false000153983800015398382025-02-242025-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 24, 2025

___________

DIAMONDBACK ENERGY, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | | | | |

DE | 001-35700 | 45-4502447 | |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) | |

| 500 West Texas Ave. | | | | |

| Suite 100 | | | | |

Midland, TX | | | 79701 | |

(Address of principal

executive offices) | | | (Zip code) | |

(432) 221-7400

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

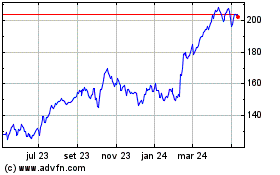

Common Stock, $0.01 Par Value | FANG | The Nasdaq Stock Market LLC |

| | (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 24, 2025, Diamondback Energy, Inc. (the “Company”) issued a press release announcing financial and operating results for the fourth quarter and full year ended December 31, 2024, including the fourth quarter 2024 base cash dividend and an increase in the annual base dividend (the “earnings release”). A copy of the earnings release is furnished to the Securities and Exchange Commission (the “SEC”) as Exhibit 99.1 to this Current Report on Form 8-K. The Company also issued a letter to its stockholders as a supplement to the earnings release, which is furnished to the SEC as Exhibit 99.2 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | DIAMONDBACK ENERGY, INC. |

| | | | |

| Date: | February 24, 2025 | | | |

| | | By: | /s/ Teresa L. Dick |

| | | Name: | Teresa L. Dick |

| | | Title: | Executive Vice President, Chief Accounting Officer and Assistant Secretary |

Exhibit 99.1

DIAMONDBACK ENERGY, INC. ANNOUNCES FOURTH QUARTER AND FULL YEAR 2024 FINANCIAL AND OPERATING RESULTS; INCREASES BASE DIVIDEND

Midland, TX (February 24, 2025) - Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback” or the “Company”) today announced financial and operating results for the fourth quarter and full year ended December 31, 2024.

FOURTH QUARTER 2024 HIGHLIGHTS

•Average production of 475.9 MBO/d (883.4 MBOE/d)

•Net cash provided by operating activities of $2.3 billion; Operating Cash Flow Before Working Capital Changes (as defined and reconciled below) of $2.3 billion

•Cash capital expenditures of $933 million

•Free Cash Flow (as defined and reconciled below) of $1.3 billion; Adjusted Free Cash Flow (as defined and reconciled below) of $1.4 billion

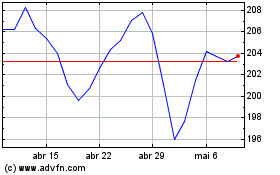

•Increased annual base dividend by 11% to $4.00 per share; declared Q4 2024 base cash dividend of $1.00 per share payable on March 13, 2025; implies a 2.6% annualized yield based on February 21, 2025 closing share price of $156.12

•Repurchased 2,326,247 shares of common stock in Q4 2024 for $402 million, excluding excise tax (at a weighted average price of $172.91 per share); repurchased 1,254,600 shares of common stock to date in Q1 2025 for $210 million, excluding excise tax (at a weighted average price of $167.42 per share)

•Total Q4 2024 return of capital of $694 million; represents ~51% of Adjusted Free Cash Flow (as defined and reconciled below) from stock repurchases and the declared Q4 2024 base dividend

•Closed previously announced TRP Energy ("TRP") transaction in December 2024

FULL YEAR 2024 HIGHLIGHTS

•Average production of 337.0 MBO/d (598.3 MBOE/d)

•Net cash provided by operating activities of $6.4 billion; Operating Cash Flow Before Working Capital Changes (as defined and reconciled below) of $6.5 billion

•Cash capital expenditures of $2.9 billion

•Free Cash Flow (as defined and reconciled below) of $3.6 billion; Adjusted Free Cash Flow (as defined and reconciled below) of $4.0 billion

•Declared total base-plus-variable dividends of $6.21 per share for the full year 2024

•Repurchased 5,525,276 shares of common stock in 2024 for $959 million, excluding excise tax (at a weighted average price of $173.57 per share)

•Total full year 2024 return of capital of $2.3 billion; represents ~57% of FY 2024 Adjusted Free Cash Flow (as defined and reconciled below)

•As previously announced, closed merger with Endeavor Energy Resources, L.P. ("Endeavor") on September 10, 2024

•Proved reserves as of December 31, 2024 of 3,557 MMBOE (1,761 MMBO, 50% oil), up 63% year over year; proved developed producing ("PDP") reserves of 2,385 MMBOE (1,121 MMBO, 47% oil, 67% of proved reserves), up 59% year over year

2025 GUIDANCE HIGHLIGHTS

Please note the guidance below gives effect to the pending acquisition of Double Eagle IV Midco, LLC (“Double Eagle”) from April 1, 2025 onward.

•Full year 2025 oil production guidance of 485 - 498 MBO/d (883 - 909 MBOE/d)

•Full year 2025 cash capital expenditures guidance of $3.8 - $4.2 billion

•The Company expects to drill between 446 - 471 gross (406 - 428 net) wells and complete between 557 - 592 gross (526 - 560 net) wells with an average lateral length of approximately 11,500 feet in 2025

•Q1 2025 oil production guidance of 470 - 475 MBO/d (860 - 875 MBOE/d)

•Q1 2025 cash capital expenditures guidance of $900 million - $1.0 billion

•Implies Q2 2025 – Q4 2025 run-rate oil production of 490 – 505 MBO/d (891 – 920 MBOE/d)

•Full year 2025 Midland Basin well costs per lateral foot guidance of $555 - $605

•Implies full year 2025 oil production per million dollars of cash capital expenditures (“MBO per $MM of CAPEX”) of 44.8, 10% better than the Company’s original pro forma 2025 outlook provided in February 2024

OPERATIONS UPDATE

The tables below provide a summary of operating activity for the fourth quarter of 2024.

| | | | | | | | | | | |

| Total Activity (Gross Operated): | | | |

| Number of Wells Drilled | | Number of Wells Completed |

| Midland Basin | 131 | | | 124 | |

| Delaware Basin | 6 | | | 4 | |

| | | |

| Total | 137 | | | 128 | |

| | | | | | | | | | | |

| Total Activity (Net Operated): | | | |

| Number of Wells Drilled | | Number of Wells Completed |

| Midland Basin | 124 | | | 113 | |

| Delaware Basin | 5 | | | 4 | |

| | | |

| Total | 129 | | | 117 | |

During the fourth quarter of 2024, Diamondback drilled 131 gross wells in the Midland Basin and six gross wells in the Delaware Basin. The Company turned 124 operated wells to production in the Midland Basin and four gross wells in the Delaware Basin, with an average lateral length of 11,810 feet. Operated completions during the fourth quarter consisted of 26 Wolfcamp A wells, 26 Lower Spraberry wells, 24 Wolfcamp B wells, 19 Jo Mill wells, 15 Middle Spraberry wells, four Wolfcamp D wells, four Dean wells, three Upper Spraberry wells, three Barnett wells, two Second Bone Spring wells and two Third Bone Spring wells.

For the year ended December 31, 2024, Diamondback drilled 342 gross wells in the Midland Basin and 30 gross wells in the Delaware Basin. The Company turned 391 operated wells to production in the Midland Basin and 19 operated wells to production in the Delaware Basin. The average lateral length for wells completed during the year ended December 31, 2024 was 11,719 feet, and consisted of 98 Lower Spraberry wells, 87 Wolfcamp A wells, 69 Wolfcamp B wells, 59 Jo Mill wells, 49 Middle Spraberry wells, 13 Wolfcamp D wells, 13 Dean wells, nine Upper Spraberry wells, six Third Bone Spring wells, four Barnett wells and three Second Bone Spring wells.

FINANCIAL UPDATE

Diamondback's fourth quarter 2024 net income was $1.1 billion, or $3.67 per diluted share. Adjusted net income (as defined and reconciled below) for the fourth quarter was $1.1 billion, or $3.64 per diluted share. For the full year ended December 31, 2024, Diamondback’s net income was $3.3 billion, or $15.53 per diluted share. Adjusted net income for the full year was $3.6 billion, or $16.57 per diluted share.

Fourth quarter 2024 net cash provided by operating activities was $2.3 billion. For the full year ended December 31, 2024, Diamondback's net cash provided by operating activities was $6.4 billion.

During the fourth quarter of 2024, Diamondback spent $834 million on operated and non-operated drilling and completions, $93 million on infrastructure and environmental and $6 million on midstream, for total cash capital expenditures of $933 million. For the full year ended 2024, Diamondback spent $2.6 billion on operated and non-operated drilling and completions, $221 million on infrastructure and environmental and $14 million on midstream, for total cash capital expenditures of $2.9 billion.

