false000086343600008634362025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 29, 2025 |

BENCHMARK ELECTRONICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Texas |

001-10560 |

74-2211011 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

56 South Rockford Drive |

|

Tempe, Arizona |

|

85288 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (623) 300-7000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.10 per share |

|

BHE |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 29, 2025, Benchmark Electronics, Inc. (the “Company”) issued a press release announcing its results of operations for the quarter and year ended December 31, 2024. A copy of the press release and accompanying investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein. The information disclosed under this Item 2.02, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

BENCHMARK ELECTRONICS, INC. |

|

|

|

|

Date: |

January 29, 2025 |

By: |

/s/ Stephen J. Beaver |

|

|

|

Stephen J. Beaver, Esq.

Senior Vice President, General Counsel and Chief Legal Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

BENCHMARK REPORTS FOURTH QUARTER AND FISCAL YEAR 2024 RESULTS

TEMPE, AZ, January 29, 2025 – Benchmark Electronics, Inc. (NYSE: BHE) today announced financial results for the fourth quarter and year ended December 31, 2024.

Fourth quarter 2024 results(1):

•Revenue of $657 million with year-over-year growth in Semi-Cap, A&D and Industrials offset by anticipated weakness in Medical and AC&C

•GAAP and non-GAAP gross margin of 10.3% and 10.4%

•GAAP and Non-GAAP operating margin of 4.3% and 5.1%

•GAAP and non-GAAP earnings per share of $0.50 and $0.61

•Delivered 7th consecutive quarter of positive Free Cash Flow

Full year 2024 results(1):

•Revenue of $2.7 billion driven by strength in Semi-Cap and A&D

•GAAP and non-GAAP gross margin of 10.2%, up 70 and 60 basis points year-over-year

•GAAP and non-GAAP operating margin of 4.1% and 5.1%

•GAAP earnings per share of $1.72, with non-GAAP earnings of $2.29

•Delivered $156 million in Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

(Amounts in millions, except per share data) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

Sales |

|

$ |

657 |

|

|

$ |

658 |

|

|

$ |

691 |

|

Net income |

|

$ |

18 |

|

|

$ |

15 |

|

|

$ |

18 |

|

Income from operations |

|

$ |

29 |

|

|

$ |

28 |

|

|

$ |

32 |

|

Net income – non-GAAP(1) |

|

$ |

22 |

|

|

$ |

21 |

|

|

$ |

23 |

|

Income from operations – non-GAAP(1) |

|

$ |

33 |

|

|

$ |

35 |

|

|

$ |

38 |

|

Diluted earnings per share |

|

$ |

0.50 |

|

|

$ |

0.42 |

|

|

$ |

0.49 |

|

Diluted earnings per share – non-GAAP(1) |

|

$ |

0.61 |

|

|

$ |

0.57 |

|

|

$ |

0.65 |

|

Operating margin |

|

|

4.3 |

% |

|

|

4.3 |

% |

|

|

4.6 |

% |

Operating margin – non-GAAP(1) |

|

|

5.1 |

% |

|

|

5.3 |

% |

|

|

5.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

|

|

|

December 31, |

|

(Amounts in millions, except per share data) |

|

|

|

2024 |

|

|

2023 |

|

Sales |

|

|

|

$ |

2,656 |

|

|

$ |

2,839 |

|

Net income |

|

|

|

$ |

63 |

|

|

$ |

64 |

|

Income from operations |

|

|

|

$ |

109 |

|

|

$ |

110 |

|

Net income – non-GAAP(1) |

|

|

|

$ |

84 |

|

|

$ |

85 |

|

Income from operations – non-GAAP(1) |

|

|

|

$ |

135 |

|

|

$ |

139 |

|

Diluted earnings per share |

|

|

|

$ |

1.72 |

|

|

$ |

1.79 |

|

Diluted earnings per share – non-GAAP(1) |

|

|

|

$ |

2.29 |

|

|

$ |

2.38 |

|

Operating margin |

|

|

|

|

4.1 |

% |

|

|

3.9 |

% |

Operating margin – non-GAAP(1) |

|

|

|

|

5.1 |

% |

|

|

4.9 |

% |

(1) A reconciliation of non-GAAP results to the most directly comparable GAAP measures and a discussion of why management believes these non-GAAP results are useful are included below.

“The past year has reinforced that our strategy is working, as we have continued to drive margin expansion and free cash flow generation. Our demonstrated execution across cycles gives me confidence in our ability to continue to drive value for our stakeholders,” said Jeff Benck, Benchmark’s President and CEO.

Benck continued “We will continue to focus on maintaining financial discipline during this dynamic environment, while strategically investing in our future growth. To that end, we are breaking ground on our fourth building in Penang, Malaysia in support of our ongoing momentum in the Semiconductor Capital Equipment sector.”

