false

0001022671

0001022671

2025-02-24

2025-02-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported) February 24, 2025

STEEL

DYNAMICS, INC.

(Exact name of registrant as specified in its

charter)

| Indiana |

|

0-21719 |

|

35-1929476 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

7575

West Jefferson Blvd, Fort Wayne, Indiana

46804

(Address of principal executive offices) (Zip

Code)

Registrant’s telephone number, including

area code: 260-969-3500

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common

Stock voting, $0.0025 par value |

STLD |

NASDAQ

Global Select Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events

On February

24, 2025, Steel Dynamics, Inc. issued a press release titled “Steel Dynamics Announces First Quarter 2025 Cash Dividend

Increase of 9% and an Additional $1.5 Billion Share Repurchase Authorization.” A copy of that press release is attached hereto

as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d ) Exhibits.

The following exhibit is filed with this report:

| 104 | Cover Page Interactive Data File – the cover page interactive

data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this Report to be signed on its behalf by the undersigned hereto duly authorized.

| |

|

STEEL DYNAMICS, INC. |

| |

| |

|

/s/ Theresa E. Wagler |

| Date: February 25, 2025 |

By: |

Theresa E. Wagler |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Press Release

February 24, 2025 |  |

7575 W. Jefferson Blvd.

Fort Wayne, IN 46804

Steel Dynamics Announces First Quarter 2025

Cash Dividend Increase of 9%

and an Additional $1.5 Billion

Share Repurchase Authorization

FORT WAYNE, INDIANA,

February 24, 2025 / PRNewswire / Steel Dynamics, Inc. (NASDAQ/GS: STLD) today announced that the company’s board of directors

declared a first quarter cash dividend of $0.50 per common share, representing a 9% increase over the company's 2024

quarterly rate. The dividend is payable to shareholders of record at the close

of business on March 31, 2025, and is payable on or about April 11, 2025.

The company’s board of directors also authorized an additional

share repurchase program of $1.5 billion of the company’s common stock. The authorization is effective immediately and is additive

to the previous $1.5 billion program authorized on November 3, 2023, which had $194 million remaining authorized and available for

repurchase on December 31, 2024.

Since 2017, the company has repurchased $6.7 billion of its common

stock, representing 41 percent of its outstanding shares, and has paid cash dividends of $1.7 billion through December 31, 2024.

In the last five years, the company continued its meaningful strategic growth, investing $7.1 billion in capital investments and acquisitions,

while maintaining a best-in-class, after-tax-return-on-invested capital of 24 percent.

“These actions reflect the Board’s and senior leadership’s

confidence in the consistency and strength of our cash generation capabilities,” said Mark D. Millett, Co-founder, Chairman, and

Chief Executive Officer. “We have consistently increased our cash dividend in alignment with our growth initiatives, while complementing

it through our share repurchase program in periods of strong cash generation. Based on our strong capital foundation and consistent cash

generation, we are able to execute organic and transactional strategic growth initiatives, while sustaining strong shareholder distributions

and remaining committed to maintaining our investment grade credit ratings.”

Under the company’s share repurchase program, purchases take

place as and when determined by the company in open-market or private transactions, including transactions that may be affected pursuant

to Rule 10b5-1 of the Securities Exchange Act of 1934, as amended. Pursuant to this program, purchases of shares of the company’s

common stock, are made based upon the market price of the company’s common stock, the nature of other investment and growth opportunities,

expected free cash flow, and general economic conditions. The share repurchase program does not require the company to acquire any specific

number of shares and may be modified, suspended, extended or terminated by the company at any time without prior notice.

About Steel Dynamics, Inc.

Steel Dynamics is one of the largest domestic steel producers and metals

recyclers in North America, based on estimated annual steelmaking and metals recycling capability, with facilities located throughout

the United States, and in Mexico. Steel Dynamics produces steel products, including hot roll, cold roll, and coated sheet steel, structural

steel beams and shapes, rail, engineered special-bar-quality steel, cold finished steel, merchant bar products, specialty steel sections,

and steel joists and deck. In addition, the company produces liquid pig iron and processes and sells ferrous and nonferrous scrap.

Note Regarding Financial Metrics

The company believes that after-tax return-on-invested capital (After-tax

ROIC) provides an indication of the effectiveness of the company’s invested capital and is calculated as follows:

| After-tax ROIC = |

Net Income Attributable to Steel Dynamics, Inc. |

| (Quarterly Average Current Maturities of Long-term Debt + Long-term Debt + Total Equity) |

Forward-Looking Statements

This press release contains some predictive statements about future

events, including statements related to conditions in domestic or global economies, conditions in steel, aluminum, and recycled metals

market places, Steel Dynamics' revenues, costs of purchased materials, future profitability and earnings, and the operation of new, existing

or planned facilities. These statements, which we generally precede or accompany by such typical conditional words as "anticipate",

"intend", "believe", "estimate", "plan", "seek", "project", or "expect",

or by the words "may", "will", or "should", are intended to be made as "forward-looking", subject

to many risks and uncertainties, within the safe harbor protections of the Private Securities Litigation Reform Act of 1995. These statements

speak only as of this date and are based upon information and assumptions, which we consider reasonable as of this date, concerning our

businesses and the environments in which they operate. Such predictive statements are not guarantees of future performance, and we undertake

no duty to update or revise any such statements. Some factors that could cause such forward-looking statements to turn out differently

than anticipated include: (1) domestic and global economic factors; (2) global steelmaking overcapacity and imports of steel,

together with increased scrap prices; (3) pandemics, epidemics, widespread illness or other health issues; (4) the cyclical

nature of the steel industry and the industries we serve; (5) volatility and major fluctuations in prices and availability of scrap

metal, scrap substitutes and supplies, and our potential inability to pass higher costs on to our customers; (6) cost and availability

of electricity, natural gas, oil, and other energy resources are subject to volatile market conditions; (7) increased environmental,

greenhouse gas emissions and sustainability considerations from our customers or related regulations; (8) compliance with and changes

in environmental and remediation requirements; (9) significant price and other forms of competition from other steel and aluminum

producers, scrap processors and alternative materials; (10) availability of an adequate source of supply of scrap for our metals

recycling operations; (11) cybersecurity threats and risks to the security of our sensitive data and information technology; (12) the

implementation of our growth strategy; (13) litigation and legal compliance; (14) unexpected equipment downtime or shutdowns; (15) governmental

agencies may refuse to grant or renew some of our licenses and permits; (16) our senior unsecured credit facility contains, and any future

financing agreements may contain, restrictive covenants that may limit our flexibility; and (17) the impacts of impairment charges.

More specifically, we refer you to our more detailed explanation of

these and other factors and risks that may cause such predictive statements to turn out differently, as set forth in our most recent Annual

Report on Form 10-K under the headings Special Note Regarding Forward-Looking Statements and Risk Factors, in our Quarterly Reports

on Form 10-Q, or in other reports which we file with the Securities and Exchange Commission. These reports are available publicly

on the Securities and Exchange Commission website, www.sec.gov, and on our website, www.steeldynamics.com under “Investors –

SEC Filings.”

Contact: Investor Relations — +1.260.969.3500

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

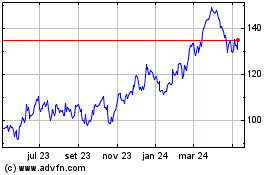

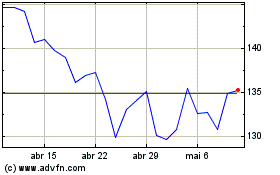

Steel Dynamics (NASDAQ:STLD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Steel Dynamics (NASDAQ:STLD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025