false

0001023994

0001023994

2025-01-08

2025-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January

8, 2025

SAFE & GREEN HOLDINGS CORP.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-38037 |

|

95-4463937 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

990 Biscayne Blvd.

#501, Office 12

Miami, FL 33132

(Address of Principal Executive Offices, Zip Code)

(Former name or former address, if changed since

last report.)

Registrant’s telephone number, including

area code: 646-240-4235

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 |

|

SGBX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement.

Binding Letter of Intent

On January 8, 2025 (the “Effective Date”),

Safe & Green Holdings Corp., a Delaware corporation (the “Company”), entered into a binding Letter of Intent (the “Letter

of Intent”) with New Asia Holdings, Inc., a Nevada corporation (“NAHD”) and Olenox Corp., a Wyoming corporation and

a wholly owned subsidiary of NAHD (“OLOX” and, together with NAHD, the “Seller”). Upon the terms of and subject

to the satisfaction of the conditions set forth in the Letter of Intent, and in one or more definitive agreements to be entered into among

the Company and Seller, the Company will acquire all of the issued and outstanding securities of NAHD in exchange for shares of Company

stock (the “Transaction”). The Letter of Intent provides that the shares of Company stock to be issued in the Transaction

shall be valued at $1.00 per share and the shares of NAHD to be acquired in the Transaction shall be valued at $0.20 per share.

The Letter of Intent is a binding agreement that

represents the basis on which the parties will proceed to consummate the Transaction pursuant to one or more written definitive, long-form

agreements. The Letter of Intent provides that the parties will use their good faith best efforts to prepare and enter into such definitive

agreement(s) incorporating the terms of the Letter of Intent with an effective date of January 15, 2025 and to close the Transaction as

soon as possible after receipt of necessary approvals. Closing of the contemplated transaction is contingent upon completion of satisfactory

due diligence, execution of definitive transaction documents, receipt of all necessary consents and approvals, and certain other customary

closing conditions.

The Letter of Intent further provides that either

party may terminate the Letter of Intent (i) after completion of due diligence, in the event such party determines that the information

provided is unacceptable for any reason, or (ii) after January 28, 2025, by giving written notice to the other of the notifying party’s

desire to terminate the Letter of Intent.

The foregoing terms and conditions are subject

to change based upon the negotiation and execution of definitive agreement(s) by and among the Company and Seller. Closing of the Transaction

will be subject to the terms and conditions of the definitive agreement(s), including completion of due diligence and satisfaction or

waiver of closing conditions. There can be no assurance that definitive agreement(s) will be entered into or that the proposed Transaction

will be consummated.

There exists a material relationship between the

Company and the Seller in that Michael McLaren serves as the Company’s chief executive officer and chairman of the board, as well

as NAHD’s sole officer and director and as OLOX’s chief executive officer and a member of its board of directors.

The foregoing description of the Letter of Intent

does not purport to be complete and is qualified in its entirety by reference to the full text of the Letter of Intent, a copy of which

is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On January 14, 2025, the Company issued a press

release (the “Press Release”) announcing that had entered into the Letter of Intent. A copy of the Press Release is furnished

as Exhibit 99.1 to this Current Report.

The information furnished pursuant to this Item

7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference into any filing under the Exchange Act or the Securities Act 1933, as amended (the “Securities Act”), except

as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

The Press Release and the statements contained

therein may include “forward-looking” statements within the meaning of Section 27A of the Securities Act and Section 21E of

the Exchange Act. These forward-looking statements include all statements, other than statements

of historical fact, regarding our current views and assumptions with respect to future events regarding our business, including statements

with respect to our plans, assumptions, expectations, beliefs and objectives with respect to our ability to enter into definitive

agreement(s) with NAHD, obtain all necessary consents and approvals in connection with the acquisition, timing to complete the acquisition,

the Company’s business and its plans for the business of the combined company post-closing, and the Company’s ability to maintain

its Nasdaq listing. Readers are cautioned that any forward-looking information provided by us or on our behalf is not a guarantee of future

performance. Actual results may differ materially from those contained in these forward-looking statements as a result of various factors

disclosed in our filings with the SEC, including the “Risk Factors” sections of our Annual Report on Form 10-K for the year

ended December 31, 2023 and subsequent Quarterly Reports on Form 10-Q. All forward-looking statements speak only as of the date on which

they are made, and we undertake no duty to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except to the extent required by law.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

SAFE & GREEN HOLDINGS CORP. |

| |

|

|

| Dated: January 14, 2025 |

By: |

/s/ Patricia Kaelin |

| |

|

Name: |

Patricia Kaelin |

| |

|

Title: |

Chief Financial Officer |

2

Exhibit 10.1

Letter Of Intent to Safe &

Green Holdings Corp

(“SGBX”)

Presented by New Asia Holdings

Inc./Olenox Corp.

