FALSE000148813900014881392025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

Ameresco, Inc.

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

| Delaware | | 001-34811 | | 04-3512838 |

(State or Other Juris-

diction of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | |

| 111 Speen Street, | Suite 410, | Framingham, | MA | | 1701 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (508) 661-2200 (Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | AMRC | New York Stock Exchange |

| | | | | | | | | | | |

| | Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | | |

| | Emerging growth company | ☐ |

| | | |

| | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

On February 27, 2025, Ameresco, Inc. (“we” or the “Company”) announced its financial results for the quarter and fiscal year ended December 31, 2024. The Company also posted supplemental information with respect to its fourth quarter and full year results on the Investor Relations section of its website at www.ameresco.com. The press release and the supplemental information issued in connection with the announcement are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

The information in this Form 8-K (including Exhibit 99.1 and Exhibit 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The exhibits listed on the Exhibit Index immediately preceding such exhibits are furnished as part of this Current Report on Form 8-K.

EXHIBIT INDEX | | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | | |

| AMERESCO, INC.

| |

| February 27, 2025 | By: | /s/ Mark Chiplock |

| | Mark Chiplock | |

| | Senior Vice President and Chief Financial Officer

(duly authorized and principal financial officer) |

|

Exhibit 99.1

Ameresco Reports Fourth Quarter and Full Year 2024 Financial Results

FY24 Total Revenue Growth of 29%

Total Project Backlog up 24% Y/Y to $4.8 billion

Record Q4 Contract Conversions of $1.1 billion Drives Y/Y Contracted Backlog up 92%

Record 241 MWe Energy Assets Placed in Operation During 2024

Full Year and Fourth Quarter 2024 Financial Highlights:

•Revenues of $1,769.9 million and $532.7 million

•Net income attributable to common shareholders of $56.8 million and $37.1 million

•GAAP EPS of $1.07 and $0.70

•Non-GAAP EPS of $1.20 and $0.88

•Adjusted EBITDA of $225.3 million and $87.2 million

FRAMINGHAM, MA - February 27, 2025 – Ameresco, Inc. (NYSE: AMRC), a leading energy solutions provider dedicated to helping customers navigate the energy transition, today announced financial results for the fiscal quarter ended December 31, 2024. The Company also furnished supplemental information in conjunction with this press release in a Current Report on Form 8-K. The supplemental information, which includes Non-GAAP financial measures, has been posted to the “Investors” section of the Company’s website at www.ameresco.com. Reconciliations of Non-GAAP measures to the appropriate GAAP measures are included herein. All financial result comparisons made are against the prior year period unless otherwise noted.

CEO George Sakellaris commented, “The fourth quarter represented a strong and resilient finish to an excellent year for Ameresco. Our team continued to deliver solid results in a dynamic business environment while positioning the Company for future growth and adding to our multi-year visibility. Our record revenue performance was driven by growth across our business lines, reflecting robust demand for cost effective projects that provide energy savings and resilience. This was also a record quarter in project contract conversions with over $1 billion, bringing our contracted project backlog to over $2.5 billion at year-end, approximately twice 2023 levels. We also placed a record 241 MWe of energy assets into service during the year. These

accomplishments have added considerably to our total multiyear revenue visibility which now stands at almost $10 billion. During the quarter, we also successfully divested our AEG business unit allowing us to remain focused on our core businesses and the exciting growth opportunities within our target markets.”

Fourth Quarter Financial Results

(All financial result comparisons made are against the prior year period unless otherwise noted.)

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | Q4 2024 | Q4 2023 |

| Revenue | Net Income (1) | Adj. EBITDA | Revenue | Net Income (1) | Adj. EBITDA |

| Projects | $418.3 | $0.4 | $13.7 | $346.5 | $27.2 | $26.3 |

| Energy Assets | $57.6 | $8.9 | $31.1 | $43.9 | $1.3 | $23.3 |

| O&M | $26.5 | $1.7 | $2.6 | $24.4 | $4.1 | $3.4 |

| Other | $30.2 | $26.2 | $39.8 | $26.6 | $1.1 | $1.9 |

Total (2) | $532.7 | $37.1 | $87.2 | $441.4 | $33.7 | $54.9 |

| | | | | | |

(1) Net Income represents net income attributable to common shareholders |

(2) Numbers in table may not sum due to rounding. |

Total revenue increased 20.7% to $532.7 million, with growth across all four of our business lines. Projects revenue grew 20.7% to $418.3 million, driven by our focus on project execution and the conversion of our awarded backlog to contracts. Energy Assets revenue increased 31.2% to $57.6 million, on the strength of record growth in assets placed in service. O&M revenue increased 8.6% to $26.5 million reflecting a solid attachment rate to our growing projects business. Other revenue increased 13.7% to $30.2 million. Gross margin of 12.5% for the quarter was significantly lower than expected. Unanticipated cost overruns on two of our large-scale legacy projects, negatively impacted gross profit by approximately $20 million, or 400 basis points. Operating income of $44.6 million, included a gain recognized on the sale of our AEG business unit of approximately $38.0 million, was partially offset by non-cash impairment charges of approximately $12.0 million taken on certain energy assets and higher depreciation expenses of $8.0 million. Interest and other expenses, net was $23.4 million, representing an increase of 45.7%. We continued to take advantage of clean energy tax incentives, resulting in an effective tax rate benefit of (58.9)% compared to a benefit of (67.0)% in 2023. Net income attributable to common shareholders was $37.1 million, increasing by 14.6%. Adjusted EBITDA of $87.2 million, increased 58.7%.

Balance Sheet and Cash Flow Metrics

| | | | | |

| ($ in millions) | December 31, 2024 |

Total Corporate Debt (1) | $243.1 |

Corporate Debt Leverage Ratio (2) | 3.2x |

| |

Total Energy Asset Debt (3) | $1,390.2 |

Energy Asset Book Value (4) | $1,915.3 |

Energy Debt Advance Rate (5) | 73% |

| |

| Q4 Cash Flows from Operating Activities | $18.4 |

| Plus: Q4 Proceeds from Federal ESPC Projects | $35.4 |

| Equals: Q4 Adjusted Cash from Operations | $53.8 |

| |

| 8-quarter rolling average Cash Flows from Operating Activities | $6.0 |

| Plus: 8-quarter rolling average Proceeds from Federal ESPC Projects | $39.9 |

| Equals: 8-quarter rolling average Adjusted Cash from Operations | $45.8 |

| |

(1) Subordinated debt, term loans, and drawn amounts on the revolving line of credit, net of debt discount and issuance costs | |

(2) Debt to EBITDA, as calculated under our Sr. Secured Credit Facility | |

(3) Term loans, sale-leasebacks and construction loan project financings for our Energy Assets in operations and in-construction and development | |

(4) Book Value of our Energy Assets in operations and in-construction and development | |

(5) Total Energy Asset Debt divided by Energy Asset Book Value | |

The Company ended 2024 with $108.5 million in cash. During the fourth quarter the Company executed the planned, strategic divestiture of our energy technology and advisory services business, AEG, which resulted in significant cash proceeds and a higher than expected gain of approximately $38.0 million. The Company used the net cash proceeds from the sale to pay down its corporate term loan, resulting in an improvement in the corporate debt leverage ratio as of December 31, 2024. Our total corporate debt including our subordinated debt, term loans and drawn amounts on our revolving line of credit declined to $243.1 million from $272.5 million. Subsequent to the year-end, we extended and increased this facility, providing further financial flexibility and increased capacity to help fund our growth. During the fourth quarter we successfully executed approximately $237.0 million in project financing commitments to help fund our Energy Asset business. Our Energy Asset Debt was $1.4 billion with an Energy Debt Advance rate of 73% on the Energy Asset Book Value. Our Adjusted Cash from Operations during the quarter was $53.8 million. Our 8-quarter rolling average Adjusted Cash from Operations was $45.8 million.