Cash Conversion Cycle

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

Accounts receivable days |

|

|

57 |

|

|

|

51 |

|

|

|

59 |

|

Contract asset days |

|

|

23 |

|

|

|

26 |

|

|

|

23 |

|

Inventory days |

|

|

85 |

|

|

|

89 |

|

|

|

99 |

|

Accounts payable days |

|

|

(54 |

) |

|

|

(54 |

) |

|

|

(53 |

) |

Advance payments from customers days |

|

|

(22 |

) |

|

|

(22 |

) |

|

|

(30 |

) |

Cash conversion cycle days |

|

|

89 |

|

|

|

90 |

|

|

|

98 |

|

Fourth Quarter 2024 Industry Sector Update

Revenue and percentage of sales by industry sector were as follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

(In millions) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

Semi-Cap |

|

$ |

198 |

|

|

|

30 |

% |

|

$ |

188 |

|

|

|

28 |

% |

|

$ |

168 |

|

|

|

24 |

% |

Complex Industrials |

|

|

140 |

|

|

|

21 |

|

|

|

151 |

|

|

|

23 |

|

|

|

132 |

|

|

|

19 |

|

Medical |

|

|

117 |

|

|

|

18 |

|

|

|

107 |

|

|

|

16 |

|

|

|

126 |

|

|

|

18 |

|

A&D |

|

|

117 |

|

|

|

18 |

|

|

|

102 |

|

|

|

16 |

|

|

|

102 |

|

|

|

15 |

|

AC&C |

|

|

85 |

|

|

|

13 |

|

|

|

110 |

|

|

|

17 |

|

|

|

163 |

|

|

|

24 |

|

Total |

|

$ |

657 |

|

|

|

100 |

% |

|

$ |

658 |

|

|

|

100 |

% |

|

$ |

691 |

|

|

|

100 |

% |

Revenue decreased quarter over quarter primarily due to decreases in Advanced Computing and Communications (AC&C) sales, which were partially offset by increases in Semi-Cap and A&D sales. Revenue decreased year-over-year primarily due to decreases in Medical and AC&C sales, which were partially offset by increases in Semi-Cap and A&D sales.

First Quarter 2025 Guidance

•Revenue between $620 million - $660 million

•Diluted GAAP earnings per share between $0.34 - $0.40

•Diluted non-GAAP earnings per share between $0.48 - $0.54

•Non-GAAP earnings per share guidance excludes stock-based compensation expense of approximately $4.5 million and other non-operating expenses of $2.6 million to $2.8 million which includes restructuring, amortization of intangibles and other expenses.

Fourth Quarter 2024 Earnings Conference Call

The Company will host a conference call to discuss the results today at 5:00 p.m. Eastern Time. The live webcast of the call and accompanying reference materials will be accessible by logging on to the Company’s website at www.bench.com. A replay of the broadcast will also be available on the Company’s website.

About Benchmark Electronics, Inc.

Benchmark provides comprehensive solutions across the entire product life cycle by leading through its innovative technology and engineering design services, leveraging its optimized global supply chain and delivering world-class manufacturing services in the following industries: semiconductor capital equipment, complex industrials, medical, commercial aerospace, defense, and advanced computing and communications. Benchmark’s global operations include facilities in seven countries and its common shares trade on the New York Stock Exchange under the symbol BHE.

For More Information, Please Contact:

Paul Mansky, Investor Relations and Corporate Development

1-623-300-7052 or paul.mansky@bench.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts and may include words such as “anticipate,” “believe,” “intend,” “plan,” “project,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” “could,” “predict,” and similar expressions of the negative or other variations thereof. In particular, statements, express or implied, concerning the Company’s outlook and guidance for first quarter and fiscal year 2025 results, future operating results or margins, the ability to generate sales and income or cash flow, expected revenue mix, the Company’s business strategy and strategic initiatives, the Company’s repurchases of shares of its common stock, the Company’s expectations regarding restructuring charges, stock-based compensation expense, amortization of intangibles, award of any tax incentives and capital expenditures, and the Company’s intentions concerning the payment of dividends, among others, are forward-looking statements. Although the Company believes these statements are based on and derived from reasonable assumptions, they involve risks, uncertainties and assumptions that are beyond the Company’s ability to control or predict, relating to operations, markets and the business environment generally, including those discussed under Part I, Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2023, and in any of the Company’s subsequent reports filed with the Securities and Exchange Commission. Events relating to the possibility of customer demand fluctuations, supply chain constraints, continuing inflationary pressures, the effects of foreign currency fluctuations and high interest rates, geopolitical uncertainties including continuing hostilities and tensions, trade restrictions and sanctions, or the ability to utilize the Company’s manufacturing facilities at sufficient levels to cover its fixed operating costs, may have resulting impacts on the Company’s business, financial condition, results of operations, and the Company’s ability (or inability) to execute on its plans. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes, including the future results of the Company’s operations, may vary materially from those indicated. Undue reliance should not be placed on any forward-looking statements. Forward-looking statements are not guarantees of performance. All forward-looking statements included in this document are based upon information available to the Company as of the date of this document, and the Company assumes no obligation to update.

