Chairman | |

| Purchaser: |

|

| |

|

|

| [__________] |

|

| |

|

| By: |

|

|

| Name: |

[__________] |

|

| Title: |

[__________] |

|

Exhibits:

Exhibit A – Purchase Notice

Exhibit B – Issuance Authorization

Exhibit C - Irrevocable Transfer Agent Instruction Letter &

Medallion Signature Waiver

Exhibit D - Legal Opinion Letter

11

Exhibit 5.1

FLG Flangas

Law Group

Writer’s email: kps@fdlawlv.com

December 12, 2024

Equiniti Trust Company

Attn: Chad Dalton

Transfer Department

1110 Centre Pointe Curve, Suite 101

Mendota Heights, MN 55120

chad.dalton@equiniti.com

Board of Directors

China Pharma Holdings, Inc.

Second Floor, No. 17, Jinpan Road

Haikou, Hainan Province, China 570216

| Re: | China Pharma Holdings, Inc. |

Ladies and Gentlemen:

We have acted as special Nevada

counsel to China Pharma Holdings, Inc., a Nevada corporation (the “Company”), in connection with a Registration Statement

on Form S-3 (File No. 333-276481) (the “Registration Statement”), heretofore filed with the U.S. Securities and Exchange

Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”) and declared

effective by the SEC on February 14, 2024, with respect to the registration of up to $50,000,000 of any combination of (i) common stock,

par value $0.001 per share (the “Common Stock”), of the Company, (ii) preferred stock, par value $0.001 per share,

of the Company (the “Preferred Stock”), (iii) debt securities of the Company (the “Debt Securities”),

(iv) warrants to purchase Common Stock, Preferred Stock, Debt Securities or Units (as defined below) (“Warrants”),

(v) units comprised of Common Stock, Preferred Stock, Debt Securities and Warrants in any combination (“Units”) or

(vi) rights to purchase shares of Common Stock or Preferred Stock (“Rights”). The Common Stock, Preferred Stock, Warrants,

Debt Securities, Units and Rights are sometimes referred to collectively herein as the “Securities.” Securities may

be issued in an unspecified number (with respect to Common Stock, Preferred Stock, Warrants, Units and Rights) or in an unspecified principal

amount (with respect to Debt Securities). The Registration Statement provides that the Securities may be offered separately or together,

in separate series, in amounts, at prices and on terms to be set forth in one or more prospectus supplements (each a “Prospectus

Supplement”) to the prospectus contained in the Registration Statement. As of December 12, 2024, the Company has entered into

a Securities Purchase Agreement with Liqueous LP (the “Securities Purchase Agreement”) to purchase a total number of

up to 4,000,000 shares of Common Stock with an aggregate purchase amount of up to $600,000, not to exceed 20% of the outstanding Common

Stock. We are providing this letter to express our opinion confirming the eligibility of the issuance of the Common Stock pursuant to

the Securities Purchase Agreement.

3275 South Jones Blvd., Suite 105 | Las Vegas, Nevada 89146 | Phone: (702) 307-9500 | Fax: (702) 382-9452

December 12, 2024

Page 2 of 4

In arriving at the opinion

expressed below, we have examined such corporate proceedings, records and documents, and such matters of law, as we have considered necessary

for the purposes of this opinion. As to matters of fact, we have examined and relied upon the representations of the Company contained

in the Registration Statement and, where we have deemed appropriate, representations or certificates of officers of the Company or public

officials. As part of our examination, we have examined the following documents, among others:

A. the Registration Statement

(including the prospectus contained therein);

B. the Securities Purchase

Agreement;

C. the Articles of Incorporation

of the Company;

D. the Bylaws of the Company;

E. a Certificate of Good Standing

issued by the Secretary of State of the State of Nevada, dated December 11, 2024, certifying that the Company is in existence and in good

standing in the State of Nevada;

F. certain resolutions of

the Board of Directors of the Company;

L. certain certificates of

the officers of the Company certifying as to certain factual matters.

In rendering the opinion expressed

below, we have assumed without verification the genuineness of all signatures, the legal capacity of natural persons, the authenticity

of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as copies and the authenticity

of the originals of such copies, and the due authorization, execution and delivery of all documents by all parties and the validity, binding

effect and enforceability thereof (other than the authorization, execution and delivery of documents by the Company and the validity,

binding effect and enforceability thereof upon the Company). In addition, we have assumed and not verified the accuracy as to the factual

matters of each document we have reviewed and the accuracy of, and each applicable party’s full compliance with, any representations

and warranties contained therein. Accordingly, we are relying upon (without any independent investigation thereof) the truth and accuracy

of the statements, covenants, representations and warranties set forth in the documents we have reviewed.