January 8, 2025

Board of Directors

990 Biscayne Boulevard

Suite 501, Office 12

Miami, FL 33132

United States

To the Board of Directors of Safe & Green Holdings Corp.

This Letter of Intent (“LOI”)

outlines our mutual understanding of certain basic terms regarding a transaction described herein (collectively, the “Transaction”)

involving New Asia Holdings Inc./Olenox Corp., a Nevada corporation (“OLOX”

or “NAHD”), and Safe and Green Holding Corp., a Delaware

Corporation (“SGBX”), such that SGBX will acquire 100%

of the issued and outstanding shares of NAHD on a fully diluted basis in a sign and close transaction. This LOI constitutes a binding

obligation and the commitment of the parties hereto with respect to any matter provided for or contemplated herein (except as otherwise

provided herein), while this LOI is subject to the subsequent execution and delivery of definitive documents with respect to all matters

pertaining to the Transactions.

1. Definitive

Documentation. Promptly following the completion of any due diligence review, the parties hereto shall commence the negotiation

and preparation of definitive documentation (the “Definitive

Documentation”), providing for or effecting the Transactions, in forms mutually satisfactory to them, containing

definitive terms, provisions, and conditions for the Transactions. The Definitive Documentation shall contain terms, provisions and

conditions reflecting the following:

| a) | The Transaction: At Closing (as defined hereafter), OLOX

shall enter into a transaction with SGBX to acquire 100% of the issued and outstanding shares of NAHD on a fully diluted basis in a sign

and close transaction (the “Transaction”). Valuation

for the Transaction shall be $1.00 per share for SGBX, and $0.20 per share for NAHD. |

2. Closing Date. The Parties

agree that they will use their good faith best efforts to prepare and enter into the Definitive Documentation evidencing and memorializing

the terms and conditions of this LOI with an effective date as of January 15, 2025 (the “Effective

Date”) as soon as possible hereinafter the nearest date post registration statement approval (the “Closing

Date”).

3. Due

Diligence. The Parties each agree to (a) give to the other party and its authorized representatives such access during

regular business hours to the covenanting party’s books, records, properties, personnel and to such other information as the other

party reasonably requests and shall instruct the covenanting party’s independent public accountants to provide access to their work

papers and such other information as the other party may reasonably request, and (b) cause its officers to furnish the other party

with such financial and operating data and other information with respect to the business and properties of the covenanting party as

the other party may reasonably request. Each party’s obligation to complete the Transactions is expressly conditioned upon the

receipt of information regarding the other party as such first party may request and upon such first party’s determination to move

forward with the Transactions after receipt of all such due diligence information. If either of the parties finds any such

information unacceptable for any reason, such party may elect not to enter into the Definitive Documentation or to consummate the

Transactions and may, with written notice to the other, terminate this LOI.

4. Confidentiality.

Neither party shall disclose to any third person (other than its accountants, attorneys, consultants, employees, agents and other

representatives for purposes of evaluating the Transactions), except as may be required by applicable law, unless such information

is otherwise already known by the party without a breach of this paragraph 4 or is generally available to the public, or hereafter

is disclosed to the party by a person who did not have an obligation not to disclose such information or hereafter becomes generally

available to the public. In the event that the Transactions are not consummated by the Closing Date as it may be hereafter extended,

each party shall promptly return all nonpublic information,

documents and other written information containing information obtained pursuant to this LOI, including any item obtained in any

investigation permitted pursuant to this LOI, and any copies thereof. Each party shall require its accountants, attorneys,

consultants, employees, agents and other representatives not to disclose such information, unless required by applicable law or any

applicable securities regulations or exchange rules.

