ANNEX A

The following sets forth, as of the

date of this Schedule 13D, the aggregate number and percentage of Class A ordinary shares beneficially owned by each of the

Reporting Persons, as well as the number of Class A ordinary shares as to which each Reporting Person has the sole power to

vote or to direct the vote, sole power to dispose or to direct the disposition, or shared power to dispose or to direct the

disposition of as of the date hereof.

| Reporting Person | |

Amount beneficially owned(1) | |

Percent of class(2) | |

Sole power to vote or direct the vote | |

Shared power to vote or to direct the vote | |

Sole power to dispose or to direct the disposition of | |

Shared

power to

dispose or

to direct

the

disposition

of |

| INEOS | |

| 49,880,646 | | |

| 56.23 | % | |

| 0 | | |

| 49,880,646 | | |

| 0 | | |

| 49,880,646 | |

| James A. Ratcliffe | |

| 0 | (3) | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Trawlers | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| (1) | INEOS is the record holder of 33,692,463 Class B ordinary shares, which are convertible on a one-for-one basis into Class A

ordinary shares at any time at the option of the holder. |

| (2) | Based on 55,016,448 Class A ordinary shares outstanding as of the close of business on August 16, 2024, and assumes conversion

of the Class B ordinary shares held by the Reporting Persons. |

| (3) | James A. Ratcliffe, Andy Currie and John Reece collectively have voting and investment power over the Ordinary Shares held by INEOS.

James A. Ratcliffe, Andy Currie and John Reece each disclaim beneficial ownership over the Ordinary Shares held by INEOS and neither the

filing of this Amendment No. 1 nor any of its contents shall be deemed to constitute an admission by James A. Ratcliffe, Andy Currie and

John Reece that they are the beneficial owners of any of the Class A ordinary shares referred to herein for purposes of Section 13(d)

or 13(g) of the Securities Exchange Act of 1934, as amended, or for any other purpose. |

EXHIBIT

I

Joint Filing AGREEMENT

In accordance with Rule 13d-1(k)(1) promulgated under the Securities

Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with each other on behalf of each of them of such a

statement on Schedule 13D with respect to the Class A ordinary shares of Manchester United plc beneficially owned by each of them. This

Joint Filing Agreement shall be included as an Exhibit to such Amendment No. 1.

IN WITNESS WHEREOF, the undersigned hereby execute this Joint Filing

Agreement as of the 18th day of December, 2024.

| |

INEOS LIMITED |

|

| |

|

|

|

| |

By: |

/s/ Simon Morland |

|

| |

|

Name: Simon Morland |

|

| |

|

Title: Officer |

|

| |

JAMES A. RATCLIFFE |

|

| |

|

|

|

| |

By: |

/s/ Jonathan Ginns** |

|

| |

|

|

|

| |

TRAWLERS LIMITED |

|

| |

|

|

|

| |

By: |

/s/ Tim Shepherd |

|

| |

|

Name: Tim Shepherd |

|

| |

|

Title: Officer |

|

** The Power of Attorney, executed

by James A. Ratcliffe authorizing the signatory to sign and file Amendment No.1 on James A. Ratcliffe’s behalf, filed as Exhibit

B to the Original Schedule 13D.

EXHIBIT J

ASSIGNMENT AND ASSUMPTION

AGREEMENT

ASSIGNMENT AND ASSUMPTION

AGREEMENT (“Agreement”) dated as of December 18, 2024 between Trawlers Limited, a company limited by shares

incorporated under the laws of the Isle of Man with company number 021222V (“Assignor”) and INEOS Limited, a company

limited by shares incorporated under the laws of the Isle of Man with company number 013377V (“Assignee”). Each capitalized

term used but not defined herein has the meaning ascribed to it in the Transaction Agreement (as defined below).

RECITALS

WHEREAS, Assignor

and Manchester United plc, an exempted company with limited liability incorporated under the Law of the Cayman Islands with company number

268512 (the “Company”) are parties, among other persons, to that certain Transaction Agreement dated as of December

24, 2023 (the “Transaction Agreement”);

WHEREAS, pursuant

to Section 10.06(b) of the Transaction Agreement, Assignor desires to assign all the rights, interests and obligations of Assignor under

the Transaction Agreement (including, without limitation, in respect of the Subsequent Share Subscription) to Assignee and Assignee desires

to accept the assignment from Assignor and to assume all such rights, interests and obligations, subject to the terms and conditions of

the Transaction Agreement; and

WHEREAS, pursuant

to a share purchase agreement to be entered into simultaneously with this Agreement, the Assignor has agreed to sell its interest in the

Company to the Assignee for the consideration set out therein (the “Transfer”).