Project and Asset Highlights

| | | | | | | | |

| ($ in millions) | | At December 31, 2024 |

Awarded Project Backlog (1) | | $2,274 |

| Contracted Project Backlog | | $2,544 |

| Total Project Backlog | | $4,818 |

12-month Contracted Backlog (2) | | $1,146 |

| | |

| O&M Revenue Backlog | | $1,378 |

Energy Asset Visibility (3) | | $3,325 |

| | |

| Operating Energy Assets | | 731 MWe |

Ameresco's Net Assets in Development (4) | | 637 MWe |

| | |

(1) Customer contracts that have not been signed yet |

(2) We define our 12-month backlog as the estimated amount of revenues that we expect to recognize in the next twelve months from our fully-contracted backlog |

(3) Estimated contracted revenue and incentives during PPA period plus estimated additional revenue from operating RNG assets over a 20-year period, assuming RINs at $1.50/gallon and brown gas at $3.50/MMBtu with $3.00/MMBtu for LCFS on certain projects |

(4) Net MWe capacity includes only our share of any jointly owned assets |

•Ameresco brought 31 MWe of Energy Assets into operation, including the 15.6 MWe Roxana RNG plant.

•Ameresco’s Assets in Development increased 48 MWe during the quarter to 637 MWe with the addition of a number of large battery and PV assets.

•The Southern California Edison projects continue to progress and we expect them to be finalized this year.

Summary and Outlook

“Entering 2025, Ameresco is well-positioned for continued long term profitable growth even in an evolving industry and political landscape. While we expect continued growth in our recurring energy assets and O&M businesses, our projects business, and specifically our federal projects, will be impacted as the new administration determines which projects align with its funding priorities. We expect there to be continued long-term demand for our budget-neutral, cost-saving solutions as energy demand and prices continue to increase. We also expect the growing need for resilient, reliable power and infrastructure upgrades to drive the continued growth of our energy solutions as these drivers align with the new administration's priorities. Additionally, we foresee growing contributions from our European business, with renewable projects driven by decarbonization and net-zero commitments. These critical market drivers and our proven tailored solutions will continue to bolster our status as a leading global market player.”

Given the current unpredictable political and regulatory environment, we have evaluated our federal government exposure in our 2025 guidance. We are guiding revenue of $1.9 billion and adjusted EBITDA $235 million at the midpoints of our ranges. We have reviewed risks related to project cancellations, pauses and re-scopes and factored that into our guidance. However, if these factors last longer than anticipated, our earnings could be impacted.

We anticipate placing approximately 100-120 MWe of energy assets in service, including 1-2 RNG plants. Our expected capex is $350 million to $400 million, the majority of which we expect to fund with additional energy asset debt, tax equity or tax credit sales.

We anticipate that first quarter revenue and Adjusted EBITDA will be similar to Q1 last year. Because the first quarter is our seasonally lowest revenue quarter, and due to the generally linear nature of depreciation and interest expenses, we expect to have negative EPS. With respect to the cadence of revenue, we expect revenues in the second half of the year to represent approximately 60% of our total revenue for 2025. This is consistent with our performance from the past couple of years.

Our 2025 guidance does not include the potential impact of a change in accounting principle related to sale-leaseback arrangements that is currently being assessed. If implemented, this change could result in lower annual interest and other expenses with an estimated impact of approximately $20 million in 2025.

| | | | | | | | | | |

| FY 2025 Guidance Ranges | | |

| Revenue | $1.85 billion | $1.95 billion | | |

| Gross Margin | 15.5% | 16.0% | | |

| Adjusted EBITDA | $225 million | $245 million | | |

| Depreciation & Amortization | $103 million | $105 million | | |

| Interest Expense & Other | $85 million | $90 million | | |

| Effective Tax Rate | (50)% | (35)% | | |

| Income Attributable to Non-Controlling Interest | ($5) million | ($8) million | | |

| Non-GAAP EPS | $0.70 | $0.90 | | |

The Company’s Adjusted EBITDA and Non-GAAP EPS guidance excludes the potential impact of redeemable non-controlling interest activity, one-time charges, energy asset and goodwill impairment charges, changes in contingent consideration, restructuring activities, as well as any related tax impact.

Conference Call/Webcast Information

The Company will host a conference call today at 4:30 p.m. ET to discuss fourth quarter 2024 financial results, business and financial outlook, and other business highlights. To participate on the day of the call, dial 1-888-596-4144, or internationally 1-646-968-2525, and enter the conference ID: 4966851, approximately 10 minutes before the call. A live, listen-only webcast of the conference call will also be available over the Internet. Individuals wishing to listen can access the call through the “Investors” section of the Company’s website at www.ameresco.com. If you are unable to listen to the live call, an archived webcast will be available on the Company’s website for one year.

Use of Non-GAAP Financial Measures

This press release and the accompanying tables include references to adjusted EBITDA, Non- GAAP EPS, Non-GAAP net income and adjusted cash from operations, which are Non-GAAP financial measures. For a description of these Non-GAAP financial measures, including the reasons management uses these measures, please see the section following the accompanying tables titled “Exhibit A: Non-GAAP Financial Measures”. For a reconciliation of these Non-GAAP financial measures to the most directly comparable financial measures prepared in accordance

with GAAP, please see Non-GAAP Financial Measures and Non-GAAP Financial Guidance in the accompanying tables.

About Ameresco, Inc.

Founded in 2000, Ameresco, Inc. (NYSE:AMRC) is a leading energy solutions provider dedicated to helping customers reduce costs, enhance resilience, and decarbonize to net zero in the global energy transition. Our comprehensive portfolio includes implementing smart energy efficiency solutions, upgrading aging infrastructure, and developing, constructing, and operating distributed energy resources. As a trusted full-service partner, Ameresco shows the way by reducing energy use and delivering diversified generation solutions to Federal, state and local governments, utilities, educational and healthcare institutions, housing authorities, and commercial and industrial customers. Headquartered in Framingham, MA, Ameresco has more than 1,500 employees providing local expertise in North America and Europe. For more information, visit www.ameresco.com.

