false

0000094344

0000094344

2025-02-05

2025-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13

OR 15(d) OF THE

SECURITIES EXCHANGE ACT

OF 1934

DATE OF REPORT (DATE

OF EARLIEST EVENT REPORTED): February 5, 2025

STEWART

INFORMATION SERVICES CORPORATION

(EXACT NAME OF REGISTRANT

AS SPECIFIED IN ITS CHARTER)

| Delaware |

|

001-02658 |

|

74-1677330 |

(STATE OR OTHER

JURISDICTION) |

|

(COMMISSION FILE NO.) |

|

(I.R.S. EMPLOYER

IDENTIFICATION NO.) |

1360

Post Oak Blvd, Suite 100, Houston,

Texas 77056

(Address Of Principal Executive Offices) (Zip

Code)

Registrant’s Telephone

Number, Including Area Code: (713) 625-8100

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, $1 par value |

STC |

New

York Stock Exchange (NYSE) |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

A press release issued by

Stewart Information Services Corporation on February 5, 2025, regarding financial results for the three months ended December 31,

2024, is attached hereto as Exhibit 99.1, and is incorporated herein by reference. This information is not deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934 and is not incorporated by reference in any filing under the

Securities Act of 1933, as amended.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) EXHIBITS

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

STEWART INFORMATION SERVICES CORPORATION |

| |

(Registrant) |

| |

|

| |

By: |

/s/ David C. Hisey |

| |

David C. Hisey, |

| |

Chief Financial Officer and Treasurer |

Date: February 5, 2025

Exhibit 99.1

NEWS RELEASE

|

STEWART INFORMATION SERVICES CORP.

P.O. Box 2029

Houston, Texas 77252-2029

www.stewart.com |

CONTACT

Kathryn Bass / Brian Glaze

Investor Relations

(713) 625-8633 |

Stewart Reports Fourth Quarter and Full Year

2024 Results

| · | Total revenues of $665.9 million ($664.2 million on an adjusted basis)

compared to $582.2 million ($577.4 million on an adjusted basis) in the prior year quarter |

| · | Net income of $22.7 million ($31.5 million on an adjusted basis) compared

to $8.8 million ($16.6 million on an adjusted basis) in the prior year quarter |

| · | Diluted earnings per share of $0.80 ($1.12 on an adjusted basis) compared

to prior year quarter diluted EPS of $0.32 ($0.60 on an adjusted basis) |

| · | Full year 2024 net income of $73.3 million ($94.4 million on an adjusted

basis) compared to 2023 net income of $30.4 million ($66.6 million on an adjusted basis) |

| · | Full year 2024 diluted earnings per share of $2.61 ($3.35 on an adjusted

basis) compared to $1.11 ($2.42 on an adjusted basis) for 2023 |

HOUSTON, February 5, 2025 - Stewart Information Services Corporation

(NYSE: STC) today reported net income attributable to Stewart of $22.7 million ($0.80 per diluted share) for the fourth quarter 2024,

compared to $8.8 million ($0.32 per diluted share) for the fourth quarter 2023. On an adjusted basis, net income for the fourth quarter

2024 was $31.5 million ($1.12 per diluted share) compared to $16.6 million ($0.60 per diluted share) in the fourth quarter 2023. Pretax

income before noncontrolling interests for the fourth quarter 2024 was $35.4 million ($47.3 million on an adjusted basis) compared to

$18.8 million ($29.1 million on an adjusted basis) for the fourth quarter 2023.

Fourth quarter 2024 results included $1.7 million of pretax net realized

and unrealized gains, primarily related to net gains from fair value changes of equity securities investments and an acquisition liability

adjustment, partially offset by losses from a sale of an office and an investment impairment. Fourth quarter 2023 results included $4.8

million of pretax net realized and unrealized gains, primarily driven by net gains from fair value changes of equity securities investments

and an acquisition liability adjustment.

“We are pleased with our fourth quarter and full year 2024 results

as they demonstrate both our progress and resilience in these continued challenging macro-housing conditions,” commented Fred Eppinger,

chief executive officer. “We continue to improve on our operations to win share and fortify our position and look forward to continuing

to do so in 2025. We remain focused on our pursuit of growth and margin improvement across all business lines.”

Selected Financial Information

Summary results of operations are as follows (dollars in millions,

except per share amounts, pretax margin and adjusted pretax margin, and amounts may not add as presented due to rounding):

