As filed with the Securities and Exchange Commission on January 28, 2025

File No. 33-89088

811-08972

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST

EFFECTIVE AMENDMENT NO. 35

TO

Form S-6

FOR

REGISTRATION UNDER THE SECURITIES ACT OF 1933 OF

SECURITIES OF UNIT INVESTMENT TRUSTS REGISTERED

ON FORM N-8B-2

SPDR S&P MIDCAP 400 ETF TRUST

(formerly known as MIDCAP SPDR TRUST SERIES 1 prior to January 27, 2010)

(I.R.S. Employer Identification Number: 13-7077797)

PDR SERVICES LLC

| C. |

Complete address of Depositor’s principal executive office: |

PDR SERVICES LLC

c/o NYSE

Holdings LLC

11 Wall Street

New York, New York 10005

| D. |

Name and complete address of agent for service: |

Patrick Troy, Esq.

PDR SERVICES

LLC

c/o NYSE Holdings LLC

11 Wall Street

New York, New

York 10005

Copy to:

Gregory S. Rowland, Esq.

Davis

Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

It is

proposed that this filing will become effective:

| |

☒ |

immediately upon filing pursuant to paragraph (b) of Rule 485. |

| E. |

Title of securities being registered: |

An indefinite number of Units pursuant to Rule 24f-2 under the Investment Company Act of 1940.

| F. |

Approximate date of proposed public offering: |

AS SOON AS PRACTICABLE AFTER THE EFFECTIVE DATE OF THE REGISTRATION STATEMENT.

| |

☐ |

Check box if it is proposed that this filing will become effective on [date] at [time] pursuant to Rule 487.

|

SPDR S&P MIDCAP 400 ETF TRUST

Cross Reference Sheet

Pursuant to Regulation C

Under the Securities Act of 1933, as amended

(Form N-8B-2 Items required by Instruction 1

as to Prospectus in Form S-6)

|

|

|

| Form N-8B-2 |

|

Form S-6 |

| Item Number |

|

Heading in Prospectus |

| I. Organization and General Information |

|

|

|

|

| 1. (a) Name of Trust |

|

Registration Statement Front Cover |

|

|

| (b) Title of securities issued |

|

Registration Statement Front Cover |

|

|

| 2. Name, address and Internal Revenue Service Employer Identification Number of

depositor |

|

Sponsor |

|

|

| 3. Name, address and Internal Revenue Service Employer Identification Number of

trustee |

|

Trustee |

|

|

| 4. Name, address and Internal Revenue Service Employer Identification Number of

principal underwriter |

|

* |

|

|

| 5. State of organization of Trust |

|

Organization of the Trust |

|

|

| 6. (a) Dates of execution and termination of Trust

Agreement |

|

Organization of the Trust |

|

|

| (b) Dates of execution and termination of Trust Agreement |

|

Same as set forth in 6(a) |

|

|

| 7. Changes of name |

|

* |

|

|

| 8. Fiscal Year |

|

* |

|

|

| 9. Material Litigation |

|

* |

|

|

| II. General Description of the Trust and Securities of the Trust |

|

|

|

|

| 10. (a) Registered or bearer securities |

|

Summary—Voting Rights; Book-Entry-Only System; Book-Entry-Only System |

|

|

| (b) Cumulative or distributive |

|

Summary—Dividends; Dividends and Distributions; Additional Information Regarding Dividends and Distributions |

|

|

| (c) Rights of holders as to withdrawal or redemption |

|

Summary—Redemption of Units; Purchases and Redemptions of Creation Units—Redemption |

|

|

| (d) Rights of holders as to conversion, transfer, etc. |

|

Summary—Redemption of Units; Purchases and Redemptions of Creation Units—Redemption; Trust Agreement |

|

|

| (e) Lapses or defaults in principal payments with respect to periodic payment

plan certificates |

|

* |

|

|

| (f) Voting rights |

|

Summary—Voting Rights; Book-Entry-Only System; Trust Agreement |

|

|

| (g) Notice to holders as to change in: |

|

|

|

|

| (1) Composition of Trust assets |

|

* |

|

|

| (2) Terms and conditions of Trust’s securities |

|

Summary—Amendments to the Trust Agreement; Trust Agreement—Amendments to the Trust Agreement |

|

|

| (3) Provisions of Trust Agreement |

|

Same as set forth in 10(g)(2) |

|

|

| (4) Identity of depositor and trustee |

|

Sponsor; Trustee |

|

|

| (h) Consent of holders required to change: |

|

|

|

|

| (1) Composition of Trust assets |

|

* |

|

|

| (2) Terms and conditions of Trust’s securities |

|

Summary—Amendments to the Trust Agreement; Trust Agreement—Amendments to the Trust Agreement |

|

|

| (3) Provisions of Trust Agreement |

|

Same as set forth in 10(h)(2) |

|

|

| (4) Identity of depositor and trustee |

|

Sponsor; Trustee |

| * |

Not applicable, answer negative or not required. |

i

|

|

|

| Form N-8B-2 |

|

Form S-6 |

| Item Number |

|

Heading in Prospectus |

| (i) Other principal features of the securities |

|

Summary—The Trust’s Investments and Portfolio Turnover; Summary—Redemption of Units; Summary—Amendments to the Trust Agreement; Purchases and Redemptions of Creation Units; Trust Agreement |

|

|

| 11. Type of securities comprising units |

|

Summary—The Trust’s Investments and Portfolio Turnover; Portfolio Adjustments |

|

|

| 12. Certain information regarding securities comprising periodic payment

certificates |

|

* |

|

|

| 13. (a) Certain information regarding loads, fees, expenses and

charges |

|

Summary—Fees and Expenses of the Trust; Summary—The Trust’s Investments and Portfolio Turnover; Expenses of the Trust; Purchases and Redemptions of Creation Units—Redemption |

|

|

| (b) Certain information regarding periodic payment plan certificates |

|

* |

|

|

| (c) Certain percentages |

|

Same as set forth in 13(a) |

|

|

| (d) Reasons for certain differences in prices |

|

* |

|

|

| (e) Certain other loads, fees, or charges payable by holders |

|

* |

|

|

| (f) Certain profits receivable by depositor, principal underwriters,

custodian, trustee or affiliated persons |

|

Summary—The Trust’s Investments and Portfolio Turnover; Portfolio Adjustments—Adjustments to the Portfolio Deposit |

|

|

| (g) Ratio of annual charges and deductions to income |

|

* |

|

|

| 14. Issuance of Trust’s securities |

|

Purchases and Redemptions of Creation Units—Purchase (Creation) |

|

|

| 15. Receipt and handling of payments from purchasers |

|

Purchases and Redemptions of Creation Units |

|

|

| 16. Acquisition and disposition of underlying securities |

|

Purchases and Redemptions of Creation Units; |

|

|

|

|

Portfolio Adjustments; Trust Agreement |

|

|

| 17. (a) Withdrawal or redemption by holders |

|

Trust Agreement; Purchases and Redemptions of Creation Units—Redemption |

|

|

| (b) Persons entitled or required to redeem or repurchase securities |

|

Same as set forth in 17(a) |

|

|

| (c) Cancellation or resale of repurchased or redeemed securities |

|

Same as set forth in 17(a) |

|

|

| 18. (a) Receipt, custody and disposition of income |

|

Additional Information Regarding Dividends and Distributions—General Policies |

|

|

| (b) Reinvestment of distributions |

|

Dividends and Distributions—Dividend Reinvestment Service |

|

|

| (c) Reserves or special funds |

|

Same as set forth in 18(a) |

|

|

| (d) Schedule of distributions |

|

* |

|

|

| 19. Records, accounts and reports |

|

The S&P MidCap 400 Index; Additional Information Regarding Dividends and Distributions—General Policies; |

|

|

|

|

Investments by Investment Companies; Expenses of the Trust |

|

|

| 20. Certain miscellaneous provisions of Trust Agreement |

|

|

|

|

| (a) Amendments |

|

Trust Agreement—Amendments to the Trust Agreement |

|

|

| (b) Extension or termination |

|

Trust Agreement—Amendments to the Trust Agreement;

