0001569345FALSE441 9th Avenue12th FloorNew YorkNew York00015693452025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2025

Sprinklr, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40528 | | 45-4771485 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| |

441 9th Avenue 12th Floor New York, New York | | | | 10001 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (917) 933-7800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol | | Name of each exchange

on which registered |

| Class A Common stock, par value $0.00003 per share | | CXM | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Director Appointments

On January 29, 2025, the Board of Directors (the “Board”) of Sprinklr, Inc. (the “Company”) increased the size of the Board from eight to ten directors and, following the recommendation of the Company’s Nominating and Corporate Governance Committee, appointed (i) Jan R. Hauser to serve as a member of the Board as a Class I director, for a term expiring at the Company’s 2025 Annual Meeting of Stockholders, and (ii) Stephen M. Ward, Jr. to serve as a member of the Board as a Class II director, for a term expiring at the Company’s 2026 Annual Meeting of Stockholders, each effective as of January 29, 2025. Ms. Hauser will serve as a member of the Audit Committee of the Board (the “Audit Committee”), and Mr. Ward will serve as a member of the Compensation Committee of the Board (the “Compensation Committee”). The Board has determined that each of Ms. Hauser and Mr. Ward is “independent” pursuant to the rules of The New York Stock Exchange and other governing laws and applicable regulations.

Ms. Hauser, age 65, served in various capacities at the General Electric Company (“GE”) from April 2013 until March 2019, including as Vice President, Chief Accounting Officer and Controller. Prior to GE, Ms. Hauser was a partner in the national office of PricewaterhouseCoopers LLP (“PwC”), where she served as a senior technical resource on multiple topics. Early in her career, Ms. Hauser was selected for a two-year fellowship in the Office of the Chief Accountant at the U.S. Securities and Exchange Commission. Ms. Hauser currently sits on the boards of directors of Enfusion, Inc., where she is chair of the audit committee and a member of the compensation committee, and Magna International Inc., where she is a member of the audit committee and technology committee. She previously served on the boards of directors of Proterra Inc., from June 2022 to March 2024, and Vonage Holdings Corp., from October 2019 to July 2022. Ms. Hauser holds a B.B.A. in Accounting, summa cum laude, from the University of Wisconsin-Whitewater.

Mr. Ward, age 69, is the former President and Chief Executive Officer of Lenovo Corporation, the international personal computer company formed by the acquisition of IBM’s personal computer division by Lenovo. Prior to joining Lenovo, Mr. Ward was IBM’s Chief Information Officer and General Manager of Thinkpad, as well as other business units. He currently sits on the boards of directors of C3.ai, Inc., where he serves as chair of its compensation committee and a member of its nominating and corporate governance committee, and Carpenter Technology Corporation, where he serves as chair of its corporate governance committee and a member of both its human capital management committee and its science, technology and sustainability committee. Mr. Ward also currently sits on the board of directors of Molekule Inc., a private company. From November 2022 to October 2024, Mr. Ward served on the board of directors of Molekule Group, Inc., and from June 2021 to July 2022, he served on the board of directors of Vonage Holdings Corp. He also previously served on the boards of directors of KLX Energy Services Holdings, Inc., E2Open Corporation, E-Ink Corporation, KLX Aerospace, QD Vision, Inc. and Lenovo. Mr. Ward holds a B.S. in Mechanical Engineering from California Polytechnic State University, San Luis Obispo.

There are no arrangements or understandings between Ms. Hauser or Mr. Ward and any other person pursuant to which they were selected as a director, and there are no family relationships between Ms. Hauser or Mr. Ward and any of the Company’s other directors or executive officers. There are no transactions between Ms. Hauser or Mr. Ward and the Company that would be required to be reported under Item 404(a) of Regulation S-K.

As non-employee directors of the Company, each of Ms. Hauser and Mr. Ward is eligible to participate in the Company’s Amended and Restated Non-Employee Director Compensation Policy, a description of which is included in the Company’s Proxy Statement on Form DEF 14A filed on May 3, 2024 and is incorporated herein by reference, as such policy may be amended from time to time (the “Policy”).

