0000825313false00008253132024-12-192024-12-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 19, 2024

ALLIANCEBERNSTEIN HOLDING L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-09818 | 13-3434400 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

501 Commerce Street, Nashville, TN 37023

(Address of principal executive offices)

(Zip Code)

(615) 622-0000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on which Registered |

| Units rep. assignments of beneficial ownership of limited partnership interests in AB Holding | AB | NYSE |

Item 3.02. Unregistered sale of equity securities.

On December 19, 2024, AllianceBernstein L.P. (“AB”) entered into a master exchange agreement (the “Exchange Agreement”) providing for the issuance by AB of up to 10,000,000 units representing assignments of beneficial ownership of limited partnership interests in AB (“AB Units”) to Equitable Holdings, Inc. (“EQH”) and any of its wholly-owned subsidiaries in exchange for an equal number of units representing assignments of beneficial ownership of limited partnership interests in AllianceBernstein Holding L.P. (“AB Holding Units”) owned by EQH and such subsidiary, with such exchanges to occur from time to time over the next two years. Each AB Holding Unit so exchanged for will be retired following such exchange.

At the time the Exchange Agreement was entered into, AB and EQH exchanged 5,211,194 AB Units for AB Holding Units (thereby reducing the 10,000,000 AB Units available for future exchange), and the acquired AB Holding Units were retired. The issuance of the AB Units was exempt from the registration requirements of the Securities Act of 1933, as amended, by virtue of Section 4(a)(2) thereof because such issuance did not involve a public offering.

In addition to the Exchange Agreement, on December 19, 2024, AB entered into a purchase agreement (the "Purchase Agreement") providing for, and consummated, the sale by AB of 4,215,140 AB Units to EQH for a cash purchase price per share of $35.59. AB intends to use the proceeds from the sale for debt repayment, to extend borrowing capacity in anticipation of funding recently announced investment initiatives in insurance asset management. The issuance of the AB Units was exempt from the registration requirements of the Securities Act of 1933, as amended, by virtue of Section 4(a)(2) thereof because such issuance did not involve a public offering.

Forward-looking Statements

The Company cautions that all statements, other than statements of historical facts, contained in this Current Report on Form 8-K, or furnished herewith, are forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels or activity, performance or achievements to be materially different from those anticipated by such statements. The use of words such as “may,” “might,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “intend,” “future,” “potential,” or “continue,” and other similar expressions are intended to identify forward looking statements. However, the absence of these words does not mean that statements are not forward-looking. All forward-looking statements are based on current estimates, assumptions and expectations by our management that, although we believe to be reasonable, are inherently uncertain. Any forward-looking statement expressing an expectation or belief as to future events is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future events and are subject to risks and uncertainties and other factors beyond our control that may cause actual results to differ materially from those expressed in any forward-looking statement.

Any forward-looking statement speaks only as of the date on which it was made. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | ALLIANCEBERNSTEIN HOLDING L.P. |

| Dated: December 19, 2024 | | By: | /s/ Mark Manley |

| | | Mark Manley

Corporate Secretary |

MASTER EXCHANGE AGREEMENT

This master exchange agreement (this “Agreement”) is entered into as of December 19, 2024, between AllianceBernstein L.P., a Delaware limited partnership (“AB”), and Equitable Holdings, Inc., a Delaware corporation (“EQH”).

WHEREAS, EQH and certain of its wholly-owned subsidiaries (EQH and such subsidiaries, “EQH Owners”) are owners of units representing assignments of beneficial ownership of limited partnership interests (“AB Holding Units”) in AllianceBernstein Holding L.P., a Delaware limited partnership (“Holding”) and EQH Owners may from time to time during the term of this Agreement acquire ownership of additional AB Holding Units; and

WHEREAS, EQH (on behalf of itself and the other EQH Owners) and AB desire to exchange AB Holding Units for units representing assignments of beneficial ownership of limited partnership interests in AB (“AB Units”) from time to time during the term of this Agreement, upon the terms and subject to the conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the mutual promises, agreements and covenants hereinafter set forth, the receipt and sufficiency of which is hereby acknowledged, and intending to be legally bound hereby, each of AB and EQH (each, a “Party” and, collectively, the “Parties”) agree as follows:

ARTICLE I PURCHASE AND SALE

Section 1.1 Exchange of Units. Subject to the terms and conditions of this Agreement, at one or more Closings (as defined below), (a) AB shall issue, sell and deliver during the term of this Agreement up to 10 million AB Units to EQH or to such other EQH Owner as EQH may designate (the “New Units”), and (b) EQH shall deliver, or cause such other designated EQH Owner to deliver, in exchange therefore an equal number of AB Holding Units to AB (the “Exchange Units”). The identity of the EQH Owners and the number of Exchange Units to be exchanged by each EQH Owner at each Closing shall be as mutually agreed upon by EQH and the Partnership and shall be set forth in writing in the form provided as Exhibit A (“Exchange Notice”), which shall become effective and binding hereunder upon execution by each of the Partnership and EQH; provided, however that at the first Closing, (a) AB shall issue, sell and deliver 3,766,838 AB Units to EQH and 1,444,356 AB Units to Alpha Units Holdings, Inc. (“Alpha”), and (b) EQH shall deliver in exchange therefore 3,766,838 AB Holding Units to AB and shall cause Alpha to deliver in exchange therefore 1,444,356 AB Holding Units to AB.

Section 1.2 Closing; Closing Date. Closing (each, a “Closing”) of the exchanges under Section 1.1 shall take place remotely via the exchange of documents and signatures at 9:00 a.m. (New York City time) on such date as EQH and the Partnership designate in the applicable Exchange Notice (each, a “Closing Date”), subject to the satisfaction or waiver of the conditions to the obligations of EQH and AB set forth in Sections 4 and 5, respectively; provided, however, that the first Closing shall occur concurrently with the execution and delivery

-1-

of this Agreement, subject to the satisfaction or waiver of the conditions to the obligations of EQH and AB set forth in Sections 4 and 5, respectively.

Section 1.3 Deliveries. At each Closing, (a) EQH shall deliver or cause the applicable EQH Owner to deliver to AB certificates (which for purposes of this Agreement shall include book-entry account statements related to the ownership of AB Holding Units) representing the applicable Exchange Units along with an appropriate unit transfer instrument duly executed in blank and (b) AB shall deliver to EQH or such applicable EQH Owner certificates (which for purposes of this Agreement shall include book-entry account statements related to the ownership of AB Units) representing the New Units, free and clear of all liens, claims, charges, restrictions and other encumbrances of any nature whatsoever, other than restrictions under the Amended and Restated Limited Partnership Agreement of AB, as amended to date (the “LPA”), and applicable securities law restrictions.

Section 1.4 Determinations. In connection with each Closing occurring after the date hereof, AB shall use commercially reasonable efforts to obtain an Assignment Determination, Limited Liability Determination and Tax Determination (as those terms are defined in the LPA) with respect to the applicable issuance of AB Units occurring at such Closing.

ARTICLE II REPRESENTATIONS AND WARRANTIES OF AB

AB represents and warrants to EQH and each EQH Owner as follows as of the date hereof and as of each Closing:

Section 2.1 Capacity of AB. AB is a limited partnership duly organized, validly existing and in good standing under the laws of the State of Delaware and has all limited liability company power and authority required to enter into, deliver and perform its obligations under this Agreement.

Section 2.2 Authorization of Agreement. AB has full right, authority and power under the LPA to execute and deliver this Agreement, to perform its obligations hereunder and to consummate the transactions contemplated hereby. The execution and delivery by AB of this Agreement, the performance by AB of its obligations hereunder, and the consummation of the transactions contemplated hereby have been duly authorized by all necessary company action of AB, and no other company action on the part of AB is required in connection herewith. This Agreement has been duly and validly executed and delivered by AB and constitutes a legal, valid and binding obligation of AB, enforceable against AB except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, or other laws of general application relating to or affecting the enforcement of creditors’ rights generally, or (b) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

Section 2.3 Valid Issuance of Units. The New Units, when issued, sold and delivered in accordance with the terms and for the consideration set forth in this Agreement, will be duly

authorized and validly issued under the LPA and will be delivered free of liens, claims, charges, restrictions and other encumbrances of any nature whatsoever other than pursuant to the terms of the LPA and restrictions on transfer under applicable state and federal securities laws. Based in part on the accuracy of the representations of EQH in Section 3.4 of this Agreement, the offer, sale and issuance of the New Units to be issued pursuant to this Agreement will be issued in compliance with all applicable federal and state securities laws.