Trust Agreement—Termination of the Trust Agreement;

Organization of the Trust |

|

|

| (c) Removal or resignation of trustee |

|

Trustee |

|

|

| (d) Successor trustee |

|

Same as set forth in 20(c) |

|

|

| (e) Removal or resignation of depositor |

|

Sponsor |

|

|

| (f) Successor depositor |

|

Same as set forth in 20(e) |

|

|

| 21. Loans to security holders |

|

* |

|

|

| 22. Limitations on liabilities |

|

Trustee; Sponsor |

|

|

| 23. Bonding arrangements |

|

* |

|

|

| 24. Other material provisions of Trust Agreement |

|

* |

|

|

| III. Organization, Personnel and Affiliated Persons of Depositor |

|

|

|

|

| 25. Organization of depositor |

|

Sponsor |

|

|

| 26. Fees received by depositor |

|

* |

| * |

Not applicable, answer negative or not required. |

ii

|

|

|

| Form N-8B-2 |

|

Form S-6 |

| Item Number |

|

Heading in Prospectus |

| 27. Business of depositor |

|

Sponsor |

|

|

| 28. Certain information as to officials and affiliated persons of depositor |

|

Sponsor |

|

|

| 29. Ownership of voting securities of depositor |

|

Sponsor |

|

|

| 30. Persons controlling depositor |

|

Sponsor |

|

|

| 31. Payments by depositor for certain services rendered to Trust |

|

* |

|

|

| 32. Payments by depositor for certain other services rendered to Trust |

|

* |

|

|

| 33. Remuneration of employees of depositor for certain services rendered to

Trust |

|

* |

|

|

| 34. Compensation of other persons for certain services rendered to Trust |

|

* |

|

|

| IV. Distribution and Redemption of Securities |

|

|

|

|

| 35. Distribution of Trust’s securities in states |

|

* |

|

|

| 36. Suspension of sales of Trust’s securities |

|

* |

|

|

| 37. Denial or revocation of authority to distribute |

|

* |

|

|

| 38. (a) Method of distribution |

|

Purchases and Redemptions of Creation Units—Purchase (Creation) |

|

|

| (b) Underwriting agreements |

|

Purchases and Redemptions of Creation Units |

|

|

| (c) Selling agreements |

|

Same as set forth in 38(b) |

|

|

| 39. (a) Organization of principal underwriter |

|

Distributor |

|

|

| (b) NASD membership of principal underwriter |

|

Distributor |

|

|

| 40. Certain fees received by principal underwriters |

|

* |

|

|

| 41. (a) Business of principal underwriters |

|

Purchases and Redemptions of Creation Units; Distributor |

|

|

| (b) Branch offices of principal underwriters |

|

* |

|

|

| (c) Salesmen of principal underwriters |

|

* |

|

|

| 42. Ownership of Trust’s securities by certain persons |

|

* |

|

|

| 43. Certain brokerage commissions received by principal underwriters |

|

* |

|

|

| 44. (a) Method of valuation for determining offering

price |

|

Portfolio Adjustments; Determination of Net Asset Value |

|

|

| (b) Schedule as to components of offering price |

|

* |

|

|

| (c) Variation in offering price to certain persons |

|

* |

|

|

| 45. Suspension of redemption rights |

|

* |

|

|

| 46. (a) Certain information regarding redemption or withdrawal

valuation |

|

Determination of Net Asset Value; Purchases and Redemptions of Creation Units—Redemption |

|

|

| (b) Schedule as to components of redemption price |

|

* |

|

|

| 47. Maintenance of position in underlying securities |

|

Purchases and Redemptions of Creation Units; Portfolio Adjustments; Determination of Net Asset Value; Additional Information Regarding Dividends and Distributions—General Policies |

|

|

| V. Information Concerning the Trustee or Custodian |

|

|

|

|

| 48. Organization and regulation of trustee |

|

Trustee |

|

|

| 49. Fees and expenses of trustee |

|

Summary—Fees and Expenses of the Trust; Expenses of the Trust; Purchases and Redemptions of Creation Units—Redemption |

|

|

| 50. Trustee’s lien |

|

Expenses of the Trust; Purchases and Redemptions of Creation Units—Redemption |

|

|

| VI. Information Concerning Insurance of Holders of Securities |

|

|

|

|

| 51. (a) Name and address of insurance company |

|

* |

|

|

| (b) Types of policies |

|

* |

|

|

| (c) Types of risks insured and excluded |

|

* |

|

|

| (d) Coverage |

|

* |

|

|

| (e) Beneficiaries |

|

* |

|

|

| (f) Terms and manner of cancellation |

|

* |

|

|

| (g) Method of determining premiums |

|

* |

| * |

Not applicable, answer negative or not required. |

iii

|

|

|

| Form N-8B-2 |

|

Form S-6 |

| Item Number |

|

Heading in Prospectus |

| (h) Aggregate premiums paid |

|

* |

|

|

| (i) Recipients of premiums |

|

* |

|

|

| (j) Other material provisions of Trust Agreement relating to insurance |

|

* |

|

|

| VII. Policy of Registrant |

|

|

|

|

| 52. (a) Method of selecting and eliminating securities from the

Trust |

|

Purchases and Redemptions of Creation Units; Portfolio Adjustments; Trust Agreement |

|

|

| (b) Elimination of securities from the Trust |

|

Portfolio Adjustments |

|

|

| (c) Policy of Trust regarding substitution and elimination of

securities |

|

Portfolio Adjustments; Trust Agreement |

|

|

| (d) Description of any other fundamental policy of the Trust |

|

* |

|

|

| (e) Code of Ethics pursuant to Rule

17j-1 of the 1940 Act |

|

Code of Ethics |

|

|

| 53. (a) Taxable status of the Trust |

|

Federal Income Taxes |

|

|

| (b) Qualification of the Trust as a regulated investment company |

|

Same as set forth in 53(a) |

|

|

| VIII. Financial and Statistical Information |

|

|

|

|

| 54. Information regarding the Trust’s last ten fiscal years |

|

* |

|

|

| 55. Certain information regarding periodic payment plan certificates |

|

* |

|

|

| 56. Certain information regarding periodic payment plan certificates |

|

* |

|

|

| 57. Certain information regarding periodic payment plan certificates |

|

* |

|

|

| 58. Certain information regarding periodic payment plan certificates |

|

* |

|

|

| 59. Financial statements (Instruction 1(c) to Form

S-6) |

|

* |

| * |

Not applicable, answer negative or not required. |

iv

Undertaking to File Reports

Subject to the terms and conditions of Section 15(d) of the Securities Exchange Act of 1934, the undersigned registrant hereby undertakes

to file with the Securities and Exchange Commission such supplementary and periodic information, documents and reports as may be prescribed by any rule or regulations of the Commission heretofore or hereafter duly adopted pursuant to authority

conferred in that section.

v

SPDR® S&P MIDCAP 400® ETF Trust

(“MDY” or the “Trust”)

(A Unit Investment Trust)

Principal U.S. Listing Exchange for SPDR® S&P MIDCAP 400® ETF Trust: NYSE Arca, Inc. under the symbol “MDY”

Prospectus

Dated January 28, 2025

The U.S. Securities and Exchange Commission has not approved or disapproved these securities or passed upon the

accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. Securities of the Trust (“Units”) are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other agency of

the U.S. Government, nor are such Units deposits or obligations of any bank. Such Units of the Trust involve investment risks, including the loss of principal.