Non-GAAP Financial Measures

Management discloses certain non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. These non-GAAP financial measures exclude restructuring charges, stock-based compensation expense, amortization of intangible assets acquired in business combinations, certain legal and other settlement losses (gains), customer insolvency losses (recoveries), asset impairments, other significant non-recurring costs and the related tax impacts of all of the above. A detailed reconciliation between GAAP results and results excluding certain items (“non-GAAP”) is included in the following tables attached to this document. In situations where a non-GAAP reconciliation has not been provided, the Company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, a non-GAAP measure, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

###

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(Amounts in Thousands, Except Per Share Data)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Sales |

|

$ |

656,887 |

|

|

$ |

691,354 |

|

|

$ |

2,656,105 |

|

|

$ |

2,838,976 |

|

Cost of sales |

|

|

588,962 |

|

|

|

620,350 |

|

|

|

2,386,081 |

|

|

|

2,567,906 |

|

Gross profit |

|

|

67,925 |

|

|

|

71,004 |

|

|

|

270,024 |

|

|

|

271,070 |

|

Selling, general and administrative expenses |

|

|

37,470 |

|

|

|

35,646 |

|

|

|

149,460 |

|

|

|

147,025 |

|

Amortization of intangible assets |

|

|

1,204 |

|

|

|

1,204 |

|

|

|

4,817 |

|

|

|

5,979 |

|

Restructuring charges and other costs |

|

|

727 |

|

|

|

2,054 |

|

|

|

6,336 |

|

|

|

8,402 |

|

Income from operations |

|

|

28,524 |

|

|

|

32,100 |

|

|

|

109,411 |

|

|

|

109,664 |

|

Interest expense |

|

|

(6,175 |

) |

|

|

(8,692 |

) |

|

|

(26,922 |

) |

|

|

(31,875 |

) |

Interest income |

|

|

2,879 |

|

|

|

2,033 |

|

|

|

10,208 |

|

|

|

6,256 |

|

Other expense, net |

|

|

(1,350 |

) |

|

|

(3,105 |

) |

|

|

(8,802 |

) |

|

|

(2,825 |

) |

Income before income taxes |

|

|

23,878 |

|

|

|

22,336 |

|

|

|

83,895 |

|

|

|

81,220 |

|

Income tax expense |

|

|

5,455 |

|

|

|

4,784 |

|

|

|

20,568 |

|

|

|

16,905 |

|

Net income |

|

$ |

18,423 |

|

|

$ |

17,552 |

|

|

$ |

63,327 |

|

|

$ |

64,315 |

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.51 |

|

|

$ |

0.49 |

|

|

$ |

1.76 |

|

|

$ |

1.81 |

|

Diluted |

|

$ |

0.50 |

|

|

$ |

0.49 |

|

|

$ |

1.72 |

|

|

$ |

1.79 |

|

Weighted-average number of shares used in

calculating earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

35,973 |

|

|

|

35,658 |

|

|

|

35,970 |

|

|

|

35,566 |

|

Diluted |

|

|

36,659 |

|

|

|

35,956 |

|

|

|

36,759 |

|

|

|

35,973 |

|

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In Thousands)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

315,152 |

|

|

$ |

277,391 |

|

Restricted cash |

|

|

12,875 |

|

|

|

5,822 |

|

Accounts receivable, net |

|

|

412,458 |

|

|

|

449,404 |

|

Contract assets |

|

|

167,578 |

|

|

|

174,979 |

|

Inventories |

|

|

553,654 |

|

|

|

683,801 |

|

Prepaid expenses and other current assets |

|

|

42,512 |

|

|

|

44,350 |

|

Total current assets |

|

|

1,504,229 |

|

|

|

1,635,747 |

|

Property, plant and equipment, net |

|

|

225,097 |

|

|

|

227,698 |

|

Operating lease right-of-use assets |

|

|

117,995 |

|

|

|

130,830 |

|

Goodwill and other long-term assets |

|

|

292,143 |

|

|

|

280,480 |

|

Total assets |

|

$ |

2,139,464 |

|

|

$ |

2,274,755 |

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Current installments of long-term debt |

|

$ |

6,737 |

|

|

$ |

4,283 |

|

Accounts payable |

|

|

354,218 |

|

|

|

367,480 |

|

Advance payments from customers |

|

|

143,614 |

|

|

|

204,883 |

|

Accrued liabilities |

|

|

144,530 |

|

|

|

136,901 |

|

Total current liabilities |

|

|

649,099 |

|

|

|

713,547 |

|

Long-term debt, net of current installments |

|

|

250,457 |

|

|

|

326,674 |

|

Operating lease liabilities |

|

|

108,997 |

|

|

|

123,385 |

|

Other long-term liabilities |

|

|

17,598 |

|

|

|

32,064 |

|

Total liabilities |

|

|

1,026,151 |

|

|

|

1,195,670 |

|

Shareholders’ equity |

|

|

1,113,313 |

|

|

|

1,079,085 |

|

Total liabilities and shareholders’ equity |

|

$ |

2,139,464 |

|

|

$ |

2,274,755 |

|

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In Thousands)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

