Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

29 Janeiro 2025 - 7:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2025

Commission File Number: 001-14475

TELEFÔNICA BRASIL S.A.

(Exact name of registrant as specified in its charter)

TELEFONICA BRAZIL S.A.

(Translation of registrant’s name into English)

Av. Eng° Luís Carlos Berrini, 1376 - 28º andar

São Paulo, S.P.

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

TELEFÔNICA BRASIL S.A.

Publicly Held Company

CNPJ No. 02.558.157/0001-62 - NIRE 35.3.0015881-4

MATERIAL FACT

Telefônica Brasil S.A.

(B3: VIVT3; NYSE: VIV) (“Company”), pursuant to and for the purposes of Article 157, paragraph 4, of Law No. 6,404/1976,

and CVM Resolution No. 44/2021, hereby informs its shareholders and the market in general that, at a meeting held on this date, the Company’s

Board of Directors approved the convening of an Extraordinary Shareholders’ Meeting to be held, on first call, on March 13th, 2025

(“ESM”), to deliberate on the proposal to reverse split all the common shares issued by the Company, in the proportion

of 40 (forty) shares to 1 (one) share, and subsequently split, so that 1 (one) grouped share corresponds to 80 (eighty) shares, without

any change to the Company’s capital stock value, but solely to its total number of shares (“Operation”), with

the consequent amendment to the Company’s Bylaws. The proposed Operation does not imply a change in the total amount of securities

of the Company traded on the American stock market (American Depositary Receipt - “ADR”).

The notice to the ESM and other pertinent documents were disclosed today.

The Operation aims to provide greater liquidity to the shares issued

by the Company and, consequently, improve the process of forming its price by increasing the quantity of outstanding shares effectively

negotiated and adjusting its price. In addition, the Operation aims to: (a) reduce operational and administrative costs resulting from

the current configuration of the Company's shareholder base; (b) provide greater efficiency in managing its shareholder base; (c) improve

the efficiency of book-entry share registration and custody systems, (d) enhance the provision of information and communication, improving

the service to shareholders, and (e) provide greater efficiency in distributing proceeds to the Company's shareholders.

The proposed Operation considers the implementation according to

the following procedures:

| (i) | The authorization for the Company’s Executive

Board to define the date to start the procedures to implement the Operation, which should be within a period of 6 (six) months from the

date of the ESM. |

| (ii) | Once the Executive Board defines the date to start

the procedures to implement the Operation, a period of not less than 30 (thirty) days will be determined for the shareholders holding

common shares of the Company to, if necessary, aggregate their shares into whole lots in multiples of 40 (forty), at their own discretion

("Position Adjustment Period"). |

| (iii) | After the end of the Position Adjustment Period, any fractional shares

held by shareholders who have not adjusted their position in multiples of 40 (forty) shares will be grouped into whole numbers and sold

at an auction, to be held at B3 S.A. - Brasil, Bolsa e Balcão on behalf of the holders of the fractions. The net proceeds from

the sale of these shares will be proportionally distributed among all holders of the fractional shares, on a date and in a manner to be

informed in due course by the Company, with amounts belonging to unidentified holders being held at the Company for the legal period,

for collection by the respective holder upon providing full registration information. |

The proposal, to be submitted to the ESM, considers that the Operation:

(i) will be applied to all Company shareholders, (ii) will not result in a change in the value of Company's share capital, (iii) will

not modify the rights conferred by the Company's issued shares to its holders; and (iv) will imply in the change alongside the execution

of the Operation, of the number of shares composing each ADR, with 1 (one) ADR then representing 2 (two) common shares issued by the Company,

not changing the total number of outstanding ADRs.

The company will promptly disclose further details regarding

the procedures to be adopted for the implementation of the Operation, including information about the Position Adjustment Period and the

procedures relating to the Auction.

São Paulo, January 29th, 2025.

David Melcon Sanchez-Friera

CFO and Investor Relations Officer

Telefônica Brasil –

Investor Relations

Tel: +55 11 3430-3687

Email:

ir.br@telefonica.com

| https://ri.telefonica.com.br/ | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

TELEFÔNICA BRASIL S.A. |

|

Date: |

January 29, 2025 |

|

By: |

/s/ João Pedro Carneiro |

|

|

|

|

|

Name: |

João Pedro Carneiro |

|

|

|

|

|

Title: |

Investor Relations Director |

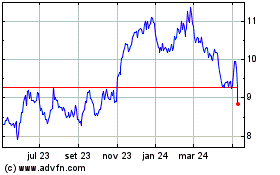

Telefonica Brasil (NYSE:VIV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

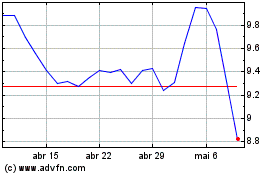

Telefonica Brasil (NYSE:VIV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025