CARPENTER TECHNOLOGY CORP false 0000017843 0000017843 2025-01-30 2025-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: January 30, 2025

CARPENTER TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-5828 |

|

23-0458500 |

(State of or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

I.D. No.) |

|

|

|

| 1735 Market Street Philadelphia, Pennsylvania |

|

19103 |

| (Address of principal executive offices) |

|

(Zip Code) |

(610) 208-2000

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or required to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common Stock, $5 Par Value |

|

CRS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b.2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On January 30, 2025, Carpenter Technology Corporation held its second quarter fiscal year 2025 earnings call, broadcast live by webcast. A copy of the slides presented during the call are furnished as Exhibit 99.1 to this Form 8-K and shall not be deemed to be “filed” for any purpose.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| CARPENTER TECHNOLOGY CORPORATION |

|

|

| By |

|

/s/ Timothy Lain |

|

|

Timothy Lain |

|

|

Senior Vice President and Chief Financial Officer |

Date: February 3, 2025

CARPENTER TECHNOLOGY CORPORATION 2nd

Quarter Fiscal Year 2025 Earnings Call January 30, 2025 Exhibit 99.1

Cautionary Statement Forward-looking

statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ

from those projected, anticipated or implied. The most significant of these uncertainties are described in Carpenter Technology’s filings with the Securities and Exchange Commission, including its report on Form 10-K for the fiscal year ended

June 30, 2024, Form 10-Q for the fiscal quarter ended September 30, 2024, and the exhibits attached to those filings. They include but are not limited to: (1) the cyclical nature of the specialty materials business and certain end-use markets,

including aerospace, defense, medical, energy, transportation, industrial and consumer, or other influences on Carpenter Technology's business such as new competitors, the consolidation of competitors, customers, and suppliers or the transfer of

manufacturing capacity from the United States to foreign countries; (2) the ability of Carpenter Technology to achieve cash generation, growth, earnings, profitability, operating income, cost savings and reductions, qualifications, productivity

improvements or process changes; (3) the ability to recoup increases in the cost of energy, raw materials, freight or other factors; (4) domestic and foreign excess manufacturing capacity for certain metals; (5) fluctuations in currency exchange and

interest rates; (6) the effect of government trade actions, including tariffs; (7) the valuation of the assets and liabilities in Carpenter Technology's pension trusts and the accounting for pension plans; (8) possible labor disputes or work

stoppages; (9) the potential that our customers may substitute alternate materials or adopt different manufacturing practices that replace or limit the suitability of our products; (10) the ability to successfully acquire and integrate acquisitions;

(11) the availability of credit facilities to Carpenter Technology, its customers or other members of the supply chain; (12) the ability to obtain energy or raw materials, especially from suppliers located in countries that may be subject to

unstable political or economic conditions; (13) Carpenter Technology's manufacturing processes are dependent upon highly specialized equipment located primarily in facilities in Reading and Latrobe, Pennsylvania and Athens, Alabama for which there

may be limited alternatives if there are significant equipment failures or a catastrophic event; (14) the ability to hire and retain a qualified workforce and key personnel, including members of the executive management team, management,

metallurgists and other skilled personnel; (15) fluctuations in oil and gas prices and production; (16) the impact of potential cyber attacks and information technology or data security breaches; (17) the ability of suppliers to meet obligations due

to supply chain disruptions or otherwise; (18) the ability to meet increased demand, production targets or commitments; (19) the ability to manage the impacts of natural disasters, climate change, pandemics and outbreaks of contagious diseases and

other adverse public health developments; (20) geopolitical, economic, and regulatory risks relating to our global business, including geopolitical and diplomatic tensions, instabilities and conflicts, such as the war in Ukraine, the war between

Israel and HAMAS, the war between Israel and Hezbollah, Houthi attacks on commercial shipping vessels and other naval vessels as well as compliance with U.S. and foreign trade and tax laws, sanctions, embargoes and other regulations; (21) challenges

affecting the commercial aviation industry or key participants including, but not limited to production and other challenges at The Boeing Company; and (22) the consequences of the announcement, maintenance or use of Carpenter Technology’s

share repurchase program. Any of these factors could have an adverse and/or fluctuating effect on Carpenter Technology's results of operations. The forward-looking statements in this document are intended to be subject to the safe harbor protection

provided by Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended. We caution you not to place undue reliance on forward-looking statements, which speak only

as of the date of this presentation or as of the dates otherwise indicated in such forward-looking statements. Carpenter Technology undertakes no obligation to update or revise any forward-looking statements. Non-GAAP and other financial measures

Financial information included in this presentation is unaudited. Some of the information included in this presentation is derived from Carpenter Technology's consolidated financial information but is not presented in Carpenter Technology's

financial statements prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our

GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in

the Appendix to this presentation.