| | |

Quarter Ended

December 31, | | |

Year Ended

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total revenues | |

| 665.9 | | |

| 582.2 | | |

| 2,490.4 | | |

| 2,257.3 | |

| Pretax income before noncontrolling interests | |

| 35.4 | | |

| 18.8 | | |

| 114.3 | | |

| 60.9 | |

| Income tax expense | |

| (8.2 | ) | |

| (5.7 | ) | |

| (26.2 | ) | |

| (15.3 | ) |

| Net income attributable to noncontrolling interests | |

| (4.5 | ) | |

| (4.3 | ) | |

| (14.8 | ) | |

| (15.2 | ) |

| Net income attributable to Stewart | |

| 22.7 | | |

| 8.8 | | |

| 73.3 | | |

| 30.4 | |

| Non-GAAP adjustments, after taxes* | |

| 8.8 | | |

| 7.8 | | |

| 21.1 | | |

| 36.2 | |

| Adjusted net income attributable to Stewart* | |

| 31.5 | | |

| 16.6 | | |

| 94.4 | | |

| 66.6 | |

| Pretax margin | |

| 5.3 | % | |

| 3.2 | % | |

| 4.6 | % | |

| 2.7 | % |

| Adjusted pretax margin* | |

| 7.1 | % | |

| 5.0 | % | |

| 5.8 | % | |

| 4.8 | % |

| Net income per diluted Stewart share | |

| 0.80 | | |

| 0.32 | | |

| 2.61 | | |

| 1.11 | |

| Adjusted net income per diluted Stewart share* | |

| 1.12 | | |

| 0.60 | | |

| 3.35 | | |

| 2.42 | |

* Adjusted net income, adjusted pretax margin and adjusted

net income per diluted share are non-GAAP measures. See Appendix A for explanation and reconciliation of non-GAAP adjustments.

Title Segment

Summary results of the title segment are as follows (dollars in millions,

except pretax margin and adjusted pretax margin):

| | |

Quarter

Ended December 31, | |

| | |

2024 | | |

2023 | | |

%

Change | |

| Operating

revenues | |

| 562.7 | | |

| 502.9 | | |

| 12 | % |

| Investment

income | |

| 14.5 | | |

| 13.0 | | |

| 12 | % |

| Net

realized and unrealized gains | |

| 2.8 | | |

| 5.1 | | |

| (46 | )% |

| Pretax

income | |

| 45.2 | | |

| 27.3 | | |

| 65 | % |

| Non-GAAP

adjustments to pretax income* | |

| 5.3 | | |

| 4.0 | | |

| | |

| Adjusted

pretax income* | |

| 50.5 | | |

| 31.4 | | |

| 61 | % |

| Pretax

margin | |

| 7.8 | % | |

| 5.2 | % | |

| | |

| Adjusted

pretax margin* | |

| 8.8 | % | |

| 6.1 | % | |

| | |

| | * Adjusted

pretax income and adjusted pretax margin are non-GAAP financial measures. See Appendix A for explanation and reconciliation of

non-GAAP adjustments. |

|

Title segment operating revenues in the fourth quarter 2024 improved

$59.8 million, or 12 percent, driven by increased revenues from our direct and agency title operations, while total segment operating

expenses increased $41.0 million, or 8 percent, compared to the fourth quarter 2023. Agency retention expenses in the fourth quarter 2024

increased $13.7 million, or 6 percent, consistent with the $16.6 million, or 6 percent, increase in gross agency revenues compared to

the prior year quarter.

Total title segment employee costs and other operating expenses for

the fourth quarter 2024 increased $27.1 million, or 11 percent, compared to the prior year quarter, primarily due to increased incentive

compensation expenses related to higher title revenues, higher outside search expenses resulting from higher commercial revenues, and

increased severance expenses, primarily related to an executive retirement announced in September 2024. As a percentage of operating

revenues, total segment employee costs and other operating expenses slightly improved to 48.7 percent in the fourth quarter 2024 compared

to 49.1 percent in the prior year quarter.

Title loss expense in the fourth quarter 2024 was $20.7 million, which

was comparable to the fourth quarter 2023, primarily as a result of our overall favorable claim experience offsetting the incremental

title loss expense related to increased title revenues. As a percentage of title revenues, title loss expense was 3.7 percent for the

fourth quarter 2024 compared to 4.1 percent in the prior year quarter.

In addition to the net realized and unrealized gains presented above,

non-GAAP adjustments to the title segment’s pretax income for the fourth quarters 2024 and 2023 included $8.1 million and $9.1 million,

respectively, of total acquisition intangible asset amortization and related expenses, executive severance expenses and office closure

costs (refer to Appendix A).

Direct title revenues information is presented below (dollars in millions):

| | |

Quarter Ended December 31, | |

| | |

2024 | | |

2023 | | |

% Change | |

| Non-commercial: | |

| | | |

| | | |

| | |

| Domestic | |

| 162.5 | | |

| 153.8 | | |

| 6 | % |

| International | |

| 25.9 | | |

| 24.0 | | |

| 8 | % |

| | |

| 188.4 | | |

| 177.8 | | |

| 6 | % |

| Commercial: | |

| | | |

| | | |

| | |

| Domestic | |

| 84.1 | | |

| 56.1 | | |

| 50 | % |

| International | |

| 11.1 | | |

| 6.5 | | |

| 71 | % |

| | |

| 95.2 | | |

| 62.6 | | |

| 52 | % |

| Total direct title revenues | |

| 283.6 | | |

| 240.4 | | |

| 18 | % |

Domestic non-commercial revenues in the fourth quarter 2024 improved

by $8.7 million, or 6 percent, primarily due to increased total non-commercial domestic transactions compared to the fourth quarter 2023.

