UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number: 333-226308

COLOR STAR TECHNOLOGY CO., LTD.

(Translation of registrant’s name into English)

80 Broad Street, 5th Floor

New York, NY 10005

Tel: +1 (929) 317-2699

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Change of Auditor

On January 23, 2025, Coloar Star Technology Co., Ltd.

(the “Company”), upon the approval and ratification of the board of directors of the Company (the “Board”) and

the audit committee of the Board (the “Audit Committee”), dismissed Audit Alliance LLP (“Audit Alliance”), the

former independent registered public accounting firm of the Company, effective on January 23, 2025, and appointed AssentSure PAC (PCAOB

ID: 6783) (“AssentSure”) to serve as its independent registered public accounting firm, effective on January 23, 2025, for

the year ended June 30, 2025 and the six months period ended December 31, 2024.

Audit Alliance’s reports on the Company’s

financial statements for the fiscal years ended June 30, 2024 and 2023 did not contain any adverse opinion or disclaimers of opinion and

were not qualified or modified as to uncertainty, audit scope, or accounting principles. Furthermore, during the Company’s most

recent fiscal year, there were no disagreements with Audit Alliance on any matter of accounting principles or practices, financial statement

disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Audit Alliance, would have caused

Audit Alliance to make reference to the subject matter of the disagreements in connection with its reports on the Company’s financial

statements for such year. Also, during this time, there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation

S-K.

The Company provided Audit Alliance with a copy of

the above disclosure and requested that Audit Alliance furnish the Company with a letter addressed to the U.S. Securities and Exchange

Commission stating whether or not it agrees with the above statements. A copy of Audit Alliance’s letter is filed as Exhibit 16.1

to this Form 6-K.

During the two most recent fiscal years and any subsequent

interim periods prior to the engagement of AssentSure, neither the Company, nor someone on behalf of the Company, has consulted AssentSure

regarding (i) the application of accounting principles to any specified transaction, either completed or proposed or the type of audit

opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice

was provided to the Company that AssentSure concluded was an important factor considered by the Company in reaching a decision as to any

accounting, auditing, or financial reporting issue, or (ii) any matter that was either the subject of a “disagreement,” as

defined in Item 304(a)(1)(iv) of Regulation S-K, or a “reportable event,” as defined in Item 304(a)(1)(v) of Regulation S-K,

or any other matters set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

Additional Closing of Notes and Warrants

As previously disclosed by the Company, on January

16, 2025, the Company and certain institutional investors (the “Purchasers”) elected to consummate an Additional Closing pursuant

to that certain securities purchase agreement dated September 27, 2024, as amended, pursuant to which the Company issued senior secured

convertible notes to the Purchasers in the aggregate principal amount of approximately $8.7 million (the “New Notes”), having

an original issue discount of 8%, a maturity date twelve months from the date of issuance, bearing an interest rate of 6% per annum, and

convertible into Class A Ordinary Shares, par value $0.0001 per share (“Ordinary Shares”) of the Company, and accompanying

Series B Warrants to purchase up to an aggregate of 2,467,692 Ordinary Shares, with an exercise price of $2.11 per Ordinary Share (the

“Third Offering”).

The Third Offering closed on January 21, 2025, upon

the satisfaction or waiver of all closing conditions, and resulted in gross proceeds to the Company of approximately $8 million before

deducting placement agent fees and other estimated offering expenses

Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: January 23, 2025

| |

COLOR STAR TECHNOLOGY CO., LTD. |

| |

|

|

| |

By: |

/s/ Louis Luo |

| |

Name: |

Louis Luo |

| |

Title: |

Chief Executive Officer |

Exhibit 16.1

AUDIT

ALLIANCE LLP®

AUDIT

ALLIANCE LLP®

A Top 18 Audit Firm

10 Anson Road, #20-16 International Plaza, Singapore

079903.

UEN:

T12LL1223B GST Reg No: M90367663E Tel: (65) 6227 5428

Website:

www.allianceaudit.com

January

23, 2025

Securities

and Exchange Commission 100 F Street, N.E.

Washington,

D.C. 20549 Commissioners:

We

have read Form 6-K dated January 23, 2025, of Color Star Technology Co., Ltd. (“Registrant”) and are in agreement with the

statements contained therein as it pertains to our firm; we are not in a position to agree or disagree with other statements of Registrant

contained therein.

Very

truly yours,

/s/

Audit Alliance LLP Singapore

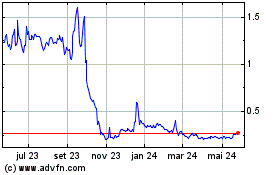

Color Star Technology (NASDAQ:ADD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

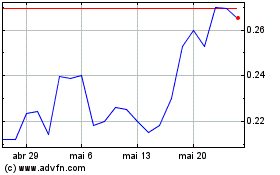

Color Star Technology (NASDAQ:ADD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025