2nd QUARTER FISCAL YEAR 2025 Tony

Thene | President and Chief Executive Officer

Safety is Our Highest Value Total case

incident rate

Performance: record second quarter

operating income and increasing earnings guidance Record second quarter profits with positive adjusted free cash flow Adjusted Operating Income ($M) * + Strengthening outlook; increasing FY25 operating income guidance *Detailed schedule included in

Non-GAAP Schedules in Appendix. SAO continues to expand adjusted operating margins SAO Adjusted Operating Margin (%) * SAO operating income of $135.6 million, up 63% year-over-year Margin expansion from higher productivity, improving mix and pricing

actions Generated $38.6 million in adjusted free cash flow* Executed $8.2 million in share repurchases Future: expect continued earnings growth beyond FY25 Today: increasing FY25 guidance to $500 million to $520 million 10/2024: guided to high end

of $460 million to $500 million range 07/2024: accelerated goal to FY25 04/2024: moved goal to FY26 05/2023: announced goal of $460 million to $500 million in operating income for FY27

Second Quarter Fiscal Year 2025 Net

Sales MARKET Q2-25 NET SALES EX. SURCHARGE ($M)* % NET SALES EX. SURCHARGE VS. Q1-25 VS. Q2-24 AEROSPACE & DEFENSE $333.8 61% -5% +35% MEDICAL $73.4 13% 0% +1% ENERGY $32.2 6% -18% -13% TRANSPORTATION $21.4 4% +1% -20% INDUSTRIAL & CONSUMER

$67.4 12% -7% -16% Successfully navigating Aerospace supply chain dynamics Aerospace and Defense and Medical end-use markets (together, ~74% of net sales ex. surcharge) up year-over-year Partnering with customers to manage short-term priorities

Optimizing production schedules through supply chain visibility and manufacturing flexibility Long-term demand remains robust, with strong customer engagement and high backlogs Expect fiscal third quarter net sales to increase sequentially *Excludes

sales through Carpenter’s Distribution businesses.

2nd QUARTER FISCAL YEAR 2025 FINANCIAL

OVERVIEW Tim Lain | Senior Vice President and Chief Financial Officer

*Detailed schedule included in

Non-GAAP Schedules in Appendix. $ millions, except per share amounts Q2-25 Q1-25 Q2-24 SEQUENTIAL CHANGE YEAR-OVER-YEAR CHANGE Pounds (‘000) 46,170 51,568 49,082 (5,398) (2,912) Net Sales 676.9 717.6 624.2 (40.7) 52.7 Net Sales ex. Surcharge

Revenue* 548.0 577.4 485.3 (29.4) 62.7 Gross Profit 177.5 176.3 122.6 1.2 54.9 Selling, General and Administrative Expenses 58.6 59.1 52.8 (0.5) 5.8 Operating Income 118.9 113.6 69.8 5.3 49.1 Special Item included in Operating Income — 3.6

— (3.6) — Adjusted Operating Income ex. Special Item* 118.9 117.2 69.8 1.7 49.1 Adjusted Operating Margin ex. Surcharge Rev. and Special Item* 21.7% 20.3% 14.4% 1.4% 7.3% Effective Tax Rate ex. Special Item 20.0% 16.4% 22.6% 3.6% (2.6%)

Net Income 84.1 84.8 42.7 (0.7) 41.4 Diluted Earnings per Share $1.66 $1.67 $0.85 ($0.01) $0.81 Adjusted Diluted Earnings per Share ex. Special Item* $1.66 $1.73 $0.85 ($0.07) $0.81 Income Statement Summary

SAO Segment Summary Net sales

excluding surcharge increased 15% year-over-year, driven by Aerospace and Defense end-use market Record second quarter operating income and margin, the result of ongoing efforts to increase productivity, improve product mix and realize benefits of

pricing actions Maintaining focus on additional opportunities to increase productivity, while managing operating costs closely and optimizing product mix Q3-25 operating income expected to be in the range of $140 million to $145 million $ millions