Fourth quarter 2024 Consolidated Adjusted EBITDA (as defined and reconciled below) was $2.6 billion. Adjusted EBITDA net of non-controlling interest (as defined and reconciled below) for the fourth quarter was $2.5 billion. For the full year ended December 31, 2024, Consolidated Adjusted EBITDA was $7.7 billion. Adjusted EBITDA net of non-controlling interest for the full year was $7.3 billion.

Diamondback's fourth quarter 2024 Free Cash Flow (as defined and reconciled below) was $1.3 billion. Adjusted Free Cash Flow (as reconciled and defined below) for the fourth quarter was $1.4 billion. For the full year ended December 31, 2024, Diamondback's Free Cash Flow was $3.6 billion, with $4.0 billion of Adjusted Free Cash Flow over the same period.

Fourth quarter 2024 average unhedged realized prices were $69.48 per barrel of oil, $0.48 per Mcf of natural gas and $19.27 per barrel of natural gas liquids ("NGLs"), resulting in a total equivalent unhedged realized price of $42.71 per BOE.

Diamondback's cash operating costs for the fourth quarter of 2024 were $10.30 per BOE, including lease operating expenses ("LOE") of $5.67 per BOE, cash general and administrative ("G&A") expenses of $0.69 per BOE, production and ad valorem taxes of $2.77 per BOE and gathering, processing and transportation expenses of $1.17 per BOE.

As of December 31, 2024, Diamondback had $134 million in standalone cash and no borrowings outstanding under its revolving credit facility, with approximately $2.5 billion available for future borrowings under the facility and approximately $2.6 billion of total liquidity. As of December 31, 2024, the Company had consolidated total debt of $13.2 billion and consolidated net debt (as defined and

reconciled below) of $13.0 billion, up from consolidated total debt of $13.1 billion and consolidated net debt of $12.7 billion as of September 30, 2024.

DIVIDEND DECLARATIONS

Diamondback announced today that the Company's Board of Directors declared a base cash dividend of $1.00 per common share for the fourth quarter of 2024 payable on March 13, 2025 to stockholders of record at the close of business on March 6, 2025.

Future base and variable dividends remain subject to review and approval at the discretion of the Company's Board of Directors.

COMMON STOCK REPURCHASE PROGRAM

During the fourth quarter of 2024, Diamondback repurchased ~2.3 million shares of common stock at an average share price of $172.91 for a total cost of approximately $402 million, excluding excise tax. To date, Diamondback has repurchased ~25.8 million shares of common stock at an average share price of $136.82 for a total cost of approximately $3.5 billion and has approximately $2.5 billion remaining on its current share buyback authorization. Subject to factors discussed below, Diamondback intends to continue to purchase common stock under the common stock repurchase program opportunistically with cash on hand, free cash flow from operations and proceeds from potential liquidity events such as the sale of assets. This repurchase program has no time limit and may be suspended from time to time, modified, extended or discontinued by the Board at any time. Purchases under the repurchase program may be made from time to time in privately negotiated transactions, or in open market transactions in compliance with Rule 10b-18 under the Securities Exchange Act of 1934, as amended, and will be subject to market conditions, applicable regulatory and legal requirements and other factors. Any common stock purchased as part of this program will be retired.

RESERVES

Estimates of Diamondback's proved reserves as of December 31, 2024 were prepared by Diamondback's internal reservoir engineers and audited by Ryder Scott Company, L.P., an independent petroleum engineering firm. Reference prices of $75.48 per barrel of oil and $2.13 per Mmbtu of natural gas were used in accordance with applicable rules of the Securities and Exchange Commission. Realized prices with applicable differentials were $76.15 per barrel of oil, $0.54 per Mcf of natural gas and $22.02 per barrel of natural gas liquids.

Proved reserves at year-end 2024 of 3,557 MMBOE represent a 63% increase over year-end 2023 reserves. Proved developed reserves increased by 59% to 2,385 MMBOE (67% of total proved reserves) as of December 31, 2024, reflecting the continued development of the Company's horizontal well inventory. Proved undeveloped reserves ("PUD" or "PUDs") increased to 1,173 MMBOE, a 72% increase over year-end 2023, and are comprised of 1,381 horizontal locations in which we have a working interest, of which 1,310 are in the Midland Basin. Crude oil represents 50% of Diamondback's total proved reserves.

Net proved reserve additions of 1,599 MMBOE resulted in a reserve replacement ratio of 730% (defined as the sum of extensions and discoveries, revisions, purchases and divestitures, divided by annual production). The organic reserve replacement ratio was 68% (defined as the sum of extensions and discoveries and revisions, divided by annual production).

Net purchases of reserves were the primary contributor to the increase in reserves totaling 1,449 MMBOE followed by Extensions and discoveries of reserves totaling 279 MMBOE, with downward revisions of 129 MMBOE. PDP extensions were the result of 1,172 new wells in which the Company has an interest, and PUD extensions were the result of 445 new locations in which the Company has a working interest. Net purchases of reserves of 1,449 MMBOE were the net result of acquisitions of 1,569 MMBOE and divestitures of 121 MMBOE. Downward revisions of 129 MMBOE were primarily the result of negative revisions of 89 MMBOE associated with lower commodity prices, 49 MMBOE due to PUD downgrades related to changes in the corporate development plan and 17 MMBOE due to a decline in well performance. These were partially offset by positive performance revisions of 26 MMBOE related to ownership and acquisition variance revisions.

The SEC PUD guidelines allow a company to book PUD reserves associated with projects that are to occur within the next five years. With its current development plan, the Company expects to continue its strong PUD conversion ratio in 2025 by converting an estimated 33% of its PUDs to a Proved Developed category, and develop approximately 78% of the consolidated 2024 year-end PUD reserves by the end of 2027.

| | | | | | | | | | | | | | | | | | | | | | | |

| Oil (MBbls) | | Gas (MMcf) | | Liquids (MBbls) | | MBOE |

| As of December 31, 2023 | 1,143,944 | | | 2,997,422 | | 534,247 | | 2,177,761 | |

| Extensions and discoveries | 168,375 | | | 310,421 | | 58,696 | | 278,808 | |

| Revisions of previous estimates | (78,142) | | | (158,468) | | (24,518) | | (129,071) | |

| Purchase of reserves in place | 697,702 | | | 2,391,264 | | 473,236 | | 1,569,482 | |

| Divestitures | (47,505) | | | (240,044) | | (33,080) | | (120,592) | |

| Production | (123,325) | | | (275,680) | | (49,700) | | (218,972) | |

| As of December 31, 2024 | 1,761,049 | | | 5,024,915 | | 958,881 | | 3,557,416 | |

Diamondback's exploration and development costs in 2024 were $3.2 billion. PD F&D costs were $10.51/BOE. PD F&D costs are defined as exploration and development costs, excluding midstream, divided by the sum of reserves associated with transfers from proved undeveloped reserves at year-end 2023 including any associated revisions in 2024 and extensions and discoveries placed on production during 2024. Drill bit F&D costs were $19.12/BOE including the effects of all revisions including pricing revisions. Drill bit F&D costs are defined as the exploration and development costs, excluding midstream, divided by the sum of extensions, discoveries and revisions.