5. Conduct

of Business. After the date hereof and until the Closing or the abandonment of the Transactions, each of OLOX and SGBX

will conduct its business in the ordinary course consistent with past practice and shall use reasonable efforts to keep its assets

in good repair and working order except for ordinary wear and tear, maintain any existing insurance on the assets, and preserve

intact their business.

6. Conditions

Precedent to Closing. The Definitive Documentation shall provide that the Transactions are expressly conditioned upon the

following:

| a) | All third party and other consents required for the Transactions

shall have been obtained; |

| b) | The Transactions shall have been approved by all necessary

entity action on the part of OLOX, and SGBX in accordance with all applicable law; |

| c) | There shall not have been any material adverse change in

the financial condition, operations, business prospects, employee relations, customer relations, assets, liabilities (accrued, absolute,

contingent, or otherwise) or income of OLOX or SGBX or their respective businesses. |

7. Expenses.

Each party shall be responsible for its own attorney fees, auditors and other costs and expenses, anticipated or otherwise, relating

to the Transactions, including negotiating and preparing the Definitive Documentation.

8. Publicity.

OLOX and SGBX agree that the terms of this LOI shall remain strictly confidential, and the Confidentiality provisions stated herein

shall be strictly adhered to, unless such statements are required by applicable law. OLOX and SGBX shall not be permitted to make

any public disclosure of this document or public statements regarding the terms stated herein without mutual consent at any time

unless required by applicable law.

9. Governing

Law. THIS LETTER OF INTENT AND THE DEFINITIVE DOCUMENTATION SHALL BE GOVERNED BY AND INTERPRETED IN ACCORDANCE WITH THE

LAWS OF THE STATE OF TEXAS.

10. Termination.

Each Party understands and agrees that (i) the rights, obligations, and liabilities of each party shall arise only upon the duly

authorized execution of this LOI; and (ii) this LOI may be terminated after January 28, 2025, by either Party by giving written

notice to the other of the notifying Party’s desire to terminate this LOI, and thereafter this LOI shall have no force and effect

and the Parties shall have no further rights, obligations or liabilities hereunder, except in connection with the Binding

Obligations. Such termination will not terminate the obligations set forth in paragraphs 4, 8, 9, 10, 11, 12 and 13 of this LOI (the

“Binding Obligations”), which Binding Obligations

shall continue to bind the Parties and be enforceable by all parties in law or equity.

11. Finder’s Fees. No finder’s fees are owing to any third party as a result of the Transactions.

12. No

Obligation to Complete Transactions. Nothing herein shall obligate either Party to complete the Transactions.

13. Signatures.

The signatures below indicate the intention of each Party, and authorization of their respective organizations, to be bound by the

terms stated herein as of the applicable Date of Execution. The Parties warrant and represent that the person executing this

Agreement is duly authorized to execute this Agreement and to bind the Party to the terms and conditions contained herein. This

Agreement may be executed in counterparts, each of which shall be deemed an original, and of which together shall constitute one and

the same instrument. This Agreement may be delivered by facsimile, email or electronic transmission, including by DocuSign or

similar software, and such signatures shall be treated as original signatures for all applicable purposes.

| Accepted By: | |

Accepted

By: |

| | |

|

| /s/ Mike McLaren | |

/s/ Thomas Meharey |

| Mike McLaren, CEO | |

Thomas Meharey,

Director |

| New Asia Holdings

Inc./Olenox Corp. | |

Safe and Green Holding Corp. |

| | |

|

| 1/8/2025 | |

1/8/2025 |

| Date | |

Date |

3

Exhibit 99.1

Safe & Green Holdings Announces LOI for

Transformative Acquisition of Olenox and Machfu.com

Strategic Transaction Introduces Game-Changing

Energy and IoT Innovations,

Setting the Stage for Long-Term Shareholder Value

Michael McLaren appointed Chairman of Safe &

Green

MIAMI—January 14, 2025 -- Safe &

Green Holdings Corp. (NASDAQ: SGBX) (“Safe & Green Holdings” or the “Company”), a leading developer, designer,

and fabricator of modular structures, today announced the execution of a binding Letter of Intent (“LOI”) to acquire 100%

of the outstanding securities of New Asia Holdings Inc. (OTCQB: NAHD) (“NAHD”). The acquisition includes a diversified energy

company Olenox Corp. (“Olenox”), a wholly owned subsidiary of NAHD. The acquisition also includes Machfu.com (“Machfu”),

a wholly owned subsidiary of Olenox, specializing in secure connectivity and automation solutions for industries such as oil & gas,

utilities, and manufacturing.

