UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting material Pursuant to §240.14a-12 |

Air Products and Chemicals, Inc.

(Name of Registrant as Specified In Its Charter)

MANTLE RIDGE LP

EAGLE FUND A1 LTD

EAGLE ADVISOR LLC

PAUL HILAL

ANDREW EVANS

TRACY MCKIBBEN

DENNIS REILLEY

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

On January 13, 2025, Mantle Ridge LP, which,

together with its affiliates (collectively, “Mantle Ridge”), beneficially owns approximately $1.3 billion of the outstanding

common shares of Air Products and Chemicals, Inc. (NYSE: APD) (“Air Products” or the “Company”), issued and uploaded

to its website, www.RefreshingAirProducts.com, the following press release:

LEADING PROXY ADVISORY FIRM ISS RECOMMENDS

AIR PRODUCTS AND CHEMICALS, INC. SHAREHOLDERS VOTE “FOR” MANTLE RIDGE DIRECTOR NOMINEES ANDREW EVANS, PAUL HILAL, AND DENNIS

REILLEY

Institutional Shareholder Services “ISS”

Finds Incumbent Board Has Failed to “Properly Oversee” a “Credible Succession Plan” and States that Reconstitution

of the Board with a “New Chairman” Would “Allow Fresh Board Assessment of Board Leadership and the Careful Deliberation

on Optimal Timing for a CEO Transition”

ISS Recommends Shareholders Vote “WITHHOLD”

Against Seifi Ghasemi, Charles Cogut and Edward L. Monser – Company Nominees Opposed by Mantle Ridge – Further Reinforcing

the Need for Change

ISS Finds Company’s Framing of Mr. Eduardo

Menezes’ Qualifications “Disingenuous at Best”

ISS Recommends Shareholders Vote “FOR”

Mantle Ridge Nominees Andrew Evans, Paul Hilal, And Dennis Reilley and States that Tracy McKibben is “Well Qualified to Serve as

a Member of the APD Board”

Mantle Ridge Reiterates Belief that the Root

Cause of Air Products’ Current Issues is Mr. Ghasemi’s Entrenchment, Dominion Over the Company, and Subordination and Comprehensive

Failure of the Current Board to Function as a Governing Body

Mantle Ridge Believes a Reconstituted Board

– Refreshed with Four Shareholder Nominees – Would Be Best Positioned to Lead a Bona-Fide CEO Succession Process and Create

Substantial Long-Term Value for Shareholders

Mantle Ridge Urges Shareholders to Vote the

BLUE Proxy Card “FOR” All Four of its Superbly Qualified Director Nominees – Andrew Evans, Paul

Hilal, Tracy McKibben, and Dennis Reilley – and “WITHHOLD” on the Company Nominees Charles Cogut, Lisa A. Davis,

Seifollah “Seifi” Ghasemi, and Edward L. Monser

New York – January 13, 2025 –

Mantle Ridge LP, which, together with its affiliates (collectively, “Mantle Ridge”), beneficially owns approximately

$1.3 billion of the outstanding common shares of Air Products and Chemicals, Inc. (NYSE: APD) (“Air Products” or the “Company”),

today announced that Institutional Shareholder Services Inc. (“ISS”), a leading independent proxy advisory firm, has recommended

that Air Products shareholders vote “FOR” the election of Mantle Ridge nominees Andrew Evans, Paul Hilal, and Dennis Reilley

to the Company’s Board of Directors (the “Board”) at its 2025 Annual Meeting of Shareholders, scheduled for January

23, 2025. ISS also noted that Tracy McKibben is “well qualified to serve as a member of the APD board.”

ISS also joined proxy advisory firm Glass Lewis

& Co. in recommending change is needed on the Air Products Board and that shareholders vote “WITHHOLD” on the Company

nominees Charles Cogut, Seifollah “Seifi” Ghasemi, and Edward L. Monser.

Paul Hilal, Founder and CEO of Mantle Ridge,

commented, “We are pleased that ISS recognizes the clear need for change at Air Products, and has recommended that shareholders

vote for the election of three of our highly qualified independent nominees to the Company’s Board, and vote to remove Messrs.

Ghasemi, Monser, and Cogut. We believe a shareholder-led reconstitution of the Board is necessary, and positions the refreshed Board

to properly reconsider allowing Mr. Ghasemi’s dominion over the Company to extend indefinitely. It also will finally allow the

Board to conduct a bona fide CEO succession process that no longer excludes Mr. Eduardo Menezes – the exceptional executive

widely hailed as a part of the ‘Dream Team’ to lead Air Products. A reconstituted Board could also more objectively revisit

the Company’s strategic and operational issues and challenged projects.”