63,327 |

|

|

$ |

64,315 |

|

Depreciation and amortization |

|

|

46,144 |

|

|

|

45,410 |

|

Stock-based compensation expense |

|

|

13,366 |

|

|

|

15,286 |

|

Accounts receivable |

|

|

33,953 |

|

|

|

42,050 |

|

Contract assets |

|

|

7,401 |

|

|

|

8,634 |

|

Inventories |

|

|

127,840 |

|

|

|

45,071 |

|

Accounts payable |

|

|

(18,283 |

) |

|

|

(35,320 |

) |

Advance payments from customers |

|

|

(61,269 |

) |

|

|

6,946 |

|

Other changes in working capital and other, net |

|

|

(23,254 |

) |

|

|

(18,098 |

) |

Net cash provided by operating activities |

|

|

189,225 |

|

|

|

174,294 |

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Additions to property, plant and equipment and software |

|

|

(33,253 |

) |

|

|

(77,739 |

) |

Other investing activities, net |

|

|

486 |

|

|

|

601 |

|

Net cash used in investing activities |

|

|

(32,767 |

) |

|

|

(77,138 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Share repurchases |

|

|

(5,100 |

) |

|

|

— |

|

Net debt activity |

|

|

(74,283 |

) |

|

|

5,509 |

|

Other financing activities, net |

|

|

(29,723 |

) |

|

|

(29,087 |

) |

Net cash used in financing activities |

|

|

(109,106 |

) |

|

|

(23,578 |

) |

|

|

|

|

|

|

|

Effect of exchange rate changes |

|

|

(2,538 |

) |

|

|

2,205 |

|

Net increase in cash and cash equivalents and restricted cash |

|

|

44,814 |

|

|

|

75,783 |

|

Cash and cash equivalents and restricted cash at beginning of year |

|

|

283,213 |

|

|

|

207,430 |

|

Cash and cash equivalents and restricted cash at end of year |

|

$ |

328,027 |

|

|

$ |

283,213 |

|

Benchmark Electronics, Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Results

(Amounts in Thousands, Except Per Share Data)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

Dec 31, |

|

|

Sep 30, |

|

|

Jun 30, |

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Sep 30, |

|

|

Jun 30, |

|

|

Dec 31, |

|

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Income from operations (GAAP) |