Section 2.4 Approvals and Consents. No approvals or consents of, or applications or notices to, third persons or entities are necessary for the lawful consummation by AB of the transactions contemplated by this Agreement.

ARTICLE III REPRESENTATIONS AND WARRANTIES OF EQH

EQH represents and warrants to AB as follows as of the date hereof and as of each Closing:

Section 3.1 Capacity of EQH; Ownership.

(a)EQH is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and has all corporate power and authority required to enter into, deliver and perform its obligations under this Agreement.

(b)EQH or the applicable EQH Owner is the record and beneficial owner (as defined in Section 13d-3 adopted by the U.S. Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended) of the Exchange Units, which will be delivered free of liens, claims, charges, restrictions and other encumbrances of any nature whatsoever other than pursuant to the terms of the Amended and Restated Limited Partnership Agreement of AB Holding, as amended to date, and restrictions on transfer under applicable state and federal securities laws.

Section 3.2 Authorization of Agreement. EQH has full right, authority and power under its governing documents to execute and deliver this Agreement, to perform its obligations hereunder and to consummate the transactions contemplated hereby. The execution and delivery by EQH of this Agreement, the performance by EQH of its obligations hereunder, and the consummation of the transactions contemplated hereby have been duly authorized by all necessary corporate action of EQH, and no other company action on the part of EQH is required in connection herewith. This Agreement has been duly and validly executed and delivered by EQH and constitutes a legal, valid and binding obligation of EQH, enforceable against EQH except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, or other laws of general application relating to or affecting the enforcement of creditors’ rights generally, or (b) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies. EQH is the sole direct or indirect equity owner of each EQH Owner and has the ability to cause each EQH Owner to take the actions contemplated hereunder.

Section 3.3 Approvals and Consents. No approvals or consents of, or applications or notices to, third persons or entities are necessary for the lawful consummation by EQH or any other EQH Owner of the transactions contemplated by this Agreement.

Section 3.4 Securities Law Matters.

(a)EQH hereby confirms that the New Units to be acquired by EQH or any other EQH Owner will be acquired for investment for the account of EQH or such other EQH Owner, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and that neither EQH nor any other EQH Owner has any present intention of selling, granting any participation in, or otherwise distributing the same. By executing this Agreement, EQH further represents that neither EQH nor any other EQH Owner presently has any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participations to such person or to any third person, with respect to any of the New Units.

(b)EQH and each EQH Owner understands that the New Units have not been, and will not be, registered under the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of EQH’s representations regarding EQH and each EQH Owner as expressed herein. EQH understands that the New Units are “restricted securities” under applicable United States federal and state securities laws and that, pursuant to these laws, EQH or the applicable EQH Owner must hold the New Units indefinitely unless they are registered with the Securities and Exchange Commission or an exemption from such registration requirement is available. EQH acknowledges that AB has no obligation to register the New Units. The New Units and any securities issued in respect of or exchange for the New Units, may bear any legend required by the securities laws of any state to the extent such laws are applicable to the New Units represented by the certificate so legended.

ARTICLE IV

CONDITIONS TO OBLIGATIONS OF EQH

The obligations of EQH and any EQH Owner under this Agreement shall be subject to the satisfaction on or before the applicable Closing Date of each of the following conditions unless previously waived in writing by EQH:

Section 5.1 Representations and Warranties of AB to be True. The representations and warranties contained in Article 2 shall be true and accurate in all respects as of the applicable Closing Date as if made on that date.

Section 5.2 No Prohibitions. No order of any court or any administrative agency or law shall be in effect which restrains or prohibits the transactions contemplated by this Agreement.

ARTICLE VI CONDITIONS TO OBLIGATIONS OF AB

The obligations of AB under this Agreement shall be subject to the satisfaction on or before the applicable Closing Date of each of the following conditions unless previously waived in writing by AB:

Section 6.1 Representations and Warranties of EQH to be True. The representations and warranties contained in Section 3 shall be true and accurate in all respects as of the applicable Closing Date as if made on that date.

Section 6.2 No Prohibitions. No order of any court or any administrative agency or law shall be in effect which restrains or prohibits the transactions contemplated by this Agreement.