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 | | 2022 |

| (In millions) |

| Acquisition costs: | | | | | |

| Proved properties | $ | 21,275 | | | $ | 1,314 | | | $ | 778 | |

| Unproved properties | 15,568 | | | 1,701 | | | 1,536 | |

| Development costs | 2,992 | | | 1,962 | | | 566 | |

| Exploration costs | 194 | | | 768 | | | 1,698 | |

| Total | $ | 40,029 | | | $ | 5,745 | | | $ | 4,578 | |

FULL YEAR 2025 GUIDANCE

Below is Diamondback's guidance for the full year 2025, which includes first quarter production, cash tax and capital guidance. This guidance gives effect to the estimated contribution related to the pending Double Eagle acquisition, which is expected to close on April 1, 2025, subject to the satisfaction of customary closing conditions and regulatory approval.

| | | | | | | | |

| 2025 Guidance | 2025 Guidance |

| Diamondback Energy, Inc. | Viper Energy, Inc. |

| | |

| 2025 Net production - MBOE/d | 883 - 909 | |

| 2025 Oil production - MBO/d | 485 - 498 | |

| Q1 2025 Oil production - MBO/d (total - MBOE/d) | 470 - 475 (860 - 875) | 30.0 - 31.0 (54.0 - 56.0) |

| | |

| Unit costs ($/BOE) | | |

| Lease operating expenses, including workovers | $5.90 - $6.30 | |

| G&A | | |

| Cash G&A | $0.60 - $0.75 | |

| Non-cash equity-based compensation | $0.25 - $0.35 | |

| DD&A | $14.00 - $15.00 | |

| Interest expense (net of interest income) | $0.25 - $0.50 | |

Gathering, processing and transportation | $1.20 - $1.40 | |

| | |

| Production and ad valorem taxes (% of revenue) | ~7% | |

| Corporate tax rate (% of pre-tax income) | 23% | |

| Cash tax rate (% of pre-tax income) | 17% - 20% | |

| Q1 2025 Cash taxes ($ - million) | $280 - $340 | |

| | |

| Capital Budget ($ - million) | | |

Operated drilling and completion | $3,130 - $3,440 | |

Capital workovers, non-operated properties and science | $280 - $320 | |

Infrastructure, environmental and midstream(1) | $390 - $440 | |

| 2025 Total capital expenditures | $3,800 - $4,200 | |

| Q1 2025 Capital expenditures | $900 - $1,000 | |

| | |

| Gross horizontal wells drilled (net) | 446 - 471 (406 - 428) | |

| Gross horizontal wells completed (net) | 557 - 592 (526 - 560) | |

| Average lateral length (Ft.) | ~11,500' | |

| FY 2025 Midland Basin well costs per lateral foot | $555 - $605 | |

| FY 2025 Delaware Basin well costs per lateral foot | $860 - $910 | |

Midland Basin completed net lateral feet (%) | ~95% | |

Delaware Basin completed net lateral feet (%) | ~5% | |

(1) Includes approximately $60 million in estimated midstream capital expenditures for the full year 2025.

CONFERENCE CALL

Diamondback will host a conference call and webcast for investors and analysts to discuss its results for the fourth quarter of 2024 on Tuesday, February 25, 2025 at 8:00 a.m. CT. Access to the webcast, and replay which will be available following the call, may be found here. The live webcast of the earnings conference call will also be available via Diamondback’s website at www.diamondbackenergy.com under the “Investor Relations” section of the site.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural gas company headquartered in Midland, Texas focused on the acquisition, development, exploration and exploitation of unconventional, onshore oil and natural gas reserves primarily in the Permian Basin in West Texas. For more information, please visit www.diamondbackenergy.com.

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, which involve risks, uncertainties, and assumptions. All statements, other than statements of historical fact, including statements regarding Diamondback’s: future performance; business strategy; future operations (including drilling plans and capital plans); estimates and projections of revenues, losses, costs, expenses, returns, cash flow, and financial position; reserve estimates and its ability to replace or increase reserves; anticipated benefits or other effects of strategic transactions (including the recently completed Endeavor merger, the pending Double Eagle acquisition and other acquisitions or divestitures); and plans and objectives of management (including plans for future cash flow from operations and for executing environmental strategies) are forward-looking statements. When used in this news release, the words “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “model,” “outlook,” “plan,” “positioned,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” and similar expressions (including the negative of such terms) as they relate to Diamondback are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Although Diamondback believes that the expectations and assumptions reflected in its forward-looking statements are reasonable as and when made, they involve risks and uncertainties that are difficult to predict and, in many cases, beyond Diamondback’s control. Accordingly, forward-looking statements are not guarantees of future performance and Diamondback’s actual outcomes could differ materially from what Diamondback has expressed in its forward-looking statements.

Factors that could cause the outcomes to differ materially include (but are not limited to) the following: changes in supply and demand levels for oil, natural gas, and natural gas liquids, and the resulting impact on the price for those commodities; the impact of public health crises, including epidemic or pandemic diseases and any related company or government policies or actions; actions taken by the members of OPEC and Russia affecting the production and pricing of oil, as well as other domestic and global political, economic, or diplomatic developments, including any impact of the ongoing war in Ukraine and the Israel-Hamas war on the global energy markets and geopolitical stability; instability in the financial markets; inflationary pressures; higher interest rates and their impact on the cost of capital; regional supply and demand factors, including delays, curtailment delays or interruptions of production, or governmental orders, rules or regulations that impose production limits; federal and state legislative and regulatory initiatives relating to hydraulic fracturing, including the effect of existing and future laws and governmental regulations; physical and transition risks relating to climate change; those risks described in Item 1A of Diamondback’s Annual Report on Form 10-K, filed with the SEC on February 22, 2024, and those risks disclosed in its subsequent filings on Forms 10-K, 10-Q and 8-K, which can be obtained free of

charge on the SEC’s website at http://www.sec.gov and Diamondback’s website at www.diamondbackenergy.com/investors.

In light of these factors, the events anticipated by Diamondback’s forward-looking statements may not occur at the time anticipated or at all. Moreover, Diamondback operates in a very competitive and rapidly changing environment and new risks emerge from time to time. Diamondback cannot predict all risks, nor can it assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those anticipated by any forward-looking statements it may make. Accordingly, you should not place undue reliance on any forward-looking statements. All forward-looking statements speak only as of the date of this letter or, if earlier, as of the date they were made. Diamondback does not intend to, and disclaims any obligation to, update or revise any forward-looking statements unless required by applicable law.

| | | | | | | | | | | |

| Diamondback Energy, Inc. |

Consolidated Balance Sheets |

| (unaudited, in millions, except share amounts) |

| | | |

| December 31, | | December 31, |

| 2024 | | 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents ($27 million and $26 million related to Viper) | $ | 161 | | | $ | 582 | |

| Restricted cash | 3 | | | 3 | |

| Accounts receivable: | | | |

| Joint interest and other, net | 198 | | | 192 | |

Oil and natural gas sales, net ($149 million and $109 million related to Viper) | 1,387 | | | 654 | |

| | | |

| Inventories | 116 | | | 63 | |

| Derivative instruments | 168 | | | 17 | |

| Prepaid expenses and other current assets | 77 | | | 110 | |

| Total current assets | 2,110 | | | 1,621 | |

| Property and equipment: | | | |

Oil and natural gas properties, full cost method of accounting ($22,666 million and $8,659 million excluded from amortization at December 31, 2024 and December 31, 2023, respectively) ($5,713 million and $4,629 million related to Viper and $2,180 million and $1,769 million excluded from amortization related to Viper) | 82,240 | | | 42,430 | |

| Other property, equipment and land | 1,440 | | | 673 | |

Accumulated depletion, depreciation, amortization and impairment ($1,081 million and $866 million related to Viper) | (19,208) | | | (16,429) | |

| Property and equipment, net | 64,472 | | | 26,674 | |

| Funds held in escrow | 1 | | | — | |

| Equity method investments | 375 | | | 529 | |

| | | |

| Derivative instruments | 2 | | | 1 | |

| Deferred income taxes, net ($185 million and $57 million related to Viper) | 173 | | | 45 | |

| | | |

| Other assets | 159 | | | 131 | |

| Total assets | $ | 67,292 | | | $ | 29,001 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable - trade | $ | 253 | | | $ | 261 | |

| Accrued capital expenditures | 690 | | | 493 | |

| Current maturities of debt | 900 | | | — | |

| Other accrued liabilities | 1,020 | | | 475 | |

| Revenues and royalties payable | 1,491 | | | 764 | |

| Derivative instruments | 43 | | | 86 | |

| Income taxes payable | 414 | | | 29 | |

| Total current liabilities | 4,811 | | | 2,108 | |

Long-term debt ($1,083 million and $1,083 million related to Viper) | 12,075 | | | 6,641 | |

| Derivative instruments | 106 | | | 122 | |

| Asset retirement obligations | 573 | | | 239 | |

| Deferred income taxes | 9,826 | | | 2,449 | |

| Other long-term liabilities | 39 | | | 12 | |

| Total liabilities | 27,430 | | | 11,571 | |

| Stockholders’ equity: | | | |

Common stock, $0.01 par value; 800,000,000 shares authorized; 290,984,373 and 178,723,871 shares issued and outstanding at December 31, 2024 and December 31, 2023, respectively | 3 | | | 2 | |

| Additional paid-in capital | 33,501 | | | 14,142 | |

| Retained earnings (accumulated deficit) | 4,238 | | | 2,489 | |

| Accumulated other comprehensive income (loss) | (6) | | | (8) | |

| Total Diamondback Energy, Inc. stockholders’ equity | 37,736 | | | 16,625 | |

| Non-controlling interest | 2,126 | | | 805 | |

| Total equity | 39,862 | | | 17,430 | |

| Total liabilities and stockholders' equity | $ | 67,292 | | | $ | 29,001 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Diamondback Energy, Inc. |