| | | | | | | | | | | |

Contact: | Media Relations | | Leila Dillon, 508.661.2264, news@ameresco.com |

| Investor Relations | | Eric Prouty, AdvisIRy Partners, 212.750.5800, eric.prouty@advisiry.com |

| | | Lynn Morgen, AdvisIRy Partners, 212.750.5800, lynn.morgen@advisiry.com |

Safe Harbor Statement

Any statements in this press release about future expectations, plans and prospects for Ameresco, Inc., including statements about market conditions, pipeline, visibility, backlog, pending agreements, financial guidance including estimated future revenues, net income, adjusted EBITDA, Non-GAAP EPS, gross margin, effective tax rate, interest rate, depreciation, tax attributes and capital investments, as well as statements about our financing plans, the impact the IRA, the impact of policies and regulatory changes implemented by the new U.S. administration, supply chain disruptions, shortage and cost of materials and labor, and other macroeconomic and geopolitical challenges; the impact from a possible change in accounting principle; our expectations related to our agreement with SCE including the impact of delays and any requirement to pay liquidated damages, and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including: demand for our energy efficiency and renewable energy solutions; the timing of, and ability to, enter into contracts for awarded projects on the terms proposed or at all; the timing of work we do on projects where we recognize revenue on a percentage of completion basis; the ability to perform under signed contracts without delay and in accordance with their terms and the potential for liquidated and other damages we may be subject to; the fiscal health of the government and the risk of government shutdowns and reductions in the federal workforce; our ability to complete and operate our projects on a profitable basis and as committed to our customers; our cash flows from operations and our ability to arrange financing to fund our operations and projects; our customers’ ability to finance their projects and credit risk from our customers; our ability to comply with covenants in our existing debt agreements; the impact of macroeconomic challenges, weather related events and climate change; our reliance on third parties for our

construction and installation work; availability and cost of labor and equipment particularly given global supply chain challenges, tariffs and global trade conflicts; global supply chain challenges, component shortages and inflationary pressures; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy; the ability of customers to cancel or defer contracts included in our backlog; the output and performance of our energy plants and energy projects; cybersecurity incidents and breaches; regulatory and other risks inherent to constructing and operating energy assets; the effects of our acquisitions and joint ventures; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; the addition of new customers or the loss of existing customers; market price of our Class A Common stock prevailing from time to time; the nature of other investment opportunities presented to our Company from time to time; risks related to our international operation and international growth strategy; and other factors discussed in our most recent Annual Report on Form 10-K and our quarterly reports on Form 10-Q. The forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

AMERESCO, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share amounts)

| | | | | | | | | | | |

| December 31, |

| | 2024 | | 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 108,516 | | | $ | 79,271 | |

| Restricted cash | 69,706 | | | 62,311 | |

| Accounts receivable, net | 256,961 | | | 153,362 | |

| Accounts receivable retainage | 39,843 | | | 33,826 | |

| Unbilled revenue | 644,105 | | | 636,163 | |

| Inventory | 11,556 | | | 13,637 | |

| Prepaid expenses and other current assets | 145,906 | | | 123,391 | |

| Income tax receivable | 1,685 | | | 5,775 | |

| Project development costs, net | 22,856 | | | 20,735 | |

| Total current assets | 1,301,134 | | | 1,128,471 | |

| Federal ESPC receivable | 609,128 | | | 609,265 | |

| Property and equipment, net | 11,040 | | | 17,395 | |

| Energy assets, net | 1,915,311 | | | 1,689,424 | |

| Goodwill, net | 66,305 | | | 75,587 | |

| Intangible assets, net | 8,814 | | | 6,808 | |

| Right-of-use assets, net | 80,149 | | | 58,586 | |

| Restricted cash, non-current portion | 20,156 | | | 12,094 | |

| Deferred income tax assets, net | 56,523 | | | 26,411 | |

| Other assets | 89,948 | | | 89,735 | |

| Total assets | $ | 4,158,508 | | | $ | 3,713,776 | |

|

| LIABILITIES, REDEEMABLE NON-CONTROLLING INTERESTS AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Current portions of long-term debt and financing lease liabilities, net | $ | 149,363 | | | $ | 322,247 | |

| Accounts payable | 529,338 | | | 402,752 | |

| Accrued expenses and other current liabilities | 107,293 | | | 108,831 | |

| Current portions of operating lease liabilities | 10,536 | | | 13,569 | |

| Deferred revenue | 91,734 | | | 52,903 | |

| Income taxes payable | 744 | | | 1,169 | |

| Total current liabilities | 889,008 | | | 901,471 | |

| Long-term debt and financing lease liabilities, net of current portion, unamortized discount and debt issuance costs | 1,483,900 | | | 1,170,075 | |

| Federal ESPC liabilities | 555,396 | | | 533,054 | |

| Deferred income tax liabilities, net | 2,223 | | | 4,479 | |

| Deferred grant income | 6,436 | | | 6,974 | |

| Long-term operating lease liabilities, net of current portion | 59,479 | | | 42,258 | |

| Other liabilities | 114,454 | | | 82,714 | |

| Commitments and contingencies | | | |

AMERESCO, INC.

CONSOLIDATED BALANCE SHEETS - (Continued)

(In thousands, except share amounts)

| | | | | | | | | | | |

| December 31, |

| | 2024 | | 2023 |

| Redeemable non-controlling interests, net | $ | 2,463 | | | $ | 46,865 | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.0001 par value, 5,000,000 shares authorized, no shares issued and outstanding at December 31, 2024 and 2023 | — | | | — | |

| Class A common stock, $0.0001 par value, 500,000,000 shares authorized, 36,603,048 shares issued and 34,501,213 shares outstanding at December 31, 2024, 36,378,990 shares issued and 34,277,195 shares outstanding at December 31, 2023 | 3 | | | 3 | |

| Class B common stock, $0.0001 par value, 144,000,000 shares authorized, 18,000,000 shares issued and outstanding at December 31, 2024 and 2023 | 2 | | | 2 | |

| Additional paid-in capital | 378,321 | | | 320,892 | |

| Retained earnings | 652,561 | | | 595,911 | |

| Accumulated other comprehensive loss, net | (5,874) | | | (3,045) | |

Treasury stock, at cost, 2,101,835 shares at December 31, 2024 and 2,101,795 at December 31, 2023 | (11,788) | | | (11,788) | |

| Stockholders’ equity before non-controlling interest | 1,013,225 | | | 901,975 | |

| Non-controlling interests | 31,924 | | | 23,911 | |

| Total stockholders’ equity | 1,045,149 | | | 925,886 | |

| Total liabilities, redeemable non-controlling interests and stockholders’ equity | $ | 4,158,508 | | | $ | 3,713,776 | |

AMERESCO, INC.