Section 6.2 Determinations. Other than the Closing occurring on the date hereof, AB shall have received an Assignment Determination, Limited Liability Determination and a Tax Determination (as those terms are defined in the LPA) with respect to the issuance of AB Units occurring at such Closing.

ARTICLE VII GENERAL PROVISIONS

Section 7.1 Waiver of Terms. Any of the terms or conditions of this Agreement may be waived at any time by the Party or Parties entitled to the benefit thereof, but only by a written notice signed by the Party or Parties waiving such terms or conditions.

Section 7.2 Amendment of Agreement. This Agreement may be amended, supplemented or modified at any time only by a written instrument duly executed by all the Parties hereto.

Section 7.3 Contents of Agreement; Integration; Parties in Interest; Assignment, etc. This Agreement and the documents referred to herein set forth the entire understanding of the Parties with respect to the subject matter hereof. Any previous agreements or understandings relating to the subject matter hereof are merged into and superseded by this Agreement. The terms and conditions of this Agreement shall be binding upon and inure to the benefit of and, to the extent provided herein, be enforceable by the respective successors and assigns of the Parties.

Section 7.4 Governing Law; Jurisdiction. This Agreement and the legal relations between the Parties shall be governed by and construed and enforced in accordance with the laws of the State of Delaware, without giving effect to the principles of conflicts of laws thereof. Any judicial proceedings with respect to this Agreement shall be brought in the Delaware Court of Chancery or, in the event that the Delaware Court of Chancery lacks jurisdiction, any federal court in the State of Delaware, and by execution and delivery of this Agreement, each Party accepts, generally and unconditionally, the exclusive jurisdiction of such courts and any related appellate courts, and irrevocably agrees to be bound by any judgment rendered thereby.

Section 7.5 Severability. In the event that any portion of this Agreement shall be declared by any court of competent jurisdiction to be invalid, illegal or unenforceable, such

portion shall be deemed severed from this Agreement and the remaining parts hereof shall remain in full force and effect as fully as if those such invalid, illegal or unenforceable portions had never been a part of this Agreement.

Section 7.6 Notices. Any notice that a Party is required or permitted to give pursuant to this Agreement shall be sufficiently given for all purposes hereunder if in writing and delivered by hand, courier or overnight delivery service, or five days after being mailed by certified or registered mail, with appropriate postage prepaid, or when received in the form of email transmission, and shall be directed to the address or email address, as applicable, set forth below (or at such other address or email address as such Party shall designate by like notice):

If to AB:

AllianceBernstein L.P. 501 Commerce Street

Nashville, TN 37203

Attention: Mark Manley

If to EQH:

Equitable Holdings, Inc. 1345 Avenue of the Americas New York, NY 10105

Attention: Ralph Petruzzo

Section 7.7 Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which shall be considered one and the same agreement.

Section 7.8 Expenses. EQH and AB shall each pay its own taxes, costs and expenses (without limitation, costs, expenses and fees of its investment bankers, legal counsel, accountants, financial advisors, and other consultants and agents) in the negotiation, preparation and implementation of this Agreement and all transactions contemplated herein.

Section 7.9 Cooperation. Each of the Parties hereby agrees to execute such documents and do all other acts as may be reasonably necessary and within such Party’s control to carry out the purposes and intent of this Agreement.

Section 7.10 No Third Party Beneficiaries. This Agreement shall not convey any rights on a person not a party hereto.

Section 7.11 Assignment. Neither this Agreement nor any of the rights or obligations hereunder may be assigned by either Party without the prior written consent of the other Party; provided, however, that EQH shall have the right to assign this Agreement and any of the rights (but not the obligations) hereunder to any subsidiary thereof.

Section 7.12 Term. This Agreement shall commence on the date first set forth above and terminate as of the earlier of the second anniversary of the date hereof or the date on which 10 million AB Holding Units shall have been exchanged for AB Units.

[Signature page follows]

IN WITNESS WHEREOF, each of the Parties has caused this Agreement to be duly executed as of the day and year first written above.

ALLIANCE BERNSTEIN L.P.

By: /s/ Mark Manley

Name: Mark Manley

Title: General Counsel and Corporate Secretary

EQUITABLE HOLDINGS, INC.