Consolidated Statements of Operations |

| (unaudited, $ in millions except per share data, shares in thousands) |

| | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Oil, natural gas and natural gas liquid sales | $ | 3,471 | | | $ | 2,165 | | | $ | 10,100 | | | $ | 8,228 | |

| | | | | | | |

| Sales of purchased oil | 225 | | | 52 | | | 923 | | | 111 | |

| Other operating income | 15 | | | 11 | | | 43 | | | 73 | |

| Total revenues | 3,711 | | | 2,228 | | | 11,066 | | | 8,412 | |

| Costs and expenses: | | | | | | | |

| Lease operating expenses | 461 | | | 254 | | | 1,286 | | | 872 | |

| Production and ad valorem taxes | 225 | | | 104 | | | 638 | | | 525 | |

| Gathering, processing and transportation | 95 | | | 78 | | | 356 | | | 287 | |

| Purchased oil expense | 225 | | | 52 | | | 921 | | | 111 | |

| Depreciation, depletion, amortization and accretion | 1,156 | | | 469 | | | 2,850 | | | 1,746 | |

| | | | | | | |

| | | | | | | |

| General and administrative expenses | 72 | | | 39 | | | 213 | | | 150 | |

| | | | | | | |

| Merger and integration expense | 30 | | | — | | | 303 | | | 11 | |

| Other operating expenses | 35 | | | 27 | | | 103 | | | 140 | |

| Total costs and expenses | 2,299 | | | 1,023 | | | 6,670 | | | 3,842 | |

| Income (loss) from operations | 1,412 | | | 1,205 | | | 4,396 | | | 4,570 | |

| Other income (expense): | | | | | | | |

| Interest expense, net | (34) | | | (29) | | | (135) | | | (159) | |

| Other income (expense), net | (7) | | | (9) | | | 80 | | | 52 | |

| | | | | | | |

| Gain (loss) on derivative instruments, net | 36 | | | 99 | | | 137 | | | (259) | |

| | | | | | | |

| | | | | | | |

| Gain (loss) on extinguishment of debt | — | | | — | | | 2 | | | (4) | |

| Income (loss) from equity investments, net | (2) | | | 9 | | | 21 | | | 48 | |

| Total other income (expense), net | (7) | | | 70 | | | 105 | | | (322) | |

| Income (loss) before income taxes | 1,405 | | | 1,275 | | | 4,501 | | | 4,248 | |

| Provision for (benefit from) income taxes | 115 | | | 264 | | | 800 | | | 912 | |

| Net income (loss) | 1,290 | | | 1,011 | | | 3,701 | | | 3,336 | |

| Net income (loss) attributable to non-controlling interest | 216 | | | 51 | | | 363 | | | 193 | |

| Net income (loss) attributable to Diamondback Energy, Inc. | $ | 1,074 | | | $ | 960 | | | $ | 3,338 | | | $ | 3,143 | |

| | | | | | | |

| Earnings (loss) per common share: | | | | | | | |

| Basic | $ | 3.67 | | | $ | 5.34 | | | $ | 15.53 | | | $ | 17.34 | |

| Diluted | $ | 3.67 | | | $ | 5.34 | | | $ | 15.53 | | | $ | 17.34 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 291,851 | | 178,811 | | 213,545 | | 179,999 |

| Diluted | 291,851 | | 178,811 | | 213,545 | | 179,999 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Diamondback Energy, Inc. |

Consolidated Statements of Cash Flows |

| (unaudited, in millions) |

| | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net income (loss) | $ | 1,290 | | | $ | 1,011 | | | $ | 3,701 | | | $ | 3,336 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | |

| Provision for (benefit from) deferred income taxes | (165) | | | 193 | | | 15 | | | 378 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Depreciation, depletion, amortization and accretion | 1,156 | | | 469 | | | 2,850 | | | 1,746 | |

| | | | | | | |

| (Gain) loss on extinguishment of debt | — | | | — | | | (2) | | | 4 | |

| | | | | | | |

| (Gain) loss on derivative instruments, net | (36) | | | (99) | | | (137) | | | 259 | |

| Cash received (paid) on settlement of derivative instruments | (15) | | | (48) | | | (51) | | | (110) | |

| (Income) loss from equity investment, net | 2 | | | (9) | | | (21) | | | (48) | |

| | | | | | | |

| Equity-based compensation expense | 16 | | | 14 | | | 65 | | | 54 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other | 12 | | | 28 | | | 89 | | | 5 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | (103) | | | 147 | | | (42) | | | (71) | |

| | | | | | | |

| Income tax receivable | (3) | | | 16 | | | 9 | | | 283 | |

| | | | | | | |

| Prepaid expenses and other current assets | (24) | | | (94) | | | 54 | | | (89) | |

| Accounts payable and accrued liabilities | 114 | | | 11 | | | (376) | | | 57 | |

| | | | | | | |

| | | | | | | |

| Income taxes payable | 138 | | | (9) | | | 87 | | | (5) | |

| Revenues and royalties payable | 59 | | | (16) | | | 168 | | | 123 | |

| | | | | | | |

| Other | (100) | | | 10 | | | 4 | | | (2) | |

| Net cash provided by (used in) operating activities | 2,341 | | | 1,624 | | | 6,413 | | | 5,920 | |

| Cash flows from investing activities: | | | | | | | |

| Drilling, completions, infrastructure and midstream additions to oil and natural gas properties | (933) | | | (649) | | | (2,867) | | | (2,701) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Property acquisitions | (926) | | | (820) | | | (8,920) | | | (2,013) | |

| | | | | | | |

| | | | | | | |

| Proceeds from sale of assets | 8 | | | 7 | | | 467 | | | 1,407 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other | (4) | | | (2) | | | 99 | | | (16) | |

| Net cash provided by (used in) investing activities | (1,855) | | | (1,464) | | | (11,221) | | | (3,323) | |

| Cash flows from financing activities: | | | | | | | |

| Proceeds under term loan agreement | — | | | — | | | 1,000 | | | — | |

| Repayments under term loan agreement | (100) | | | — | | | (100) | | | — | |

| Proceeds from borrowings under credit facilities | 2,190 | | | 313 | | | 3,375 | | | 4,779 | |

| Repayments under credit facilities | (2,044) | | | (300) | | | (3,377) | | | (4,668) | |

| Proceeds from senior notes | — | | | 400 | | | 5,500 | | | 400 | |

| Repayment of senior notes | — | | | — | | | (25) | | | (134) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Repurchased shares under buyback program | (402) | | | (131) | | | (959) | | | (840) | |

| Repurchased shares/units under Viper's buyback program | — | | | (28) | | | — | | | (95) | |

| | | | | | | |

| Proceeds from partial sale of investment in Viper Energy, Inc. | — | | | — | | | 451 | | | — | |

| Net proceeds from Viper's issuance of common stock | — | | | — | | | 476 | | | — | |

| Dividends paid to stockholders | (262) | | | (603) | | | (1,578) | | | (1,444) | |

| Dividends/distributions to non-controlling interest | (70) | | | (45) | | | (227) | | | (129) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other | (7) | | | (11) | | | (149) | | | (45) | |

| Net cash provided by (used in) financing activities | (695) | | | (405) | | | 4,387 | | | (2,176) | |

| Net increase (decrease) in cash and cash equivalents | (209) | | | (245) | | | (421) | | | 421 | |

| Cash, cash equivalents and restricted cash at beginning of period | 373 | | | 830 | | | 585 | | | 164 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 164 | | | $ | 585 | | | $ | 164 | | | $ | 585 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diamondback Energy, Inc. |

| Selected Operating Data |

| (unaudited) |

| | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | | | | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | | | | | | | |

| Production Data: | | | | | | | | | | | | | |

| Oil (MBbls) | | | | | | | 43,785 | | | 25,124 | | | 123,325 | | | 96,176 | |

| Natural gas (MMcf) | | | | | | | 107,249 | | | 50,497 | | | 275,680 | | | 198,117 | |

| Natural gas liquids (MBbls) | | | | | | | 19,615 | | | 9,016 | | | 49,700 | | | 34,217 | |