NOW, THEREFORE,

in consideration of the foregoing promises (including, for the avoidance of doubt, the Transfer), the agreements, covenants and obligations

hereinafter contained, and other good and valuable consideration, the receipt and sufficiency of which are acknowledged, Assignor and

Assignee, intending to be legally bound, hereby agree as follows:

1. Effectiveness.

This Agreement shall be effective as of the date hereof.

2. Assignment

and Assumption. Assignor hereby irrevocably assigns all the rights, interests and obligations of Assignor under the Transaction Agreement

(including, without limitation, in respect of the Subsequent Share Subscription). Assignee hereby irrevocably accepts the assignment from

Assignor and assumes such rights, interests and obligations, subject to the terms and conditions of the Transaction Agreement.

3. Governing

Law. This Agreement (and any claims, disputes, controversies and causes of action or other Proceedings (whether at Law, in contract,

in tort or otherwise) arising out of or relating to this Agreement, the Subsequent Share Subscription or the actions of Assignor or Assignee

in the negotiation, administration, performance and enforcement thereof) shall be governed by, and construed in accordance with, the Laws

of the State of Delaware, without regard to Laws that may be applicable under conflicts of

laws principles that would cause the application

of the Laws of any jurisdiction other than the Laws of the State of Delaware.

4. Counterparts.

This Agreement may be executed manually or electronically in two or more counterparts, each of which shall be deemed an original, but

all of which together shall be considered one and the same agreement. A signed copy of this Agreement delivered by facsimile, email or

other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

5. Amendment.

This Agreement may be altered, modified or amended only by a written instrument signed by Assignor and Assignee that makes specific reference

to this Agreement.

[Signature Pages Follow]

| |

TRAWLERS LIMITED |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Tim Shepherd |

|

| |

Name: |

Tim Shepherd |

|

| |

Title: |

Director |

|

[Signature Page to Assignment and Assumption Agreement]

| |

INEOS LIMITED |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Simon Morland |

|

| |

Name: |

Simon Morland |

|

| |

Title: |

Officer |

|

[Signature Page to Assignment and Assumption Agreement]

EXHIBIT

K

DATED 18 DECEMBER 2024

TRAWLERS

LIMITED

and

INEOS

LIMITED

________________________________________

SHARE

PURCHASE AGREEMENT

relating to the sale and purchase of shares in

MANCHESTER UNITED PLC

________________________________________

Slaughter

and May

One Bunhill Row

London EC1Y 8YY

(ADJ/DJUM/DXQP)

588024820

CONTENTS

| 1. |

Interpretation |

1 |

| |

|

|

| 2. |

Sale

and purchase |

2 |

| |

|

|

| 3. |

Consideration |

2 |

| |

|

|

| 4. |

Completion |

2 |

| |

|

|

| 5. |

Seller’s

warranties |

3 |

| |

|

|

| 6. |

Further

assurance |

3 |

| |

|

|

| 7. |

Entire

agreement |

3 |

| |

|

|

| 8. |

Assignment |

4 |

| |

|

|

| 9. |

Variation |

4 |

| |

|

|

| 10. |

Counterparts |

4 |

| |

|

|

| 11. |

Contracts

(Rights of Third Parties) Act 1999 |

4 |

| |

|

|

| 12. |

Governing law and jurisdiction |

4 |

THIS AGREEMENT

is made on 18 December 2024

BETWEEN:

| 1. | TRAWLERS

LIMITED, a company limited by shares incorporated under the laws of the Isle of Man with

company number 021222V and having its registered office at Fort Anne, Douglas, IM1 5PD, Isle

of Man (the “Seller”); and |

| 2. | INEOS

LIMITED, a company limited by shares incorporated under the laws of the Isle of Man with

company number 013377V and having its registered office at First Names House, Victoria Road,

Douglas, IM2 4DF, Isle of Man (the “Purchaser”). |

WHEREAS:

| A. | The

Seller is owned by Sir James Arthur Ratcliffe, and the Purchaser is owned by Sir James Arthur

Ratcliffe (who holds 62% of its issued share capital), Andrew Currie (who holds 19% of its

issued share capital) and John Reece (who holds 19% of its issued share capital). |

| B. | The

Seller has agreed to sell and the Purchaser has agreed to purchase the Shares (as defined

in this Agreement) on the terms and subject to the conditions of this Agreement. |