COPYRIGHT 2025 PDR Services LLC

SPDR S&P MIDCAP 400 ETF TRUST

“Standard & Poor’s®,” “S&P®,” “SPDR®,” “S&P MidCap 400®,” “Standard & Poor’s MidCap 400 Indextm,” “S&P MidCap 400 Indextm” and “Standard & Poor’s MidCap 400 Depositary ReceiptsTM” are trademarks of Standard & Poor’s

Financial Services LLC and have been licensed for use by S&P Dow Jones Indices LLC (“S&P”), and sublicensed for use by State Street Global Advisors Funds Distributors, LLC. The Trust is permitted to use these trademarks pursuant to

a sublicense from State Street Global Advisors Funds Distributors, LLC. The Trust is not sponsored, endorsed, sold or promoted by S&P, its affiliates or its third-party licensors.

i

SUMMARY

Investment Objective

SPDR® S&P MIDCAP 400® ETF

Trust (the “Trust”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P MidCap 400® IndexTM (the “Index”).

Fees and Expenses of the Trust

This table estimates the fees and expenses that the Trust pays on an annual basis, which you therefore pay indirectly when you buy and hold

Units. It does not reflect brokerage commissions and other fees to financial intermediaries that you may pay for purchases and sales of Units on the secondary markets.

|

|

|

| Unitholder Fees: |

|

None |

| (fees paid directly from your investment) |

|

|

|

| Estimated Annual Trust Ordinary Operating Expenses: |

| (expenses that you pay each year as a percentage of the value of your investment) |

|

|

|

|

|

| Current Estimated Annual Trust Ordinary Operating

Expenses |

|

As a % of

Trust Average

Net Assets |

|

| Trustee’s Fee |

|

|

0.10 |

% |

| S&P License Fee |

|

|

0.03 |

% |

| Marketing |

|

|

0.10 |

% |

| Other Operating Expenses |

|

|

0.00 |

%* |

|

|

|

|

|

| Total |

|

|

0.23 |

% |

|

|

|

|

|

| * |

Actual amount of “Other Operating Expenses” is 0.0031% and has been rounded down for purposes of this

table. |

Future accruals will depend primarily on the level of the Trust’s net assets and the level of expenses.

There is no guarantee that the Trust’s ordinary operating expenses will not exceed 0.23% of the Trust’s daily net asset value.

1

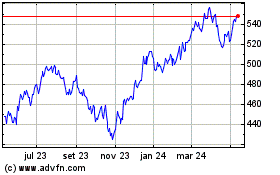

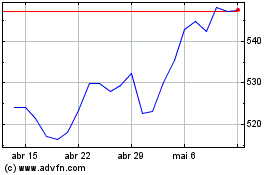

Growth of $10,000 Investment Since Inception(1)(2)

| (1) |

Past performance is not necessarily an indication of how the Trust will perform in the future.

|

| (2) |

Effective as of September 30, 1997, the Trust’s fiscal year end changed from December 31 to

September 30. |

The Trust’s Investments and Portfolio Turnover

The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the Index (the

“Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the Index.

In this prospectus, the term “Portfolio Securities” refers to the common stocks that are actually held by the Trust and make up the

Trust’s Portfolio, while the term “Index Securities” refers to the common stocks that are included in the Index, as determined by the index provider, S&P Dow Jones Indices LLC (“S&P”). At any time, the Portfolio will

consist of as many of the Index Securities as is practicable. To maintain the correspondence between the composition and weightings of Portfolio Securities and Index Securities, the Bank of New York Mellon (the “Trustee”) adjusts the

Portfolio from time to time to conform to periodic changes made by S&P to the identity and/or relative weightings of Index Securities in the Index. The Trustee aggregates certain of these adjustments and makes changes to the Portfolio at least

monthly, or more frequently in the case of significant changes to the Index.

The Trust may pay transaction costs, such as brokerage

commissions, when it buys and sells securities (or “turns over” its Portfolio). Such transaction costs may be higher if there are significant rebalancings of Index Securities in the Index, which may also result in higher taxes when Units

are held in a taxable account. These costs, which are not reflected in estimated annual Trust ordinary operating expenses, affect the Trust’s performance. During the most recent fiscal year, the Trust’s portfolio turnover rate was 20.43%

of the average value of its portfolio. The Trust’s portfolio turnover rate does not include securities received or delivered from processing creations or redemptions of Units. Portfolio turnover will be a function of changes to the Index as

well as requirements of the Trust Agreement (as defined below in “Organization of the Trust”).

2

Although the Trust may fail to own certain Index Securities at any particular time, the Trust

generally will be substantially invested in Index Securities, which should result in a close correspondence between the performance of the Index and the performance of the Trust. See “The S&P MidCap 400 Index” below for more

information regarding the Index. The Trust does not hold or trade futures or swaps and is not a commodity pool.

Dividends

Payments of dividends are made quarterly, on the last Business Day (as defined in Purchases and Redemptions of Creation Units —

Purchase (Creation)”) of April, July, October and January. See “Dividends and Distributions” and “Additional Information Regarding Dividends and Distributions.”

Redemption of Units

Only certain institutional investors (typically market makers or other broker-dealers) are permitted to purchase or redeem Units directly with

the Trust, and they may do so only in large blocks of 25,000 Units known as “Creation Units.” See “Purchases and Redemptions of Creation Units — Redemption” and “Trust Agreement” for more information regarding

the rights of Beneficial Owners (as defined in “Book-Entry-Only System”).

Voting Rights; Book-Entry-Only System

Beneficial Owners shall not have the right to vote concerning the Trust, except with respect to termination and as otherwise expressly

set forth in the Trust Agreement. See “Trust Agreement.” Units are represented by one or more global securities registered in the name of Cede & Co., as nominee for The Depository Trust Company (“DTC”), and

deposited with, or on behalf of, DTC. See “Book-Entry-Only System.”

Amendments to the Trust Agreement

The Trust Agreement (as defined below in “Organization of the Trust”) may be amended from time to time by the Trustee and PDR

Services, LLC (the “Sponsor”) without the consent of any Beneficial Owners to cure certain defects or as may be required by applicable laws. The Trust Agreement may also be amended by the Sponsor and the Trustee with the consent of

the Beneficial Owners to modify the rights of Beneficial Owners under certain circumstances. Promptly after the execution of an amendment to the Trust Agreement, the Trustee arranges for written notice to be provided to Beneficial Owners. See

“Trust Agreement — Amendments to the Trust Agreement.”

3

Principal Risks of Investing in the Trust

As with all investments, there are certain risks of investing in the Trust, and you could lose money on an investment in the Trust. Prospective

investors should carefully consider the risk factors described below, as well as the additional risk factors under “Additional Risk Information” and the other information included in this prospectus, before deciding to invest in Units.

Passive Strategy/Index Risk. The Trust is not actively managed. Rather, the Trust attempts to track the performance of an

unmanaged index of securities. This differs from an actively managed fund, which typically seeks to outperform a benchmark index. As a result, the Trust will hold constituent securities of the Index regardless of the current or projected performance

of a specific security or a particular industry or market sector. Maintaining investments in securities regardless of market conditions or the performance of individual securities could cause the Trust’s return to be lower than if the Trust

employed an active strategy.

Index Tracking Risk. While the Trust is intended to track the performance of the Index as

closely as possible (i.e., to achieve a high degree of correlation with the Index), the Trust’s return may not match or achieve a high degree of correlation with the return of the Index due to expenses and transaction costs

incurred in adjusting the Portfolio. In addition, it is possible that the Trust may not always fully replicate the performance of the Index due to the unavailability of certain Index Securities in the secondary market or due to other extraordinary

circumstances (e.g., if trading in a security has been halted).