In connection with their appointments, the Company and each of Ms. Hauser and Mr. Ward will enter into the Company’s standard form of indemnification agreement (the “Indemnification Agreement”). The Indemnification Agreement requires the Company to indemnify each director, to the fullest extent permitted by Delaware law, for certain liabilities to which such director may become subject as a result of such director’s affiliation with the Company.

Director Departure

On January 29, 2025, Edwin Gillis notified the Board of his decision to resign as Chair of the Audit Committee, effective as of the close of business on March 31, 2025, and as a Class II director of the Company and a member of the Audit Committee, effective as of the close of business on June 12, 2025 (the “Effective Date”). Mr. Gillis’s decision to resign from the Board was not the result of any disagreement between Mr. Gillis and the Company, its management, the Board or any committees thereof on any matter relating to the Company’s operations, policies or practices. In connection with Mr. Gillis’s departure, the Company has extended the post-termination exercise period for all of Mr. Gillis’s vested options until June 12, 2026.

Ms. Hauser will succeed Mr. Gillis as Chair of the Audit Committee, effective as of March 31, 2025, and will receive additional compensation pursuant to the Policy. In connection with Mr. Gillis’s departure, the Board approved a decrease in the size of the Board from ten to nine directors, effective as of the Effective Date.

A copy of the Company’s press release announcing the director changes described above is attached hereto as Exhibit 99.1 and is hereby incorporated by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description of Exhibits |

| |

| 99.1 | | |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Date: January 30, 2025 | | | | Sprinklr, Inc. |

| | | |

| | | | By: | | /s/ Jacob Scott |

| | | | | | Jacob Scott |

| | | | | | General Counsel & Corporate Secretary |

Sprinklr Announces Appointments to Board of Directors

•Jan R. Hauser appointed as a Member of the Board and the Audit Committee.

•Steve M. Ward appointed as a Member of the Board and the Compensation Committee

•As of March 31, 2025, Ed Gillis to step down as Chair of Audit Committee, and Jan R. Hauser will assume the role of Chair of the Audit Committee

•Ed Gillis to step down from the Board as of June 12, 2025.

NEW YORK, NY — January 30, 2025 – Sprinklr (NYSE: CXM), the unified customer experience management (Unified-CXM) platform for modern enterprises, has appointed Jan R. Hauser, a global finance leader and retired PricewaterhouseCoopers (PwC) partner, and Stephen M. Ward, Jr., a former Chief Executive Officer of Lenovo Group Limited and member of the founding team of C3.ai, to its Board of Directors, effective January 29, 2025.

Current Board member and Audit Committee Chair, Ed Gillis, has notified the Company of his decision to step down as Chair of the Audit Committee effective March 31, 2025. Subsequently, Ms. Hauser will assume the role of Chair of the Audit Committee. Thereafter, Mr. Gillis will step down from the board on June 12, 2025. Mr. Gillis has served as a member of our Board since November 2015.

“We are happy to welcome Jan Hauser and Steve Ward to the Sprinklr Board,” said Sprinklr Founder and Chairman of the Board, Ragy Thomas. “Their proven leadership and expansive expertise will be invaluable as we work to execute against our strategic vision and bring value to customers with our AI-powered platform. We also want to thank Ed Gillis for his many years of service on the Board and his unwavering dedication that helped Sprinklr to become the industry-changing enterprise software company that we are today.”