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| | (Unaudited) | | (Unaudited) | | | | | | |

| Revenues | $ | 532,667 | | | $ | 441,368 | | | $ | 1,769,928 | | | $ | 1,374,633 | | | |

| Cost of revenues | 465,877 | | | 367,192 | | | 1,513,837 | | | 1,128,204 | | | |

| Gross profit | 66,790 | | | 74,176 | | | 256,091 | | | 246,429 | | | |

| Selling, general and administrative expenses | 47,841 | | | 36,672 | | | 173,761 | | | 162,138 | | | |

| Gain on sale of business, net | 38,007 | | | — | | | 38,007 | | | — | | | |

| Asset impairments | 12,384 | | | 3,831 | | | 12,384 | | | 3,831 | | | |

| Earnings from unconsolidated entities | 68 | | | 402 | | | 792 | | | 1,758 | | | |

| Operating income | 44,640 | | | 34,075 | | | 108,745 | | | 82,218 | | | |

| Interest and other expenses, net | 23,406 | | | 16,066 | | | 74,805 | | | 43,949 | | | |

| Income before income taxes | 21,234 | | | 18,009 | | | 33,940 | | | 38,269 | | | |

| Income tax benefit | (16,676) | | | (15,083) | | | (20,000) | | | (25,635) | | | |

| Net income | 37,910 | | | 33,092 | | | 53,940 | | | 63,904 | | | |

| Net (income) loss attributable to non-controlling interests and redeemable non-controlling interests | (825) | | | 643 | | | 2,817 | | | (1,434) | | | |

| Net income attributable to common shareholders | $ | 37,085 | | | $ | 33,735 | | | $ | 56,757 | | | $ | 62,470 | | | |

| Net income per share attributable to common shareholders: | | | | | | | | | |

| Basic | $ | 0.71 | | | $ | 0.65 | | | $ | 1.08 | | | $ | 1.20 | | | |

| Diluted | $ | 0.70 | | | $ | 0.64 | | | $ | 1.07 | | | $ | 1.17 | | | |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic | 52,463 | | | 52,247 | | | 52,380 | | | 52,140 | | | |

| Diluted | 53,257 | | | 53,063 | | | 53,140 | | | 53,228 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

AMERESCO, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 53,940 | | | $ | 63,904 | |

| Adjustments to reconcile net income to net cash flows from operating activities: | | | |

| Depreciation of energy assets, net | 82,114 | | | 59,390 | |

| Depreciation of property and equipment | 4,963 | | | 4,155 | |

| Amortization of debt discount and debt issuance costs | 5,151 | | | 4,201 | |

| Amortization of intangible assets | 2,134 | | | 2,366 | |

| Increase in contingent consideration | 149 | | | 347 | |

| Accretion of ARO liabilities | 332 | | | 258 | |

| Impairment of goodwill | — | | | 2,222 | |

| Provision for bad debts | 1,340 | | | 356 | |

| Impairment of long-lived assets / loss on disposal | 12,815 | | | 1,710 | |

| Gain on sale of business, net of transaction costs | (38,007) | | | — | |

| Non-cash project revenue related to in-kind leases | (4,164) | | | (3,164) | |

| | | |

| Earnings from unconsolidated entities | (792) | | | (1,758) | |

| Net gain from derivatives | (1,027) | | | (1,108) | |

| Stock-based compensation expense | 14,130 | | | 10,318 | |

| Deferred income taxes, net | (24,315) | | | (27,602) | |

| Unrealized foreign exchange loss (gain) | 2,216 | | | (368) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (96,867) | | | 52,647 | |

| Accounts receivable retainage | (14,342) | | | 4,337 | |

| Federal ESPC receivable | (158,937) | | | (260,378) | |

| Inventory, net | 2,081 | | | 581 | |

| Unbilled revenue | 54,953 | | | (13,211) | |

| Prepaid expenses and other current assets | 22,576 | | | (41,125) | |

| Project development costs | (3,255) | | | (5,486) | |

| Other assets | (5,287) | | | (6,896) | |

| Accounts payable, accrued expenses, and other current liabilities | 143,776 | | | 53,238 | |

| Deferred revenue | 50,738 | | | 26,202 | |

| Other liabilities | 7,504 | | | 3,559 | |

| Income taxes receivable, net | 3,679 | | | 1,314 | |

| Cash flows from operating activities | 117,598 | | | (69,991) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (4,291) | | | (5,713) | |

| Capital investment in energy assets | (416,992) | | | (538,418) | |

| Capital investment in major maintenance of energy assets | (17,063) | | | (7,636) | |

| Grant award received on energy asset | 400 | | | — | |

| | | |

| Net proceeds from sale of business | 54,249 | | | — | |

| Net proceeds from sale of equity investment | 13,091 | | | — | |

| Acquisitions, net of cash received | — | | | (9,182) | |

AMERESCO, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS - (Continued)

(In thousands)

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| Contributions to equity and other investments | (11,757) | | | (5,429) | |

| Loans to joint venture investments | — | | | (565) | |

| Purchases of subsurface land easements | (4,274) | | | — | |

| Cash flows from investing activities | (386,637) | | | (566,943) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Cash flows from financing activities: | | | |

| Payments on long-term corporate debt financings | (127,000) | | | (155,000) | |

| Proceeds from long-term corporate debt financings | 100,000 | | | — | |

| Payments on senior secured revolving credit facility, net | (4,900) | | | (43,000) | |

| Proceeds from long-term energy asset debt financings | 643,529 | | | 843,498 | |

| Payments on long-term energy asset debt and financing leases | (424,421) | | | (148,057) | |

| Payment on seller's promissory note | (61,941) | | | — | |

| | | |

| Payments of debt discount and debt issuance costs | (15,308) | | | (9,315) | |

| Proceeds from Federal ESPC projects | 164,779 | | | 154,338 | |

| Net proceeds from energy asset receivable financing arrangements | 6,012 | | | 14,512 | |

| Proceeds from exercises of options and ESPP | 2,763 | | | 4,455 | |

| Contributions from non-controlling interest | 35,407 | | | 3,738 | |

| Distributions to non-controlling interest | (1,368) | | | (21,842) | |

| Distributions to redeemable non-controlling interests, net | (422) | | | (658) | |

| Investment fund call option exercise | (3,186) | | | — | |

| | | |

| Payment of contingent consideration | — | | | (1,866) | |

| Cash flows from financing activities | 313,944 | | | 640,803 | |

| Effect of exchange rate changes on cash | (203) | | | (81) | |

| Net increase in cash, cash equivalents, and restricted cash | 44,702 | | | 3,788 | |

| Cash, cash equivalents, and restricted cash, beginning of year | 153,676 | | | 149,888 | |

| Cash, cash equivalents, and restricted cash, end of year | $ | 198,378 | | | $ | 153,676 | |

Non-GAAP Financial Measures (Unaudited, in thousands)

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2024 |

| Adjusted EBITDA: | Projects | Energy Assets | O&M | Other | Consolidated |

| Net income attributable to common shareholders | $ | 364 | | $ | 8,899 | | $ | 1,651 | | $ | 26,171 | | $ | 37,085 | |

| | | | | |

| (Less) plus: Income tax (benefit) provision | (1,096) | | (26,787) | | (8) | | 11,215 | | (16,676) | |

| Plus: Other expenses, net | 10,203 | | 11,896 | | 508 | | 799 | | 23,406 | |

| Plus: Depreciation and amortization | 1,032 | | 24,245 | | 276 | | 992 | | 26,545 | |

| Plus: Stock-based compensation | 2,974 | | 398 | | 180 | | 210 | | 3,762 | |

| Plus: Energy asset impairment charges | — | | 12,384 | | — | | — | | 12,384 | |

| Plus: Contingent Consideration, restructuring and other charges | 232 | | 15 | | 4 | | 428 | | 679 | |

| | | | | |

| Adjusted EBITDA | $ | 13,709 | | $ | 31,050 | | $ | 2,611 | | $ | 39,815 | | $ | 87,185 | |

