0000050863false00000508632025-02-282025-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2025

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 000-06217 | 94-1672743 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | |

2200 Mission College Boulevard, Santa Clara, California | 95054-1549 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (408) 765-8080

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value | INTC | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 1, 2024, Intel Corporation (“Intel”) appointed Michelle Johnston Holthaus as Chief Executive Officer of the Intel Products business. In connection with such appointment, Intel entered into a letter agreement (“Agreement”) with Ms. Johnston Holthaus on February 28, 2025, setting forth the terms and conditions of her increased compensation and employment. Commencing January 1, 2025, Ms. Johnston Holthaus’ annual base salary increased to $1,000,000, her annual cash bonus target opportunity increased to 200% of her base salary or $2,000,000, and her annual long-term incentive equity award target value increased to approximately $16,000,000. She also received a one-time award of restricted stock units with an aggregate target value of approximately $5,000,000.

Pursuant to the Agreement, in addition to being eligible to receive severance benefits pursuant to the terms and conditions of the Intel Corporation Executive Severance Plan, Ms. Johnston Holthaus will also be eligible for such benefits if she resigns for good reason (as defined in the Agreement) within two years following the appointment of a new Chief Executive Officer of Intel, subject to her execution and non-revocation of a release of claims in favor of the company.

The foregoing description of Ms. Johnston Holthaus’ compensation arrangements is qualified in its entirety by reference to the Agreement, which is attached as Exhibit 10.1 to this Report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are provided as part of this report:

| | | | | |

| Exhibit Number | Description |

| 10.1 | Letter Agreement with Michelle Johnston Holthaus executed on February 28, 2025. |

| 104 | Cover Page Interactive Data File, formatted in Inline XBRL and included as Exhibit 101. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | INTEL CORPORATION (Registrant) |

| | | | | |

| Date: | February 28, 2025 | | By: | | /s/ April Miller Boise |

| | | | | April Miller Boise |

| | | | | Executive Vice President and Chief Legal Officer |

Exhibit 10.1

Michelle Johnston Holthaus

c/o Corporate Headquarters

Intel Corporation

2200 Mission College Blvd

Santa Clara, CA, 95054-1549

February 27, 2025

Dear Michelle:

Congratulations! On behalf of Intel Corporation (“Intel” or the “Company”), I am pleased to promote you to the position of Chief Executive Officer, Intel Products, reporting to the Chief Executive Officer of Intel once named.

Base Salary. As of January 1, 2025 (“Effective Date”), your annual base salary will be $1,000,000 less applicable taxes, deductions, and withholdings.

Annual Performance Bonus (APB): You will remain eligible for an Annual Performance Bonus (“APB”). As of the Effective Date, your target APB payout will be 200% of your annual base salary or $2,000,000 (“APB Payout Goal”). Payouts under the APB are subject to eligibility and other program conditions, as well as the Company’s performance of its financial and operational goals.

Target Cash Compensation. As of the Effective Date, your target annual cash compensation is $3,000,000; this is composed of your base salary and APB Payout Goal. Your base salary and APB Payout Goal will be reviewed annually as part of our performance review process.

Annual Long-Term Incentive Equity Awards. As of the Effective Date, the target value of your annual long-term incentive equity award will be approximately $16,000,000, which will be comprised of a mix of time-based restricted stock units (“RSUs”) and performance-based stock units (“PSUs”), as determined by the Talent and Compensation Committee (“Committee”). The RSUs will vest in equal annual installments over a three-year period following the grant date such that the grant is fully vested on the three-year anniversary of the grant date. It is anticipated that the RSUs will be granted on the Company’s next regularly scheduled grant date for annual equity awards following the Effective Date (“Grant Date”). The exact number of RSUs and PSUs to be granted to you will be determined on the Grant Date, based on the average daily (on days where trading occurred) market value of Intel stock over thirty (30) calendar days leading up to and including that date. The PSUs will be eligible to vest following the Committee’s certification of the performance results for the applicable performance goals established for the respective three-year performance period. The RSUs and PSUs will be subject to the terms and conditions of the Intel Corporation 2006 Equity Incentive Plan, the Notice of Grant for each award, and grant agreement linked to your Notice of Grant.