Equity Investing and Market Risk. An investment in the

Trust involves risks similar to those of investing in any fund of equity securities, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates, perceived trends in securities prices, war,

acts of terrorism, the spread of infectious disease or other public health issues. Local, regional or global events such as war, acts of terrorism, the spread of infectious disease or other public health issues, recessions, or other events could

have a significant impact on the Trust and its investments and could result in increased premiums or discounts to the Trust’s net asset value. For example, conflict, loss of life and disaster connected to ongoing armed conflicts between Ukraine

and Russia in Europe and Israel and Hamas in the Middle East could have severe adverse effects on their respective regions, including significant adverse effects on the regional or global economies and the markets for certain securities.

Russia’s invasion of Ukraine has resulted in sanctions against Russian governmental institutions, Russian entities, and Russian individuals that may result in the devaluation of Russian currency; a downgrade in the country’s credit rating;

a freeze of Russian foreign assets; and a decline in the value and liquidity of Russian securities, properties, or interests. These Russian-related sanctions as well as the potential for military escalation and other corresponding events in Europe

and the Middle East, and the resulting disruption of the Russian and Israeli economies, may cause volatility in other regional and global markets and may negatively impact the

4

performance of various sectors and industries, as well as companies in other countries, which could have a negative effect on the performance of the Trust, even if the Trust does not have direct

exposure to securities of Russian or Israeli issuers.

An investment in the Trust is subject to the risks of any investment in a broadly

based portfolio of equity securities, including the risk that the general level of stock prices may decline, thereby adversely affecting the value of such investment. The value of Portfolio Securities may fluctuate in accordance with changes in the

financial condition of the issuers of Portfolio Securities, the value of equity securities generally and other factors. The identity and weighting of Index Securities and the Portfolio Securities change from time to time.

The financial condition of issuers of Portfolio Securities may become impaired or the general condition of the stock market may deteriorate,

either of which may cause a decrease in the value of the Portfolio and thus in the value of Units. Since the Trust is not actively managed, the adverse financial condition of an issuer will not result in its elimination from the Portfolio unless

such issuer is removed from the Index. Equity securities are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. These investor

perceptions are based on various and unpredictable factors, including expectations regarding government, economic, monetary and fiscal policies, inflation and interest rates, economic expansion or contraction, and global or regional political,

economic and banking crises, as well as war, acts of terrorism and the spread of infectious disease or other public health issues.

The

impact of infectious disease outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health

crises may exacerbate other pre-existing political, social and economic risks in certain countries or globally. These factors, as well as any restrictive measures instituted in order to prevent or control a

pandemic or other public health crisis could have a material and adverse effect on the Trust’s investments.

Holders of common

stocks of any given issuer incur more risk than holders of preferred stocks and debt obligations of the issuer because the rights of common stockholders, as owners of the issuer, generally are subordinate to the rights of creditors of, or holders of

debt obligations or preferred stocks issued by, such issuer. Further, unlike debt securities that typically have a stated principal amount payable at maturity, or preferred stocks that typically have a liquidation preference and may have stated

optional or mandatory redemption provisions, common stocks have neither a fixed principal amount nor a maturity. Equity securities values are subject to market fluctuations as long as the equity securities remain outstanding. The value of the

Portfolio will fluctuate over the entire life of the Trust.

There can be no assurance that the issuers of Portfolio Securities will pay

dividends. Distributions generally depend upon the declaration of dividends by the

5

issuers of Portfolio Securities, and the declaration of such dividends generally depends upon various factors, including the financial condition of the issuers and general economic conditions.

Mid-Capitalization Companies Risk. The companies in which the Trust invests are

generally considered mid-capitalization companies. Stock prices of mid-capitalization companies may be more volatile than those of large-capitalization companies and,

therefore, the Trust’s Unit price may be more volatile than those of funds that invest a larger percentage of their assets in stocks issued by large-capitalization companies. Stock prices of

mid-capitalization companies are also more vulnerable than those of large-capitalization companies to adverse business or economic developments, and the stocks of

mid-capitalization companies may be less liquid, making it difficult for the Trust to buy and sell them. In addition, mid-capitalization companies generally have less

diverse product lines than large-capitalization companies and are more susceptible to adverse developments related to their products.

Trust Performance

The following bar chart and table provide an indication of the risks of investing in the Trust by showing

changes in the Trust’s performance based on net assets from year to year and by showing how the Trust’s average annual return for certain time periods compares with the average annual return of the Index. The Trust’s past performance

(before and after taxes) is not necessarily an indication of how the Trust will perform in the future. Updated performance information is available online at http://www.spdrs.com.

The payable and reinvestment dates for distributions are on the last Business Day of April, July, October and January, the month following the

declaration of distributions (see “Dividends and Distributions”). The total returns in the bar chart, as well as the total and after-tax returns presented in the table, have been calculated assuming

that the reinvestment price for the last income distribution made in the last calendar year shown below (i.e., 12/20/24) was the net asset value per Unit (“NAV”) on the last Business Day of such year (i.e., 12/31/24), rather

than the actual reinvestment price for such distribution which was the NAV on the last Business Day of January of the following calendar year (e.g., 1/31/25). Therefore, the actual performance calculation for the last calendar year may be

different from that shown below in the bar chart and table.

6

Annual Total Return (years ended 12/31)

Highest Quarterly Return: 24.29% for the quarter ended December 31, 2020

Lowest Quarterly Return: -29.78% for the quarter ended March 31, 2020

Average Annual Total Returns (for periods ending December 31, 2024)

The after-tax returns presented in the table are calculated using the highest historical individual

federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold Units through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. The returns after

taxes can exceed the return before taxes due to an assumed tax benefit for a holder of Units from realizing a capital loss on a sale of the Units.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Past

One Year |

|

|

Past

Five Years |

|

|

Past

Ten Years |

|

| Trust |

|

|

|

|

|

|

|

|

|

|

|

|

| Return Before Taxes |

|

|

13.57 |

% |

|

|

10.03 |

% |

|

|

9.37 |

% |

| Return After Taxes on Distributions |

|

|

13.01 |

% |

|

|

9.48 |

% |

|

|

8.80 |

% |

| Return After Taxes on Distributions and Redemption of Creation Units |

|

|

8.02 |

% |

|

|

7.68 |

% |

|

|

7.37 |

% |

| Index (assumes reinvestment of dividends; reflects no deduction for fees, expenses or

taxes) |

|

|

13.93 |

% |

|

|

10.34 |

% |

|

|

9.68 |

% |

PURCHASE AND SALE INFORMATION

Individual Units of the Trust may be purchased and sold on NYSE Arca, Inc. (the “Exchange”), under the market symbol “MDY,”

through your broker-dealer at market prices. Units trade at market prices that may be greater than NAV (premium) or less than NAV (discount). Units may be purchased on other trading markets or venues in addition to the Exchange.

7

Only certain institutional investors (typically market makers or other broker-dealers) are

permitted to purchase or redeem Units directly with the Trust, and they may do so only in large blocks of 25,000 Units known as “Creation Units.” Creation Unit transactions are conducted in exchange for the deposit or delivery of in-kind securities and/or cash constituting a substantial replication of the securities included in the Index.

TAX INFORMATION

The Trust will make distributions that are expected to be taxable currently to you as ordinary income and/or capital gains, unless you are

investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account. See “Federal Income Taxes,” below, for more information.