Domestic commercial revenues in the fourth quarter 2024 increased by $28.0 million, or 50 percent, primarily due to a higher average transaction

size and a 13 percent increase in commercial transactions compared to the prior year quarter. Fourth quarter 2024 average domestic commercial

fee per file was $19,600, or 33 percent higher compared to $14,800 from the fourth quarter 2023, while average domestic residential fee

per file was $2,900, or 8 percent lower compared to $3,200 from the prior year quarter, primarily due to a lower purchase transaction

mix during the fourth quarter 2024.

Real Estate Solutions Segment

Summary results of the real estate solutions segment are as follows

(dollars in millions, except pretax margin and adjusted pretax margin):

| | |

Quarter

Ended December 31, | |

| | |

2024 | | |

2023 | | |

%

Change | |

| Operating

revenues | |

| 87.0 | | |

| 61.4 | | |

| 42 | % |

| Pretax

income | |

| 0.9 | | |

| 1.4 | | |

| (34 | )% |

| Non-GAAP

adjustments to pretax income* | |

| 5.5 | | |

| 6.0 | | |

| | |

| Adjusted

pretax income* | |

| 6.5 | | |

| 7.4 | | |

| (13 | )% |

| Pretax

margin | |

| 1.1 | % | |

| 2.3 | % | |

| | |

| Adjusted

pretax margin* | |

| 7.4 | % | |

| 12.0 | % | |

| | |

| | * Adjusted pretax income and adjusted pretax margin are non-GAAP financial measures. See Appendix A for an explanation and reconciliation of non-GAAP adjustments. |

|

Fourth quarter 2024 operating revenues increased $25.6 million, or

42 percent, primarily due to increased revenues from our credit information and valuation services operations compared to the fourth quarter

2023. On a combined basis, the segment’s employee costs and other operating expenses increased $26.2 million, or 49 percent, primarily

driven by higher vendor prices for credit information services and increased employee count in anticipation of new customers and related

revenue. Non-GAAP adjustments to pretax income shown in the schedule above were primarily related to acquisition intangible asset amortization

expenses (refer to Appendix A).

Corporate Segment

The segment’s fourth quarter 2024 results included net expenses

attributable to corporate operations of $9.7 million, which were comparable to the prior year quarter, and a $1.1 million unrealized loss

related to an investment impairment.

Expenses

Consolidated employee costs in the fourth quarter 2024 increased by

$21.3 million, or 12 percent, compared to the fourth quarter 2023, primarily driven by higher incentive compensation on overall improved

revenues, increased salaries primarily due to higher employee counts in commercial services and real estate solutions, and higher executive

severances expenses primarily related to a title segment executive retirement announced in September 2024. As a percentage of total

operating revenues, employee costs improved to 30.7 percent in the fourth quarter 2024 compared to 31.6 percent in the prior year quarter.

Consolidated other operating expenses in the fourth quarter 2024 increased

$31.9 million, or 25 percent, primarily driven by higher service expenses and outside search fees related to higher revenues from real

estate solutions and commercial title operations, respectively, partially offset by lower office closures compared to the fourth quarter

2023. As a percentage of total operating revenues, fourth quarter 2024 total other operating expenses increased to 24.5 percent compared

to 22.5 percent in the prior year quarter, primarily due to increased real estate solutions service expenses.

Other

Net cash provided by operations in the fourth quarter 2024 was $68.0

million compared to $39.5 million in the fourth quarter 2023, primarily driven by the higher consolidated net income in the fourth quarter

2024.

Fourth Quarter Earnings Call

Stewart will hold a conference call to discuss the fourth quarter 2024

earnings at 8:30 a.m. Eastern Time on Thursday, February 6, 2025. To participate, dial (800) 343-5172 (USA) or (203) 518-9856

(International) – access code STCQ424. Additionally, participants can listen to the conference call through Stewart’s Investor

Relations website at https://investors.stewart.com/news-and-events/events/default.aspx.

The conference call replay will be available from 11:00 a.m. Eastern Time on February 6, 2025 until midnight on February 13,

2025 by dialing (800) 753-5479 (USA) or (402) 220-2675 (International).

About Stewart

Stewart (NYSE-STC) is a global real estate services company, offering

products and services through our direct operations, network of Stewart Trusted Providers™ and family of companies. From residential

and commercial title insurance and closing and settlement services to specialized offerings for the mortgage and real estate industries,

we offer the comprehensive service, deep expertise and solutions our customers need for any real estate transaction. At Stewart, we are

dedicated to becoming the premier title services company and we are committed to doing so by partnering with our customers to create mutual

success. Learn more at stewart.com.

Cautionary statement regarding forward-looking statements. Certain

statements in this press release are "forward-looking statements", including statements related to Stewart’s future business

plans and expectations, including our plans to achieve market growth and pretax margin improvements. Forward-looking statements, by their

nature, are subject to various risks and uncertainties that could cause our actual results to differ materially. Such risks and uncertainties

include the volatility of general economic conditions and adverse changes in the level of real estate activity, as well as a number of

other risk and uncertainties discussed in detail in our documents filed with the Securities and Exchange Commission, including our Annual

Report on Form 10-K for the year ended December 31, 2023, and if applicable, as supplemented by any risk factors contained in

our Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K filed subsequently. Additional information will also

be set forth in our Annual Report on Form 10-K for the year ended December 31, 2024. We expressly disclaim any obligation to

update, amend or clarify any forward-looking statements contained in this press release to reflect events or circumstances that may arise

after the date hereof, except as may be required by applicable law.