|

$ |

28,524 |

|

|

$ |

28,105 |

|

|

$ |

27,253 |

|

|

$ |

25,529 |

|

|

$ |

32,100 |

|

|

$ |

30,341 |

|

|

$ |

24,481 |

|

|

$ |

109,411 |

|

|

$ |

109,664 |

|

Restructuring charges and other costs |

|

|

727 |

|

|

|

795 |

|

|

|

1,471 |

|

|

|

3,343 |

|

|

|

2,054 |

|

|

|

1,437 |

|

|

|

2,364 |

|

|

|

6,336 |

|

|

|

7,281 |

|

Stock-based compensation expense |

|

|

2,626 |

|

|

|

4,379 |

|

|

|

4,185 |

|

|

|

2,176 |

|

|

|

2,955 |

|

|

|

3,674 |

|

|

|

3,867 |

|

|

|

13,366 |

|

|

|

15,286 |

|

Amortization of intangible assets |

|

|

1,204 |

|

|

|

1,205 |

|

|

|

1,204 |

|

|

|

1,204 |

|

|

|

1,204 |

|

|

|

1,592 |

|

|

|

1,591 |

|

|

|

4,817 |

|

|

|

5,979 |

|

Asset impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

198 |

|

|

|

923 |

|

|

|

— |

|

|

|

1,121 |

|

Legal and other settlement loss |

|

|

239 |

|

|

|

367 |

|

|

|

317 |

|

|

|

855 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,778 |

|

|

|

— |

|

Customer insolvency (recovery) |

|

|

— |

|

|

|

— |

|

|

|

(316 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(316 |

) |

|

|

— |

|

Non-GAAP income from operations |

|

$ |

33,320 |

|

|

$ |

34,851 |

|

|

$ |

34,114 |

|

|

$ |

33,107 |

|

|

$ |

38,313 |

|

|

$ |

37,242 |

|

|

$ |

33,226 |

|

|

$ |

135,392 |

|

|

$ |

139,331 |

|

GAAP operating margin |

|

|

4.3 |

% |

|

|

4.3 |

% |

|

|

4.1 |

% |

|

|

3.8 |

% |

|

|

4.6 |

% |

|

|

4.2 |

% |

|

|

3.3 |

% |

|

|

4.1 |

% |

|

|

3.9 |

% |

Non-GAAP operating margin |

|

|

5.1 |

% |

|

|

5.3 |

% |

|

|

5.1 |

% |

|

|

4.9 |

% |

|

|

5.5 |

% |

|

|

5.2 |

% |

|

|

4.5 |

% |

|

|

5.1 |

% |

|

|

4.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (GAAP) |

|

$ |

67,925 |

|

|

$ |

66,741 |

|

|

$ |

67,950 |

|

|

$ |

67,408 |

|

|

$ |

71,004 |

|

|

$ |

69,077 |

|

|

$ |

67,031 |

|

|

$ |

270,024 |

|

|

$ |

271,070 |

|

Stock-based compensation expense |

|

|

503 |

|

|

|

413 |

|

|

|

326 |

|

|

|

426 |

|

|

|

416 |

|

|

|

420 |

|

|

|

423 |

|

|

|

1,668 |

|

|

|

1,655 |

|

Customer insolvency (recovery) |

|

|

— |

|

|

|

— |

|

|

|

(316 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(316 |

) |

|

|

— |

|

Non-GAAP gross profit |

|

$ |

68,428 |

|

|

$ |

67,154 |

|

|

$ |

67,960 |

|

|

$ |

67,834 |

|

|

$ |

71,420 |

|

|

$ |

69,497 |

|

|

$ |

67,454 |

|

|

$ |

271,376 |

|

|

$ |

272,725 |

|

GAAP gross margin |

|

|

10.3 |

% |

|

|

10.1 |

% |

|

|

10.2 |

% |

|

|

10.0 |

% |

|

|

10.3 |

% |

|

|

9.6 |

% |

|

|

9.1 |

% |

|

|

10.2 |

% |

|

|

9.5 |

% |

Non-GAAP gross margin |

|

|

10.4 |

% |

|

|

10.2 |

% |

|

|

10.2 |

% |

|

|

10.0 |

% |

|

|

10.3 |

% |

|

|

9.7 |

% |

|

|

9.2 |

% |

|

|

10.2 |

% |

|

|

9.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

$ |

37,470 |

|

|

$ |

36,636 |

|

|

$ |

38,022 |

|

|

$ |

37,332 |

|

|

$ |

35,646 |

|

|

$ |

35,509 |

|

|

$ |

37,672 |

|

|

$ |

149,460 |

|

|

$ |

147,025 |

|

Stock-based compensation expense |

|

|

(2,123 |

) |

|

|

(3,966 |

) |

|

|

(3,859 |

) |

|

|

(1,750 |

) |

|

|

(2,539 |

) |

|

|

(3,254 |

) |

|

|

(3,444 |

) |

|

|

(11,698 |

) |

|

|

(13,631 |

) |

Legal and other settlement loss |

|

|

(239 |

) |

|

|

(367 |

) |

|

|

(317 |

) |

|

|

(855 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,778 |

) |

|

|

— |

|

Non-GAAP selling, general and administrative expenses |

|

$ |

35,108 |

|

|

$ |