THE S&P MIDCAP 400 INDEX

The Index is composed of four hundred (400) selected stocks, all of which are listed on national stock exchanges, and span a broad range

of major industries. As of December 31, 2024, the five largest industry groups represented in the Index were: Capital Goods 14.71%; Financial Services 6.92%; Banks 6.57%; Equity Real Estate Investment Trusts 6.46%; and Materials 6.33%. Current

information regarding the market value of the Index is available from market information services. The Index is determined, comprised and calculated without regard to the Trust.

S&P is not responsible for and does not participate in the creation or sale of Units or in the determination of the timing, pricing, or

quantities and proportions of purchases or sales of Index Securities or Portfolio Securities by the Trust. The information in this prospectus concerning S&P and the Index has been obtained from sources that the Sponsor believes to be reliable,

but the Sponsor takes no responsibility for the accuracy of such information.

8

The following table shows the actual performance of the Index for the years 1991 through

2024. The results shown should not be considered representative of the income yield or capital gain or loss that may be generated by the Index in the future. THE RESULTS SHOULD NOT BE CONSIDERED REPRESENTATIVE OF THE PERFORMANCE OF THE TRUST.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

Calendar

Year-End Index

Value*

December 31,

1990 = 100 |

|

|

Change in

Index for

Calendar Year |

|

|

Calendar

Year-End

Yield** |

|

| 1990 |

|

|

100.00 |

|

|

|

— |

% |

|

|

3.16 |

% |

| 1991 |

|

|

146.59 |

|

|

|

+46.59 |

|

|

|

2.03 |

|

| 1992 |

|

|

160.56 |

|

|

|

+9.53 |

|

|

|

1.96 |

|

| 1993 |

|

|

179.33 |

|

|

|

+11.72 |

|

|

|

1.85 |

|

| 1994 |

|

|

169.44 |

|

|

|

-5.54 |

|

|

|

2.10 |

|

| 1995 |

|

|

217.84 |

|

|

|

+28.56 |

|

|

|

1.65 |

|

| 1996 |

|

|

255.58 |

|

|

|

+17.32 |

|

|

|

1.62 |

|

| 1997 |

|

|

333.37 |

|

|

|

+30.44 |

|

|

|

1.38 |

|

| 1998 |

|

|

392.31 |

|

|

|

+17.68 |

|

|

|

1.22 |

|

| 1999 |

|

|

444.67 |

|

|

|

+13.35 |

|

|

|

1.07 |

|

| 2000 |

|

|

516.76 |

|

|

|

+16.21 |

|

|

|

0.99 |

|

| 2001 |

|

|

508.31 |

|

|

|

-1.64 |

|

|

|

1.05 |

|

| 2002 |

|

|

429.79 |

|

|

|

-15.45 |

|

|

|

1.21 |

|

| 2003 |

|

|

576.01 |

|

|

|

+34.02 |

|

|

|

1.08 |

|

| 2004 |

|

|

663.31 |

|

|

|

+15.16 |

|

|

|

1.08 |

|

| 2005 |

|

|

738.05 |

|

|

|

+11.27 |

|

|

|

1.14 |

|

| 2006 |

|

|

804.37 |

|

|

|

+8.99 |

|

|

|

1.24 |

|

| 2007 |

|

|

858.20 |

|

|

|

+6.69 |

|

|

|

1.21 |

|

| 2008 |

|

|

538.28 |

|

|

|

-37.28 |

|

|

|

2.18 |

|

| 2009 |

|

|

726.67 |

|

|

|

+35.00 |

|

|

|

1.45 |

|

| 2010 |

|

|

907.25 |

|

|

|

+24.85 |

|

|

|

1.33 |

|

| 2011 |

|

|

879.16 |

|

|

|

-3.10 |

|

|

|

1.52 |

|

| 2012 |

|

|

1,020.43 |

|

|

|

+16.07 |

|

|

|

1.47 |

|

| 2013 |

|

|

1,342.53 |

|

|

|

+31.57 |

|

|

|

1.31 |

|

| 2014 |

|

|

1,452.44 |

|

|

|

+8.19 |

|

|

|

1.48 |

|

| 2015 |

|

|

1,398.58 |

|

|

|

-3.71 |

|

|

|

1.71 |

|

| 2016 |

|

|

1,660.58 |

|

|

|

+18.73 |

|

|

|

1.54 |

|

| 2017 |

|

|

1,900.57 |

|

|

|

+14.45 |

|

|

|

1.44 |

|

| 2018 |

|

|

1,663.04 |

|

|

|

-12.50 |

|

|

|

1.84 |

|

| 2019 |

|

|

2,063.02 |

|

|

|

+24.05 |

|

|

|

1.60 |

|

| 2020 |

|

|

2,306.62 |

|

|

|

+11.81 |

|

|

|

1.37 |

|

| 2021 |

|

|

2,842.01 |

|

|

|

+23.21 |

|

|

|

1.18 |

|

| 2022 |

|

|

2,430.38 |

|

|

|

-14.48 |

|

|

|

1.69 |

|

| 2023 |

|

|

2,781.54 |

|

|

|

+14.45 |

|

|

|

1.59 |

|

| 2024 |

|

|

3,120.94 |

|

|

|

+12.20 |

|

|

|

1.48 |

|

| * |

Source: S&P. Reflects no deduction for fees, expenses or taxes. |

| ** |

Source: S&P. Yields are obtained by dividing the aggregate cash dividends by the aggregate market value of

the stocks in the Index. |

9

DIVIDENDS AND DISTRIBUTIONS

Dividends and Capital Gains

Holders of Units receive on the last Business Day of April, July, October and January an amount corresponding to the amount of any cash

dividends declared on the Portfolio Securities during the applicable period, net of fees and expenses associated with operation of the Trust, and taxes, if applicable. Because of such fees and expenses, the dividend yield for Units is ordinarily

less than that of the Index. Although all such distributions are currently made quarterly, under certain limited circumstances the Trustee may vary the times at which distributions are made.

Any capital gain income recognized by the Trust in any taxable year that is not distributed during the year ordinarily is distributed at least

annually in January of the following taxable year. The Trust may make additional distributions shortly after the end of the year in order to satisfy certain distribution requirements imposed by the Internal Revenue Code of 1986, as amended (the

“Code”).

The amount of distributions may vary significantly from period to period. Under certain limited circumstances, special

dividend payments also may be made to holders of Units. See “Additional Information Regarding Dividends and Distributions.” Investors should consult their tax advisors regarding tax consequences associated with Trust dividends, as well as

those associated with Unit sales or redemptions.

Dividend Reinvestment Service

The Trust has made the Dividend Reinvestment Service available for use by Beneficial Owners through DTC Participants for reinvestment of their

cash proceeds. Some DTC Participants may not elect to utilize the Dividend Reinvestment Service; therefore, an interested investor may wish to contact his or her broker or other custodian to ascertain the availability of the Dividend Reinvestment

Service. Each broker may require investors to adhere to specific procedures and timetables in order to participate in the Dividend Reinvestment Service.

Distributions reinvested in additional Units through the Dividend Reinvestment Service are nevertheless taxable dividends to Beneficial Owners

to the same extent as if such dividends had been received in cash.

The Trustee credits to the Trust cash equal to the net asset value of

the Units issued to Beneficial Owners participating in reinvestment through the Dividend Reinvestment Service and generally applies the cash in the ordinary administration of the Trust to the acquisition of Index Securities in connection with

portfolio deposits and portfolio rebalancing. The portion of the participating Beneficial Owners’ dividend distribution which exceeds the cash credited to the Trust in respect of the creation of Units is distributed, on a pro rata basis, to the

participating Beneficial

10

Owners. Brokerage commissions, if any, incurred in obtaining Index Securities necessary to create additional Units with the cash from the distributions are an expense of the Trust.*

From 1999 until April 1, 2014 the Trustee used the services of an affiliated

broker-dealer, BNY ConvergEx Execution Solutions LLC (“ConvergEx”), an affiliated broker-dealer, for the execution of all brokerage transactions for the Trust, including all acquisitions of securities relating to the Dividend Reinvestment

Service. Starting April 1, 2014, the Trustee used BNY Mellon Capital Markets, LLC, an affiliate of the Trustee, and one or more unaffiliated broker-dealers, instead of ConvergEx, for the execution of all brokerage transactions for the Trust.