Promotion Equity Award. You will be granted an award of RSUs (“Promotion RSUs”) with a target value of approximately $5,000,000, with the number of shares determined on the Grant Date based on the average daily (on days where trading occurred) market value of Intel stock over thirty (30) calendar days leading up to and including that date. The Promotion RSUs will vest in equal annual installments over a three-year period following the Grant Date such that the Promotion RSUs are fully vested on the three-year anniversary of the Grant Date. The Promotion RSUs will be subject to the terms and conditions of the Intel Corporation 2006 Equity Incentive Plan, the Notice of Grant, and Grant Agreement linked to your Notice of Grant.

Severance. You will continue to be eligible for the benefits under the Intel Corporation Executive Severance Plan, as amended from time to time (“Severance Plan”), subject to the terms and conditions of the Severance Plan. In addition, if you voluntarily resign your employment for Good Reason (as defined below) within two years of the start date of a new Chief Executive Officer of Intel following the date hereof, and you sign and do not revoke a release of claims in favor of Intel and its affiliates, you will be eligible to receive the Severance Benefits (as defined in the Severance Plan), subject to the terms and conditions of the Severance Plan.

A resignation for “Good Reason” means that you have complied with the Good Reason Process (as defined below) following the occurrence, without your express, written consent, of one or more of the following conditions: (a) a material reduction in your title, duties, responsibilities, or authority, in each case, with respect to the Intel Products business, and other than in connection with a sale or similar transaction of a business unit(s) within Intel Products; or (b) a material reduction by Intel of your annual base salary or target annual bonus opportunity as in effect on the Effective Date, other than across-the-board compensation and benefit reductions that affect all similarly situated executives of Intel. For the avoidance of doubt, Good Reason will not exist as a result of you no longer serving in the position of the interim Co-CEO of Intel and no longer receiving the compensation associated with such role. “Good Reason Process” means that (1) a Good Reason condition has occurred; (2) you notified Intel in writing within sixty (60) days of you first becoming aware of the events or circumstances claimed to give rise to Good Reason; (3) Intel fails to cure such events or circumstances to your satisfaction within the thirty (30) days following such notice (“Cure Period”); and (4) you terminate your employment by written notice to the Chief Executive Officer of Intel within thirty (30) days after the end of the Cure Period. If Intel cures the Good Reason condition during the Cure Period, Good Reason shall be deemed not to have existed in such case.

Comprehensive Benefits. You will continue to be eligible for our medical, dental, vision, short-term and long-term disability, and life insurance programs, as well as the Employee Stock Purchase Plan, 401(k) Plan, and deferred compensation plan. You remain eligible for 4 weeks of vacation and 10 company holidays each year, as well as our fully paid sabbaticals. Each of these benefits is subject to the terms and conditions of the benefit program and plans.

Relocation Assistance. To assist you and your family with a one-time relocation to a primary Intel site should you decide to relocate, we will provide you a comprehensive relocation package based on your individual needs and Intel relocation guidelines, including temporary living accommodations for up to 12 months. A Relocation Consultant will be made available by Intel to discuss the best package options for you.

Outside Activities During Employment. During your employment, you shall devote your full business efforts and time to Intel. This obligation, however, shall not preclude you from engaging in appropriate civic, charitable or religious activities, as long as they do not materially interfere with your job. Any outside activities, including serving on a Board of Directors, must be in compliance with Intel’s Code of Conduct and subject to applicable approvals and policies.

Company Policies/Protection of Intellectual Property. Your employment remains subject to the Employment Agreement you signed, which outlines your obligations as an employee, including among others your obligation to protect Intel’s intellectual property (as well as confidential information of your prior employers and other third parties). You will be expected to abide by the Company’s policies and procedures, including without limitation Intel’s Employment Guidelines and Code of Conduct.