| Adjusted EBITDA margin | 3.3 | % | 53.9 | % | 9.8 | % | 131.7 | % | 16.4 | % |

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| Adjusted EBITDA: | Projects | Energy Assets | O&M | Other | Consolidated |

| Net income attributable to common shareholders | $ | 27,149 | | $ | 1,333 | | $ | 4,145 | | $ | 1,108 | | $ | 33,735 | |

| Impact from redeemable non-controlling interests | — | | (299) | | — | | — | | (299) | |

| Less: Income tax benefit | (7,312) | | (6,722) | | (991) | | (58) | | (15,083) | |

| Plus: Other expenses, net | 4,130 | | 11,551 | | 110 | | 275 | | 16,066 | |

| Plus: Depreciation and amortization | 1,202 | | 16,304 | | 295 | | 733 | | 18,534 | |

| Plus: Stock-based compensation | (1,113) | | (440) | | (210) | | (237) | | (2,000) | |

| Plus: Energy asset and goodwill impairment charges | 2,222 | | 1,609 | | — | | — | | 3,831 | |

| Plus: Contingent Consideration, restructuring and other charges | 76 | | 21 | | 2 | | 56 | | 155 | |

| | | | | |

| Adjusted EBITDA | $ | 26,354 | | $ | 23,357 | | $ | 3,351 | | $ | 1,877 | | $ | 54,939 | |

| Adjusted EBITDA margin | 7.6 | % | 53.3 | % | 13.7 | % | 7.1 | % | 12.4 | % |

| | | | | |

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2024 |

| Adjusted EBITDA: | Projects | Energy Assets | O&M | Other | Consolidated |

| Net income attributable to common shareholders | $ | 1,779 | | $ | 13,981 | | $ | 12,252 | | $ | 28,745 | | $ | 56,757 | |

| Impact from redeemable non-controlling interests | — | | (3,766) | | — | | — | | (3,766) | |

| Plus (less): Income tax provision (benefit) | 1,762 | | (34,170) | | 588 | | 11,820 | | (20,000) | |

| Plus: Other expenses, net | 25,235 | | 45,715 | | 1,511 | | 2,344 | | 74,805 | |

| Plus: Depreciation and amortization | 3,929 | | 80,849 | | 1,232 | | 3,201 | | 89,211 | |

| Plus: Stock-based compensation | 10,687 | | 1,703 | | 850 | | 890 | | 14,130 | |

| Plus: Energy asset impairment charges | — | | 12,384 | | — | | — | | 12,384 | |

| Plus: Contingent Consideration, restructuring and other charges | 1,162 | | 116 | | 19 | | 523 | | 1,820 | |

| | | | | |

| Adjusted EBITDA | $ | 44,554 | | $ | 116,812 | | $ | 16,452 | | $ | 47,523 | | $ | 225,341 | |

| Adjusted EBITDA margin | 3.3 | % | 54.8 | % | 15.5 | % | 42.6 | % | 12.7 | % |

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| Adjusted EBITDA: | Projects | Energy Assets | O&M | Other | Consolidated |

| Net income attributable to common shareholders | $ | 39,263 | | $ | 12,992 | | $ | 7,965 | | $ | 2,250 | | $ | 62,470 | |

| Impact from redeemable non-controlling interests | — | | 570 | | — | | — | | 570 | |

| (Less) plus: Income tax (benefit) provision | (15,717) | | (10,642) | | 345 | | 379 | | (25,635) | |

| Plus: Other expenses, net | 14,257 | | 27,701 | | 669 | | 1,322 | | 43,949 | |

| Plus: Depreciation and amortization | 4,103 | | 58,455 | | 1,218 | | 2,135 | | 65,911 | |

| Plus: Stock-based compensation | 7,516 | | 1,343 | | 694 | | 765 | | 10,318 | |

| Plus: Energy asset and goodwill impairment charges | 2,222 | | 1,609 | | — | | — | | 3,831 | |

| Plus: Contingent consideration, restructuring and other charges | 1,223 | | 69 | | 17 | | 267 | | 1,576 | |

| | | | | |

| Adjusted EBITDA | $ | 52,867 | | $ | 92,097 | | $ | 10,908 | | $ | 7,118 | | $ | 162,990 | |

| Adjusted EBITDA margin | 5.3 | % | 51.5 | % | 11.8 | % | 7.0 | % | 11.9 | % |

| | | | | | | | | | | | | | |

| Three Months Ended December 31, | Year Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| Non-GAAP net income and EPS: | | | | |

| Net income attributable to common shareholders | $ | 37,085 | | $ | 33,735 | | $ | 56,757 | | $ | 62,470 | |

| Adjustment for accretion of tax equity financing fees | (27) | | (27) | | (107) | | (108) | |

| Impact from redeemable non-controlling interests | — | | (299) | | (3,766) | | 570 | |

| Plus: Goodwill impairment | — | | 2,222 | | — | | 2,222 | |

| Plus: Energy asset impairment | 12,384 | | 1,609 | | 12,384 | | 1,609 | |

| Plus: Contingent consideration, restructuring and other charges | 679 | | 155 | | 1,820 | | 1,576 | |

| | | | |

| Income tax effect of Non-GAAP adjustments | (3,396) | | (649) | | (3,692) | | (1,018) | |

| Non-GAAP net income | $ | 46,725 | | $ | 36,746 | | $ | 63,396 | | $ | 67,321 | |

| | | | |

| Diluted net income per common share | $ | 0.70 | | $ | 0.64 | | $ | 1.07 | | $ | 1.17 | |

| Effect of adjustments to net income | 0.18 | | 0.05 | | 0.13 | | 0.09 | |

| Non-GAAP EPS | $ | 0.88 | | $ | 0.69 | | $ | 1.20 | | $ | 1.26 | |

| | | | |

| Adjusted cash from operations: | | | | |

| Cash flows from operating activities | $ | 18,376 | | $ | (29,570) | | $ | 117,598 | | $ | (69,991) | |

| Plus: proceeds from Federal ESPC projects | 35,380 | | 47,035 | | 164,779 | | 154,338 | |

| Adjusted cash from operations | $ | 53,756 | | $ | 17,465 | | $ | 282,377 | | $ | 84,347 | |

Other Financial Measures (In thousands) (Unaudited)

| | | | | | | | | | | | | | |

| Three Months Ended December 31, | Year Ended December 31, |

| 2024 | 2023 | 2024 | 2023 |

| New contracts and awards: | | | | |

| New contracts | $ | 1,093,914 | | $ | 477,280 | | $ | 2,527,854 | | $ | 1,276,660 | |

New awards (1) | $ | 711,845 | | $ | 519,600 | | $ | 2,246,669 | | $ | 2,193,225 | |

|

| (1) Represents estimated future revenues from projects that have been awarded, though the contracts have not yet been signed. |

Non-GAAP Financial Guidance

| | | | | | | | |

| Adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA): |

|

Year Ended December 31, 2025 |

| Low | High |

Operating income (1) | $113 million | $132 million |

| Depreciation and amortization | $103 million | $105 million |

| Stock-based compensation | $14 million | $16 million |

| Income attributable to non-controlling interest | $(5) million | $(8) million |

| Adjusted EBITDA | $225 million | $245 million |

(1) Although net income is the most directly comparable GAAP measure, this table reconciles adjusted EBITDA to operating income because we are not able to calculate forward-looking net income without unreasonable efforts due to significant uncertainties with respect to the impact of accounting for our redeemable non-controlling interests and taxes.