Based upon the foregoing and

subject to the assumptions, exceptions, limitations and qualifications set forth herein, we are of the opinion that:

1. The

Company is a corporation validly existing and in good standing under the laws of the state of Nevada.

December 12, 2024

Page 3 of 4

2. The

Securities Purchase Agreement has been duly authorized, executed and delivered by the Company.

3. The

shares of Common Stock to be purchased pursuant to the Securities Purchase Agreement have been duly authorized for issuance and sale pursuant

to the Securities Purchase Agreement and, when issued and delivered by the Company pursuant to the Securities Purchase Agreement against

payment of the consideration set forth therein, will be validly issued, fully paid and nonassessable.

4. The

execution and delivery of the Securities Purchase Agreement by the Company, and the performance by the Company of its obligations under

such agreement (other than performance by the Company of its indemnification obligations, as to which no opinion is rendered) will not

result in any (i) violation of the provisions of the Articles of Incorporation, as amended, or bylaws of the Company; (ii) conflict with

or result in a breach of any of the terms and provisions of, or constitute a default (or an event which with notice or lapse of time,

or both, would constitute a default) under, or result in the creation or imposition of any lien, charge or encumbrance upon any property

or assets of the Company or any of its subsidiaries pursuant to, any of the agreements (the “Material Agreements”) that are

exhibits contained in filings made by the Company pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and incorporated by reference in the Registration Statement; or (iii) will not result in any violation of any federal

or Nevada law or, to our knowledge any administrative regulation or administrative or court decree, applicable to the Company.

5.

No consent, approval, authorization or other order of, or registration or filing with, any

court or other governmental or regulatory authority or agency, is required for the consummation of the transactions contemplated by

the Securities Purchase Agreement, except such as have been obtained or made by the Company and are in full force and effect under

the Securities Act or applicable state securities or blue sky laws.

6. To

our knowledge, the Company is not in violation of its Articles of Incorporation, as amended, or in default under any of the Material Agreements,

except for such violation or default as would not, individually or in the aggregate, result in a Material Adverse Change.

We render this opinion only

with respect to, and we express no opinion herein concerning the application or effect of the laws of any jurisdiction other than, the

existing laws of the state of Nevada. We express no opinion with respect to any other laws or with respect to the “blue sky”

securities laws of any state.

We render this opinion subject

to applicable bankruptcy, insolvency (including, without limitation, all laws relating to fraudulent transfer or conveyance), reorganization,

moratorium and other similar laws affecting creditors’ rights generally and to general principles of equity (regardless of whether

enforcement is sought in a proceeding in equity or at law), including, without limitation, (a) the possible unavailability of specific

performance, injunctive relief or any other equitable remedy and (b) concepts of materiality, reasonableness, good faith and fair dealing,

and we express no opinion herein with respect to provisions relating to severability or separability.

December 12, 2024

Page 4 of 4

No opinion is expressed herein

as to any matter pertaining to the contents of the Registration Statement, other than as and to the extent expressly stated herein with

respect to the authorization and issuance of the Common Stock.

This opinion is limited to

the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein. This opinion speaks

only as of the date of this letter, and we do not undertake by delivery of this opinion or otherwise to advise you of any change in any

matter set forth herein, whether based on a change in law (whether by legislative action, judicial decision, administrative decision or

otherwise) or a change in any fact arising subsequent to the date hereof that might affect any of the opinions expressed herein.

This opinion is furnished

for the benefit of the addressee hereof and for use solely in connection with the transactions contemplated by the Securities Purchase

Agreement and may not be used, circulated, quoted or otherwise relied upon for any other purpose.

| |

Very truly yours, |

| |

|

| |

/s/ FLANGAS LAW GROUP |

| |

FLANGAS LAW GROUP |

Exhibit 99.1

China Pharma Announces the Entry of “At-The-Market”

Equity Offering

HAIKOU CITY, December 13, 2024 – China

Pharma Holdings, Inc. (NYSE American: CPHI) (“China Pharma,” or the “Company”), a specialty pharmaceutical company,

today announced that it has filed a prospectus supplement with the U.S. Securities and Exchange Commission (the “SEC”) under

which the Company may offer and sell from time to time shares of common stock, par value $0.001 per share (the “Common Stock”),

with an aggregate offering price of up to $600,000 (the “Financing”).