Q2-25 Q1-25 Q2-24 SEQUENTIAL CHANGE YEAR-OVER-YEAR CHANGE Pounds ('000) 44,714 50,100 50,114 (5,386) (5,400) Net Sales 601.5 645.1 549.4 (43.6) 52.1 Net Sales ex. Surcharge Revenue* 479.6 510.9 416.2 (31.3) 63.4 Operating Income 135.6 134.5 83.3 1.1

52.3 Adjusted Operating Margin ex. Surcharge Revenue* 28.3% 26.3% 20.0% 2.0% 8.3% Q2-25 Business Results Q3-25 Outlook *Detailed schedule included in Non-GAAP Schedules in Appendix.

PEP Segment Summary Net sales

excluding surcharge decreased 7% sequentially and 2% year-over-year; increasing sales of titanium in Aerospace and Defense and Medical end-use markets offset by customer order deferrals in Additive business Operating income results for current

quarter reflect improving year-over-year performance in titanium business more than offset by order deferrals in Additive business Continuing to drive actions to enhance productivity and throughput rates across manufacturing facilities to support

strong demand for titanium solutions, while managing costs in other businesses Improving visibility to strategic customer orders expected to drive volumes higher in Additive business Q3-25 operating income expected to be in the range of $10 million

to $12 million *Pounds includes only Dynamet and Additive businesses. **Detailed schedule included in Non-GAAP Schedules in Appendix. $ millions Q2-25 Q1-25 Q2-24 SEQUENTIAL CHANGE YEAR-OVER-YEAR CHANGE Pounds ('000)* 2,208 2,634 2,318 (426) (110)

Net Sales 95.0 100.8 95.7 (5.8) (0.7) Net Sales ex. Surcharge Revenue** 86.2 92.4 87.9 (6.2) (1.7) Operating Income 7.0 7.3 7.1 (0.3) (0.1) Adjusted Operating Margin ex. Surcharge Revenue** 8.1% 7.9% 8.1% 0.2% —% Q2-25 Business Results Q3-25

Outlook

Cash Flow & Liquidity Summary

The clerical accuracy of certain amounts may be impacted due to rounding. *Detailed schedule included in Non-GAAP Schedules in Appendix. $ millions Q2-25 Q1-25 6 MOS FY25 6 MOS FY24 Net Income + Noncash Items 125.0 128.7 253.8 173.8 Inventory (63.9)

(16.8) (80.7) (157.5) Working Capital / Other 12.3 (62.1) (49.9) 10.4 Total Net Working Capital / Other (51.6) (78.9) (130.6) (147.1) Pension Plan Contributions (5.5) (9.6) (15.1) (4.8) Net Cash Provided from Operating Activities 67.9 40.2 108.1

21.9 Purchases of Property, Plant, Equipment and Software (29.3) (26.9) (56.2) (47.3) Adjusted Free Cash Flow* 38.6 13.3 51.9 (25.4) $ millions Q2-25 Q1-25 6 MOS FY25 6 MOS FY24 Cash 162.1 150.2 162.1 15.7 Available Borrowing Under Credit Facility

348.9 348.9 348.9 334.4 Total Liquidity 511.0 499.1 511.0 350.1 Generated $38.6 million in adjusted free cash flow Repurchased 45,000 shares ($8.2 million) against $400 million repurchase authorization Funded consistent quarterly cash dividend of

$10.1 million ($0.20 per share)

2nd QUARTER FISCAL YEAR 2025

CLOSING COMMENTS Tony Thene | President and Chief Executive Officer

Strong execution with record second

quarter Strengthening earnings growth outlook Navigating Aerospace production rate “re-ramp” Record second quarter profits up 70% year-over-year SAO continues to expand operating margins Generated $38.6 million in adjusted free cash flow

Executed $8.2 million in share repurchases Partnering with customers to address near-term priorities Optimizing production schedules through supply chain visibility and manufacturing flexibility Strong long-term demand across markets like Defense,

Medical and Energy with Aerospace-like margins Anticipating Q3 operating income of $126 million to $134 million Increasing FY25 operating income guidance to $500 million to $520 million Expecting earnings growth beyond FY25 Will communicate

long-term outlook at upcoming investor event (2/18/25)