FEDERAL INCOME TAXES

The following is a description of the material U.S. federal income tax consequences of owning and disposing of Units. The discussion below

provides general tax information relating to an investment in Units, but it does not purport to be a comprehensive description of all the U.S. federal income tax considerations that may be relevant to a particular person’s decision to invest in

Units. This discussion does not describe all of the tax consequences that may be relevant in light of the particular circumstances of a beneficial owner of Units, including alternative minimum tax consequences, Medicare contribution tax consequences

and tax consequences applicable to beneficial owners subject to special rules, such as:

| |

• |

|

certain financial institutions; |

| |

• |

|

regulated investment companies; |

| |

• |

|

real estate investment trusts; |

| |

• |

|

dealers or traders in securities that use a

mark-to-market method of tax accounting; |

| |

• |

|

persons subject to special accounting rules under Section 451(b) of the Code; |

| |

• |

|

persons holding Units as part of a hedging transaction, straddle, wash sale, conversion transaction or integrated

transaction or persons entering into a constructive sale with respect to the Units; |

| |

• |

|

U.S. Holders (as defined below) whose functional currency for U.S. federal income tax purposes is not the U.S.

dollar; |

| |

• |

|

entities classified as partnerships or otherwise treated as pass-through entities for U.S. federal income tax

purposes; |

| * |

It is difficult to estimate the annual dollar amount of brokerage commissions that might be incurred in

connection with the Dividend Reinvestment Service during any fiscal year. The Trustee estimates that during fiscal year 2024, the approximate amount of brokerage commissions incurred in implementing the Dividend Reinvestment Service was less than

$0.0000001 per Unit. |

11

| |

• |

|

certain former U.S. citizens and residents and expatriated entities; |

| |

• |

|

tax-exempt entities, including an “individual retirement

account” or “Roth IRA”; or |

If an entity that is classified as a partnership for U.S. federal income tax purposes holds Units, the U.S. federal income tax treatment of a

partner will generally depend on the status of the partner and the activities of the partnership. Partnerships holding Units and partners in such partnerships should consult their tax advisors as to the particular U.S. federal income tax

consequences of holding and disposing of the Units in light of their specific circumstances.

The following discussion applies only to an

owner of Units that (i) is treated as the beneficial owner of such Units for U.S. federal income tax purposes and (ii) holds such Units as capital assets.

This discussion is based on the Code, administrative pronouncements, judicial decisions, and final, temporary and proposed Treasury regulations

all as of the date hereof, any of which is subject to change, possibly with retroactive effect.

Prospective purchasers of Units are urged

to consult their tax advisors with regard to the application of the U.S. federal income and estate tax laws to their particular situations, as well as any tax consequences arising under the laws of any state, local or

non-U.S. taxing jurisdiction.

Taxation of the Trust

The Trust believes that it qualified as a regulated investment company under Subchapter M of the Code (a “RIC”) for its taxable year

ended September 30, 2024 and intends to qualify as a RIC in the current and future taxable years. Assuming that the Trust so qualifies and that it satisfies the distribution requirements described below, the Trust generally will not be subject

to U.S. federal income tax on income distributed in a timely manner to the holders of its Units (“Unitholders”).

To qualify

as a RIC for any taxable year, the Trust must, among other things, satisfy both an income test and an asset diversification test for such taxable year. Specifically, (i) at least 90% of the Trust’s gross income for such taxable year must

consist of dividends; interest; payments with respect to certain securities loans; gains from the sale or other disposition of stock, securities or foreign currencies; other income (including, but not limited to, gains from options, futures or

forward contracts) derived with respect to its business of investing in such stock, securities or currencies; and net income derived from interests in “qualified publicly traded partnerships” (such income, “Qualifying RIC

Income”) and (ii) the Trust’s holdings must be diversified so that, at the end of each quarter of such taxable year, (a) at least 50% of the value of the Trust’s total assets is represented by cash and cash items,

12

securities of other RICs, U.S. government securities and other securities, with such other securities limited, in respect of any one issuer, to an amount not greater than 5% of the value of the

Trust’s total assets and not greater than 10% of the outstanding voting securities of such issuer and (b) not more than 25% of the value of the Trust’s total assets is invested (x) in the securities (other than U.S. government

securities or securities of other RICs) of any one issuer or of two or more issuers that the Trust controls and that are engaged in the same, similar or related trades or businesses or (y) in the securities of one or more “qualified

publicly traded partnerships.” A “qualified publicly traded partnership” is generally defined as an entity that is treated as a partnership for U.S. federal income tax purposes if (i) interests in such entity are traded on an

established securities market or are readily tradable on a secondary market or the substantial equivalent thereof and (ii) less than 90% of such entity’s gross income for the relevant taxable year consists of Qualifying RIC Income. The

Trust’s share of income derived from a partnership other than a “qualified publicly traded partnership” will be treated as Qualifying RIC Income only to the extent that such income would have constituted Qualifying RIC Income if

derived directly by the Trust.

In order to be exempt from U.S. federal income tax on its distributed income, the Trust must distribute to

its Unitholders on a timely basis at least 90% of the sum of (i) its “investment company taxable income” (determined prior to the deduction for dividends paid by the Trust) and (ii) its net

tax-exempt interest income for each taxable year. In general, a RIC’s “investment company taxable income” for any taxable year is its taxable income, determined without regard to net capital

gain (that is, the excess of net long-term capital gains over net short-term capital losses) and with certain other adjustments. Any taxable income, including any net capital gain, that the Trust does not distribute to its Unitholders in a timely

manner will be subject to U.S. federal income tax at regular corporate rates.

A RIC will be subject to a nondeductible 4% excise tax on

certain amounts that it fails to distribute during each calendar year. In order to avoid this excise tax, a RIC must distribute during each calendar year an amount at least equal to the sum of (i) 98% of its ordinary taxable income for the calendar

year, (ii) 98.2% of its capital gain net income for the one-year period ended on October 31 of the calendar year and (iii) any ordinary income and capital gains for previous years that were not

distributed during those years. For purposes of determining whether the Trust has met this distribution requirement, (i) certain ordinary gains and losses that would otherwise be taken into account for the portion of the calendar year after

October 31 will be treated as arising on January 1 of the following calendar year and (ii) the Trust will be deemed to have distributed any income or gains on which it has paid U.S. federal income tax. Amounts distributed and

reinvested pursuant to the Dividend Reinvestment Service are treated as distributed for all U.S. tax purposes, including for purposes of the distribution requirement described above and the excise tax.

13

If the Trust failed to qualify as a RIC or failed to satisfy the 90% distribution requirement in

any taxable year, the Trust would be subject to U.S. federal income tax at regular corporate rates on its taxable income, including its net capital gain, even if such income were distributed to its Unitholders, and all distributions out of earnings

and profits would be taxable as dividend income. Such distributions generally would be eligible for the dividends-received deduction in the case of corporate U.S. Holders (defined below) and would constitute “qualified dividend income” for

individual U.S. Holders. See “Federal Income Taxes — Tax Consequences to U.S. Holders — Distributions.” In addition, the Trust could be required to recognize unrealized gains, pay taxes and make distributions (which could be

subject to interest charges) before requalifying for taxation as a RIC. If the Trust fails to satisfy the income test or diversification test described above, however, it may be able to avoid losing its status as a RIC by timely curing such failure,

paying a tax and/or providing notice of such failure to the U.S. Internal Revenue Service (the “IRS”).