WHEREBY

IT IS AGREED as follows:

| |

“Company” |

means Manchester United plc,

an exempted company with limited liability incorporated under the law of the Cayman Islands, with company number 268512; |

| |

|

|

| |

“Completion” |

means completion of the sale and purchase

of the Shares under and in accordance with this Agreement; |

| |

|

|

| |

“Encumbrance” |

means any mortgage, charge (fixed or floating),

pledge, lien, option, hypothecation, right to acquire, right of pre-emption, deposit by way of security, assignment by way of

security or trust arrangement for the purpose of providing security, any other third party right or claim or any other form of security

interest, encumbrance or equity of any kind; |

| |

|

|

| |

“Shares” |

means 15,204,733.062 Class A

ordinary shares and 31,645,609.998 Class B ordinary shares, in each case at $0.0005 par value per share, in the capital of the Company,

representing c.27.67% of the Company’s issued share capital and the Seller’s entire holding and interest in the Company. |

| 1.2 | In

this Agreement, unless otherwise specified: |

| (A) | references

to clauses and sub-clauses are to clauses and sub-clauses of this Agreement; |

| (B) | a

reference to any statute or statutory provision shall be construed as a reference to the

same as it may have been, or may from time to time be, amended, modified or re-enacted; and |

| (C) | headings

to clauses are for convenience only and do not affect the interpretation of this Agreement. |

| 2.1 | Subject

to the terms and conditions of this Agreement, the Seller shall sell, and the Purchaser shall

purchase, the Shares free from all Encumbrances and together with all rights attached or

accruing to them as at Completion. |

| 2.2 | For

the avoidance of doubt, Part 1 of the Law of Property (Miscellaneous Provisions) Act 1994

shall not apply for the purposes of this clause. |

In

consideration for the sale of the Shares the Purchaser shall pay $1,546,061,321 to the Seller, which shall be left outstanding as a debt

owed by the Purchaser to the Seller from Completion (“Consideration”).

| 4.1 | Completion

shall take place immediately upon execution of this Agreement. |

| 4.2 | Prior

to Completion, the Seller shall procure that a board meeting of the Company is held at which

it shall be resolved that the transfer of the Shares that will take effect as at Completion

shall be approved for registration and (subject only to the transfer being duly stamped)

that the Purchaser will be registered as the holder of all of the Shares in the register

of members of the Company. |

| (A) | the

Seller shall deliver to the Purchaser: |

| (i) | a

duly executed stock transfer form in respect of all of the Shares in favour of the Purchaser;

and |

| (ii) | such

waivers or consents as the Purchaser may require to enable the Purchaser to be registered

as holders of the Shares; and |

| (B) | from

receipt of the duly executed stock transfer form referred to in sub-clause 4.3(A)(i) the

Consideration shall be left outstanding as a debt owed by the Purchaser to the Seller. |

| 5.1 | The

Seller warrants to the Purchaser in the following terms: |

| (A) | The

Seller is the sole legal and beneficial owner of the Shares. |

| (B) | The

Seller has the requisite power, capacity and authority to enter into and perform this Agreement. |

| (C) | There

is no Encumbrance on, over or affecting the Shares or any of them and there is no agreement

or commitment to give or create any and no claim has been made by any person to be entitled

to any. |

Each

party shall from time to time, on being required to do so by the other party, do or procure the carrying out of all such acts and/or

execute or procure the execution of all such documents as the other may reasonably consider necessary for giving full effect to this

Agreement.

| 7.1 | This

Agreement and any other documents referred to in this Agreement (the “Share Purchase

Documents”) constitute the whole and only agreement between the parties relating

to the sale and purchase of the Shares. Except in the case of fraud, each party acknowledges

that, in entering into the Share Purchase Documents, it is not relying upon any pre-contractual

statement which is not repeated in the Share Purchase Documents. |

| 7.2 | Except

in the case of fraud, no party shall have any right of action against any other party to

this Agreement arising out of or in connection with any pre-contractual statement except

to the extent that it is repeated in the Share Purchase Documents. |

| 7.3 | For

the purposes of this clause, “pre-contractual statement” means any draft,

agreement, undertaking, representation, warranty, promise, assurance or arrangement of any

nature whatsoever, whether or not in writing, relating to the subject matter of the Share

Purchase Documents made or given by any person at any time prior to this Agreement becoming

legally binding. |

Either

party may at any time assign all or any part of the benefit of, or its rights or benefits under, this Agreement.