32,303 |

|

|

$ |

33,847 |

|

|

$ |

34,727 |

|

|

$ |

33,107 |

|

|

$ |

32,255 |

|

|

$ |

34,228 |

|

|

$ |

135,984 |

|

|

$ |

133,394 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (GAAP) |

|

$ |

18,423 |

|

|

$ |

15,374 |

|

|

$ |

15,528 |

|

|

$ |

14,002 |

|

|

$ |

17,552 |

|

|

$ |

20,412 |

|

|

$ |

13,991 |

|

|

$ |

63,327 |

|

|

$ |

64,315 |

|

Restructuring charges and other costs |

|

|

727 |

|

|

|

795 |

|

|

|

1,471 |

|

|

|

3,343 |

|

|

|

2,899 |

|

|

|

1,437 |

|

|

|

2,364 |

|

|

|

6,336 |

|

|

|

8,126 |

|

Stock-based compensation expense |

|

|

2,626 |

|

|

|

4,379 |

|

|

|

4,185 |

|

|

|

2,176 |

|

|

|

2,955 |

|

|

|

3,674 |

|

|

|

3,867 |

|

|

|

13,366 |

|

|

|

15,286 |

|

Amortization of intangible assets |

|

|

1,204 |

|

|

|

1,205 |

|

|

|

1,204 |

|

|

|

1,204 |

|

|

|

1,204 |

|

|

|

1,592 |

|

|

|

1,591 |

|

|

|

4,817 |

|

|

|

5,979 |

|

Asset impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

198 |

|

|

|

923 |

|

|

|

— |

|

|

|

1,121 |

|

Legal and other settlement loss (gain) |

|

|

239 |

|

|

|

367 |

|

|

|

317 |

|

|

|

855 |

|

|

|

(37 |

) |

|

|

(3,375 |

) |

|

|

(1,155 |

) |

|

|

1,778 |

|

|

|

(4,567 |

) |

Customer insolvency (recovery) |

|

|

— |

|

|

|

— |

|

|

|

(316 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(316 |

) |

|

|

— |

|

Income tax adjustments(1) |

|

|

(971 |

) |

|

|

(1,406 |

) |

|

|

(1,437 |

) |

|

|

(1,393 |

) |

|

|

(1,280 |

) |

|

|

(529 |

) |

|

|

(1,484 |

) |

|

|

(5,207 |

) |

|

|

(4,816 |

) |

Non-GAAP net income |

|

$ |

22,248 |

|

|

$ |

20,714 |

|

|

$ |

20,952 |

|

|

$ |

20,187 |

|

|

$ |

23,293 |

|

|

$ |

23,409 |

|

|

$ |

20,097 |

|

|

$ |

84,101 |

|

|

$ |

85,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted (GAAP) |

|

$ |

0.50 |

|

|

$ |

0.42 |

|

|

$ |

0.43 |

|

|

$ |

0.38 |

|

|

$ |

0.49 |

|

|

$ |

0.57 |

|

|

$ |

0.39 |

|

|

$ |

1.72 |

|

|

$ |

1.79 |

|

Diluted (Non-GAAP) |

|

$ |

0.61 |

|

|

$ |

0.57 |

|

|

$ |

0.57 |

|

|

$ |

0.55 |

|

|

$ |

0.65 |

|

|

$ |

0.65 |

|

|

$ |

0.56 |

|

|

$ |

2.29 |

|

|

$ |

2.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of shares used in calculating diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted (GAAP) |

|

|

36,659 |

|

|

|

36,629 |

|

|

|

36,497 |

|

|

|

36,401 |

|

|

|

35,956 |

|

|

|

35,876 |

|

|

|

35,676 |

|

|

|

36,759 |

|

|

|

35,973 |

|

Diluted (Non-GAAP) |

|

|

36,659 |

|

|

|

36,629 |

|

|

|

36,497 |

|

|

|

36,401 |

|

|

|

35,956 |

|

|

|

35,876 |

|

|

|

35,676 |

|

|

|

36,759 |

|

|

|

35,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operations |

|

$ |

45,916 |

|

|

$ |

39,036 |

|

|

$ |

55,816 |

|

|

$ |

48,457 |

|

|

$ |

137,079 |

|

|

$ |

37,583 |

|

|

$ |

24,538 |

|

|

$ |

189,225 |

|

|

$ |

174,294 |

|

Additions to property, plant and equipment and software |

|

|

(9,032 |

) |

|

|

(9,814 |

) |

|

|

(8,504 |

) |

|

|

(5,903 |

) |

|

|

(11,026 |

) |

|

|

(19,664 |

) |

|

|

(8,318 |

) |

|

|

(33,253 |

) |

|

|

(77,739 |

) |

Free cash flow |

|

$ |

36,884 |

|

|

$ |

29,222 |

|

|

$ |

47,312 |

|

|

$ |

42,554 |

|

|

$ |

126,053 |

|

|

$ |

17,919 |

|

|

$ |

16,220 |

|

|

$ |

155,972 |

|

|

$ |

96,555 |

|

(1) This amount represents the tax impact of the non-GAAP adjustments using the applicable effective tax rates.

Benchmark Electronics Fourth Quarter and Fiscal Year 2024 Results January 29, 2025