With respect to Air Products’ material

underperformance for shareholders over the last five years, poor track record of capital allocation, and poor execution of and disclosures

regarding challenged projects, ISS stated*:

| · | “[S]ince

the company began implementing its capital deployment strategy, namely expanding APD’s

scope to coal gasification, as well as committing to build clean hydrogen mega projects around

the world, return on capital has declined and APD TSR has significantly underperformed its

two closest peers and the broader market. These projects introduced risks into a historically

predictable business, leading investors to question whether the promised returns would adequately

compensate them for the uncertainty and potential challenges of these projects.” |

| · | “Prior

to public reports of Mantle Ridge’s position in the company, APD’s P/E multiple

had fallen well below those of its peers, reflecting investor skepticism about the strategy.” |

| · | “APD’s

decision to pursue mega projects beyond the scope of its traditional business has resulted

in deterioration of key metrics and investor sentiment, driving TSR underperformance relative

to peers.” |

| · | “The

company’s TSR has underperformed that of its peers in every measurable period since

the company began implementing its articulated capital deployment strategy, as well over

the entirety of Ghasemi tenure, despite Ghasemi’s successful turnaround of the business

upon his initial appointment. Although most of the clean hydrogen projects are still several

years away from beginning operations and may ultimately prove successful, the budget increases

and delays, coupled with the decline in ROCE, have damaged management and the board’s

credibility.” |

| · | “The

company is continuing to assure investors that it will deliver its promised rate of return.

In the meantime, World Energy, which was initially guided to 2025 start, had a budget increase

from $2.0 to $2.5 billion, experienced delays in receiving permits and is currently on hold.

Louisiana Blue has had a budget increase from $4.5 billion to $7.0 billion, no off-take agreement,

and is also delayed from the original guidance. NEOM initially did not have an off-take agreement,

introduced commodity exposure and operational and technological risk, and significant capital

commitments.” |

| · | “It

is worth noting that tracking the progress of each project is not trivial for investors.

Despite the company’s frequent appearances at investor conferences, direct questions

are often met with vague answers, or assertions that the company cannot disclose information

due to competitive reasons or confidentiality agreements with their partners. Cancellations

and project delays are not proactively announced, as was the case with Yankuang, Indonesia,

and World Energy, and certain unusual features of the structure are only disclosed after

they begin affecting financials[.]” |

With respect to the current Board’s

succession planning failures and entrenched Chairman & CEO Seifi Ghasemi, ISS stated:

| · | “Confoundingly,

the board appears to have ceded control of deciding on Ghasemi’s successor to Ghasemi

himself, and extended an evergreen contract to Ghasemi shortly after purportedly beginning

an extensive search for a qualified CEO successor. As a result of these failures to properly

oversee the succession process, the company now has an 80-year-old CEO and no credible succession

plan for investors to evaluate.” |

| · | “It

appears that the board's independent members lost control, if they ever had it, of the non-emergency

CEO succession planning process…” |

| · | "[T]he

independent members of the board do not appear to have credibly discharged their responsibility

to manage the CEO succession process." |

| · | “Although

the board states that it has a short list of five candidates for the newly created position

of company president, who would be expected to eventually take over as CEO, once again, Ghasemi’s

statements that he has decided to bring an executive who ‘can be my successor if something

unexpected were to happen to me’ suggest that the board is not fully in control of

the process, or of Ghasemi's public characterizations of it.” |

| · | “The

board’s stated requirement that the president candidates have public company CEO experience

also raises questions about the viability of this approach. Would a successful public company

CEO really agree to be president under a CEO who has an evergreen contract, appears to have

significant influence over the board, and has publicly indicated that he would like to stay

as long as possible?” |

| · | “[Mr.

Ghasemi’s] removal from the board would allow for a fresh board assessment of board

leadership and the careful deliberation on optimal timing for a CEO transition.” |

| · | “Lead

Independent Director Monser is one of the longest-tenured directors on the board and does

not appear to have been a sufficiently strong counterbalance to Ghasemi. Similarly, director