ST-IR

STEWART INFORMATION SERVICES CORPORATION

CONDENSED STATEMENTS OF INCOME

(In thousands of dollars, except per share amounts and except where

noted)

| | |

Quarter Ended

December 31, | | |

Year Ended December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues: | |

| | |

| | |

| | |

| |

| Title revenues: | |

| | | |

| | | |

| | | |

| | |

| Direct operations | |

| 283,606 | | |

| 240,432 | | |

| 1,020,380 | | |

| 962,674 | |

| Agency operations | |

| 279,092 | | |

| 262,513 | | |

| 1,043,173 | | |

| 985,989 | |

| Real estate solutions | |

| 86,998 | | |

| 61,408 | | |

| 358,559 | | |

| 263,577 | |

| Total operating revenues | |

| 649,696 | | |

| 564,353 | | |

| 2,422,112 | | |

| 2,212,240 | |

| Investment income | |

| 14,538 | | |

| 13,021 | | |

| 55,370 | | |

| 45,135 | |

| Net realized and unrealized gains (losses) | |

| 1,699 | | |

| 4,795 | | |

| 12,937 | | |

| (34 | ) |

| | |

| 665,933 | | |

| 582,169 | | |

| 2,490,419 | | |

| 2,257,341 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Amounts retained by agencies | |

| 230,724 | | |

| 217,021 | | |

| 864,807 | | |

| 813,519 | |

| Employee costs | |

| 199,418 | | |

| 178,084 | | |

| 745,405 | | |

| 712,794 | |

| Other operating expenses | |

| 159,071 | | |

| 127,171 | | |

| 603,959 | | |

| 507,701 | |

| Title losses and related claims | |

| 20,656 | | |

| 20,555 | | |

| 80,411 | | |

| 80,282 | |

| Depreciation and amortization | |

| 15,549 | | |

| 15,600 | | |

| 61,612 | | |

| 62,447 | |

| Interest | |

| 5,147 | | |

| 4,959 | | |

| 19,914 | | |

| 19,737 | |

| | |

| 630,565 | | |

| 563,390 | | |

| 2,376,108 | | |

| 2,196,480 | |

| Income before taxes and noncontrolling interests | |

| 35,368 | | |

| 18,779 | | |

| 114,311 | | |

| 60,861 | |

| Income tax expense | |

| (8,156 | ) | |

| (5,675 | ) | |

| (26,155 | ) | |

| (15,263 | ) |

| Net income | |

| 27,212 | | |

| 13,104 | | |

| 88,156 | | |

| 45,598 | |

| Less net income attributable to noncontrolling interests | |

| 4,471 | | |

| 4,289 | | |

| 14,846 | | |

| 15,159 | |

| Net income attributable to Stewart | |

| 22,741 | | |

| 8,815 | | |

| 73,310 | | |

| 30,439 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings per diluted share attributable to Stewart | |

| 0.80 | | |

| 0.32 | | |

| 2.61 | | |

| 1.11 | |

| Diluted average shares outstanding (000) | |

| 28,277 | | |

| 27,751 | | |

| 28,129 | | |

| 27,520 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selected financial information: | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by operations | |

| 67,953 | | |

| 39,464 | | |

| 135,609 | | |

| 83,042 | |

| Other comprehensive (loss) income | |

| (19,093 | ) | |

| 23,406 | | |

| (8,182 | ) | |

| 16,128 | |

Fourth

Quarter Domestic Order Counts:

| Opened Orders 2024: | |

Oct | | |

Nov | | |

Dec | | |

Total | | |

Closed Orders 2024: | |

Oct | | |

Nov | | |

Dec | | |

Total | |

| Commercial | |

| 1,471 | | |

| 1,226 | | |

| 1,586 | | |

| 4,283 | | |

Commercial | |

| 1,363 | | |

| 1,174 | | |

| 1,766 | | |

| 4,303 | |

| Purchase | |

| 15,852 | | |

| 12,224 | | |

| 11,323 | | |

| 39,399 | | |

Purchase | |

| 11,545 | | |

| 10,098 | | |

| 10,662 | | |

| 32,305 | |

| Refinancing | |

| 7,245 | | |

| 4,782 | | |

| 5,225 | | |

| 17,252 | | |

Refinancing | |

| 4,990 | | |

| 3,724 | | |

| 3,441 | | |

| 12,155 | |

| Other | |

| 4,076 | | |

| 2,239 | | |

| 2,090 | | |

| 8,405 | | |

Other | |

| 4,339 | | |

| 3,937 | | |

| 2,386 | | |

| 10,662 | |

| Total | |

| 28,644 | | |

| 20,471 | | |

| 20,224 | | |

| 69,339 | | |

Total | |

| 22,237 | | |

| 18,933 | | |

| 18,255 | | |

| 59,425 | |

| | |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | |

| Opened Orders 2023: | |

| Oct | | |

| Nov | | |

| Dec | | |

| Total | | |

Closed Orders 2023: | |

| Oct | | |

| Nov | | |

| Dec | | |

| Total | |

| Commercial | |

| 1,031 | | |

| 1,335 | | |

| 1,381 | | |

| 3,747 | | |

Commercial | |

| 1,074 | | |

| 1,264 | | |

| 1,463 | | |

| 3,801 | |

| Purchase | |

| 16,995 | | |

| 14,076 | | |

| 11,679 | | |

| 42,750 | | |

Purchase | |

| 12,187 | | |

| 10,595 | | |

| 10,989 | | |

| 33,771 | |

| Refinancing | |

| 5,165 | | |

| 5,038 | | |

| 5,194 | | |

| 15,397 | | |

Refinancing | |

| 3,479 | | |

| 3,034 | | |

| 3,045 | | |

| 9,558 | |

| Other | |

| 1,912 | | |

| 1,506 | | |

| 3,271 | | |

| 6,689 | | |

Other | |

| 2,000 | | |

| 1,309 | | |

| 1,367 | | |

| 4,676 | |

| Total | |

| 25,103 | | |

| 21,955 | | |

| 21,525 | | |

| 68,583 | | |

Total | |

| 18,740 | | |

| 16,202 | | |

| 16,864 | | |

| 51,806 | |

STEWART INFORMATION SERVICES CORPORATION

CONDENSED BALANCE SHEETS

(In thousands of dollars)

| | |

December 31, 2024 | | |

December 31, 2023 | |

| Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

| 216,298 | | |

| 233,365 | |

| Short-term investments | |

| 41,199 | | |

| 39,023 | |

| Investments in debt and equity securities, at fair value | |

| 669,098 | | |

| 679,936 | |

| Receivables – premiums from agencies | |

| 36,753 | | |

| 38,676 | |

| Receivables – other | |

| 111,735 | | |

| 93,811 | |

| Allowance for uncollectible amounts | |

| (7,725 | ) | |

| (7,583 | ) |

| Property and equipment, net | |

| 87,613 | | |

| 82,335 | |

| Operating lease assets, net | |

| 102,210 | | |

| 115,879 | |

| Title plants | |

| 74,862 | | |

| 73,359 | |

| Goodwill | |

| 1,084,139 | | |

| 1,072,129 | |

| Intangible assets, net of amortization | |

| 173,075 | | |

| 193,196 | |

| Deferred tax assets | |

| 4,827 | | |

| 3,776 | |

| Other assets | |

| 136,061 | | |

| 84,959 | |

| | |

| 2,730,145 | | |

| 2,702,861 | |

| Liabilities: | |

| | | |

| | |

| Notes payable | |

| 445,841 | | |

| 445,290 | |

| Accounts payable and accrued liabilities | |

| 214,580 | | |

| 190,054 | |

| Operating lease liabilities | |

| 118,835 | | |

| 135,654 | |

| Estimated title losses | |

| 511,534 | | |

| 528,269 | |

| Deferred tax liabilities | |

| 28,266 | | |

| 25,045 | |

| | |

| 1,319,056 | | |

| 1,324,312 | |

| Stockholders’ equity: | |

| | | |

| | |

| Common Stock and additional paid-in capital | |

| 358,721 | | |

| 338,451 | |

| Retained earnings | |

| 1,089,484 | | |

| 1,070,841 | |

| Accumulated other comprehensive loss | |

| (43,397 | ) | |

| (35,215 | ) |

| Treasury stock | |

| (2,666 | ) | |

| (2,666 | ) |

| Stockholders’ equity attributable to Stewart | |

| 1,402,142 | | |

| 1,371,411 | |

| Noncontrolling interests | |

| 8,947 | | |

| 7,138 | |

| Total stockholders’ equity | |

| 1,411,089 | | |

| 1,378,549 | |

| | |

| 2,730,145 | | |

| 2,702,861 | |

| Number of shares outstanding (000) | |

| 27,764 | | |

| 27,370 | |

| Book value per share | |

| 50.50 | | |

| 50.11 | |

STEWART INFORMATION SERVICES CORPORATION

SEGMENT INFORMATION

(In thousands of dollars)

| Quarter Ended: | |

December 31, 2024 | | |

December 31, 2023 | |

| | |

Title | | |

Real

Estate

Solutions | | |

Corporate | | |

Total | | |

Title | | |

Real

Estate

Solutions | | |

Corporate | | |

Total | |

| Revenues: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Operating revenues | |

| 562,698 | | |

| 86,998 | | |

| - | | |

| 649,696 | | |

| 502,945 | | |

| 61,408 | | |

| - | | |

| 564,353 | |

| Investment income | |

| 14,511 | | |

| 27 | | |

| - | | |

| 14,538 | | |

| 12,996 | | |

| 25 | | |

| - | | |

| 13,021 | |

| Net realized and unrealized gains (losses) | |

| 2,760 | | |

| - | | |

| (1,061 | ) | |

| 1,699 | | |

| 5,094 | | |

| (3 | ) | |

| (296 | ) | |

| 4,795 | |

| | |

| 579,969 | | |

| 87,025 | | |

| (1,061 | ) | |

| 665,933 | | |

| 521,035 | | |

| 61,430 | | |

| (296 | ) | |

| 582,169 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amounts retained by agencies | |