APPENDIX OF NON-GAAP

SCHEDULES

$ millions Q2-25 Q1-25 Q2-24 Net

Sales 676.9 717.6 624.2 Less: Surcharge Revenue 128.9 140.2 138.9 Net Sales ex. Surcharge Revenue 548.0 577.4 485.3 Operating Income 118.9 113.6 69.8 Special Item: Restructuring and asset impairment charges — 3.6 —

Adjusted Operating Income ex. Special Item 118.9 117.2 69.8 Operating Margin 17.6% 15.8% 11.2% Adjusted Operating Margin ex. Surcharge Revenue and Special Item 21.7% 20.3% 14.4% Management believes that removing the impact of raw material surcharge

from operating margin provides a more consistent basis for comparing results of operations from period to period, thereby permitting management to evaluate performance and investors to make decisions based on the ongoing operations of the Company.

In addition, management believes that excluding the impact of special items from operating margin is helpful in analyzing the operating performance of the Company, as these items are not indicative of ongoing operating performance. Management uses

its results excluding these amounts to evaluate its operating performance and to discuss its business with investment institutions, the Company's board of directors and others. Adjusted Operating Margin ex. Surcharge Revenue and Special Item

Non-GAAP Schedules

SAO SAO SAO PEP PEP PEP $ millions

Q2-25 Q1-25 Q2-24 Q2-25 Q1-25 Q2-24 Net Sales 601.5 645.1 549.4 95.0 100.8 95.7 Less: Surcharge Revenue 121.9 134.2 133.2 8.8 8.4 7.8 Net Sales ex. Surcharge Revenue 479.6 510.9 416.2 86.2 92.4 87.9 Operating Income 135.6 134.5 83.3 7.0 7.3 7.1

Operating Margin 22.5% 20.8% 15.2% 7.4% 7.2% 7.4% Adjusted Operating Margin ex. Surcharge Revenue 28.3% 26.3% 20.0% 8.1% 7.9% 8.1% Management believes that removing the impact of raw material surcharge from operating margin provides a more

consistent basis for comparing results of operations from period to period, thereby permitting management to evaluate performance and investors to make decisions based on the ongoing operations of the Company. Management uses its results excluding

these amounts to evaluate its operating performance and to discuss its business with investment institutions, the Company's board of directors and others. Adjusted Segment Operating Margin ex. Surcharge Revenue Non-GAAP Schedules

$ millions, except per share

amounts Q2-25 Q1-25 Q2-24 Diluted Earnings per Share $1.66 $1.67 $0.85 Net Income 84.1 84.8 42.7 Special Item, net of tax: Restructuring and asset impairment charges — 2.7 — Special Item, net of tax: — 2.7

— Net Income Excluding Special Item 84.1 87.5 42.7 Adjusted Diluted Earnings per Share Excluding Special Item $1.66 $1.73 $0.85 Adjusted Diluted Earnings Per Share Non-GAAP Schedules Management believes that earnings per share adjusted to

exclude the impact of special items is helpful in analyzing the operating performance of the Company, as these items are not indicative of ongoing operating performance. Management uses its results excluding these amounts to evaluate its operating

performance and to discuss its business with investment institutions, the Company's board of directors and others.

$ millions Q2-25 Q1-25 6 MOS FY25 6

MOS FY24 Net Cash Provided from Operating Activities 67.9 40.2 108.1 21.9 Purchases of Property, Plant, Equipment and Software (29.3) (26.9) (56.2) (47.3) Adjusted Free Cash Flow 38.6 13.3 51.9 (25.4) Management believes that the adjusted free cash

flow measure provides useful information to investors regarding the Company’s financial condition because it is a measure of cash generated, which management evaluates for alternative uses. The clerical accuracy of certain amounts may be

impacted due to rounding. Non-GAAP Schedules Adjusted Free Cash Flow

Carpenter Technology Corporation

(NYSE: CRS) is a recognized leader in high-performance specialty alloy materials and process solutions for critical applications in the aerospace and defense, medical, and other markets. Founded in 1889, Carpenter Technology has evolved to become a

pioneer in premium specialty alloys including nickel, cobalt, and titanium and material process capabilities that solve our customers' current and future material challenges. Your trusted partner in innovation.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

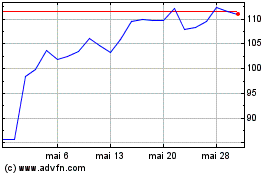

Carpenter Technology (NYSE:CRS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Carpenter Technology (NYSE:CRS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025