In order to meet the

distribution requirements necessary to be exempt from U.S. federal income and excise tax, the Trust may be required to make distributions in excess of the yield performance of the Portfolio Securities and may be required to sell securities.

Unless stated otherwise, the remaining discussion assumes that the Trust is treated as a RIC.

Tax Consequences to U.S. Holders

The discussion in this section applies only to U.S. Holders. A “U.S. Holder” is (i) an individual who is a citizen or resident

of the United States; (ii) a corporation, or other entity taxable as a corporation, created or organized in or under the laws of the United States, any state therein or the District of Columbia; or (iii) an estate or trust the income of

which is subject to U.S. federal income taxation regardless of its source.

Distributions. Distributions of the

Trust’s ordinary income and net short-term capital gains will, except as described below with respect to distributions of “qualified dividend income,” generally be taxable to U.S. Holders as ordinary income to the extent such

distributions are paid out of the Trust’s current or accumulated earnings and profits, as determined for U.S. federal income tax purposes. Distributions (or deemed distributions, as described below), if any, of net capital gains will be taxable

as long-term capital gains, regardless of the length of time the U.S. Holder has owned Units and such distributions generally will not be considered dividends for purposes of the U.S. Holder’s tax treatment. A distribution of an amount in

excess of the Trust’s current and accumulated earnings and profits will be treated as a return of capital that will be applied against and reduce the U.S. Holder’s basis in its Units. If the amount of any such distribution exceeds the U.S.

Holder’s basis in its Units, the excess will be treated as gain from a sale or exchange of the

14

Units. Distributions will be treated in the manner described above regardless of whether paid in cash or invested in additional Units pursuant to the Dividend Reinvestment Service.

The ultimate tax characterization of the distributions that the Trust makes during any taxable year cannot be determined until after the end of

the taxable year. As a result, it is possible that the Trust will make total distributions during a taxable year in an amount that exceeds its current and accumulated earnings and profits. Return-of-capital distributions may result, for example, if the Trust makes distributions of cash amounts deposited in connection with Portfolio Deposits (as defined below in “Purchases and Redemptions

of Creation Units — Purchase (Creation)”). Return-of-capital distributions may be more likely to occur in periods during which the number of outstanding Units

fluctuates significantly.

Distributions of the Trust’s “qualified dividend income” to an individual or other non-corporate U.S. Holder will be treated as “qualified dividend income” and will therefore be taxed at rates applicable to long-term capital gains, provided that the U.S. Holder meets certain holding

period and other requirements with respect to its Units and that the Trust meets certain holding period and other requirements with respect to the underlying shares of stock. “Qualified dividend income” generally includes dividends from

domestic corporations and dividends from foreign corporations that meet certain specified criteria.

Dividends distributed by the Trust

to a corporate U.S. Holder will qualify for the dividends-received deduction only to the extent that the dividends consist of distributions of dividends eligible for the dividends-received deduction received by the Trust, the Trust meets certain

holding period requirements with respect to the underlying shares of stock and the U.S. Holder meets certain holding period and other requirements with respect to the underlying shares of stock. Dividends eligible for the dividends-received

deduction generally are dividends from domestic corporations. Distributions of net capital gains by the Trust to a corporate U.S. Holder will not qualify for the dividends-received deduction.

The Trust intends to distribute its net capital gains at least annually. If, however, the Trust retains any net capital gains for reinvestment,

it may elect to treat such net capital gains as having been distributed to the Unitholders. If the Trust makes such an election, each U.S. Holder will be required to report its share of such undistributed net capital gain as long-term capital gain

and will be entitled to claim its share of the U.S. federal income taxes paid by the Trust on such undistributed net capital gain as a credit against its own U.S. federal income tax liability, if any, and to claim a refund on a properly filed U.S.

federal income tax return to the extent that the credit exceeds such tax liability. In addition, each U.S. Holder will be entitled to increase the adjusted tax basis of its Units by the difference between its share of such undistributed net capital

gain and the related credit and/or refund. There can be no assurance that the Trust will make this election if it retains all or a portion of its net capital gain for a taxable year.

15

Because the tax treatment of a distribution depends upon the Trust’s current and accumulated

earnings and profits, a distribution received shortly after an acquisition of Units may be taxable, even though, as an economic matter, the distribution represents a return of the U.S. Holder’s initial investment. Although dividends generally

will be treated as distributed when paid, dividends declared in October, November or December, payable to Unitholders of record on a specified date in one of those months, and paid during the following January, will be treated for U.S. federal

income tax purposes as having been distributed by the Trust and received by the Unitholders on December 31 of the year in which declared. Unitholders will be notified annually as to the U.S. federal tax status of distributions.

Sales and Redemptions of Units. In general, upon the sale or other disposition of Units, a U.S. Holder will recognize capital gain

or loss in an amount equal to the difference, if any, between the amount realized on the sale or other disposition and the U.S. Holder’s adjusted tax basis in the relevant Units. Such gain or loss generally will be long-term capital gain or

loss if the U.S. Holder’s holding period for the relevant Units was more than one year on the date of the sale or other disposition. Under current law, net capital gain (that is, the excess of net long-term capital gains over net short-term

capital losses) recognized by non-corporate U.S. Holders is generally subject to U.S. federal income tax at lower rates than the rates applicable to ordinary income.

Losses recognized by a U.S. Holder on the sale or other disposition of Units held for six months or less will be treated as long-term capital

losses to the extent of any distribution of long-term capital gain received (or deemed received, as discussed above) with respect to such Units. In addition, no loss will be allowed on a sale or other disposition of Units if the U.S. Holder acquires

Units (including pursuant to the Dividend Reinvestment Service), or enters into a contract or option to acquire Units, within 30 days before or after such sale or other disposition. In such a case, the basis of the Units acquired will be adjusted to

reflect the disallowed loss.

If a U.S. Holder receives an in-kind distribution in redemption of

Units (which must constitute a Creation Unit, as discussed in “Purchases and Redemptions of Creation Units — Redemption”), the U.S. Holder will realize gain or loss in an amount equal to the difference between the aggregate fair

market value as of the redemption date of the stocks and cash received in the redemption and the U.S. Holder’s adjusted tax basis in the relevant Units. The U.S. Holder will generally have an initial tax basis in the distributed stocks equal to

their respective fair market values on the redemption date. The IRS may assert that any resulting loss may not be recognized on the ground that there has been no material change in the U.S. Holder’s economic position. The Trust will not

recognize gain or loss for U.S. federal income tax purposes on an in-kind distribution in redemption of Creation Units.

Under U.S. Treasury regulations, if a U.S. Holder recognizes losses with respect to Units of $2 million or more for an individual U.S.

Holder or $10 million or more for a corporate U.S. Holder, the U.S. Holder must file with the IRS a disclosure statement on IRS Form 8886. Direct shareholders of portfolio securities are in many

16

cases exempted from this reporting requirement, but under current guidance, shareholders of a RIC are not exempted. The fact that a loss is reportable under these regulations does not affect the

legal determination of whether the U.S. Holder’s treatment of the loss is proper. Certain states may have similar disclosure requirements.

Portfolio Deposits. Upon the transfer of a Portfolio Deposit (as defined below in “Purchases and Redemptions of Creation

Units — Purchase (Creation)”) to the Trust, a U.S. Holder will generally realize gain or loss with respect to each stock included in the Portfolio Deposit in an amount equal to the difference, if any, between the amount received with

respect to such stock and the U.S. Holder’s basis in the stock. The amount received with respect to each stock included in a Portfolio Deposit is determined by allocating among all of the stocks included in the Portfolio Deposit an amount equal

to the fair market value of the Creation Units received (determined as of the date of transfer of the Portfolio Deposit) plus the amount of any cash received from the Trust, reduced by the amount of any cash that the U.S. Holder pays to the Trust.