Combined volumes (MBOE)(1) | | | | | | | 81,275 | | | 42,556 | | | 218,972 | | | 163,413 | |

| | | | | | | | | | | | | |

| Daily oil volumes (BO/d) | | | | | | | 475,924 | | | 273,087 | | | 336,954 | | | 263,496 | |

| Daily combined volumes (BOE/d) | | | | | | | 883,424 | | | 462,565 | | | 598,284 | | | 447,707 | |

| | | | | | | | | | | | | |

| Average Prices: | | | | | | | | | | | | | |

| Oil ($ per Bbl) | | | | | | | $ | 69.48 | | | $ | 76.42 | | | $ | 73.52 | | | $ | 75.68 | |

| Natural gas ($ per Mcf) | | | | | | | $ | 0.48 | | | $ | 1.29 | | | $ | 0.32 | | | $ | 1.32 | |

| Natural gas liquids ($ per Bbl) | | | | | | | $ | 19.27 | | | $ | 19.96 | | | $ | 18.99 | | | $ | 20.08 | |

| Combined ($ per BOE) | | | | | | | $ | 42.71 | | | $ | 50.87 | | | $ | 46.12 | | | $ | 50.35 | |

| | | | | | | | | | | | | |

Oil, hedged ($ per Bbl)(2) | | | | | | | $ | 68.72 | | | $ | 75.59 | | | $ | 72.68 | | | $ | 74.72 | |

Natural gas, hedged ($ per Mcf)(2) | | | | | | | $ | 0.82 | | | $ | 1.31 | | | $ | 0.91 | | | $ | 1.48 | |

Natural gas liquids, hedged ($ per Bbl)(2) | | | | | | | $ | 19.27 | | | $ | 19.96 | | | $ | 18.99 | | | $ | 20.08 | |

Average price, hedged ($ per BOE)(2) | | | | | | | $ | 42.76 | | | $ | 50.40 | | | $ | 46.38 | | | $ | 49.98 | |

| | | | | | | | | | | | | |

| Average Costs per BOE: | | | | | | | | | | | | | |

| Lease operating expenses | | | | | | | $ | 5.67 | | | $ | 5.97 | | | $ | 5.87 | | | $ | 5.34 | |

| Production and ad valorem taxes | | | | | | | 2.77 | | | 2.44 | | | 2.91 | | | 3.21 | |

| Gathering, processing and transportation expense | | | | | | | 1.17 | | | 1.83 | | | 1.63 | | | 1.76 | |

| General and administrative - cash component | | | | | | | 0.69 | | | 0.59 | | | 0.68 | | | 0.59 | |

| Total operating expense - cash | | | | | | | $ | 10.30 | | | $ | 10.83 | | | $ | 11.09 | | | $ | 10.90 | |

| | | | | | | | | | | | | |

| General and administrative - non-cash component | | | | | | | $ | 0.20 | | | $ | 0.33 | | | $ | 0.30 | | | $ | 0.33 | |

| Depreciation, depletion, amortization and accretion | | | | | | | $ | 14.22 | | | $ | 11.02 | | | $ | 13.02 | | | $ | 10.68 | |

| Interest expense, net | | | | | | | $ | 0.42 | | | $ | 0.68 | | | $ | 0.62 | | | $ | 0.97 | |

| | | | | | | | | | | | | |

(1)Bbl equivalents are calculated using a conversion rate of six Mcf per one Bbl.

(2)Hedged prices reflect the effect of our commodity derivative transactions on our average sales prices and include gains and losses on cash settlements for matured commodity derivatives, which we do not designate for hedge accounting. Hedged prices exclude gains or losses resulting from the early settlement of commodity derivative contracts.

NON-GAAP FINANCIAL MEASURES

ADJUSTED EBITDA

Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. The Company defines Adjusted EBITDA as net income (loss) attributable to Diamondback Energy, Inc., plus net income (loss) attributable to non-controlling interest ("net income (loss)") before non-cash (gain) loss on derivative instruments, net, interest expense, net, depreciation, depletion, amortization and accretion, depreciation and interest expense related to equity method investments, (gain) loss on extinguishment of debt, if any, non-cash equity-based compensation expense, capitalized equity-based compensation expense, merger and integration expenses, other non-cash transactions and provision for (benefit from) income taxes, if any. Adjusted EBITDA is not a measure of net income as determined by United States generally accepted accounting principles ("GAAP"). Management believes Adjusted EBITDA is useful because the measure allows it to more effectively evaluate the Company’s operating performance and compare the results of its operations from period to period without regard to its financing methods or capital structure. The Company adds the items listed above to net income (loss) to determine Adjusted EBITDA because these amounts can vary substantially from company to company within its industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Further, the Company excludes the effects of significant transactions that may affect earnings but are unpredictable in nature, timing and amount, although they may recur in different reporting periods. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP or as an indicator of the Company’s operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets. The Company’s computation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies or to such measure in our credit facility or any of our other contracts.

The following tables present a reconciliation of the GAAP financial measure of net income (loss) attributable to Diamondback Energy, Inc. to the non-GAAP financial measure of Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diamondback Energy, Inc. |

| Reconciliation of Net Income (Loss) to Adjusted EBITDA |

| (unaudited, in millions) |

| | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | | | | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) attributable to Diamondback Energy, Inc. | | | | | | | $ | 1,074 | | | $ | 960 | | | $ | 3,338 | | | $ | 3,143 | |

| Net income (loss) attributable to non-controlling interest | | | | | | | 216 | | | 51 | | | 363 | | | 193 | |

| Net income (loss) | | | | | | | 1,290 | | | 1,011 | | | 3,701 | | | 3,336 | |

| Non-cash (gain) loss on derivative instruments, net | | | | | | | (51) | | | (147) | | | (188) | | | 149 | |

| Interest expense, net | | | | | | | 34 | | | 29 | | | 135 | | | 159 | |

| Depreciation, depletion, amortization and accretion | | | | | | | 1,156 | | | 469 | | | 2,850 | | | 1,746 | |

| Depreciation and interest expense related to equity method investments | | | | | | | 30 | | | 18 | | | 91 | | | 70 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (Gain) loss on extinguishment of debt | | | | | | | — | | | — | | | (2) | | | 4 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-cash equity-based compensation expense | | | | | | | 24 | | | 21 | | | 95 | | | 80 | |

| Capitalized equity-based compensation expense | | | | | | | (8) | | | (7) | | | (30) | | | (26) | |

| Merger and integration expenses | | | | | | | 30 | | | — | | | 303 | | | 11 | |

| Other non-cash transactions | | | | | | | 2 | | | 12 | | | (62) | | | (52) | |

| Provision for (benefit from) income taxes | | | | | | | 115 | | | 264 | | | 800 | | | 912 | |

| Consolidated Adjusted EBITDA | | | | | | | 2,622 | | | 1,670 | | | 7,693 | | | 6,389 | |

| Less: Adjustment for non-controlling interest | | | | | | | 118 | | | 82 | | | 411 | | | 290 | |

| Adjusted EBITDA attributable to Diamondback Energy, Inc. | | | | | | | $ | 2,504 | | | $ | 1,588 | | | $ | 7,282 | | | $ | 6,099 | |

ADJUSTED NET INCOME

Adjusted net income is a non-GAAP financial measure equal to net income (loss) attributable to Diamondback Energy, Inc. plus net income (loss) attributable to non-controlling interest ("net income (loss)") adjusted for non-cash (gain) loss on derivative instruments, net, (gain) loss on extinguishment of debt, if any, merger and integration expense, other non-cash transactions and related income tax adjustments, if any. The Company’s computation of adjusted net income may not be comparable to other similarly titled measures of other companies or to such measure in our credit facility or any of our other contracts. Management believes adjusted net income helps investors in the oil and natural gas industry to measure and compare the Company's performance to other oil and natural gas companies by excluding from the calculation items that can vary significantly from company to company depending upon accounting methods, the book value of assets and other non-operational factors. Further, in order to allow investors to compare the Company's performance across periods, the Company excludes the effects of significant transactions that may affect earnings but are unpredictable in nature, timing and amount, although they may recur in different reporting periods.