Bryan Schumaker, EVP and CFO Today’s Speakers Jeff Benck, President and CEO

Forward-Looking 2025 Statements This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts and may include words such as “anticipate,” “believe,” “intend,” “plan,” “project,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” “could,” “predict,” and similar expressions of the negative or other variations thereof. In particular, statements, express or implied, concerning the Company’s outlook and guidance for first quarter and fiscal year 2025 results, future operating results or margins, the ability to generate sales and income or cash flow, expected revenue mix, the Company’s business strategy and strategic initiatives, the Company’s repurchases of shares of its common stock, the Company’s expectations regarding restructuring charges, stock-based compensation expense, amortization of intangibles, award of any tax incentives and capital expenditures, and the Company’s intentions concerning the payment of dividends, among others, are forward-looking statements. Although the Company believes these statements are based on and derived from reasonable assumptions, they involve risks, uncertainties and assumptions that are beyond the Company’s ability to control or predict, relating to operations, markets and the business environment generally, including those discussed under Part I, Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2023, and in any of the Company’s subsequent reports filed with the Securities and Exchange Commission. Events relating to the possibility of customer demand fluctuations, supply chain constraints, continuing inflationary pressures, the effects of foreign currency fluctuations and high interest rates, geopolitical uncertainties including continuing hostilities and tensions, trade restrictions and sanctions, or the ability to utilize the Company’s manufacturing facilities at sufficient levels to cover its fixed operating costs, may have resulting impacts on the Company’s business, financial condition, results of operations, and the Company’s ability (or inability) to execute on its plans. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes, including the future results of the Company’s operations, may vary materially from those indicated. Undue reliance should not be placed on any forward-looking statements. Forward-looking statements are not guarantees of performance. All forward-looking statements included in this document are based upon information available to the Company as of the date of this document, and the Company assumes no obligation to update. Non-GAAP Financial Information Management discloses certain non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. These non-GAAP financial measures exclude restructuring charges, stock-based compensation expense, amortization of intangible assets acquired in business combinations, certain legal and other settlement losses (gains), customer insolvency losses (recoveries), asset impairments, other significant non-recurring costs and the related tax impacts of all of the above. A detailed reconciliation between GAAP results and results excluding certain items (“non-GAAP”) is included in the following tables attached to this document. In situations where a non-GAAP reconciliation has not been provided, the Company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, a non-GAAP measure, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

Fourth Quarter 2024 Results * * See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results Revenue of $657M was in-line with guidance Solid year-over-year growth in Semi-Cap, A&D and Industrials Offset by anticipated softness in Medical and AC&C GAAP EPS of $0.50 and non-GAAP EPS of $0.61 GAAP and non-GAAP gross margin of 10.3% and 10.4% GAAP operating margin of 4.3% with non-GAAP margin of 5.1% 7th consecutive quarter of positive Free Cash Flow generation

Fiscal Year 2024 Results * * See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results Revenue of $2.7 billion, down 6% year-over-year Strength in Semi-Cap and A&D Industrials improved in the back half; Medical and AC&C remained challenged GAAP and non-GAAP gross margin of 10.2%, expanded 70 and 60 basis points year-over-year GAAP operating margin of 4.1% with non-GAAP margin of 5.1% represents 4th consecutive year of improvement Delivered GAAP EPS of $1.72 and non-GAAP EPS of $2.29 Generated $156 million in Free Cash Flow led by a 20% reduction in inventory

Fourth Quarter 2024 Revenue by Market Sector Q4-24 Q4-23 Revenue by Mix and Market Sector Q3-24 Q4-24 (Dollars in Millions) Sector Revenue Mix % Revenue Mix % Revenue Mix % Q/Q Y/Y Semi-Cap $168 24% $188 28% $198 30% 6% 18% Complex Industrials $132 19% $151 23% $140 21% (7%) 5% Medical $126 18% $107 16% $117 18% 9% (7%) A&D $102 15% $102 16% $117 18% 15% 15% AC&C $163 24% $110 17% $85 13% (23%) (48%) Total Revenue $691 100% $658 100% $657 100% 0% (5%)

Fourth Quarter 2024 Financial Summary * * See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (non-GAAP TTM income from operations + Stock-based compensation – non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters] (Dollars in Millions, except EPS) Q4-23 Q3-24 Q4-24 Q/Q Y/Y Net Sales $691 $658 $657 0% (5%) GAAP Gross Margin 10.3% 10.1% 10.3% 20 bps 0 bps GAAP SG&A $35.6 $36.6 $37.5 2% 5% GAAP Operating Margin 4.6% 4.3% 4.3% 0 bps (30) bps GAAP Diluted EPS $0.49 $0.42 $0.50 19% 2% GAAP ROIC 7.3% 7.7% 7.7% 0 bps 40 bps Non-GAAP Gross Margin 10.3% 10.2% 10.4% 20 bps 10 bps Non-GAAP SG&A $33.1 $32.3 $35.1 9% 6% Non-GAAP Operating Margin 5.5% 5.3% 5.1% (20) bps (40) bps Non-GAAP Diluted EPS $0.65 $0.57 $0.61 7% (6%) Non-GAAP ROIC 9.3% 9.9% 9.9% 0 bps 60 bps

Fiscal Year 2024 Revenue by Market Sector FY-24 Revenue by Mix and Market Sector (Dollars in Millions) FY 2023 FY 2024 Sector Revenue Mix % Revenue Mix % Y/Y Semi-Cap $646 23% $723 27% 12% Complex Industrials $596 21% $573 22% (4%) Medical $557 20% $451 17% (19%) A&D $362 13% $434 16% 20% AC&C $678 23% $475 18% (30%) Total Revenue $2,839 100% $2,656 100% (6%)