At-Will Employment. Your employment with Intel remains “at will,” which means that both Intel and you have the right to end your employment at any time, with or without advance notice, and with or without cause. The at-will nature of your employment may not be modified or amended except by written agreement signed by Intel’s Chief Executive Officer and you.

Counterparts. This letter agreement may be executed in counterparts, all of which shall be considered one and the same agreement and shall become effective when one or more counterparts have been signed by each of the parties and delivered to the other parties.

Section 409A. It is intended that the reimbursements, payments, and benefits payable under this letter agreement be exempt from or comply with Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”) and the regulations and other guidance promulgated thereunder. If the Company believes, at any time, that any of such reimbursement, payment or benefit is not exempt or does not so comply, the Company shall promptly advise you and shall reasonably and in good faith amend the terms of such arrangement such that it is exempt or complies (with the most limited possible economic effect on you and on the Company) or to minimize any additional tax, interest, and/or penalties that may apply under Section 409A if exemption or compliance is not practicable. The Company agrees that it shall not without your prior written consent, knowingly take any action, or knowingly refrain from taking any action, other than as required by law, that would result in the imposition of tax, interest, and/or penalties on you under Section 409A, unless such action or omission is pursuant to your written request. To the extent applicable, any installment payments to be made pursuant under this letter agreement or pursuant to the Severance Plan shall be treated as a separate payment and not as one of a series of payments treated as a single payment for purposes of Treasury Regulation Section 1.409A-2(b)(2)(iii).If you are a ‘specified employee’ (determined by the Company in accordance with Section 409A and Treasury Regulation Section 1.409A-3(i)(2)) as of the date you experiences a ‘separation from service’ with the Company, as defined for purposes of Section 409A (a “Separation from Service”), and if any reimbursement, payment, or benefit to be paid or provided under this letter agreement, the Severance Plan or otherwise both (i) constitutes a ‘deferral of compensation’ within the meaning of and subject to Section 409A (“Nonqualified Deferred Compensation”) and (ii) cannot be paid or provided in a manner otherwise provided herein without subjecting you to additional tax, interest, and/or penalties under Section 409A, then any such reimbursement, payment, or benefit that is payable during the first six (6) months following the your date of termination shall be paid or provided to you in a lump sum cash payment to be made on the earlier of (A) the date of your death and (B) the first business day of the seventh (7th) month immediately following your Separation from Service or as soon as administratively

practicable after such date. No interest shall be due on any amounts so deferred. Except to the extent any reimbursement, payment, or benefit to be paid or provided to you hereunder (or otherwise) does not constitute Nonqualified Deferred Compensation, (i) the amount of expenses eligible for reimbursement or the provision of any in-kind benefit (as defined in Section 409A) during any calendar year shall not affect the amount of expenses eligible for reimbursement or provided as in-kind benefits in any other calendar year (subject to any lifetime and other annual limits provided under the Company’s health plans), (ii) the reimbursements for expenses for which you are entitled shall be made on or before the last day of the calendar year following the calendar year in which the applicable expense is incurred, and (iii) the right to payment or reimbursement or in-kind benefits may not be liquidated or exchanged for any other benefit.

Entire Agreement. This letter agreement including the referenced documents forms the entire agreement between you and Intel and replaces all prior communications on matters related to your promotion and employment at Intel.

Sincerely,

/s/ Frank Yeary

______________________________

Frank Yeary

Interim Executive Chairman of the Board

Accepted and Agreed:

/s/ Michelle Johnston Holthaus 2/28/2025

______________________________ ________________________

Michelle Johnston Holthaus Date

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

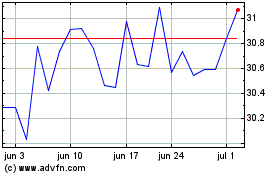

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025