The following table presents a reconciliation of the GAAP financial measure of net income (loss) attributable to Diamondback Energy, Inc. to the non-GAAP measure of adjusted net income:

| | | | | | | | | | | | | | | | | | | | | | | |

| Diamondback Energy, Inc. |

| Adjusted Net Income |

| (unaudited, $ in millions except per share data, shares in thousands) |

| | | | | |

| Three Months Ended December 31, 2024 | | Year Ended December 31, 2024 |

| Amounts | | Amounts Per Diluted Share | | Amounts | | Amounts Per Diluted Share |

Net income (loss) attributable to Diamondback Energy, Inc.(1) | $ | 1,074 | | | $ | 3.67 | | | $ | 3,338 | | | $ | 15.53 | |

| Net income (loss) attributable to non-controlling interest | 216 | | | 0.74 | | | 363 | | | 1.70 | |

Net income (loss)(1) | 1,290 | | | 4.41 | | | 3,701 | | | 17.23 | |

| Non-cash (gain) loss on derivative instruments, net | (51) | | | (0.17) | | | (188) | | | (0.88) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| (Gain) loss on extinguishment of debt | — | | | — | | | (2) | | | (0.01) | |

| | | | | | | |

| | | | | | | |

| Merger and integration expense | 30 | | | 0.10 | | | 303 | | | 1.42 | |

| Other non-cash transactions | 2 | | | — | | | (62) | | | (0.29) | |

Adjusted net income excluding above items(1) | 1,271 | | | 4.34 | | | 3,752 | | | 17.47 | |

| Income tax adjustment for above items | 2 | | | 0.01 | | | (9) | | | (0.04) | |

Adjusted net income(1) | 1,273 | | | 4.35 | | | 3,743 | | | 17.43 | |

| Less: Adjusted net income attributable to non-controlling interest | 206 | | | 0.71 | | | 183 | | | 0.86 | |

Adjusted net income attributable to Diamondback Energy, Inc.(1) | $ | 1,067 | | | $ | 3.64 | | | $ | 3,560 | | | $ | 16.57 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | | 291,851 | | | | | 213,545 | |

| Diluted | | 291,851 | | | | | 213,545 | |

(1) The Company’s earnings (loss) per diluted share amount has been computed using the two-class method in accordance with GAAP. The two-class method is an earnings allocation which reflects the respective ownership among holders of common stock and participating securities. Diluted earnings per share using the two-class method is calculated as (i) net income attributable to Diamondback Energy, Inc, (ii) less the reallocation of $4 million and $21 million in earnings attributable to participating securities for the three months ended December 31, 2024 and the year ended December 31, 2024, respectively, (iii) divided by diluted weighted average common shares outstanding for the respective periods.

OPERATING CASH FLOW BEFORE WORKING CAPITAL CHANGES AND FREE CASH FLOW

Operating cash flow before working capital changes, which is a non-GAAP financial measure, represents net cash provided by operating activities as determined under GAAP without regard to changes in operating assets and liabilities. The Company believes operating cash flow before working capital changes is a useful measure of an oil and natural gas company’s ability to generate cash used to fund exploration, development and acquisition activities and service debt or pay dividends. The Company also uses this measure because changes in operating assets and liabilities relate to the timing of cash receipts and disbursements that the Company may not control and may not relate to the period in which the operating activities occurred. This allows the Company to compare its operating performance with that of other companies without regard to financing methods and capital structure.

Free Cash Flow, which is a non-GAAP financial measure, is cash flow from operating activities before changes in working capital in excess of cash capital expenditures. The Company believes that Free Cash Flow is useful to investors as it provides measures to compare both cash flow from operating activities and additions to oil and natural gas properties across periods on a consistent basis as adjusted for non-recurring tax impacts from divestitures, merger and integration expenses, the early termination of derivative contracts and settlements of treasury locks. These measures should not be considered as an alternative to, or more meaningful than, net cash provided by operating activities as an indicator of operating performance. The Company's computation of Free Cash Flow may not be comparable to other similarly titled measures of other companies. The Company uses Free Cash Flow to reduce debt, as well as return capital to stockholders as determined by the Board of Directors.

The following tables present a reconciliation of the GAAP financial measure of net cash provided by operating activities to the non-GAAP measure of operating cash flow before working capital changes and to the non-GAAP measure of Free Cash Flow:

| | | | | | | | | | | | | | | | | | | | | | | |

| Diamondback Energy, Inc. |

Operating Cash Flow Before Working Capital Changes and Free Cash Flow |

| (unaudited, in millions) |

| | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | $ | 2,341 | | | $ | 1,624 | | | $ | 6,413 | | | $ | 5,920 | |

| Less: Changes in cash due to changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | (103) | | | 147 | | | (42) | | | (71) | |

| Income tax receivable | (3) | | | 16 | | | 9 | | | 283 | |

| Prepaid expenses and other current assets | (24) | | | (94) | | | 54 | | | (89) | |

| Accounts payable and accrued liabilities | 114 | | | 11 | | | (376) | | | 57 | |

| Income taxes payable | 138 | | | (9) | | | 87 | | | (5) | |

| Revenues and royalties payable | 59 | | | (16) | | | 168 | | | 123 | |

| Other | (100) | | | 10 | | | 4 | | | (2) | |

| Total working capital changes | 81 | | | 65 | | | (96) | | | 296 | |

| Operating cash flow before working capital changes | 2,260 | | | 1,559 | | | 6,509 | | | 5,624 | |

| Drilling, completions, infrastructure and midstream additions to oil and natural gas properties | (933) | | | (649) | | | (2,867) | | | (2,701) | |

| Total Cash CAPEX | (933) | | | (649) | | | (2,867) | | | (2,701) | |

| Free Cash Flow | 1,327 | | | 910 | | | 3,642 | | | 2,923 | |

Tax impact from divestitures(1) | — | | | — | | | — | | | 64 | |

| Merger and integration expenses | 30 | | | — | | | 303 | | | — | |

| Early termination of derivatives | — | | | — | | | 37 | | | — | |

| Treasury locks | — | | | — | | | 25 | | | — | |

| Adjusted Free Cash Flow | $ | 1,357 | | | $ | 910 | | | $ | 4,007 | | | $ | 2,987 | |

(1) Includes the tax impact for the disposal of certain Midland Basin water assets and Delaware Basin oil gathering assets.

NET DEBT

The Company defines the non-GAAP measure of net debt as total debt (excluding debt issuance costs, discounts, premiums and unamortized basis adjustments) less cash and cash equivalents. Net debt should not be considered an alternative to, or more meaningful than, total debt, the most directly comparable GAAP measure. Management uses net debt to determine the Company's outstanding debt obligations that would not be readily satisfied by its cash and cash equivalents on hand. The Company believes this metric is useful to analysts and investors in determining the Company's leverage position because the Company has the ability to, and may decide to, use a portion of its cash and cash equivalents to reduce debt.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diamondback Energy, Inc. |

| Net Debt |

| (unaudited, in millions) |

| | | | | | | | | | | |

| December 31, 2024 | | Net Q4 Principal Borrowings/(Repayments) | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 |

| (in millions) |

Diamondback Energy, Inc.(1) | $ | 12,069 | | | $ | (215) | | | $ | 12,284 | | | $ | 11,169 | | | $ | 5,669 | | | $ | 5,697 | |

Viper Energy, Inc.(1) | 1,091 | | | 261 | | | 830 | | | 1,007 | | | 1,103 | | | 1,093 | |

| Total debt | 13,160 | | | $ | 46 | | | 13,114 | | | 12,176 | | | 6,772 | | | 6,790 | |

| Cash and cash equivalents | (161) | | | | | (370) | | | (6,908) | | | (896) | | | (582) | |

| Net debt | $ | 12,999 | | | | | $ | 12,744 | | | $ | 5,268 | | | $ | 5,876 | | | $ | 6,208 | |

(1) Excludes debt issuance costs, discounts, premiums and unamortized basis adjustments.