Olenox’s operations include three vertically

integrated business units: Oil & Gas Production, Energy Services, and Energy Technologies. Olenox specializes in acquiring and revitalizing

underdeveloped energy assets, leveraging proprietary technologies and operational expertise to enhance production efficiency, lower costs,

and minimize environmental impact.

Key achievements of Olenox include expanding production

from 113 barrels of oil equivalent per day (BOE/day) to a projected 700 BOE/day through increased operational capacity and innovative

technologies. By focusing on distressed and neglected oil and gas fields in Texas, Oklahoma, and Kansas, Olenox has created a scalable

model that addresses industry inefficiencies while maintaining a strong commitment to sustainability. Following the acquisition of NAHD,

Safe & Green will continue to maintain its current operations and fabrication of modular structures. In addition, the Company plans

to leverage its existing facilities, including its Waldron facility in Durant, Oklahoma, to support its new operations in the oil and

gas industry. Company management expects that this dual focus will enable the combined entity to achieve greater efficiencies and benefit

from economies of scale across its business segments. This approach aligns with the Company’s overarching vision to lead advancements

in sustainable energy, food, water, and shelter as essential pillars for fostering global resilience.

Olenox’s proprietary plasma pulse and ultrasonic

cleaning tools set it apart from traditional energy players. These advanced technologies allow for cost-effective recovery of oil and

gas while reducing the environmental footprint, ensuring alignment with global sustainability trends. Olenox’s Energy Services division,

with its customized service rigs and reclamation capabilities, enhances the value of its production assets while generating additional

revenue streams through third-party contracts.

Machfu.com is a trailblazer in the Industrial

IoT sector. Its flagship product, the MachGateway®, and Edge-to-Enterprise™ software enable seamless integration of legacy systems

with modern IoT platforms. With over 20,000 gateways deployed globally, Machfu has proven its ability to deliver real-time data analytics,

predictive maintenance, and operational efficiency to industrial clients.

Machfu’s technology supports cost reduction

and productivity gains by minimizing downtime and optimizing equipment performance. For example, its Bluetooth IoT gateways connect over

125 sensors per device, enabling scalable, low-cost solutions for monitoring and control in industrial environments. These capabilities

directly address the growing demand for automation and digital transformation in energy and other key industries, creating high-margin

recurring revenue opportunities for the combined entity.

In connection with the transaction, Michael McLaren,

recently appointed CEO of Safe & Green, as well as founder and CEO of Olenox, will assume the additional role of Chairman of Safe

& Green, succeeding Paul Galvin, who will remain on Safe & Green’s board of directors. McLaren brings decades of experience

in energy production, sustainability, and innovation, making him uniquely positioned to lead the company’s expanded vision.

Newly appointed Chairman and CEO Michael McLaren

Michael McLaren stated, “We believe that

the combination of Olenox and Machfu with Safe & Green will create a powerful, diversified entity with robust growth potential in

both the energy and technology sectors. Olenox provides stable and growing revenues from its oil and gas assets, complemented by the scalability

of Machfu’s recurring IoT revenue streams. We believe that this synergy will position the combined company to capture significant

market opportunities in renewable energy, digital transformation, and industrial automation. By maintaining Safe & Green’s current

modular operations, while leveraging facilities such as our Waldron facility to support oil and gas activities, we expect to achieve greater

operational efficiencies and economies of scale. For Safe & Green shareholders, this transaction represents a strategic pivot toward

high-growth markets. Olenox’s proven financial performance, including strong asset utilization and innovative technologies, enhances

the Company’s equity position and profitability potential. Machfu’s advanced IoT capabilities further diversify the revenue

base, providing exposure to a rapidly growing global market. I am honored to lead this next chapter and deeply appreciate Paul Galvin’s

exceptional leadership and dedication. I look forward to working closely with Paul and the board to realize our shared vision.”