By: /s/ Peter Tian

Name: Peter Tian

Title: Treasurer

[Signature Page to Exchange Agreement]

Exhibit A: Exchange Notice

| | | | | | | | |

Closing Date | EQH Owner | Exchange Units |

| | |

| | |

| | |

By executing below, EQH and the Partnership each agree to effect the transactions contemplated by the Agreement and this Exchange Notice.

ALLIANCE BERNSTEIN L.P.

By: Name:

Title:

EQUITABLE HOLDINGS, INC.

By: Name:

Title:

AGREEMENT FOR THE PURCHASE AND SALE OF UNITS

This agreement (this “Agreement”) for the purchase and sale of units representing assignments of beneficial ownership of limited partnership interests (“AB Units”) in AllianceBernstein L.P., a Delaware limited partnership (“AB”), is entered into as of December 19, 2024, between AB and Equitable Holdings, Inc., a Delaware corporation (“EQH”).

WHEREAS, AB desires to sell to EQH, and EQH desires to purchase from AB, the AB Units provided for herein, upon the terms and subject to the conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the mutual promises, agreements and covenants hereinafter set forth, the receipt and sufficiency of which is hereby acknowledged, and intending to be legally bound hereby, each of AB and EQH (each, a “Party” and, collectively, the “Parties”) agree as follows:

ARTICLE I PURCHASE AND SALE

Section 1.1 Purchase and Sale of AB Units. Subject to the terms and conditions of this Agreement, at the Closing (as defined below), (a) AB shall issue, sell and deliver 4,215,140 AB Units to EQH (the “New Units”), and (b) EQH shall purchase the New Units from AB.

Section 1.2 Purchase Price. The purchase price for the New Units (the “Purchase Price”) shall be the average closing price on the New York Stock Exchange of AllianceBernstein Holding L.P units (NYSE: AB) for the five business days immediately prior to the purchase or

$35.59 per New Unit, and the total consideration is the product of the New Units and the Purchase Price or $149,999,972.04 (the “Total Consideration”) which shall be paid as provided in Section 1.4 below.

Section 1.3 Closing; Closing Date. The closing (the “Closing”) of the purchase and sale of the AB Units shall take place remotely via the exchange of documents and signatures at 9:00 a.m. (New York City time) on December 19, 2024, or at such other place and time as EQH and AB shall agree (the “Closing Date”), subject to the satisfaction or waiver of the conditions to the obligations of EQH and AB set forth in Sections 4 and 5, respectively.

Section 1.4 Deliveries; Payment. At the Closing, (a) AB shall cause the transfer agent to issue in book entry form the number of AB Units being sold hereunder, free and clear of all liens, claims, charges, restrictions and other encumbrances of any nature whatsoever, other than restrictions under the Amended and Restated Limited Partnership Agreement of AB, as amended to date (the “LPA”), and applicable securities law restrictions, and (b) EQH shall pay to AB the Total Consideration in cash by wire transfer of immediately available funds to a bank account previously designated by AB.

-1-

ARTICLE II REPRESENTATIONS AND WARRANTIES OF AB

AB represents and warrants to EQH as follows:

Section 2.1 Capacity of AB. AB is a limited partnership duly organized, validly existing and in good standing under the laws of the State of Delaware and has all limited liability company power and authority required to enter into, deliver and perform its obligations under this Agreement.

Section 2.2 Authorization of Agreement. AB has full right, authority and power under the LPA to execute and deliver this Agreement, to perform its obligations hereunder and to consummate the transactions contemplated hereby. The execution and delivery by AB of this Agreement, the performance by AB of its obligations hereunder, and the consummation of the transactions contemplated hereby have been duly authorized by all necessary company action of AB, and no other company action on the part of AB is required in connection herewith. This Agreement has been duly and validly executed and delivered by AB and constitutes a legal, valid and binding obligation of AB, enforceable against AB except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, or other laws of general application relating to or affecting the enforcement of creditors’ rights generally, or (b) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

Section 2.3 Valid Issuance of Units. The New Units, when issued, sold and delivered in accordance with the terms and for the consideration set forth in this Agreement, will be duly authorized and validly issued under the LPA and will be delivered free of liens, claims, charges, restrictions and other encumbrances of any nature whatsoever other than pursuant to the terms of the LPA and restrictions on transfer under applicable state and federal securities laws. Based in part on the accuracy of the representations of EQH in Section 3 of this Agreement, the offer, sale and issuance of the New Units to be issued pursuant to this Agreement will be issued in compliance with all applicable federal and state securities laws.