DERIVATIVES

As of February 21, 2025, the Company had the following outstanding consolidated derivative contracts, including derivative contracts at Viper Energy, Inc. The Company’s derivative contracts are based upon reported settlement prices on commodity exchanges, with crude oil derivative settlements based on New York Mercantile Exchange West Texas Intermediate pricing and Crude Oil Brent pricing and with natural gas derivative settlements based on the New York Mercantile Exchange Henry Hub pricing. When aggregating multiple contracts, the weighted average contract price is disclosed.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Crude Oil (Bbls/day, $/Bbl) | | |

| Q1 2025 | | Q2 2025 | | Q3 2025 | | Q4 2025 | | FY2026 | | |

| Long Puts - Crude Brent Oil | 52,000 | | 48,000 | | 27,000 | | 12,000 | | — | | |

| Long Put Price ($/Bbl) | $60.00 | | $58.44 | | $56.85 | | $55.00 | | — | | |

| Deferred Premium ($/Bbl) | $-1.48 | | $-1.50 | | $-1.54 | | $-1.56 | | — | | |

| Long Puts - WTI (Magellan East Houston) | 83,000 | | 86,000 | | 72,000 | | 35,000 | | — | | |

| Long Put Price ($/Bbl) | $55.84 | | $55.12 | | $55.00 | | $55.00 | | — | | |

| Deferred Premium ($/Bbl) | $-1.59 | | $-1.58 | | $-1.60 | | $-1.62 | | — | | |

| Long Puts - WTI (Cushing) | 142,000 | | 137,000 | | 101,000 | | 41,000 | | — | | |

| Long Put Price ($/Bbl) | $56.58 | | $55.58 | | $55.00 | | $55.00 | | — | | |

| Deferred Premium ($/Bbl) | $-1.59 | | $-1.58 | | $-1.58 | | $-1.61 | | — | | |

| Costless Collars - WTI (Cushing) | 13,000 | | — | | — | | — | | — | | |

| Long Put Price ($/Bbl) | $60.00 | | — | | — | | — | | — | | |

| Short Call Price ($/Bbl) | $89.55 | | — | | — | | — | | — | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Basis Swaps - WTI (Midland) | 64,000 | | 66,000 | | 66,000 | | 66,000 | | — | | |

| $1.09 | | $1.05 | | $1.05 | | $1.05 | | — | | |

Roll Swaps - WTI | 16,389 | | 25,000 | | 25,000 | | 25,000 | | — | | |

| $0.93 | | $0.93 | | $0.93 | | $0.93 | | — | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Natural Gas (Mmbtu/day, $/Mmbtu) | | |

| Q1 2025 | | Q2 2025 | | Q3 2025 | | Q4 2025 | | FY 2026 | FY 2027 | | |

| Costless Collars - Henry Hub | 750,000 | | 690,000 | | 690,000 | | 690,000 | | 500,000 | — | | |

| Long Put Price ($/Mmbtu) | $2.52 | | $2.49 | | $2.49 | | $2.49 | | $2.64 | — | | |

| Ceiling Price ($/Mmbtu) | $5.26 | | $5.28 | | $5.28 | | $5.28 | | $6.31 | — | | |

| Natural Gas Basis Swaps - Waha Hub | 670,000 | | 610,000 | | 610,000 | | 610,000 | | 230,000 | 200,000 | | |

| $-0.82 | | $-0.84 | | $-0.84 | | $-0.84 | | $-1.41 | $-1.42 | | |

Investor Contact:

Adam Lawlis

+1 432.221.7467

alawlis@diamondbackenergy.com

Exhibit 99.2

LETTER TO STOCKHOLDERS ISSUED BY DIAMONDBACK ENERGY, INC.

Midland, TX (February 24, 2025)

Diamondback Stockholders,

This letter is meant to be a supplement to our earnings release and is being furnished to the Securities and Exchange Commission (SEC) and released to our stockholders simultaneously with our earnings release. Please see the information regarding forward-looking statements and non-GAAP financial information included at the end of this letter.

2024: Year in Review

2024 was arguably the most transformational year in the Company’s history. In February, we announced the $26 billion merger with Endeavor Energy, creating the must own Permian Pure Play. The merger not only made Diamondback bigger, with a combined ~722,000 net acres in the core of the Midland Basin, but better, giving Diamondback the ability to bring its industry leading operational structure onto a world class asset with differentiated inventory quality and duration. The deal closed on September 10th, and since then the combined Diamondback team has seamlessly integrated, sharing best practices and immediately delivering on the operational synergies we highlighted to the market at deal announcement.

Even considering the potential challenges that come with a large integration, our team was able to remain focused and execute each quarter. In 2024, our daily average production was 598 MBOE/d (56% oil) with capital expenditures of $2.9 billion. We generated $6.4 billion of net cash provided by operating activities and $4.0 billion of Adjusted Free Cash Flow of which $2.3 billion, or approximately 57%, was returned to stockholders through our stable and growing base dividend, variable dividends and buyback program. We repurchased nearly $1 billion worth of stock in 2024 as our buyback program allowed us to effectively buy during periods of market weakness and be an anchor order in the secondary offering completed last September.

Operational Update

Over the past year, the team has seen a step change in efficiency improvements in the field. We pushed well costs lower every quarter last year, and today we are announcing a new Midland Basin well cost range of $555 - $605 per foot, down approximately $45 per foot (over 7%) year over year. This is a testament to our drilling, completions and production groups who continue to strive to be the best at what they do, day in and day out.

On the drilling side, our use of clear fluids combined with an improved downhole assembly has allowed us to consistently achieve record drilling times. We drilled over 1.6 million lateral feet in the fourth quarter and are now averaging approximately 7 days from spud to target depth on our average Midland Basin

13,000’ lateral. We set a basin record in the fourth quarter by drilling 20,386 total feet (vertical section, curve and lateral) in one bit run.

Our completions teams continue to utilize SimulFrac fleets for nearly all of our completions, which speed up cycle times and reduce ancillary rental days. We are running four electric SimulFrac fleets today and expect to average five completion crews this year. Each crew can now complete approximately 100 wells per year at an average of over 3,700 lateral feet per day, up from 80 wells and ~3,000 lateral feet per day at this time last year. These electric fleets have enabled us to realize meaningful value through higher uptimes and fuel cost savings.

Since closing the Endeavor merger, we have also started to see the benefits of some un-modeled synergies. We expect a new standardized facility design, comprised of best practices from Diamondback and Endeavor, to save us ~10% versus our prior design. We are also seeing improved efficiencies and cycle times in our drillout process, courtesy of the legacy Endeavor team. Lastly, we are starting to see the benefit of size and scale in our procurement process, with an estimated per well savings of 2% - 3%. We believe we will continue to capture synergies, particularly on the production side of our business, through shared learning as the integration process continues.

Fourth Quarter Performance

For the quarter, Diamondback produced 475.9 MBO/d (883.4 MBOE/d), above the high end of the guidance range of 470 - 475 MBO/d (840 - 850 MBOE/d). Well performance continued to impress with strong results in our Sale and Robertson Ranch areas and on the recently acquired TRP acreage in Upton County. Capital expenditures were $933 million, below the low end of our guidance range of $950 million to $1.05 billion. This beat was primarily driven by Midland Basin well costs continuing to move lower, settling below our stated fourth quarter $600 per lateral foot estimate.

We generated $2.3 billion of net cash provided by operating activities and $1.4 billion of Adjusted Free Cash Flow of which approximately $694 million, or approximately 51%, was delivered to stockholders through our base dividend and buyback program. We leaned into buybacks in the fourth quarter as we felt our share price was below the intrinsic value of our business, particularly during the volatility witnessed in December. We have continued to buy back shares in January and February, and through last Friday had repurchased 1,254,600 of shares at a weighted average price of $167.42.

This quarter, we announced an 11% increase to the base dividend, moving the dividend from $0.90 per share to $1.00 per share per quarter ($4.00 per share annually). As we continue to lower costs and develop our highest quality inventory, our capital efficiency improves and lowers our corporate break even (the dollar per barrel of oil needed for us to maintain our current production levels and protect our dividend). Today, we are confident we can protect the increased dividend and our base level of activity below $40 a barrel at our current cost structure.

Drop Down Acquisition

In January, we announced a significant mineral and override drop down of legacy Endeavor assets to our subsidiary, Viper Energy, Inc. in a transaction valued at approximately $4.45 billion. Diamondback will receive $1 billion in cash and 69.6 million units of Viper’s operating subsidiary. The cash proceeds will be used to pay down near-term debt and the units received will push Diamondback’s ownership in Viper back above 50%, increasing Diamondback’s exposure to Viper’s differentiated growth profile and robust minerals position. We view Viper as a one-of-a-kind mineral company, with an exciting trajectory that includes unique insight into the Diamondback drill-bit. We believe in the long term distribution growth potential at Viper, and our pro forma position is worth approximately $7.5 billion assuming Friday’s stock price.

Double Eagle Acquisition

Last week, we announced a unique transaction with Double Eagle IV. We agreed to purchase the northern portion of their acreage position for approximately $4.1 billion. Consideration mix is made up of approximately 6.9 million shares of Diamondback common stock and $3 billion of cash.

We felt that this asset was the most attractive remaining position in our backyard, public or private. The Double Eagle team did an impressive job putting together undrilled units in the highest returning parts of the Basin, and the roughly 400 core locations we expect to acquire immediately slot into our near-term drilling profile. The acreage is also adjacent to our existing position and we expect additional synergies from over 20 lateral length extensions and infrastructure sharing. We also entered into a partnership to accelerate development on the southernmost acreage we acquired from Endeavor, which is expected to add significantly to Free Cash Flow in 2026 at no cost to Diamondback.