| 230,724 | | |

| - | | |

| - | | |

| 230,724 | | |

| 217,021 | | |

| - | | |

| - | | |

| 217,021 | |

| Employee costs | |

| 181,436 | | |

| 14,667 | | |

| 3,315 | | |

| 199,418 | | |

| 163,142 | | |

| 11,987 | | |

| 2,955 | | |

| 178,084 | |

| Other operating expenses | |

| 92,580 | | |

| 65,124 | | |

| 1,367 | | |

| 159,071 | | |

| 83,777 | | |

| 41,587 | | |

| 1,807 | | |

| 127,171 | |

| Title losses and related claims | |

| 20,656 | | |

| - | | |

| - | | |

| 20,656 | | |

| 20,555 | | |

| - | | |

| - | | |

| 20,555 | |

| Depreciation and amortization | |

| 8,921 | | |

| 6,301 | | |

| 327 | | |

| 15,549 | | |

| 8,819 | | |

| 6,401 | | |

| 380 | | |

| 15,600 | |

| Interest | |

| 420 | | |

| 1 | | |

| 4,726 | | |

| 5,147 | | |

| 378 | | |

| 48 | | |

| 4,533 | | |

| 4,959 | |

| | |

| 534,737 | | |

| 86,093 | | |

| 9,735 | | |

| 630,565 | | |

| 493,692 | | |

| 60,023 | | |

| 9,675 | | |

| 563,390 | |

| Income (loss) before taxes | |

| 45,232 | | |

| 932 | | |

| (10,796 | ) | |

| 35,368 | | |

| 27,343 | | |

| 1,407 | | |

| (9,971 | ) | |

| 18,779 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| |

| Year Ended: | |

December 31, 2024 | | |

December 31, 2023 | |

| | |

Title | | |

Real

Estate

Solutions | | |

Corporate | | |

Total | | |

Title | | |

Real

Estate

Solutions | | |

Corporate | | |

Total | |

| Revenues: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Operating revenues | |

| 2,063,553 | | |

| 358,559 | | |

| - | | |

| 2,422,112 | | |

| 1,948,663 | | |

| 263,577 | | |

| - | | |

| 2,212,240 | |

| Investment income | |

| 55,256 | | |

| 114 | | |

| - | | |

| 55,370 | | |

| 45,028 | | |

| 107 | | |

| - | | |

| 45,135 | |

| Net realized and unrealized gains (losses) | |

| 14,146 | | |

| - | | |

| (1,209 | ) | |

| 12,937 | | |

| 3,437 | | |

| (3 | ) | |

| (3,468 | ) | |

| (34 | ) |

| | |

| 2,132,955 | | |

| 358,673 | | |

| (1,209 | ) | |

| 2,490,419 | | |

| 1,997,128 | | |

| 263,681 | | |

| (3,468 | ) | |

| 2,257,341 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amounts retained by agencies | |

| 864,807 | | |

| - | | |

| - | | |

| 864,807 | | |

| 813,519 | | |

| - | | |

| - | | |

| 813,519 | |

| Employee costs | |

| 677,378 | | |

| 54,572 | | |

| 13,455 | | |

| 745,405 | | |

| 648,832 | | |

| 49,320 | | |

| 14,642 | | |

| 712,794 | |

| Other operating expenses | |

| 339,950 | | |

| 258,827 | | |

| 5,182 | | |

| 603,959 | | |

| 320,529 | | |

| 179,640 | | |

| 7,532 | | |

| 507,701 | |

| Title losses and related claims | |

| 80,411 | | |

| - | | |

| - | | |

| 80,411 | | |

| 80,282 | | |

| - | | |

| - | | |

| 80,282 | |

| Depreciation and amortization | |

| 35,047 | | |

| 25,104 | | |

| 1,461 | | |

| 61,612 | | |

| 35,000 | | |

| 25,802 | | |

| 1,645 | | |

| 62,447 | |

| Interest | |

| 1,584 | | |

| 9 | | |

| 18,321 | | |

| 19,914 | | |

| 1,442 | | |

| 239 | | |

| 18,056 | | |

| 19,737 | |

| | |

| 1,999,177 | | |

| 338,512 | | |

| 38,419 | | |

| 2,376,108 | | |

| 1,899,604 | | |

| 255,001 | | |

| 41,875 | | |

| 2,196,480 | |

| Income (loss) before taxes | |

| 133,778 | | |

| 20,161 | | |

| (39,628 | ) | |

| 114,311 | | |

| 97,524 | | |

| 8,680 | | |

| (45,343 | ) | |

| 60,861 | |

Appendix A

Non-GAAP Adjustments

Management uses a variety of financial and operational measurements

other than its financial statements prepared in accordance with United States Generally Accepted Accounting Principles (GAAP) to analyze

