UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

January, 2025

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 9th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

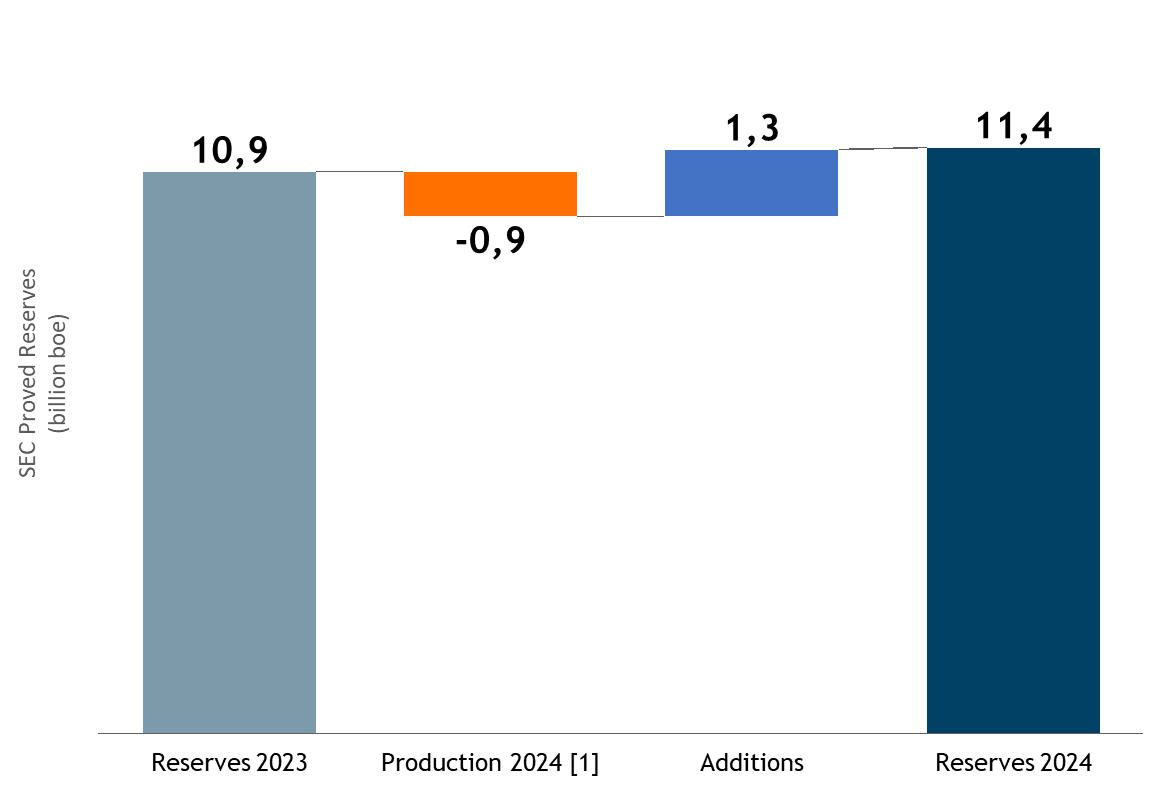

Petrobras informs about Proved Reserves

in 2024

—

Rio de Janeiro, January 29,

2025 – A Petróleo Brasileiro S.A. - Petrobras discloses its proved reserves of oil, condensate and natural gas, according

to SEC (US Securities and Exchange Commission) regulation, estimated at 11.4 billion barrels of oil equivalent (boe), as of December 31,

2024. Oil and condensate, and natural gas correspond to 85% and 15% of this total, respectively.

In 2024, Petrobras followed the

trajectory of reserves addition (1.3 billion boe), with a reserve replacement rate (IRR) of 154%, focusing on profitable assets and keeping

alignment with the search for a just energy transition, generating value for society and shareholders.

The reserves addition occurred

mainly due to the progress in the development of Atapu and Sépia fields, and to the good performance of the assets, with emphasis

on Búzios, Itapu, Tupi and Sépia fields in Santos Basin. There were no relevant changes related to the variation in the

oil price.

The evolution of proved reserves

is shown in the graph below.

Apparent differences in sums are

due to rounding. [1] Does not consider: (a) natural gas liquids, since the reserve is estimated at a reference point prior

to gas processing, except in the United States and Argentina; (b) volumes of injected gas; (c) production from extended well tests in

exploration blocks; and (d) production in Bolivia, since the Bolivian Constitution does not allow the registration of reserves by the

company.

The ratio between proved reserves

and production (R/P ratio) is 13.2 years.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9th floor –

20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

Considering the expected production

for the coming years, it is essential to continue investing in maximizing the recovery factor, exploring new frontiers and diversifying

the exploratory portfolio to replace oil and gas reserves.

Petrobras historically submits

at least 90% of its proved reserves according to SEC definition to independent evaluation. Currently, this evaluation is conducted by

DeGolyer and MacNaughton (D&M).

Petrobras also estimates reserves

according to the ANP/SPE (National Agency of Petroleum, Natural Gas and Biofuels / Society of Petroleum Engineers) definitions. As of

December 31, 2024, the proved reserves according to these definitions reached 11.7 billion barrels of oil equivalent (boe). The differences

between the reserves estimated by ANP/SPE definitions and those estimated using SEC regulation are mainly due to different economic assumptions

and the possibility of considering as reserves the volumes expected to be produced beyond the concession contract expiration date in fields

in Brazil according to ANP reserves regulation.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9th floor –

20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 29, 2025

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025