Exhibit A: Non-GAAP Financial Measures

We use the Non-GAAP financial measures defined and discussed below to provide investors and others with useful supplemental information to our financial results prepared in accordance with GAAP. These Non-GAAP financial measures should not be considered as an alternative to any measure of financial performance calculated and presented in accordance with GAAP. For a reconciliation of these Non-GAAP measures to the most directly comparable financial measures prepared in accordance with GAAP, please see Non-GAAP Financial Measures and Non-GAAP Financial Guidance in the tables above.

We understand that, although measures similar to these Non-GAAP financial measures are frequently used by investors and securities analysts in their evaluation of companies, they have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for the most directly comparable GAAP financial measures or an analysis of our results of operations as reported under GAAP. To properly and prudently evaluate our business, we encourage investors to review our GAAP financial statements included above, and not to rely on any single financial measure to evaluate our business.

Adjusted EBITDA and Adjusted EBITDA Margin

We define adjusted EBITDA as net income attributable to common shareholders, including impact from redeemable non-controlling interests, before income tax (benefit) provision, other expenses net, depreciation, amortization of intangible assets, accretion of asset retirement obligations, stock-based compensation expense, energy asset and goodwill impairment, contingent consideration, restructuring and other charges, gain or loss on sale of equity investment, and gain or loss upon deconsolidation of a variable interest entity. We believe adjusted EBITDA is useful to investors in evaluating our operating performance for the following reasons: adjusted EBITDA and similar Non-GAAP measures are widely used by investors to measure a company's operating performance without regard to items that can vary substantially from company to company depending upon financing and accounting methods, book values of assets, capital structures and the methods by which assets were acquired; securities analysts often use adjusted EBITDA and similar Non-GAAP measures as supplemental measures to evaluate the overall operating performance of companies; and by comparing our adjusted EBITDA in different historical periods, investors can evaluate our operating results without the additional variations of depreciation and amortization expense, accretion of asset retirement

obligations, stock-based compensation expense, impact from redeemable non-controlling interests, contingent consideration, restructuring and asset impairment charges. We define adjusted EBITDA margin as adjusted EBITDA stated as a percentage of revenue.

Our management uses adjusted EBITDA and adjusted EBITDA margin as measures of operating performance, because they do not include the impact of items that we do not consider indicative of our core operating performance; for planning purposes, including the preparation of our annual operating budget; to allocate resources to enhance the financial performance of the business; to evaluate the effectiveness of our business strategies; and in communications with the board of directors and investors concerning our financial performance.

Non-GAAP Net Income and EPS

We define Non-GAAP net income and earnings per share (EPS) to exclude certain discrete items that management does not consider representative of our ongoing operations, including energy asset and goodwill impairment, contingent consideration, restructuring and other charges, impact from redeemable non-controlling interest, gain or loss on sale of equity investment, and gain or loss upon deconsolidation of a variable interest entity. We consider Non-GAAP net income and Non-GAAP EPS to be important indicators of our operational strength and performance of our business because they eliminate the effects of events that are not part of the Company's core operations.

Adjusted Cash from Operations

We define adjusted cash from operations as cash flows from operating activities plus proceeds from Federal ESPC projects. Cash received in payment of Federal ESPC projects is treated as a financing cash flow under GAAP due to the unusual financing structure for these projects. These cash flows, however, correspond to the revenue generated by these projects. Thus, we believe that adjusting operating cash flow to include the cash generated by our Federal ESPC projects provides investors with a useful measure for evaluating the cash generating ability of our core operating business. Our management uses adjusted cash from operations as a measure of liquidity because it captures all sources of cash associated with our revenue generated by operations.

© 2025 Ameresco, Inc. All rights reserved. ameresco.com Q4 2024 Supplemental Information February 27, 2025

2 Safe Harbor Forward Looking Statements Any statements in this presentation about future expectations, plans and prospects for Ameresco, Inc., including statements about market conditions, pipeline, visibility, backlog, pending agreements, financial guidance including estimated future revenues, net income, adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), Non-GAAP EPS, gross margin, effective tax rate, interest rate, depreciation, tax attributes and capital investments, as well as statements about our financing plans, the impact the IRA, the impact of policies and regulatory changes implemented by the new U.S. administration, supply chain disruptions, shortage and cost of materials and labor, and other macroeconomic and geopolitical challenges, the impact from a possible change in accounting principle; our expectations related to our agreement with SCE including the impact of delays and any requirement to pay liquidated damages, and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including: demand for our energy efficiency and renewable energy solutions; the timing of, and ability to, enter into contracts for awarded projects on the terms proposed or at all; the timing of work we do on projects where we recognize revenue on a percentage of completion basis; the ability to perform under signed contracts without delay and in accordance with their terms and the potential for liquidated and other damages we may be subject to; the fiscal health of the government and the risk of government shutdowns and reductions in the federal workforce; our ability to complete and operate our projects on a profitable basis and as committed to our customers; our cash flows from operations and our ability to arrange financing to fund our operations and projects; our customers’ ability to finance their projects and credit risk from our customers; our ability to comply with covenants in our existing debt agreements; the impact of macroeconomic challenges, weather related events and climate change; our reliance on third parties for our construction and installation work; availability and cost of labor and equipment particularly given global supply chain challenges, tariffs and global trade conflicts; global supply chain challenges, component shortages and inflationary pressures; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy; the ability of customers to cancel or defer contracts included in our backlog; the output and performance of our energy plants and energy projects; cybersecurity incidents and breaches; regulatory and other risks inherent to constructing and operating energy assets; the effects of our acquisitions and joint ventures; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; the addition of new customers or the loss of existing customers; market price of our Class A Common stock prevailing from time to time; the nature of other investment opportunities presented to our Company from time to time; risks related to our international operation and international growth strategy; and other factors discussed in our most recent Annual Report on Form 10-K and our quarterly reports on Form 10-Q. The forward-looking statements included in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. Use of Non-GAAP Financial Measures This presentation and the accompanying tables include references to adjusted EBITDA, Non-GAAP EPS, Non-GAAP net income and adjusted cash from operations, which are Non-GAAP financial measures. For a description of these Non-GAAP financial measures, including the reasons management uses these measures, please see the section in the back of this presentation titled “Non-GAAP Financial Measures”. For a reconciliation of these Non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the table at the end of this presentation titled “GAAP to Non-GAAP Reconciliation.”