No

variation to or waiver under this Agreement shall be effective unless made in writing and signed by or on behalf of each party.

| 10.1 | This

agreement may be executed in any number of counterparts, and by the parties on separate counterparts,

but shall not be effective until each party has executed at least one counterpart. |

| 10.2 | Each

counterpart shall constitute an original of this agreement, but all the counterparts shall

together constitute but one and the same instrument. |

| 11. | Contracts

(Rights of Third Parties) Act 1999 |

The

parties to this Agreement do not intend that any term of this Agreement should be enforceable, by virtue of the Contracts (Rights of

Third Parties) Act 1999, by any person who is not a party to this Agreement.

| 12. | Governing

law and jurisdiction |

| 12.1 | This

Agreement is to be governed by and construed in accordance with English law. Any matter,

claim or dispute arising out of or in connection with this agreement, whether contractual

or non-contractual, is to be governed by and determined in accordance with English law. |

| 12.2 | Each

party irrevocably submits and agrees that the courts of England and Wales shall have exclusive

jurisdiction to settle any dispute or claim that arises out of or in connection with this

Agreement, its subject matter or its formation (including non-contractual disputes or claims). |

This

Agreement has been entered into on the date stated at the beginning of this Agreement.

Seller

| Signed by |

Tim

Shepherd |

|

|

|

|

| for and on behalf of |

|

|

/s/ Tim Shepherd |

|

| TRAWLERS LIMITED |

|

|

(Signature of named signatory) |

|

[Signature

page to share purchase agreement]

Purchaser

| Signed by |

Simon

Morland |

|

|

|

|

| for and on behalf of |

|

|

/s/ Simon Morland |

|

| INEOS LIMITED |

|

|

(Signature of named signatory) |

|

[Signature

page to share purchase agreement]

EXHIBIT L

Directors and

Executive Officers of Trawlers and INEOS

Directors and Executive Officers of

Trawlers. The following table sets forth the name, citizenship, business address and present occupation or employment for each director

and each executive officer of Trawlers.

Name |

|

Citizenship |

|

Present

Principal Occupation or Employment |

| Graeme Leask |

|

UK |

|

CFO of INEOS |

| |

|

|

|

|

| Simon Morland |

|

UK |

|

Director of INEOS and Family Office Manager for INEOS |

| |

|

|

|

|

| George Ratcliffe |

|

UK |

|

Commercial Director of INEOS Automotive |

| |

|

|

|

|

| Tristan Head |

|

UK |

|

Director and joint corporate and commercial head of Cains Advocates Limited (“Cains”) |

| |

|

|

|

|

| Timothy Shepherd |

|

UK |

|

Managing director and joint corporate and commercial head of Cains |

The principal business address for each

of Mr. Leask, Mr. Morland and Mr. Ratcliffe at INEOS is as follows: Hawkslease, Chapel Lane, Lyndhurst, Hampshire, SO43 7FG, United Kingdom.

The principal business address for each

of Mr. Head and Mr. Shepherd is as follows: Fort Anne, Douglas, IM1 5PD, Isle of Man.

Directors and Executive Officers

of INEOS(1). The following table sets

the name, citizenship, business address and present occupation or employment for each director and each executive officer of for each

director and each executive officer of INEOS.

Name |

|

Citizenship |

|

Present

Principal Occupation or Employment |

| James A. Ratcliffe |

|

UK |

|

CEO and Chairman of INEOS |

| |

|

|

|

|

| Andrew Currie |

|

UK |

|

Director of INEOS |

| |

|

|

|

|

| John Reece |

|

UK |

|

Finance Director of INEOS |

| |

|

|

|

|

| Jonathan Ginns |

|

UK |

|

Head of Mergers & Acquisitions for INEOS |

| |

|

|

|

|

| Simon Morland |

|

UK |

|

Director of INEOS and Family Office Manager for INEOS |

| (1) | James A. Ratcliffe is a citizen of the

United Kingdom and is the CEO and Chairman of INEOS and a Director of INEOS. The business

address of James A. Ratcliffe at INEOS is set forth on Schedule I to the Offer to Purchase

and is incorporated by reference as Exhibit C herein. |

The principal business address for each

of Mr. Currie, Mr. Reece, Mr. Ginns and Mr. Morland at INEOS is as follows: Hawkslease, Chapel Lane, Lyndhurst, Hampshire, SO43 7FG,

United Kingdom.

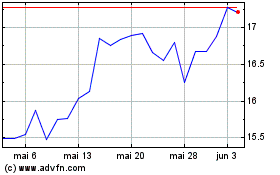

Manchester United (NYSE:MANU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Manchester United (NYSE:MANU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024