The shares will be offered pursuant to a certain

Securities Purchase Agreement (the “SPA”) the Company entered into with certain investor (the “Investor”) on December

12, 2024. Pursuant to the SPA, the Investor agrees to, at its discretion, purchase, from time to time over the commitment period from

December 12, 2024 through December 31, 2024, through one or more closings, up to $600,000 worth of the Common Stock, at the prices related

to prevailing market prices, which equals to the lower of (i) the closing price the day prior to the purchase notice, or (ii) the five

(5) day average closing prices of the Company as reported by Bloomberg or on the NYSE American Market’s website and in accordance

with NYSE Rule Section 312.03(c), provided, in no event shall the price per share be lower than $0.15 per share. The timing of any sales

and the number of Common Stock sold, if any, will depend on a variety of factors to be determined by the Investor. There can be no assurance

that the Company will be able to issue and sell any Common Stock.

The prospectus supplement filed today adds to,

updates or otherwise changes information contained in the accompanying prospectus contained in the Company’s shelf registration

statement on Form S-3 (File No. 333-276481) filed by the Company with the SEC on January 12, 2024, as amended, and which became effective

on February 6, 2024. Prospective investors should read the prospectus in that registration statement and the prospectus supplement (including

the documents incorporated by reference therein) for more complete information about the Company and the Financing, including the risks

associated with investing in the Company. Copies of the prospectus supplement and related prospectus may be obtained from China Pharma

Holdings, Inc., Attn: Zhilin Li, 2nd Floor, No. 17, Jinpan Road, Haikou, Hainan Province, China 570216. You may also obtain these documents

free of charge when they are available by visiting EDGAR on the SEC’s website at www.sec.gov.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy, nor will there be any sale of these securities, in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Any offer, solicitation or sale will be made only by means of the prospectus supplement and the accompanying prospectus.

About China Pharma Holdings, Inc.

China Pharma

Holdings, Inc. is a specialty pharmaceutical company that develops, manufactures and markets a diversified portfolio of products,

focusing on conditions with high incidence and high mortality rates in China, including cardiovascular, CNS, infectious, and

digestive diseases. The Company’s cost-effective business model is driven by market demand and supported by new GMP-certified

product lines covering the major dosage forms. In addition, the Company has a broad and expanding nationwide distribution network

across all major cities and provinces in China. The Company’s wholly-owned subsidiary, Hainan Helpson Medical &

Biotechnology Co., Ltd., is located in Haikou City, Hainan Province. For more information about China Pharma Holdings, Inc., please

visit http://www.chinapharmaholdings.com/ The Company routinely posts important information on

its website.

Forward-Looking Statements

Certain statements in

this press release constitute forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation

Reform Act of 1995. Any statements set forth above that are not historical facts are forward-looking statements that involve risks and

uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such risks and uncertainties

may include, but are not limited to: the achievability of financial guidance; success of new product development; unanticipated changes

in product demand; increased competition; downturns in the Chinese economy; uncompetitive levels of research and development; and other

information detailed from time to time in the Company’s filings and future filings with the United States Securities and Exchange Commission.

The forward-looking statements made herein speak only as of the date of this press release and the Company undertakes no duty to update

any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations, except as required

by applicable law or regulation.

For more information, please contact Investor Relations:

China Pharma Holdings, Inc.

Ms. Diana Na Huang

Phone: +86-898-6681-1730 (China)

Email: hps@chinapharmaholdings.com

v3.24.3

Cover

|

Dec. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 12, 2024

|

| Entity File Number |

001-34471

|

| Entity Registrant Name |

CHINA PHARMA HOLDINGS, INC.

|

| Entity Central Index Key |

0001106644

|

| Entity Tax Identification Number |

73-1564807

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

Second Floor

|

| Entity Address, Address Line Two |

No. 17, Jinpan Road

|

| Entity Address, Address Line Three |

Haikou

|

| Entity Address, City or Town |

Hainan Province

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

570216

|

| City Area Code |

86

|

| Local Phone Number |

898-6681-1730

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CPHI

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

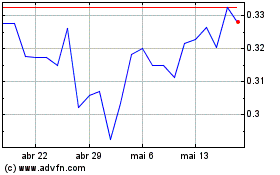

China Pharma (AMEX:CPHI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

China Pharma (AMEX:CPHI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025