Sources of Revenue – Q4 2024 3 Projects Energy efficiency and renewable energy projects Recurring Energy & incentive revenue from owned energy assets; plus recurring O&M from projects Other Services, software and integrated PV $418.3M $84.1M $30.2M

$1.8B Revenue Projects 76% Assets 12% O&M 6% Other 6% Projects 20% Assets 52% O&M 7% Other 21% $225.3M Adjusted EBITDA* 59% of Adjusted EBITDA Came From Recurring Lines of Business 4 * Adjusted EBITDA percentages allocate corporate expenses according to revenue shareFiscal Year 2024 59% Recurring 18% Recurring

Energy Asset Portfolio – 12/31/2024 5 731 MWe of Energy Assets in Operation: 83 MW of non-RNG biogas, 70 MW of RNG, 403 MW of Solar, 166 MW of Battery, and 9 MW of Other 637 MWe of total assets in development; No minority partners in assets in development currently Operating Energy Assets, 731 MWe Other, 1% Battery, 23% Solar, 55% Biogas: RNG, 11% Biogas: Non-RNG, 10% Energy Assets in Development & Construction, 637 MWe EaaS*, 22% Battery, 39% Solar, 25% Biogas, 15% Numbers may not sum due to rounding *$5M of our anticipated Assets in Development spending is for Energy as a Service assets which do not include generation assets that can be measured in MWe. This metric also includes Puuloa and Ukiu Energy engine plants. Ameresco’s Ownership

Energy Asset Balance Sheet – 12/31/2024 6 *Debt to EBITDA, as calculated under our Sr. Secured Credit agreement **Net of unamortized debt discount and debt issuance costs of $4.9M on Corporate Debt and $36.0M on Energy Debt $1.04B** of our Energy Asset Debt is associated with operating energy assets. $0.35B** of our Energy Asset Debt is associated with energy assets still in development & construction. $1.39B of the $1.63B** of total debt on our balance sheet is debt associated with our energy assets (“Energy Asset Debt”). Total Debt $1.63B Corporate Debt $0.24B Energy Asset Debt $1.39B 3.2x* leverage $0.43B $0.35B $1.49B $1.04B Energy Asset Book Value Energy Asset Debt 70% advance rate Operating Development & Construction 81% advance rate

Adjusted Cash from Operations Trend 7 ($20.0) ($10.0) $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 m illi on s 8-Quarter Rolling Average Adjusted Cash from Operations

$0 $500,000,000 $1,000,000,000 $1,500,000,000 $2,000,000,000 $2,500,000,000 $3,000,000,000 $3,500,000,000 Awarded Project Backlog Contracted Project Backlog Operating Energy Assets O&M Backlog Tremendous Forward Visibility: Backlog & Recurring Revenue Business 8 $2.5 billion1 $3.3 billion ~ 12-24 months to contract ~ 12-36 months of revenue 16.7 year weighted average lifetime $2.3 billion1 $1.4 billion 15.2 year weighted average PPA remaining 2 $1.8B Additional estimated revenue from market price RNG 3 $1.5B 1 Project backlog after minority interests 2 Estimated contracted revenue and incentives during PPA period 3 Estimated additional revenue from operating RNG assets over a 20-year period, assuming RINs at $1.50/gallon and brown gas at $3.50/MMBtu with $3.00/MMBtu for LCFS on certain projects

Sustainable & Profitable Business Model 9 Expected to Expand Earnings at a Faster Rate than Revenue FY 2025 guidance, as released February 27, 2025 Revenue ($M) $1,032 $1,216 $1,824 $1,375 $1,770 $1,850 2020 2021 2022 2023 2024 2025 Guidance $1,950 2025 Guidance • High-End 13.6% 5 - Year CAGR • Low-End 12.4% 5 - Year CAGR $118 $153 $205 $163 $225 $225 2020 2021 2022 2023 2024 2025 Guidance Adjusted EBITDA ($M) $245 2025 Guidance • High-End 15.7% 5 - Year CAGR • Low-End 13.8% 5 - Year CAGR

Destination: Net Zero Since 2010, Ameresco’s renewable energy assets & customer projects delivered a Carbon Emission Reduction equivalent to: 125+ Million Metric Tons of CO2 10 Carbon dioxide emissions from… ~ 44 billion miles driven by an average passenger vehicle Carbon sequestered by… ~17 million acres of U.S. forests in one year or Ameresco’s 2024 Carbon Emission Reduction of approximately 17M Metric Tons of CO2 is equal to one of… Note: Annual figures rounded from historic reporting. These preliminary data estimates are derived from a methodology that leverages data captured on Ameresco assets owned and operating and customer projects. The annual carbon impact is calculated using these Ameresco inputs and source GHG emission factors published by the US EPA eGrid database to calculate the avoided carbon emissions of any given asset or project. 10

ameresco.com © 2025 Ameresco, Inc. All rights reserved. to Our Customers, Employees, and Shareholders Thank You

12 Non-GAAP Financial Measures We use the Non-GAAP financial measures defined and discussed below to provide investors and others with useful supplemental information to our financial results prepared in accordance with GAAP. These Non-GAAP financial measures should not be considered as an alternative to any measure of financial performance calculated and presented in accordance with GAAP. For a reconciliation of these Non-GAAP measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the table at the end of this presentation titled “GAAP to Non-GAAP Reconciliation.” We understand that, although measures similar to these Non- GAAP financial measures are frequently used by investors and securities analysts in their evaluation of companies, they have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for the most directly comparable GAAP financial measures or an analysis of our results of operations as reported under GAAP. To properly and prudently evaluate our business, we encourage investors to review our GAAP financial statements and not to rely on any single financial measure to evaluate our business. Adjusted EBITDA and Adjusted EBITDA Margin We define adjusted EBITDA as net income attributable to common shareholders, including impact from redeemable non-controlling interests, before income tax (benefit) provision, other expenses net, depreciation, amortization of intangible assets, accretion of asset retirement obligations, stock-based compensation expense, energy asset and goodwill impairment, contingent consideration, restructuring and other charges, gain or loss on sale of equity investment, and gain or loss upon deconsolidation of a variable interest entity. We believe adjusted EBITDA is useful to investors in evaluating our operating performance for the following reasons: adjusted EBITDA and similar Non-GAAP measures are widely used by investors to measure a company's operating performance without regard to items that can vary substantially from company to company depending upon financing and accounting methods, book values of assets, capital structures and the methods by which assets were acquired; securities analysts often use adjusted EBITDA and similar Non-GAAP measures as supplemental measures to evaluate the overall operating performance of companies; and by comparing our adjusted EBITDA in different historical periods, investors can evaluate our operating results without the additional variations of depreciation and amortization expense, accretion of asset retirement obligations, stock-based compensation expense, impact from redeemable non-controlling interests, contingent consideration, restructuring and asset impairment charges. We define adjusted EBITDA margin as adjusted EBITDA stated as a percentage of revenue. Our management uses adjusted EBITDA and adjusted EBITDA margin as measures of operating performance, because they do not include the impact of items that we do not consider indicative of our core operating performance; for planning purposes, including the preparation of our annual operating budget; to allocate resources to enhance the financial performance of the business; to evaluate the effectiveness of our business strategies; and in communications with the board of directors and investors concerning our financial performance. Non-GAAP Net Income and EPS We define Non-GAAP net income and earnings per share (EPS) to exclude certain discrete items that management does not consider representative of our ongoing operations, including energy asset and goodwill impairment, contingent consideration, restructuring and other charges, impact from redeemable non-controlling interest, gain or loss on sale of equity investment, and gain or loss upon deconsolidation of a variable interest entity. We consider Non-GAAP net income and Non-GAAP EPS to be important indicators of our operational strength and performance of our business because they eliminate the effects of events that are not part of the Company's core operations. Adjusted Cash from Operations We define adjusted cash from operations as cash flows from operating activities plus proceeds from Federal ESPC projects. Cash received in payment of Federal ESPC projects is treated as a financing cash flow under GAAP due to the unusual financing structure for these projects. These cash flows, however, correspond to the revenue generated by these projects. Thus we believe that adjusting operating cash flow to include the cash generated by our Federal ESPC projects provides investors with a useful measure for evaluating the cash generating ability of our core operating business. Our management uses adjusted cash from operations as a measure of liquidity because it captures all sources of cash associated with our revenue generated by operations.