Section 2.4 Approvals and Consents. No approvals or consents of, or applications or notices to, third persons or entities are necessary for the lawful consummation by AB of the transactions contemplated by this Agreement.

ARTICLE III REPRESENTATIONS AND WARRANTIES OF EQH

EQH represents and warrants to AB as follows:

Section 3.1 Capacity of EQH. EQH is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and has all corporate power and authority required to enter into, deliver and perform its obligations under this Agreement.

Section 3.2 Authorization of Agreement. EQH has full right, authority and power under its governing documents to execute and deliver this Agreement, to perform its obligations hereunder and to consummate the transactions contemplated hereby. The execution and delivery by EQH of this Agreement, the performance by EQH of its obligations hereunder, and the consummation of the transactions contemplated hereby have been duly authorized by all necessary corporate action of EQH, and no other company action on the part of EQH is required in connection herewith. This Agreement has been duly and validly executed and delivered by EQH and constitutes a legal, valid and binding obligation of EQH, enforceable against EQH except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, or other laws of general application relating to or affecting the enforcement of creditors’ rights generally, or (b) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

Section 3.3 Approvals and Consents. No approvals or consents of, or applications or notices to, third persons or entities are necessary for the lawful consummation by EQH of the transactions contemplated by this Agreement.

Section 3.4 Securities Law Matters.

(a)EQH hereby confirms that the New Units to be acquired by EQH will be acquired for investment for EQH’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and that EQH has no present intention of selling, granting any participation in, or otherwise distributing the same. By executing this Agreement, EQH further represents that EQH does not presently have any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participations to such person or to any third person, with respect to any of the New Units.

a.EQH understands that the New Units have not been, and will not be, registered under the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of EQH’s representations as expressed herein. EQH understands that the New Units are “restricted securities” under applicable United States federal and state securities laws and that, pursuant to these laws, EQH must hold the New Units indefinitely unless they are registered with the Securities and Exchange Commission or an exemption from such registration requirement is available. EQH acknowledges that AB has no obligation to register the New Units. The New Units and any securities issued in respect of or exchange for the New Units, may bear any legend required by the securities laws of any state to the extent such laws are applicable to the New Units represented by the certificate so legended, and will include the legend on Exhibit A.

ARTICLE IV

CONDITIONS TO OBLIGATIONS OF EQH

The obligations of EQH under this Agreement shall be subject to the satisfaction on or before the Closing Date of each of the following conditions unless previously waived in writing by EQH:

Section 5.1 Representations and Warranties of AB to be True. The representations and warranties contained in Article 2 shall be true and accurate in all respects as of the Closing Date as if made on that date.

Section 5.2 No Prohibitions. No order of any court or any administrative agency or law shall be in effect which restrains or prohibits the transactions contemplated by this Agreement.

ARTICLE VI CONDITIONS TO OBLIGATIONS OF AB

The obligations of AB under this Agreement shall be subject to the satisfaction on or before the Closing Date of each of the following conditions unless previously waived in writing by AB:

Section 6.1 Representations and Warranties of EQH to be True. The representations and warranties contained in Section 3 shall be true and accurate in all respects as of the Closing Date as if made on that date.

Section 6.2 No Prohibitions. No order of any court or any administrative agency or law shall be in effect which restrains or prohibits the transactions contemplated by this Agreement.

ARTICLE VII GENERAL PROVISIONS

Section 7.1 Waiver of Terms. Any of the terms or conditions of this Agreement may be waived at any time by the Party or Parties entitled to the benefit thereof, but only by a written notice signed by the Party or Parties waiving such terms or conditions.

Section 7.2 Amendment of Agreement. This Agreement may be amended, supplemented or modified at any time only by a written instrument duly executed by all the Parties hereto.