Fiscal Year 2024 Financial Summary * * See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (non-GAAP TTM income from operations + Stock-Based Compensation – non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters] (Dollars in Millions, except EPS) FY 2023 FY 2024 Y/Y (%) Net Sales $2,839 $2,656 (6%) GAAP Gross Margin 9.5% 10.2% 70 bps GAAP SG&A $147.0 $149.5 2% GAAP Operating Margin 3.9% 4.1% 20 bps GAAP Diluted EPS $1.79 $1.72 (4%) GAAP ROIC 7.3% 7.7% 40 bps Non-GAAP Gross Margin 9.6% 10.2% 60 bps Non-GAAP SG&A $133.4 $136.0 2% Non-GAAP Operating Margin 4.9% 5.1% 20 bps Non-GAAP Diluted EPS $2.38 $2.29 (4%) Non-GAAP ROIC 9.3% 9.9% 60 bps

Trended Non-GAAP Results *�(Dollars in Millions, except EPS) * See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results

Cash Conversion Cycle Update

Liquidity Update Debt Structure (In Millions) Q4-24 Senior Secured Term Loan $123 Revolving Credit Facility Drawn Amount $135 Borrowing Capacity Available under Revolver $411 (In Millions) FY 2023 FY 2024 Q4-23 Q3-24 Q4-24 Cash Flows from Operations $174 $189 $137 $39 $46 FCF (1) $97 $156 $126 $29 $37 Cash $283 $328 $283 $324 $328 Continued inventory reductions, contributing to Free Cash Flow Further reduced revolving debt balance Strong balance sheet and leverage ratio * (1) Free Cash Flow (FCF) is defined as net cash provided by (used in) operations less capex * Leverage ratio is Net Debt / LTM Adjusted EBITDA, as defined in the credit facility, is a non-GAAP measure

Capital Allocation Update Capital Expenditures Share Repurchases Cash Dividends Capex for Fiscal Year 2025 expected to be $65 - $75 million Continuing to support current dividend Will evaluate share repurchases opportunistically In FY 2024, paid $33 million in capital expenditures Capital expenditures tightly aligned to future organic growth objectives In FY 2024, paid cash dividends of $24 million Committed to supporting return of capital via consistent dividend payments FY 2024: repurchased 0.1M shares for $5M Approximately $150 million remains available under Board authorized share repurchase program

First Quarter 2025 Guidance * Non-GAAP earnings per share guidance excludes stock-based compensation and other non-operating expenses including restructuring, amortization and other expenses. This guidance takes into consideration all known constraints for the quarter and assumes no further significant interruptions to our supply base, operations or customers.

Sector Outlook Q1-25 Q/Q 2025 Y/Y Sector Commentary Semi-Cap Breaking ground on building #4 in Penang in support of Semi-Cap expansion Expect >10% growth in 2025 on further new program ramps Growth is being largely driven by share gain in wafer fab equipment Complex Industrials Q4 grew Y/Y as expected, full year growth anticipated in 2025 Intelligent controls, test and measurement, and automation are drivers Significant TAM in Industrial; we have increased our Business Development focus Medical Seeing ongoing inventory corrections in medical device customer base New bookings momentum continues providing confidence in growth Anticipating gradual recovery in second half as these programs take longer to ramp A&D Upside led by defense, with stable commercial aero demand Dept of Homeland Security border surveillance win launched in Q4 Anticipating continued double-digit growth in FY 2025 AC&C Next gen HPC platform delays due to technology transition impacting near-term revenue Pursuing new compute opportunities leveraging our cooling expertise and domestic factory infrastructure New communications win expected to ramp in second half of 2025

Year End Summary Progress Toward Key Objectives Manage demand volatility while continuing to progress toward improved profitability Continued non-GAAP Gross and Operating Margin expansion despite modest revenue decline Drive Free Cash Flow Reduced inventory by ~$130M Delivered $156M in Free Cash Flow Return capital to investors Increased our recurring dividend during the year Resumed share repurchase activity

Appendix

(Dollars in Thousands, Except Per Share Data) – (UNAUDITED) APPENDIX 1 - Reconciliation of GAAP to non-GAAP Financial Results

v3.24.4

Document And Entity Information

|

Jan. 29, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

BENCHMARK ELECTRONICS, INC.

|

| Entity Central Index Key |

0000863436

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-10560

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Tax Identification Number |

74-2211011

|

| Entity Address, Address Line One |

56 South Rockford Drive

|

| Entity Address, City or Town |

Tempe

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85288

|

| City Area Code |

(623)

|

| Local Phone Number |

300-7000

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| Trading Symbol |

BHE

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

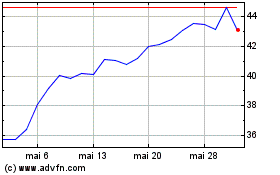

Benchmark Electronics (NYSE:BHE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Benchmark Electronics (NYSE:BHE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025