GAAP to Non-GAAP Reconciliation 13 (Unaudited) (Unaudited) (Unaudited) (Unaudited) Adjusted EBITDA: Net income attributable to common shareholders 37,085$ 33,735$ 56,757$ 62,470$ Impact from redeemable non-controlling interests -$ (299)$ (3,766) 570 Plus (Less): Income tax provision (benefit) (16,676)$ (15,083) (20,000) (25,635) Plus: Other expenses, net 23,406$ 16,066 74,805 43,949 Plus: Depreciation and amortization 26,545$ 18,534 89,211 65,911 Plus: Stock-based compensation 3,762$ (2,000) 14,130 10,318 Plus: Energy asset and goodwill impairment charges 12,384$ 3,831 12,384 3,831 Plus: Contingent consideration, restructuring and other charges 679$ 155 1,820 1,576 Adjusted EBITDA 87,185$ 54,939$ 225,341 162,990$ Adjusted EBITDA margin 16.4% 12.4% 12.7% 11.9% Non-GAAP net income and EPS: Net income attributable to common shareholders 37,085$ 33,735$ 56,757$ 62,470$ Adjustment for accretion of tax equity financing fees (27)$ (27) (107) (108) Impact of redeemable non-controlling interests -$ (299) (3,766) 570 Plus: Goodwill Impairment -$ 2,222 - 2,222 Plus: Energy asset impairment 12,384$ 1,609 12,384 1,609 Plus: Contingent consideration, restructuring and other charges 679$ 155 1,820 1,576 Income Tax effect of Non-GAAP adjustments (3,396)$ (649) (3,692) (1,018) Non-GAAP net income 46,725$ 36,746$ 63,396$ 67,321$ Earnings per share: Diluted net income per common share 0.70$ 0.64$ 1.07$ 1.17$ Effect of adjustments to net income 0.18 0.05 0.13 0.09 Non-GAAP EPS 0.88$ 0.69$ 1.20$ 1.26$ Adjusted cash from operations Cash flows from operating activities 18,376$ (29,570)$ 117,598$ (69,991)$ Plus: proceeds from Federal ESPC projects 35,380 47,035 164,779$ 154,338$ Adjusted cash from operations 53,756$ 17,465$ 282,377$ 84,347$ 2024 2023 2024 2023 Twelve Months Ended December 31,Three Months Ended December 31,

GAAP to Non-GAAP Reconciliation (continued) 14 * Adjusted EBITDA by Line of Business includes corporate expenses allocated according to revenue share $000 USD Projects Operating Assets O&M Other Consolidated Adjusted EBITDA: Net income attributable to common shareholders 1,779$ 13,981$ 12,252$ 28,745$ 56,757$ Impact from redeemable non-controlling interests -$ (3,766)$ -$ -$ (3,766)$ Plus (less): Income tax provision (benefit) 1,762$ (34,170)$ 588$ 11,820$ (20,000)$ Plus: Other expenses, net 25,235$ 45,715$ 1,511$ 2,344$ 74,805$ Plus: Depreciation and amortization 3,929$ 80,849$ 1,232$ 3,201$ 89,211$ Plus: Stock-based compensation 10,687$ 1,703$ 850$ 890$ 14,130$ Plus: Energy asset impairment charges -$ 12,384$ -$ -$ 12,384$ Plus: Contingent Consideration, restructuring and other charges 1,162$ 116$ 19$ 523$ 1,820$ Adjusted EBITDA 44,554$ 116,812$ 16,452$ 47,523$ 225,341$ Adjusted EBITDA margin 3.3% 54.8% 15.5% 42.6% 12.7% Twelve Months Ended December 31, 2024

GAAP to Non-GAAP Reconciliation (continued) 15 ($ in Thousands) 2015 2016 2017 2018 2019 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Cash Flow from Operations (22,083) (14,877) 4,341 (16,919) (15,069) (24,653) (7,654) (10,696) (31,786) (19,633) (39,337) (45,803) (37,071) (20,066) 25,097 (21,160) (58,094) (51,160) (11,471) (75,568) Proceeds from Federal ESPC projects 18,015 22,855 20,976 16,125 16,385 22,374 26,316 24,964 35,167 38,869 48,303 42,673 36,582 33,082 43,906 44,667 39,598 43,189 32,769 83,802 Adjusted Cash from Operations (4,068) 7,978 25,317 (794) 1,316 (2,279) 18,662 14,268 3,381 19,237 8,966 (3,130) (489) 13,016 69,003 23,506 (18,496) (7,971) 21,298 8,234 Rolling 8-quarter Adjusted Cash from Operations 9,981 9,412 7,372 9,595 7,550 8,481 9,888 7,845 7,553 7,327 9,239 15,531 16,686 13,952 10,551 12,092 13,513 ($ in Thousands) 2020 2021 2022 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Cash Flow from Operations (51,640) (21,955) (10,193) (18,796) (38,724) (57,758) (19,862) (55,952) (276,122) (31,722) 34,674 (65,118) 58,772 (92,621) (6,572) (29,570) 20,820 53,314 25,091 18,376 Proceeds from Federal ESPC projects 61,198 72,402 60,987 54,331 33,520 36,640 44,026 45,031 64,788 56,943 52,134 64,495 42,309 34,390 30,604 47,035 19,581 100,547 9,271 35,380 Adjusted Cash from Operations 9,558 50,447 50,794 35,535 (5,204) (21,118) 24,163 (10,921) (211,333) 25,220 86,808 (623) 101,081 (58,231) 24,032 17,464 40,401 153,861 34,362 53,756 Rolling 8-quarter Adjusted Cash from Operations 14,769 19,447 17,171 18,675 20,336 18,693 19,051 16,657 (10,955) (14,108) (9,606) (14,126) (840) (5,479) (5,496) (1,948) 29,519 45,599 39,043 45,841

v3.25.0.1

Cover

|

Feb. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2025

|

| Entity Registrant Name |

Ameresco, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34811

|

| Entity Tax Identification Number |

04-3512838

|

| Entity Address, Address Line One |

111 Speen Street,

|

| Entity Address, City or Town |

Framingham,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

1701

|

| City Area Code |

508

|

| Local Phone Number |

661-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001488139

|

| Entity Address, Address Line Two |

Suite 410,

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

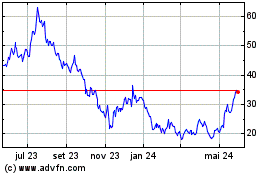

Ameresco (NYSE:AMRC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

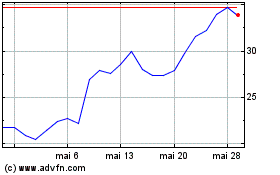

Ameresco (NYSE:AMRC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025