Section 7.3 Contents of Agreement; Integration; Parties in Interest; Assignment, etc. This Agreement and the documents referred to herein set forth the entire understanding of the Parties with respect to the subject matter hereof. Any previous agreements or understandings relating to the subject matter hereof are merged into and superseded by this Agreement. The terms and conditions of this Agreement shall be binding upon and inure to the benefit of and, to the extent provided herein, be enforceable by the respective successors and assigns of the Parties.

Section 7.4 Governing Law; Jurisdiction. This Agreement and the legal relations between the Parties shall be governed by and construed and enforced in accordance with the laws of the State of Delaware, without giving effect to the principles of conflicts of laws thereof. Any judicial proceedings with respect to this Agreement shall be brought in the Delaware Court of Chancery or, in the event that the Delaware Court of Chancery lacks jurisdiction, any federal court in the State of Delaware, and by execution and delivery of this Agreement, each Party accepts, generally and unconditionally, the exclusive jurisdiction of such courts and any related appellate courts, and irrevocably agrees to be bound by any judgment rendered thereby.

Section 7.5 Severability. In the event that any portion of this Agreement shall be declared by any court of competent jurisdiction to be invalid, illegal or unenforceable, such portion shall be deemed severed from this Agreement and the remaining parts hereof shall remain in full force and effect as fully as if those such invalid, illegal or unenforceable portions had never been a part of this Agreement.

Section 7.6 Notices. Any notice that a Party is required or permitted to give pursuant to this Agreement shall be sufficiently given for all purposes hereunder if in writing and delivered by hand, courier or overnight delivery service, or five days after being mailed by certified or registered mail, with appropriate postage prepaid, or when received in the form of email transmission, and shall be directed to the address or email address, as applicable, set forth below (or at such other address or email address as such Party shall designate by like notice):

If to AB:

AllianceBernstein L.P. 501 Commerce Street

Nashville, TN 37203

Attention: Mark Manley

If to EQH:

Equitable Holdings, Inc. 1345 Avenue of the Americas New York, NY 10105

Attention: Ralph Petruzzo

Section 7.7 Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which shall be considered one and the same agreement.

Section 7.8 Expenses. EQH and AB shall each pay its own taxes, costs and expenses (without limitation, costs, expenses and fees of its investment bankers, legal counsel,

accountants, financial advisors, and other consultants and agents) in the negotiation, preparation and implementation of this Agreement and all transactions contemplated herein.

Section 7.9 Cooperation. Each of the Parties hereby agrees to execute such documents and do all other acts as may be reasonably necessary and within such Party’s control to carry out the purposes and intent of this Agreement.

Section 7.10 No Third Party Beneficiaries. This Agreement shall not convey any rights on a person not a party hereto.

Section 7.11 Assignment. Neither this Agreement nor any of the rights or obligations hereunder may be assigned by either Party without the prior written consent of the other Party; provided, however, that EQH shall have the right to assign this Agreement and any of the rights (but not the obligations) hereunder to any subsidiary thereof.

[Signature page follows]

IN WITNESS WHEREOF, each of the Parties has caused this Agreement to be duly executed as of the day and year first written above.

ALLIANCEBERNSTEIN L.P.

By: /s/ Mark Manley

Name:Mark Manley

Title: General Counsel and Corporate Secretary

EQUITABLE HOLDINGS, INC.

By: /s/ Peter Tian

Name: Peter Tian

Title: Treasurer

[Signature Page to Purchase Agreement ]

Exhibit A

THE REGISTERED HOLDER OF THE UNITS REPRESENTED BY THIS CERTIFICATE IS AN AFFILIATE OF THE PARTNERSHIP AS DEFINED IN RULE 144(A) (1) UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). THESE UNITS MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE DISPOSED OF EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR APPROPRIATE EXEMPTION FROM REGISTRATION UNDER THE ACT. ACCORDINGLY, THESE SECURITIES MAY NOT BE TRANSFERRED EXCEPT UPON THE WRITTEN APPROVAL OF THE PARTNERSHIP OR ITS COUNSEL. THIS LEGEND REPRESENTS A RESTRICTION ON TRANSFERABILITY OF THE UNITS REPRESENTED HEREBY.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

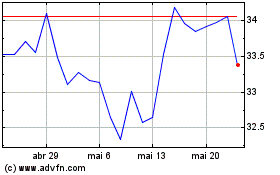

AllianceBernstein (NYSE:AB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AllianceBernstein (NYSE:AB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024