Paul Galvin added, “This transaction marks

an exciting milestone for Safe & Green and its shareholders. The combination of Olenox and Machfu with Safe & Green creates a

powerful, diversified entity with robust growth potential in both the energy and technology sectors. We expect that this transaction will

expand the Company’s addressable markets, increase operational efficiencies, and position the combined entity as a leader in innovative,

sustainable solutions. Importantly, we believe leveraging existing facilities to support both modular and oil and gas operations will

maximize efficiency and drive economies of scale. Moreover, Olenox is already profitable and on a strong growth trajectory. By combining

their operations with our own, I am confident this transaction will drive significant value for shareholders. Furthermore, we believe

this transaction will help address the Company’s Nasdaq listing deficiency by strengthening our financial position. I am also thrilled

to welcome Mike McLaren as Chairman as we enter this new phase of growth and innovation.”

About Safe & Green Holdings Corp.

Safe & Green Holdings Corp., a leading modular

solutions company, operates under core capabilities which include the development, design, and fabrication of modular structures, meeting

the demand for safe and green solutions across various industries. The firm supports third-party and in-house developers, architects,

builders, and owners in achieving faster execution, greener construction, and buildings of higher value. For more information, visit https://www.safeandgreenholdings.com/

and follow us at @SGHcorp on Twitter.

No Offer or Solicitation

This communication is for informational purposes

only and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities,

or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Safe Harbor Statement

Certain statements in this press release constitute

“forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “might,”

“will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,”

“predict,” “forecast,” “project,” “plan,” “intend” or similar expressions, or statements

regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current

estimates and assumptions and include statements regarding the Company’s letter of intent to acquire NAHD, including its subsidiary

Olenox and Olenox’s subsidiary Machfu.com, closing of such acquisition, the Company’s plans to leverage its existing facilities

to support the combined company’s operations in the oil and gas industries, Olenox’s proprietary plasma pulse and ultrasonic

cleaning tools that allow for cost-effective recovery of oil and gas while reducing the environmental footprint, and Machfu’s MachGateway®

and Edge-to-Enterprise™ software which enable seamless integration of legacy systems with modern IoT platforms, and the Company’s

ability to maintain its Nasdaq listing. These forward-looking statements are subject to various risks and uncertainties, many of which

are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set

forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current

expectations include, among others, the Company’s ability to successfully complete the transaction with NAHD, the timing to consummate

the proposed acquisition, the diversion of management time on transaction-related issues, unexpected costs, charges or expenses resulting

from the acquisition, potential litigation relating to the acquisition that could be instituted against the parties to the letter of intent

or their respective directors, managers or officers, including the effects of any outcomes related thereto, the Company’s ability

to successfully leverage its existing facilities to support its planned new operations for the combined entity in the oil and gas industries,

Olenox’s ability to successfully leverage its proprietary plasma pulse and ultrasonic cleaning tools, Olenox’s ability to

successfully generate additional revenue streams through third-party contracts, Machfu.com’s ability to successfully leverage its

advanced IoT capabilities to diversify and increase its revenue base, the effect of government regulation, the Company’s ability

to maintain compliance with the NASDAQ listing requirements, and the other factors discussed in the Company’s Annual Report on Form

10-K for the year ended December 31, 2023 and its subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q

and 8-K. The information in this release is provided only as of the date of this release, and we undertake no obligation to update any

forward-looking statements contained in this release on account of new information, future events, or otherwise, except as required by

law.

Investor Relations:

Crescendo Communications, LLC

(212) 671-1020

sgbx@crescendo-ir.com

3

v3.24.4

Cover

|

Jan. 08, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2025

|

| Entity File Number |

001-38037

|

| Entity Registrant Name |

SAFE & GREEN HOLDINGS CORP.

|

| Entity Central Index Key |

0001023994

|

| Entity Tax Identification Number |

95-4463937

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

990 Biscayne Blvd.

|

| Entity Address, Address Line Two |

#501

|

| Entity Address, Address Line Three |

Office 12

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33132

|

| City Area Code |

646

|

| Local Phone Number |

240-4235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

SGBX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

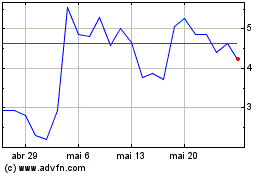

Safe and Green (NASDAQ:SGBX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Safe and Green (NASDAQ:SGBX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025