Through this transaction, we continue to high-grade our inventory base in the most productive parts of the Midland Basin, maximize near-term Free Cash Flow generation and extend inventory duration. While we recognize this deal was done shortly after closing the Endeavor merger, we don’t often control deal timing, and we prepare our organization to always “be ready” when an opportunity arises. That said, the opportunity set is shrinking, particularly for remaining quality private opportunities in the Basin. As we have proven time and again, we expect to seamlessly integrate this asset and execute flawlessly. We are positioning Diamondback to have the best long-term capital efficiency in the Permian Basin through a combination of inventory quality, duration and execution cost structure.

2025 Guidance: Maximizing Capital Efficiency

In 2025, we have again chosen capital efficiency and Free Cash Flow generation over volume growth for our capital plan. This is a decision we have consistently made over the last four years, and it has been consistently rewarded by the market and applauded by our stockholders, who own the Company. The output of this year's plan is the most capital efficient drilling program in the Company’s history.

We measure our capital efficiency using oil barrels produced divided by every dollar of capital spent. When we announced the Endeavor transaction a year ago, we expected to be able to produce approximately 470 - 480 MBO/d with a capital budget of approximately $4.1 - $4.4 billion in 2025, which equated to approximately 40.8 MBO per million dollars of capex spend. Today, we are announcing a 2025 capital plan that generates 485 - 498 MBO/d with a capital budget of approximately $3.8 - $4.2 billion, or approximately 44.8 MBO per million dollars of capex spend.

This ~10% improvement in capital efficiency is the direct result of applying the lowest cost structure in the Basin on top of our differentiated asset base. We plan to drill approximately 460 wells and complete approximately 575 wells this year, continuing to draw down on the DUC backlog we acquired from Endeavor, TRP and Double Eagle. At this pace, we are confident we can maintain this level of capital efficiency for nearly a decade, once again highlighting Diamondback’s differentiated inventory quality.

Balance Sheet

At year-end we had approximately $13.2 billion of gross debt and $13.0 billion of net debt on a consolidated basis. We ended the year with ~$2.6 billion of liquidity at Diamondback, with an undrawn credit facility. This equated to a consolidated fourth quarter leverage ratio of approximately 1.2x.

As we stated previously, we expect to fund the $3 billion cash portion of the Double Eagle transaction through a combination of cash on hand, borrowings under the Company’s credit facility and/or proceeds from term loans and senior notes offerings.

This increase in our total debt will be partially offset by $1 billion of cash received from Viper upon the anticipated closing of the drop-down acquisition in the second quarter. In addition, we have committed to

at least $1.5 billion of near-term asset sales, which we expect to include sales of our equity method investments, Endeavor’s water infrastructure and non-operated assets.

We pride ourselves on our balance sheet strength and continue to reiterate our intent to reduce net debt to $10 billion and maintain long-term leverage of $6 billion to $8 billion. We expect to achieve this de-leveraging naturally through robust Free Cash Flow generation, dedicating approximately 50% of Free Cash Flow to debt paydown, with acceleration from proceeds from non-core asset sales as noted above.

Leadership Transition

On Thursday last week, we announced our leadership transition plan where I will move from CEO to Executive Chairman effective as of the Company’s 2025 Annual Meeting. At that time, Kaes Van’t Hof will assume the CEO role and join the Board of Directors. This is the culmination of a thorough succession planning process and Kaes has my full support, as well as support from the Board of Directors in taking on his new role.

I will remain close to the Company in my new role as Executive Chairman as well as my future role on the Board of Directors. While this is not my final stockholder letter, I would like to say that representing the employees of Diamondback as CEO over the last 13 years has been an incredible privilege. I always believed in the growth opportunity for Diamondback, even when we were a small cap oil producer that no one had ever heard of. The success of this Company since the IPO in 2012 has never been about any individual, but rather the collective efforts of an extremely talented employee base with a strong culture based on trust and a well-defined strategy.

Closing

2024 was an incredible year for Diamondback. We are uniquely positioned to succeed for the long term, and continue to focus, day in and day out, on making our company better. I am so proud of our team and the work they have put in over the past 13 years to turn Diamondback into what it is today.

Thank you for your ongoing support and interest in Diamondback Energy.

Travis D. Stice

Chairman of the Board and Chief Executive Officer

Investor Contact:

Adam Lawlis

+1 432.221.7467

alawlis@diamondbackenergy.com

Forward-Looking Statements:

This letter contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended, which involve risks, uncertainties, and assumptions. All statements, other than statements of historical fact, including statements regarding future performance; business strategy; future operations (including drilling plans and capital plans); estimates and projections of revenues, losses, costs, expenses, returns, cash flow, and financial position; reserve estimates and its ability to replace or increase reserves; anticipated benefits or other effects of strategic transactions (including the recently completed Endeavor merger and other acquisitions or divestitures); the expected amount and timing of synergies from the Endeavor merger; and plans and objectives of management (including plans for future cash flow from operations and for executing environmental strategies) are forward-looking statements. When used in this letter, the words “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “model,” “outlook,” “plan,” “positioned,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” and similar expressions (including the negative of such terms) are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Although Diamondback believes that the expectations and assumptions reflected in its forward-looking statements are reasonable as and when made, they involve risks and uncertainties that are difficult to predict and, in many cases, beyond Diamondback’s control. Accordingly, forward-looking statements are not guarantees of future performance and actual outcomes could differ materially from what Diamondback has expressed in its forward-looking statements.

Factors that could cause the outcomes to differ materially include (but are not limited to) the following: changes in supply and demand levels for oil, natural gas, and natural gas liquids, and the resulting impact on the price for those commodities; the impact of public health crises, including epidemic or pandemic diseases and any related company or government policies or actions; actions taken by the members of OPEC and Russia affecting the production and pricing of oil, as well as other domestic and global political, economic, or diplomatic developments, including any impact of the ongoing war in Ukraine and the Israel-Hamas war on the global energy markets and geopolitical stability; instability in the financial markets; concerns over a potential economic slowdown or recession; inflationary pressures; higher interest rates and their impact on the cost of capital; regional supply and demand factors, including delays, curtailment delays or interruptions of production, or governmental orders, rules or regulations that impose production limits; federal and state legislative and regulatory initiatives relating to hydraulic fracturing, including the effect of existing and future laws and governmental regulations; physical and transition risks relating to climate change; those risks described in Item 1A of Diamondback’s Annual Report on Form 10-K, filed with the SEC on February 22, 2024, and those risks disclosed in its subsequent filings on Forms 10-Q and 8-K, which can be obtained free of charge on the SEC’s website at http://www.sec.gov and Diamondback’s website at www.diamondbackenergy.com/investors.

In light of these factors, the events anticipated by Diamondback’s forward-looking statements may not occur at the time anticipated or at all. Moreover, Diamondback operates in a very competitive and rapidly changing environment and new risks emerge from time to time. Diamondback cannot predict all risks, nor can it assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those anticipated by any forward-looking statements it may make. Accordingly, you should not place undue reliance on any forward-looking statements. All forward-looking statements speak only as of the date of this letter or, if earlier, as of the date they were made. Diamondback does not intend to, and disclaims any obligation to, update or revise any forward-looking statements unless required by applicable law.

Non-GAAP Financial Measures

This letter includes financial information not prepared in conformity with generally accepted accounting principles (GAAP), including free cash flow. The non-GAAP information should be considered by the reader in addition to, but not instead of, financial information prepared in accordance with GAAP. A reconciliation of the differences between these non-GAAP financial measures and the most directly comparable GAAP financial measures can be found in Diamondback's quarterly results posted on Diamondback's website at www.diamondbackenergy.com/investors/. Furthermore, this letter includes or references certain forward-looking, non-GAAP financial measures. Because Diamondback provides these measures on a forward-looking basis, it cannot reliably or reasonably predict certain of the necessary components of the most directly comparable forward-looking GAAP financial measures, such as future impairments and future changes in working capital. Accordingly, Diamondback is unable to present a quantitative reconciliation of such forward-looking, non-GAAP financial measures to the respective most directly comparable forward-looking GAAP financial measures. Diamondback believes that these forward-looking, non-GAAP measures may be a useful tool for the investment community in comparing Diamondback's forecasted financial performance to the forecasted financial performance of other companies in the industry.

v3.25.0.1

DEI Document

|

Feb. 24, 2025 |