This allocation is made among such stocks in accordance with their relative fair market values as of the date of transfer of the Portfolio Deposit. The IRS may assert that any loss resulting from the transfer of a Portfolio Deposit to the Trust may

not be recognized on the ground that there has been no material change in the economic position of the U.S. Holder. The Trust will not recognize gain or loss for U.S. federal income tax purposes on the issuance of Creation Units in exchange for

Portfolio Deposits.

Backup Withholding and Information Reporting. Payments on the Units and proceeds from a sale or other

disposition of Units will be subject to information reporting unless the U.S. Holder is an exempt recipient. A U.S. Holder will be subject to backup withholding on all such amounts unless (i) the U.S. Holder is an exempt recipient or

(ii) the U.S. Holder provides its correct taxpayer identification number (generally, on IRS Form W-9) and certifies that it is not subject to backup withholding. Backup withholding is not an additional

tax. Any amounts withheld pursuant to the backup withholding rules will be allowed as a credit against the U.S. Holder’s U.S. federal income tax liability and may entitle the U.S. Holder to a refund, provided that the required information is

furnished to the IRS on a timely basis.

Tax Consequences to Non-U.S. Holders

The discussion in this section applies only to Non-U.S. Holders. A “Non-U.S. Holder” is a person that, for U.S. federal income tax purposes, is a beneficial owner of Units and is a nonresident alien individual, a foreign corporation, a foreign trust or a foreign estate.

The discussion below does not apply to a Non-U.S. Holder who is a nonresident alien individual and is present in the United States for 183 days or more during any taxable year; a nonresident alien individual

who is a former citizen or resident of the United States; an expatriated entity; a controlled foreign corporation; a passive foreign investment company; a foreign government for purposes of Section 892 of the Code; or a tax-exempt organization for U.S. federal income tax

17

purposes. Such Non-U.S. Holders should consult their tax advisors with respect to the particular tax consequences to them of an investment in the Trust.

The U.S. federal income taxation of a Non-U.S. Holder depends on whether the income that the Non-U.S. Holder derives from the Trust is “effectively connected”

with a trade or business that the Non-U.S. Holder conducts in the United States (and, if required by an applicable tax treaty, is attributable to a U.S. permanent establishment maintained by the Non-U.S. Holder).

If the income that a Non-U.S. Holder derives

from the Trust is not “effectively connected” with a U.S. trade or business conducted by such Non-U.S. Holder (or, if an applicable tax treaty so provides, the

Non-U.S. Holder does not maintain a permanent establishment in the United States), distributions of “investment company taxable income” to such Non-U.S. Holder

(including amounts distributed and reinvested pursuant to the Dividend Reinvestment Service) will generally be subject to U.S. federal withholding tax at a rate of 30% (or lower rate under an applicable tax treaty). Provided that certain

requirements are satisfied, this withholding tax will not be imposed on dividends paid by the Trust to the extent that the underlying income out of which the dividends are paid consists of U.S.-source interest income or short-term capital gains that

would not have been subject to U.S. withholding tax if received directly by the Non-U.S. Holder (“interest-related dividends” and “short-term capital gain dividends,” respectively).

A Non-U.S. Holder whose income from the Trust is not “effectively connected” with a U.S.

trade or business (or, if an applicable tax treaty so provides, does not maintain a permanent establishment in the United States) will generally be exempt from U.S. federal income tax on capital gain dividends and any amounts retained by the Trust

that are designated as undistributed capital gains. In addition, such a Non-U.S. Holder will generally be exempt from U.S. federal income tax on any gains realized upon the sale or exchange of Units.

If the income from the Trust is “effectively connected” with a U.S. trade or business carried on by a

Non-U.S. Holder (and, if required by an applicable tax treaty, is attributable to a U.S. permanent establishment maintained by the Non-U.S. Holder), any distributions of

“investment company taxable income,” any capital gain dividends, any amounts retained by the Trust that are designated as undistributed capital gains and any gains realized upon the sale or exchange of Units will be subject to U.S. federal

income tax, on a net income basis, at the rates applicable to U.S. Holders. In such a case, the Non-U.S. Holder will be exempt from the U.S. federal withholding tax on distributions of “investment company

taxable income” discussed above, although the Non-U.S. Holder will need to deliver to the relevant withholding agent a properly executed IRS Form W-8ECI in order to

claim an exemption from withholding. A Non-U.S. Holder that is a corporation may also be subject to the U.S. branch profits tax.

Information returns will be filed with the IRS in connection with certain payments on the Units and may be filed in connection with payments of

the proceeds from a sale or other disposition of Units. A Non-U.S. Holder may be subject to

18

backup withholding on distributions or on the proceeds from a redemption or other disposition of Units if such Non-U.S. Holder does not certify its

non-U.S. status under penalties of perjury or otherwise establish an exemption. Backup withholding is not an additional tax. Any amounts withheld pursuant to the backup withholding rules will be allowed as a

credit against the Non-U.S. Holder’s U.S. federal income tax liability, if any, and may entitle the Non-U.S. Holder to a refund, provided that the required

information is furnished to the IRS on a timely basis.

In order to qualify for the exemption from U.S. withholding on interest-related

dividends, to qualify for an exemption from U.S. backup withholding and to qualify for a reduced rate of U.S. withholding tax on Trust distributions pursuant to an income tax treaty, a Non-U.S. Holder must

generally deliver to the withholding agent a properly executed IRS form (generally, Form W-8BEN or Form W-8BEN-E, as applicable).

In order to claim a refund of any Trust-level taxes imposed on undistributed net capital gain, any withholding taxes or any backup withholding, a Non-U.S. Holder must obtain a U.S. taxpayer identification

number and file a U.S. federal income tax return, even if the Non-U.S. Holder would not otherwise be required to obtain a U.S. taxpayer identification number or file a U.S. income tax return.

Under Sections 1471 through 1474 of the Code (“FATCA”), a withholding tax at the rate of 30% will generally be imposed on payments of

dividends on Units to certain foreign entities (including financial intermediaries) unless the foreign entity provides the withholding agent with certifications and other information (which may include information relating to ownership by U.S.

persons of interests in, or accounts with, the foreign entity). Treasury and the IRS have issued proposed regulations that (i) provide that “withholdable payments” will not include gross proceeds from the disposition of property that

can produce U.S.-source dividends or interest, as otherwise would have been the case after December 31, 2018, and (ii) state that taxpayers may rely on these provisions of the proposed regulations until final regulations are issued. If

FATCA withholding is imposed, a beneficial owner of Units that is not a foreign financial institution generally may obtain a refund of any amounts withheld by filing a U.S. federal income tax return (which may entail significant administrative

burden). Non-U.S. Holders should consult their tax advisors regarding the possible implications of FATCA on their investment in Units.

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustee and Unitholders of SPDR S&P MidCap 400 ETF Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of SPDR S&P MidCap 400 ETF

Trust (the “Trust”) as of September 30, 2024, the related statements of operations and of changes in net assets for each of the three years in the period ended September 30, 2024, including the related notes, and the financial

highlights for each of the five years in the period ended September 30, 2024 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial

position of the Trust as of September 30, 2024, the results of its operations and the changes in its net assets for each of the three years in the period ended September 30, 2024 and the financial highlights for each of the five years in

the period ended September 30, 2024 in conformity with accounting principles generally accepted in the United States of America.

Basis for

Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an