Jan Hauser is a global finance leader, retired PricewaterhouseCoopers (PwC) partner and board member with more than thirty-five years of experience dealing with complex business transactions and strategies. Ms. Hauser served in various capacities at the General Electric Company (“GE”) from April 2013 until March 2019, including as Vice President, Chief Accounting Officer and Controller. Prior to joining GE, Ms. Hauser was a senior partner in the National Office of PwC, where she served as a senior technical resource on multiple topics. Early in her career, Ms. Hauser was selected for a prestigious fellowship in the Office of the Chief Accountant at the SEC. Ms. Hauser currently sits on the boards of directors of Enfusion, Inc., where she is chair of the audit committee and a member of the compensation committee, and Magna International Inc., where she is a member of the audit committee and technology committee. She previously served on the boards of directors of Proterra Inc., from June 2022 to March 2024, and Vonage

Holdings Corp., from October 2019 to July 2022. Ms. Hauser holds a B.B.A. in Accounting, summa cum laude, from the University of Wisconsin-Whitewater.

"I am honored to join the Sprinklr Board," said Ms. Hauser. "I look forward to being a part such of an innovative company that is defining a market as it works to establishes itself as a critical enterprise technology platform for leading enterprise brands."

Stephen M. Ward is the former President and Chief Executive Officer of Lenovo Corporation, the international personal computer company formed by the acquisition of IBM's personal computer division by Lenovo. Prior to joining Lenovo, Mr. Ward was IBM’s Chief Information Officer and General Manager of Thinkpad, as well as other business units. He currently sits on the boards of directors of C3.ai, Inc., where he serves as chair of its compensation committee and a member of its nominating and corporate governance committee, and Carpenter Technology Corporation, where he serves as chair of its corporate governance committee and a member of both its human capital management committee and its science, technology and sustainability committee. Mr. Ward also currently sits on the board of directors of Molekule Inc., a private company. He also previously served on the boards of directors of Vonage Holdings Corp, KLX Energy Services Holdings, Inc., E2Open Corporation, E-Ink Corporation, KLX Aerospace, QD Vision, Inc. and Lenovo. Mr. Ward holds a B.S. in Mechanical Engineering from California Polytechnic State University, San Luis Obispo.

"I look forward to leveraging my experience with digital transformation to contribute to Sprinklr’s success as a member of the Board and the Compensation Committee," Ward said. "Sprinklr’s AI-powered platform gives the company a unique position to deliver unified customer experiences in an expanding and evolving market. I look forward to being a part of the strategy to support Sprinklr in driving innovation, profitable growth, and long-term value."

About Sprinklr

Sprinklr is a leading enterprise software company for all customer-facing functions. With advanced AI, Sprinklr's unified customer experience management (Unified-CXM) platform helps companies deliver human experiences to every customer, every time, across any modern channel. Headquartered in New York City with employees around the world, Sprinklr works with more than 1,800 valuable enterprises — global brands like Microsoft, P&G, Samsung and more than 60% of the Fortune 100. Sprinklr’s value to the enterprise is simple: We un-silo teams to make customers happier.

Forward Looking Statements

This press release contains forward-looking information and statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements

regarding the potential benefits of appointing Jan R. Hauser and Stephen M. Ward, Jr. as members of Sprinklr’s board of directors. By their nature, forward-looking information and statements are subject to risks, uncertainties, and contingencies, including (i) the risk that the potential benefits of Ms. Hauser and Mr. Ward’s appointments are not realized and (ii) risks, uncertainties and contingencies that may apply to Sprinklr’s business. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are discussed in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2024, filed with the Securities and Exchange Commission (the “SEC”) on December 4, 2024, under the caption “Risk Factors,” and in other filings that we make from time to time with the SEC. Sprinklr does not undertake to update any forward-looking statements or information, including those contained in this press release.

v3.24.4

Cover

|

Jan. 29, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

Sprinklr, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40528

|

| Entity Tax Identification Number |

45-4771485

|

| Entity Address, Address Line One |

441 9th Avenue

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

917

|

| Local Phone Number |

933-7800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common stock, par value $0.00003 per share

|

| Trading Symbol |

CXM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001569345

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

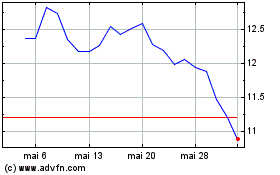

Sprinklr (NYSE:CXM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Sprinklr (NYSE:CXM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025