Cogut has been on the board for nine years, and worked at the law firm that represented Rockwood

when Ghasemi was CEO there. The replacement of these two directors would further facilitate

the reconstituted board's ability to appoint a new independent chairman and accomplish the

goals outlined above.” |

With respect to the qualifications of Mantle

Ridge’s superior director nominees and proposed CEO candidate, Eduardo Menezes, ISS stated:

| · | “There

are concerns with oversight of strategy and succession planning that will require substantial

change to rectify. Specifically, a reconstituted board would need to focus on de-risking

the existing project commitments, evaluating underperformance, rebuilding credibility with

investors, and developing and executing an effective succession plan. The dissident's slate

includes candidates that have skills and experience to help the board address these issues.” |

| · | “Under

the leadership of a new chairman, the reconstituted board would be better able to get succession

planning back on track, including an impartial assessment of the CEO successor candidates

currently identified by the board, as well as the dissident's candidate, Menezes, whose industry

knowledge was apparent during engagement with ISS.” |

| · | “The

current board’s dismissal of Menezes as a candidate appears premature and shortsighted,

as his experience in multiple executive roles at Praxair and Linde would be valuable and

relevant at APD, and the attempt to frame Menezes as unqualified due to the fact that he

was ‘passed over’ for the CEO role at Linde, a substantially larger company,

seems disingenuous at best.” |

| · | “There

is no question that the board would benefit from Reilley's expertise, built during his multi-decade

experience at industrial chemical companies and as CEO of Praxair. He is the best-suited

candidate from the dissident slate to tackle the critical task of evaluating and de-risking

existing projects.” |

| · | “The

company's repeated attempts to publicly discredit Reilley reflect poorly on the board's judgement.” |

| · | “The

board would also benefit from dissident nominee Evans' experience as CFO and CEO in a capital-intensive

industry. Along with his public company board experience, these skills would be particularly

useful in assessing the company's current strategic direction and focus on large-scale projects.” |

| · | “Finally,

Hilal's perspective as a shareholder, his prior involvement with the company, and his financial

expertise would bring a strong independent voice to the board deliberations.” |

| · | “The

fourth dissident nominee, McKibben, seems likewise well qualified to serve as a member of

the APD board.” |

*Mantle Ridge has neither sought nor obtained

consent from ISS to use previously published information in this press release.

To Enhance Air Products' Performance and Create

the Long-Term Value that Shareholders Deserve, Mantle Ridge Urges Shareholders to Vote the BLUE Proxy Card “FOR” Mantle

Ridge's Four Highly Qualified Director Nominees – Andrew Evans, Paul Hilal, Tracy McKibben, and Dennis Reilley – and “WITHHOLD”

on the Company Nominees Charles Cogut, Lisa A. Davis, Seifollah "Seifi" Ghasemi and Edward L. Monser.

Additional information regarding Mantle Ridge’s highly qualified

nominees, as well as voting instructions, may be found at www.RefreshingAirProducts.com.

***

About Mantle Ridge

Founded in 2016, Mantle Ridge LP is an engaged,

long-term owner-steward that works closely and constructively with company boards to create durable long-term value for all stakeholders.

None of Mantle Ridge’s affiliated entities is a hedge fund or other investment vehicle with a structurally short-term incentive.

Mantle Ridge engages with the expectation of maintaining an ownership position over the very long-term. Mantle Ridge has raised separate,

single-investment, five-year special purpose vehicles to support its previous engagements with companies including CSX Corporation, Aramark,

and Dollar Tree. For more information, visit https://www.mantleridge.com/.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains “forward-looking

statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or

current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,”

“anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,”

“forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations

on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking

statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein

is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of

Mantle Ridge LP and its affiliates (collectively, “Mantle Ridge”) or any of the other participants in the proxy solicitation

described herein prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly,

forward-looking statements should not be regarded as a representation by Mantle Ridge that the future plans, estimates or expectations

contemplated will ever be achieved. Certain statements and information included herein may have been sourced from third parties. Mantle

Ridge does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information.

Except as may be expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from

such third parties, nor has Mantle Ridge paid for any such statements or information. Any such statements or information should not be

viewed as an indication of support from such third parties for the views expressed herein. Mantle Ridge disclaims any obligation to update

the information herein or to disclose the results of any revisions that may be made to any projected results or forward-looking statements

herein to reflect events or circumstances after the date of such information, projected results or statements or to reflect the occurrence

of anticipated or unanticipated events.

Investor Contact

D.F. King & Co., Inc.

Edward McCarthy

Tel: (212) 493-6952

Media Contacts

Jonathan Gasthalter / Nathaniel Garnick

Gasthalter & Co.

Tel: (212) 257-4170

Email: RefreshingAPD@gasthalter.com

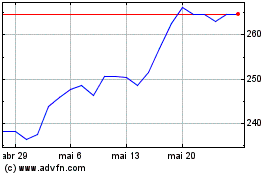

Air Products and Chemicals (NYSE:APD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Air Products and Chemicals (NYSE:APD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025