its performance. These include: (1) adjusted revenues, which are reported revenues adjusted for net realized and unrealized gains

and losses and (2) adjusted pretax income and adjusted net income, which are reported pretax income and reported net income after

earnings from noncontrolling interests, respectively, adjusted for net realized and unrealized gains and losses, acquisition intangible

asset amortization and other expenses (acquisition-related), office closure costs, executive severance expenses, and other nonrecurring

expenses. Adjusted diluted earnings per share (adjusted diluted EPS) is calculated using adjusted net income divided by the diluted average

weighted outstanding shares. Adjusted pretax margin is calculated using adjusted pretax income divided by adjusted total revenues. Management

views these measures as important performance measures of core profitability for its operations and as key components of its internal

financial reporting. Management believes investors benefit from having access to the same financial measures that management uses.

Below are reconciliations of the non-GAAP financial measures used by

management to the most directly comparable GAAP measures for the quarter and year ended December 31, 2024 and 2023 (dollars in millions,

except shares, per share amounts and pretax margins, and amounts may not add as presented due to rounding).

| | |

Quarter Ended December 31, | | |

Year Ended December, | |

| | |

2024 | | |

2023 | | |

% Chg | | |

2024 | | |

2023 | | |

% Chg | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Total revenues | |

| 665.9 | | |

| 582.2 | | |

| 14 | % | |

| 2,490.4 | | |

| 2,257.3 | | |

| 10 | % |

| Non-GAAP revenue adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized and unrealized gains | |

| (1.7 | ) | |

| (4.8 | ) | |

| | | |

| (12.9 | ) | |

| - | | |

| | |

| Adjusted total revenues | |

| 664.2 | | |

| 577.4 | | |

| 15 | % | |

| 2,477.5 | | |

| 2,257.3 | | |

| 10 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Details of net realized and unrealized gains: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unrealized gains on equity securities fair value | |

| 1.4 | | |

| 3.7 | | |

| | | |

| 12.6 | | |

| 2.1 | | |

| | |

| Gains (losses) on acquisition liability adjustments | |

| 2.4 | | |

| 0.9 | | |

| | | |

| 2.4 | | |

| (2.3 | ) | |

| | |

| Sale of offices | |

| (0.8 | ) | |

| (0.1 | ) | |

| | | |

| (0.8 | ) | |

| (0.1 | ) | |

| | |

| Impairment of investments and other assets | |

| (1.1 | ) | |

| (0.2 | ) | |

| | | |

| (1.2 | ) | |

| (0.2 | ) | |

| | |

| Other items, net | |

| (0.3 | ) | |

| 0.6 | | |

| | | |

| 0.1 | | |

| 0.5 | | |

| | |

| Total net realized and unrealized gains | |

| 1.7 | | |

| 4.8 | | |

| | | |

| 12.9 | | |

| - | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pretax income | |

| 35.4 | | |

| 18.8 | | |

| 88 | % | |

| 114.3 | | |

| 60.9 | | |

| 88 | % |

| Non-GAAP pretax adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized and unrealized gains | |

| (1.7 | ) | |

| (4.8 | ) | |

| | | |

| (12.9 | ) | |

| - | | |

| | |

| Acquisition intangible asset amortization and other expenses | |

| 8.5 | | |

| 8.7 | | |

| | | |

| 33.6 | | |

| 36.0 | | |

| | |

| Office closure costs | |

| 1.2 | | |

| 5.5 | | |

| | | |

| 3.1 | | |

| 7.3 | | |

| | |

| Executive severance expenses | |

| 3.9 | | |

| 0.9 | | |

| | | |

| 4.6 | | |

| 3.1 | | |

| | |

| State sales tax assessment expense | |

| - | | |

| - | | |

| | | |

| - | | |

| 1.2 | | |

| | |

| Adjusted pretax income | |

| 47.3 | | |

| 29.1 | | |

| 63 | % | |

| 142.8 | | |

| 108.5 | | |

| 32 | % |

| GAAP pretax margin | |

| 5.3 | % | |

| 3.2 | % | |

| | | |

| 4.6 | % | |

| 2.7 | % | |

| | |

| Adjusted pretax margin | |

| 7.1 | % | |

| 5.0 | % | |

| | | |

| 5.8 | % | |

| 4.8 | % | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Quarter Ended December 31, | | |

Year Ended December 31, | |

| | |

2024 | | |

2023 | | |

% Chg | | |

2024 | | |

2023 | | |

% Chg | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net income attributable to Stewart | |

| 22.7 | | |

| 8.8 | | |

| 158 | % | |

| 73.3 | | |

| 30.4 | | |

| 141 | % |

| Non-GAAP pretax adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized and unrealized gains | |

| (1.7 | ) | |

| (4.8 | ) | |

| | | |

| (12.9 | ) | |

| - | | |

| | |

| Acquisition intangible asset amortization and other expenses | |

| 8.5 | | |

| 8.7 | | |

| | | |

| 33.6 | | |

| 36.0 | | |

| | |

| Office closure costs | |

| 1.2 | | |

| 5.5 | | |

| | | |

| 3.1 | | |

| 7.3 | | |

| | |

| Executive severance expenses | |

| 3.9 | | |

| 0.9 | | |

| | | |

| 4.6 | | |

| 3.1 | | |

| | |

| State sales tax assessment expense | |

| - | | |

| - | | |

| | | |

| - | | |

| 1.2 | | |

| | |

| Net tax effects of non-GAAP adjustments | |

| (3.1 | ) | |

| (2.5 | ) | |

| | | |

| (7.4 | ) | |

| (11.4 | ) | |

| | |

| Non-GAAP adjustments, after taxes | |

| 8.8 | | |

| 7.8 | | |

| | | |

| 21.1 | | |

| 36.2 | | |

| | |

| Adjusted net income attributable to Stewart | |

| 31.5 | | |

| 16.6 | | |

| 90 | % | |

| 94.4 | | |

| 66.6 | | |

| 42 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted average shares outstanding (000) | |

| 28,277 | | |

| 27,751 | | |

| | | |

| 28,129 | | |

| 27,520 | | |

| | |

| GAAP net income per share | |

| 0.80 | | |

| 0.32 | | |

| | | |

| 2.61 | | |

| 1.11 | | |

| | |

| Adjusted net income per share | |

| 1.12 | | |

| 0.60 | | |

| | | |

| 3.35 | | |

| 2.42 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| |

| | |

Quarter Ended December 31, | | |

Year Ended December 31, | |

| | |

2024 | | |

2023 | | |

% Chg | | |

2024 | | |

2023 | | |

% Chg | |

Title

Segment: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenues | |

| 580.0 | | |

| 521.0 | | |

| 11 | % | |

| 2,133.0 | | |

| 1,997.1 | | |

| 7 | % |

| Net realized and unrealized gains | |

| (2.8 | ) | |

| (5.1 | ) | |

| | | |

| (14.1 | ) | |

| (3.4 | ) | |

| | |

| Adjusted total revenues | |

| 577.2 | | |

| 515.9 | | |

| 12 | % | |

| 2,118.8 | | |

| 1,993.7 | | |

| 6 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pretax income | |

| 45.2 | | |

| 27.3 | | |

| 65 | % | |

| 133.8 | | |

| 97.5 | | |

| 37 | % |

| Non-GAAP revenue adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized and unrealized gains | |

| (2.8 | ) | |

| (5.1 | ) | |

| | | |

| (14.1 | ) | |

| (3.4 | ) | |

| | |

| Acquisition intangible asset amortization and other expenses | |

| 3.0 | | |

| 2.9 | | |

| | | |

| 11.5 | | |

| 12.3 | | |

| | |

| Office closure costs | |

| 1.2 | | |

| 5.5 | | |

| | | |

| 3.1 | | |

| 7.3 | | |

| | |

| Executive severance expenses | |

| 3.9 | | |

| 0.7 | | |

| | | |

| 4.6 | | |

| 2.3 | | |

| | |

| Adjusted pretax income | |

| 50.5 | | |

| 31.4 | | |

| 61 | % | |

| 138.9 | | |

| 116.0 | | |

| 20 | % |

| GAAP pretax margin | |

| 7.8 | % | |

| 5.2 | % | |

| | | |

| 6.3 | % | |

| 4.9 | % | |

| | |

| Adjusted pretax margin | |

| 8.8 | % | |

| 6.1 | % | |

| | | |

| 6.6 | % | |

| 5.8 | % | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Real

Estate Solutions Segment: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenues | |

| 87.0 | | |

| 61.4 | | |

| 42 | % | |

| 358.7 | | |

| 263.7 | | |

| 36 | % |

| Pretax income | |

| 0.9 | | |

| 1.4 | | |

| (34 | %) | |

| 20.2 | | |

| 8.7 | | |

| 132 | % |

| Non-GAAP revenue adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisition intangible asset amortization | |

| 5.5 | | |

| 5.8 | | |

| | | |

| 22.2 | | |

| 23.7 | | |

| | |

| Executive severance expenses | |

| - | | |

| 0.2 | | |

| | | |

| - | | |

| 0.3 | | |

| | |

| State sales tax assessment expense | |

| - | | |

| - | | |

| | | |

| - | | |

| 1.2 | | |

| | |

| Adjusted pretax income | |

| 6.5 | | |

| 7.4 | | |

| (13 | %) | |

| 42.3 | | |

| 33.8 | | |

| 25 | % |

| GAAP pretax margin | |

| 1.1 | % | |

| 2.3 | % | |

| | | |

| 5.6 | % | |

| 3.3 | % | |

| | |

| Adjusted pretax margin | |

| 7.4 | % | |

| 12.0 | % | |

| | | |

| 11.8 | % | |

| 12.8 | % | |

| | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

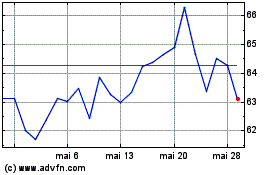

Stewart Information Serv... (NYSE:STC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Stewart Information Serv... (NYSE:STC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025